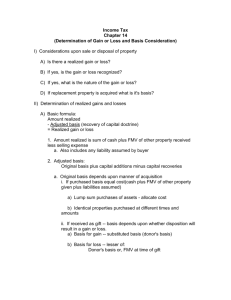

Federal Income Tax Outline Federal Income Tax 1/19/2022 Syllogism-If there is an “and” need all items to trigger output from computational system or logism. If “or”, can use any of those. Basic Tax Skills 1. Find the IRC section relevant to the given fact pattern. 2. Derive the logism- convert law to know relationship between input and output 3. Convert the facts back to the definition/computational system a. Ordinary language-unless code language defines it differently b. All or nothing(all gift or no gift) c. Substance over form for federal tax level- since tax payer has so much control. i. Sometimes form is repected. 4. Perform logism computations to get tax result 5. Tax planning-change facts to pay the least tax Overview of the Federal Income Tax System o Prisoner’s Dilema-With taxes, require all to pay taxes. o We impose taxes to pay for federal government o Inheretience tax, Corporate taxes 10%., Payroll taxes 34%, Income 47%, VAT(federal)-0%-any value transfer Tax computation Tax Base o Exemptions S 101 st 1 adjusters o 161 deductions=adjusted gross income o Non-62 dedcutions(161) o Personal exemption( 63,151)=taxable income o Then you get you “taxable income”-Base shrinks bys ubtracting expsnes, nd o 2 adjusters x taxable income o Rate tables 1(a-h),11 o Tax before credit o Splitting- If you split 50k into 2 25ks, can save 5k(Wont work if rate is flat). o Deferalls- Present value of 1k to receive in certain amount of years at x interest. Saving off paying taxes till later. Ex. Invest 614 today to get 1k in future. o Capital gains o Fuzzingrd o 3 adjusters(credits) subtracted from ^ to get “tax due” Basic tax avoidance strategies Keep it out of the tax base o Fringes, exceptions, and 62 deductions for production of income o Must be above the line deduction. Splitting Deferall th 16 amendment-Congress shall have the power to lay and collect taxes on income from whatever source derived IRC 61 a) GI means all income from whatever source derived, including the following items… 26 CFR 1.61 1(a)- GI means all income from whatever source derived…. income realized in any form… in the form of services, meals, accommodations, stock, or other property, cash… Cesarini v. U.S.-found $ in 1964 in piano bought 65. Filed 64 return and reported 5k as income. Claimed refund in 1965. Argues o 1. 5k don’t fit into 61(a). [16th am] and IRC 61(covers most of what wld be in 16)-from whatever source derived. AS long as accession to welath(NW on balance sheet) Argue ambiguous where treasure trove sld fit so sld be able to exclude under 102-no. basic concept of 61 is that all included unless excluded. Accession cld be from not cash but service, product Treasury regulations issued by treasury explore/expand staute. Can come out of committee reports. Auth by sec of treasury (IRC 7805) S1.61-1(a) Revenue ruling 61 1953-1. CB-Treasury issue revenue ruling for tax q. Private letter ruling that can rely on(not supp to rely on those) can be converted toPublic revenue ruling-guides all tax payers. Here, finding a treasure trove is receipt of taxable income for tax year refer to on disputed possession. IRC 7805-secreatry of treasury authorizes Decision -Doughrety case- 30k in chair incl in GI regardless of if found. (§ 1.61-14 -In addition to the items enumerated in 61(a) …Treasure trove, to the extent of its value in US currency constitutes gross income for the taxable year in which it is reduced to undisputed possession. o 2. if they do fit in, income was properly reported in 57 when got ownership of piano and 5k. (3 year SOL from later of April 15 or when file returns). Ohio subst law-finders don’t have prop rights till find. SOL strt 64 If rightful owner comes to claim in 65, deduction for the year they paid it back. May not make them whole o 3. even if income in 1964 we get capital gains for it(taxed lighter than income) Need capital asset, real property/stock. Sold/exchanged. held for time.. Old colony v US-Co. pays tax of Pres for his salary from 1918 in 1919(due 1919). X didn’t recvei $-nothing crossed barrier of ownership. Accession to welath NW up, source x matter unless it’s a 102 exclusion source(gift). o OMG encouraging behavior - If debt payoff x GI, emps will ask for taxes paid instead of cash. Fringes not included in GI. If embezzle, legal ob to repay so no NW rise/ no tax. Wld encrg so makes sense to tax. Pay tax. Playboy case-tax evasion-didn’t report gifts. Gifts not Gi so encouraging Commissioner v Glenshaw-X co. got $ for punitive damages. Need accession to wealth (inc assets) clearly