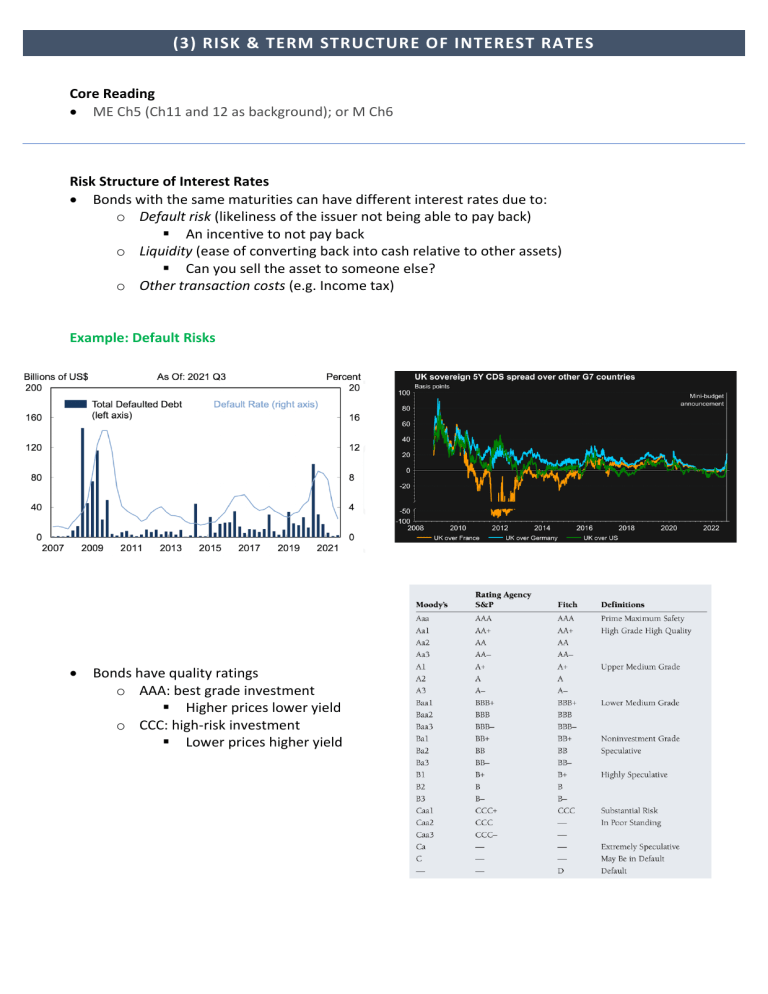

(3) RISK & TERM STRUCTURE OF INTEREST RATES Core Reading • ME Ch5 (Ch11 and 12 as background); or M Ch6 Risk Structure of Interest Rates • Bonds with the same maturities can have different interest rates due to: o Default risk (likeliness of the issuer not being able to pay back) § An incentive to not pay back o Liquidity (ease of converting back into cash relative to other assets) § Can you sell the asset to someone else? o Other transaction costs (e.g. Income tax) Example: Default Risks • Bonds have quality ratings o AAA: best grade investment § Higher prices lower yield o CCC: high-risk investment § Lower prices higher yield (3) RISK & TERM STRUCTURE OF INTEREST RATES Risk Structure: Demand & Supply Analysis 1. An increase in default risk decreases the demand for corporate bonds a. As fewer people are willing to invest their money if it is likely they will not get paid back 2. This will increase the demand for government treasury bonds a. As government bonds are default-free (the government will always pay you back) b. Government bonds are typically used as the benchmark rate 3. This increases the price (lowers rates) of government bonds and lowers the price (increases rates) of corporate bonds a. This increases the spread between the interest rates of corporate vs government bonds. Risk-Free Rate & LIBOR • Risk-Free Rate: the interest rate an investor can expect to earn on an investment that carries no risk. • LIBOR: the average interest rate calculated from estimates submitted by leading London banks • Risk-free rates now replace LIBOR as the benchmark rate. (3) RISK & TERM STRUCTURE OF INTEREST RATES Income Tax Factor: Demand & Supply Analysis 1. Tax-free status increases demand for municipal bonds (bonds issued by local county and state governments that are tax-free) 2. This decreases the demand for treasury government bonds 3. Resulting in municipal bonds having higher prices and lower interest rates than government treasury bonds. Term Structure & Yield Curves • Term structure of interest rates: bonds with similar characteristics (risk, liquidity, tax) but differing maturity • Yield curve: a plot of the yield on similar bonds against their different terms of maturity • Term spread: long-term interest rate – short-term interest rate (slope of the yield curve) (3) RISK & TERM STRUCTURE OF INTEREST RATES Theories for the Term Structure of Interest Rates • Interest rates of different maturities move together over time. • Yield curves tend to have a steep upward slope when short rates are low, and a downward slope when short rates are high. • Yield curves mostly upward sloping I. Expectations theory: explains 1st & 2nd but not 3rd II. Segmented markets theory: explains only 3rd III. Liquidity premium theory: explains all Pure Expectations Theory Investors choosing similar bonds with different maturities • Key assumptions: o Bonds with different maturities are perfect substitutes o Investors only consider the expected interest returns • Implication: long-term rate equals the average of short-term rates covering the same period. Two-period example • it spot interest rate on a one-period bond • iet+1 expected one-period interest rate (at t+1) • i2t spot interest rate (APR) on a two-period bond • Strategy 1: buy-and-hold investments on the long-term bond • Strategy 2: rolling-over investments on the short-term bonds • In equilibrium, both strategies result in the same expected return (if everyone using the same) N-period example • The one-year interest rate over the next five years is expected to be 5%, 6%, 7%, 8%, and 9%. o The two-year bond is expected to be: (3) RISK & TERM STRUCTURE OF INTEREST RATES o The five-year bond is expected to be: • Therefore, interest rates on one-to-five-year bonds are expected to be 5%, 5.5%, 6%, 6.5% and 7%. Pure expectations theory can explain why: • Interest rates with different maturities tend to move together (1st) o The long-term rate is the average of short-term rates. o If long-term rates are higher, means short-term rates have increased too. • Yield curves tend to slope upward when short-term rates are low, and downward when rates are high (2nd) Segmented Markets Theory Investors choosing similar bonds with different maturities • Key assumptions: o Bonds with different maturities are not substitutes o The interest rate for given maturity is determined by the demand and supply of the bond. o Investors have preferences over bonds with different maturities • Implication: interest rates are determined separately. • Segmented markets can explain why yield curves slope upward (3rd) but not the other two facts. Liquidity Premium & Preferred Habitat Theories Investors choosing similar bonds with different maturities • Key assumptions: o Bonds with different maturities are imperfect substitutes o Investors consider the expected interest returns o Investors prefer short-term bonds over long-term • Implication: incorporate segmented market theory with pure expectations theory. iNt: the liquidity premium for the Nth period at t iNt is positive and increasing with N • Explains all three facts o 1st & 2nd from expectations theory o 3rd from segmented market theory (preferred habitat) (3) RISK & TERM STRUCTURE OF INTEREST RATES