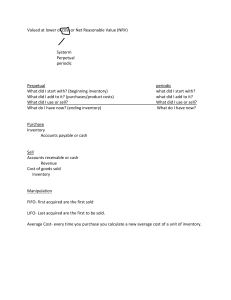

CHAPTER IV WORKING CAPITAL MANAGEMENT “The Lord is my shepherd, I shall not be in want. He makes me lie down in green pastures, he leads me beside quiet waters, he restores my soul. He guides me in paths of righteousness for his name’s sake. Even though I walk through the valley of the shadow of death, I will fear no evil, for you are with me; your rod and your staff, they comfort me.” Psalm 23:1-4 LEARNING OBJECTIVES: After studying this chapter, you should be able to: 1. Explain the goal of working capital management. 2. Explain the tradeoff between the firm’s profitability and the related risk. 3. Explain the factors to be considered in managing working capital. 4. Explain the different techniques to be employed in cash and marketable securities management. 5. Explain the different techniques to be employed in receivable management. 6. Explain the different techniques to be employed in inventory management. 7. Explain the different techniques to be employed in accounts payable management. 8. Explain the different techniques to be employed in short-term credit management. 1 INTRODUCTION Working capital management is an important yardstick to measure a company’s operational and financial efficiency. This aspect must form part of the company's strategic and operational thinking. Efforts should constantly be made to improve the working capital position. This will yield greater efficiencies and improve customer satisfaction. The firm’s balance sheet provides information about the structure of the firm’s investments on one hand and the structure of its financing sources on the other hand. The structures chosen should consistently lead to the maximization of the value of the owner’s investment in the firm. Important components of the firm’s financial structure include the level of investment in current assets and the extent of current liability financing. The goal of working capital management is to manage each of the firm’s current assets (inventory, accounts receivable, cash and marketable securities) and current liabilities (accounts payable, accruals, and notes payable) to achieve a balance between profitability and risk that contributes positively to the firm’s value. TRADEOFF BETWEEN PROFITABILITY AND RISK A tradeoff exists between a firm’s profitability and its risk. Profitability is the relationship between revenues and costs generated by using the firm’s assets-both current and fixed in productive activities. A firm’s profits can be increased by (1) increasing revenues and (2) decreasing costs. Risk is the probability that a firm will be unable to pay its bills as they come due. It is generally assumed that the greater the firm’s net working capital, the lower its risk. In other words, the more net working capital, the more liquid the firm and therefore the lower its risk of becoming technically insolvent. WORKING CAPITAL MANAGEMENT Working capital management refers to the management of current or short-term assets and short-term liabilities. Components of short-term assets include inventories, loans and advances, debtors, investments and cash and bank balances. Short-term liabilities include creditors, trade advances, borrowings and provisions. 2 The major emphasis is, however, on short-term assets, since short-term liabilities arise in the context of short-term assets. It is important that companies minimize risk by prudent working capital management. FACTORS TO CONSIDER IN MANAGING WORKING CAPITAL APPROPRIATE LEVEL – This refers to adequacy of working capital. Consider the nature of business and length of operating cycle. STRUCTURAL HEALTH – This refers to composition of working capital. Consider the need for cash, accounts receivable and other current assets. LIQUIDITY – This refers to the relative transformation (and its rate) of current assets into more liquid current assets (ex. Cash and marketable securities). In general, sound working capital policy requires: Managing cash and its temporary investment efficiently. (Cash/Marketable Securities Management) Ensuring efficient manufacturing operations and sound material procurement. (Inventory Management) Drafting and implementing effective credit and collection policies. (Receivable Management) Seeking favorable terms from suppliers and other temporary creditors. (Shortterm Credit Financing) CASH & MARKETABLE SECURITIES MANAGEMENT Cash Management involves the maintenance of the appropriate level of cash to meet the firm’s cash requirements and to maximize income on idle funds. On the other hand, MS Management involves the process of planning and controlling investment in marketable securities to meet the firm’s cash requirements and to maximize income on idle funds. The main objective of Cash and MS Management is to minimize the amount of cash on hand while retaining sufficient liquidity to satisfy business requirements (ex. Take advantage of cash discounts, maintain credit rating, and meet unexpected needs). 3 REASONS FOR HOLDING CASH 1. Transaction Motive (Liquidity Motive) - Cash is held to facilitate normal transactions of the business. 2. Precautionary Motive (Contingent Motive) - Cash is held beyond the normal operating requirement level to provide for buffer against contingencies, such as slow-down in accounts receivable collection, possibilities of strikes, etc. 3. Speculative Motive - Cash is held to avail of business incentives (ex. Discounts) and investment opportunities. 