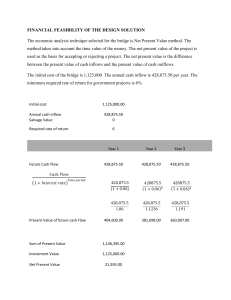

Cash Flow forecasting RETRIEVAL STARTER EXPLAIN THE DIFFERENCE BETWEEN A VARIABLE AND FIXED COST? IDENTIFY TWO FIXED COST AND TWO VARIABLE COST AT: ST BONNAVENTURES TESCO SUPERMARKET CHALLENGE A GREENGROCER BUYS PUNNETS OF STRAWBERRIES FOR 50p AND SELLS THEM FOR £1. SHE MUST ALSO PAY £120 IN WEEKLY RENT AND £180 FOR OTHER FIXED COST. WHAT IS THE TOTAL COST OF SELLING 500 PUNNETS PER WEEK? WHAT IS THE TOTAL COST OF SELLING 1,000 PUNNETS PER WEEK? DEFINITION PAIR TASK PROFIT INVOICE the money you have left after paying for business expenses. a company receives in its day-to-day business operations INSOLVENT a decrease in net income that is outside the normal operations of the business. CASH-FLOW a payment with either cash or credit to purchase goods or services. EXPENDITURE company can't pay its debts. REVENUE a document issued by a seller to the buyer that indicates the quantities and costs of the products or services provider by the seller. LOSS a measurement of the amount of cash that comes into and out of your business in a particular period of time. DEFINITION PAIR TASK PROFIT INVOICE the money you have left after paying for business expenses. a company receives in its day-to-day business operations INSOLVENT a decrease in net income that is outside the normal operations of the business. CASH-FLOW a payment with either cash or credit to purchase goods or services. EXPENDITURE company can't pay its debts. REVENUE a document issued by a seller to the buyer that indicates the quantities and costs of the products or services provider by the seller. LOSS a measurement of the amount of cash that comes into and out of your business in a particular period of time. MONTHS JANUARY FEBUARY MARCH TOTAL PUT THE FOLLOWING HEADINGS INTO CATEGORIES (CASH INFLOW & CASH OUTFLOW) Income tax, VAT & Corporation tax Cash Sales Buying equipment Repayment on loans Sale of spare assets Receipt of bank loan Payment of wages & salaries Government grants Payment of dividends Interest on bank loan or overdraft Payment of leasing or hire purchase rentals Receipts from trade customers Payment of suppliers (raw materials, stock) Personal funds Investment of share capital Receipts from factoring CASH INFLOWS AND OUTFLOWS (WHAT IT SHOULD LOOK LIKE) Cash Flow Activity Who can be first to work it out……..?!?! There is a concert in two weeks time and you really want to go… • Tickets cost £65 and has to be paid before the concert • Your mum gives you £20 • You worked 7 hours at a restaurant for £4.50 per hour • You find a £10 note in an old pair of jeans • Your gran has promised you £30 for your birthday the week after the concert • BUT you already owe your best friend £26 that he needs ASAP Can you afford to go to the concert? What could you arrange to do to be able to afford the ticket? Cash Flow Activity Answers 7hour * 4.5= 31.50 Mum £20 £10 £61.50 You owe £26 so this comes to £35.50 £30 after concert With your grans money, you will have £65.50 Explain how this task is going to relate to everyday life? 28/11/2022 14:37 Activate Cash Flow Forecasting Title: Cash Flow Forecasting LO: To understand the importance of cash flow for a business Success Criteria I can define cash flow forecasting (SC1) I can understand how to calculate cash flow (SC2) I can recommend how to improve cash flow for a business (SC3) SC1 SC2 SC3 Inflow vs Outflow Create the following table in your books and identify how cash can come in or how cash can come out? Cash Inflow Cash Outflow 28/11/20 22 14:37 Inflow vs Outflow Cash Inflow • • • • Sales Bank Loan Grants Interest Cash Outflow • • • • • • Wages Stock Utility bills Advertising Payback of loans Interest 28/11/20 22 14:37 Cash Flow Forecast Look at the task sheet provided and looking at the answers already provided, write down what the calculation would be for the following: Total Inflow Total Outflow Net Cash Flow Opening Balance Closing Balance Clue: If the number is in a bracket, it is a negative figure! 28/11/20 22 14:37 Calculations Total inflow = All inflows added up for that month Total outflow = All outflows added up for that month Net Cash Flow = Total Inflows – Total Outflows Opening Balance = Closing Balance from the month before Closing Balance = Net Cash Flow + Opening Balance 28/11/20 22 14:37 Missing Figures Now that you know the calculations, attempt to complete the rest of the missing figures 28/11/20 22 14:37 70,000 150,000 120,000 130,000 135,000 130,000 40,000 50,000 (65,000) 20,000 80,000 80,000 (80,000) (60,000) 20,000 20,000 100,000 (80,000) 28/11/20 22 14:37 (60,000) Now that you know have completed a cash flow forecast, now it is time to explain what it is showing Define cash flow based on what you have calculated? What is a forecast? 28/11/20 22 14:37 Interpret… Looking at the cash flow forecast that you have created, explain: Why the business is doing well? Why the business may be performing badly? 28/11/20 22 14:37 Recommend… Identify and explain how this business could improve it’s cash flow Explain why this would help? What do you need to consider with each recommendation? 28/11/20 22 14:37 Possible recommendations… 28/11/20 22 14:37 28/11/2022 14:37 Activate Rights of the individuals Title: Cash Flow Forecasting LO: To understand the importance of cash flow for a business Success Criteria I can define cash flow forecasting (SC1) I can understand how to calculate cash flow (SC2) I can recommend how to improve cash flow for a business (SC3) SC1 SC2 SC3 Sit down = True = False Sales Revenue is an outflow Wages are an outflow Net Cash Flow = Inflow + Outflow Closing balance is what you start with at the beginning of the month Interest is an inflow 28/11/20 22 14:37