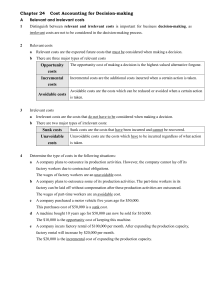

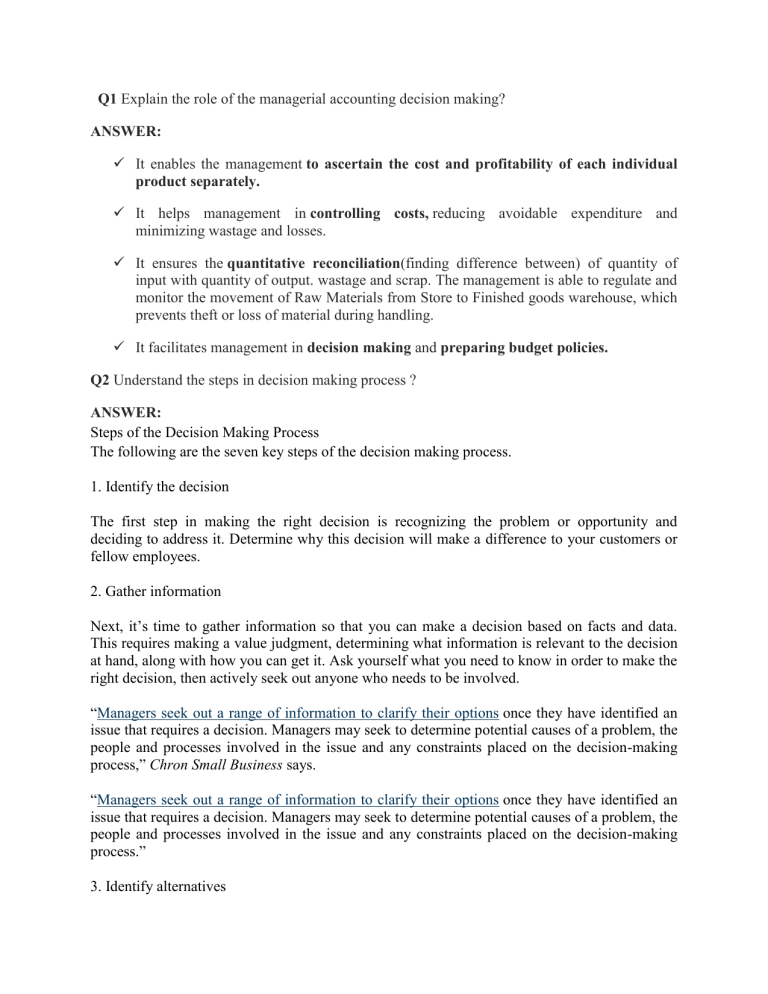

Q1 Explain the role of the managerial accounting decision making? ANSWER: It enables the management to ascertain the cost and profitability of each individual product separately. It helps management in controlling costs, reducing avoidable expenditure and minimizing wastage and losses. It ensures the quantitative reconciliation(finding difference between) of quantity of input with quantity of output. wastage and scrap. The management is able to regulate and monitor the movement of Raw Materials from Store to Finished goods warehouse, which prevents theft or loss of material during handling. It facilitates management in decision making and preparing budget policies. Q2 Understand the steps in decision making process ? ANSWER: Steps of the Decision Making Process The following are the seven key steps of the decision making process. 1. Identify the decision The first step in making the right decision is recognizing the problem or opportunity and deciding to address it. Determine why this decision will make a difference to your customers or fellow employees. 2. Gather information Next, it’s time to gather information so that you can make a decision based on facts and data. This requires making a value judgment, determining what information is relevant to the decision at hand, along with how you can get it. Ask yourself what you need to know in order to make the right decision, then actively seek out anyone who needs to be involved. “Managers seek out a range of information to clarify their options once they have identified an issue that requires a decision. Managers may seek to determine potential causes of a problem, the people and processes involved in the issue and any constraints placed on the decision-making process,” Chron Small Business says. “Managers seek out a range of information to clarify their options once they have identified an issue that requires a decision. Managers may seek to determine potential causes of a problem, the people and processes involved in the issue and any constraints placed on the decision-making process.” 3. Identify alternatives Once you have a clear understanding of the issue, it’s time to identify the various solutions at your disposal. It’s likely that you have many different options when it comes to making your decision, so it is important to come up with a range of options. This helps you determine which course of action is the best way to achieve your objective. 4. Weigh the evidence In this step, you’ll need to “evaluate for feasibility, acceptability and desirability” to know which alternative is best, according to management experts Phil Higson and Anthony Sturgess. Managers need to be able to weigh pros and cons, then select the option that has the highest chances of success. It may be helpful to seek out a trusted second opinion to gain a new perspective on the issue at hand. 5. Choose among alternatives When it’s time to make your decision, be sure that you understand the risks involved with your chosen route. You may also choose a combination of alternatives now that you fully grasp all relevant information and potential risks. 6. Take action Next, you’ll need to create a plan for implementation. This involves identifying what resources are required and gaining support from employees and stakeholders. Getting others onboard with your decision is a key component of executing your plan effectively, so be prepared to address any questions or concerns that may arise. 