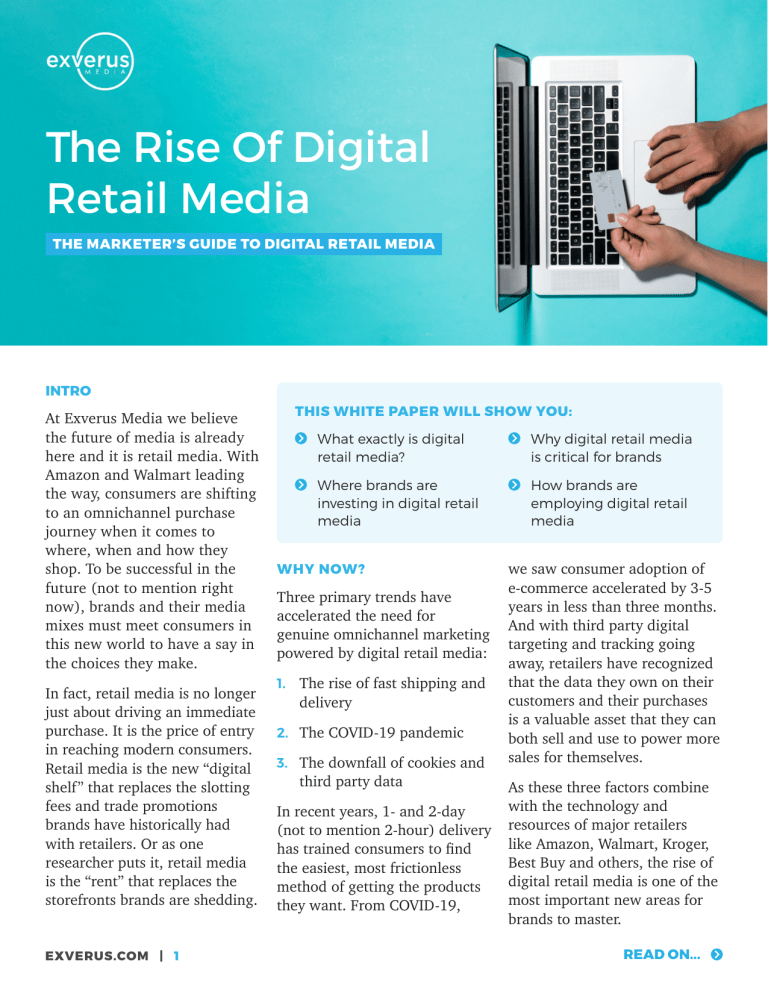

The Rise Of Digital Retail Media THE MARKETER’S GUIDE TO DIGITAL RETAIL MEDIA INTRO At Exverus Media we believe the future of media is already here and it is retail media. With Amazon and Walmart leading the way, consumers are shifting to an omnichannel purchase journey when it comes to where, when and how they shop. To be successful in the future (not to mention right now), brands and their media mixes must meet consumers in this new world to have a say in the choices they make. In fact, retail media is no longer just about driving an immediate purchase. It is the price of entry in reaching modern consumers. Retail media is the new “digital shelf” that replaces the slotting fees and trade promotions brands have historically had with retailers. Or as one researcher puts it, retail media is the “rent” that replaces the storefronts brands are shedding. EXVERUS.COM | 1 THIS WHITE PAPER WILL SHOW YOU: What exactly is digital retail media? Where brands are investing in digital retail media WHY NOW? Three primary trends have accelerated the need for genuine omnichannel marketing powered by digital retail media: 1. The rise of fast shipping and delivery 2. The COVID-19 pandemic 3. The downfall of cookies and third party data In recent years, 1- and 2-day (not to mention 2-hour) delivery has trained consumers to find the easiest, most frictionless method of getting the products they want. From COVID-19, Why digital retail media is critical for brands How brands are employing digital retail media we saw consumer adoption of e-commerce accelerated by 3-5 years in less than three months. And with third party digital targeting and tracking going away, retailers have recognized that the data they own on their customers and their purchases is a valuable asset that they can both sell and use to power more sales for themselves. As these three factors combine with the technology and resources of major retailers like Amazon, Walmart, Kroger, Best Buy and others, the rise of digital retail media is one of the most important new areas for brands to master. READ ON... WHAT DO I NEED TO SCALE MY ADVERTISING IN DIGITAL RETAIL MEDIA? The question we receive most at Exverus is what a brand needs to effectively scale its advertising in digital retail media. In our experience, there are three things you’ll need: 1. The Right Distribution Whether your own storefront on Amazon or shelf space at a retailer available on Instacart, your brand must be sold by the retailers who are active in the retail media space (see a complete list of the top retailers later in this document). Speaking of your goals, working directly with your 2. The Right Budgets retailer, sales and agency teams to set big but Scaling your digital retail achievable goals should be media presence is different step one of the planning for each brand, product and process. And remember, retailer. Make sure you are not all sales data is created working with a team that equal - verify when retailers knows how to size and scale are reporting their own ROAS the opportunity and then figures and “grading their sets budgets that will achieve own homework.” your goals. SO WHAT IS RETAIL MEDIA? Retail media should be a native part of the shopping experience. You may be wondering what we mean by “retail media” and why it deserves to be a topic of discussion for brand marketers. In reality, retail media is nothing new. If you have ever received a flyer from your local grocery store, then you know what retail media is. Today’s retail media still includes those free-standing (printed) inserts, but it has gone digital and achieved an unprecedented scale. That is what we are talking about here – the power of digital retail media for modern brands. Unlike broad consumer media, where the brand hopes to intercept a consumer during his or her entertainment, commuting or informationseeking time, retail media