4. Contractual Motive (Compensating Balance Requirements) - A company is required by a bank to maintain a certain compensating balance in its demand deposit account as a condition of a loan extended to it. CASH CONVERSION CYCLE Refers to the average length of time a peso is tied up in current assets. It runs from the date the company makes payment of raw materials to the date company receives cash inflows thru collection of accounts receivable. In other words, cash conversion cycle is simply the company’s operating cycle less the payment period. The formula for cash conversion cycle is as follows: Cash Conversion Cycle = Ave. Age of Inventory + Ave. Collection Period – Ave. Payment Period The firm’s goal should be to shorten its cash conversion cycle without hurting operations. The longer is the cash conversion cycle, the greater the need for external financing; hence, the more cost of financing. 4 FUNDING REQUIREMENTS OF THE CASH CONVERSION CYCLE 1. Permanent Funding Requirement This happens when the firm’s sales are constant which means its investment in operating assets should also be constant. 2. Seasonal Funding Requirement This happens when the firm’s sales are cyclic that results in an investment in operating assets that vary over time with its sales cycles. This is in addition to the permanent funding required for its minimum investment in operating assets. Seasonal funding requirements can either be aggressive or conservative. Under an aggressive funding strategy, the firm funds its seasonal requirements with shortterm debt and its permanent requirements with long term debt. On the other hand, in a conservative funding strategy, the firm funds both its seasonal and its permanent requirements with long-tem debt. The difference between a conservative and aggressive funding strategy are summarized below: Level of current assets Reliance on long-term financing Liquidity risk Profitability and returns -CONSERVATIVECURRENT LIABILITIES CURRENT ASSETS Working Capital Policy Conservative Aggressive HIGH LOW HIGH LOW LOW HIGH LOW HIGH -AGGRESSIVECURRENT ASSETS CURRENT LIABILITIES STRATEGIES FOR MANAGING THE CASH CONVERSION CYCLE A positive cash conversion cycle means that the firm must use negotiated liabilities (such as bank loans) to support its operating assets. Negotiated liabilities carry an explicit cost, so the firm benefits by minimizing their use in supporting operating assets. Simply stated, the goal is to minimize the length of the cash conversion 5 cycle, which minimizes negotiated liabilities. This goal can be realized through the application of the following strategies: 1. Turn over inventory as quickly as possible without stockouts that result in lost sales. 2. Collect accounts receivable as quickly as possible without losing sales from highpressure collection techniques. 3. Manage mail, processing, and clearing time to reduce them when collecting from customers and to increase them when paying suppliers. 4. Pay accounts payable as slowly as possible without damaging the firm’s credit rating. THE CONCEPT OF FLOAT Float refers to funds that have been sent by the payer but are not yet usable funds to the payee. Float is important in the cash conversion cycle because its presence lengthens both the firms average collection period and its average payment period. However, the goal of the firm should be to shorten its average collection period and lengthen its average payment period. Both can be accomplished by managing the float. Types of float: 1. POSITIVE (Disbursement) Float – slowing down payment means increasing payment float and therefore increasing the firm’s average payment period (ex. Controlled disbursing). 2. NEGATIVE (Collection) Float – speeding up of collections reduces customer collection float time and thus reduces the firm’s average collection period, which reduces the investment the firm must make in its cash conversion cycle (ex. Lockbox system). A lockbox system works as follows: Instead of mailing payments to the company, customers mail payments to a post office box. The firm’s bank empties the post office box regularly, processes each payment, and deposits the payments in the firm’s account. Component of a float: 1. Mail Float – refers to the time delay between when payment is placed in the mail and when it is received. 6 2. Processing Float – is the time between receipt of payment and its deposit into the firm’s account. 3. Clearing Float – refers to the time between deposit of the payment and when spendable funds become available to the firm. This component of float is attributable to the time required for a check to clear the banking system. OPTIMAL CASH BALANCE Another aspect of cash management is knowing the optimal cash balance. There are a number of methods that try to determine the magical cash balance, which should be targeted so that costs are minimized and yet adequate liquidity exists to ensure bills are paid on time (hopefully with something left over for emergency purposes). One of the first steps in managing the cash balance is measuring liquidity. There are numerous ways to measure this, including: cash to total assets ratio, current ratio (current assets divided by current liabilities), quick ratio (current assets less inventory, divided by current liabilities), and the net liquid balance (cash plus marketable securities less short-term notes payable, divided by total assets). The higher the number generated by the liquidity measure, the greater the liquidity and vice versa. There is a trade off, however, between liquidity and profitability that discourages firms from having excessive liquidity. To help manage cash on a day-to-day basis in actual dollars and cents, there are a number of cash management models. These include the Baumol Model, Miller-Orr Model, and the Stone Model. In this discussion we will discuss only Baumol Model. BAUMOL MODEL. The Baumol Model is similar to the Economic Order Quantity (EOQ) Model. Mathematically it is: __________________________________________ Optimal Cash Balance = √ 2 (Annual Cash Requirement) (Cost