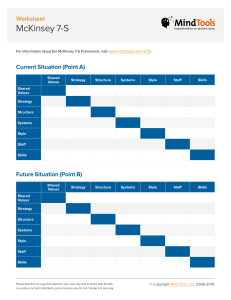

McKinsey Strategic Analysis: Competitive Advantage & Disruption

advertisement

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/347103577 Strategic Analysis - McKinsey & Company; How Competitive Advantage Diminishes in the Environment of Industry Disruption Preprint · November 2020 DOI: 10.13140/RG.2.2.17427.50721 CITATIONS READS 0 6,244 1 author: Andria Biggs Texas A&M University-Commerce 9 PUBLICATIONS 0 CITATIONS SEE PROFILE Some of the authors of this publication are also working on these related projects: Marketing Analysis View project Marketing Analysis View project All content following this page was uploaded by Andria Biggs on 15 December 2020. The user has requested enhancement of the downloaded file. Andria Biggs Texas A&M University – Commerce College of Business November 26, 2020 Strategic Audit – McKinsey & Company I. Introduction to the Organization McKinsey & Company is a global consulting firm with a primary focus in change management, process improvement, disruption planning, and technological innovation for business (“About Us”, 2020). McKinsey & Company began its existence as an accounting firm who purported itself as management-by-accounting consulting firm (“History of Our Firm”, 2020). McKinsey & Company has gone on to become a leader in the industry, expanding both its service offerings and its well of expertise. Today it is known as one of the most prestigious global consulting firms in the industry (Byrne, 2017). A. Organizational Founding and History McKinsey & Company was founded in 1926 by James O. McKinsey, a management accounting specialist and professor at the University of Chicago. McKinsey & Company (McKinsey) would first open as a management accounting firm, advising on accounting tools in business management. Shortly after the founding, James McKinsey would take on two partners, Tom Kearney and Marvin Bower. All three would play leading roles in the early years of McKinsey, though Marvin Bower would be credited with creating the company’s core values and business focus (“History of Our Firm”, 2020). The competitive advantage of McKinsey & Company expertise is largely attributed to Marvin Bower’s “up or out” policy, that promoted high performers while thinning out low talent or under-performing associates ("Great American Business Leaders of the 20th Century | Marvin Bower", 2020). Through a private partnership Stovall, Wellington, & Company in 1935, it would also increase its reach and its client base (Greiner et al., 2005). The partnership was not destined to last, however. Upon James O. McKinsey’s death in 1937, the accounting division would be returned to Stovall, Wellington, & Co., while McKinsey would become its own separate consulting entity. However, McKinsey would leave the Stovall partnership with one key advantage, a Stovall & Wellington executive, Guy Crockett, who would leave Stovall to become an investor and managing partner of McKinsey & Company with one of the original McKinsey partners, Marvin Bower. While Crockett was commanding the helm of McKinsey & Co., Bower has been attributed with setting the strategy and direction (Bhide, 1995). B. Corporate Ownership McKinsey & Co. Is a private company that is currently held in private corporate partnership. A unique model that gives part ownership to McKinsey employees who have made partner, but requires associates to return McKinsey ownership shares upon their exit from the organization ("McKinsey & Company, Inc. - Company Profile, Information, Business Description, History, Background Information on McKinsey & Company, Inc.", 2020). C. Board of Directors and Top Leadership The top executive, Kevin Sneader, who serves as McKinsey’s Global Managing Partner, has been with McKinsey since 1989 upon his graduation from Glasgow University with his Bachelor of Laws degree. Sneader would begin work as an analyst at McKinsey’s London, England office then go on to lead both the UK office and Asia regional offices. Sneader would be appointed Global Managing Partner in 2018 having also received his terminal degree as an MBA graduate of Harvard and Baker’s scholar (“Kevin Sneader | Profile” 2020). In an analysis of top executives at McKinsey, you will find that a majority of their executives are Harvard graduates (“Our People | McKinsey & Company”, 2020). While Harvard is certainly known as one of the most prestigious and thorough universities for business graduates, it shows that leadership is primarily homogenous in educational training (Bauer & Erdogan, 2020). Some top executives received their end degrees from universities other than Harvard, such as Oxford, Cambridge, and Carnegie Mellon universities, these schools also have a homogeneity of thought similar to that that you would find at Harvard (“Our People | McKinsey & Company” 2020). The danger I fear this poses, is not only a homogeneity of thought, but also a lack of diversity by virtue of the ethnic, wealth, and gender enrollment that is often seen at top universities (Bauer & Erdogan, 2020). This theory would seem to bear out when we see that 90%, 8 of the 9, top leadership are male and 90% are Caucasian or of Caucasian decent. Kevin Sneader himself admits “... On diversity of gender, ethnicity, and sexual orientation, we have a lot of work to do. I believe we’ve got to look like the clients we serve and the societies in which we operate. And we’ve got to be relentless about working toward that objective” (“Meet Our New Managing Partner | McKinsey”, 2018). This type of homogeneity can create an echo chamber, create an environment of group think, and even broaden the dangers of unethical action (Bauer & Erdogan, 2020). D. Firm Business Model McKinsey & Co’s business strategy is to use its prestigious name recognition, coupled with its highly skilled and knowledgeable consultants, to bring new business solutions, issue diagnosis and recommendation, and disruption planning to large organizations and governments, in a forward-facing and innovative environment (Bhide, 1995). E. Global Impact McKinsey & Company was also a first mover in global expansion, opening its first European office in 1959 and quickly growing from there. McKinsey would grow across the European Union and then continue its global expansion opening its first Asia office in 1976. As of 1984 McKinsey boasted that more than half of its consultants carried a non-US passport. Since then, McKinsey has grown exponentially across the globe and now has presence in North America, Canada, South and Central America, Europe, Asia, Africa, and the Middle East. With their expansion across the globe also came an expansion in McKinsey’s core competencies and expertise. With an early move into global expansion and the knowledge acquired therein, McKinsey has cemented its