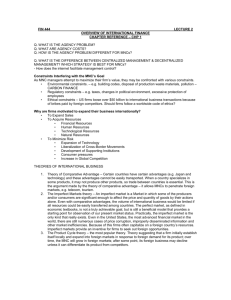

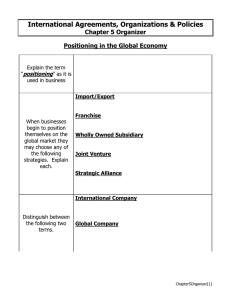

International Business Management Succeeding in a Culturally Diverse World (Kamal Fatehi, Jeongho Choi) (z-lib.org) - Copy

advertisement