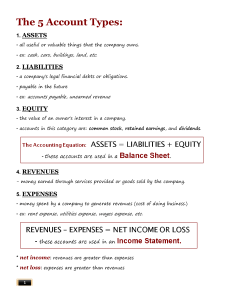

Accounting Exam 1 Study Guide Chapter 1: Financial accounting – the process of identifying, measuring, and communicating financial information about an economic entity to various user groups within the legal, economic, political, and social environment Assists in the efficient allocation of capital Enables efficient resource allocation decisions based on the risks and returns of a particular investment Directs capital flows to their most productive uses, linking the demand for financial information to the allocation of scarce resources Four Basic Financial Statements: 1. 2. 3. 4. Balance sheet (statement of financial position) Statement of comprehensive income Statement of cash flows Statement of shareholder’s equity Other Financial Information: Letter to the shareholders Formal discussion and analysis of the firm by management Management report Auditor’s report Financial summary Economic entity – an organization or unit with activities that are separate from those of its owners and other entities Corporations, partnerships, sole proprietorships, or governmental organizations Financial Statement User Groups: equity investors – shareholders of the company creditors – banks and other financial institutions that lend money to the company financial analysts – use financial information to review and analyze reported results of the companies they cover and make investment recommendations employees and labor unions – use financial information during negotiations of new labor agreements and compensation contracts suppliers and customers – use financial statements to determine whether to conduct business or purchase products from a company government agencies – review the financial statements of publicly traded companies for a variety of reasons that are in the public interest competitors – use financial information to determine their market position relative to the reporting entity and to attempt to identify future strategies of the reporting entity external auditors – independent of the company and responsible for ensuring that management prepares and issues financial statements that comply with accounting standards and fairly present the financial position and economic performance of the company internal auditors – employees of the company serving in an advisory role to management; they provide information to management regarding the company’s operations and proper functioning of its internal controls regulatory bodies – protect investors and oversee the accounting and auditing standard setting processes professional organizations – support accounting professionals throughout their careers by providing training, professional skills development, and other resources GAAP – a collection of methods used to process, prepare, and present public accounting information in the US Rules vs. Principles Based Standards (pg. 16): Principles – relies on theories, concepts, and principles of accounting that are linked to a welldeveloped theoretical framework Rules – contains specific, prescriptive procedures rather than relying on a consistent theoretical framework US GAAP is more rules based compared to IFRS Standard Setting Process: 1. Identification of an issue 2. 3. 4. 5. 6. 7. Decision to pursue Public meetings Exposure draft Public roundtables Re-deliberation Publication of the final standard Chapter 2: Conceptual framework – set of objectives and fundamentals that lead to consistent rules and prescribes the nature, function, and limits of financial accounting and financial statements Ensures accounting standards are coherent, uniform, and guide standard setters Fundamental vs. Enhancing: Fundamental – basic characteristics that determine what is useful financial information Relevance – capable of making a difference in decision making by showing predictive value, confirmatory value, and materiality Faithful representation – financial information depicts the substance of an economic event in a manner that is complete, neutral, and free from error Enhancing – help distinguish more useful information from less useful information Comparability – compare entities for capital allocation decisions Verifiability – an amount can be verified Timeliness – the information is timely enough to be useful for decision making Understandability – the quality of information that lets reasonably informed users see its significance Point-In-Time Elements: Balance sheet components Assets – probable future economic benefits controlled by an entity as a result of a past transaction Liabilities – probable future sacrifices of economic benefits arising from a present obligation as a result of a past transaction Equity – net assets of the business (assets minus liabilities) Period-In-Time Elements: Income statement components Investments by owners – buying common stock Distributions by owners – cash dividends Revenues – sales, fees, and takings Gains – profit obtained from selling long-term assets Expenses – rent expense, wages expense, COGS Losses – loss obtained from selling long-term assets Comprehensive income – change in equity in one year from non-owner sources Accrual – firms recognize revenues according to the revenue recognition principle and recognize expenses according to the expense recognition concept (financial accounting) General recognition, revenue recognition, expense recognition, and bases of measurement Cash – recognizes revenues when the cash is received and expenses when the cash is paid Recognition – the process of reporting and economic event and is included in the financial statements Occurs when the item meets the definition of an element, is measurable, reliable, and relevant Revenue is recognized when it is realized or realizable and earned Expense is recognized when economic benefits are consumed, or an asset has experienced a reduced future benefit Five Measurement Bases: 1. 