position as a global leader in the consulting industry (Bhide, 1995). Though, their global success has not come without controversy. McKinsey has taken criticism for its work supporting authoritarian regimes (Bogdanich & Forsythe, 2018). McKinsey has consulted for countries in experiencing significant civil unrest such as Ukraine, Saudi Arabia, and South Africa (Kolhatkar, 2018; Bogdanich & Forsythe, 2018). These consultancy contracts that support emerging countries is one of the reasons McKinsey has such a global presence. The foot in the door if you will. One has to ask though, is this the right step in McKinsey’s global expansion, particularly in an atmosphere of greater awareness, and demand for change, in corporate social responsibility measures. F. The Prestige of McKinsey & Company Many would be surprised to know that the basis of McKinsey’s prestige is an illusion that McKinsey itself built. In the 1960’s as strategic consulting was beginning to take shape as an industry, competitors like Boston Consulting Group (BCG) and others were gaining a reputation for expertise that would rival McKinsey’s. In response, McKinsey, wanting to be the premier firm, had a clever idea to create an illusion of their own prestige. They devised a plan to send out job postings simply so they could reject high-level candidates. “Only the Best”. These types of ads were intended to instill the industry perception that only the top tier of consultants worked at McKinsey & Company. It worked. BCG would soon follow suit in these mechanisms and along with Bain & Company, create the prestige of the “Big Three” (Markovitz, 2020). The prestige these consultancy firms created, as we will examine later in our analysis, is what could now hinder their success in competing in new and evolving markets in the strategic consulting industry (Christenson, Wang, & Van Bever, 2013). II. Industry and the Competitor Identification Competitors: Though McKinsey & Company, and the industry writ large, is experiencing more market entrants and competitors, for the sake of this analysis we will focus on the three primary competitors. Two of those competitors, Boston Consulting Group and Bain & Company are large historical competitors that compete in the traditional model of McKinsey & Company. The third, Accenture (“Accenture Strategy & Consulting | Change with Confidence”, 2020), is a new and quickly growing entrant that is challenging the traditional definition of consulting (Christensen et al., 2013). In McKinsey’s competition within its traditional strategic group, they vie for market share above anything else. In part due to the oligarchic nature of McKinsey’s traditional strategic group, the “Big Three”, market saturation is high. The firms competing in this group all have similar products, processes, and expertise. Due to the large market share each hold, untapped market share is almost non-existent. Each firm is competing to take business away from one of the other firms and competition is fierce (Rothaermel, 2020). However, the consulting industry, which has long been static and not as susceptible to industry disruption, is beginning to see a shift in the industry and its strategic groups. As knowledge and expertise becomes more widely accessible to practitioners, some of that gained in the hands of McKinsey’s own alumni, new entrants are choosing to apply the same expertise in different structures of product competition, such as single-issue boutique services (Christensen et al., 2013). An example of this shifting in product structure can be found in Accenture. Accenture, founded over a half of a decade later than McKinsey in 1989, has managed exponential growth. Financial disclosures show revenues of $44.2b in Financial Year (FY) 2019 (“Earnings Reports | Accenture”, 2019), four times that of McKinsey’s $10.5b (“McKinsey & Co. | Company Profile”, 2020). Accenture looks not only to be a disruptor in the industry, but also a challenger to the strategic consulting model all together (Christensen et al., 2013) III. Industry Analysis A. Strategic Group(s) McKinsey & Company competes in the wider Strategic Consulting industry, but has a narrower scope of strategic group competition (Byrnes, 2017). McKinsey primarily competes within a strategic group of other large, full-scale consulting firms such as Boston Consulting Group, Bain & Company (Reibstein, et al., 2006). All three of the firms offer consulting services to large commercial, industrial, and government clients that cover many of the same areas of expertise in Operations, Processes, Logistics, Technology, and Sustainability (Byrnes, 2017). This is where McKinsey’s primary competitive focus is, and has been, for several decades (“History of Our Firm”, 2020). However, new market entrants, such as Accenture, are having a significant impact in how the strategic consulting industry and strategic groups are defined and is making it harder for McKinsey to rely on its expertise in its traditional business model to stay competitive. In our Accenture example, rather than try to enter an already saturated highend market, Accenture chose to siphon off market share from the lower end market of firms that cannot afford, or do not need, large full-service solutions Accenture has tapped a market that McKinsey, Bain, and BCG have all ignored (“The Disruption of Management Consulting l CB Insights”, 2020). In this, McKinsey has a weaker competitive position (Rothaermel, 2020). McKinsey has traded on its prestige and only focuses its attention to large scale organizations who need, and can afford, to pay the lofty price that McKinsey’s prestige demands. McKinsey’s prestige is now hampering its move into a lower market that is producing higher returns in bit-piece consulting services. A market that has allowed Accenture, and other bit-piece consulting services, to capitalize tens of millions more in annual revenue (“The Disruption of Management Consulting l CB Insights”, 2020). McKinsey, by virtue of its multilateral industry approach to its business model, must also compete with strategic groups within the industries in which it participates. Other pioneers, innovators, and leaders within these business areas also is working to develop innovations and ideas to solve the same complex problems that have been outsourced to McKinsey (Rothaermel, 2020). We will drill down on these business areas and their strategic importance later in our report. B. Global Reach While all of the "Big Three” have a significant global presence, McKinsey by far has the largest global reach, operating 137 offices in 65 countries. Boston Consulting Group and Bain & Co. Come in at the two and three ranked spots for global reach (Bhide, 1995). It is in global expansion that McKinsey experiences its greatest competition in the Big Three