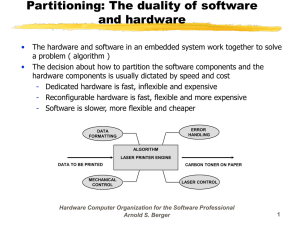

S w 909B06 ADAMAC INC. Emily Saunders wrote this case under the supervision of Elizabeth M.A. Grasby solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. Richard Ivey School of Business Foundation prohibits any form of reproduction, storage or transmission without its written permission. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Richard Ivey School of Business Foundation, The University of Western Ontario, London, Ontario, Canada, N6A 3K7; phone (519) 661-3208; fax (519) 661-3882; e-mail cases@ivey.uwo.ca. Copyright © 2009, Richard Ivey School of Business Foundation Version: (A) 2011-02-09 It was a Sunday afternoon in mid-August 2008, and Ryan Olliver, a shareholder and employee of Adamac Inc. (Adamac), finally had the opportunity to reflect on the disaster that had struck his plant two weeks earlier: a machine malfunction had caused a complete shutdown of operations for eight days. Adamac was a small laser and water jet cutting corporation, located west of Toronto. The company was growing very quickly, which continuously presented multiple challenges and opportunities that had to be dealt with in a timely manner. To keep up with this rapid growth and to avoid another disaster, Adamac was in need of an expansion, which meant new equipment, more personnel and a bigger location. But was the investment worth the returns? In addition, Olliver wondered whether he should buy out one of his shareholders. Where would the money come from for one or both of these investments? THE CANADIAN MANUFACTURING INDUSTRY The manufacturing industry was comprised of establishments primarily engaged in the physical or chemical transformation of materials or substances into new products.1 Since Adamac and its clients were part of this industry, it was important that Olliver paid close attention to its current and future state. Unfortunately, the North American manufacturing industry had not performed well over the previous five years. Although Canadian manufacturing revenue had increased each year since 2002, the growth rate had decreased dramatically. The largest contributor to this drop in growth came from the transportation equipment industry, the largest subsector in the manufacturing sector,2 where sales had declined since 2005 and were not expected to improve in the near future. Another contributor to the decline in growth was the rising Canadian dollar’s value relative to its U.S. dollar counterpart. Many Canadian manufacturing companies sold to U.S. clients, and with the increasing value of the Canadian dollar, manufactured goods became more expensive to buy in American funds, thus making it less attractive to American companies to purchase Canadian goods. 1 2 www.ic.gc.ca/canadian_industry_statistics/cis.nsf/IDE/cis31-33defe.html, January 19, 2009. www40.statcan.ca/l01/cst01/manuf11.htm, January 19, 2009. This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860 Page 2 9B09B006 Manufacturing companies regularly imported needed components from countries throughout the world because prices were cheaper, primarily due to lower labour costs. These manufacturing companies imported hundreds of thousands of dollars worth of components each month. Even if Adamac could compete on price with international companies, it did not have the capacity to supply many of these clients; consequently, Adamac and its direct competitors processed manufacturers’ orders that were too small to be worthwhile contracting offshore. ADAMAC: 2003 TO 2008 History After many years as a cutting machine operator for Perts, a laser cutting and water jet company in the Greater Toronto Area, Ryan Olliver was promoted to a management position where he learned the “ins and outs” of the business and soon realized how inefficiently Perts’s operations were run. In Olliver’s opinion, the company had too many upper managers who did not understand the basics of the business, yet were paid six-figure salaries. Olliver knew that Perts was in trouble, and he decided that it was in his best interest to leave Perts and to start a company of his own. Olliver and a fellow Perts employee, Ben Watts, incorporated their own company, Adamac Inc., on June 1, 2003, and began operations. Adamac would offer the same services as Perts, but the new company would operate more efficiently and would offer its clients exceptional customer service. The decision to leave a stable job to start his own business was a risky one for Olliver. He used all the family’s savings accumulated over the past decade to start Adamac, with no guarantee of success. Olliver knew that if Adamac did do well, he would be able to provide his wife and children with opportunities that he had never thought possible, but the risk of failure was alarming. After discussions with a bank, it became clear that, alone, the two partners did not have the necessary startup capital to secure a loan. The hunt for a third shareholder began, as well as the search for a potential site for Adamac. In early 2003, during discussions with a potential landlord, Watts