income-taxation-tabag-summary-chapter-1-and-chapter-2docx compress

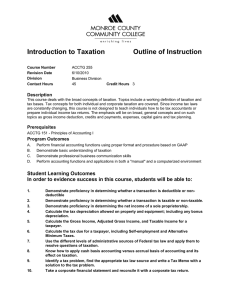

advertisement

TAXATION – the process by which the sovereign, through its lawmaking body, imposes burdens for the purpose of raising revenues to carry out legitimate objects of the government TAXES – the enforced contributions levied by the law-making body of the state for the support of the government and all the public needs. 3 INHERENT POWERS OF THE STATE 1. Police Power- the power of promoting public welfare and regulating the use of liberty and property. 2. Power of Taxation – the power which raises revenue for the expenses of the government 3. Power of Eminent Domain – the power to acquire private property for public purpose upon payment of just compensation NATURE/ CHARACTERISTICS OF THE STATE’S POWER OF TAX a) It is inherent in sovereignty. -can enforce contribution in the absence of law b) It is legislative in character. -cannot be exercised by executive and juridical branches c) d) e) f) Exemption of government entities, agencies and instrumentalities. International Comity Limitation of territorial jurisdiction Strongest among all the inherent powers of the state Agencies performing governmental function are tax exempt unless expressly taxed Agencies performing proprietary functions are subject to tax unless expressly exempted GOCCs performing proprietary functions are subject to tax, however the following are granted tax exemptions: Government Service Insurance System (GSIS) Social Security System (SSS) Philippine Health Insurance Corporation (PHIC) Philippine Charity Sweepstakes Office (PCSO) Local Water Districts (RA 10026) PURPOSES OF TAXATION 1. Primary: Revenue or Fiscal Purpose - to provide funds or property with which to promote general welfare and protection of its citizens 2. Secondary: Regulatory Purpose - employed as a devise for regulation or control Effects: ● Promotion of General Welfare ● Reduction of Social Inequality ● Economic Growth THEORIES OF TAXATION 1. Necessity Theory - to preserve the state’s sovereignty - a means to give for protection and facilities 2. Lifeblood Theory - used to continue to perform the government’s basic function of serving and protecting its people - give tangible and intangible benefits Basis of Taxation – The government may be able to perform its functions while the citizens may be secured in the enjoyment of the benefits. MANIFESTATION OF LIFEBLOOD THEORY 1. Rule of “No Estoppel against the government” 2. Collection of taxes cannot be stopped by injunction Court of Tax Appeals – have the authority to grant injunction to restrain collection of internal revenue tax, fee or charge 3. Taxes could not be the subject of compensation or set-off Tax is compulsory not bargain. 4. Right to select objects (subjects) of taxation a) Subject or object to be taxed b) Purpose of the tax (as long as it is a public purpose) c) Amount or rate of the tax d) Kind of tax e) Apportionment of the tax f) Situs (place) of taxation g) Manner, means, and agencies of collection of the tax 5. A valid tax may result in the destruction of the taxpayer’s property. Lawful tax cannot be defeated. Bring out the insolvency of the taxpayer Forfeiture of property through police power SCOPE OF TAXATION The power of taxation is the most absolute of all the powers of the government. a) Comprehensive – covers all (persons, businesses, professions) b) Unlimited – absence of limitations c) Plenary – it is complete d) Supreme – ESSENTIAL ELEMENTS OF TAX a) b) c) d) e) f) It is an enforced contribution. It is generally payable in money. It is proportionate in character. It is levied on persons, property or right. It is levied by the law-making body of the state. It is levied for public purpose. ASPECTS OF TAXATION a) Levying or imposition of tax b) Assessment or determination of the correct amount c) Collection of tax CLASSIFICATION OF TAXES 1. As to scope: National- imposed by the national government Local – imposed by the local government 2. As to subject matter or object: Personal, poll, or capitation – tax of a fixed amount imposed upon individual residing within a specified territory. Property – tax imposed on property in proportion to its value Excise – tax on certain rights and privileges (sin products or imported goods) 3. As to who bears the burden: Direct – taxpayer cannot shift to