realized (crossed barrier of ownership). X sep income from penalty o Realizing event-NOT Unrealized increase in value of property-space btwn 16th power and 61 reach. Wldnt be incl under 61 (also $ from phys injury) Not stock that goes up in value until sell, not piano that turns out to be valuable until sell (Gates/ Buffets/ Musk issue). Already ownership circle. Deferee the extra value till sell and keep gain out of tax base. Helps prob of needing ppl to be able to pay the tax *paid x for it If know mistaken price, no GI-market trans, What paid will override value. Measure value of stock by FMV when buy it. Future earning stream-x tax count current value of FE, just count as go in. Abandoned piano when take it or when police say yours. Catch valuable baseball and Return to player-welath transfer gift tax, but court said like leaving abandoned piano. If caught and pay tax, capital asset. If wait a yr and donate, deduction. If sell or give, capital gain. If give to hall of fame, tax and IRS will take negotiable insmt 1/100 chance of winning 200k lotto. FMV ticket 2k deductable from 200k if win. If don’t win and paid ticket tax, personal loss(also bankrupt stock) When win fridge on game show, et gamble it away. Illegal kickback et increase in A and L Improvements of lessor NOT GI EXCEPT as rent (109 exclusion, TR 1.61(8)(c)) T GI also if does labor(for other or O/direct cash or if no cash) and can deduct expenses th (16 X incl stock dividend tax when all sharheolders getting equal since x accession to wealth) o S 22 GI--“…or gains or profits and income derived from any source whatever”. Different defs of “income” depdning on context/“purpose” to help bus make decisions/inform shareholders vs to raise revenue(IRC purpose-common defense/icome transfer). income for alimony and not tax if sports player not working income for trust beenfiiaries within the trust o impose the tax when cash to pay( tax trust since ben x have $ to pay tax), then tax ben and give trust deduction income from nursing home for medicaid IRC 61 “income”- salary. But found money x reoccurring so x income economically, imputed income like rent cld make on house, unrealized gains like stock value increase, or realized gain of 55k for selling stock bought at 50k are income economically X need to be in cash/ given directly. If tell employer, give car to xdirecting value (2036, 674) o Source cld matter-farmer growing crops and eating some (GI but hard to tax), Imputed income-source is fact that I own car that could technically rent (dnt wnt to think of as income), Return of capital outlay-repaid for 5k loan o Motive matters-Gift crosses barrier and increase assets but 102 but significant gift from employer-income since OMG-large bonuses will be excl from GI o Tax must be effective,hard to avoid (tax on labor not capital), politically acceptable(perceived as fair), Efficient and easy to administer(customs), Observable attributes when possible( paid cash easy to see but paid loans..) o Treasury regulation 1.16-14(1)(a)-included in 61….punitive damages… Charley-scheme to keep money from miles out of tax base. FFM belonged to X who bills client first class, buys coach, use miles to upgrade, agent puts diff in acct. and then switches. Gets $ difference. X could use or withdraw FFM cash o Labor goes in(travel for comp), cash out-GI. Realized when transferred to sep prsnl acct-values coming acorss Usually FFM accession but valuation/realization prob. Personal FFM, not income-either return of capital or discounted prucahse price. o If x upgrade but overcharg client for flying coach and billing for first class, illegal but GI o Could have GI if nonexepmt receipt of valuable benefits thats accession clearly realized in 61, compensation in property(sub to SS that employer withholds), or belong to employee sale of agent (gain is amt realized but if held for more than year can be long term capital gain or can uselong term capital losses to diminish) Fun income-not included in tax base, tax free-utility not inc in tax base o Satisfaction of wants,varies,valuation prob o Ex. Reading poetry, watching football game, self-service, beach trip o Imputed income-living in your house, using your car o Family services-spouse serv of cooking not taxable et “exchange” Encourages traditional role (otherwise taxed at high rate, pay for serv) and not economically optimal-free trade o Fringe benefits-office from UM, secretary o NOT fun but GI when 1k in bank, 5% interest but inflation 7%. Can buy less at end of year than could have in beginning, but still have GI. o Not GI because