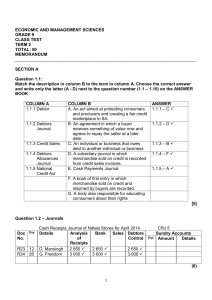

Trade and other receivables Myburgh hoofstuk/chapter 11 Learning outcomes After completion of this lecture, you should be able to: • Apply the accounting treatment of debtors. • Know when an asset is classified as a current asset. • To understand, calculate and disclose Credit losses and Allowance for credit losses Dad what is the difference between a debtor and a creditor? A debtor is a man who owes money. AND A creditor is the man who thinks he is going to get it. ACCF121 (PTY) LIMITED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2015 Note 2015 2014 R R ASSETS Non-current assets Property, plant and equipment 2 0 0 Intangible assets 3 0 0 Financial assets 4 0 0 Inventory 5 0 0 Trade and other receivables 6 0 0 Cash and cash equivalents 7 0 0 0 0 Current assets Total assets What is a current asset? An asset is a current asset if it satisfies the following criteria: • it is expected to be realised in, or is intended for sale or consumption in, the entity’s normal operating cycle; • it is held primarily for the purpose of being traded; • it is expected to be realised within twelve months after the end of the reporting period; or • it is cash or a cash equivalent (unless it is restricted in use for at least 12 months after year-end). Current assets Current assets: • Inventory • Debtors • Cash and cash equivalent Credit policy • How much credit may be given to debtors • Credit terms • Settlement discount • Levying of interest Accounting records General ledger Debtors ledger Debtors list debtors control account account for each debtors list of DL balances Regular reconciliation: Debtors control with debtors ledger Debtors with credit balances Debtors with credit balances should be shown as creditors. IAS 1 Credit losses (bad debt) A debtor's account is irrecoverable settle his account. debtor is unable to Debtor is no longer an asset (no of future economic benefits). That debtor must therefore be written off as an expense. This expense is called credit losses. Class example Jeff Skilling is a debtor of PUK Traders and owes R10 000. However, Jeff Skilling has been sequestrated and his estate paid 5 cents for each rand that he owes. Class example Dr Bank 500 Cr Dr Debtors Credit loss (expense) Cr Debtors 500 9 500 9 500 What happens if… What happens if an entity expects that a debtor is unable to settle his account (or part thereof)? Allowance for credit losses Expected losses In some cases an entity may have an expectation that a debtor(s) may not be able to settle their debts. Since an expectation already exists in that period, an expense (loss) should be recognised. Dr Credit losses(E) Cr Allowance for credit losses (A) Set off against debtors in Financial statements Allowance for credit losses Expected losses This allowance is normally adjusted at the end of every year to the expected credit losses incurred. Credit losses and VAT Output VAT initially charged (e.g. at the time of the sale), may be claimed as input VAT. This may only be done once the debt has been written off (confirmed as being irrecoverable). Not with allowance Credit losses and VAT When an allowance for credit losses is created for specific debtors, it is done at the amount excluding VAT. Presentation and disclosure ABC Traders Statement of financial position as at 29 February 2012 Note R Current assets Trade and other receivables 7 49,000 Presentation and disclosure ABC Traders Notes for the year ended 29 February 2012 7. Trade and other debtors Trade debtors less: allowance for credit losses Accrued income Prepaid expenses 50,000 -3,000 1,500 500 49,000