per Transaction) Opportunity Cost of Holding Cash Total Costs of Cash Balance = Holding Costs + Transaction Costs Holding Costs = Average Cash Balance* x Opportunity Cost Transaction Costs = Number of Transactions** x Cost per Transaction * Average cash balance = OCB ÷ 2 7 * Number of transactions = Annual Cash Requirement ÷ OCB One shortcoming of this model is that it accommodates only a net cash outflow situation as opposed to both inflows and outflows. Also, the cash outflow is at a constant rate, with no variation. ACCOUNTS RECEIVABLE MANAGEMENT Accounts receivable management involves the determination of the amount and terms of credit to extend to customers and monitoring receivables from credit customers. The objective for managing accounts receivable is to collect accounts receivable as quickly as possible without losing sales from high-pressure collection techniques. Accomplishing this goal encompasses three topics: (1) credit selection and standards, (2) credit terms, and (3) credit monitoring. CREDIT SELECTION AND STANDARDS Credit selection involves the application of techniques for determining which customers should receive credit. This process involves evaluating the customer’s creditworthiness and comparing it to the firm’s credit standards, its minimum requirements for extending credit to customers. Factors to be considered in establishing credit standards – the Five C’s of Credit: 1. Character – the customers’ willingness to pay. 2. Capacity – the customers’ ability to generate cash flows. 3. Capital – the customers’ financial sources. 4. Conditions – the current general and industry-specific economic conditions, and any unique conditions surrounding a specific transaction. 5. Collateral – the customers’ assets to secure debt. CHANGING CREDIT STANDARDS The firm sometimes will contemplate changing its credit standards in an effort to improve its returns and create greater value for its owners. This can be done through relaxation of credit standards. The entity must consider that relaxing credit standards may attract more customers thereby creating greater sales, however it would entail more costs of AR such as collection, bad debts and interests (opportunity costs). 8 CREDIT TERMS Credit terms are the terms of sale for customers who have been extended credit by the firm. Terms of net 30 mean the customer has 30 days from the beginning of the credit period to pay the full invoice amount. CASH DISCOUNT Including a cash discount in the terms is a popular way to achieve the goal of speeding up collections without putting pressure on customers. The cash discount provides an incentive for customers to pay sooner. By speeding collections, the discount decreases the firm’s investment in accounts receivable, but also it decreases the per-unit profit. Additionally, initiating a cash discount should reduce bad debts because customers will pay sooner, and it should increase sales volume because customers who take the discount pay a lower price for the product. CREDIT MONITORING The final issue a firm should consider in its accounts receivable management is credit monitoring. Credit monitoring is an ongoing review of the firm’s accounts receivable to determine whether customers are paying according to the stated credit terms. Slow payments are costly to a firm because they lengthen the average collection period and thus increase the firm’s investment in accounts receivable. Two frequently used techniques for credit monitoring are (1) average collection period and (2) aging of accounts receivable. AVERAGE COLLECTION PERIOD The average collection period is the number of days that credit sales are outstanding. It has two components: (1) the time from sale until the customer places the payment in the mail and (2) the time to receive, process, and collect the payment once it has been mailed by the customer. The formula for finding the average collection period is 9 Average collection period = Accounts receivable Average sales per day Assuming receipt, processing, and collection time is constant, the average collection period tells the firm, on average, when its customers pay their accounts. Knowing its average collection period enables the firm to determine whether there is general problem with accounts receivable. AGING OF ACCOUNTS RECEIVABLE An aging schedule breaks down accounts receivable into groups on the basis of their time origin. The breakdown is typically made on a month-by-month basis. The resulting schedule indicates the percentages of the total accounts receivable balance that have been outstanding for specified periods of time. The purpose of the aging schedule is to enable the firm to pinpoint problems. INVENTORY MANAGEMENT Inventory Management refers to the process of formulation and administration of plans and policies to efficiently and satisfactorily meet production and merchandising requirements and minimizes costs relative to inventories. Its objective is to maintain inventory at a level that best balances the estimates of actual savings, the cost of carrying additional inventory, and the efficiency of inventory control. COMMON TECHNIQUES FOR MANAGING INVENTORY Numerous techniques are available for effectively managing the firm’s inventory. The four commonly used techniques used are as follows: 1. THE ABC SYSTEM A firm using ABC inventory system divides its inventory into three groups: A, B, and C. The A group consists of the largest peso investment. Thus, requiring highest possible control. The B group consists of items that account for the next largest investment in inventory. They require normal control. The C group consists of a 10 large number of items that require a relatively small investment. They require the simplest possible control. The A group