category (“The Top-10 Strategy Consulting Firms Compared”, 2020). McKinsey has a significant advantage owning to its early entry into global markets, which pre-dated the founding of these firms (“History of Our Firm | McKinsey & Company”, 2020), the early entrant advantage is fading in the face of a mature market where the full utilization of prior learning has been achieved (Rothaermel, 2020). The Big Three all firms utilize many of the same development tools, innovation, process management techniques, and even employees. Though each has its own product model, the primary source of competition, is who can do it better (Rothaermel, 2020). C. Rivalry among Competitors Rivalry in the industry is fierce. Since the market is not in a growth stage, rivalry among competitors is for the gaining more of existing market share (Rothaermel, 2013). Again, we example Accenture, who rather than tap a saturated market has created a whole new market. In this, not only has Accenture created its own market, but is also challenging the existing structures of the consulting industry (Christensen et al., 2013). D. Threat of new competitors entering the industry The threat of new entrants to the market has been historically low due to the market share being held by four large full-service consulting firms. However, the industry is changing and new entrants that provide smaller, more focused, boutique consultants (Bhide, 1995). Competing in the traditional “Big Three” market is not McKinsey’s biggest threat. Accenture, the new market entrant in our analysis, and other similar firms, poses the biggest threat due to its power in creating and challenging the structure of traditional consulting services (Christensen et al., 2013). With new entrants taking advantage expansion of knowledge and prior learning in the industry, new entrants are able to start from a much better position. Additionally, new entrants under the changing structure of bit-piece services have a lower cost to enter and a lower cost to exit as they do not have to contend with a large complex organizational structure. These exampled firms, utilize a contract consultant structure, that reduces labor costs and infrastructure needs (Rothaermel, 2020). E. Threat of substitute products or services The biggest threat to big consultancy firms, McKinsey included, is that as access to information and learning is more widely available, companies are bringing many of the functions that used to be outsourced, in-house (Rothaermel,2020; Christensen, et al. 2013). Additionally, smaller firms just entering the market are offering consulting services in a more focused structure offering single services for a lower price (“The Disruption of Management Consulting l CB Insights”, 2020). We turn again to our Accenture example. Accenture has been able to succeed in creating its own market. While Accenture has a smaller product offering, it has a larger customer base. Again, utilizing the bottom of the strategic consulting market, and offering bit-services at a reasonable cost, has allowed Accenture to grow exponentially. Though Accenture doesn’t offer the large-scale consulting services, the danger is that Accenture will be able to siphon off business from larger clients from the upper market, who need single issue solutions. As Accenture is expanding the market, McKinsey may find that their traditional clients may choose to take advantage of new market solutions such as Accenture (Rothaermel, 2020; Christensen et al. 2013). F. Bargaining power of buyers The consulting industry has historically been opaque with means and methods being either unknown, or a result of a deep well of expertise that most individual organizations did not possess (Bhide, 1995). However, the power of the buyer is changing. As information and knowledge is becoming increasingly easier to access, organizations are able to assess many of their own issues and their resolutions (Rothaermel, 2020). Additionally, many competing firms, large organizations, and even small boutique firms have been able to access the expertise once held only by McKinsey, through the employment and contracting of McKinsey alumni (Rothaermel, 2020; Christensen et al., 2013) G. Bargaining power of suppliers; Potential Profitability of the Industry - What organizations have succeeded and failed in the industry and why? While there have been previous entrants in the industry, it has been a difficult one to break into for firms without historical origins of expertise. The three largest firms, McKinsey, BCG, and Bain gained majority market share early on, making market entrance difficult for smaller firms. Additionally, the expertise found at McKinsey was difficult to imitate. However, as the experience curve grows with prior learning, you see inverted growth in dependence of even large firms for outside services (Bhide, 1995, Rothaermel, 2020). H. What are the Critical Success Factors for the industry? • Expertise McKinsey is still the premier firm for strategic consultancy service, but contends with a wider knowledge, a fully developed learning curve in the industry, and the expertise of McKinsey alumni being recruited in the wider industry (“The Disruption of Management Consulting l CB Insights”). McKinsey must continue to hone its own expertise, while also transforming the organization’s structure to be able to compete in a changing industry structure (Rothaermel, 2020). McKinsey must work to highlight more technological capabilities that will be need to solve issues in an ever-more technological environment (Blair, 2020). • Innovation McKinsey’s digital labs are a step in the right direction to allow client teams to gain hands-on experience in the process and innovation implementation and learning of McKinsey’s services (“History of Our Firm | McKinsey & Company”). Additionally, McKinsey has developed and is continuing to develop a suite of enterprise software and process management systems that would allow organizations to more easily implement and monitor basic processes improvement (“McKinsey & Company Global Management Consulting”, 2020). McKinsey is attempting to step into the technological arena, but need to move quicker to address new entrants into the market that have already began tapping expertise and markets for technology focused industry needs (Blair, 2020). • Diversification McKinsey, while steeped in industry expertise, suffers from a lack of diversification in its recruiting practices for leadership and top-level consultants (“Meet our next global managing partner: Kevin Sneader”, 2018). Though MBA’s are a great source of deep knowledge, they do not necessarily represent the changing face of the industry today (Blair, 2020). Having such a homogenous view within the organization can make it difficult to respond to diversity in the