political expidiencey (resistance if rental value of home incl), Admin convenience (hard to measure/value-FFM/need realization), hard to enforce/police(-eat produce you grow), de minimus to worry about Income w/o receipt of cash or property o Imputed income not taxable GI (indepdent Life) Not house owned by corporation being lived in by its owners, despite them living there before transfer and substance over form (Dean). GI since discharging husb of ob to provide home. Et house crosses barrier of ownership and accession to wealth clearly realized, Corp GI x incl capital contribution of corp. S118 State law determines x rights and duties, then IRC uses to impose fed taxe o Rev Rule 79-24 Put cash in the middle with exchanges to clarify Exchanging services(cleaning) or capital(painting) for x-income Not exchanging money for watch, no change in NW Gifts-S 102 No test but can derive rule from previous cases o Duberstein-red Cadillac from employer is a gift Must be careful to preserve tax base which wages are large part of. Cong passes 102(c)-generally, employer/employee transfer not gift (is exception). 132-provides for fringe benefits and exclusions. Court has “dominant motive” formulation but we use objective to classify State law fixes the right and fed law classifies (gift at state law, x fed) Also Walder-bequest at state law, not fed Gifts have diff meanings for diff purposes Little oversight by appeals court- Need no reasonable juror cld find, or, if facts found by judge, must be clearly erroeneous to over turn. Tips given in course of employment likely GI, if given for serve or after service, don’t want to confuse by distinguishing categories IRC 132(a)-exclusions from GI-No addiotnal cost service-pilot taking ride, , Qualified employee discount, Working condition fringe-faculty assistenet, De minimus fringe, Qualified transportation fringe, Qualified retirement planning services, qualified moving expense reimbursmenet If employee son given more valuable case of wine, prob GI if given at work Cong giving reverend money-likely gift. More likely if each give individually. Collegue contribution to employees bday trip but not employer’s. Bequests- S 102 Exclusions from GI are realizations not recognized (from code-109, 102, 131, 132) o Wolder-O leaves lawyer PS which she exchanged before death for another comp CS and BS. Then got cash for the PS. Bequest. Lawyer’s bequest is GI. Qualified corp reorg(exchanging stock)- Gains can be realized(exchanging prop for stock) but not recognized. Appreciation of O’s stock, not GI (no realization). Redemption of O stock for cash, GI. Corp redemption of stock for cash, not GI because cash basis equal to itself. When O or Co exchange stock for corp reorg, not GI IRC 132-Exclusions for Fringe benefits (above the line deduction/Reduces tax base) Forced consumption notion-market value of transfer may not be same to employee. o All or nothing issues. Incl at FMV or exclude. Code splits diff sometimes. o (a)GI shall not include any fringe benefit which qualifies as a— o (b)No-additional-cost service-pilots ride from where live to station x cost extra o (c)Qualified employee discount-20% discnt in services/gross profits for goods, o (d)Working condition fringe-paying offcie rent or admin assiantatn salary o (e)De minimis fringe-admin assistant typing my letter, extra soda from machine o (f) transportation fringe-free parking, transit pass (cash reimbursement is GI) o (j)on premises athletic facilties-golf courses o Deals with employees but some (h) will limit benefits to spouses, kids, ex-employees. o Cannot be limited to certain employees and get tax benefits. Must ben for everyone. IRC 119-Exlcusions for Meals or lodging: (a) There shall be excluded from GI of an employee the value of any meals or lodging furnished to him, his spouse, or any of his dependents by or on behalf of his employer for the convenience of the employer, but only if— (1)in the case of meals, the meals are furnished on the business premises of the employer, or (2)in the case of lodging, the employee is required to accept such lodging on the business premises of his employer as a condition of his employment. TP majority stockholder, CEO, and employee in Co. in funeral bus and owned apt above parlor where lived and was on call. Corp properly deducted fmv of apt lived in (Hatt v Commissioner) o Whther facts fit into 119 is factual q not legal q. TP has burden Gains under S61 Gain-excess of amt realized(total received) over adjusted basis o Basis-what have in it, Tax number designed to transcend particular tax year Can be