items are tracked on a perpetual inventory system that allows daily verification of each item’s inventory level. B group items are frequently controlled through periodic, perhaps weekly, checking of their levels. C group items are monitored with unsophisticated techniques, such as the two bin method. With the two bin method, the items are stored in two bins. As an item is needed, inventory is removed from the first bin. When the bin is empty, an order is placed to refill the first bin while inventory is drawn from the second bin. The second bin is used until empty, and so on. 2. THE ECONOMIC ORDER QUANTITY (EOQ) MODEL One of the most common techniques for determining the optimal order size for inventory items is the EOQ model. The EOQ model considers various costs of inventory and then determines what order size minimizes total inventory cost. The EOQ assumes that the relevant costs of inventory can be divided into order costs and carrying costs. Order costs include the fixed clerical costs of placing and receiving orders. Carrying costs are the variable costs per unit of holding an item of inventory for a specific period of time. The EOQ model analyzes the tradeoff between order costs and carrying costs to determine the order quantity that minimizes the total inventory cost. The formulas for the EOQ model are as follows: ______________________________ EOQ = √ 2 x Annual Demand x Ordering Cost Carrying Cost Ordering Cost = Annual Demand EOQ Carrying Cost = EOQ 2 x Order cost per order x Carrying cost per unit 11 REORDER POINT Once the firm has determined its economic order quantity, its must determine when to place an order. The reorder point reflects the firm’s daily usage of the inventory item and the number of days needed to place and receive an order. Assuming that the inventory is used at a constant rate, the formula for the reorder point is Reorder point = Days of lead time x daily usage 3. JUST-IN-TIME (JIT) SYSTEM The JIT System is used to minimize inventory investment. The philosophy is that materials should arrive at exactly the time they are needed for production. Ideally, the firm would only have work-in-process inventory. Because its objective is to minimize inventory investment, a JIT System uses no (or very little) safety stock. The goal of the JIT System is manufacturing efficiency. It uses inventory as a tool for attaining efficiency by emphasizing quality of the materials used and their timely delivery. When JIT is working properly, it forces process inefficiencies to surface. 4. COMPUTERIZED SYSTEMS FOR RESOURCE CONTROL Today a number of systems are available for controlling inventory and other resources. Some of the basic techniques include the following: A. Materials Requirement Planning (MRP) System MRP is an inventory management technique that applies EOQ concepts and computer to compare production needs to available inventory balances and determine when orders should be placed for various items on a product’s bill of materials. 12 B. Manufacturing Resource Planning II (MRP II) MRP II is a sophisticated computerized system that integrates data from numerous areas such as finance, accounting, marketing, engineering, and manufacturing and generates production plans as well as numerous financial and management reports. C. Enterprise Resource Planning (ERP) ERP is a computerized system that electronically integrates external information about the firm’s suppliers and customers with the firm’s departmental data so that information on all available resourceshuman and material-can be instantly obtained in a fashion that eliminates production delays and controls costs. ACCOUNTS PAYABLE MANAGEMENT Accounts payable are the major source of unsecured short-term financing for business firms. They result from transactions in which merchandise is purchased but no formal note is signed to show the purchaser’s liability to the seller. Accounts payable management is the management by the firm of the time elapse between its purchase of raw materials and its mailing payment to the supplier. The firm’s goal is to pay as slowly as possible without damaging its credit rating. This means that accounts should be paid on the last possible, given the supplier’s stated credit terms. ANALYZING CREDIT TERMS The credit terms that a firm is offered by its suppliers enable it to delay payments for its purchases. Because the supplier’s cost of having its money tied up in merchandise after it is sold is probably reflected in the purchase price, the purchaser is already indirectly paying for this benefit. The purchaser should therefore carefully analyze credit terms to determine the best trade credit strategy. If a firm extended credit terms that include a cash discount, it has two options - to take the cash discount or give it up. 1. Taking the Cash Discount If a firm intends to take a cash discount, it should pay on the last day of the discount period. There is no cost associated with taking a cash discount. 