Major Outline

Remedies – UVA Law

Prof. Laycock, Fall 2016

Strategy:

Big Picture: lump claim/parties into groups that can easily be disposed of based on similar facts

Alternative Grounds: don’t hedge, but be sure to note alternative grounds and ambiguities

Make sure you address every party and all theories of liability (see liabilities/COA sheet)

Always evaluate strength of arguments, but don’t hedge and be decisive

Consider which possibile remedy (if >1 available) will be best for the plaintiff

Themes, Policy, and History:

Remedy:

Economic Theory vs. Corrective Justice

o Economic Theory: remedies outcomes should be used to create proper incentives that create

economically efficient outcomes (optimal number of violations)

Criticism: sometimes leaves those wronged not fully compensated, also morality

o Corrective Justice: Compensate because it is just; reduce violations of law to smallest possible

number

Criticism: sometimes creates wasteful overdeterrence

o LAYCOCK: everything takes both into account, but one will be primary (often come out the

same way). More judges prioritize justice than law & economics. But see Posner.

Writ System: old writs (with their own rules) have been replaced with one single civil COA

Why do we compensate K expectancy rather than just reliance?

o Economy treats future values as present values. You can borrow against a contract.

o Promises rely in ways that are hard to measure and that can approach full value of expectancy.

o Moral or conventional sense of what promises mean.

o Substantive law of contract commits court and parties to situation post-performance, not to

situation pre-contract, and remedies should reflect that. Contracts work better if both sides can

assume they will generally be performed.

o Efficient breach theory does not explain compensating expectancy

Freedom of Contract vs. Abuse/Efficient Outcomes:

o We want to let sophisticated parties have freedom of contract, but not to the extent that it is

subject to abuse

o See Kearney and limitations on damages cases

Law/Equity:

Judicial Discretion:

Jury Fallibility

The Rightful Position

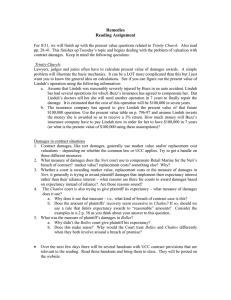

Pp. xxiii-xvii, 1-18

Damages

Rightful Position

o {

o Rightful Position: P is entitled to recovery that puts him in the position he occupied before the

injury.

Specificity (Hatahley; see also uncertainty Bigelow, Glendale Federal)

Lesser of Two Rule: P gets lesser of market value or replacement cost. See In re

September 11th Litigation.

Exception: For special purpose property, replacement cost even if greater.

(Trinity Church real property & King Fisher Marine chattels; rule in In re

September 11th Litigation)

See also environmental cases for varying views on the rightful position

o Expectancy vs. Reliance:

Contracts: Expectancy is default rightful position in contract (see UCC section).

See UCC buyer and seller defaults

Torts: No expectancy in tort (Smith) EXCEPT in fraud cases (in most states).

o }

o United States v. Hatahley (10th Cir. 1958 p. 11) – Specificity & Standard

FACTS: government took and killed special Indian horses, Indians didn’t mitigate

because they didn’t have $, lost other livestock. Emotional distress claim.

D Court:

Awarded $395 for each horse (replacement cost was $300)

Awarded $3500 for emotional damages for each plaintiff

Awarded half of the value of the lost livestock since they couldn’t figure out what

was lost because of killed horses

Precision/Specificity/Standard: remedy must be grounded in legal standard with

sufficient facts and reasoning to justify the damages amount so as to put P in the rightful

position.

But see: Excessive precision. At some point it is not economically efficient to

litigate to perfect accuracy.

E.g., Mass Torts: formulas avoid need for individual damages hearings. D

strategy—destroy class by forcing every individual P to prove their precise

damages, but requires specificity.

Abstract losses (e.g. anguish): Lower, but still existent, specificity requirements.

Usually go to jury because they can pull a number out of thin air. Judge can’t.

APPLICATION: horse remedy pulled out of thin air.

Proximate Cause: must show how the harm lead to each particular claim for damages,

and to what extent

APPLICATION: Trial court erred in finding 50% of other livestock costs for no

reason (too speculative)

Mitigation: No compensation for losses after time by which plaintiff could reasonably

have been expected to mitigate.

APPLICATION: Indians’ damages cut off at time when they should have had

replacement horses.

But see Alaska Case: fisherman didn’t pay child support because of bad business,

D court said get a real job, AK Supreme Court reversed saying that due to cultural

differences, no proof that it would be better

Emotional Distress: must be calculated plaintiff by plaintiff, and explain reasoning

(Laycock: medical/psych. fees, missed work, pain normally judged by jury)

OUTCOME: remand for new trial on damages

o Value as the Measure of Rightful Position

Pp. 18-35; Supp. Preface, 1-3

In re September 11th Litigation (S.D.N.Y 2008 p. 18)

Lesser of Two Rule: Plaintiff is awarded lesser of market value or replacement

cost (alternatively, the easier one to calculate).