2. 3. 4. 5. Historical cost Current cost Current market value Net realizable value Present value of future cash flows Going-concern – assumes entity will continue to operate indefinitely Business or economic entity – owners and business affairs are separated and reported separately Monetary unit – all items are valued according to an accepted currency and it is assumed the currency remains stable over time in terms or purchasing power Periodicity – entity is to divide its life into artificial time periods for the purpose of providing periodic reports on its economic activities Chapter 3: Financial statement disclosures – (accounting policy footnote) indicate where managers used judgment in the financial reporting process Obstacles Faced in Preparing Financial Information: Factors may influence management to intentionally bias their estimates (bonuses tied to income) Cognitive biases (systematic deviations from rationality) Complexity of the business environment and transactions (new industries and environments, complex investment instruments) Three Reasons Why Accounting Standards May Be Unclear: 1. Judgement is involved because standard setters allow for management discretion 2. Issue is complex that it requires research to determine correct answer 3. No information in the accounting standards that directly provides guidance to resolve a specific issue Financial Accounting Standards Board Accounting Standards Codification (ASC): Groups and summarizes all current accounting standards by topic Divided into topics, subtopics, sections, and paragraphs o 9 major topics o Subtopics are distinguished by area or scope o Sections uniform across subtopics Steps in Accounting Research Process: 1. 2. 3. 4. 5. 6. Establish and understand the facts Identify the issue: what is the research question? Search the authoritative literature Evaluate the results of the search Develop conclusions Communicate the results of the research Chapter 4: Accounting Cycle: 1. 2. 3. 4. 5. 6. 7. 8. 9. Analyze the transaction Journalize the transaction Post to the general ledger Prepare the unadjusted trial balance Prepare adjusting journal entries Prepare the adjusted trial balance Prepare financial statements Close temporary accounts Prepare post-closing trial balance Deferrals – occur when a company receives or pays cash before recognizing the revenue or expense in the financial statements Deferred expense – prepaid rent, prepaid insurance Deferred revenue – unearned revenue, advanced collections Accruals – occur when the economic event that gives rise to revenue or expenses occurs before the cash is received or paid Accrued revenue – interest revenue, commissions Accrued expenses – interest, rent, taxes, salaries Adjusted Trial Balance – the listing of all accounts and their ending debit or credit balances after making the adjusting journal entries Close Temporary Accounts: Revenue accounts – debit all revenue and gain accounts and credit income summary Expense accounts – debit income summary and credit all expense and loss account Income summary account – debit income summary and credit retained earnings for amount of net income; credit income summary and debit retained earnings in the event of a net loss Dividends account – debit retained earnings and credit dividends account Chapter 5: Comprehensive income = net income + other comprehensive income Income Statement: Useful: Provides information that helps investors and creditors predict the amounts, timing, and uncertainty of future cash flows Helps evaluate the past performance of the company Provides a basis for predicting future performance Allows us to evaluate risks and uncertainty of achieving future cash flows Limitations: Companies omit items that cannot be measured reliably Income is affected by the accounting methods employed Income measurement involves judgment and estimation Earnings is the most forecasted, discussed, and disclosed number Earnings Quality: Reduced if earnings information is less useful for predicting future earnings and cash flows Permanence of earnings and earnings management impact earnings quality Income from continuing operations = operating income + non-operating revenues/gain and expenses/losses + income tax provision Operating income = gross profit – all operating expenses Gross profit = net sales revenue – cost of goods sold Income before tax = operating income + non-operating income Net income = income before taxes – income tax provision Comprehensive income = net income + other comprehensive income Discontinued Operations: 1. Income or loss from operations of discontinued segment, unit or group, net of tax 2. Gain or loss on re-measurement of net assets held for sale for fair value less disposal costs, net of tax 3. Gain or loss on disposal of assets or disposal groups constituting the discontinued operation, net of tax Chapter 6: Balance Sheet: Useful Balance sheet is as of a specific point in time Useful for assessing liquidity, solvency, and financial flexibility Limitations Most assets and liabilities are reported at historical cost Many valuations involve estimates and judgements Omits many items that are of financial value Liquidity – how quickly the firm can convert assets into cash and pay liabilities Solvency – a measure of a firm’s long-term ability to pay its obligations as they mature Financial flexibility – ability of company to alter cash flows to take advantage of unexpected investment opportunities or needs Working capital = current assets – current liabilities