typically (though not always) EXVERUS.COM | 2 3. The Right Metrics reaches the consumer while shopping or thinking about what to buy. The term “digital retail media” typically applies to paid advertising that sits within a retailer’s website or other retailer-owned channels (like Amazon.com), although it can also extend into other media channels when a retailer’s shopper data is leveraged (like Amazon’s display ad solution which applies Amazon user data across 1,000’s of websites). Instead of interrupting, retail media should be a native part of the shopping experience. It is often expected, relevant and solution-oriented. And, by being directly integrated with the retailer’s ecommerce and instore sales platforms, the brand receives valuable data about how consumers are responding on the back end. WHO ARE THE PLAYERS IN RETAIL MEDIA? KEY RETAILERS Not surprisingly, large retailers who sell popular product categories are the major players in retail media. While Amazon has cornered a massive share of the market, other retailers who sell popular, high volume categories are growing every month. Brands primarily in the food, beverage, apparel, beauty, home furnishings, toys and consumer electronics categories are finding new opportunities to increase their digital presence. This has led to an explosion of digital media companies and divisions created exclusively to buy and sell ad space on retailer properties (Walmart, Target, Kroger, Albertson’s, Best Buy and more). The top five players in terms of audience are below: MONTHLY USERS IN MILLIONS (U.S. ONLY) 200 US Audience (MM) Per Month, Aug 2020 150 100 50 0 Amazon Walmart Target Kroger Albertsons Source: site proprietary data NEXT UP: OP RETAIL T MEDIA PLATFORMS EXVERUS.COM | 3 TOP DIGITAL RETAIL MEDIA PLATFORMS TYPES OF ADVERTISING OFFERED PLATFORM BACKGROUND J Amazon DSP AMAZON Amazon has become a critical distribution and sales channel for nearly every type of advertiser. Beyond e-commerce, Amazon is a leading content platform and content distributor through its increasing investment in FireTV, Prime Video and Music. Advertisers have the opportunity to appear in Sponsored Search Listings, Promoted Product Listings and through a variety of display and video ad formats across Desktop, Mobile and OTT. The largest US retailer at over 4,700 locations, Walmart’s proprietary inventory and consumer data feeds omnichannel shopping and advertising. Shop both in-store and online using Walmart’s eCommerce Website & App. J In-grid Search Ads (Sponsored Products) WALMART TARGET/ ROUNDEL EXVERUS.COM | 4 Target is the 8th largest retailer in the U.S, and has invested in media in a big way. Whether carried at Target or not, brands can partner with Roundel to build and reach custom audiences using Target’s 1st party transactional data across Target.com & App, Social, plus curated network on Desktop, Mobile, App, CTV, Criteo SPA, Google Search and Target.com. J Amazon “Search” J Sponsored Brands J Sponsored Display J Sponsored Products J Audio Ads J Video J Custom J ROAS Attribution Data J Buybox Search Ads (Sponsored Brands) J Display Ads J Walmart Shopper Data Provides Closed Loop Attribution J Omnichannel Display Media (Desktop and Mobile) J Video Media (CTV, Desktop, and Mobile) J Closed-loop Media Exposure Attributed Purchases at Target through ROAS TOP DIGITAL RETAIL MEDIA PLATFORMS PLATFORM BACKGROUND Leading supermarket in the U.S. and largest U.S. grocery website with kroger.com eCommerce (Desktop & Mobile) and App KROGER ALBERTSONS PERFORMANCE MEDIA CRITEO INSTACART EXVERUS.COM | 5 Powered by 84.51, Kroger Precision Marketing includes PromoteIQ (think Sponsored Brand Listings on Amazon, but exclusive to Kroger owned Digital Properties). TYPES OF ADVERTISING OFFERED J Addressable TV, Pinterest, Facebook, Influencers, Video, Display & Native, Pandora, Direct Mail/Coupons, Push Notifications, Email, Search J Offline and online