Accounting Exercises: Equity, Income, Liabilities, Assets

advertisement

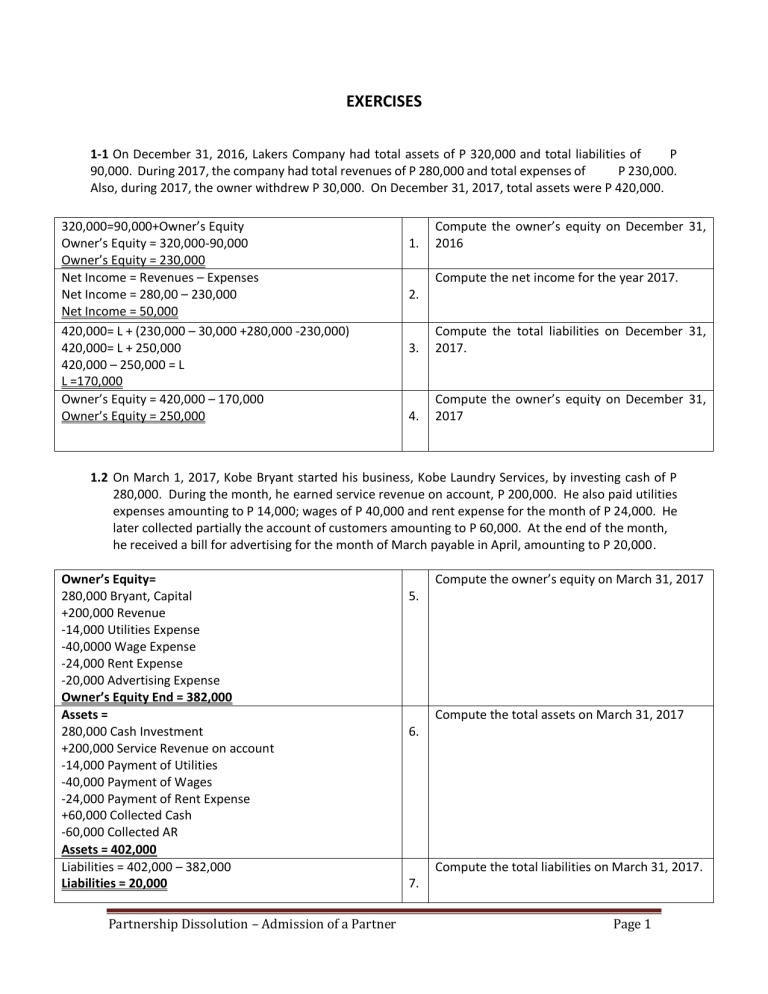

EXERCISES 1-1 On December 31, 2016, Lakers Company had total assets of P 320,000 and total liabilities of P 90,000. During 2017, the company had total revenues of P 280,000 and total expenses of P 230,000. Also, during 2017, the owner withdrew P 30,000. On December 31, 2017, total assets were P 420,000. 320,000=90,000+Owner’s Equity Owner’s Equity = 320,000-90,000 Owner’s Equity = 230,000 Net Income = Revenues – Expenses Net Income = 280,00 – 230,000 Net Income = 50,000 420,000= L + (230,000 – 30,000 +280,000 -230,000) 420,000= L + 250,000 420,000 – 250,000 = L L =170,000 Owner’s Equity = 420,000 – 170,000 Owner’s Equity = 250,000 1. Compute the owner’s equity on December 31, 2016 Compute the net income for the year 2017. 2. 3. Compute the total liabilities on December 31, 2017. 4. Compute the owner’s equity on December 31, 2017 1.2 On March 1, 2017, Kobe Bryant started his business, Kobe Laundry Services, by investing cash of P 280,000. During the month, he earned service revenue on account, P 200,000. He also paid utilities expenses amounting to P 14,000; wages of P 40,000 and rent expense for the month of P 24,000. He later collected partially the account of customers amounting to P 60,000. At the end of the month, he received a bill for advertising for the month of March payable in April, amounting to P 20,000. Owner’s Equity= 280,000 Bryant, Capital +200,000 Revenue -14,000 Utilities Expense -40,0000 Wage Expense -24,000 Rent Expense -20,000 Advertising Expense Owner’s Equity End = 382,000 Assets = 280,000 Cash Investment +200,000 Service Revenue on account -14,000 Payment of Utilities -40,000 Payment of Wages -24,000 Payment of Rent Expense +60,000 Collected Cash -60,000 Collected AR Assets = 402,000 Liabilities = 402,000 – 382,000 Liabilities = 20,000 Partnership Dissolution – Admission of a Partner Compute the owner’s equity on March 31, 2017 5. Compute the total assets on March 31, 2017 6. Compute the total liabilities on March 31, 2017. 7. Page 1 Net Income = 200,000 – (14,000+40,000+24,000+20,000) Net Income = 200,000 – 98,000 Net Income = 102,000 8. Compute the net income for the month of March 2017 1-3 During the current year, the assets of Clipper’s Company increased by P 232,000 and the liabilities decreased by P 54,000. If the owner’s equity in the business is P 620,000 at the end of the year, how much is the owner’s equity at the beginning of the year? A = Beginning Assets L = Beginning Liabilities A – L = END OE A+232,000 = (L – 54,000) + 620,000 A-L = 620,000 – 54,0000 -232,000 A-L = 334,000 1-4 The balance sheet of Miami Company shows owner’s equity of P 680,000, which is equal to 2/3 of the amount of total assets. What is the amount of total assets? Total liabilities? 680,000/(2/3) = L + 680,000 1,020,000 = L + 680,000 L = 1,020,000 - 680,000 L = 340,000 A=1,020,000; L=340,000; OE=680,000 1-5 The following data relates to Warriors Company: Withdrawals by the owner Total revenues during the year Owner’s equity, January 1 Additional investments Total expenses during the year P 56,000 308,000 220,000 94,000 232,000 How much is the owner’s equity at the end of the year? Owner’s equity, January 1 Additional investments Withdrawals by the owner Total revenues during the year Total expenses during the year Owner’s Equity, end 1-6 220,000 94,000 (56,000) 308,000 (232,000) 334,000 Given are the following selected data of Thunder Repair Service Company Revenue from professional services rendered for cash P 490,000 Revenue from professional services rendered on account 160,000 Additional investment by the owner 104,000 Cash collected from account customers 230,000 Partnership Dissolution – Admission of a Partner Page 2 Operating expenses incurred on account Operating expenses incurred for cash Cash withdrawn by the owner 48,000 140,000 76,000 Compute for the net income of the company. Revenue from professional services rendered for cash Revenue from professional services rendered on account Operating expenses incurred on account Operating expenses incurred for cash Net Income 1-7 490,000 160,000 (48,000) (140,000) 462,000 You are given the following data: Assets Liabilities December 31, 2016 P 520,000 ? December 31, 2017 P 670,000 300,000 During 2017: Net loss, P 20,000; Additional investment, P 35,000; Drawings, P 60,000 Compute for the beginning balance of liabilities. Beginning OE = 670,000-300,000+20,000-35,000+60,000 Beginning OE = 415,000 Beginning L = 520,000-415,000 Beginning L = 105,000 1-8. The following trial balance did not balance. JERRY WEST, CPA Trial Balance December 31, 2017 Debit Cash Accounts receivable Supplies Office equipment Accounts payable Jerry West, Capital Jerry West, Drawing Professional fees Salaries expense Advertising expense Rent expense Partnership Dissolution – Admission of a Partner Credit 28,400 +2700 22,310-2700 30,000-23400 50,000+23400 46,600+540 90,000 _8,000+5000 42,660+8010 24,000+60005000 9,100-5000 4,000 Page 3 Utilities expense Miscellaneous expense 5,000+2500+2500 1,000 181,810 179,260 The following errors were detected: 1. Cash received from a customer on account was debited for P 4,700 and Accounts Receivable was credited for the same amount. The actual collection was for P 7,400. 2. The purchase of a computer on account for P 23,400 was recorded as a debit to supplies for P 23,400 and a credit to Accounts payable for P 23,400. 3. Services were performed on account to a client for P 8,900. Accounts receivable was debited for P 8,900 while Professional fees was credited for P 890. 4. A debit posting to Salaries expense of P 6,000 was omitted. 5. A payment on account for P 2,060 was credited to Cash for P 2,060 but debited to Accounts payable for P 2,600. 6. The withdrawal of P 5,000 cash by the owner for his personal use was debited Salaries expense. 7. Utilities expense of P 2,500 was posted as a credit rather than a debit. 8. The balance of Advertising expense is P 4,100 but it was listed as P 9,100 on the trial balance. Required: Prepare a corrected trial balance. JERRY WEST, CPA Trial Balance December 31, 2017 Debit Cash Accounts receivable Supplies Office equipment Accounts payable Jerry West, Capital Jerry West, Drawing Professional fees Salaries expense Advertising expense Rent expense Utilities expense Miscellaneous expense 31,100 19,610 6,600 73,400 47,140 90,000 13,000 50,670 25,000 4,100 4,000 10,000 1,000 187,810 1-9 Credit 187,810 Given the following independent cases, answer the following: Partnership Dissolution – Admission of a Partner Page 4 1. On June 1, 2017, ABC Company collected a total of P 43,200 as payment in advance of a oneyear subscription contract to a monthly magazine from a client beginning June 1, 2017. Give the entries needed to record (a) the receipt of the subscription fees and (b) to adjust the accounts on December 31, 2017 using the liability method and the revenue method. Liability Method Cash Unearned Revenue 43,200 43,200 Adjustment Unearned Revenue Fees Earned 2. 3. 43,200 43,200 Adjustment 25,200 25,200 Fees Earned Unearned Revenue 18,000 18,000 Sincere Company incurs salaries at the rate of P 12,600 per day. It pays the employees every Saturday for a 6 day work-week. The last payday was January 27. Give the adjusting entry on January 31. Salaries Expense 37,800 Salaries Payable 37,800 Gonzales and Mendoza, a law firm, performed legal services in late December, 2017 for clients. The P 42,000 of the services will be billed to the clients in January, 2018. Give the adjusting entry that is necessary on December 31, 2017 if the financial statements are prepared at the end of each month. Accounts Receivable Service Revenue 4. Income Method Cash Fees Earned 42,000 42,000 Assume that a company acquires a building on January 1, 2017 at a cost of P 1,410,000. The building has an estimated useful life of 25 years and an estimated residual value of P 150,000. What adjusting entry is needed on December 31, 2017 to record the depreciation for the entire year? Depreciation Expense = (1,410,000-150,000)/(1/25) Depreciation Expense = 50,400 Depreciation Expense Accumulated Depreciation 5. 50,400 50,400 Give the adjusting entries needed as of December 31, the last day of the current year. Show your computations after each entry. (a) The balance of the supplies account is a debit of P 14,125. The inventory of supplies on December 31 amounts to P 4,220. Partnership Dissolution – Admission of a Partner Page 5 (b) (c) (d) (e) (f) (g) Supplies Expense 9,905 Supplies 9,905 The insurance expense account has a debit balance of P 46,800 which represent a oneyear insurance premium paid in advance on October 1. Prepaid Insurance 35,100 Insurance Expense 35,100 The balance of the prepaid rent account is a debit of P 27,000 which represent a 6-month rent received in advance on October 15. Rent Expense 11,250 Prepaid Rent 11,250 The taxes expense account includes a debit of P 64,800 which represent an advance payment of taxes for one year beginning April 30. Prepaid tax 21,600 Tax expense 21,600 The advertising expense account includes a debit of P 111,072 which represent the cost of an advertising contract to publish the company ad in 52 consecutive issues of weekly magazine. As of December 31, advertisements had appeared in 32 issues already. Prepaid Advertisement 42,720 Advertising Expense 42,720 The balance of the equipment account is a debit of P 235,200 which represent the cost of office equipment purchased at the beginning of the year. This equipment was estimated to have a life of 15 years with a residual value of P 9,600. Depreciation Expense – Equipment 15,040 Accumulated Depreciation – Equipment 15,040 An automobile was acquired on July 1 at a cost of P 720,000. This automobile was estimated to have a life of 8 years with a residual value of P 90,000. Depreciation Expense – Equipment 39,375 Accumulated Depreciation – Equipment 6. 