larger environment (Bauer & Erdogan, 2020). McKinsey would do well to start creating a larger diversity in their recruiting efforts if they expect the organization to effectively compete in areas of technology and innovation. • Enterprise Systems In enterprise technology McKinsey has historically been successful. McKinsey is credit with developing the retail Universal Product Code (UPC) barcodes that are now utilized world-wide (“History of Our Firm | McKinsey & Company”). In its present initiatives, McKinsey is concentrating on developing its own enterprise process management and monitoring programs that allow organizations to apply McKinsey knowledge in a continuous and more independent way. This is a great step towards cementing some of McKinsey’s customers that may otherwise churn after the successful conclusion of a McKinsey large-scale issue resolution. IV. Analysis of the Macro-Environment A. Political/Legal McKinsey, by nature of its business model and its private ownership, has very little regulatory oversight. McKinsey doesn’t report to the Securities & Exchange Commission (SEC) because they are privately held. Though McKinsey must take regulatory measures into account when developing a solution, they are not the ones who are ultimately responsible, from a legal standpoint, for the compliance of issue resolutions that they create for client organizations. B. What economic forces affect the industry? Economic forces in the industry can be viewed from a macro-level on a global economic scale, such as the global credit crisis or from the micro-level on a national level, such as national unemployment rates or national investment markets, within countries McKinsey operates. McKinsey must also take into consideration exchange rates and monetary valuations as they relate to wider profitability on a global scale. C. What social forces affect the industry? Population growth rate, income distribution, career attitudes, cultural barriers are social forces that most firms contend with. McKinsey has a much larger interest in these forces within separate national attitudes and demographics of individual regions and countries. McKinsey, like many organizations, needs to also consider the move towards corporate social responsibility and sustainability. A good example of this would be the firm’s controversial work for authoritarian or corrupt governments. Clients and the larger market have brought more pressure to bear on organizations to operate ethically not only in their home countries, but also in their global operations. D. What technological forces affect the industry? The level of innovation, automation, research and development (R&D) activity, technological change, and the amount of technological learning that the market possesses all pose significant threats to the organization that is experiencing a shift in product and service offerings that increasingly depend on technology. E. What are the threats and opportunities facing the organization? External Analysis: ▪ ▪ V. Opportunities ▫ Expanding Lower Market ▫ Technological Innovation ▫ Opportunities to recruit from a wider market of technology experts ▫ Opportunities to further expand into emerging markets Threats ▫ Challenges to the industry structure ▫ Challenges to product structures ▫ Prior learning Utilization within the industry ▫ Greater demand for corporate social responsibility Organization’s measurement and control system A. Current financial position Since McKinsey & Company is a privately held corporation, and one known to covet proprietary information, McKinsey’s financials are extremely opaque. Analyst do not have traditional financial filings that are required of publicly held companies. They also do not have the type of public disclosure, however limited, of a private firm seeking large equity capital. Much like all knowledge at McKinsey, this information is tightly held. Primarily the information accessible to an academic analyst of the organization’s financial success would be noted in only two measures, Revenue and Annual Growth Rate. These available financials, is what our analysis has primarily relied on as a measure of profitability both in the industry and in competition. The organization, in FY 2019, posted $10.5b in revenues, which is significantly better than its two closest competitors, Bain & Co. (8.5b) and BCG (4.5b). More concerning, McKinsey is lagging behind its newest, and fastest growing competitor, Accenture, at $43.2b. Additionally, while McKinsey still continues to grow, its growth percentage has dropped from 13.64% to just 5% in the two years between 2019 and 2019. Much of the decline in growth is associated with the full maturity of the market, decreasing entry barriers, comparable imitation, and a shifting market structure. Source: Craft & Co. B. Compare with competitors and standards. Revenue of Traditional and Non-Traditional Competitors - FY2019 McKinsey & Co. $10.5b (FY, 2019) Boston Consulting Group (BCG) $8.5b (FY, 2019) Bain & Co. $4.5b (FY, 2019) Accenture $43.2b (FY, 2019) McKinsey & Company, still the leading firm of the big three, has managed to stay comfortably ahead of its two largest competitors Bain & Co. And BCG, posting two billion dollars more than its closest competitor and twice the revenue as the firm in the third spot. Its competitive advantage in the lower market and in the bit-piece market is weak, however, causing McKinsey to allow tens of billions of dollars in profits to consultancy firms in missed opportunity. In ignoring a large portion of the market, McKinsey is allowing its smaller competitors to reap the kinds of rewards that will allow them to become much more effective competitors in the future. C. Use financial analysis tools McKinsey & Co., by virtue of being privately held, can be more difficult to assess financially due to the opaqueness of its financials: In-depth financial analysis will be completed using what publicly disclosed financial information is available Annual Revenue and Annual Growth. As shown in the chart below, that McKinsey experienced average annual revenues and weak annual growth when compared to all three of our comparable firms in the analysis. USD McKinsey FY 2016 FY2017 FY2018 FY2019 Annual Revenue Annual Growth 8.8b 5% 10.0b 14% 10.0b 10.5b 5% 5.6b 48% 6.3b 48% 7.5b 26% 8.5b 13% 2.3b 12% 3.4b 13% 4.3b 19% 4.5b 13% 32.9b 6% 34.9b 6% 39.6b 14% 43.2b 5% - Bain & Company Annual Revenue Annual Growth BCG Annual Revenue Annual Growth Accenture Annual Revenue Annual Growth *McKinsey, BCG, Bain & Co. Source: Craft Enterprise Solutions *Accenture Source: Accenture Investor Reports D. What are the organization’s Key Performance Indicators (KPI’s)? o Revenue o Net Profit o Annual Growth o Customer Lifetime Value o Sales per employee o Innovation Spending VI. Analysis of