Krugman, Obstfeld, Melitz - International Economics, Theory and Policy

advertisement

M

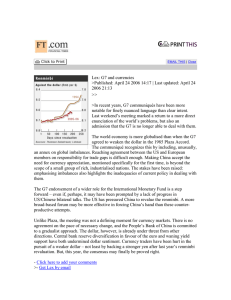

erchandise Trade Flows with the United States

Canada

Japan

We

Eu

United States

Mexico

Australia and

New Zealand

Other Latin

America

Key

= Exports

= Imports

= Less than $20 billion per year

= $20–50 billion

= $50–100 billion

= $100–150 billion

= $150–200 billion

= more than $200 billion

s

Russia

Eastern Europe

Western

Europe

Japan

China

Africa

Other

Asia

Australia and

New Zealand

Source: IMF Direction of Trade Statistics, 2013.

THE PEARSON SERIES IN ECONOMICS

Abel/Bernanke/Croushore

Macroeconomics*

Bade/Parkin

Foundations of Economics*

Berck/Helfand

The Economics of the

Environment

Bierman/Fernandez

Game Theory with

Economic Applications

Blanchard

Macroeconomics*

Blau/Ferber/Winkler

The Economics of Women,

Men, and Work

Boardman/Greenberg/

Vining/Weimer

Cost-Benefit Analysis

Boyer

Principles of

Transportation Economics

Branson

Macroeconomic Theory

and Policy

Bruce

Public Finance and the

American Economy

Carlton/Perloff

Modern Industrial

Organization

Case/Fair/Oster

Principles of Economics*

Chapman

Environmental Economics:

Theory, Application, and

Policy

Cooter/Ulen

Law & Economics

Daniels/VanHoose

International Monetary &

Financial Economics

Downs

An Economic Theory of

Democracy

Ehrenberg/Smith

Modern Labor Economics

Farnham

Economics for Managers

Folland/Goodman/Stano

The Economics of Health

and Health Care

Fort

Sports Economics

*denotes

Froyen

Macroeconomics

Fusfeld

The Age of the Economist

Gerber

International Economics*

González-Rivera

Forecasting for Economics

and Business

Gordon

Macroeconomics*

Greene

Econometric Analysis

Gregory

Essentials of

Economics

Gregory/Stuart

Russian and Soviet

Economic Performance

and Structure

Hartwick/Olewiler

The Economics of Natural

Resource Use

Heilbroner/Milberg

The Making of the Economic

Society

Heyne/Boettke/Prychitko

The Economic Way of

Thinking

Holt

Markets, Games, and

Strategic Behavior

Hubbard/O’Brien

Economics*

Money, Banking, and the

Financial System*

Hubbard/O’Brien/Rafferty

Macroeconomics*

Hughes/Cain

American Economic

History

Husted/Melvin

International

Economics

Jehle/Reny

Advanced Microeconomic

Theory

Johnson-Lans

A Health Economics

Primer

Keat/Young/Erfle

Managerial Economics

Klein

Mathematical Methods for

Economics

Krugman/Obstfeld/Melitz

International Economics:

Theory & Policy*

Laidler

The Demand for Money

Leeds/von Allmen

The Economics of Sports

Leeds/von Allmen/Schiming

Economics*

Lynn

Economic Development:

Theory and Practice for a

Divided World

Miller

Economics Today*

Understanding Modern

Economics

Miller/Benjamin

The Economics of Macro

Issues

Miller/Benjamin/North

The Economics of Public

Issues

Mills/Hamilton

Urban Economics

Mishkin

The Economics of Money,

Banking, and Financial

Markets*

The Economics of Money,

Banking, and Financial

Markets, Business School

Edition*

Macroeconomics: Policy

and Practice*

Murray

Econometrics: A Modern

Introduction

O’Sullivan/Sheffrin/Perez

Economics: Principles,

Applications and Tools*

Parkin

Economics*

Perloff

Microeconomics*

Microeconomics: Theory

and Applications with

Calculus*

Perloff/Brander

Managerial Economics

and Strategy*

MyEconLab Visit www.myeconlab.com to learn more.

Phelps

Health Economics

Pindyck/Rubinfeld

Microeconomics*

Riddell/Shackelford/Stamos/

Schneider

Economics: A Tool for

Critically Understanding

Society

Roberts

The Choice: A Fable of

Free Trade and Protection

Rohlf

Introduction to Economic

Reasoning

Roland

Development Economics

Scherer

Industry Structure,

Strategy, and Public

Policy

Schiller

The Economics of Poverty

and Discrimination

Sherman

Market Regulation

Stock/Watson

Introduction to

Econometrics

Studenmund

Using Econometrics: A

Practical Guide

Tietenberg/Lewis

Environmental and

Natural Resource

Economics

Environmental Economics

and Policy

Todaro/Smith

Economic Development

Waldman/Jensen

Industrial Organization:

Theory and Practice

Walters/Walters/Appel/

Callahan/Centanni/Maex/

O’Neill

Econversations: Today’s

Students Discuss Today’s

Issues

Weil

Economic Growth

Williamson

Macroeconomics

MyEconLab Provides the Power of Practice

®

Optimize your study time with MyEconLab, the online assessment and tutorial system. When you

take a sample test online, MyEconLab gives you targeted feedback and a personalized Study Plan to

identify the topics you need to review.

Study Plan

The Study Plan shows you the sections

you should study next, gives easy access

to practice problems, and provides you

with an automatically generated quiz to

prove mastery of the course material.

Unlimited Practice

As you work each exercise, instant feedback

helps you understand and apply the concepts.

Many Study Plan exercises contain

algorithmically generated values to ensure that

you get as much practice as you need.