39,375 Give the adjusting entries needed as of December 31, the end of the current fiscal year. Show your computations after each entry. (a) The rent revenue account showed a credit balance of P 48,000 which represent a 6month rent received in advance from a tenant on October 31. Rent Revenue 32,000 Unearned Revenue 32,000 (b) The balance of the unearned commissions account is a credit of P 35,100 which represent commissions received in advance for selling one dozen computer sets. As of December 31, only 5 computer sets were sold. Unearned commission 14,625 Commission 14,625 (c) Service fees of P 264,000 were collected for one year in advance on April 1. These are credited to Unearned Service Fees when received. Unearned Service Fees 198,000 Service Fees 198,000 (d) Subscriptions income has a credit balance of P 14,040 which represent a one-year subscription to a monthly magazine received in advance on May 31. Subscription Income 5,850 Partnership Dissolution – Admission of a Partner Page 6 (e) (f) 1-10 1. Unearned Subscription income 5,850 The company pays a total of P 90,000 every Friday for a 5-day work week ending Friday. Assume that the last day of the year falls on a Wednesday. Wages Expense 54,000 Wages Payable 54,000 The company had rendered services to a client towards the end of December. The bill for P 14,100 will be sent in January of the following year. Accounts Receivable 14,100 Service Revenue 14,100 Prepare the adjusting entries on December 31, 2017, the end of the annual accounting period, on the following independent data. Show your computations after each entry. The Insurance Expense account had a debit balance on December 31, 2017 of P 72,000 representing premium for a 2-year fire insurance policy effective October 1, 2017. Prepaid Insurance Insurance Expense 2. 63,000 63,000 Rent Income was credited for P 58,500 on November 1, 2017 representing 9 months rent collected in advance. Rent Income 45,500 Unearned Rent Income 45,500 3. Machinery per general ledger on December 31, 2017 shows a balance of P 558,000. Machinery acquired during the year was P 78,000 on March 1, 2017. All machinery is to be depreciated at the rate of 25% per annum. Depreciation Expense – Machinery Accumulated Depreciation – Machinery 4. 18,000 18,000 Supplies costing P 18,000 bought during the period was debited to the Supplies account. Of the amount, P 8,000 were consumed during the year. Supplies Expense Supplies 6. 8,000 8,000 Unearned Subscriptions account showed a credit balance of P 76,000 per general ledger on December 31. Of this, 40% had been actually earned during the period. Unearned Subscription Subscription Revenue 7. 136,250 As of December 31, 2017, commissions already earned but not yet collected amounted to P 18,000. Accounts Receivable Commission 5. 136,250 30,400 30,400 On December 31, 2017 a 60-day, 9% Notes Payable has a balance of P 360,000 per general ledger. The note was issued on December 5, 2017. No interest has been taken on this note. Interest Expense Interest Payable 2,340 2,340 Partnership Dissolution – Admission of a Partner Page 7 8. Fees Collected in Advance has a balance of P 600,000 of which 60% has been earned. Unearned Fees Fees Earned 9. 360,000 360,000 Notes Receivable has a balance of P 300,000 received from a customer in settlement of an open account on November 16, 2017. The note is a 90-day, 12% note. No interest has been taken on this note. Interest Receivable Interest Revenue 10. 4,500 4,500 The Prepaid Insurance account has balance of P 105,000 on December 31, 2017. The balance represented two fire insurance policies acquired during 2017. The first policy, Policy I for P 60,000 was acquired on March 1, 2017 and the second policy, Policy II was acquired on August 1, 2017 for P 45,000. Policy I is payment for a 2-year plan while Policy II is for a one-year plan. Insurance Expense 43,750 Prepaid Insurance 43,750 I-11. Compute for the missing items as indicated by a letter below. Sales 175,000 D 280,000 440,000 Beginning Inventory A 62,000 72,000 90,000 Net Purchases 85,000 E 217,000 I Ending Inventory 60,000 68,000 F 110,000 Cost of Goods sold B 158,000 G J Gross Profit 90,000 110,000 100,000 K Operating Expenses C 40,000 H 170,000 A. 60,000 (85,000+60,000-85,000) G. 180,000 (280,000-100,000) B. 85,000 (175,000-90,000=85,000) H. 151,000 (100,000+51,000) C. 28,000 (90,000-62,000=28,000) I. 200,000 (180,000+110,000-90,000) D. 268,000 (158,000+110,000) J. 180,000 (440,000-260,000) E. 164,000 (158,000+68,000-62,000) K. 260,000 (170,000+90,000) Net Income (Net Loss) 62,000 70,000 (51,000) 90,000 F. 109,000 (72,000+217,000-180,000) 1-12. Given the following data, solve for the following: Debit Sales Sales returns and allowances Partnership Dissolution – Admission of a Partner Credit P 425,000 P 14,000 Page 8 Accounts receivable Allowance for bad debts 43,000 760 1. If the estimate of uncollectibles is made by taking 10% of outstanding accounts receivable, the amount of the adjustment is 3,540. 2. The following accounts were abstracted from Lakers Co.’s unadjusted trial balance at December 31, 2017. Accounts receivable Allowance for bad debts Net credit sales Debit P 700,000 8,000 Credit P 3,000,000 Lakers estimates that 1% of the gross account receivable will become uncollectible. After adjustment at December 31, 2017, the Allowance for Bad Debts should have a credit balance of 15,000. 1-13. The following accounts were found in the ledger of Blondie Company on December 31, 2017: Accounts receivable Allowance for bad debts Cash Sales Credit Sales Debit P 356,800 8,760 Credit P 913,800 1,851,000 Instructions: 1.) Prepare the adjusting entry to take up the provision for bad debts account on the books of Blondie Company under each of the following independent assumptions: a) Analysis indicates that 5%of the outstanding accounts receivable will not be collected. Required ending balance of Allowance for Doubtful Accounts P17,840 (5% x P 356,800) Add debit balance of allowance before adjustment 8,760 Doubtful Accounts Expense for the period P26,600 Doubtful Accounts Expense Allowance for Doubtful Accounts 26,600 26,600 b) Accounts receivable of P 40,000 will become uncollectible. Required ending balance of Allowance for Doubtful Accounts Add debit balance of allowance before adjustment Doubtful Accounts Expense for the period Partnership Dissolution – Admission of a Partner P 40,000 8,760 P 48, 760 Page 9 Doubtful Accounts Expense Accounts Receivable 48,760 48,760 c) Accounts receivable of P 10,000 is to be written off, and that the allowance for bad debts is to be adjusted to 10% of the outstanding accounts receivable. Allowance for doubtful accounts Accounts Receivable 10,000 10,000 Required ending balance of Allowance for Doubtful Accounts (10% x P 346,800) Add debit balance of allowance before adjustment Doubtful Accounts Expense for the period Doubtful Accounts Expense Allowance for Doubtful Accounts P 34,680 18,760 P 53,440 53,440 53,440 2.) Show how the Accounts Receivable and the Allowance for Bad Debts would appear on the December 31, 2017 Statement of Financial Position. Accounts Receivable Allowance for Bad Debts Debit 298,040 Partnership Dissolution – Admission of a Partner Credit 61,280 Page 10 EXERCISES 2-1 Harmon joined a partnership by contributing the following: cash, P 20,000; accounts receivable, P 4,000; land P 240,000 cost, P 400,000 fair value; and accounts payable, P 16,000. What will be the initial amount recorded in Harmon’s capital account? Give the entry to record the investment of Harmon. Cash 20,000 AR 4,000 Land 400,000 AP 16,000 Harmon, Capital 408,000 Solution: 20k + 4k + 400k – 16K = 408k 2-2 Prepare the journal entry to record the investment of Mar Gonzales in the new partnership assuming the following independent cases: a. Merchandise inventory with a cost of P 200,000 with an agreed value equal to 70% of its cost. b. Cash of P 800,000. c. Accounts receivable of P 430,000 with an estimated uncollectible accounts of P 50,000. d. Office equipment with a cost of P 800,000 with an accumulated depreciation of P 200,000 after 5 years of use with no residual value. The office equipment was accepted to have an agreed 10 year useful life. Adjustments: a) Merchandise Inventory 140,000 Gonzales, Capital 140,000 (200,000*70% = 140,000) b) Cash 800,000 Gonzales, Capital 800,000 c) AR 430,000 Allowance for Bad Debts 50,00 Gonzales, Capital 380,000 d) Office Equipment 400,000 Gonzales, Capital 400,000 (800,000*(5/10) Cash AR Merchandise Inventory Office Equipment Allowance for Bad Debts Gonzales