POLICY: P is made whole in least expensive way

Exception: Special Purpose Property (NY): you get replacement costs

even if they are greater. See also Trinity Church. Requires:

(1) The improvement must be unique and must be specially built

for the specific purpose for which it was designed

(2) There must be a specific use for which the improvement is

designed and the improvement must be so specially used

(3* Most Important) There must be no market for the type of

property and no sales of property for such use; and

LAYCOCK: WTC had a market, even if it was a limited

one (few could afford it)

In practice, if this is satisfied, courts will find other ones

satisfied as well

(4) The improvement must be an appropriate improvement at the

time of the taking and its use must be economically feasible and

reasonably expected to be replaced

Market Value: “Price at which property would change hands between willing

buyer/seller, neither under compulsion to buy/sell, and both having reasonable

knowledge of relevant facts.” US v. Cartwright (SCOTUS, p. 22).

If total loss: Market value with interest includes every stream of income.

No additional recovery for lost rent, etc., even if MV+interest is less than

MV+lost rent.

Laycock thinks this is undercompensatory

If temporary loss: Market value calculated by loss of use for time period

of loss.

Property of Fluctuating Value (e.g. oil, soybeans): Apply the New York

Rule of highest market value between date of loss and date by which P

should have replaced.

Replacement Cost: cost to replace. Can depend on P’s subjective situation (see

Hatahley)

FACTS: WTC 40 years old, sold just before 9/11 for $2.8B, spent $16B to

replace. Insurance pay? Also had lease of property for 99 years to obtain rents.

Now only capable of getting rents for 86 years.

APPLICATION: Owner gets MV, anything else would be windfall. 1960’s

buildings not worth the money it took to build state of art new WTC. Court said

$2.8B included value for rents discount to PV. Also gets interest (should, but

doesn’t really, compensate for rent)

Trinity Church v. John Hancock Mutual Life Insurance Co.

(Mass. 1987 p. 28) – Special Purpose Real Property

FACTS: Zero MV because landmark status restricts use, high replacement cost.

Outcome: Replacement value minus depreciation awarded.

Special Purpose Property (MA): Lesser of two does not apply when proven

value to owner is unjustly far from MV OR where there’s no way to determine

market value

See also: New York test from 9/11 case.

Reasonable Replacement Costs: Remedy: replacement cost minus depreciation

IF (1) replacement occurs AND (2) replacement is reasonable.

APPLICATION: here, reasonable replacement was done by reasonable

repairing

King Fisher Marine v. NP Sunbonnet (5th Cir 1984 p. 27) –

Special Purpose Chattle

FACTS: P bought barge for $30k, was going to convert into drydock. Negligence

sunk it. 1/6 similar to it in the world. Expert testimony that it was ideally situated

for conversion

RULE: Where P can convince a trial that there was non-speculative value to him,

they can recover replacement cost (here $233k)

Environmental/Land Restoration Cases: compare…

Sunburst School District No. 2 (MT 2007): benzene contamination of

school/homes. Court awarded $15 mil to restore properties even though property

was only worth $2 mil (avoid giving power akin to private right of eminent

domain)

Poffenbarger (AL 2007, p. 33): oil spill reduced value of land by $6k, remediation

costs were between $15k-$2.6million. Awarded reduction in market value.

Peevyhouse (OK 1963, p. 33): Restoration costs after coal mining were grossly

excessive to reduction in MV, so court only awarded MV reduction despite term

in K requiring D to restore land (not “principal purpose” of K).

o Expectancy or Reliance as the Measure of Rightful Position

Torts: (Smith)

FEDERAL RULE: No expectancy in tort – only out of pocket loss. Comes up

often in securities fraud cases.

MAJORITY OF STATES: you can recover beyond out of pocket losses for fraud.

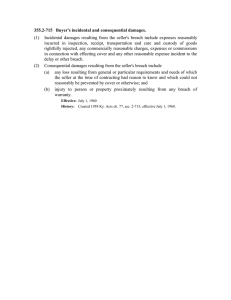

UCC Default Remedies for Breach of K

Seller (p. 37)

If buyer repudiates K or refuses to accept goods (Neri)

Difference between contract price and market value

If goods resold, difference between contract price and

resale price

If buyer keeps goods and fails to pay

Contract price

Return of goods: if buyer is insolvent

Incidentals less (cost of covering) expenses saved by buyer’s breach

Lost volume profits: when seller covers, but would have able to sell even

more if not for breach

Cannot get consequential damages or specific performance

Buyer (p. 47)

If not delivered:

K price less (market value OR cover price)

AND incidentals (cost of covering); consequential damages

OR Specific Performance: only if goods not readily available

elsewhere

If good not delivered as warranted:

Value of goods as warranted less value of goods received (UCC 2714(2)) at time of acceptance (Chatlos)

AND incidentals and consequential damages (UCC 2-714(3))

Neri v. Retail Marine Corp (N.Y. 1972 p. 35) Reliance v.

Expectancy for Retail Sales

FACTS: buyer breaches K (bargained away option to cancel for expedited

delivery on consideration of deposit) for sale of boat bc disabled and needs

surgery (unsure if disabled and wouldn’t be able to make payments, or disabled

and wouldn’t be able to use boat); seller sells to another after incurring incidental

storage costs.