Learning Resources

Study Plan problems link to learning resources that

further reinforce concepts you need to master.

r Help Me Solve This learning aids help you break down a

problem much the same way as an instructor would do during

office hours. Help Me Solve This is available for select problems.

r eText links are specific to the problem at hand so that related

concepts are easy to review just when they are needed.

r A graphing tool enables you to build and manipulate graphs to

better understand how concepts, numbers, and graphs connect.

MyEconLab

®

Find out more at www.myeconlab.com

Real-Time Data Analysis Exercises

Up-to-date macro data is a great way to engage in

and understand the usefulness of macro variables

and their impact on the economy. Real-Time Data

Analysis exercises communicate directly with the

Federal Reserve Bank of St. Louis’s FRED® site,

so every time FRED posts new data, students

see new data.

End-of-chapter exercises accompanied by the

Real-Time Data Analysis icon

include RealTime Data versions in MyEconLab.

Select in-text figures labeled MyEconLab RealTime Data update in the electronic version of the

text using FRED data.

Current News Exercises

Posted weekly, we find the latest microeconomic

and macroeconomic news stories, post them,

and write auto-graded multi-part exercises that

illustrate the economic way of thinking about

the news.

Interactive Homework Exercises

Participate in a fun and engaging activity that

helps promote active learning and mastery of

important economic concepts.

Pearson’s experiments program is flexible and

easy for instructors and students to use. For

a complete list of available experiments, visit

www.myeconlab.com.

Choices

Complete Digital Experience

MyEconLab

+

eText

=

Providing Options and Value in Economics

Allow your students to save by purchasing a stand-alone MyEconLab directly from

Pearson at www.myeconlab.com. Pearson’s industry-leading learning solution features

a full Pearson eText and course management functionality. Most importantly,

MyEconLab helps you hold students accountable for class preparation

and supports more active learning styles.Visit www.myeconlab.com to

find out more.

Digital

Students can purchase a three-hole-punched, full-color version of the text via myeconlab.com at a significant discount delivered right to their door.

Instant

eText

Access

Homework

and

Tutorial Only

MyEconLab

=

The CourseSmart eBookstore provides instant, online access to the textbook and

course materials students need at a lower price. CourseSmart’s eTextbooks

are fully searchable and offer the same paging and appearance as the printed

texts. You can preview eTextbooks online anytime at www.coursesmart.com.

=

Same great assessment technology without the Pearson eText.

Students can purchase a three-hole-punched, full-color version of the text via myeconlab.com at a significant discount delivered right to their door.

Great Content + Great Value

Digital + Print

MyEconLab

=

Package our premium bound textbook with a MyEconLab access code for

the most enduring student experience. Find out more at www.myeconlab.com.

Great Content + Great Price

MyEconLab

=

Save your students money and promote an active learning environment by

offering a Student Value Edition—a three-hole-punched, full-color version of

the premium textbook that’s available at a 35% discount—packaged with a

MyEconLab access code at your bookstore.

Custom

Customized Solutions

=

Customize your textbook to match your syllabus. Trim your text to include just the chapters

you need or add chapters from multiple books. With no unused material or

unnecessary expense, Pearson Learning Solutions provides the right content

you need for a course that’s entirely your own. www.pearsonlearningsolutions.com

Contact your Pearson representative for more information on Pearson Choices.

International Economics

THEORY AND POLICY

TENTH EDITION

Paul R. Krugman

Princeton University

Maurice Obstfeld

University of California, Berkeley

Marc J. Melitz

Harvard University

Boston Columbus Indianapolis New York San Francisco Upper Saddle River

Amsterdam Cape Town Dubai London Madrid Milan Munich Paris Montréal Toronto

Delhi Mexico City São Paulo Sydney Hong Kong Seoul Singapore Taipei Tokyo

For Robin—P.K.

For my family—M.O.

For Clair, Benjamin, and Max—M.M.

Editor in Chief: Donna Battista

Acquisitions Editor: Christina Masturzo

Program Manager: Carolyn Philips

Editorial Assistants: Patrick Henning and Christine Mallon

Executive Marketing Manager: Lori DeShazo

Managing Editor: Jeff Holcomb

Production Project Manager: Carla Thompson

Procurement Specialist: Carol Melville

Senior Art Director: Jonathan Boylan

Cover Design: Jonathan Boylan

Interior Design: Integra-Chicago

Image Manager: Rachel Youdelman

Photo Research: Aptara, Inc.

Text Permissions Associate Project Manager: Samantha

Graham

Text Permissions Research: Electronic Publishing

Services, Inc.

Director of Media: Susan Schoenberg

Content Leads, MyEconLab: Courtney Kamauf

and Noel Lotz

Senior Media Producer: Melissa Honig

Full-Service Project Management and Composition:

Integra-Chicago

Printer/Binder: Courier/Kendallville

Cover Printer: Lehigh-Phoenix Color/Hagerstown

Text Font: 10/12 Times New Roman

Acknowledgments of material borrowed from other sources and reproduced, with permission, in this textbook appear on

appropriate page within text. Credits appear on page 753, which constitutes a continuation of the copyright page.

FRED ® is a registered trademark and the FRED ® Logo and ST. LOUIS FED are trademarks of the Federal Reserve Bank

of St. Louis. http://research.stlouisfed.org/fred2/

Microsoft and/or its respective suppliers make no representations about the suitability of the information contained in the

documents and related graphics published as part of the services for any purpose. All such documents and related graphics

are provided “as is” without warranty of any kind. Microsoft and/or its respective suppliers hereby disclaim all warranties and

conditions with regard to this information, including all warranties and conditions of merchantability, whether express, implied

or statutory, fitness for a particular purpose, title and non-infringement. In no event shall Microsoft and/or its respective

suppliers be liable for any special, indirect or consequential damages or any damages whatsoever resulting from loss of use,

data or profits, whether in an action of contract, negligence or other tortious action, arising out of or in connection with the

use or performance of information available from the services.