Capital 800,000 430,000 140,000 400,000 Partnership Dissolution – Admission of a Partner 50,000 1,720,000 Page 11 2-3 The following data as of May 1, 2017 were taken from the records of Andre and Andy: ANDRE ANDY Cash P 11,000 P 22,354 Accounts receivable 234,536 567,890 Inventories 120,035 260,102 Land 603,000 Building 428,267 Furniture & Fixtures 50,345 34,789 Other Assets 2,000 3,600 Total Assets P1,020,916 ========= P1,317,002 ========= Accounts Payable Notes Payable Andre, Capital Andy, Capital P 178,940 200,000 641,976 P 243,650 345,000 Total Liabilities and Capital P1,020,916 ========= 728,352 P1,317,002 ========= Andre and Andy agreed to form a partnership by contributing their respective assets and equities subject to the following adjustments: a) Inventories of P 5,500 and P 6,700 are worthless in Andre’s and Andy’s respective books. b) Accounts receivable of P 20,000 in Andre’s book and P 35,000 in Andy’s book are uncollectible. c) Other assets of P 2,000 and P 3,600 in Andre’s and Andy’s respective books are to be written off. 1) Assuming the partnership will use the books of Andre, give the entries to adjust the account balances of Andre and to record the investment of Andy. Adjust the books of Andre a) Andre, Capital 5,500 Inventories 5,500 b) Andre, Capital 20,000 Accounts Receivable 20,000 c) Andre, Capital 2,000 Other assets 2,000 Record the investment of Andy Cash Accounts Receivable (567,890-35,000) Inventories 22,354 532,890 253,402 Partnership Dissolution – Admission of a Partner Page 12 2) 3) (260,102-6,700=253,402) Building 428,267 Furniture &Fixtures 34,789 Accounts Payable 243,650 Notes Payable 345,000 Andy, Capital 683,052 Give the entries to adjust and close the books of Andy. a) Andy Capital 6,700 Inventories 6,700 b) Andy, Capital 35,000 Accounts Receivable 35,000 c) Andy, Capital 3,600 Other Asset 3,600 Accounts Payable 243,650 Notes Payable 345,000 Andy Capital 683,052 Cash 22,354 Accounts Receivable 532,890 Inventories 253,402 (260,102-6,700=253,402) Building 428,267 Furnitures &Fixtures 34,789 Assuming the partnership will use new set of books, give the entries to record the investment of Andre and Andy. Cash 22,354 Accounts Receivable 532,890 Inventories 253,402 Building 428,267 Furnitures &Fixtures 34,789 Accounts Payable 243,650 Notes Payable 345,000 Andy, Capital 683,052 To record the investment of Andy Cash Accounts Receivable Inventories (120,035 – 5,500 = 114,535) Land Furnitures &Fixtures Accounts Payable Notes Payable Andy, Capital To record the investment of Andre 11,000 214,536 114,535 603,000 50,345 Partnership Dissolution – Admission of a Partner 178,940 200,000 614,476 Page 13 4) Prepare the statement of financial position of the new partnership. Andre and Andy Statement of Financial Position May 1, 2017 Current Assets Cash Accounts receivable Inventories 33,354 747,426 367,937 Non-Current Assets Land Building Furniture & Fixtures Total Assets 603,000 428,267 85,134 2,265,118 Accounts Payable Notes Payable Andre, Capital Andy, Capital 422,590 545,000 614,476 683,052 Total Liabilities &Capital 2,265,118 2-4 On July 1, 2017. Ding and Dong agreed to invest equal amounts and share profits and losses equally in a partnership with Ding investing P 110,000 cash and merchandise valued at P 140,000. Dong will also invest a total of P 250,000, including cash, and the agreed values of various items as shown below: INVESTMENT BY DONG BOOK VALUE FAIR MARKET VALUE Accounts Receivable P 195,000 P 195,000 Allowance for Bad Debts 8,750 12,500 Merchandise Inventory 23,250 26,250 Equipment, net 30,000 20,000 Accounts Payable 75,000 75,000 1. What amount of cash should Dong invest upon the formation of the partnership? Accounts Receivable Merchandise Inventory Equipment Allowance for Bad Debt Accounts Payable Dong, Capital To record the Investment of Dong Cash Partnership Dissolution – Admission of a Partner 195,000 26,250 20,000 12,500 75,000 153,750 110,000 Page 14 Merchandise Inventory Ding, Capital To record the investment of Ding 140,000 250,000 Solution: 195K+26,250+20K-12500-75K = 153, 750 250K(Ding’s Cap) – 153,750 = 96,250 Dong should invest an additional cash of 96,250. 2. Give the required entries assuming the partnership will use new set of books. Cash Accounts Receivable Merchandise Inventory Equipment Allowance for Bad Debt Accounts Payable Dong, Capital To record the Investment of Dong Cash Merchandise Inventory Ding, Capital To record the investment of Ding 2-5 1) 96,250 195,000 26,250 20,000 12,500 75,000 250,000 110,000 140,000 250,000 King invites Ace to join him in his business. Ace agreed to join King provided that the following adjustments are taken up in the books of King: • Prepaid expenses of P 10,000 and accrued expenses of P 6,000 are to be recognized. • Accumulated Depreciation on King’s equipment will be increased by P 10,000. King’s capital before adjustment for the above items was 405,000. Ace will invest enough cash to make his interest equal to 40%. How much is King’s adjusted capital balance? Adjustments on King’s books a) Prepaid Expenses 10,000 King, Capital 10,000 King, Capital 6,000 Accrued Expenses 6,000 b) King, Capital 10,000 Accumulated Depreciation 10,000 Partnership Dissolution – Admission of a Partner Page 15 Acrrued Exp. Accu Dep. 2) King, Capital 6,000 405,000 10,000 10,000 399,000 Capital, beg. Prepaid Exp. Adjusted Capital How much should Ace invest to give him a 40% equity in the firm? Required total partnership capital using adjusted King, Capital as the base: ( P 399,000/60% ) Ace share is 40% ( P 665,000 x 40% ) 2-6 P 665,000 P 266,000 On June 1, 2017, Calvin and Klein formed a partnership with each contributing the following assets: Merchandise Inventory Building Machinery and Equipment Furniture and Fixtures CALVIN P 500,000 450,000 300,000 KLEIN P 900,000 2,450,000 950,000 The building is subject to a mortgage loan of P 1,300,000, which is to be assumed by the partnership. The partnership agreement provides that Calvin and Klein share profits and losses 40% and 60%, respectively. 1) What is the adjusted capital of each partner on June 1, 2017? Merchandise Inventory 500,000 Machinery Equipment 450,000 Furniture and Fixtures 300,000 Calvin, Capital 1,250,000 To record the investment of Calvin Solution: 500k+450k+300k = 1,250,000 Merchandise Inventory Building Machinery Equipment Mortgage Payable Klein, Capital To record the investment of Klein 900,000 2,450,000 950,000 1,300,000 3,000,000 Solution (900k+2,450,000+950K)-1.3M = 3M Partnership Dissolution – Admission of a Partner Page 16 2) Assuming that the partners agreed to bring their respective capital in proportion to their respective profit and loss ratio, and using Klein’s capital as the base, how much cash is to be invested by Calvin? Required total partnership capital using adjusted Klein, Capital as the base: ( P 3,000,000/60% ) Calvin share is 40% ( P 5,000,000 x 40% ) P 5,000,000 P 2,000,000 2,000,000 – 1,250,000 = 750,000 Calvin needs to invest an additional 750,000 cash to have a 40% share to capital. 2-7 1) Polo and Loco entered into a partnership on August 1, 2017 by investing the following assets: POLO LOCO Cash P 400,000 --Merchandise inventory --P 500,000 Land --1,150,000 Building --750,000 Equipment 650,000 --The agreement between Polo and Loco provides that profits and losses are to be divided into 30% (to Polo) and 70% (to Loco), and that the partnership is to assume the P 350,000 mortgage loan on the building. If Loco is to receive a capital credit equal to his profit and loss ratio, how much cash must he invest? Merchandise Inventory 500,000 Land 1,150,000 Building 750,000 Mortgage Payable 350,000 Loco, Capital 2,050,000 To record the Investment of Loco Cash Equipment Polo, Capital To record the investment of Polo 400,000 650,000 1,050,000 Required total partnership capital using adjusted Polo, Capital as the base: ( P 1,050,000/30% ) Loco share is 70% ( P 3,500,000 x 70% ) 2) P 3,500,000 P 2,450,000 2,450,000 – 2,050,000 = 400,000 Loco must invest an additional 400,000 cash to have a 70% capital share. Assuming that Loco invests P 600,000 cash and each partner is to be credited for the full amount of the net assets invested, how much is the total capital of the partnership? Partnership Dissolution – Admission of a Partner Page 17 Assets Current Cash Merchandise Inventory 1,000,000 (400k – Polo +600k – Loco) 500,000 Non-current Land Equipment Building Total Assets 1,150,000 650,000 750,000 4,050,000 Liability Mortgage Payable Partnership Capital Loco, Capital Polo, Capital Total Liabilities &Capital 350,000 2,650,000 1,050,000 4,050,000 Solution: 3) 1,050,000+2,050,000+600,000 = 3,700,000 Using the data in number 2, how much is the total assets of the partnership? Solution: 400k+650k+500k+1,150,000+750k+600k = 4,050,000 2-8 Curry and Thompson are combining their businesses to form a partnership. Cash and noncash assets are to be contributed. The non-cash assets to be contributed and the liabilities to be assumed are: Accounts Receivable, net Merchandise Inventory Property and Equipment, net Accounts payable CURRY Book Value P 50,000 200,000 400,000 280,000 Fair Value P 40,000 240,000 320,000 280,000 THOMPSON Book Fair Value Value P 100,000 P 90,000 160,000 150,000 40,000 