13 2. Giving up the Cash Discount If the firm chooses to give up the cash discount, it should pay on the final day of the credit period. There is an implicit cost associated with giving up a cash discount. The cost of giving up cash discount is the implied rate of interest paid to delay payment of an accounts payable for an additional number of days. In other words, the amount is the interest being paid by the firm to keep its money for a number of days. Cost of giving up cash discount = Annualized cost of giving up CD = Cash Discount x CD 100% - CD # of Working Days # of days payment can be delayed x # of Working Days # of days payment can be delayed STRETCHING ACCOUNTS PAYABLE A strategy that is often employed by a firm is stretching accounts payable – that is, paying bills as late as possible without damaging its credit rating. Such a strategy can reduce the cost of giving up a cash discount. Assuming, Lawrence Industries was extended credit terms of 2/10 net 30 EOM. The cost of giving up the cash discount, assuming on the last day of the credit period, was found to be approximately 36.5% [2% x ( 365/20)]. If the firm were able to stretch its accounts payable to 70 days without damaging its credit rating, the cost of giving up the cash discount would be only 12.2% [2% x (365/60)]. Stretching accounts payable reduces the implicit cost of giving up a cash discount. Although stretching accounts payable may be financially attractive, it raises an important ethical issue: It may cause the firm to violate the agreement it entered into with its supplier when it purchased merchandise. Clearly, a supplier would not look kindly on a customer who regularly and purposely postponed paying for purchases. 14 SHORT-TERM LOAN MANAGEMENT BANK LOANS & COMMERCIAL PAPERS The cost of bank loan is actually the entity’s effective annual rate. The cost of bank loan and commercial papers can be computed by using the following formula. COST OF BANK LOAN 1. Without Compensating Balance a. If not discounted (cash proceeds normally equal face value). COST = Interest Amount Received (Face) b. If discounted (cash proceeds is net of interest – deducted in advance). COST = Interest Face Value – Interest 2. With Compensating Balance (CB) a. If not discounted COST = Interest Face Value - CB OR Nominal % 100% - CB% COST = b. If discounted COST = Interest Face Value – Interest – CB OR Nominal % 100% - Nominal% - CB% COST = COST OF COMMERCIAL PAPER COST = Interest + Issue Costs Face Value – Interest – Issue Costs x 360 days Term 15 ILLUSTRATIVE EXERCISES CASH CONVERSION CYCLE Koyot Company, a producer of paper dinnerware, has annual sales of P10,000,000, a cost of goods sold of 75% of sales, and purchases that are 65% of cost of goods sold. Average inventory is P1,250,000, average receivables is P1,500,000 and average accounts payable is P406,250. Required: 1. Compute for the Receivable Turnover. 2. Compute for the Inventory Turnover. 3. Compute for the Payable Turnover. 4. Compute for the Average Collection Period, Age of Inventory, and Payment Period. 5. Compute for Operating Cycle. 6. Compute for Cash Conversion Cycle. FUNDING REQUIREMENTS Arius Company holds, on average, P50,000 in cash and marketable securities, P1,250,000 in inventory, and P750,000 in accounts receivable. Arius’ business is stable over time, so its operating assets can be viewed as permanent. In addition, Arius’ accounts payable of P425,000 are stable over time. In contrast, Julien Isabel Company, which produces bicycle pumps, has seasonal funding needs. Julien has seasonal sales, with its peak sales being driven by the summertime purchases of bicycle pumps. Julien holds at minimum, P25,000 in cash and marketable securities, P100,000 in inventory, and P60,000 in accounts receivable. At peak times, Julien’s inventory increases to P750,000 and its accounts receivable increases to P400,000. To capture production efficiencies, Julien produces pumps at a constant rate throughout the year. Thus, accounts payable remain at P50,000 throughout the year. Required: 1. Compute for Arius Company’s permanent funding requirement. 2. Compute for Julien Isabel Company’s permanent funding requirement. 3. Compute for Julien Isabel Company’s peak seasonal funding requirement. 16 OPTIMAL CASH BALANCE Matinik Corporation is expecting to have total payments of P1,800,000 for one year, cost per transaction amounted to P25 and the interest rate of marketable securities is 10%. Required: 1. What is the company’s optimal initial cash balance that minimizes total cost? 2. What is the total number of transactions (cash conversions) that will be required per year? 3. What will be the average cash balances for the period? 4. What is the total cost of maintaining cash balances? (Adapted: Principles of Managerial Finance by Lawrence J. Gitman) FLOAT AND LOCKBOX SYSTEM It typically takes Matinik Corporation 8 calendar days to receive and deposit customer remittances. Matinik is considering adopting a lockbox system and anticipates that the system will reduce the float time to 5 days. Average daily cash receipts are P220,000. The rate of return is 10 percent. Required: 1. How much is the reduction of float in cash balances associated with implementing the system? 2. What is the amount of return associated with the earlier receipt of the funds? 3. If the lockbox costs P7,500 per month to implement, should the system be implemented? (Adapted: Financial Management Principles and Applications by Keown, et. al.) CREDIT POLICY – RELAXATION SPSBL Corp., a manufacturer of tools is currently selling a product for P10 per unit. Sales (all on credit) for last year were 60,000 units. The variable cost per unit is P6. The firm’s total fixed costs are P120,000. The firm is currently contemplating a relaxation of credit standards that is expected to result in the following: a 5% increase in unit sales to 63,000 units; an increase in the average collection period from 30 days to 45 days; an increase in bad-debt expenses from 1% of sales to 2%. The firm’s required return no equal-risk investments, which is the opportunity cost of tying up funds in accounts receivable, is 15%. 