modified by depreciating the asset Generally linked to particular assets for prop purposes, not bus. o IRC 1001(a) computation of gain or losss: gain is excess of amt realized over adjust absis provided by 1011 for determining gain. 1001(b) amount realized: sum of money received by fmv of propert recveied 1011(a)- adjusted basis for determining the gain or loss from the sale or other disposition of property, whenever acquired, shall be the basis (det under 1012 or other applicable…) adjusted as provided in 1016 1012(a)-The basis of property shall be the cost of such property Mortgages and options are included S 61(a)(3)-converts gain into GI S 63 GI converted into taxable income Treas Reg 1/IRC 1-coverts taxable income to tax due before creditsprogreesive rate structure for splitting technique. o 1016-Proper adjustment in respect of prop…(1)for expenditures…properly chargeable to capital account…(2)…for exhaustion, wear and tear, obsolescence… to the extent of the amount—(A)allowed as deductions in computing taxable income Must acct for depreciation or capital. Buy watch for 5 hold it then sell for 11. 1012 says basis is 5, 1001(b) says amt realized is 11. Therefore gain is 6-1001(a). If bus watch and cld depreciate legally, basis can go down ev year by a dollar. 1019- Neither the basis nor adjusted basis of of real property shall, in the case of the lessor of such property, be increased/diminished on account of income derived by the lessor in respect of such property and excludable from GI under 109. Not a 61 Gain if realized but not accession to welath o Realized w/o accession to wealth: Loan-liability offsets asset, or return of capitalreturn offset by disappearance of accounts receivable. o Exception from GI-102 Gift or 121 sale of property (encouraging stable households) from recogniztion-1041-trnafers of prop between spouses or incident of divroce (encouraging stable households) Basis of an illiquid asset is the FMV of property received. o Philadelphia Park-X gets 10 year franchise extension for bridge. Basis is FMV of franchise extension(can recover the capital of bridge basis). 3 yr SOL x run because basis continues If no comparable, unhelpful replacement costs, and no income to capitalize but more easily valued asset in exchange, FMV or prop given cld be good indication of fmv of prop received (cost to build new bridge) Overcoming ordinary language of “cost” because of system integrity. o Buy watch for 5. Value rises to 11 when exchange for a bike with a value of 17 that later sells for 20. 1012 basis/adjusted basis is 5. FMV of prop received is 17. Gain by exchange is excess of 17/5-12. When sell, FMV of cash received is 20 and FMV or prop is 0. To end with a basis of 15, must use bike cost as basis fmv of the amount received. Excess of 17/20. o S exchanges land w CB of 6 and value of 9 w D’s stock w cost basis of 8 worth 10. S-FMV of porp received is 10 over 6 so gain of 4 and new basis of 10 If x determine value of stock, assuming arms length exchange, assume is equal to value of what receiving so 9k. 9/6 -gain of 3 and basis of 9. D-9 over 8 so gain of 1 and new basis of 9 IRC 1015-basis of prop acquired by gift and transfer- If the property was acquired by gift…basis shall be the same as it would be in the hands of the donor…except if basis (adjusted for the period before the date of the gift as provided in 1016) is greater than fmv of the property at time of gift, then for the purpose of determining loss the basis shall be such fmv (x wnt TP to trade in losses) o O buys watch 5. Appreciates to 11. Gives watch to TP(x gain). TP sells for 20. Basis transfers to TP and no adjustment so gain is 15. o “When” q (deferral tax shelter-403b, 401k, IRA, done selling gift for gain) vs “whether” q (imputed income, gifts/inheritance, fringe ben, meals/lodging, conditions of employment, scholarships, life insurance bens, income from dischre of indebtneds) o Farid: Stock X got in exchange for dower was purchase, not 1015 gift bases, so basis was the 1012 cost, value at exchange. Gains from original exchange? For x: cnt calc fmv of prop received so use stock wrth of 10 (arm llegnths exchange) to measure dower. Gain would be 10 in excess of X adjusted basis, .16, realized when married. if never file tax return, SOL open forever. For F: no basis in dower interest. Stock for dower interest would be accession to wealth clearly realized but never try to tax dower interest and incl in GI. Ecouaring spousal gifts, stay at home mothers. o Donor sells donnee prop. Cost donor 30k, ad 20k fmv at time of sale. Donee sells for 15k-No gain, 5k gain using 20k as basis. Donee sells for 24k-0 gain and 0 loss using 20k as basis o 1015(6)- In the case of any gift… increase in basis …wrt any gift for the gift tax paid…shall be an amount (not in excess of the amount of tax so paid) which bears the same ratio to…tax paid as the net appreciation in value of the gift: amount of the gift. (B)net appreciation=amount by which the fmv of the gift exceeds the donor’s adjusted basis immediately before the gift. G got gift from R. R bought for 200k and gave when worth 300k. R paid 60k gift tax on transfer. G sells to S for 320k. G basis: 100/300: x/60=20/60. 