40,000 After the above adjustments, Curry and Thompson are to contribute or to withdraw cash to bring their respective capital to P 350,000 each. Based on the above information, answer the following: Partnership Dissolution – Admission of a Partner Page 18 1) 2) 3) 4) 5) 6) 2-9 How much is the capital of Thompson after giving effect to the above adjustments but before the cash investment or withdrawal as the case may be? Accounts Receivable 90,000 Merchandise Inventory 150,000 Accounts Payable 40,000 Thompson, Capital 200,000 Solution: 90K+150K-40K = 200,000 How much is the capital of Curry after giving effect to the above adjustments but before the cash investment or withdrawal as the case may be? Accounts Receivable 40,000 Merchandise Inventory 240,000 PPE 320,000 Accounts Payable 280,000 Curry, Capital 320,000 Solution: 40k+240k+320k-280k = 320,000 How much is the cash investment or withdrawal of Curry? Indicate whether investments or withdrawal Required Capital 350,000 Curry, Capital 320,000 Additional Cash Investment 30,000 How much is the cash investment or withdrawal of Thompson? Indicate whether investments or withdrawal Required Capital 350,000 Thompson, Capital 200,000 Additional Cash Investment 150,000 How much is the total currents assets of the partnership immediately after its formation? Cash 180,00 Accounts Receivable 130,000 Merchandise Inventory 390,000 Total current assets 700,000 How much is the total assets of the partnership immediately after its formation? Cash 180,000 (30K + 150k) Accounts Receivable 130,000 Merchandise Inventory 390,000 PPE 320,000 Total assets 1,020,000 Nash invested in a partnership a parcel of land which cost his father P 2,000,000. The land had a market value of P 3,000,000 when Nash inherited it three years ago. Currently, the land is independently appraised at P 5,000,000 even though Nash insisted that he “would not take P 9,000,000 for it.” Partnership Dissolution – Admission of a Partner Page 19 What is the amount that should be recorded in the accounts of the partnership for the parcel of Land? 5,000,000 (Appraised value will be recorded if there’s no indicated current market or fair value) EXERCISES 3-1 The capital accounts of Jose and Andres at the end of the calendar of 2019 are as follows: Jose, Capital January 1 Balance P 63,000 May 1 Investment 27,000 October 1 Withdrawal P 18,000 Partnership Dissolution – Admission of a Partner Page 20 Andres, Capital January 1 April 1 Balance Withdrawal P 45,000 P 9,000 The partnership profit for the year ended December 31, 2019 is P 90,000. Instructions: Give the journal entries to record the sharing of the partnership income under each of the following independent cases: 1. Profit is divided 2:1 to Jose and Andres respectively. Date Dec. 31, 2019 2. P/R Debit 90,000.00 Credit 60,000.00 30,000.00 Profit is divided in the ratio of capital balances at the beginning of the period. Date Dec. 31, 2019 3. Description Income Summary Jose, Capital Andres, Capital Jose = 90,000 x 2/3 = 30,000 Andres = 90,000 x 1/3 = 60,000 Description Income Summary Jose, Capital Andres, Capital Jose = 90,000 x 63/108 = 52,500 Andres = 90,000 x 45/108 = 37,500 P/R Debit 90,000.00 Credit 52,500.00 37,500.00 Profit is divided in the ratio of average capital. Partnership Dissolution – Admission of a Partner Page 21 Date Dec. 31, 2019 Description Income Summary Jose, Capital Andres, Capital P/R Debit 90,000.00 Credit 60,000.00 30,000.00 Computation: Jose, Capital Date Capital Balance (B) Jan. 1, 2016 May 1, 2016 Oct 1, 2016 63,000.00 90,000.00 72,000.00 Number of Months Unchanged (C) 4 5 3 12 Peso Months (Col. B x C) Average Capital 252,000.00 450,000.00 216,000.00 918,000.00 76,500.00 Andres, Capital Date Capital Balance (B) Jan. 1, 2016 April 1, 2016 45,000.00 36,000.00 Number of Months Unchanged (C) 3 9 12 TOTAL Peso Months (Col. B x C) Average Capital 135,000.00 324,000.00 459,000.00 1,377,000 38,250 114,750 Using Peso Months Jose share in profits: (918/1377) x 90,000 = 60,000 Andres share in profits: (459/1377) x 90,000 = 30,000 90,000 Using Average Capital Jose share in profits: (76,500/114,750) x90,000 = 60,000 Andres share in profits: (38,250/114,750) x 90,000 = 30,000 90,000 4. Interest of 8% is allowed on average capital and the balance of profit divided equally. Partnership Dissolution – Admission of a Partner Page 22 Date Dec. 31, 2019 Description Income Summary Jose, Capital Andres, Capital P/R Debit 90,000.00 Credit 46,530.00 43,470.00 Computation: Interest Allowance 76,500*.08 38,250*.08 Remainder to be divided equally 90,000-9,180 = 80,820 80,820/2 80,820/2 TOTAL 5. Jose, Capital P 6,120.00 Andres, Capital Total P 9,180.00 3,060.00 40,410.00 P46,530.00 40,410.00 P43,470.00 80,820.00 P90,000.00 Salaries of P 24,000 and P 19,000 are allowed to Jose and Andres, respectively, the balance of profit is divided in the ratio of capital balances at the end of the period. Date Dec. 31, 2019 Description Income Summary Jose, Capital Andres, Capital P/R Debit 90,000.00 Credit 55.333 34,667 Computation: Salary Allowance Remainder: 90k-43k = 47k 47,000*72/108; 47,000 *36/108 TOTAL Jose P24,000.00 Andres P19,000.00 Total P43,000.00 47,000.00 31,333 P55.333 Partnership Dissolution – Admission of a Partner 15,667 P34,667 P90,000.00 Page 23 6. Andres is allowed a bonus of 20% of profit after bonus, the balance of the profit divided in the ratio of the average capital. Date Dec. 31, 2019 Description Income Summary Jose, Capital Andres, Capital P/R Debit 90,000.00 Credit 50,000.00 40,000.00 Computation: Jose Bonus to Andres 90K*.20/1.20 Remainder: 90k-15k = 75k 75,000*76,500/114,750 75,000*38,250/114,750 TOTAL 3-2 Andres P15,000.00 Total P15,000.00 75,000.00 50,000 25,000 P40,000.00 P50,000.00 P90,000.00 The partnership agreement of Justin and Kyle provides that interest at 10% per annum is to be credited to each partner on the basis of average capital balances. A summary of Kyle’s capital accounts for the year ended December 31, 2019 is as follows: Balance, January 1 Additional investment, June 30 Withdrawal, July 31 Balance, December 31 1. P 280,000 80,000 30,000 330,000 How much is the average capital of Kyle? 307,500 Computation: Date Jan. 1, 2019 June 30, 2016 July 31, 2019 dec3 Capital Balance (B) Number of Months Unchanged (C) 280,000.00 6 1,680,000 360,000.00 1 360,000.00 330,000.00 5 1,650,000 12 3,690,000.00 Partnership Dissolution – Admission of a Partner Peso Months (Col. B x C) Average Capital 307,500 Page 24 2. What amount of interest should be credited to Kyle for the year 2019? 30,750 Computation: 307,500*10% = 30,750 3-3 The partnership agreement of Malik, Michael and Marco provides for the year-end allocations of profit in the following manner: • First, Malik is to receive bonus of 10% of profit for the first P 100,000, and 20% of profit in excess of P 100,000; • Second, Michael and Marco each will receive 5% of remaining profit after the above bonus to Malik; • Balance of profit to be divided equally. The partnership’s 2019 profit was P 360,000 before any allocation to partners. Computation: Malik Amount being Allocated Allocation: 1. Bonus to Malik First 100k: 100k*10% Over 100k: (360k-100k)*20% 2. 5% to Michael and Marco 5%(360k-62k) 3. Allocation of remaining profit (360k-10k-52k-29,800)/3 As Allocated 62,000 1. Michael Marco 10,000 52,000 Total 360,000 10,000 52,000 14,900 14,900 29,800 89,400 89,400 89,400 268,200 151,400 104,300 104,300 360,000 How much is the bonus of Malik? Computation: First 100k: 100k*10% = 10,000 Over 100k: (360k-100k)*20% = 52,000 151,400 10k+52k = 62,000 2. How much is the share of Malik in the partnership profit? Computation: 62,000 – bonus +89,400 – share in the remaining profit = 151,400 Partnership Dissolution – Admission of a Partner Page 25 104,300 3. How much is the share of Michael in the partnership profit? Computation: 14,900 – Bonus +89,400 – share in the remaining profit =104,300 104,300 4. How much is the share of Marco in the partnership profit? Computation: 14,900 – Bonus +89,400 – share in the remaining profit =104,300 3-4 Daquis and Dionela are partners who share profits and losses in the ratio of 60% and 40%, respectively. Daquis’ salary is P 60,000 and P 30,000 for Dionela. The partners are also paid interest on their average capital balances. In 2019, Daquis received P 30,000 of interest and Dionela, P 12,000. The profit and loss allocation is determined after deductions for the salary and interest payments. Dionela’s share in the residual income (balance after deducting salaries and interest) was P 78,000 in 2019. 327,000 1. What was the total partnership profit? Computation: 78K/40% = 195,000 195K*60% (Daqui’s share in residual income) = 117,000 60k – Daqui’s Salay 30k – Dionela’s Salary 30k – Daqui’s interest 12k – Dionela’s interest 78k – Dionela’s share in residual income 117K - Daqui’s share in residual income 327,000 Partnership Dissolution – Admission of a Partner Page 26 3-5 Carter, Vince and Wayne are partners with beginning capital balances of P 100,000, P 200,000 and P 300,000, respectively. The partnership agreement provides for the following division of profits and losses: a. Salaries to Carter, Vince and Wayne amounting to P 30,000, P 40,000 and P 50,000, respectively; b. 10% interest on beginning capital balances; c. Partner Carter is to receive a bonus of 20% of profit after deducting salaries, interest, and bonus; d. Any remainder of profit is divided equally. If the profit before deducting salaries, interest, and bonus amounted to P 300,000, how much is the share of each partner in the partnership profit? Computation: Amount being Allocated Allocation: 1. Salaries 2. 