the Organization A. Mission “To help our clients make distinctive, lasting, and substantial improvements in their performance and to build a great firm that attracts, develops, excites, and retains exceptional people.” B. Vision “To help create positive, enduring change in the world.” C. Core Values and Operating Guidelines McKinsey’s Core Values fall into three core pillars. Adhere to the Highest Professional Standards, Improve Client’s Performance Significantly, and Create an Unrivaled Environment for Exceptional People. McKinsey’s Operational Guidelines are built into its core values as the way that McKinsey will accomplish its vision and mission in pursuit of its goals. ▪ ▪ ▪ Adhere to the highest professional standards Put client interests ahead of the firm’s Maintain high standards and conditions for client service Observe high ethical standards Preserve client confidences, maintain an independent perspective Manage client and firm resources cost-effectively Improve our clients’ performance significantly Follow the top-management approach Pursue holistic impact Use our global network to deliver the best of the firm to all clients Bring innovations in management practice to clients Build client capabilities to sustain improvement Build enduring relationships based on trust Create an unrivaled environment for exceptional people Be nonhierarchical and inclusive Sustain a caring meritocracy Develop one another through apprenticeship and mentoring Uphold the obligations to engage and dissent Embrace diverse perspectives with curiosity and respect Govern ourselves as a “one firm” partnership McKinsey’s core values have changed very little since the beginning of its founding, in 1937 Marvin Bower established McKinsey’s first set of “rules” for the firm. ▪ ▪ ▪ ▪ ▪ “Up or Out” employment policy Consultants should put the interests of clients before McKinsey's revenues Not discuss client affairs Tell the truth even if it means challenging the client's opinion Only perform work that is both necessary and that McKinsey can do well McKinsey’s core values and operating guidelines perfectly exemplify the firm itself. McKinsey strives to have the highest professional standards, to strive to improve client performance, and employ exceptional people. D. Organization’s Core Competencies • Expertise The expertise at McKinsey has long been coveted. McKinsey alumni receive top offers and are often headhunted for their knowledge and expertise both in the academic arena and the type of proprietary skills that they gained at McKinsey. • Innovation McKinsey has always managed on the frontlines of industry and created many innovative solutions across a wide range of industries and applications. Now, McKinsey is seeking to develop its own suite of basic process solutions that can be implemented on-site and controlled and monitored in real time with remote access by McKinsey consultants. This is both an answer to Accenture’s bit-piece solution services and a way to reduce churn rate of current and future clients. • Agility By nature of McKinsey’s global reach, expert knowledge, and extensive library of issue resolutions, McKinsey is quickly able to adjust to issues within industries, organizations, and even emerging economies. The sheer number of consultants and expertise McKinsey has to hand makes the organization able to quickly adjust to new threats in the macroenvironment. • Process Creation McKinsey has an extensive collection of prior learning, process improvements, scaling solutions, financial knowledge, operations expertise, transformative restructuring, and environmental disruption plans. McKinsey has for decades been the leader in the type of process improvements and issue resolution that has brought it to its success today. E. Organization’s Broad and Specific Goals “We help organizations across the private, public, and social sectors create the Change that Matters most to them. From the C-suite to the front line, we partner with our clients to transform their organizations, embed technology into everything they do, and build enduring capabilities. With exceptional people in 65 countries, we combine global expertise and local insight to help you turn your ambitious goals into reality.” VII. Analysis of the Organization – Organization-Level and Business Unit Strategies A. Organizational Strategies The organizational strategy of McKenzie strives to help “clients to transform their organizations, embed technology into everything they do, and build enduring capabilities” (Overview | About Us | McKinsey & Company, 2020). McKinsey’s organizational strategies are applied through its business level process solutions that include several key operational areas. McKinsey employs its organizational strategies of key areas of competition that include Acceleration, Digital, Mergers & Acquisitions, Marketing & Sales, Operations, Organization, Risk, Strategy & Corporate Finance, Sustainability, and Transformation (“McKinsey & Company Global Management Consulting”). These organizational strategic pursuit areas can be further broken down into the individual industries and business units they serve. B. Business Unit Strategies Strategic Consulting across a wide array of industry: Source: (“McKinsey & Company Global Management Consulting”) Industrial • Advanced Electronics, Aerospace & Defense, Metals & Mining, Oil & Gas, Agriculture, Automotive & Assembly, Electric Power & Natural Gas, Chemicals, and Semiconductors. McKinsey, while a consultant, must ensure that it is constantly driving innovation and sustainability in its industrial sector. McKinsey competes with other top consultants, in-house expertise, industry leaders, and global resource groups to provide innovation not just in coordination, but in development of highly complex innovative technologies that must compete with the ideas and expertise of technology giants, large utility competitors, leaders of historical industry, and government to produce a competitive advantage (Bhide, 1995; Rothaermel, 2013). Financial • Financial Services, Private Equity & Principal Investors, Capital Projects & Infrastructure, and Real Estate The financial business area is one where McKinsey has historically worked within strategic groups in banking, investment, and stock management. McKinsey, in search of greater competitive advantage expanded its expertise into risk and capital management, and mergers & acquisitions. In this way McKinsey expanded its strategic groups from banking, financial, and government, to also include insurance companies, lending institutions, and venture capital. Commercial Goods • Paper, Forest Products & Packaging, Pharmaceuticals & Medical Products, Retail, Consumer Packaged Goods. In McKinsey’s Commercial Goods sector, primarily focuses on industrial processing, process