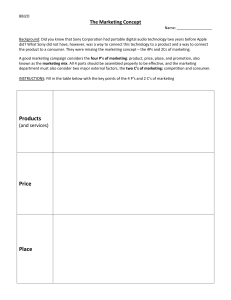

SONY CORPORATION: IS THE SUM GREATER THAN THE PARTS? This study source was downloaded by 100000855448779 from CourseHero.com on 10-24-2022 20:20:30 GMT -05:00 Synopsis • Founded in 1946 by Masaru Ibuka and Akio Morita as a Telecommunications company and renamed Sony in 1958. • Sony has been regarded as a premier consumer electronics brand for decades and have also introduced many innovative consumer electronics products including: • The first transistor radios in the 1950s • The Betamax VCR in 1975 • The Sony Walkman in 1979 • The Discman in 1984 • Sony in 2013 was an enormously complex company operating 8 broadly-defined business segments employing 146,000 people: 1) Imaging Products & Solutions, 2) Games, 3) Mobile Products & Communications, 4) Home Entertainment & Sound, 5) Devices, 6) Pictures, 7) Music, and 8) Financial Services. This study source was downloaded by 100000855448779 from CourseHero.com on 10-24-2022 20:20:30 GMT -05:00 Synopsis • Sony’s history of diversification • In 1961 and the next few years, miscellaneous businesses such as real estate management (Sony Enterprise Co.), retailing, restaurants (the French restaurant Maxim’s), travels (Sony Travel service), and importing sports equipment and luxury goods • In 1962, chemicals (Sony Chemicals Corporation). • In 1965, instrumentation and measuring equipment (a JV with Tektronix) • In 1968, music (a JV with CBS and later acquired CBS Records in 1988) • In 1969, precision measuring instruments (Sony Magnescale) • In 1975, batteries (a JV with Union Carbide) • In 1979, cosmetics (Sony Creative Products Inc.) • In 1979, life insurance (a JV with Prudential Insurance) • In 1980s, computers • In 1989, motion picture (acquired Columbia Pictures Entertainment) • In 1993, game consoles and game titles (Sony Computer Entertainment) • In 1996, digital cameras This study source was downloaded by 100000855448779 from CourseHero.com on 10-24-2022 20:20:30 GMT -05:00 Synopsis • 8 Major Businesses • Imaging Products & Solutions (10.9%): Digital Imaging Products (e.g., compact digital cameras, video cameras, and interchangeable single-lens cameras) + Professional Solutions (e.g., broadcast and professional-use products) • Mobile Products & Communications (18.7%): Mobile phones (Xperia) + computers (VAIO) • Home Entertainment & Sound (14.8%): Televisions (e.g., BRAVIA) and audio and video products (e.g., Blu-ray Disc players and recorders, and portable audio devices) • Game (10.5%): Playstation consoles and game titles • Devices (12.6%): Semiconductor (e.g., CMOS image sensors) + Components (e.g., batteries, recording media, and data recording systems) • Pictures (10.9%): Sony Pictures Entertainment, motion pictures and television production and distribution, based in the US. • Music (6.6%): Sony Music Entertainment This study source was downloaded by 100000855448779 from CourseHero.com on 10-24-2022 20:20:30 GMT -05:00 Synopsis • In 2013, Third Point LLC, a hedge fund based in New York, became the largest owner of Sony Corporation shares (7%). In May 2013, Daniel Loeb, CEO of Third Point, sent a letter to Sony President and CEO Kazuo Hirai with the following proposal: “To maximize Sony’s overall success, we believe the Company should change the structure of its ownership of Sony Entertainment. Doing so will strengthen Sony by reducing its burdensome debt, thereby providing additional resources and capital to focus on revitalizing the resurgent Sony Electronics. • Step 1: Take Public a 15-20% Stake in Sony Entertainment, Allowing It to Thrive independently with the Support of the Sony Parent Company While Increasing Capital to Revitalize Sony Electronics. • Step 2: Focus on Industry-Leading Businesses to Bring Growth to Sony Electronics.” This study source was downloaded by 100000855448779 from CourseHero.com on 10-24-2022 20:20:30 GMT -05:00 Discussion Questions • Check out the history of diversification in Sony as well as current business areas in 2013. Do you think the diversification strategy has benefited Sony? • What was the strategic rationale for entering the entertainment sector? Was it a good choice? • Based on Appendix 2 and Exhibit 1, evaluate the corporate strategy. • Evaluate possible synergies between different business divisions in Sony. Which divisions would generate synergies and which ones would not? Would any of the businesses operate more profitably if they were spun off or sold to another firm? • Given the letter from Third Point LLC, is the entertainment division better off by being owned by Sony? Why does Sony Entertainment underperform most of its peers (as shown in Exhibit 3 and 4)? • Is the other parts of Sony than the entertainment division better off by being operated together with the entertainment division? For instance, what about the insurance division? This study source was downloaded by 100000855448779 from CourseHero.com on 10-24-2022 20:20:30 GMT -05:00 Powered by TCPDF (www.tcpdf.org)