17 Required: 1. Should the proposed relaxation in credit standards be implemented? CREDIT TERMS – CASH DISCOUNTS X Company has an average collection period of 40 days. In accordance with the firm’s credit terms of net 30, this period is divided into 32 days until the customers place their payments in the mail and 8 days to receive, process, and collect payment once they are mailed. X Company is considering initiating a cash discount by changing its credit terms from net 30 to 2/10 net 30. The firm expects this change to reduce the amount of time until the payments are placed in the mail, resulting in an average collection period of 25 days. X has raw materials with current annual usage of 1,100 units. Each finished product produced requires 1 unit of this raw material at a variable cost of P1,500 per unit, incurs another P800 of variable cost in the production process, and sells for P3,000 on terms net 30. X Company estimates that 80% of its customers will take the 2% discount and that offering the discount will increase sales of the finished product by 50 units per year but will not alter its bad-debt percentage. X opportunity cost of funds invested in accounts receivable is 14%. Required: 1. Should X offer the proposed cash discount? DISCOUNT POLICY Jems Company presents the following information: Annual credit sales: P25,200,000 Rate of return: 18% Collection period: 3 months Terms: n/30 The company considers to offer a 4/10, n/30 credit term. It anticipates that 30% of its customers will take advantage of the discount while sales would remain constant. The collection period is expected to decrease to two months. Required: 1. What is the net advantage (disadvantage) of implementing the proposed discount policy? 18 CREDIT POLICY – RELAXATION The Leaf Corporation reports the following information: Selling price per unit P10 Variable cost per unit P8 Total fixed costs P120,000 Annual credit sales 240,000 units Collection period 3 months Rate of return 25% The Leaf Corporation, which has enough idle capacity, considers relaxing its credit standards (i.e., more liberal extension of credit). The following is expected to result: sales will increase by 25%; collection period will increase to 4 months; bad debt losses are expected to be 5% on the incremental sales; and collection costs will increase by P40,000. Required: 1. Should the proposed relaxation in credit standards be implemented? ECONOMIC ORDER QUANTITY & REORDER POINT S Company has an A group inventory item that is vital to the production process. This item costs P1,500 and S uses 1,100 units of the item per year. The cost per order is P150 per order while the carrying cost per unit per year is P200. S wants to determine its optimal order strategy for the item. S operates 250 days per year. Its lead time is 2 days and S wants to maintain a safety stock of 4 units. Required: 1. Compute for the Economic Order Quantity. 2. Compute for the reorder point. CASH CONVERSION CYCLE Hurkin Manufacturing Company pays accounts payable on the tenth day after purchase. The average collection period is 30 days, and the average age of inventory is 40 days. The firm currently has annual sales of about P18 Million. The firm is considering a plan that would stretch its accounts payable by 20 days. It the firm pays 12% per year for its resource investment, what annual savings can it realize by this plan? 19 EOQ ANALYSIS Thompson Paint Company uses 60,000 gallons of pigment per year. The cost of ordering pigment is P200 per order, and the cost of carrying the pigment in inventory is P1 per gallon per year. The firm uses pigment at a constant rate every day throughout the year. Required: 1. Calculate the EOQ. 2. Assuming that it takes 20 days to receive an order it has been placed, determine the reorder point in terms of gallons of pigment. RELAXING CREDIT STANDARDS Regency Rug Repair Company is trying to decide whether it should relax its credit standards. The firm repairs 72,000 rugs per year at an average price of P32 each. Bad debt expenses are 1% of sales, the average collection period is 40 days, and the variable cost per unit is P28. Regency expects that if it does relax its credit standards, the average collection period will increase to 48 days and that bad debt expense will increase to 1and 1/2% of sales. Sales will increase by 4,000 repairs per year. The firm has a required rate of return on equal-risk investments of 14%. Required: 1. Should the company relax its credit standards? TAKING & GIVING UP THE CASH DISCOUNT Law Industries, operator of a small chain video stores, purchased P1,000 worth of merchandise on February 27 from a supplier extending terms of 2/10 net 30 EOM. If Law gives up the cash discount, payment can be made on March 30. To keep its money for an extra 20 days, it will cost the firm P20 to delay payment for 20 days. Required: 1. Should the company take or give up the cash discount? 20 TAKING & GIVING UP THE CASH DISCOUNT Mason Products, a large building-supply company, has four possible suppliers, each offering different credit terms. The information for the four suppliers are as follows: Supplier Credit Terms A 2/10 net 30 B 1/10 net 55 C 3/20 net 70 D 4/10 net 60 If the firm needs short term funds, it can borrow from its bank at an interest rate of 13%. Required: 1. Which of the following suppliers discount should be taken up and which is to be given up? COST OF BANK LOANS ABC Trading Co. was granted a P200,000 bank loan with 12% stated interest. Required: The effective annual rate under the following cases: 1. ABC receives the entire amount of P200,000. 2. ABC was granted a discounted loan. 3. ABC is required to maintain a compensating balance of P10,000 under the nondiscounted loan. 4. ABC is required to maintain a compensating balance of 10% under a discounted loan. COST OF COMMERCIAL PAPER ABC Co. plans to sell P100,000,000 in 180-day maturity paper, which it expects to pay discounted interest at an annual rate of 12%. Due to this commercial paper, ABC expects to incur P100,000 in dealer placement fees and paper issuance costs. Required: The effective cost of ABC’s credit. 