The documents and related graphics contained herein could include technical inaccuracies or typographical errors. Changes are

periodically added to the information herein. Microsoft and/or its respective suppliers may make improvements and/or

changes in the product(s) and/or the program(s) described herein at any time. Partial screen shots may be viewed in full within the

software version specified.

Microsoft®, Excel®, PowerPoint®, Windows®, and Word® are registered trademarks of the Microsoft Corporation in the

U.S.A. and other countries. This book is not sponsored or endorsed by or affiliated with the Microsoft Corporation.

Copyright © 2015, 2012, 2009 Paul R. Krugman, Maurice Obstfeld, and Marc J. Melitz. All rights reserved.

Manufactured in the United States of America. This publication is protected by copyright, and permission should be obtained

from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by any

means, electronic, mechanical, photocopying, recording, or likewise. To obtain permission(s) to use material from this work,

please submit a written request to Pearson Education, Inc., to Pearson Education, Inc., Permissions Department, One Lake

Street, Upper Saddle River, New Jersey 07458, or you may fax your request to 201-236-3290.

Many of the designations by manufacturers and seller to distinguish their products are claimed as trademarks. Where those

designations appear in this book, and the publisher was aware of a trademark claim, the designations have been printed in

initial caps or all caps.

Library of Congress Cataloging-in-Publication Data

Krugman, Paul R.

International economics: theory and policy/Paul R. Krugman, Princeton University, Maurice Obstfeld,

University of California, Berkeley, Marc J. Melitz, Harvard University.—10th edition.

pages cm

Includes bibliographical references and index.

ISBN 978-0-13-342364-8—ISBN 978-0-13-342363-1 (finance split) —ISBN 978-0-13-342367-9 (trade split)

1. International economic relations. 2. International finance.

I. Obstfeld, Maurice. II. Melitz, Marc J. III. Title.

HF1359.K78 2015

337—dc23

2013046411

10 9 8 7 6 5 4 3 2 1

ISBN 10:

0-13-342364-6

ISBN 13: 978-0-13-342364-8

vii

■

Brief Contents

Contents

Preface

1

PART 1

Introduction

ix

xxiii

1

International Trade Theory

10

2

World Trade: An Overview

10

3

Labor Productivity and Comparative Advantage:

The Ricardian Model

24

4

Specific Factors and Income Distribution

51

5

Resources and Trade: The Heckscher-Ohlin Model

84

6

The Standard Trade Model

118

7

External Economies of Scale and the International

Location of Production

145

8

Firms in the Global Economy: Export Decisions,

Outsourcing, and Multinational Enterprises

164

International Trade Policy

206

The Instruments of Trade Policy

206

10

The Political Economy of Trade Policy

236

11

Trade Policy in Developing Countries

275

12

Controversies in Trade Policy

290

Exchange Rates and Open-Economy Macroeconomics

313

13

National Income Accounting and the Balance of Payments

313

14

Exchange Rates and the Foreign Exchange Market:

An Asset Approach

342

15

Money, Interest Rates, and Exchange Rates

379

16

Price Levels and the Exchange Rate in the Long Run

413

17

Output and the Exchange Rate in the Short Run

451

18

Fixed Exchange Rates and Foreign Exchange Intervention

495

International Macroeconomic Policy

538

19

International Monetary Systems: An Historical Overview

538

20

Financial Globalization: Opportunity and Crisis

597

21

Optimum Currency Areas and the Euro

634

22

Developing Countries: Growth, Crisis, and Reform

670

PART 2

9

PART 3

PART 4

vii

viii

Brief Contents

Mathematical Postscripts

713

Postscript to Chapter 5: The Factor-Proportions Model ...................................................... 713

Postscript to Chapter 6: The Trading World Economy ......................................................... 717

Postscript to Chapter 8: The Monopolistic Competition Model ........................................... 725

Postscript to Chapter 20: Risk Aversion and International Portfolio Diversification ............ 727

Index

735

Credits

753

Contents

Preface ............................................................................................................................xxiii

1

Introduction

1

What Is International Economics About? ...............................................................................3

The Gains from Trade .............................................................................................................4

The Pattern of Trade ...............................................................................................................5

How Much Trade? ...................................................................................................................5

Balance of Payments ................................................................................................................6

Exchange Rate Determination .................................................................................................6

International Policy Coordination ...........................................................................................7

The International Capital Market ............................................................................................8

International Economics: Trade and Money ...........................................................................8

PART 1

2

International Trade Theory

10

World Trade: An Overview

10

Who Trades with Whom? ..................................................................................................... 10

Size Matters: The Gravity Model ........................................................................................... 11

Using the Gravity Model: Looking for Anomalies ................................................................. 13

Impediments to Trade: Distance, Barriers, and Borders ......................................................... 14

The Changing Pattern of World Trade ................................................................................. 16

Has the World Gotten Smaller? .............................................................................................. 16

What Do We Trade? ............................................................................................................... 18

Service Offshoring .................................................................................................................. 19

Do Old Rules Still Apply? .................................................................................................... 21

Summary ............................................................................................................................. 22

3

Labor Productivity and Comparative Advantage:

The Ricardian Model

24

The Concept of Comparative Advantage .............................................................................. 25

A One-Factor Economy ....................................................................................................... 26

Relative Prices and Supply ..................................................................................................... 28

Trade in a One-Factor World ............................................................................................... 29

Determining the Relative Price after Trade ............................................................................ 30

BOX:

Comparative Advantage in Practice: The Case of Babe Ruth ........................................ 33

The Gains from Trade ............................................................................................................ 34