20k increase + original 200k that passes through=220k basis. AR=320k. G gain 100k. S basis is 300k If R buys for 80k sub to 120k mortgage. 30k gift tax(value sub to gift tax is 300-120=180). S pays 200k for it and took w mortgage. o G AR=320. G basis=100/300: x/30=10k addition to 200k original basis=210k. G gain 110k. S basis 320k. TR 1.001-1(e) (1) Where a transfer of property is in part a sale and in part gift, the transferor has a gain to extent that AR by him exceeds his adjusted basis in the property. However, no loss is sustained on such a transfer if AR is less than the adjusted basis. CFR 1.1015-4: (a) Where a transfer of property is in part a sale and in part a gift, the unadjusted basis of the property in the hands of the transferee is sum of (1) Whichever of the following is the greater:(i) The amount paid by the transferee for the property, or (ii) The transferor's adjusted basis for the property at the time of the transfer, and o F purchased land for 100k, value 200k when transferred to D for 100k as part gift and part sale: F has no gain and D has 100k If trans viewed as sale of half of land and outright gift for other half-For first parcel, F gets 100k, 50k basis, so 50k gain. D takes w basis of 100k. For parcel as gift, D takes w 50k basis and X has no gain Slight changes in tax planning can have huge effects on tax outcome. Commissioner can choose on approach over other and rearrange if says middle part has no substance so will treat same. IRC 74 Awards IRC 74 (b)…GI does not incl amts received as prizes and awards made primarily in recognition of religious, charitable, scientific, educational, artistic(diff for diff professionals, baseball v ballet, even if we call hitting artistic), literary, or civic achievement, but only if— o (1)the recipient was selected without any action on his part to enter the contest or proceeding; o (2)the recipient is not required to render substantial future services as a condition to receiving the prize or award; and o (3)the prize or award is transferred by the payor to a governmental unit or organization described in paragraph (1) or (2) of section 170(c) pursuant to a designation made by the recipient Required job trip not taxable award, even if enjoy. (McDonell’s) o Objective not subjective determination. IRC 117 Scholarships and Fellowships (a) GI does not include received as a qualified scholarship by an individual who is a candidate for a degree at an ed org(w faculty/students) described in 170(b)(1)(A)(ii). (b)(1) “qualified scholarship” - amt received by an individual as a scholarship or fellowship grant used for qualified tuition and related expenses. (2) “qualified tuition and related expenses”: o (A)tuition and fees required for the enrollment or attendance of a student at an educational organization described in section 170(b)(1)(A)(ii), and o (B)fees, books, supplies, and equipment required for courses of instruction at such an ed organization.(not personal living -meals/lodging, or comp for services like teaching and research) (d)GI shall not include any qualified tuition reduction: amount of any reduction in tuition provided to an employee ed org for the education (below the graduate level) IRC 127 Education assistance programs: (a)(1) GI of an employee does not include amounts paid or expenses incurred by the employer for educational assistance(tuition, books etc.) to the employee if the assistance is furnished pursuant to a program which is described in subsection (b). (2)$5,250 maximum exclusion. Transfers between Spouses 1001(c) Realized gains are recognized unless otherwise stated by Statute IRC 1041 (a)No gain or loss shall be recognized on a transfer of property from an individual to (or in trust for the benefit of)— o (1)a spouse, or (2)a former spouse, but only if transfer is incident to the divorce. (b)In the case of any transfer of property described in subsection (a)— o (1)for purposes of this subtitle, the property shall be treated as acquired by the transferee by gift, and o (2)the basis of the transferee in the property shall be the adjusted basis of the transferor. If spouses exchange prop w value of 70k. S has basis of 50, A has basis of 40. No gain or loss. S has 40k basis and Andre has 50k basis. S has lower basis and more potential gain on property. A gift between spouses cld trigger 1015 and 1041. 