21 PRACTICE EXERCISES (Sources: CMA/CIA/RPCPA/AICPA/Various test banks) 1. Wales Company has P8,000,000 in current assets, P3,500,000 of which are considered permanent current assets. In addition, the firm has P6,000,000 invested in fixed assets. Wales Company wishes to finance all fixed assets and permanent current assets plus half of its temporary current assets with long-term financing costing 15 percent. Short-term financing currently costs 10 percent. Wales Company’s earnings before interest and taxes are P2,200,000. Income tax rate is 40 percent. How much would Wales Company’s earnings after taxes under this financing plan? A. P212,500 C. P225,000 B. P127,500 D. P 85,000 2. Luminous Co. has total fixed assets of P100,000 and no current liabilities. The table below displays its wide variation in current asset components. 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Cash P 20,000 P 10,000 P 15,000 P 20,000 Accts receivable 66,000 25,000 47,000 88,000 Inventory 20,000 65,000 59,000 10,000 Total P106,000 P100,000 P121,000 P118,000 If Luminous’ policy is to finance all fixed assets and half the permanent current assets with long-term financing and rest with short-term financing, what is the level of long-term financing? A. P 68,000 C. P150,000 B. P100,000 D. P155,625 3. Holding all other variables constant, which of the following would increase a firm's external funding requirements in the planning period? A. An increase in assets C. An increase in dividends paid B. A decrease in accruals D. All of the above 4. Common sources of short-term financing include: A. Stretching payables C. Reducing inventory B. Issuing bonds D. All of the above 22 5. The type of company most likely to need short-term financing is one that A. has no seasonality and no growth in sales from year to year B. sells only for cash C. has a high degree of seasonality D. has lower total fixed costs than total variable costs 6. The goal of managing working capital, such as inventory, should be to minimize the: A. costs of carrying inventory B. opportunity cost of capital C. aggregate of carrying and shortage costs D. amount of spoilage or pilferage 7. Zap Company follows an aggressive financing policy in its working capital management while Zing Corporation follows a conservative financing policy. Which one of the following statements is correct? A. Zap has low ratio of short-term debt to total debt while Zing has a high ratio of short-term debt to total debt. B. Zap has a low current ratio while Zing has a high current ratio. C. Zap has less liquidity risk while Zing has more liquidity risk. D. Zap finances short-term assets with long-term debt while Zing finances short-term assets with short-term debt. 8. Short-term financing plans with high liquidity have: A. high return and high risk B. moderate return and moderate risk C. low profit and low risk D. none of the above 9. Temporary working capital supports A. the cash needs of the company. B. payment of long term debt. C. acquisition of capital equipment. D. seasonal peaks. 10. As a firm's cash conversion cycle increases, the firm: A. becomes less profitable B. increases its investment in working capital C. reduces its accounts payable period 23 D. incurs more shortage costs 11. The average length of time a peso is tied up in current asset is called the: A. net working capital. C. receivables conversion period. B. inventory conversion period. D. cash conversion period. 12. All of these factors are used in credit policy administration except: A. credit standards C. peso amount of receivables B. terms of trade D. collection policy 13. Which of the following statements is most correct? If a company lowers its DSO, but no changes occur in sales or operating costs, then: A. B. C. D. the company might well end up with a higher debt ratio. the company might well end up with a lower debt ratio. the company would probably end up with a higher ROE. the company's total asset turnover ratio would probably decline. 14. All but which of the following is considered in determining credit policy? A. Credit standards C. Accounts payable deferral period B. Credit limits D. Collection efforts 15. When a specified level of safety stock is carried for an item in inventory, the average inventory level for that item A. B. C. D. decreases by the amount of the safety stock. is one-half the level of the safety stock. Increases by one-half the amount of the safety stock. Increases by the number of units of the safety stock. 16. Which of the following statements is correct for a firm that currently has total costs of carrying and ordering inventory that are 50% higher than total carrying costs? A. Current order size is greater than optimal B. Current order size is less than optimal C. Per unit carrying costs are too high D. The optimal order size is currently being used 24 17. The Spades Company has an inventory conversion period of 75 days, a receivables conversion period of 38 days, and a payable payment period of 30 days. What is the length of the firm’s cash conversion cycle? A. 83 days B. 113 days C. 67 days D. 45 days 18. Samaritan Supplies, Inc. has P5 million in inventory and P2 million in accounts receivable. Its average daily sales are P100,000. The company has P1.5 million in accounts payable. Its average daily purchases are P50,000. What is the length of the company’s cash conversion period? A. 50 days C. 30 days B. 20 days D. 40 days 19. Samaritan Supplies, Inc. has P5 million in inventory and P2 million in accounts receivable. Its average daily sales are P100,000. The company has P1.5 million in accounts payable. Its average daily purchases are P50,000. What is the length of the company’s inventory conversion period? A. 50 days C. 120 days B. 90 days D. 40 days 20. Simile Inc. has a total annual cash requirement