A Note on Relative Wages ...................................................................................................... 35

BOX: The Losses from Nontrade ........................................................................................... 36

Misconceptions about Comparative Advantage ..................................................................... 37

Productivity and Competitiveness .......................................................................................... 37

BOX:

Do Wages Reflect Productivity? ................................................................................... 38

The Pauper Labor Argument ................................................................................................. 38

Exploitation ........................................................................................................................... 39

Comparative Advantage with Many Goods ........................................................................... 40

Setting Up the Model ............................................................................................................ 40

ix

Contents

x

Relative Wages and Specialization .......................................................................................... 40

Determining the Relative Wage in the Multigood Model ....................................................... 42

Adding Transport Costs and Nontraded Goods .................................................................... 44

Empirical Evidence on the Ricardian Model ......................................................................... 45

Summary ............................................................................................................................. 48

4

Specific Factors and Income Distribution

51

The Specific Factors Model ................................................................................................. 52

BOX: What Is a Specific Factor? ........................................................................................... 53

Assumptions of the Model .................................................................................................... 53

Production Possibilities .......................................................................................................... 54

Prices, Wages, and Labor Allocation ...................................................................................... 57

Relative Prices and the Distribution of Income ..................................................................... 61

International Trade in the Specific Factors Model ................................................................ 63

Income Distribution and the Gains from Trade ..................................................................... 64

The Political Economy of Trade: A Preliminary View .......................................................... 67

Income Distribution and Trade Politics .................................................................................. 68

Trade and Unemployment................................................................................ 68

International Labor Mobility ............................................................................................... 70

CASE STUDY: Wage Convergence in the Age of Mass Migration ........................................... 72

CASE STUDY: Immigration and the U.S. Economy ................................................................. 73

Summary ............................................................................................................................. 76

Appendix: Further Details on Specific Factors ..................................................................... 80

CASE STUDY:

Marginal and Total Product ................................................................................................... 80

Relative Prices and the Distribution of Income ..................................................................... 81

5

Resources and Trade: The Heckscher-Ohlin Model

84

Model of a Two-Factor Economy ......................................................................................... 85

Prices and Production ............................................................................................................ 85

Choosing the Mix of Inputs ................................................................................................... 89

Factor Prices and Goods Prices ............................................................................................. 90

Resources and Output ............................................................................................................ 92

Effects of International Trade between Two-Factor Economies ............................................ 94

Relative Prices and the Pattern of Trade ................................................................................ 94

Trade and the Distribution of Income ................................................................................... 96

CASE STUDY: North-South Trade and Income Inequality ...................................................... 97

CASE STUDY: Skill-Biased Technological Change and Income Inequality .............................. 99

Factor-Price Equalization .................................................................................................... 102

Empirical Evidence on the Heckscher-Ohlin Model ........................................................... 103

Trade in Goods as a Substitute for Trade in Factors: Factor Content of Trade ................... 104

Patterns of Exports between Developed and Developing Countries .................................... 107

Implications of the Tests ...................................................................................................... 109

Summary ........................................................................................................................... 110

Appendix: Factor Prices, Goods Prices, and Production Decisions ..................................... 114

Choice of Technique ............................................................................................................ 114

Goods Prices and Factor Prices ........................................................................................... 115

More on Resources and Output ........................................................................................... 117

6

The Standard Trade Model

118

A Standard Model of a Trading Economy .......................................................................... 119

Production Possibilities and Relative Supply ........................................................................ 119

Relative Prices and Demand ................................................................................................ 120

Contents

xi

The Welfare Effect of Changes in the Terms of Trade ......................................................... 123

Determining Relative Prices ................................................................................................. 124

Economic Growth: A Shift of the RS curve ......................................................................... 124

Growth and the Production Possibility Frontier ................................................................... 126

World Relative Supply and the Terms of Trade .................................................................... 126

International Effects of Growth ........................................................................................... 129

CASE STUDY: Has the Growth of Newly Industrializing Countries

Hurt Advanced Nations? ................................................................................................ 129

Tariffs and Export Subsidies: Simultaneous Shifts in RS and RD ....................................... 132

Relative Demand and Supply Effects of a Tariff .................................................................. 132

Effects of an Export Subsidy ................................................................................................ 133

Implications of Terms of Trade Effects: Who Gains and Who Loses?.................................. 134

International Borrowing and Lending ................................................................................. 135

Intertemporal Production Possibilities and Trade................................................................. 135

The Real Interest Rate .......................................................................................................... 136

Intertemporal Comparative Advantage ................................................................................ 138

Summary ........................................................................................................................... 138

Appendix: More on Intertemporal Trade ............................................................................ 142

7

External Economies of Scale and the International

Location of Production

145

Economies of Scale and International Trade: An Overview ................................................. 146

Economies of Scale and Market Structure.......................................................................... 147

The Theory of External Economies .................................................................................... 148

Specialized Suppliers.......................................................................................................... 148

Labor Market Pooling ....................................................................................................... 149

Knowledge Spillovers ......................................................................................................... 150

External Economies and Market Equilibrium ...................................................................... 151

External Economies and International Trade...................................................................... 152

External Economies, Output, and Prices .............................................................................. 152

External Economies and the Pattern of Trade ...................................................................... 153

BOX: Holding the World Together ....................................................................................... 155

Trade and Welfare with External Economies ........................................................................ 156

Dynamic Increasing Returns ................................................................................................ 157

Interregional Trade and Economic Geography .................................................................... 158

BOX: Tinseltown Economics ................................................................................................ 160

Summary ........................................................................................................................... 161

8

Firms in the Global Economy: Export Decisions,

Outsourcing, and Multinational Enterprises

164

The Theory of Imperfect Competition ................................................................................ 165

Monopoly: A Brief Review .................................................................................................. 166

Monopolistic Competition ................................................................................................... 168

Monopolistic Competition and Trade ................................................................................. 173

The Effects of Increased Market Size ................................................................................... 173

Gains from an Integrated Market: A Numerical Example.................................................... 174

The Significance of Intra-Industry Trade ............................................................................. 178

CASE STUDY: Intra-Industry Trade in Action: The North American Auto Pact

of 1964 and the North American Free Trade Agreement (NAFTA) ................................ 180

Firm Responses to Trade: Winners, Losers, and Industry Performance ............................... 181

Performance Differences across Producers ........................................................................... 182

The Effects of Increased Market Size ................................................................................... 184

Trade Costs and Export Decisions...................................................................................... 185

Contents

xii

Dumping ............................................................................................................................ 188

CASE STUDY: Antidumping as Protectionism ....................................................................... 189

Multinationals and Outsourcing ......................................................................................... 190

CASE STUDY: Patterns of Foreign Direct Investment Flows Around the World ..................... 190

The Firm’s Decision Regarding Foreign Direct Investment .................................................. 194

Outsourcing ......................................................................................................................... 195

Shipping Jobs Overseas? Offshoring and Unemployment

in the United States ....................................................................................................... 197

CASE STUDY:

Consequences of Multinationals and Foreign Outsourcing .................................................. 199

Summary ........................................................................................................................... 200

Appendix: Determining Marginal Revenue ......................................................................... 205

PART 2

9

International Trade Policy

206

The Instruments of Trade Policy

206

Basic Tariff Analysis ......................................................................................................... 206

Supply, Demand, and Trade in a Single Industry ................................................................. 207

Effects of a Tariff ................................................................................................................. 209

Measuring the Amount of Protection .................................................................................. 210

Costs and Benefits of a Tariff ............................................................................................ 212

Consumer and Producer Surplus .......................................................................................... 212

Measuring the Costs and Benefits ........................................................................................ 214

BOX: Tariffs for the Long Haul ........................................................................................... 216

Other Instruments of Trade Policy ..................................................................................... 217

Export Subsidies: Theory ..................................................................................................... 217

CASE STUDY:

Europe’s Common Agricultural Policy ........................................................... 218

Import Quotas: Theory ........................................................................................................ 220

CASE STUDY: An Import Quota in Practice: U.S. Sugar ...................................................... 221

Voluntary Export Restraints................................................................................................. 224

CASE STUDY: A Voluntary Export Restraint in Practice ...................................................... 224

Local Content Requirements .............................................................................................. 225

BOX: Bridging the Gap ....................................................................................................... 226

Other Trade Policy Instruments............................................................................................ 227

The Effects of Trade Policy: A Summary ........................................................................... 227

Summary ........................................................................................................................... 228

Appendix: Tariffs and Import Quotas in the Presence of Monopoly .................................... 232

The Model with Free Trade .................................................................................................. 232

The Model with a Tariff ....................................................................................................... 233

The Model with an Import Quota ........................................................................................ 234

Comparing a Tariff and a Quota .......................................................................................... 234

10

The Political Economy of Trade Policy

236

The Case for Free Trade .................................................................................................... 237

Free Trade and Efficiency ..................................................................................................... 237

Additional Gains from Free Trade ....................................................................................... 238

Rent Seeking ........................................................................................................................ 239

Political Argument for Free Trade ........................................................................................ 239

CASE STUDY: The Gains from 1992 ..................................................................................... 240

National Welfare Arguments against Free Trade ................................................................ 242

The Terms of Trade Argument for a Tariff .......................................................................... 242

Contents

xiii

The Domestic Market Failure Argument against Free Trade................................................ 243

How Convincing Is the Market Failure Argument? .............................................................. 245

Income Distribution and Trade Policy ................................................................................ 246

Electoral Competition .......................................................................................................... 247

Collective Action .................................................................................................................. 248

BOX: Politicians for Sale: Evidence from the 1990s .............................................................. 249

Modeling the Political Process.............................................................................................. 250

Who Gets Protected? ............................................................................................................ 250

International Negotiations and Trade Policy ...................................................................... 252

The Advantages of Negotiation ........................................................................................... 253

International Trade Agreements: A Brief History ................................................................ 254

The Uruguay Round ............................................................................................................ 256

Trade Liberalization ............................................................................................................. 256

Administrative Reforms: From the GATT to the WTO........................................................ 257

Benefits and Costs ................................................................................................................ 258

BOX: Settling a Dispute—and Creating One ....................................................................... 259

CASE STUDY: Testing the WTO’s Metal .............................................................................. 260

The Doha Disappointment ................................................................................................. 261

BOX: Do Agricultural Subsidies Hurt the Third World? ....................................................... 262

Preferential Trading Agreements .......................................................................................... 263

Free Trade Area versus Customs Union ...................................................................... 265

Do Trade Preferences Have Appeal? .......................................................................... 266

CASE STUDY: Trade Diversion in South America ................................................................. 267

Summary ........................................................................................................................... 268

Appendix: Proving that the Optimum Tariff Is Positive....................................................... 272

BOX:

BOX:

Demand and Supply ............................................................................................................. 272

The Tariff and Prices ............................................................................................................ 272

The Tariff and Domestic Welfare ......................................................................................... 273

11

Trade Policy in Developing Countries

275

Import-Substituting Industrialization ................................................................................. 276

The Infant Industry Argument ............................................................................................. 277

Promoting Manufacturing Through Protection .................................................................... 278

CASE STUDY: Mexico Abandons Import-Substituting Industrialization ................................ 280

Results of Favoring Manufacturing: Problems of Import-Substituting Industrialization ...... 281

Trade Liberalization since 1985 .......................................................................................... 282

Trade and Growth: Takeoff in Asia .................................................................................... 284

BOX: India’s Boom.............................................................................................................. 287

Summary ........................................................................................................................... 287

12

Controversies in Trade Policy

290

Sophisticated Arguments for Activist Trade Policy ............................................................. 291

Technology and Externalities ............................................................................................... 291

Imperfect Competition and Strategic Trade Policy ............................................................... 293

BOX: A Warning from Intel’s Founder ................................................................................. 296

CASE STUDY: When the Chips Were Up .............................................................................. 297

Globalization and Low-Wage Labor ................................................................................... 299

The Anti-Globalization Movement ...................................................................................... 299

Trade and Wages Revisited ................................................................................................... 300

Labor Standards and Trade Negotiations............................................................................. 302

Environmental and Cultural Issues ...................................................................................... 303

The WTO and National Independence................................................................................. 303

Contents

xiv

CASE STUDY: A Tragedy in Bangladesh ............................................................................... 304

Globalization and the Environment ..................................................................................... 305

Globalization, Growth, and Pollution .................................................................................. 306

The Problem of “Pollution Havens” ..................................................................................... 307

The Carbon Tariff Dispute................................................................................................... 309

Summary ........................................................................................................................... 310

PART 3

13

Exchange Rates and Open-Economy Macroeconomics

313

National Income Accounting and the Balance

of Payments

313

The National Income Accounts .......................................................................................... 315

National Product and National Income ............................................................................... 316

Capital Depreciation and International Transfers ................................................................ 317

Gross Domestic Product ...................................................................................................... 317

National Income Accounting for an Open Economy ............................................................ 318

Consumption ....................................................................................................................... 318

Investment............................................................................................................................ 318

Government Purchases ......................................................................................................... 319

The National Income Identity for an Open Economy .......................................................... 319

An Imaginary Open Economy.............................................................................................. 320

The Current Account and Foreign Indebtedness .................................................................. 320

Saving and the Current Account .......................................................................................... 323

Private and Government Saving ........................................................................................... 324

BOX: The Mystery of the Missing Deficit ........................................................................... 325

The Balance of Payments Accounts .................................................................................... 326

Examples of Paired Transactions ......................................................................................... 327

The Fundamental Balance of Payments Identity.................................................................. 329

The Current Account, Once Again ....................................................................................... 329

The Capital Account ............................................................................................................ 330

The Financial Account ......................................................................................................... 331

Net Errors and Omissions .................................................................................................... 332

Official Reserve Transactions ............................................................................................... 332

CASE STUDY: The Assets and Liabilities of the World’s Biggest Debtor ............................... 334

Summary ........................................................................................................................... 337

14

Exchange Rates and the Foreign Exchange Market:

An Asset Approach

342

Exchange Rates and International Transactions ................................................................. 343

Domestic and Foreign Prices ................................................................................................ 344

Exchange Rates and Relative Prices...................................................................................... 345

The Foreign Exchange Market ........................................................................................... 346

The Actors ........................................................................................................................... 346

BOX:

Exchange Rates, Auto Prices, and Currency Wars...................................................... 347

Characteristics of the Market ............................................................................................... 348

Spot Rates and Forward Rates ............................................................................................. 350

Foreign Exchange Swaps ...................................................................................................... 351

Futures and Options ............................................................................................................ 351

The Demand for Foreign Currency Assets........................................................................... 352

Assets and Asset Returns ..................................................................................................... 352

Contents

BOX:

xv

Nondeliverable Forward Exchange Trading in Asia ..................................................... 353

Risk and Liquidity ............................................................................................................... 355

Interest Rates ....................................................................................................................... 356

Exchange Rates and Asset Returns ...................................................................................... 357

A Simple Rule ...................................................................................................................... 358

Return, Risk, and Liquidity in the Foreign Exchange Market .............................................. 360

Equilibrium in the Foreign Exchange Market ..................................................................... 361

Interest Parity: The Basic Equilibrium Condition ................................................................ 361

How Changes in the Current Exchange Rate Affect

Expected Returns ............................................................................................................ 362

The Equilibrium Exchange Rate .......................................................................................... 363

Interest Rates, Expectations, and Equilibrium .................................................................... 366

The Effect of Changing Interest Rates on the Current Exchange Rate ................................. 366

The Effect of Changing Expectations on the Current Exchange Rate .................................. 367

CASE STUDY: What Explains the Carry Trade? ................................................................... 368

Summary ........................................................................................................................... 370

Appendix: Forward Exchange Rates and Covered Interest Parity ........................................ 376

15

Money, Interest Rates, and Exchange Rates

379

Money Defined: A Brief Review ......................................................................................... 380

Money as a Medium of Exchange ........................................................................................ 380

Money as a Unit of Account ................................................................................................ 380

Money as a Store of Value ................................................................................................... 381

What Is Money? ................................................................................................................... 381

How the Money Supply Is Determined ................................................................................ 381

The Demand for Money by Individuals ............................................................................... 382

Expected Return................................................................................................................... 382

Risk...................................................................................................................................... 383

Liquidity .............................................................................................................................. 383

Aggregate Money Demand ................................................................................................. 383

The Equilibrium Interest Rate: The Interaction of Money Supply

and Demand .................................................................................................................. 385

Equilibrium in the Money Market ....................................................................................... 385

Interest Rates and the Money Supply ................................................................................... 387

Output and the Interest Rate ................................................................................................ 388

The Money Supply and the Exchange Rate in the Short Run............................................... 389

Linking Money, the Interest Rate, and the Exchange Rate ................................................... 389

U.S. Money Supply and the Dollar/Euro Exchange Rate ..................................................... 391

Europe’s Money Supply and the Dollar/Euro Exchange Rate .............................................. 392

Money, the Price Level, and the Exchange Rate in the Long Run ........................................ 394

Money and Money Prices..................................................................................................... 394

The Long-Run Effects of Money Supply Changes ............................................................... 395

Empirical Evidence on Money Supplies and Price Levels ..................................................... 396

Money and the Exchange Rate in the Long Run .................................................................. 397

Inflation and Exchange Rate Dynamics .............................................................................. 398

Short-Run Price Rigidity versus Long-Run Price Flexibility ................................................ 398

BOX:

Money Supply Growth and Hyperinflation in Zimbabwe ............................................ 400

Permanent Money Supply Changes and the Exchange Rate................................................. 401

Exchange Rate Overshooting ............................................................................................... 403

CASE STUDY: Can Higher Inflation Lead to Currency Appreciation? The Implications

of Inflation Targeting .................................................................................................... 405

Summary ........................................................................................................................... 408

Contents

xvi

16

Price Levels and the Exchange Rate in the Long Run

413

The Law of One Price........................................................................................................ 414

Purchasing Power Parity .................................................................................................... 415

The Relationship between PPP and the Law of One Price .................................................... 415

Absolute PPP and Relative PPP ........................................................................................... 416

A Long-Run Exchange Rate Model Based on PPP ............................................................. 417

The Fundamental Equation of the Monetary Approach ...................................................... 417

Ongoing Inflation, Interest Parity, and PPP ......................................................................... 419

The Fisher Effect .................................................................................................................. 420

Empirical Evidence on PPP and the Law of One Price ....................................................... 423

Explaining the Problems with PPP..................................................................................... 425

Trade Barriers and Nontradables ......................................................................................... 425

Departures from Free Competition ...................................................................................... 426

Differences in Consumption Patterns and Price Level Measurement.................................... 427

BOX: Some Meaty Evidence on the Law of One Price ......................................................... 427

PPP in the Short Run and in the Long Run .......................................................................... 430

CASE STUDY: Why Price Levels Are Lower in Poorer Countries .......................................... 431

Beyond Purchasing Power Parity: A General Model of Long-Run Exchange

Rates ............................................................................................................................ 432

The Real Exchange Rate ...................................................................................................... 433

Demand, Supply, and the Long-Run Real Exchange Rate.................................................... 435

BOX: Sticky Prices and the Law of One Price: Evidence from Scandinavian

Duty-Free Shops ........................................................................................................... 435

Nominal and Real Exchange Rates in Long-Run Equilibrium ............................................. 438

International Interest Rate Differences and the Real Exchange Rate................................... 440

Real Interest Parity ............................................................................................................ 441

Summary ........................................................................................................................... 443

Appendix: The Fisher Effect, the Interest Rate, and the Exchange Rate under

the Flexible-Price Monetary Approach .......................................................................... 448

17

Output and the Exchange Rate in the Short Run

451

Determinants of Aggregate Demand in an Open Economy.................................................. 452

Determinants of Consumption Demand .............................................................................. 452

Determinants of the Current Account ................................................................................. 453

How Real Exchange Rate Changes Affect the Current Account........................................... 454

How Disposable Income Changes Affect the Current Account ............................................ 455

The Equation of Aggregate Demand .................................................................................. 455

The Real Exchange Rate and Aggregate Demand ................................................................ 455

Real Income and Aggregate Demand ................................................................................... 456

How Output Is Determined in the Short Run ...................................................................... 457

Output Market Equilibrium in the Short Run: The DD Schedule ........................................ 458

Output, the Exchange Rate, and Output Market Equilibrium .............................................. 458

Deriving the DD Schedule .................................................................................................... 459

Factors that Shift the DD Schedule ...................................................................................... 459

Asset Market Equilibrium in the Short Run: The AA Schedule ........................................... 462

Output, the Exchange Rate, and Asset Market Equilibrium ................................................. 463

Deriving the AA Schedule .................................................................................................... 464

Factors that Shift the AA Schedule....................................................................................... 465

Short-Run Equilibrium for an Open Economy: Putting the DD and AA

Schedules Together ........................................................................................................ 466

Temporary Changes in Monetary and Fiscal Policy ............................................................ 468

Contents

xvii

Monetary Policy ................................................................................................................... 468

Fiscal Policy ......................................................................................................................... 469

Policies to Maintain Full Employment ................................................................................. 470

Inflation Bias and Other Problems of Policy Formulation................................................... 471

Permanent Shifts in Monetary and Fiscal Policy ................................................................ 472

A Permanent Increase in the Money Supply......................................................................... 473

Adjustment to a Permanent Increase in the Money Supply .................................................. 474

A Permanent Fiscal Expansion ............................................................................................ 475

Macroeconomic Policies and the Current Account .............................................................. 477

Gradual Trade Flow Adjustment and Current Account Dynamics ....................................... 478

The J-Curve.......................................................................................................................... 478

Exchange Rate Pass-Through and Inflation ......................................................................... 480

The Current Account, Wealth, and Exchange Rate Dynamics ............................................. 481

The Liquidity Trap............................................................................................................. 481

CASE STUDY: How Big Is the Government Spending Multiplier? .......................................... 484

Summary ........................................................................................................................... 485

Appendix 1: Intertemporal Trade and Consumption Demand .............................................. 490

Appendix 2: The Marshall-Lerner Condition and Empirical Estimates

of Trade Elasticities ...................................................................................................... 492

18

Fixed Exchange Rates and Foreign Exchange

Intervention

495

Why Study Fixed Exchange Rates? .................................................................................... 496

Central Bank Intervention and the Money Supply ............................................................... 497

The Central Bank Balance Sheet and the Money Supply ..................................................... 497