10% Interest to beg. capital 3. Bonus to Carter (300k-180k)*20%/1.20 1. Allocation of remaining profit (300k-120k-60k-20k)/3 As Allocated Carter 93,333 3-6 Carter Vince Wayne Total 300,000 30,000 40,000 50,000 120,000 10,000 20,000 30,000 60,000 20,000 20,000 33,333 33,333 33,334 100,000 93,333 93,333 113,334 300,000 Vince 93,333 Wayne 113,334 Using the same profit and loss agreement as in exercise 3-5, assume the profit after deducting salaries, interest, and bonus is P 200,000, how much is the share of each partner in the partnership profit? (take note that salaries, interest, and bonus are not operating expenses but used only as part of profit distribution) Computation: 200k+(10K+20k+30k: 10% interest to beg. Capital) + (30k+40k+50k) + 20K = 400k Carter Vince Wayne Amount being Allocated Allocation: 1. Salaries 30,000 40,000 50,000 2. 10% Interest to beg. capital 3. Bonus to Carter (420k-180k)*20%/1.20 10,000 40,000 Partnership Dissolution – Admission of a Partner 20,000 30,000 Total 420,000 120,000 60,000 40,000 Page 27 4. Allocation of remaining profit 200k/3 As Allocated Carter 146,666 3-7 66,666 66,667 66,667 200,000 146,666 126,667 146,667 420,000 Vince 126,667 Wayne 146,667 Still using the same profit and loss agreement as in exercise 3-5, assume that the residual profit after deducting salaries and interest is a loss or negative figure of P 100,000, how much is the partnership profit for the period? ____________________________ Computation: 120,000 – salaries 60,0000 – Interest (100,000) – Remaining 80,000 3-8 As of December 31, 2019, King, Jolly and Donald Partnership has the following data before effecting distribution of income summary account with a debit balance of P 300,000 from operation beginning January 1, 2019. ASSETS Cash P 400,000 Non-Cash Assets ? LIABILITIES Accounts Payable P 100,000 King, Loan 500,000 CAPITAL King, Capital P 500,000 Jolly, Capital 500,000 Donald, Capital 500,000 The partners have the following profit and loss agreement: a. All partners shall have a monthly salary of P 10,000; b. Mr. King shall have a 10% bonus on the profit before salary, interest and bonus; c. Interest on beginning capital would be 6% annually; and d. Balance divided equally. Upon distribution of P 300,000 debit balance of income summary account: Partnership Dissolution – Admission of a Partner Page 28 King Jolly Donald Total (300,000) 120,000 120,000 120,000 360,000 30,000 30,000 30,000 90,000 (250,000) (250,000) (250,000) (750,000) (100,000) (100,000) (100,000) (300,000) Amount being Allocated Allocation: a. Salaries b. Interest on Beg. Capital (6%) 500k*6% c. Allocation of remaining profit (300,000) – (360k+90k) = (750k)/3 As Allocated 1. By how much will the capital balance of Mr. King increased (decreased)? 2. How much is the adjusted capital of Mr. Jolly after distributing their respective share? 3. How much is the total partnership assets after distribution of the income summary account? Mr. King’s Capital will be decreased by 100,000 400,000 Computation: 500k-100k=400k 1,800,000 Computation: Assets before distribution: A= L + 0E A = 600k liability + 1.5M capital A = 2.1M Assets after distribution: 2.1M -300,000 = 1,800,000 Partnership Dissolution – Admission of a Partner Page 29 3-9 The partnership has the following accounting amounts: Sales, P 70,000; Cost of Sales, P 40,000; Operating expenses, P 10,000; Salary allocations to partners, P 13,000; Partners’ withdrawals, P 8,000. What was the profit (net loss) of the partnership? 33,000 Computation: Sales 70,000 Cost of Sales (40,000) Gross Profit 30,000 Operating expenses (10,000) Net Profit 20,000 3-10 Noel, Burkes and Ariza are partners of NBA Partnership. During 2019, their average capital balances are as follows: Noel – P 280,000; Burkes – P 200,000; Ariza – P 120,000 The partnership agreement includes the following: 1. 2. 3. 6% interest is allowed on average capital balances. Salary allowances to Burkes and Ariza are P 48,000 and P 40,000, respectively. Burkes is the managing partner and is to receive a bonus of 25% of profit in excess of P 72,000 after partners’ interest and salary allowances. 4. Remaining profit or loss will be divided in the ratio of 5:3:2 Required: Prepare schedules showing how profit or loss will be distributed among the three partners under each of the following independent assumptions. 1) P 25,000 loss 1. (25,000) Amount being Allocated Allocation: 1. Interest in average cap bal (6%) Computation: 280k*6%; 200k*6%; 120k*6% 2. Salary to Burkes&Ariza 3. Allocation of remaining profit (5:3:2) (25k)-36k-88k= (149k) (149k)*5/10 (36k)*3/10 (36k)*2/10 As Allocated b) P 60,000 profit c) P 250,000 profit Noel Burkes Ariza Total (25,000) 16,800 12,000 7,200 36,000 48,000 40,000 88,000 (29,800) 17,400 (149,000) (25,000) (74,500) (44,700) (57,700) Partnership Dissolution – Admission of a Partner 15,300 Page 30 2. 60,000 Amount being Allocated Allocation: 1. Interest in average cap bal (6%) Computation: 280k*6%; 200k*6%; 120k*6% 2. Salary to Burkes&Ariza 3. Allocation of remaining profit (5:3:2) 60k-36k-88k= (64k) (64k)*5/10 (36k)*3/10 (36k)*2/10 As Allocated Noel Burkes Ariza Total 60,000 16,800 12,000 7,200 36,000 48,000 40,000 88,000 (32,000) (19,200) (15,200) 40,800 (12,800) 34,400 (64,000) 60,000 Noel Burkes Ariza Total 250,000 16,800 12,000 7,200 36,000 48,000 40,000 88,000 3. 250,000 Amount being Allocated Allocation: 1. Interest in average cap bal (6%) Computation: 280k*6%; 200k*6%; 120k*6% 2. Salary to Burkes&Ariza 3. Bonus to Burkes (25%) 250k-36k-88k = 126,000 126k-72k = 54k*25% = 13,500 4. Allocation of remaining profit (5:3:2) 250k-36k-88k-13,500 = 112,500 112,500*5/10 (36k)*3/10 (36k)*2/10 As Allocated 13,500 13,500 56,250 33,750 73,050 Partnership Dissolution – Admission of a Partner 107,250 22,500 69,700 112,500 250,000 Page 31 3-11 Dick, Jane, Jack and Jill formed a partnership with the following profit or loss agreement: 1. 2. 3. 4. Dick receives a salary of P 400,000 and a bonus of 3% of profit after all bonuses; Jane receives a salary of P 200,000 and a bonus of 2% of profit after all bonuses; All partners are to receive a 10% interest on their beginning capital balances. The partners’ beginning capital balances are as follows: Dick – P 1,000,000; Jane – P 900,000; Jack – P 400,000; and Jill – P 940,000; Any remaining profits or losses are to be divided equally among the partners. Required: Prepare schedules showing how profit or loss will be distributed among the three partners under each of the following independent assumptions. 1. Prepare a schedule how a profit of P 2,100,000 would be allocated among the partners. Dick Jane 400,000 200,000 Jack Jill Amount being Allocated Allocation: 1. Salary to Dick&Jane 2. Bonus to Dick&Jane (3%;2%) 2.1M*5%/1.05 = 100K 100K*3/5 100K*2/5 3. Interest on beg, cap (10%) 1M*10%; 900K*10%; 400K810%; 940k*10% 4. Allocation of remaining profit 2.1M – (600K+100K+324K) = 1,076,000/4 As Allocated Total 2,100,0 00 600,000 100,000 60,000 40,000 100,000 90,000 40,000 94,000 324,000 269,000 269,000 269,000 269,000 829,000 599,000 309,000 363,000 1,076,0 00 2,100,0 00 Partnership Dissolution – Admission of a Partner Page 32 2. Prepare a schedule how a loss of P 800,000 would be allocated among the partners. Dick Jane Jack Jill 400,000 200,000 100,000 90,000 40,000 94,000 324,000 (431,000) (431,000) (431,000) (431,000) 69,000 (141,000) (391,000) (337,000) (1,724,0 00) (800,00 0) Amount being Allocated Allocation: 1. Salary to Dick&Jane 2. Interest on beg, cap (10%) 1M*10%; 900K*10%; 400K810%; 940k*10% 3. Allocation of remaining profit (800,000) – (600K+324K) = (1,724,000)/4 As Allocated 3. Total (800,00 0) 600,000 Prepare a schedule how a profit of P 800,000 would be allocated among the partners assuming the following priority system. Profit should be allocated by first giving priority to interest on beginning capital balances, then bonuses, then salary, and then according to the profit or loss percentages. Amount being Allocated Allocation: 1. Interest on beg, cap (10%) 1M*10%; 900K*10%; 400K810%; 940k*10% 2. Bonus to Dick&Jane 800K*5%/1.05 = 38,095 38,095*3/5 38,095*2/5 3. Salary to Dick&Jane 800k-324k-38,095 = 437,905 437,905*4/6 437,905*2/6 As Allocated Dick Jane Jack Jill Total 800,000 100,000 90,000 40,000 94,000 324,000 22,857 15,238 38,095 291,937 414,794 Partnership Dissolution – Admission of a Partner 145,968 251,206 40,000 94,000 437,905 800,000 Page 33 3-12 Stew and Peed entered into a partnership on March 1, 2019 investing P 2,000,000 and P 1,000,000 respectively. They agreed that Stew is the managing partner and is to receive a salary allowance of P 240,000 per year and a bonus of 10% of the net profit after deducting salary but before bonus. The balance is to be divided in the ratio of their original capital. Selected ledger account balances as of December 31, 2019 before adjustments showed the following: Stew, Capital Stew, Drawing Peed, Capital Peed, Drawing Sales Sales returns and allowances Purchases Operating expenses P 2,000,000 200,000 1,000,000 100,000 3,000,000 30,000 1,800,000 480,000 Inventories on December 31, 2019 were as follows: Office supplies, P 8,100; merchandise, P 500,000. Prepaid insurance of P 12,000 and accrued expenses of P 4,000 were recognized. Depreciation expense of P 40,000 was also provided. Required: 1. Determine the profit or loss of the partnership. Assuming 30% income tax rate. Net Sales Sales Sales R&A Cost of Goods Sold Purchases Merchandise Inv End Gross Profit Less Expenses: Operating Expenses Accrued Expense Depreciation Expense Less: Office Supplies Prepaid Insurance Profit before Income Tax Income Tax (30%) Net Profit 3,000,000 (30,000) 2,970,000 1,800,000 (500,000) 480,000 4,000 40,000 (8,100) (12,000) Partnership Dissolution – Admission of a Partner 1,300,000 1,670,000 (503,900) 1,116,100 (349,830) 816,270 Page 34 2. Prepare a schedule showing the distribution of partnership profit or loss. Stew Amount being Allocated Allocation: 1. Salary to Stew 240K*10/12 (March 1- Dec 31 = 10 months) 2. Bonus to Stew (10%) 816,270-200,000= 616,270 616,270*10% 3. Allocation of remaining profit 816,270-200,000-61,627= 554,643 554,643*2/3 554,643*1/3 As Allocated 3. Peed Total 816,270 200,000 200,000 61,627 61,627 369,762 631,389 184,881 184,881 554,643 816,270 Prepare a Statement of Changes in Partners’ Equity for the period ended December 31, 2019. Partnership Dissolution – Admission of a Partner Page 35 EXERCISES 4-1 Allyna and Allysa are partners with capital balances of P 480,000 and P 240,000. Their profit and loss agreement is 75% and 25%, respectively. They agree to admit Aldrick as a partner of firm. Give the required journal entries to record the admission of Aldrick under each of the following independent cases: 1. Aldrick purchases 25% interest in the firm. Aldrick pays the partners P 180,000 which is divided between Allyna and Allysa in proportion to the equities given up. Allyna, Capital Allysa, Capital Aldrick, Capital 120,000 60,000 180,000 Computation: Allyna, Capital 480,000*25% = 120,000 Allysa, Capital 240,000*25% = 60,000 Total Book Value = 180,000 2. Aldrick purchases a 1/3 interest in the firm. Aldrick pays the partners P 360,000. Asset revaluation is undertaken before Aldrick’s admission so that his 1/3 interest will be equal to the amount of his payment. Entry for the Revaluation of Asset Other Assets Allyna, Capital Allysa, Capital 360,000 270,000 90,000 New Partnership Capital Old Partners Capital Positive Asset Revaluation = P360,000 ÷ 1/3 = P 1,080,000 720,000 P 3 6 0,000 Distribution of P360,000 to old partners (based on profit and loss ratio) Allyna P360,000 x 75% = P270,000 Allysa P360,000 x 25% = P90,000 Entry for the transfer of capital Allyana, Capital Allysa, Capital Aldrick, Capital Partnership Dissolution – Admission of a Partner 250,000 110,000 360,000 Page 36 Capital balances before revaluation Share in asset revaluation Capital balances after revaluation Interest purchased Capital transferred to Aldrick Capital balances after revaluation Capital transferred to Alrick Capital balance after admission 3. P750,000 250,000 P500,000 Allysa Total P240,000 P720,000 90,000 360,000 P330,000 P1,080,000 1/3 1/3 P110,000 P360,000 P330,000 P1,080,000 110,000 360,000 P 220,000 P720,000 Aldrick invests P 360,000 for a 25% interest in the firm. Asset revaluation is recorded on the firm books prior to Aldrick’s admission. Cash Other Assets Allyna, Capital Allysa, Capital Aldrick, Capital Old (75%) New (25%) Allyna P480,000 270,000 P750,000 1/3 P250,000 360,000 360,000 270,000 90,000 360,000 AC 1,080,000 360,000 1,440,000 CC 720,000 360,000 1,080,000 + Revaluation 360,000 360,000 Computation: AC = 360,000/25% Allyna’s Share in Asset Revaluation 360,000*75 Allysa’s Share in Asset Revaluation 360,000*25 = = Partnership Dissolution – Admission of a Partner 270,000 90,000 Page 37 4. Aldrick invests P 360,000 for a ½ interest in the firm. Allyna and Allysa transfer part of their capital to Aldrick as bonus. Cash Allyana, Capital Allysa, Capital Aldrick, Capital 360,000 135,000 45,000 540,000 AC 540,000 540,000 1,080,000 Old (50%) New (50%) CC 720,000 360,000 1,080,000 Bonus (180,000) 180,000 - Computation: New PC = CC Allyna’s Share in Bonus to Aldrick 180,000*75% Allysa’s Share in Bonus to Aldrick 180,000*25% 5. 135,000 45,000 Aldrick invests P 480,000 in the firm. Bonus of P 120,000 is considered to partners Allyna and Allysa. Cash Allyana, Capital Allysa, Capital Aldrick, Capital Old (70%) New (30%) = = 480,000 90,000 30,000 360,000 AC 840,000 360,000 1,200,000 CC 720,000 480,000 1,200,000 Bonus 120,000 (120,000) - Computation: Old AC = 720,000 CC + 120,000 Bonus New AC = 480,000 – 120,000 Allyna’s Share in Bonus 120,000*75% Allysa’s Share in Bonus 120,000*25% = = Partnership Dissolution – Admission of a Partner 90,000 30,000 Page 38 6. Aldrick invests P 480,000 in the firm with P 20,000 bonus allowed to Allysa and Allyna upon his admission. Cash Allyana, Capital Allysa, Capital Aldrick, Capital Old (61.66%) New (38.33%) 480,000 15,000 5,000 460,000 AC 740,000 460,000 1,200,000 CC 720,000 480,000 1,200,000 Bonus 20,000 (20,000) - Computation: Old AC = 720,000 CC + 20,000 Bonus New AC = 480,000 – 20,000 Allyna’s Share in Bonus 20,000*75 Allysa’s Share in Bonus 20,000*25 7. 15,000 5,000 Aldrick invests P 300,000 for a ¼ interest in the firm. Total capital of the new partnership is P 1,020,000. Cash Other Assets Allyna, Capital Allysa, Capital Aldrick, Capital Old (3/4) New (1/4) = = 300,000 45,000 33,750 11,250 300,000 AC 765,000 255,000 1,020,000 CC 720,000 300,000 1,020,000 Bonus 45,000 (45,000) - Computation: Old AC = 1,020,000 Total AC x 3/4 Allyna’s Share in Bonus 45,000*75 = 33,750 Allysa’s Share in Bonus 45,000*25 = 11,250 Partnership Dissolution – Admission of a Partner Page 39 8. Aldrick invests P 330,000 for a 25% interest in the firm. The total firm capital after his admission is P 1,320,000. Cash Other Assets Allyna, Capital Allysa, Capital Aldrick, Capital Old (75%) New (25%) 330,000 270,000 202,500 67,500 330,000 AC 990,000 330,000 1,320,000 CC 720,000 330,000 1,050,000 + Asset Revaluation 270,000 270,000 Computation: Old AC = 1,320,000 Total AC x 3/4 9. Allyna’s Share in Asset Revaluation 270,000*75% = 202,500 Allysa’s Share in Asset Revaluation 270,000*25% = 67,500 Aldrick invests P 288,000 for a 1/3 interest in the firm. The total firm capital after his admission is P 1,008,000. Cash 288,000 Allyna, Capital 36,000 Allysa, Capital 12,000 Aldrick, Capital Old (2/3) New (1/3) 336,000 AC 672,000 336,000 1,008,000 CC 720,000 288,000 1,008,000 Bonus (48,000) 48,000 Computation: Old AC = 1,008,000 Total AC x 3/4 Allyna’s Share in Bonus 48,000*75 Allysa’s Share in Bonus 48,000*25 Partnership Dissolution – Admission of a Partner = = 36,000 12,000 Page 40 10. Aldrick invests sufficient cash for a 1/5 interest in the firm. Cash Aldrick, Capital 180,000 180,000 Computation: Total AC = 720,000/ (4/5) = 900,000 New CC = 900,000*1/5 = 180,000 Partnership Dissolution – Admission of a Partner Page 41 4-2 Partners Lakers and Celtics are considering the admission of Knicks into the partnership. Lakers and Celtics share profit and loss in the ratio of 2:4, respectively. Capital balances of Lakers and Celtics are P 240,000 and P 180,000 respectively. Prepare journal entries to record the admission of Knicks under each of the following independent assumptions: 1. Knicks acquired one-third of the interest of Lakers paying P 80,000. Laker, Capital 80,000 Kinicks, Capital 80,000 Computation: 240,000*1/3 = 80,000 2. Knicks acquired one-third of the interest of Celtics paying P 35,000. Celtics, Capital 60,000 Kinicks, Capital 60,000 Computation: 180,000*1/3 = 60,000 3. Knicks buys a 25% interest in the partnership from the old partners paying each P63,000. Asset revaluation has to be considered prior to the admission of Knicks. Other Assets 84,000 Lakers, Capital Celtics, Capital 28,000 56,000 Lakers, Capital Celtics, Capital Knicks, Capital 67,000 59,000 126,000 Computation: Purchase Price 63,000 x 2 = 126,000 New PC = 126,000/25% = 504,000 OP Capital 420,000 +AR 84,000 Lakers, Capital Knicks, Capital 84,000*2/6 = 28,000 84,000*2/6 = 56,000 Partnership Dissolution – Admission of a Partner Page 42 Capital balances before revaluation Share in asset revaluation Capital balances after revaluation Interest purchased Capital transferred to Aldrick 4-3 Celtics P240,000 28,000 P268,000 25% P67,000 Lakers P180,000 56,000 P236,000 25% P59,000 Total P420,000 84,000 P 504,000 25% P126,000 Utah, Atlanta and Detroit have capital balances of P 150,000, P 200,000, and P 300,000, respectively and they share profits and losses in the ration of 4:3:3. Miami purchases 15% interest in equity and profits from the partners for P 150,000. a) What would be the new capital balance of Utah, Atlanta and Detroit after the admission of Miami? Utah = 127,500 Atlanta = 170,000 Detroit = 255,000 Computation: Utah, Capital 150,000*15% = 22,500 Atlanta, Capital 200,000*15% = 30,000 Detroit, Capital 300,000*15% = 45,000 Total Book Value = 97,5000 Utah, New Capital 150,000 - 22,500 = 127,500 Atlanta, New Capital 200,000 - 30,000 = 170,000 Detroit, New Capital 300,000 - 45,000 = 255,000 Alternative Utah 150,000*85% = 127,500 Atlanta 200,000*85% = 170,000 Detroit 300,000*85% = 255,000 b) Assume that some of the assets of the partnership are undervalued, how much is the undervaluation in assets? 