improvement, industrial upscaling, and disruption management. McKinsey must employ expertise in strategic areas in logistics, supply chains, industrial mechanics, and process improvement. Functional • Healthcare Systems & Services, Public & Social Sector, Technology, Media & Telecommunications, and Travel, and Logistics & Transport Infrastructure. Consultants in functional areas employ much of the same expertise as that in commercial goods, including logistics, supply chains, and process improvement while also implementing a stronger component of technology, complex processes, governmental regulation, and environmental policy. In this business area McKinsey must employ largescale, complex concepts to address international, country, and global issues for world leaders and governments (Bhide, 1995; Rothaermel, 2020). To what extent is the organizational structure compatible with the organization’s strategies? The firm operates in a team structure lead by firm partners and a top leadership team. By virtue of McKinsey’s business model, the firm has expertise in a wide array of industries, functional areas, and processes that allows them to adjust to changing circumstances more quickly and adapt their structure as societies and economies develop and evolve (Bhide, 1995; Rothaermel, 2020). McKinsey’s strategy is well aligned with its purpose of being the industry leader of the big three market. The firm’s current strategy, however, may make it difficult to respond to new and emerging challenges to the structure of the industry (Christensen, 2013). How are the strategies aligned with the goals? Here, again, we see good alignment with McKinsey’s goals and its strategy. McKinsey strives to create exceptional solutions for its clients and to use its local and global expertise to apply gained knowledge in a global environment. It strives to imbed technology and innovative ideas into the client processes that will ensure continued success (“McKinsey & Company Global Management Consulting”). Compare strategies with those of competitors In competition in the traditional large-scale consultancy firms, McKinsey, BCG, and Bain & Co., McKinsey finds itself well placed as the undisputed industry leader (“The Top-10 Strategy Consulting Firms Compared”). However, BCG and Bain & Co. have had consistently higher growth when compared to McKinsey & Co. Though the firm is still more profitable than its traditional counterparts, it is beginning to show signs of a declining market (Rothaermel, 2020). If McKinsey cannot figure out how to “reinvent” itself to compete on a new plain, it may find itself soon overtaken (Christensen et al., et al., 2013; Rothaermel, 2020). While McKinsey has traditionally the most prestigious full-service consulting firm in the industry, it finds the consulting industry shifting. With wider access to information and learning, much of the information and processes that used to be opaque, or proprietary, are no longer the value creators they once were (Rothaermel, 2020; Christenson, 2013). As economies contract, firms have begun to search for options that allow them to employ target services to issue resolution. rather than employing costly full-service firms. We can see this highlighted in the success of Accenture (“The Disruption of Management Consulting l CB Insights”). SWOT analysis & Gap analysis to suggest strategies • • • • Strengths o Brand Recognition o Expertise o Global Reach o Emerging Markets Weaknesses o Static Structure o Market Neglect o Technological Expertise o Prestige Opportunities o Lower-market Expansion o Smaller Scale Solutions o Enterprise Systems Market Growth o Emerging Markets Threats o Challenges to the industry structure o Challenges to product structures o Prior learning Utilization within the industry o Greater demand for corporate social responsibility Strategy Application Lower-market expansion is a strategy that has the possibility of high returns. McKinsey has traditionally, and still is, ignoring this market. This could be a fatal mistake. The growth potential exampled in lower-market competitors, such as Accenture, is well documented. Lower-market concentrations are showing better returns, higher profits, and higher growth potential than McKinsey’s annual revenues or growth have in three of the last four years. The biggest obstacles to this strategy are McKinsey’s brand prestige and corporate culture (Bhide, 1995; Markovitch, 2020). It would be extremely difficult, if not impossible, to turn the firm significantly in this direction. McKinsey has significant workforce, infrastructure, and operations costs and concentrating on lower-markets would likely not meet the cost-benefit benefit that would allow the firm to compete effectively in this way. The best implementation of this strategic path would be for McKinsey to back into the market incrementally as it shifts its core competencies and strategic focus (Rothaermel, 2020). Smaller-scale solutions is a strategy that would help McKinsey back into a lowermarket expansion. While McKinsey does not have the type of small-scale product line that other new entrants in this area do, McKinsey does possess an extensive collection of decades of full-service portfolio solutions (Bhide, 1995). McKinsey has an opportunity to take its current full-scale solutions, break them apart into smaller-single issue resolutions that could be then analyzed and refined into single product offerings. However, this strategy cannot rely on simply piecemealing its current solution. While this strategy could help them back into the market more quickly, it would need to be coupled with considerable and immediate current and future investment in innovation spending that will allow McKinsey to begin upscaling its enterprise small-scale product offerings (Rothaermel, 2020). Enterprise systems market growth has seen significant growth in the past ten years and looks to continue the trend. McKinsey has taken steps to begin development of its own enterprise systems to implement, control, and monitor client performance, but it is geared more towards its existing clients and market rather than targeting new ones (“McKinsey & Company Global Management Consulting”). This problem with this strategy, is that McKinsey doesn’t possess the necessary expertise and prior learning in IT that is being employed by smaller piecemeal competitors (Christensen et al. , 2013; Evans, 2003). In this strategic path, McKinsey would need to significantly increase its innovation spending and create a much wider recruiting pool of expertise (Rothaermel, 2020). Emerging markets, in the global sense, is where McKinsey excels. However, it is not the emerging economy, but rather emerging technology and product markets that McKinsey should focus its efforts on in this strategic path. McKinsey has