Foreign Exchange Intervention and the Money Supply ........................................................ 499

Sterilization .......................................................................................................................... 500

The Balance of Payments and the Money Supply ................................................................ 500

How the Central Bank Fixes the Exchange Rate................................................................. 501

Foreign Exchange Market Equilibrium under a Fixed Exchange Rate ................................. 502

Money Market Equilibrium under a Fixed Exchange Rate .................................................. 502

A Diagrammatic Analysis .................................................................................................... 503

Stabilization Policies with a Fixed Exchange Rate .............................................................. 504

Monetary Policy ................................................................................................................... 505

Fiscal Policy ......................................................................................................................... 506

Changes in the Exchange Rate ............................................................................................. 507

Adjustment to Fiscal Policy and Exchange Rate Changes .................................................... 508

Balance of Payments Crises and Capital Flight .................................................................. 509

Managed Floating and Sterilized Intervention .................................................................... 512

Perfect Asset Substitutability and the Ineffectiveness of Sterilized Intervention ................... 512

CASE STUDY:

Can Markets Attack a Strong Currency? The Case of Switzerland ................ 513

Foreign Exchange Market Equilibrium under Imperfect Asset Substitutability.................... 515

The Effects of Sterilized Intervention with Imperfect Asset Substitutability ........................ 515

Evidence on the Effects of Sterilized Intervention ................................................................ 517

Reserve Currencies in the World Monetary System ............................................................. 518

The Mechanics of a Reserve Currency Standard .................................................................. 518

The Asymmetric Position of the Reserve Center .................................................................. 519

The Gold Standard............................................................................................................. 520

The Mechanics of a Gold Standard ..................................................................................... 520

Symmetric Monetary Adjustment under a Gold Standard ................................................... 520

Benefits and Drawbacks of the Gold Standard .................................................................... 521

The Bimetallic Standard ....................................................................................................... 522

The Gold Exchange Standard .............................................................................................. 522

Contents

xviii

CASE STUDY: The Demand for International Reserves ......................................................... 523

Summary ........................................................................................................................... 527

Appendix 1: Equilibrium in the Foreign Exchange Market with Imperfect

Asset Substitutability .................................................................................................... 532

Demand ............................................................................................................................... 532

Supply .................................................................................................................................. 533

Equilibrium .......................................................................................................................... 533

Appendix 2: The Timing of Balance of Payments Crises ..................................................... 535

PART 4 International Macroeconomic Policy

19

International Monetary Systems: An Historical Overview

538

538

Macroeconomic Policy Goals in an Open Economy ............................................................ 539

Internal Balance: Full Employment and Price Level Stability .............................................. 540

External Balance: The Optimal Level of the Current Account ............................................. 541

BOX: Can a Country Borrow Forever? The Case of New Zealand ........................................ 543

Classifying Monetary Systems: The Open-Economy Monetary Trilemma .......................... 547

International Macroeconomic Policy under the Gold Standard, 1870–1914 ......................... 548

Origins of the Gold Standard............................................................................................... 548

External Balance under the Gold Standard .......................................................................... 549

The Price-Specie-Flow Mechanism ...................................................................................... 549

The Gold Standard “Rules of the Game”: Myth and Reality ............................................... 550

Internal Balance under the Gold Standard ........................................................................... 551

CASE STUDY: The Political Economy of Exchange Rate Regimes: Conflict

over America’s Monetary Standard during the 1890s ..................................................... 552

The Interwar Years, 1918–1939 .......................................................................................... 553

The Fleeting Return to Gold ................................................................................................ 553

International Economic Disintegration ................................................................................ 554

CASE STUDY: The International Gold Standard and the Great Depression ........................... 555

The Bretton Woods System and the International Monetary Fund ...................................... 556

Goals and Structure of the IMF .......................................................................................... 557

Convertibility and the Expansion of Private Financial Flows .............................................. 558

Speculative Capital Flows and Crises ................................................................................... 559

Analyzing Policy Options for Reaching Internal and External Balance ............................... 560

Maintaining Internal Balance............................................................................................... 560

Maintaining External Balance .............................................................................................. 562

Expenditure-Changing and Expenditure-Switching Policies ................................................. 562

The External Balance Problem of the United States under Bretton Woods.......................... 564

CASE STUDY: The End of Bretton Woods, Worldwide Inflation, and

the Transition to Floating Rates .................................................................................... 565

The Mechanics of Imported Inflation .................................................................................. 566

Assessment ........................................................................................................................... 567

The Case for Floating Exchange Rates ............................................................................... 568

Monetary Policy Autonomy ................................................................................................. 568

Symmetry ............................................................................................................................. 569

Exchange Rates as Automatic Stabilizers ............................................................................. 570

Exchange Rates and External Balance.................................................................................. 572

CASE STUDY: The First Years of Floating Rates, 1973–1990 ............................................... 572

Macroeconomic Interdependence under a Floating Rate ..................................................... 576

CASE STUDY: Transformation and Crisis in the World Economy .......................................... 577

What Has Been Learned since 1973? .................................................................................. 583

Contents

xix

Monetary Policy Autonomy ................................................................................................. 583

Symmetry ............................................................................................................................. 584

The Exchange Rate as an Automatic Stabilizer .................................................................... 585

External Balance .................................................................................................................. 585

The Problem of Policy Coordination.................................................................................... 586

Are Fixed Exchange Rates Even an Option for Most Countries? ......................................... 586

Summary ........................................................................................................................... 587

Appendix: International Policy Coordination Failures ......................................................... 594

20

Financial Globalization: Opportunity and Crisis

597

The International Capital Market and the Gains from Trade .............................................. 598

Three Types of Gain from Trade .......................................................................................... 598

Risk Aversion ....................................................................................................................... 600