350,000 Computation: New Partnership Capital Old Partners Capital Positive Asset Revaluation = P150,000 ÷ 15% = Partnership Dissolution – Admission of a Partner P 1,000,000 650,000 P 3 5 0,000 Page 43 4-4 On August 1, 2020, prior to the admission of Grant, E and F Enterprises have the following account balances: Cash Accounts Receivable Allowance for Bad Debts Merchandise Inventory Equipment - net Accounts Payable Erving, Capital Fisher, Capital Partnership Dissolution – Admission of a Partner P 30,000 400,000 36,000 110,000 134,000 38,000 300,000 300,000 Page 44 Erving and Fisher share profit and loss on 1:1 ratio. Before the admission of Grant, the partners agree on the following adjustments to bring the assets and liabilities to their fair values: a. The allowance for Bad Debts should be brought to 10% of the outstanding accounts receivable. Capital Adjustment Account Allowance for Bad Debts 4,000 4,000 Computation: 400,000 AR*10% - 36,000 = 4,000 b. The current market value of the merchandise inventory is P 140,000. Merchandise Inventory Capital Adjustment Account 30,000 30,000 Computation: 140,000 – 110,000 Merchandise Inventory = 30,000 c. Accrued expenses of P 4,000 should be recognized in the accounting records. Capital Adjustment Account Accrued Expenses 4,000 4,000 Capital Adjustment Account Erving, Capital Fisher, Capital 1. 22,000 11,000 11,000 If Grant purchases 50% of Erving’s capital at its adjusted carrying value, how much is the total assets of the partnership just after the admission of Grant? Erving’s Adjusted Capital 300,000 + 11,000 = 311,000 311,000*50% = 155,500 – Grant’s Purchase Erving’s Adjusted Capital after Grant’s Purchase 311,000 – 155,500 = 155,500 Fisher’s Adjusted Capital 300,000 + 11,000 = 311,000 A = L + OE A = 38,000 AP + 4,000 Accrued Expenses + 311,000 + 155,500 + 155,500 A = 664,000 Partnership Dissolution – Admission of a Partner Page 45 2. If Grant is admitted into the partnership upon his investment of P 400,000 for 2/5 interest in capital and profit, what is the total capital of the partnership just after the admission of Grant? 1,000,000 Old Partnership Capital 600,000 + New Partner’s Investment 400,000 4-5 Jake desires to invest P 200,000 for ¼ capital and profit and loss interest in the partnership of Kim and Lim, who at that time had capital balances of P 200,000 and P300,000, respectively. Profit and loss ratio of the partners before the admission was 6:4. If a positive asset revaluation is to be recorded, what are the capital balances of Kim, Lim and Jake? Kim 260,000 Lim 340,000 Jake 200,000 Computation: Old (75%) New (25%) AC 600,000 200,000 800,000 CC 500,000 200,000 700,000 Revaluation 100,000 100,000 Computation: AC = 200,000/ (1/4) Kim’s Share in Asset Revaluation 100,000*6/10 Lin’s Share in Asset Revaluation 100,000*4/10 = = 60,000 40,000 Kim, Capital 200,000 + 60,000 Lim, Capital 300,000 + 40,000 4-6 Pierce, Allen, and Rondo are partners with capital account balances at year-end of P90,000; P 110,000; and P 50,000, respectively. The partnership profit for the year is P 110,000. They share profits and losses on a 4:4:2 ratio, after considering the following terms: a. Interest of 10% shall be paid on that portion of a partner’s capital in excess of P100,000 b. Salaries of P 10,000 and P 12,000 shall be paid to Pierce and Rondo, respectively Partnership Dissolution – Admission of a Partner Page 46 c. Rondo is to receive a bonus of 10% of profit after bonus How much is the total profit share of each partner? Pierce 40,800 Allen 31,800 Rondo Pierce Amount being Allocated Allocation: 4. Interest 110,000 – 100,000 = 10,000 10,000*10% = 1,000 Allen Rondo 1,000 10,000 6. Bonus 110,000*10%/1.10 7. Allocation of remaining profit 110,000 – 1,000 – 22,000 – 10,000 = 77,000 4-7 Total 110,000 1,000 5. Salaries 77,000*4/10 77,000*4/10 77,000*2/10 As Allocated 37,400 12,000 22,000 10,000 10,000 15,400 37,400 77,000 110,000 30,800 30,800 40,800 31,800 Anton, Barkley and Charles, partners of ABC Enterprises, have agreed on a profit and loss ratio of 3:3:4, respectively. On December 31, 2019, the partnership books showed the following capital balances: Anton – P 450,000; Barkley – P 540,000; Charles – P 900,000 On January 1, 2020, Derek was admitted as a new partner under the following terms and conditions: a. b. c. d. Derek will share ¼ in the profit and loss ratio, while the ratio of the original partners will remain proportionately the same as before Derek’s admission. Derek will purchase 1/6 of Barkley’s interest paying him P 75,000. Derek will contribute P 450,000 in cash to the partnership. Total partnership capital after Derek’s admission will be P 2,400,000 of which Derek’s capital interest will be P 480,000. Partnership Dissolution – Admission of a Partner Page 47 Instructions: 1. Using the format below, prepare a schedule showing the capital of each partner before and after the admission of Derek. Capital balances before the admission of Derek Derek’s1/6 purchase of Barkley’s Capital Anton Barkley Charles Derek Total P 450,000 P 540,000 P 900,000 - P 1,890,000 (90,000) 90,000 Derek’s Investment Bonus to Old Partners Share in +Asset Revaluation (2,400,000 – 2,340,000 = 60,000) Capital balances after the admission of Derek 450,000 18,000 18,000 24,000 (60,000) 18,000 18,000 24,000 - 486,000 486,000 948,000 480,000* P 2,400,000* AC CC +AR Bonus to OP OP 1,920,000* 1,800,000 60,000 60,000 = +120,000 NP 480,000* < 540,000 (60,000) 2,400,000* > 2,340,000 60,000 +AR Allen 60,000 3/10 = 18,000 Barkley 60,000 x 3/10 = 18,000 Charles 60,000 x 4/10 = 24,000 Same sharing for Bonus to OP New Total Capital of OP ( 486,000 + 486,000 + 948,000) = 1,920,000* 2. What is the profit and loss ratio of all the partners after Derek’s admission? Anton = ¾ x 3/10 22.5% Barkley = ¾ x 3/10 22.5% Charles = ¾ x 4/10 30% Derek = ¼ 25% Total = 100% Partnership Dissolution – Admission of a Partner Page 48 4-8 The CFM Partnership shows the following profit and loss ratios and capital balances: Carter – 60% P 252,000; Fisher – 30% P 126,000; Malone – P 10% P 42,000 The partners decide to sell Shaq 20% of their respective capital and profit and loss interests for a total payment P 90,000. Shaq will pay the money directly to the partners. 1. If the partners agree that asset revaluation is to be recorded prior to the admission of Shaq, what are the capital balances of the partners after Shaq’s admission? Carter 216,000 Fisher 108,000 Malone 36,000 Shaq 90,000 Computation: New Partnership Capital Old Partners Capital Positive Asset Revaluation = P90,000 ÷ 20% = P 450,000 420,000 P 3 0,000 Distribution of P 30,000 to old partners (based on profit and loss ratio) Carter Fisher Malone P 30,000 x 60% = P 30,000 x 30% = P 30,000 x 10% = P 18,000 P 9,000 P 3,000 252,000 +18,000 = 270,000 126,000 + 9,000 = 135,000 42,000 + 3,000 = 45,000 Capital balances before revaluation Share in asset revaluation Capital balances after revaluation Interest purchased Capital transferred to Aldrick CARTER P252,000 18,000 P270,000 20% P54,000 Fisher P126,000 9,000 P135,000 20% P27,000 Capital balances after revaluation Capital transferred to Alrick Capital balance after admission P270,000 54,000 P216,000 P135,000 P45,000 27,000 9,000 P 108,000 P 36,000 Partnership Dissolution – Admission of a Partner Malone P42,000 3,000 P45,000 20% P 9,000 Total P720,000 360,000 P 450,000 20% P90,000 Page 49 4-9 On January 1, 2020, Kevin Garnett and Steve Nash have capital balances of P 174,600 and P 110,400, respectively. On this date, Karl Malone is admitted as a partner upon his investment of P 120,000 in the firm. Kevin and Steve, sharing profits and losses in the ratio of 65:35, gave a bonus to Karl so that Karl may have a 40% interest in the firm. How much is the decrease in Steve’s capital balance? Steve’s capital balance will be decreased by 14,700 AC 243,000 162,000 405,000 Old New CC 285,000 120,000 405,000 Bonus (42,000) 42,000 - Computation: Kevin’s Share in Bonus to Aldrick 42,000*65/100 Steve’s Share in Bonus to Aldrick 42,000*35/100 4-10 = = 27,300 14,700 Jason and Kidd are partners who share profits and losses in the ratio of 3:1, respectively. On August 1, 2020, their capital balances were: Jason – P 200,000 and Kidd – P 100,000. On this date, Scottie invests 80,000 in the firm and is given a capital credit of P 50,000 which is to be 1/8 of the capital of the new partnership. 1. What is the agreed capital of the new partnership? 400,000 50,000/ (1/8) 2. What is the new capital balance of Jason after the admission of Scottie? AC CC Bonus Revaluation Old 350,000 300,000 30,000 20,000 New 50,000 80,000 ( 30,000) 400,000 380,000 20,000 Jason, Capital 50,000*3/4 = 37,500 200,000 + 37,500= 237,500 4-11 Terence and Romeo are partners who share profits and losses 60% and 40%, respectively. Their capital accounts on July 1, 2020 were as follows: Terence – P 280,000; Romeo – P240,000. On this date, they agree to admit Arwind as a new partner. 