another Indirect – indemnify himself at the expense of another 4. As to determination of fixed amount: Specific- tax of fixed amount by number, standard of weight, or measurement Ad valorem – tax of fixed proportion of the value of the property 5. As to purpose: Primary, Fiscal, or Revenue Purpose Secondary, Regulatory, Special, or Sumptuary Purpose 6. As to graduation or rate: Proportional – tax based on fixed percentages of amount Progressive – tax the rate of which increases as the tax base or bracket increases Regressive - tax the rate of which decreases as the tax base or bracket increases 7. As to taxing authority: National – imposed under National Internal Revenue Code, collected by Bureau of Internal Revenue Local – imposed by LGUs ELEMENTS OF SOUND TAX SYSTEM a. Fiscal Adequacy – sources must be adequate b. Theoretical Justice or Equity – tax should be proportionate c. Administrative Feasibility – law must be capable of effective and efficient enforcement LIMITIATIONS ON THE STATE’S POWER TO TAX 1. Inherent Limitations 2. Constitutional Limitations Progressive System – emphasis on direct taxes Regressive System – more indirect taxes imposed Regressive Tax Rates – tax rates which decreases as tax base or bracket increases FACTORS IN DETERMINING THE SITUS OF TAXATION a. b. c. d. e. f. Subject matter ( person, property, or activity) Nature of tax Citizenship Residence of the taxpayer Source of Income Place of excise, business or occupation being taxed TOLL is a sum of money for the use of something which is paid of the use of a road, bridge or public nature. PENALTY is a sanction imposed as a punishment for violation of law or acts deem injurious. SPECIAL ASSESSMENT is an enforced proportional contribution from owners of the lands for special benefits resulting from public improvements. Characteristics: a. Levied only on land b. Not a personal liability of the person assessed c. Based wholly on benefits (not necessary) d. Exceptional both as to time and place CITIZENS OF THE PHILIPPINES 1. Born with father and/or mother as Filipino citizens 2. Born before Jan. 17,1973 of Filipino mother who elects Philippine citizenship upon reaching the age of maturity 3. Acquired Philippine citizenship after birth (naturalized) in accordance with Philippine Laws NONRESIDENT CITIZEN OF THE PHILIPPINES 1. Establishes to the satisfaction of the Commissioner of Internal Revenue, the fact of his physical presence abroad with a definite intention to reside therein 2. Leaves the Philippines during the taxable year to reside abroad: As an immigrant For employment on a permanent basis For work and derives income that requires him to be physically abroad most of the time during the taxable year 3. A citizen of the Philippines who shall have stayed outside the Philippines for one hundred eighty-three days (183) or more by the end of the year. REVENUE refers to all funds or income derives by the government. SUBSIDY is a pecuniary aid directly granted by the government to an individual or enterprise deemed beneficial to the public. PERMIT or LICENSE is a charge imposed under the police power for purposes of regulation. CUSTOMS DUTIES are taxes imposed on goods exported from or imported into a country. TARIFF is the system of imposing duties on the importation or exportation of goods. A Filipino citizen taxpayer not classified as nonresident citizen is considered a RESIDENT CITIZEN for tax purposes. An ALIEN is a foreign-born person who is not qualified to acquire Philippine citizenship by birth of after birth. Section 22(F) of the Tax Code defines RESIDENT ALIENS as an individual whose residence is within the Philippines and who is not a citizen thereof. The term NONRESIDENT ALIEN under Section 22(G) of the Tax Code means an individual whose residence is not in the Philippines and who is not a citizen thereof. Under Section 22(S) of the Tax Code, “trade or business” includes performance of the functions of a public service or performance of personal service in the Philippines. A nonresident alien not engaged in trade or business is subject to 25% income tax based on gross profit from all sources within the Philippines. DIRECT DOUBLE TAXATION means taxing twice: 1. By the same taxing authority, jurisdiction or taxing district 2. For the same purpose 3. In the same year or taxing period 4. Same subject or object 5. Same kind or character