become static and homogenous in its singular pursuits and a partial shift in market focus could allow McKinsey to get ahead of the game. However, as we have noted before, expanding or shifting focus of such a large-complex, static firm would be difficult at best (Rothaermel, 2020). Again, in this strategic path, we would have to see a significant shift of resources into innovation spending Evans, 2003; Blair, 2020). Key performance indicators (KPI’s) a. Annual Revenue b. Annual Growth Some other KPI’s that are relevant, but not subject to public analysis, would include: a. Net Profitability b. New Relative Market Share VIII. c. Innovation Spending d. Product Innovation Analysis of the Organization – Functional Strategies Functional Strategies Marketing of the organization is not necessary to any large extent due to brand recognition and prestige. Marketing primarily concentrates on generating B2B interest by publication of prior innovative strategy implementations and how McKinsey can bring similar success to those organizations (Bhide, 1995). Marketing could be better utilized to advocate its enterprise software solutions to the wider and lower-markets of strategic consulting. Finance is primarily concerned with recruitment and innovation teams that can move with agility in both issue resolutions and disruptive environments (Murray, 2015). Operations are somewhat static in its original state. McKinsey, while expanding into global markets, still relies on corporate structure with satellite expertise (Bhide, 1995). This can make it slower to change the direction or focus of the organization as whole, due in part to the complexity of such a large structure (Rothaermel. 2020). Human Resources seems concentrated too heavily on one subset of universities and candidates. Though that subset is top tier, it still has the effect of restricting diversity in thought and demographics that will likely hinder success (Murray, 2015; Bauer & Erdogan, 2020). Functional Strategy Alignment Functional Strategies are aligned well with McKinsey’s strategic focus. McKinsey’s strategic focus is on client success, innovative solutions, and global expertise (“McKinsey & Company Global Management Consulting”). In these, McKinsey’s functional strategies align with its current strategic goals (Rothaermel, 2020). This may not be so true of the greater market (Christensen et al., 2013). As we highlighted previously, McKinsey’s strategic goals and values have not diverted significantly from its original form, as such, their functional strategies of central control, team-based solutions, and recruiting expertise. IX. Analyze organization’s improvement/change initiatives One of the pillars of McKinsey’s success is its use of high-performance work teams (Bhide, 1995; “Meet our next global managing partner: Kevin Sneader”). McKinsey has made it a strategic priority to ensure their teams are agile, able to work in fluid and changing situations, and include a varied set of skills and knowledge that can be combined into a team structure to address dynamic, complex issues. In this, McKinsey excels, as high-performing teams account for the majority of its workforce (Bhide, 1995; “Meet our next global managing partner: Kevin Sneader”). McKinsey’s leadership, however, seems to be lacking many of the key components for true strategic leadership. Several factors that hinder McKinsey is the corporate governance and board structures, legacy owners, and a complacency in strategic path identification (Rothaermel, 2020). By virtue of McKinsey’s corporate governance policies, top leadership is only elected by three-year terms (Bhide, 1995). While many top leaders have served several terms, it makes the individual change efforts of a three-year managing partner much more difficult. The firm leadership has been privately held since its inception (Bhide, 1995). While the smaller share junior partners come and go, senior leadership and controlling shares has been tightly held my legacy employees, as have decisions about strategic direction. The homogeneity of top leadership makes it difficult for any outside analysis or criticism to have any significant voice as it relates to strategic objectives (Rothaermel, 2020; Bauer & Erdogan, 2013). Many of the key components of strategic competition have given way to the philosophy of “continue doing what has always been successful” (Rothaermel, 2020). However, as McKinsey’s annual revenues and annual growth has shown relative to its competitors, it isn’t working as well as it has historically (“The Disruption of Management Consulting l CB Insights”). McKinsey is missing some of the key areas of focus as it relates to Total Quality Management (TQM) principles (““Total Quality Management Strategy, Implementation & Systems | ASQ”) of ISO 9000 (ISO) objectives (“Quality Management Principles | ISO”), and in the standards contained in the Malcolm Baldridge National Quality Award criteria (“What is the Malcolm Baldrige National Quality Award (MBNQA)”). We see McKinsey’s leadership weaknesses in ISO principles in key areas of customer focus, leadership, and process approach (“Quality Management Principles | ISO”). As it relates to expanding its market base and increasing revenue and market share through ISO Customer Focus, McKinsey has shown itself to have a weak position in the areas of lower-market competition. McKinsey leadership’s failure to read the shifts in expanding and changing industry structures is highlighted in McKinsey’s failure in developing and improving the capability of the organization. In areas of process approach, McKinsey fails at enhanced ability to focus effort on key processes and opportunities for improvement (Christensen, et al., 2013’ “Quality Management Principles | ISO”; Rothaermel, 2020). In our examination of the Malcolm Baldridge Award criteria, we see very similar weaknesses in several of the award’s key criteria and core values. Leadership, while successful in its aims to achieve the firm’s stated goals, has failed to effectively respond to strategic opportunity in its environment (“What is the Malcolm Baldrige National Quality Award (MBNQA)”). Weaknesses in McKinsey’s Innovation Management can be found in McKinsey’s failure to recognize and respond to an innovative disruption in the industry, as exampled in our analysis by Accenture (Rothaermel, 2020; Christensen, et al., 2013). McKinsey has also failed, and continues to fail, in the criteria of customer focus by largely ignoring lower-market opportunities and not actively working to expand and compete in these rapidly emerging business areas of strategic consulting (“What is the Malcolm Baldrige National Quality Award (MBNQA)”; “The Disruption of Management Consulting”; Rothaermel, 2020). These failures can be seen in benchmarking of McKinsey