7. Review your decision An often-overlooked but important step in the decision making process is evaluating your decision for effectiveness. Ask yourself what you did well and what can be improved next time. “Even the most experienced business owners can learn from their mistakes…be ready to adapt your plan as necessary, or to switch to another potential solution.” Q3 Understand the characteristics of relevant information? ANSWER: There is general agreement that, before it can be regarded as useful in satisfying the needs of various user groups, accounting information should satisfy the following criteria: Understandability This implies the expression, with clarity, of accounting information in such a way that it will be understandable to users - who are generally assumed to have a reasonable knowledge of business and economic activities Relevance This implies that, to be useful, accounting information must assist a user to form, confirm or maybe revise a view - usually in the context of making a decision (e.g. should I invest, should I lend money to this business? Should I work for this business?) Consistency This implies consistent treatment of similar items and application of accounting policies Comparability This implies the ability for users to be able to compare similar companies in the same industry group and to make comparisons of performance over time. Much of the work that goes into setting accounting standards is based around the need for comparability. Reliability This implies that the accounting information that is presented is truthful, accurate, complete (nothing significant missed out) and capable of being verified (e.g. by a potential investor). Objectivity This implies that accounting information is prepared and reported in a "neutral" way. In other words, it is not biased towards a particular user group or vested interest. Q4 Distinguish relevant costs and benefits from irrelevant costs and benefits? ANSWER: Difference between Relevant Cost and Irrelevant Cost Difference between Relevant Cost and Irrelevant Cost Relevant Cost is a cost that is pertinent to the decision being made. To be relevant, a cost must be a future expected cost that differs between alternatives. Relevant costs are those costs that will make a difference in a decision. Irrelevant Cost is an avoidable cost is a cost that can be eliminated in whole or in part by choosing one alternative over another. These costs are those that will not change in the future when you make one decision versus another. The difference between relevant cost and irrelevant cost are given below – Relevant cost A cost that is pertinent to the decision being made. To be relevant, a cost must be a future expected cost that differs between alternatives. Unavoidable costs are irrelevant cost. These costs are mainly related to operational or recurring expenditures. These costs are incurred mainly by the lower management. The types of relevant costs are incremental costs, avoidable costs, opportunity costs, etc. Irrelevant cost A cost that is unrelated to the decision being made. Future costs that do not differ between the alternatives. Avoidable costs are relevant costs. These costs are mainly related to capital or one-off expenditures. These costs are mainly incurred by top management. The types of irrelevant costs are committed costs, sunk costs, non-cash expenses, overhead costs, etc. Q5 Analyze situations that involve special decisions ? ANSWER: