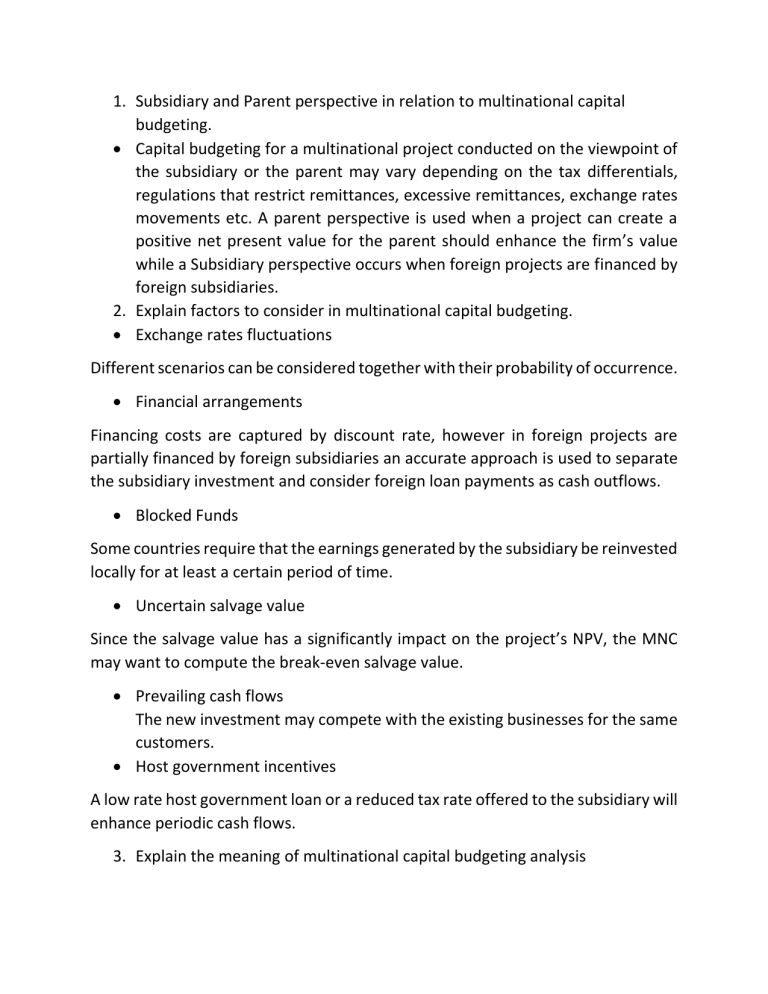

1. Subsidiary and Parent perspective in relation to multinational capital budgeting. Capital budgeting for a multinational project conducted on the viewpoint of the subsidiary or the parent may vary depending on the tax differentials, regulations that restrict remittances, excessive remittances, exchange rates movements etc. A parent perspective is used when a project can create a positive net present value for the parent should enhance the firm’s value while a Subsidiary perspective occurs when foreign projects are financed by foreign subsidiaries. 2. Explain factors to consider in multinational capital budgeting. Exchange rates fluctuations Different scenarios can be considered together with their probability of occurrence. Financial arrangements Financing costs are captured by discount rate, however in foreign projects are partially financed by foreign subsidiaries an accurate approach is used to separate the subsidiary investment and consider foreign loan payments as cash outflows. Blocked Funds Some countries require that the earnings generated by the subsidiary be reinvested locally for at least a certain period of time. Uncertain salvage value Since the salvage value has a significantly impact on the project’s NPV, the MNC may want to compute the break-even salvage value. Prevailing cash flows The new investment may compete with the existing businesses for the same customers. Host government incentives A low rate host government loan or a reduced tax rate offered to the subsidiary will enhance periodic cash flows. 3. Explain the meaning of multinational capital budgeting analysis Multinational capital budgeting analysis is the process that involves analyzing on the cash inflows and the cash outflows with the prospective long-term investment projects to determine whether the expected returns are met. 4. Explain the inputs of Multinational Capital budgeting Initial Investment Funds initially invested is necessary to start the project and additional funds to support the project overtime. Price and Consumer demand Future demand is influenced by economic conditions, which are uncertain. Costs Variable costs can be developed from comparative costs of the components while fixed costs can be estimated without an estimate of demand. Tax International tax must be determined on any proposed projects. Remitted funds The MNC policy for remitting funds to the parent influences estimated cash flows. Required Rate of Return. The MNC should estimate its cost capital, and then it can drive its required rate of return on a project based on the risk of that project. Salvage values Depends on the following factors such as success of the project and the attitude of the host government toward the project.