sales matched back to specific households through loyalty card data to measure sales lift and ROAS/ Another large U.S. retailer group with J Display Ads (Mobile, Desktop), eCommerce Website, Sponsored Social Posts (FB/IG/Pinterest/ Search, App, Social Media, Influencer, Snapchat), Influencer Social Albertson Co Digital Properties, Posts, Email Blasts, Circular Net Email, Retail Promotions, Traditional/ Downs, Digital Billboards/Kiosks Digital OOH. Criteo’s network reaches over 2.4B shoppers globally. With 4,500 direct publisher integrations and multiple retailer integrations, Criteo is able to leverage some 1st party retailer data to target off site via their programmatic network. J Display, Video, App, CTV/ OTT, Audio, DOOH, Sponsored Products, PMP, Product Carousels, Rich Media Growing quickly and available at 30,000 stores throughout the US, Instacart is a leading Desktop, Mobile, In-app grocery delivery and pickup platform. J Sponsored Featured Products, Delivery Promotions, Coupons and Hero Banners GOING BEYOND RETAILERS Savvy marketers and agencies know that retail media can have a place throughout the customer journey Beyond these individual retail media properties exists a variety of multi-retailer networks. These are media networks that cover more than one retailer media property and aggregate data across millions of consumers. One such example is Criteo, which holds 4,500 direct publisher integrations with retailers and can leverage some 1st party retailer data to target on and off those websites. News America is another leader in this space, with consumer touchpoints that extend beyond online media to their classic in-store, print and sampling touchpoints. HOW SHOULD I THINK ABOUT RETAIL MEDIA AS PART OF MY MARKETING PLAN? Retail media is typically well-suited for lower-funnel marketing objectives: to drive purchase intent, product trial and increased sales velocity. Reaching the customer close to the point of sale is the right approach when a brand wants to drive trial and measure results quickly. That said, savvy marketers and agencies know that retail media can have a place throughout the customer journey and that it does much more than just inspire an immediate purchase. Retail media is a truly full funnel channel when used strategically against your objectives: EXVERUS.COM | 6 Awareness: Making potential customers aware of a brand or product can happen in the “browsing” phase of the retail media experience. The home page is one such example you’ll notice brands taking up significant real estate on the home pages of Amazon, Target, Walmart etc., announcing new product offerings like the latest Xbox console. Familiarity & Consideration: Placing your product contextually within relevant departments and broader categories can help build the association between the brand/product and its value proposition to consumers. As consumers decide to learn more about your product, setting up robust product pages and mini-brand destinations within the retailer site can help bring shoppers down the purchase funnel, allowing them to compare and choose between different offerings. A great example of this is the Amazon Store which is a free tool for brands to set up what is essentially a brand microsite within Amazon and supplies backend data to the marketer. Purchase: The Golden Goose, purchasing is where the really exciting tactical elements of retailer media come into play. Driving purchase through retailer media can happen by purchasing sponsored links when consumers are searching for your brand terms, your competitors, or specific product formulations or item descriptions. Digital retail media also offers a wealth of behavioral and retargeting tactics allowing you to reach customers who previously browsed, search or even bought your brand or a competitor. The data that powers these targeting segments is often exclusive to the retailer, and is unlike 3rd party data