found the third investor. The landlord, Marshall Degena, was very intrigued with the business idea and mentioned it to his son, Mike Degena, who, after many deliberations, became Adamac’s third shareholder. All three shareholders would own a third of the business, and Adamac would move into Degena’s father’s building. Degena would have no part in the operations of the business. Operations began with a water jet machine, which Olliver and Watts had purchased used for $245,000. In its first fiscal year, Adamac had sales of over $200,000, and the partners decided to purchase a used laser cutter for $405,000. Adamac owned a third machine called a wire cutter, but it was used very little in comparison to the laser cutter and water jet machines. Sales doubled over the next two years wherein machine operators and an additional programmer where hired. Up until this point, Olliver had done all the programming, which involved entering the design that the client wanted into the computer so the machine would know where to cut. In fiscal 2007, sales exceeded $1.6 million, and fiscal 2008 looked like it would be even more successful. Level sales were experienced throughout the year. Refer to Exhibit 1 for each year’s statements of earnings since incorporation and to Exhibit 2 for the fiscal 2008 balance sheet. This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860 Page 3 9B09B006 Success Factors Olliver believed there were three main factors contributing to Adamac’s success: exceptional customer service, high-quality work, and the security that Adamac depended on one client’s work for no more than 10 per cent of its annual sales. As Adamac’s direct competitors became more and more price-competitive, Olliver and Watts decided not to compete on price but on service. Olliver, who had always excelled at “people skills,” provided his clients with the best customer service he could offer: We try our best to make few mistakes; however, sometimes it is out of our control. For example, the metal we buy from our suppliers may not be up to the level of satisfaction of our clients. Typically, we do not recognize this until after the metal is cut. This is an expensive problem to fix because we have to repurchase the metal and start from scratch; however, I see a big positive out of a negative –– this is a chance to show our customers how much we value their business. We always redo anything a client is not happy with –– no questions asked. Adamac charged premium prices, but offered a premium product. Olliver and Watts did not cost cut when it came to materials or labour, and they believed they offered a better product as a result. Olliver saw two major benefits to this approach. First, the majority of Adamac’s competitors offered low prices but also low quality and little customer service, so they were suffering along with the rest of the manufacturing industry. Second, customers who were willing to pay more for good customer service and a higher quality product typically ran their operations with a similar approach to that of Adamac, and, like Adamac, they were doing well in the industry even when it was declining. In the partners’ views, prosperous customers meant continued business for Adamac. Finally, Olliver worked hard to ensure a diverse group of clients contributed to Adamac’s annual revenues and that no one particular business represented more than 10 per cent of annual sales. If a business went under, Adamac would be somewhat protected from significant losses. Although the majority of Adamac’s clients were in the manufacturing industry, Adamac also had customers in sectors such as agriculture and finance. If a particular sector or subsector fell onto hard times, Adamac could look for sales from customers from other industries. Current Operations At the beginning of summer 2008, Adamac had over 70 clients and had reached its maximum capacity. Olliver managed all communication with Adamac’s suppliers and customers, and he performed half of the programming. As a result, he was working at least six days a week, including some 15-hour days. Employees included Olliver, Watts, Olliver’s wife, Jennifer, who handled most of the administrative work, one additional programmer and four machine operators. The machines ran two shifts, one in the day and one in the evening, with Watts running the evening shift. Both Olliver and Watts were exhausted, but they did not want to turn business away. Laser and Water Jet Cutting Laser and water jet cutting of materials was primarily used by industrial manufacturing companies, but work came from several other industries. A laser cutter machine used a laser to cut materials and was operated by a computer that directed the machine where to cut. A laser cutter machine used focused light This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860 Page 4 9B09B006 mixed with cutting gases to melt, burn, vaporize or blow away the material, leaving a precise edge. A water jet cutter machine operated similarly to the laser cutter, but it used a jet of water that was mixed with crushed granite as an abrasive material to precisely cut metals and other materials. In comparison to water jet cutting, laser cutting was faster and cheaper for customers; however, laser cutting was limited to thinner materials, such as flat sheet steel. Water jets could cut thicker metal, as well as stone and ceramics. For examples of the high precision cutting done by laser cutters and water jets, refer to Exhibit 3. THE CRISIS On the Monday morning of the last week in July 2008, Adamac’s laser cutter had a fatal error and stopped working completely. The machine required an extensive cleaning to get up and working again at its regular capacity, which took eight full working days. Since Adamac was already pressed to complete its customers’ orders, Olliver was forced to ship materials to two other cutting shops to complete these jobs. Contracting out this work was an expensive ordeal for Adamac. Due to the cleaning of the machine, as well as the added chaos of the recent events, not only was Adamac making no profits on its laser sales, but it was spending an additional $750 a day on material and labour on the work done at the two other cutting shops. It was also costing $250 a day to transport raw materials and finished goods between Adamac’s warehouse and the two shops’ locations. Olliver estimated that, on average, the laser cutter broke down approximately six days a year. The water jet also broke down approximately five days a year, costing Adamac $625 a day to outsource any work, plus transportation costs. In addition to the high costs of sending work out of its shop, Adamac always took a big risk that the finished product might not be of the quality its customers had come to expect. So far, Olliver had been lucky since no complaints had been made, but it was something that still concerned him. FUTURE PLANS Expansion Olliver and Watts had discussed the need for new machines, even before the current crisis. Customer demand was increasing, and both the laser cutter and water jet were operating at full capacity. When the laser cutter broke down, Olliver and Watts started looking into the purchase of a new one. If Adamac had owned a second laser cutter, it could have reduced, if not eliminated, the current disaster by operating the second machine during the night shift (instead of sending work to other shops). Olliver was trying to decide whether he should buy the laser cutter, buy a laser cutter and a water jet, or buy neither. Purchasing a second laser cutter was Olliver’s priority. He could buy a used laser cutter for approximately $500,000 and a used water jet for approximately $200,000, both including installation. Currently, the laser cutter brought in 55 per cent of Adamac’s revenue, and the water jet brought in 40 per cent. The wire cutter brought in the remaining five per cent of annual revenues. Olliver hoped that a second laser cutter would eventually bring in the equivalent sales dollars, but it would take a few years to reach this demand, so he estimated that the second laser cutter would be operating at only 40 per cent to 55 per cent capacity for the first couple of years of operations. If Olliver opted to purchase a water jet as well, he was confident that both the new laser cutter and the water jet machines would operate at an average of 40 per cent capacity the first few years after they were purchased, which included the sales Adamac was This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860 Page 5 9B09B006 currently losing when the original machines broke down. Both machines would be amortized using the straight-line method over a useful life of 10 years. The laser cutter would have an estimated salvage value of $35,000 and the water jet an estimated salvage value of $10,000. The bank supplying Adamac with the loan to purchase the equipment required a down payment of 10 per cent of the total loan. Olliver estimated that Adamac would finance the loan over four years and would make monthly principal and interest payments at an interest rate of eight per cent. Adamac had managed to produce and maintain a strong cash flow, but if Olliver and Watts decided to purchase two machines, cash could become a problem. Adding to expenses was the fact that Olliver would need to hire two additional employees if either one or both machines were purchased. Adamac would need a new machine operator, who would earn an hourly wage of $24, as well as a programmer/quoter, who would earn an annual salary of $50,000. Both employees would work 40 hours a week for 50 weeks a year. Adamac would also have no choice but to change locations if new machinery was purchased. After doing some research, Olliver concluded they would need approximately 10,000 square feet, regardless of whether Adamac purchased one or two machines. Most landlords in the area charged $1 per square foot per month, and moving costs were estimated at $50,000. If a new machine was bought, inventory would have to increase. Olliver expected materials to increase at the same rate as sales. In fiscal 2008, operating expenses, excluding management salaries, wages and benefits, and rent, were $42,079 per month. Olliver expected these operating expenses would remain the same percentage of sales for fiscal 2009. Gross margins would stay the same as for fiscal 2008. The Buyout Along with the needed expansion, Olliver and Watts had been considering buying out Degena. Degena’s original investment had been returned more than three times since 2003. He had never been involved in operations or in any company decisions, and Olliver and Watts had not seen him in months. The success of the business was almost entirely attributable to the hard work of Adamac’s employees and the decisions made by Olliver and Watts. Both shareholders were ready to become the sole owners of Adamac; in fact, they had had multiple discussions with a lawyer to begin the process of offering a buyout to Degena. This would involve monthly payments to Degena over a period of two years. If Adamac was making payments to the bank as well as supporting the current business operations, Olliver wondered whether Adamac would have the cash available to make the machinery down payments and pay off Degena. Furthermore, Olliver debated whether buying out Degena while undergoing an expansion was too risky, given the current state of the manufacturing industry. CONCLUSION Olliver sighed and decided to stay in the office for a few more hours in the hope that he could reach some conclusions. Which expansion route should Adamac take, if any? Should the two working partners attempt to buy out Degena? And if the decision was made to take on both these actions, in what order should they be done? This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860 Page 6 9B09B006 Exhibit 1 STATEMENT OF EARNINGS For the year ending May 31 Revenue Less: Cost of goods sold Gross profit Expenses: Management salaries Wages & benefits Amortization1 Repairs & maintenance Rent Loan interest Factory supplies Auto expenses Legal fees Utilities Telephone Insurance Miscellaneous Travel & entertainment Delivery charges Office supplies Computer software expense Garbage service Advertising & promotion Operating earnings before tax Income tax Net earnings after tax 2005 2006 2007 2008 $ 413,095 $ 934,938 $ 1,096,771 $ 1,613,750 87,210 220,435 241,959 282,677 325,885 714,503 854,812 1,331,073 128,360 10,038 65,165 4,441 14,805 19,398 15,852 0 2,591 16,686 3,801 4,793 3,229 3,715 1,985 4,805 0 1,663 0 301,327 133,546 147,227 85,238 4,781 36,978 25,381 31,515 0 6,380 30,801 3,807 5,881 4,722 5,093 0 5,750 0 6,021 206 533,327 189,649 208,058 61,546 20,767 41,563 15,787 33,248 21,557 5,136 30,149 4,990 9,788 0 2,522 0 6,126 2,019 5,700 449 659,054 244,219 308,434 256,099 25,305 37,714 27,847 92,886 22,884 4,242 38,711 6,848 9,283 2,962 3,405 2,385 3,817 0 8,275 0 1,095,316 24,558 181,176 195,758 235,757 4,573 33,799 36,500 44,794 $ 19,985 $ 147,377 $ 159,258 $ 190,963 Source: Adamac Inc. 1 Amortization had significantly increased, primarily due to an expensive upgrade of the wire cutter machine. This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860 Page 7 9B09B006 Exhibit 2 BALANCE SHEET As at May 31, 2008 ASSETS Current Assets: Cash Accounts receivable1 Inventory Prepaid rent $ 100,135 330,133 32,766 3,656 Fixed Assets: Computer equipment Less: Accumulated amortization 10,280 1,339 8,941 Leasehold improvements Less: Accumulated amortization 18,606 1,767 16,839 Machinery and equipment Less: Accumulated amortization 743,516 326,877 416,639 Office Equipment Less: Accumulated amortization 2,314 399 1,915 Vehicles Less: Accumulated amortization 98,600 36,400 62,200 Total Assets $ 973,224 LIABILITIES AND EQUITY Liabilities: Accounts payable2 Employee deductions payable Bank Loan Shareholders’ advances3 Total Liabilities Equity Common shares Retained earnings Total Equity Total Liabilities and Equity $ 38,814 15,307 327,201 (139,991) 241,331 214,310 517,583 731,893 $ 973,224 Source: Adamac Inc. 1 Accounts receivable was total due from customers. Accounts payable was amount due to Adamac's material suppliers. 3 Advances were to Olliver and Watts, to be repaid in equal installments over five years, with first payment due June 1, 2009. 2 This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860 Page 8 9B09B006 Exhibit 3 HIGH-PRECISION CUTTING EXAMPLES One-inch thick laminated glass being water jet cut for the Scotia Tower downtown Toronto. The stream of water is coming out at a pressure of 55,000 PSI, travelling at twice the speed of sound. Source: Adamac Inc. A stone tile inset with copper, cut for a high-end Muskoka cottage. Source: Adamac Inc. This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860 Page 9 9B09B006 Exhibit 3 (continued) Black granite inset into red granite, cut for a Ferrari dealership. Source: Adamac Inc. Two-inch-thick aluminum parts, cut for the aerospace industry. Source: Adamac Inc. This document is authorized for educator review use only by Ngoc Tran, Beta Education until Jan 2022. Copying or posting is an infringement of copyright. Permissions@hbsp.harvard.edu or 617.783.7860