of P9,075,000 which are to be paid uniformly. Simile has the opportunity to invest the money at 24% per annum. The company spends, on the average, P40 for every cash conversion to marketable securities. What is the optimal cash conversion size? A. P60,000 C. P45,000 B. P55,000 D. P72,500 21. Hyperbole Corporation estimates its total annual cash disbursements of P3,251,250 which are to be paid uniformly. Hyperbole has the opportunity to invest the money at 9% per annum. The company spends, on the average, P25 for every cash conversion to marketable securities and vice versa. What is the opportunity cost of keeping cash in the bank account? A. P3,825.00 C. P4,190.00 B. P1,912.50 D. P 188.55 25 22. What are the expected annual savings from a lock-box system that collects 150 checks per day averaging P500 each, and reduces mailing and processing times by 2.5 and 1.5 days respectively, if the annual interest rate is 7%? A. P 5,250 C. P 21,000 B. P 13,125 D. P300,000 23. The Camp Company has an inventory conversion period of 60 days, a receivable conversion period of 30 days, and a payable payment period of 45 days. The Camp’s variable cost ratio is 60 percent and annual fixed costs of P600,000. The current cost of capital for Camp is 12%. If Camp’s annual sales are P3,375,000 and all sales are on credit, what is the firm’s carrying cost on accounts receivable, using 360 days year? A. P281,250 C. P 20,250 B. P168,750 D. P 56,250 24. Caja Company sells on terms 3/10, net 30. Total sales for the year are P900,000. Forty percent of the customers pay on the tenth day and take discounts; the other 60 percent pay, on average, 45 days after their purchases. What is the average amount of receivables? A. P70,000 C. P77,200 B. P77,500 D. P67,500 25. Currently, La Carlota Company has annual sales of P2,500,000. Its average collection period is 45 days, and bad debts are 3 percent of sales. The credit and collection manager is considering instituting a stricter collection policy, whereby bad debts would be reduced to 1.5 percent of total sales, and the average collection period would fall to 30 days. However, sales would also fall by an estimated P300,000 annually. Variable costs are 75 percent of sales and the cost of carrying receivables is 10 percent. Assume a tax rate of 40 percent and 360 days per year. What would be the decrease in investment in receivables if the change were made? A. P 9,688 C. P 96,875 B. P 12,988 D. P129,975 26. Marsman Co. has determined the following for a given year: Economic order quantity (standard order size) 5,000 units 26 Total cost to place purchase orders for the year Cost to place one purchase order Cost to carry one unit for one year What is Marsman’s estimated annual usage in units? A. 1,000,000 C. 500,000 B. 2,000,000 D. 1,500,000 P40,000 P 100 P 4 27. For Raw Material L12, a company maintains a safety stock of 5,000 pounds. Its average inventory (taking into account the safety stock) is 12,000 pounds. What is the apparent order quantity? A. 18,000 lbs. C. 14,000 lbs. B. 6,000 lbs. D. 24,000 lbs 28. Durable Furniture Company uses about 200,000 yards of a particular fabric each year. The fabric costs P25 per yard. The current policy is to order the fabric four times a year. Incremental ordering costs are about P200 per order, and incremental carrying costs are about P0.75 per yard, much of which represents the opportunity cost of the funds tied up in inventory. How much total annual costs are associated with the current inventory policy? A. P19,550 C. P38,300 B. P18,750 D. P62,500 29. The cost of discounts missed on credit terms of 2/10, n/60 is A. 2.0 percent C. 12.4 percent B. 14.9 percent D. 21.2 percent 30. What is the effective rate of a 15% discounted loan for 90 days, P200,000, with 10% compensating balance? Assume 360 days per year. A. 20.0% B. 15.0% C. 17.4% D. 22.2% 31. The Premiere Company obtained a short-term bank loan for P1,000,000 at an annual interest rate 12%. As a condition of the loan, Premiere is required to maintain a compensating balance of P300,000 in its checking account. The checking account earns interest at an annual rate of 3%. Premiere would otherwise maintain only P100,000 in its checking account 27 for transactional purposes. Premiere’s effective interest costs of the loan is A. 12.00% B. 14.25% C. 16.30% D. 15.86% 32. An invoice of a P100,000 purchase has credit terms of 1/10, n/40. A bank loan for 8 percent can be arranged at any time. When should the customer pay the invoice? A. Pay on the 1st. C. Pay on the 40th B. Pay on the 10th D. Pay on the 60th 33. The Peninsula Commercial Bank and Island Corporation agreed to the following loan proposal: Stated interest rate of 10% on a one-year discounted loan; and 15% of the loan as compensating balance on zero-interest current account to be maintained by Island Corporation with Peninsula Commercial Bank. The loan requires a net proceeds of P1.5 million. What is the principal amount of loan applied for as part of the loan agreement? A. P1,666,667 B. P2,000,000 C. P1,764,706 D. P1,125,000 34. Every 15 days a company receives P10,000 worth of raw materials from its suppliers. The credit terms for these purchases are 2/10, net 30, and payment is made on the 30th day after each delivery. Thus, the company is considering a 1-year bank loan for P9,800 (98% of the invoice amount). If the effective annual interest rate on this loan is 12%, what will be the net peso savings over the year by borrowing and then taking the discount on the materials? A. P3,624 C. P4,800 B. P1,176 D. P1,224 35. Perlas Company borrowed from a bank an amount of P1,000,000. The bank charged a 12% stated rate in an add-on arrangement, payable in 12 equal monthly installments. A. 22.15% C. 25.05% B. 24.00% D. 12.70% 28