of the tax MEANS OF AVOIDING THE BURDEN OF TAXATION 1. Shifting – the transfer of the burden of tax by the original payer to someone else 2. Transformation – the producer pays the tax and endeavor to recoup himself by improving his process of production 3. Evasion – the use of illegal means to defeat or lessen tax 4. Tax Avoidance – the exploitation of legally permissible alternative tax rates of assessing taxable income to reduce tax liability 5. Exemption – the grant of immunity to particular persons of a particular class 6. Capitalization – the reduction in the selling price of income producing property by an amount equal to the capitalized value 7. Avoidance – the tax saving device within the means sanctioned by law. SOURCES OF TAX LAWS 1. 2. 3. 4. 5. 6. 7. 8. 9. Constitution National Internal Revenue Code Tariff and Customs Code Local Government Code (Book II) Local tax ordinances/ City or municipal tax codes Tax treaties and international agreements Special Laws Decision of the Supreme Court and the Court of Tax Appeals Revenue rules and regulations and administrative ruling and opinion INDIVIDUAL TAXPAYERS are natural persons with income derived from within the territorial jurisdiction of taxing authority. They are classified as: 1. Resident Citizens(RC) ● Engaged in trade/business 2. Nonresident Citizens (NRC) (NRA-ETB) 3. Resident Aliens (RA) ● Nonresident aliens not engaged 4. Nonresident Aliens (NRA) in trade or business (NRA-NETB) Importance of classification: They differ as to: Situs of income Manner of computing tax Treatment of certain passive incomes Allowable deductions References in the tax choice 1. 2. 3. APPLICABLE TAXES AND TAX RATES Classification of the Taxpayer Source of Income Taxpayer Tax Base Source of taxable Income RC Net Income Within and without NRC, RA,NRA-ETB Net Income Within NRA-NETB Gross Income Within Type of Income (APPLICABLE TAX) a) Ordinary or regular income (GRADUATED RATE) – refers to income such as compensation income, business income, and income from practice of profession b) Passive income (FINAL WITHHOLDING TAX) – subject to final withholding taxes are certain passive incomes from sources within the Philippines such as: Interest income Dividend Income Royalties Prizes Other winnings c) Capital gains subject to gains tax (CAPITAL GAIN TAX) Capital gains from sale of shares of stocks of a domestic corporation Capital gains from sale of real property in the Philippines Income Tax (TRAIN Law 2018-2022) Below 250,000 Exempt 250,000-400,000 20% excess of 250,000 400,000-800,000 30,000 + 25% excess of 400,000 800,000-2,000,000 130,000 + 30% excess of 800,000 2,000,000-8,000,000 490,000 + 32%excess of 2,000,000 Above 8,000,000 2,410,000 + 35% excess of 8,000,000 Under RA 10963 (TRAIN Law), self-employed is defined as a sole proprietor or an independent contractor who reports income earned from self-employment. PROFESSIONAL is a person formally certified by professional body belonging to a specific profession. Regular income of SELF-EMPLOYED &/or PROFESSIONALS (SEP) amounting to more than 250,000 but with a gross sales and other operation income not exceeding 3M shall have the option to avail 8% tax. MWE are exempt from income tax on: 1. Minimum wage 2. Holiday pay 3. Overtime pay 4. Night shift differential 5. Hazard pay FILING OF INCOME TAX RETURNS FINAL WITHHOLDING TAX is a kind of tax, which is prescribed on “certain income” derived from the Philippine sources. RR- 14-2012 defines DEPOSIT SUBSITUTES as an alternative form of obtaining funds from the public other than deposits. Under tax code, the following are ordinary assets: 1. Stock in trade of the tax payer or other property of a kind 2. Property used in trade or business subject to depreciation 3. Real property held by the taxpayer primarily for sale to customers in the ordinary course of business 4. Real property used in trade of the taxpayer b) Sale of real properties located in the Philippines CGT = 6% of the higher of GSP and FMV OTHER PERCENTAGE TAX is not an income tax but a business tax. The applicable tax for this is known as “stock transaction tax.” Prior to 2018 – ½ of 1% of GSP 2018 – 6/10 of 1% of GSP Subject to Basic Tax – examples: a) Sale of Share of foreign corporations b) Sale of real properties located abroad c) Sale of other personal assets other than share of stock of domestic corporations PRINCIPAL