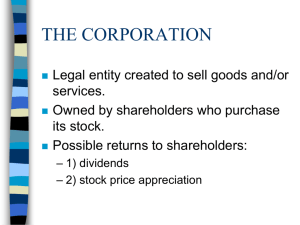

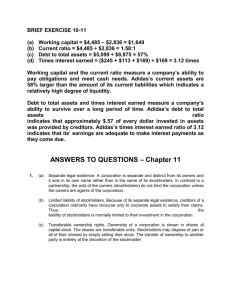

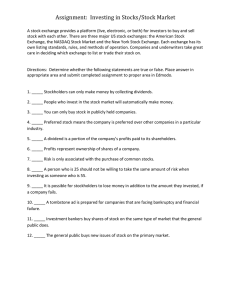

Name-Tushar Chaudhary. Student ID-251205812. Course- PHIL 2074F 550 SU22 The Fallacies in Stakeholder Theory By Tushar Chaudhary In this essay I argue that Freeman’s view that interest of each of the stakeholders must be considered by managers while making decisions and not to treat them as mere means of end is not compelling enough. I begin with an outline of Freeman’s argument that managers bear a fiduciary relationship to stakeholders (p2). I then elaborate how it leads to limiting growth and success of a firm. I end by explaining his theory leading to betterment of other stakeholders but causing distrust among current and potential stockholders towards management and corporation. Freeman’s thesis states as follows- “to revitalize the concept of managerial capitalism by replacing the notion that managers have a duty to stockholders with the concept that managers bear a fiduciary relationship to stakeholders” (p70). Those groups that have a stake in the firm including suppliers, customers, employees, stockholders, and the local community, as well as management in its role as agent for these groups are termed as stake. According to his stakeholder theory, each of these group has the right not to be treated as mere means of production and, therefore must participate in determining the future direction of the firm in which they have a stake. He understood that revenue generation is a major goal of any corporation and managers are employees of the stockholders(owners) of the corporation and are assumed to use the resources to maximize the goal of profit generation. If their interests aren’t pursued by the management, stockholders can theoretically sue them for attempting so. But he argues that corporation is a legal person, existing in contemplation of the law, managers of the corporation are constrained by the law. In today’s world, law has evolved to effectively constrain the pursuit of the stockholders at the expense of other claimants of the firm and it requires the claims of the other stakeholders to be taken into consideration. Various acts have been introduced in the past at local as well as global level(p71) to empower the other stakeholders. The concept of Caveat Emptor has somewhat totally diminished in major parts of the world and being replaced by Caveat Venditor which means let the seller beware implying the importance and power customers are able to gain in the history and consumer is equally if not more responsible than the employees for growth of business. The law has also law has also protected the rights of the interests of local communities. The management has been constrained from spoiling of commons by introduction of Clean Air Act and Clean Water Act(p71) by the Law. He argues that result of such changes in the legal system can be viewed as giving some rights to those groups that have a claim on the firm, for example, customer, suppliers, employees, local communities, stockholders, and management(p73). As per my understanding, Freemans assumes that managers have a better and more meaningful obligation to fulfill i.e., ensure the survival of the corporation and maintaining a balance among all stakeholders can be a way to achieve so. My argument is a manager may not be able to create such a function since it’s been commonly seen that the interest of various stakeholders often collides with each other. The employees might want less hours of work per day with higher wage, community might demand eco-friendly products and/or elimination of plastic use in products while the consumers will probably demand price reduction of goods. All these statements might not reasonable and justifiable theoretically but aren’t achievable or sustainable in real world situations. Also, if managers do wish to pursue so, if the shareholders do sue them, I would consider it to be the right Name-Tushar Chaudhary. Student ID-251205812. Course- PHIL 2074F 550 SU22 step because the risk bearers of the corporations don’t pool all of their finances and time in order to see lower profits as business is For-Profit organisation. Though this issue can be somewhat resolved by Freeman’s Doctrine of Fair Contracts(p77) which is informed by three political ideals, i.e., autonomy, solidarity, and fairness. It states that Fairness is realized when all parties are treated as fundamentally equal, autonomy is realized when all are granted an opportunity to choose to participate (or not), and solidarity is realized when all recognize the impact their actions have on other participants. This not only creates a true balance but allows all of them to be heard as any of them being not treated properly can cause havoc throughout the business organisation. For instance, a peaceful strike by doctors say due to insufficient availability of nurse in a private hospital too can put a lot of its patient at risk of even death which would disrupt the organisation’s image in the community, losing the potential patients to competitors and can lead to huge loss for the stockholders. Even though, Freeman’s theory is justifiable but isn’t compelling since it somehow points in the direction which doesn’t advocate giving huge importance to the stockholders. The placement of shareholders last on the list of corporate stakeholders is troubling. Shareholders come last in preference in bankruptcy and are protected by fiduciary duties primarily for that reason, and placing them last, even if simply symbolic, sends the wrong message. If an equity-holder believes they are last in line in corporate priorities, they simply will not invest or opt to become a debtholder instead, which would be a deathblow for starting new, risky, but potentially societally valuable entities. That was the original logic for shareholder primacy. He as per my understanding was not able to explain the meaning of shareholders. They aren’t just the owners of capital. They are the ones who believed in the idea of the business, who are standing at the very front if anything goes wrong and will be the first to lose. Employees if loose their job can find another, community can expect citizens and government to work for them too, consumer can shift from one brand to another, but the stockholders can lose anything and everything which they may not be able to recover from. I found his way of describing them a bit unjustifiable. Also, the theory puts a lot of stress on management and creates too much tension and worry for them. It presumably won’t be efficient if managers would be forced to not only take into consideration every stakeholder but create balance and disobey the ones that hired them for a particular reason. It diminishes managers accountability and performance. If a person is accountable to everything, he is accountable to nothing. I end by ensuring that I do not reject his theory and do admire it. My criticism for his theory is just to present the need to not put the stockholders at the end of the list since the meaning of stockholders is not the same anymore. It’s not just Wall Street titans but majorly the public who has invested hard-earned salaries in these corporations and they should be prioritized too if the business wishes to continue. Also, the concept of business would always be majorly profit making irrespective of time. Name-Tushar Chaudhary. Student ID-251205812. Course- PHIL 2074F 550 SU22 Bibliography [B. Edward Freeman,1984] The Stakeholders Theory [Charles M. Elson,2019] Three Problems with the stakeholder theory https://www.bidenschool.udel.edu/bideninstitute/bcblog/Pages/Three-Problems-With-theStakeholder-Theory.aspx