OUTCOME: Expectancy damages. Seller gets lost profits and incidental costs

(storage/insurance until later sale), and must return deposit that is in excess

thereof (restitution)

NOTE: reliance damages would have been cost to store boat. (i.e.,

incidentals)

Expectancy Damages (General Rule): Enforcement of D’s promise to move P to

a new position. Can include both what is in contract, and incidentals, etc.

POPLICY: Right to be paid in the future has value; allows for predictable

contracting; would make credit less available if creditors weren’t entitled

to expectancy.

EXCEPTION: If damages are excessively large or cannot be proven.

Criticism: Can lead to overcompensation. See Chatlos.

Reliance Damages: Returns P to his position prior to K as if he had never done

business with D.

Restitution: buyer gets back deposit (minus damages from breach) otherwise it

would be unjust enrichment

LAYCOCK: efficient breach can’t explain this; it’s a distribution case

Chatlos Systems, Inc. v. National Cash Register Corp. (3d

Cir. 1982 p. 45) Gross Expectancy in Contract

FACTS: Value as warranted ($208K) grossly in excess of purchase price ($46K)

which was grossly in excess of value of goods delivered ($6K), bc machine didn’t

do what was warranted.

MAJORITY: $202K. Value as warranted minus value of goods delivered.

Equivalent to expectancy ($162K, value as warranted minus price) plus

disgorgement of seller’s $40K profit.

DISSENT: Buyer cannot receive more than bargained for, he only bargained for

$46K of product.

LAYCOCK: Case criticized for overcompensating. Example of courts’ strong

preference for expectancy damages.

Texaco, Inc. v. Pennzoil Co. (Tex. Ct. App. 1987 p. 62)

Lowest Feasible Measure of Chosen Expectancy

FACTS: Tortious interference with right to contract. Pennzoil K’ed with Getty for

3/7 of its stock, which would give it rights to 3/7 of Getty’s oil. Getty reneged on

deal when Texaco offered higher price.

ISSUE: Pennzoil wanted to measure damages in terms of oil (more valuable).

Texaco wanted to measure damages in terms of stock.

Expectancy Choice: Look to the benefit of the bargain. Pennzoil was more

interested in the oil than acquiring minority ownership. Stock is worthless without

oil (Pennzoil was arbitraging). Thus damages measured in terms of oil.

See below for consequentials and direct damages double dipping

Lesser of Two: Pennzoil may be made whole (i.e., get oil) through difference

between K price and: (1) MV of equivalent amount of stock (to be used to buy oil,

$.5B, Epstein’s idea), (2) replacement cost of finding more oil ($7.5B), or (3)

market value of oil ($23B),

LAYCOCK: Equivalent stock is cheapest, but no other oil company was

selling this much stock, so replacement costs awarded as they were less

than MV.

Tortious Interference w/ Right to Contract: technically a tort case, but

compensates for expectancy like contract AND allows for consequential and

punitive damages

Smith v. Bolles (SCOTUS 1889 p. 50) Tort and

Expectancy (Federal Rule)

FACTS: Tort action. Stock worthless, sold for $1.50, seller fraudulently

represented it would soon be worth $10.

FEDERAL RULE: No expectancy in tort – only out of pocket loss. Comes up

often in securities fraud cases.

MAJORITY OF STATES: you can recover beyond out of pocket losses for

fraud.

Where victim of breach ends up better off from K – market:

Nobs Chemical v. Koppers (5th Cir 1980 p. 38): Contract to buy at $500, market

price drops to $200, buyer repudiates. Seller had already contracted w/ supplier to

buy at $400 w/ right to cancel. (Simplified)

K – market = $300

Seller’s expected profit = $100 (this is K price minus what it paid to obtain

goods)

Courts are split as to whether to limit recovery to lost profit.

Compensatory Damages

o {

o Types:

Direct Damages

Consequentials

Must be a normal and proximate result of the breach (Buck)

Not available if they resulted from a failure to pay money (Meinrath)

Framing: benefit of the bargain can make consequentials actually direct damages

(Texaco)

Direct vs. Consequential:

Direct (general) Damages: Initial impact of wrong; value of what was

taken/destroyed/damages/failed to deliver, etc.

Consequential (special) Damages: Everything that happens as a foreseeable and

inevitable result of the initial impact. difference is based on the

foreseeability/inevitability

o Issues:

Avoidable Consequences (Mitigation): P is only entitled to

damages that he could not reasonably avoid (mitigate).

(S.J. Groves for contract; Hataley for tort)

Limits on Damages Contract Only

Liquidated Damages Clause: Fixes fair compensation for breach to avoid

unnecessary litigation. (UCC 2-718(b))

May be the exclusive remedy, even if it undercompensates. (Northern

Illinois Gas).

May not be a penalty. TEST: Reasonable and proportional to actual loss

AND damages at time of K difficult to measure. (In Re TWA)

Limitation of Remedy Clause: Permissible unless it fails essential purpose (UCC

2-719). (see failed repair/replace clause but OK consequential damages clause

limitation in Kearney )

Collateral Source