1. If Arwind purchased ¼ of the equity of Terence for P 100,000, how much would be the total partnership capital after Arwind’s admission? 520,000 2. If Arwind invested P 180,000 for a ¼ interest in the firm and that the assets of the partnership are fairly valued, what would be the capital of Terence after Arwind’s admission? 283,000 Computation: AC 525,000 175,000 700,000 Teren’s Share in Bonus 5,000*60% = CC 520,000 180,000 700,000 3,000 Old (75%) New (25%) Bonus 5,000 (5,000) - 280,000 + 3,000 = 283,000 3. If Arwind invested P 130,000 for a 25% interest in the firm and that the assets of the partnership are fairly valued, what would be the capital of Romeo after the admission of Arwind? 227,000 Computation: AC Old (75%) 487,500 New (25%) 162,500 650,000 Romeo’s Share in Bonus 32,500*40% = CC 520,000 130,000 650,000 13,000 Bonus (32,500) 32,500 - 240,000 - 13,000 = 227,000 4. If Arwind purchased 25% of the respective capital and profits and losses of Terence and Romeo for P 150,000, how much is the share of Terence in the asset adjustment? 80,000 x 60% = 40,800 Terrence’s share in Asset Revaluation Computation: New PC 150,000/25% = 600,000 Old PC = 520,000 Asset Revaluation = 80,000 EXERCISES 5.1 Maria, Leonora and Teresa are partners with adjusted capital balances of P165,000, P150,000 and P180,000 respectively and divide profit and loss equally. At the end of the year, Maria decides to withdraw from the partnership. Maria will receive cash settlement of P150,000 Instruction: Give the entry to record the withdrawal of Maria assuming – a. Bonus Method is used Maria, Capital 165,000 Leonora, Capital Teresa, Capital Cash P15,000/2 = P 7,500 P15,000/2 = P 7,500 7,500 7,500 150,000 b. Revaluation of Asset method is used Maria, Capital 165,000 Leonora, Capital 15,000 Teresa, Capital 15,000 Other Assets 45,000 Cash 150,000 Revaluation P15,000 ÷ 1/3 = P 45,000 P45,000 x 1/3 = P15,000 P45,000 x 1/3 = P15,000 P45,000 x 1/3 = P15,000 5.2 Mercedes, Melinda and Julieta are partners sharing profit and loss 40%, 30% and 30% respectively. Capital balances of the partners before the retirement of Mercedes were at P450,000, P425,000 and P400,000. The company sustained a net loss of P45,000 during the year. The partners were allowed to withdraw P10,000 each. Instruction: Give the entry to record the retirement of Mercedes, assuming no Bonus or Revaluation will be recorded Profit and Loss ratio Capital Balance retirement Share in Net Loss Withdrawals Total before Mercedes, Capital Melinda, Capital Julieta, Capital 40% 30% 30% P450,000 P425,000 P400,000 (18,000) (13,500) (13,500) (10,000) P422,000 (10,000) P401,500 (10,000) P 376,500 Total Capital P 1,275,000 (45,000) (10,000) P 1,220,000 Mercedes, Capital Cash 5.3 422,000 Santino is to withdraw from Mariposa Partnership, owned by partners Macario, Policarpio and Santino, with capital balances of P200,000, P250,000 and P100,000. Macario purchased 60% of Santino’s interest for P65,000 while Policarpio paid Santino P50,000 for the remainder. Instruction: Give the entry to record the withdrawal of Santino from the Partnership. Santino, Capital Macario, Capital Policarpio, Capital 5.4 422,000 100,000 60,000 40,000 After closing the books of the partnership of Mutya and Associates, Lakambini announced his retirement of from the partnership. Shown below are the partners’ capital balances and the profit and loss ratio: Capital Balance LamAng, Capital Lakandula, Capital Lakambini, Capital LaLuna, Capital P 50,000 65,000 40,000 45,000 P/L ratio 30% 25% 23% 22% The partners agreed to the following before the cash settlement to Lakambini. a. The merchandise inventory will be increased by P4,500 b. Allowance for bad debts will be decreased by P2,100 c. Prepaid insurance worth P1,200 have expired. Instruction: Give the entries to record the following: 1) Adjustments in the books of the partnership a. Merchandise Inventory LamAng, Capital Lakandula, Capital Lakambini, Capital LaLuna, Capital 4,500 1,350 1,125 1,035 990 LamAng 4,500*30% = 1,350; Lakndula 4,500*25% = 1,125; Lakambini 4,500*23% = 1,035; LaLuna 4,500*22% = 990 b. Allowance for Bad Debts LamAng, Capital Lakandula, Capital Lakambini, Capital LaLuna, Capital 2,100 630 525 483 462 LamAng 2,100*30% = 630; Lakndula 2,100*25% = 525; Lakambini 2,100*23% = 483; LaLuna 2,100*22% = 462 c. LamAng, Capital Lakandula, Capital Lakambini, Capital LaLuna, Capital Prepaid Insurance 360 300 276 264 1,200 LamAng 1,200*30% = 360; Lakndula 1,200*25% = 300; Lakambini 1,200*23% = 276; LaLuna 1,200*22% = 264 Summary: Capital Adjustment Account LamAng, Capital Lakandula, Capital Lakambini, Capital LaLuna, Capital 5,400 1,620 1,350 1,242 1,188 2) Withdrawal of Lakambini from the Partnership assuming the remaining partners will give Lakambini a bonus of P10,000. 40,000 + 1,242 = 41,242 41,242+ 10,000 = 51,242 Lakambini, Capital LamAng, Capital Lakandula, Capital LaLuna, Capital Cash 41,242 3,896 3,247 2,857 51,242 10,000*30/77 = 3,896 10,000*25/77= 3,247 10,000*22/77= 2,857 3) Withdrawal of Lakambini from the partnership assuming Lakambini receives P5,000 share in asset revaluation. Lakambini, Capital Other Assets Cash LamAng, Capital Lakandula, Capital LaLuna, Capital Computation: 41,242 21,739 46,242 6,522 5,435 4,782 5,000/23% = 21,739 LamAng = 21,739*30% = 6,522 Lakandula = 21,739*25% = 5,435 Lakambini = 21,739*23% = 5,000 LaLuna = 21,739*22% = 4,782 5.5 The partners Macopa, Sineguelas and Ashitaba have capital balances of P300,000, P450,000 and P200,000 respectively, while profit and loss was divided in the ratio 4:4:2. On December 1, 2017, Macopa announced his intention to leave the partnership at the end of the year. During the year the partnership gained a Net Income of P250,000 which was distributed as follows: 5% interest on their individual capital, salaries of P6,000 to Partners Sineguelas and Ashitaba, 4% Bonus on Net income after salaries and interest on capital was allowed to partner Macopa. Instruction: 1) Compute for the distribution of Net Income at the end of the year. Macopa Amount being Allocated Allocation: 8. Interest on Capital 300,000*5% 450,000*5% 200,000 *5% 9. Salaries 10. Bonus 250,000-47,500-12,000 = 190,500 190,500*4% Siniguelas Ashitaba Total 250,000 10,000 6,000 47,500 12,000 15,000 22,500 6,000 7,620 7,620 11. Allocation of remaining profit 250,000-47,500-12,000-7,620 = 182,880 182,880*4/10 182,880*4/10 182,880*2/10 As Allocated 73,152 73,152 95,772 101,652 36,576 52,576 182,880 250,000 2) Give the entry to record the withdrawal of Macopa at the end of the year assuming Profit and Loss ratio Capital Balance retirement Share in Net Income Total before Macopa, Capital Siniguelas, Capital Ashitaba, Capital 40% 40% 20% Total Capital P300,000 P450,000 P200,000 P 950,000 95,772 P395,772 101,652 P551,652 52,576 P 252,576 250,000 P 1,200,000 a) Macopa cash settlement was P20,000 less than her capital interest and the bonus method was used. Macopa, Capital 395,772 Siniguelas, Capital 13,333 Ashitaba, Capital 6,667 Cash 375,772 P20,000 x 4/6 = P 13,333 P20,000 x 2/6 = P 6,667 b) Macopa’s cash settlement was P10,000 more than her capital interest and the asset revaluation method was used Other Assets Macopa Capital Siniguelas, Capital Ashitaba, Capital Cash 25,000 395,772 10,000 5,000 405,772 Revaluation P10,000 ÷ 40% = P25,000 P25,000 x 4/10 = P10,000 P25,000 x 4/10 = P10,000 P25,000 x 2/10 = P 5,000 c) Macopa’s cash settlement was equal to her capital interest. Macopa, Capital Cash 5.6 395,772 395,772 The following information was taken from the books of SAMPALOC and SONS PARTNERSHIP. Capital Balance Profit & Loss Ratio Sampaloc, Capital P5,000,000 35% Kamatchili, Capital Kaimito, Capital 2,500,000 1,500,000 33% 32% Kaimito is to withdrew from the partnership by selling 30% of his capital interest to Sampaloc at 2% more than his capital interest, and will sell 70% of his capital to Kamatchili at book value. After the withdrawal of Kaimito, the remaining partners will divide their profit and loss equally. Instruction: 1. Give the entry to record the retirement of Kaimito. Kaimito, Capital Sampaloc, Capital Kamatchili, Capital 1,500,000 450,000 1,050,000 2. If the remaining partners were to have equal capital interest and share in profit and loss, how much additional cash should one of the partners invest? Kamatchili should invest an additional cash of 950,000 Computation: Adjusted Capital Balances Sampaloc, Capital Kamatchili, Capital Total Equal interest (9,000,000/2) Add’l investment 5.7 4,500,000 (950,000) 5,000,000 + 450,000 = 5,450,000 2,500,000 + 1,050,000 = 3,550,000 9,000,000 4,500,000 950,000 Nilupak, Biko and Maja Blanca are partners with capital balances of P324,300, P207,000 and P158,700. After being a partner for 30 years, Biko decided to withdraw from the partnership. Upon his withdrawal, assets were revaluated, and Biko’s share was debited for P27,000. Instruction: 1. Give the entry to record the revaluation of the other assets Nilupak, Capital Biko, Capital Maja Blanca, Capital Other Assets 42,300 27,000 20,700 90,000 Revaluation P27,000 ÷ 207,000/690,000 = P90,000 P90,000 x 324,300/690,000= P42,300 P90,000 x 207,000/690,000= P 27,000 P90,000 x 158,700/690,000= P 20,700 2. Give the entry to record the withdrawal of Biko from the partnership. Biko, Capital Cash 180,000 180,000