Types of Business

advertisement

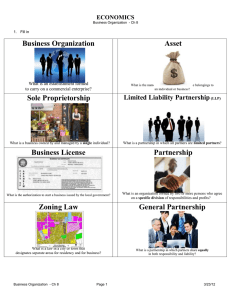

Types of Business CH. 22, SECTION 1 4 Elements of Business Expenses 1. • What you need to start & continue a business Advertising 2. • Introduction and reminder of your business Receipts & Record Keeping 3. • Needs to be accurate and dependable – for profits & losses Risk (profit vs. loss) 4. • Risk is a consequence to the advantage of being in business Considerations When Starting a Business Establishment of inventory Use of computers/Technology Turbo Tax Time – the opportunity cost. You could be working for someone else. 3 Types of Businesses 1. Sole Proprietorship • Owned by 1 person • Easy & relatively inexpensive to start would be a need • Small businesses typically • Most common form of business • Owner receives all profits • Unlimited Liability Sole Proprietorship Advantages Receive all profits Quick decisions because no consultation Relatively low taxes Disadvantages Unlimited liability Handle all decisions Time consuming Rely on own funds Business depends on one person 3 Types of Businesses cont. 2. Partnership • • • Owned by 2 or more individuals Articles of Partnership – Partners sign an agreement on what each is responsible for. Limited Partnership o o o o • Partners are not equal General Partner – majority of control Limited Partner – own a small part – do not voice opinions & are responsible only for what they put in LLPs (Limited Liability Partnerships) [mix of corporations and partnerships): Very popular with lawyers, accountants, and architects. Joint Venture o temporary partnership to do a job Partnership Advantages Losses are shared More efficient than proprietorships Pay taxes on share of profit Easier to borrow money Disadvantages Profits are shared Unlimited liability, most of the time Must reach agreements Committed partners 3 Types of Businesses cont. 3. Corporation Owned by many Started by a founder Owned by Stockholders Run by a Board of Directors State government issues a charter to run the business Complicated structure Business has the same rights as an individual Are Double Taxed Founder’s responsibilities Register with the state government for a charter Sell Stock Select the initial Board of Directors Board of Director’s responsibility Elected by Stockholders Supervise & control the corporation Make all major decisions Corporations Advantages Owners do not have to devote time to make money. Stockholders have limited liability; they only lose what they put in. Individuals trained in specific areas make decisions. Disadvantages Decisions are slow. Interest of the board may differ from the stockholders. Double taxation. Govt. taxes corporate profit than individual shares. Stockholders have little or no say in how business is run. Stocks and Bonds Stock: Individual ownership in a corporation. Shareholder receives voting rights and dividends. Bond: Promise by a corporation to pay a stated amount of interest over a period of time. Other Types of Businesses Franchise – sell the name & structure of a business Help train employees & set up the business Franchisee – pays a start up fee & annual fee Non – Profit – business does not run to make money Cooperative – individual businesses that work together to benefit all members Producer – Ex: Farmer’s Market Consumer – Ex: PCC Natural Markets, REI Service – Ex: Credit Unions, Utility companies