RESIDENCE is the family home of the individual taxpayer which refers to his dwelling house including his family. FINAL WITHHOLDING TAX ON PASSIVE INCOME Prior to 2018 - January to November – 10th day of the month December – January 15 2018 – not later than the last day of the month CAPITAL GAINS TAX a. Share of Stock Ordinary Return – 30 days after each transaction Final Consolidated Return – on or before April 15 of the following year b. Real Property – 30 days following each sale or other disposition MANNER OF FILING a. Manual Filing b. Electronic Filing and Payment System (EFPS) c. eBIR Forms 1st installment: at the time of filing the annual ITR 2nd installment: on or before October 15 following the close of the calendar year PLACE OF FILING INCOME TAX RETURN 1. Authorized Agent Banks 2. Revenue District Officer 3. Collection Agent 4. Duly Authorized City or Municipal Treasurer PERSONS REQUIRED TO FILE INCOME TAX RETURN 1. 2. 3. REQUISITES OF TAX EXEMPTION 1. 4. The proceeds are fully utilized in acquiring or constructing a new principal residence within 18 calendar months from the date of disposition. The historical cost or adjusted basis of the real property sold or disposed shall be carried over to the new principal residence built or acquired. The BIR shall have been duly notified by the taxpayer within 30 days from the date of sale or disposition through a prescribed return of his intention to avail of the tax exemption. The tax exemption can only be availed of once every 10 years. a. b. c. FORMAT IN COMPUTING TAXABLE INCOME Pure Compensation Income Earner Pure Business Income Earner Mixed Income Earner 2. 3. Benefits for Senior Citizen and PWDs: 20% discount and exemption from VAT on their purchase of specified goods and services P500 monthly social pension, for indigent senior citizens Death benefit assistance 5% discount on utilities Income tax exemption for minimum wage earners of for SC/PWDs whose annual taxable income is not more than 250,000 The term “statutory minimum wage earner (SMW)” or “minimum wage earner (MWE)” under RA 9504 shall refer to a worker in the private sector paid the statutory minimum wage. The rate is fixed by the Regional Tripartite Wage and Productivity Board as defined by the Bureau of Labor and Employment Statistics. For Business Income Earners The individual taxpayer is required to file a quarterly tax return ( May 15, Aug 15, Nov 15, and April 15) Gain on sale of ordinary assets is commonly known as ordinary or regular income | classified as capital gains. CAPITAL GAINS may be: Subject to CAPITAL GAINS TAX (CGT) pertain to sale of: a) Shares of stock of a domestic corporation sold directly to a buyer Prior to 2018 – 5% to 100,000 ; 10% to excess 2018 – 15% of capital gain BASIC TAX For Purely Compensation Income Earners On or before April 15 of the succeeding year 4. 5. 6. Individuals engaged in business and/or practice of profession Individuals deriving compensation from two or more employers concurrently at any time during the taxable year Employees deriving compensation income, the income tax of which has not been withheld correctly Individuals deriving other non-business, non-professional-related income in addition to compensation income not otherwise subject to final tax Individuals receiving purely compensation income from a single employer Non-resident alien engaged in trade or business in the Philippines deriving purely compensation income PERSONS NOT REQUIREDTO FILE INCOME TAX RETURN 1. 2. 3. 4. An individual earning purely compensation income whose taxable income does not exceed 250,000. An individual whose income tax has been correctly withheld by his employer An individual whose sole income has been subjected to final withholding tax Minimum wage earners, the Certificate of Withholding filed by the respective employers, duly stamped “Received” by the Bureau SUBSITUTED FILING OF INCOME TAX RETURNS (ITR) Under RA 9504 and RR 10-2008, individual taxpayers may no longer file income tax return provided he has (all the requirements must be satisfied): 1. Receiving purely compensation income, regardless of amount 2. The amount of income tax withheld by the employer is correct (Tax due = Tax withheld) 3. Only one employer during taxable year 4. If married, the employee’s spouse also complies with all the three aforementioned conditions, or otherwise receives no income.