Partnership Dissolution: Accounting Principles & Methods

advertisement

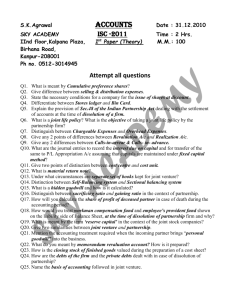

Chapter 19: Partnership Dissolution Partnership dissolution is the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on as distinguished from the winding up of the business. A partner’s capital interest is a claim against the net assets of the partnership. An interest in profit or loss determines how the partner’s capital interest will increase or decrease as a result of subsequent operations. Capital balances are historical cost figures. Assignment of an Interest to a Third Party A partnership is not dissolved when a partner assigns his/her interest in the partnership to a third party, because such an assignment does not itself change the relationship of the partners. Assignment only entitles the assignee to receive the assigning partner’s interest in future partnership profits and assets in the event of liquidation. The assignee does not obtain the rights of a partner. The only change required on the partnership books is to transfer the interest of the assignor partner to the assignee. Partnerships commonly deviate from GAAP in the following areas: o The use of cash basis instead of accrual basis o The use of prior period adjustments o The use of current values instead of historical cost o The recognition of goodwill Revaluation Approach (Goodwill Procedure/Non-GAAP) The use of fair values provides an equitable measure of each partner’s capital interest in the partnership The practice of recognizing increases in net assets is not in compliance with GAAP. This approach results in a marked departure from the historical cost principle. Bonus Approach (Book Value-GAAP) This approach retains the historical cost carrying value. The following rules are to be observed in relation to valuation of assets and liabilities on dissolution problems: 1. If there is an agreement among partners that revaluation is allowed, then reflect the necessary adjustments before dissolution. 2. In the absence of an agreement, a. Revaluation approach- assets and liabilities should be recorded at their fair value; all assets acquired by the new entity, including goodwill, should be recorded b. Bonus approach- existing book values should not be adjusted to fair value unless such adjustments would have been otherwise allowed by GAAP - Decreases or write-downs in the value of assets may be recognized even though they are not realized. - Does not prevent the recognition of asset appreciation Admission of a New Partner A new partner can be admitted with the consent of all partners in the business. This leads to the formation of a new partnership and a dissolution of the previous one. A partnership agreement is binding only when the relationship between the original parties to the agreement remains unchanged. The purchase of interest from one or more of the existing partners is a personal transaction between the incoming partner and the selling partner/s. No additional money or properties are invested in the partnership. The only entry made transfers an amount from the selling partner’s capital account to the new partner’s capital account. Comparison of Book Value and Revaluation Approach Both approaches will yield the same results if: 1. The new partner’s P/L sharing ratio must be equal to his/her capital interest 2. The old partners continue to share P/L between themselves in the original ratio Both approaches will not yield the same results if the incoming partner’s share in P/L is not identical with the percentage interest allowed in assets. Therefore, the selection process for the new partner should be: 1. Prefer book value approach if P/L interest > Capital interest 2. Prefer revaluation approach if P/L interest < Capital interest In admission by investment, any gain or loss recognized on sales subsequent to recording the admission will be allocated on the basis of the new profit and loss ratio.