1041 overrides (for case where FMV lower than done basi). Property Acquired from Decedent o 1014(a) basis of property of a person acquiring the property from a decedent or to whom the property passed from a decedent shall, if not sold, exchanged, or otherwise disposed of before the decedent’s death by such person, be (1)the fmv of the property at the date of the decedent’s death, o Will encrage to hold onto prop so cld pass to heirs tax free. “when” to whether” Transforms deferell into Keep it out of the tax abse o If O buys for 5, rises in value to 11, O dies and bequests it to TP who sells for 20, O/O estate have no gain on bequest. 9 gain for TP. (102- TP gain is not GI until sells watch for more than value at time of death) o Step up basis- basis steps up to hands of done, 11. Gain never gonna be taxed under 1015(whether). If defer long enough and die, gain will never be incl in the tax base. o If only beneficiary of sick grandma and have appreciated property, transfer under 1015. When passes, inheret back with stepped-up basis tha can sell at zero gain. o Grandma must live for more than one year or don’t get step in basis (1014) o Try and keep things with low bases till death to get stepped up for heirs o Incentive to report higher umber on wealth transfer estate tax to get higher basis o If have joint teancy, my half of joint tenancy steps up if I die but not other half. With community prop, if one half of commun die, both halves stepped up. The Amount Realized International Freighting-X co’s distribution of stock to emps w a fmv of 24k that it got at 16k should’ve incl 8k gain when claimed 24k 162 tax deduction. Emps have 24k GI. o exchange for labor-realizing 24k in services(Park) w adjusted basis of 16k o Property: AR-Basis=+1040 o Business: Gross Receipts-Business Deductions=+1040 Depreciation: X buys stitching machine for 8k. Sells at end of 10yrs for 1 cent. Instead od 8k loss, deduct over 8 yrs useful life. 1k per year. Adjust basis under 1016 1k ev year to produce 1011 adjusted basis. o X deducts 8k loss in yr 8 from other income, deduction allows measured recovery in capital of 8k before realizing income Crane v Commissioner- property left to X from husb (land and building) worth 262k (1014 basis) sub to non-recourse loan(so 262 asset cancels out 262 liabilities and x accession). X deducts depreciation of 28k on building so reduces basis to 234k. says gain is 2.5k netted on sale. X says 0 basis so only owes tax on 2.5k. IRS says 262 mortgage incl at acquisition and at sale. basis of 262k -28k depreciation=234 adjusted basis. AR is 2.5k plus 262k mortgage relief(1001b)=264.5k realized so income gain is 30.5 o both saying same thing. IRS saying sum of 28k depreciation already took plus 2.5k. she says it’s the 2.5k. real q is timing of 28k recovery. X says recover 28k at sale. IRS says cnt recover 28k earlier and then only recapture when she sells. o Relief from recourse/non-recourse debt is AR to make system work( legal q) o led to tax shelters, loss of tax revenue. o No double recovery of capital of deprecation deductions are allowed o Repercussions: Doc w 108k yearly income and 1.8 million building (non-recourse loan). 180k deduction ev year so not paying tax while lower basis of buildingdeferring income to lower basis in property. When sell prop, will be capital asset, taxed lighter. Conversion of yr 1-9 ordinary income into long term capital gain. AR includes debt relief even when prop worth less than amt of debt when dispose of prop (Tufts v Comssioner) o GP Borrow 1.8 mil to make building w Non-recourse loan. Each yr all claim as income tax decution ordinary shares and deprecation (Crane) GP fell, Each sold interest for 250. 1012 Land and building cost basis -1.85 mil. Small contribution 45k. less depreciation 440k. 1.455. Claim AR is 1.4, prop worth, and loss of 55k. IRS says borrowed 1.85, not taxed, since corresponding obligation to repay. AR is cash received (0) plus FMV of prop received incl loan-1.85. Gain on excess of 1.85 over 1.45 adjusted basis TPS really win-Instead of small capit loss and large ordinary income from loan discharge, court says gain is discharge of loan over adjust basis. Long term capital gain. TP can defer other income w artificial tax depreciation deductions created by prop and convert into capital gains when sell prop. (lower adjusted basis so greater gain but taxed lighter as capt gain) o Ex. Mortgager buys land for 100k w 80k non-recourse mortgage and 20k cash. 100k basis. Land appreciates to 300k. Takes out another 100k mortgage (no gain/GI) if 100k used to improve the land, 1016 basis adjustment to 200k. if 100k used to purchase stocks and bonds, basis remains 100k. if sells prop for 120k, Buyer assuming 180k mortgage so basis 300k. Seller 200k gain (300k-100k) if mortgager gives land to son. Part gift/part sale. Son treated as having given her 180k so moregager has 180k AR-100k basis=80k Gain is 80k. Son basis is 180k, what paid for it. If mortgager gives ladn to spouse, 1041 says spouse will take basis at 100, even after pays off mortgage. 80k gainer alzied and not recognized, no gain to mortager. No recognized gain. If land depreciates from 300k to 180k and mortgager assigns land to bank w deed, gain of 80k-AR is 180 and basis is 100k. Same if decline to 170k (Tufts) Land value, if below loan, x matter. o What if prop value is more? o Ex. Investor buys 3 acres each worth 100k. sells first for 140k, second for 160k. Break up into 3 parts. When sell first, gain of 40k. second gain of 60k. Capital/Basis Recovery Basis Recovery o TP buys personal watch for 4.8k and sells for 5000-4.8 basis, 200 gain o TP lends O 4.8k and receives at 5k end of year (like $ in bank growing w interest/ auctioning off 5k to receive in a year for 4.8)-200 GI o TP lends O 100k for 10 years and 5% interest-get 5k for 10 yrs plus 100k in yr 10. Taxable gain of 50k. Selling each of 11 separately. Basis would be PV of the 5k. income would be the diff between the PV and 5k. if add all 10 payments, get 100k. Taxable gain is 50k. realized when recover the 100k capit. Earlier recovery reduces taxable income that wld be reportable and means later realization-good for TP bad for IRS (deferral) o 3 main capital recovery possibilities (ex. 180k income, 50k machine 10 yr UL) Basis recovery first-best for TP since income pushed off (deferall) 5k each year, not taxable. In year 10, half of last payment wld be rest of capital recovery and extra 50k of income that’s taxable. 50k recovered yr 1 so 130k income yr 1. PV of deduction 50k. Basis recovery last (all receipts GI until capital recovery occurs)stocks/bonds. Worst for TP, pulls forward income. 5k each yr taxable GI and only when get 100k recover capital. 10th year get 50k deduction so 130k income. PV 23k Basis recovery in middle Precise method – each payment gets pv like “basis” to compute the GI gain for payment. Hard to administer, fair since neutral for IRS and TP (besides inflation). Gradually recovering capt (gets lower yrly) and getting income (gets larger yrly) (not rly used) approximate formula (annuities). investment 100k. 50k expected income. 150k expected return. 100/150(2/3) of each fo 11 payments is return of capital. 50/100(1/3) GI in each case.(each yr, 1.6k income 3.3k recovery of capt) o 5k deduction each year. btr for TP than last (splitting) not as good as deferall like in first. 175k yrly. 34k PV Discharge of Indebtedness-Gross Income under 61(a)(12) Reg 1.1001-2 Discharge of liabilities.(a) Inclusion in AR -(1) In general. Except as provided in paragraph (a) (2) and (3) of this section, the AR from a sale or other disposition of property includes the amount of liabilities from which the transferor is discharged as a result of the sale or disposition. o Ex. 1980, F transfers to creditor asst w fmv of 6k and creditor discharges 7500k of indebtedness F personally liable for. 6k is AR. F has income of 1500k Includes “Sell high buy back low” (Kirby Lumber) o X co borrows 12 mil and repays debt w 11.863 mil. 137k is income DOI Gambler settling 3.5 mil casino debt for 500k x have 3 mil GI from DOI (Zarin) RR 2008-34-law student’s forgive loan not GI under S 108. Poor borrowed 10k from Rich-no GI for either. And pays off with: o 7k-3k ordinary income o Painting w basis and fmv of 8k-2k ordinary income o painting w fmv of 8k and basis of 5k. cash in middle-selling painting: 8k AR 5k AB 3k capital income and 2k ordinary income o Service to remodel R’s office worth 10k. 10k ordinary income. o Service worth 8k. 8k service income and 2k ordinary income o p’s employer makes 7k payment renouncing P’s debt. 102(c) (old colony, dean). 7k in payroll taxes and 3k ordinary income. Ex. Mortgagor buys land for 100k, 20k cash and 80k mortgage. Land increases to fmv 300k, M takes another 100k to buy stocks. Land decline to 170k fmv. M transfers land to bank discharges all indebtedness (180k). o If recurse mortgage-Basis 100k(2nd mor not put in land). 80k GI-70k gain, 10k DOI o If non-recourse-fmv irrelevant. Excess of 180 discharge over 100, 80k gain (tufts) Ex. Descendent owed friend 5k and nephew owes him 10k. o If Friend neglected to file claim before SOL runs, estate has 5k income, unless friend meant to because felt bad which would make it 102 gift and exclude o If will says not to collect debt from nephew, bequest S 102 and no income to N Marriage and Divorce Alimony-Before, payee deducts and payor takes as GI. Payor would say alimony to deduct and payee would say property settlement so not GI. started tax id w deductions. o Strategic classification-spouse in lower bracket wld take amt as income and grant payor right to deduction. Split what save from IRS. o 2017-Repealed IRC 71 which incl alimony in payee GI and 215 which allowed payor deduction above line which reduced his tax base and overall tax Property settlement-throw all our stuff in single part o In divorce settlement, husb transfers land (w option to purchase back, after defaults on note). Neither spouse reports a gain (Young) 1041-trasnfers incident to divorce-she gets his 130k basis and 2.2 million AR=gain. o State law determines property interest and says who owns what. Federal tax statute classifies those interests o 2 joint teanants exchanging parts of property owned in JT so each completely own half is taxable gain except under 1041. If jointly own watch and bike-both have 6k basis and 14k fmv, exhcnaging my 50% of bike for 100% of watch….? Schedule A, C and 1040 Froms 2020 taxes- 80k in salary as teacher, 120k gross receipts from sole proprietorship catering business. 1k deduction from 120k for offcie expenses. o Not additiioanl 15k service client and client only paid in 2021 o When standard deduction higher than itemized Sched A deductions (state tax, interest paid, gifts to charity), take standard and itemized useless. On books but not claimed. Standard decution reduces tax base, above line like offcie expenses, unlike itemized, below the line, off adjusted GI. Assignment of Income Splitting-Second adjuster Splitting o Works if mult individuals/entities share common ec interest w marginal tax rates Avg rate takes into account smaller rates below it. Marginal is the rate the last dollar is taxed at Incentives for household. Beneficial to assign interest to person who has the lowest marginal tax rate. Incentive to add more to household which means lower rate. Spouses split through joint filing International corp can take income producing assets (copyrights) and put where country has lowest tax rate to generate income. Or cld take base lowering deductions to high marginal rate. o Labor income cannot be split and assigned to another unlike property producing income (capital) (Lucas v Earl) Can assign dividends(income) from stock if assign stock as well. Famous signer can record at son’s studio and waive fee. Carpenter built house (labor converted into prop) and gives to kid Author creates IP through labor and gives copyright to kid (incentivizing inventions) BUT associate billing 170/hr not taxed to associate but to firm who hired him and has the clients lawyer in PI case hired for 30% cut and settles for 100k, is 300k cut anticipatory assignment of income? Issue-IRS has said yes, all taxed to injured party. May have problems deducting cost of lawyer since not producing taxable income(injuries not taxable) BUT splitting income w spouse in community property state acc to state law allowed (Poe v Seaborn) since limited control Only btwn spouses and can’t add more, state law and not contractual whim that can be changed, TP’s only power is moving half earnings vested in “non-earner” while in earl half the earnings were “mere expectancy” in commun prop state, Half of salary belongs to other spouse o If can classify transaction as disclaimer, no gross income (Giannini v Commissioner) Corp Pres waiving income and indirectly diverting it as gift to university (et named after him) o RR 66-176-fees not includible in GI of estate executor if he effectively waives his right to receive such fees within a reasonable time after commencing to serve. TP spouse died. bequeathed half of estate to TP and half to son. TP executor. If waives fees within rsnbl time, x GI or taxable gift. o o If TP in 40% fed bracket and 0% estate bracket, sld waive fee and take money by 102 bequest under 102. If TP in 0% fed bracket and 50% estate bracket, take as fees/income