which relies on cookies which are currently being phased out of web browsers like Google Chrome. (Google still uses its own data to target consumers). Critically, most digital retail media partners can measure purchases influenced by this media, providing purchasebased accountability. Retention & Loyalty: Purchase- based retargeting of prior buyers enables personalization of ads to offer value and complementary products/ services. This encourages crosssell and brand loyalty. Using first party purchase data can target your brand buyers and incentivize users to enter their email addresses in the ad itself or drive to a landing page to collect first party data into a CRM to further build upon customer retention programs and offers. EXVERUS.COM | 7 WHAT’S THE BEST WAY TO GET STARTED? At Exverus Media, we find that the critical first step to forming a retail media strategy is understanding your current buyers and your target market: What products in your brand and category do they buy most? Where do they currently buy them (i.e. grocery, big box, D2C)? When? How often? What motivates them to buy? What do they want to see from the brand (i.e. what type of offers/content are attractive to them and perceived as more valuable) Once we understand where and how our audience is buying, we want to identify areas of opportunity for growth. Define goals that ladder up to your organization’s business goals, whether it’s entering a new market, increasing household penetration or driving increased purchase frequency. As shown above, these different goals can be achieved through different tactics within the retail media set. In one Exverus client example, a non-perishable consumer packaged beverage product was considering a robust list of 12+ brands as part of its competitive set. Exverus started a Sponsored Products campaign on Amazon against the full list of competitors. Through the course of the campaign, Exverus identified the top two competitive brands within that list that yielded the highest conversion rates and highest return on ad spend. Exverus was able to increase spend against just those top 2 competitors and increase ROAS by 4x. It’s important to remember the goals of your business overall and look at retail media as part of a holistic strategy to drive consumers to your brand. Consider how other touchpoints like television, radio, outdoor and digital might impact your brand awareness and either increase or decrease the need for retail-specific media. Consider regional strategies too: if your product is flying off shelves in one particular region of the U.S., or is difficult to ship cross-county, a national Amazon effort might not be the most efficient way to scale. Moving Forward Retail media is a powerful component in today’s digital media toolkit. Exverus clients are actively testing and scaling to drive incremental sales and grow their brand and products. Consumers are reevaluating their purchase patterns and are open to recommendations from new brands. Gone are the days of products that “live or die” on the basis of placement on the physical shelf, and embrace the new “digital shelf” that is effectively democratizing the playing field for challenger brands to introduce new products to the world. It’s an exciting opportunity and challenge, and in our view, the rewards are significant. If you’d like to get started with retail media, optimizing your current retail media investment and planning full funnel media for your brand, contact us today. ABOUT US Exverus is a paid media agency that builds culturally relevant, growth-stage brands. By utilizing custom, innovative strategies, our clients have maintained their growth and brand relevance and will continue to do so regardless of market conditions through 2021. EXVERUS.COM | 8 TALIA ARNOLD Head of Strategy and Planning BILL DURRANT Managing Director Talia@exverus.com +1 (424) 465-3064 Bill@exverus.com +1 (323) 332-1821