with its highest and lowest-level of competitors. Though McKinsey is profitable, it is not competing effectively with its competitors in these arenas. Bain & Co and BCG growth rates have been double that of McKinsey in recent history, even if revenue is be slightly lagging. Accenture, while having modest growth, has still succeeded in outperforming McKinsey’s growth and significantly outperforming McKinsey’s revenues (“BCG | Company Profile”; “Bain & Company | Company Profile”; “McKinsey & Company | Company Profile”; “Earnings Reports | Accenture”) . A. Previous & current impact/success of improvement initiatives. McKinsey’s efforts at improvement initiatives as well as their success rates are, much like the rest of the firm, very opaque. We do have generalities of direction of previous Managing Partners at McKinsey, and we will address those here. McKinsey followed its core values structure, originally created under Marvin Bower, up until Bower’s retirement in 1967. In only a few years, McKinsey experienced declining revenues and increased competition in new entrants Bain & Company and BCG (Bhide, 1995). In 1971, McKinsey would create a commission focused on the aims and goals of the organization. This commission would turn McKinsey’s direction towards a greater focus on expertise and a decrease in global expansion priorities. In 1976 under the new leadership of Ron Daniel, who would lead McKinsey from 1976-1988, McKinsey would structure itself away from generalized consulting services, bringing its product offerings into several key strategic groups, including Strategy, Operations, and Organization. Much of these key strategic group classifications are still in use today (Bhide, 1995). These strategic areas would further divide into business areas under the leadership of managing partner Fred Gluck. Gluck served as McKinsey’s managing partner from 1988-1994 and would establish “islands of activities” that would categorize McKinsey services into seven industry areas and seven functional areas. Though McKinsey was highly profitable under Gluck’s tenure, some of the unintended consequences of the further dividing categorical and functional divisions, was a bloated bureaucracy and an even more complex and disconnected organization. In 1994, the new leadership would continue the trend of dividing and expanding categorical business areas under Managing Partner Rajat Gupta, who would further divide McKinsey’s expertise by creating sixteen industry groups to study market trends (Bhide, 1995). It seems, that improvement efforts were largely on market and expertise expansion. This focus would change in 2003 when Ian Davis became Managing Partner and promised a return to the company’s core values. It is here that we see McKinsey return to the same place it began (Bhide, 1995). B. Alignment of improvement initiatives and integration into strategic management of the organization. McKinsey’s current improvement initiatives, even more so than its historical ones, is opaque as well. We can only strive to identify the mechanisms towards improvement that are visible through its public actions. McKinsey’s primary focus has continued to focus heavily on its founding principles and core values (Bhide, 1995; “Meet our next global managing partner”, 2018). In this, McKinsey is successful in aligning its improvement initiatives towards core values with its strategic goals to Adhere to the Highest Professional Standards, Improve Client’s Performance Significantly, and Create an Unrivaled Environment for Exceptional People (“McKinsey & Company Global Management Consulting”). C. Comparison of improvement initiatives with other organizations within and outside the industry. The analysis of improvement and strategic integration, while successful in the firm’s stated goals, may not be as successful in the wider market. Firms like Bain & Company and BCG are improving their strategic initiatives to take advantage of the piecemeal market by designing their own knowledge and skills systems as products. Accenture is an industry leader in highly-targeted client solutions (“The Disruption of Management Consulting”). Additionally, McKinsey, on average, charges a 25% premium on its services than its two traditional competitors Bain and BCG, allowing those competitors and new entrants a greater market share of lower-end markets. New market entrants are also placing a greater importance on technologically innovative solutions and products (“Is management consulting about to get 'Amazoned'?”). Technological single process or single-issue resolution are not McKinsey’s strongest areas and with low scaling and entry costs, this could well prove to be their weakest competitive position (Christensen, et al.; Rothaermel, 2020). X. Conclusion and Future of Organization In my analysis of McKinsey & Company I found the firm to be one of the most prestigious brands in the consulting industry. The name McKinsey brings a hefty price for their service. McKinsey is the leader in their field, both nationally and globally (“The Top-10 Strategy Consulting Firms Compared”). While these are all admirable qualities, you cannot pay the bills on prestige alone. In McKinsey’s return to their core values, the firm is further cementing itself in the past, while other firms are focusing on the future. McKinsey, while profitable, is lagging in growth behind its top three competitors and leads only in revenues by only a slim margin to its two largest traditional competitors, Bain & Company and BCG (“Bain & Company | Company Profile”; “Boston Consulting Group | Company Profile”). When compared to new market entrants such as Accenture, McKinsey is lagging in both measures (“McKinsey & Co. | Company Profile”; “Earnings Reports | Accenture”). McKinsey’s lack of innovative focus and failure to recognize and respond to emerging market disruptions, creates a much weaker competitive position when looking to the future (Christensen, et al., 2013). In McKinsey’s self-created historical prestige, they have made it more difficult to refocus strategy to fit the changing needs of consultancy clients. McKinsey’s current strategic focus of returning to the past makes even more ill-equipped to compete in the future. If the firm isn’t careful, it will be consigned to the history books as case study in failure to respond to industry disruption (Christensen et al., 2013; Rothaermel, 2020). Resources: Accenture Strategy & Consulting | Change With Confidence. Accenture.com. (2020). Retrieved 7 November 2020, from https://www.accenture.com/us-en/about/consultingindex?c=acn_glb_brandexpressiongoogle_11613500&n=psgs_1020&&c=ad_usadfy17_10000001&n=psgs_Brand-%7cUS-%7c-Exact_accentureconsulting&gclid=CjwKCAjwz6_8BRBkEiwA3p02VdlmKg5FBY4SyQMSinmcq1w4DxKKLZNyuYgUuUZz4VGkulWi _wUPlxoCgr8QAvD_BwE&gclsrc=aw.ds. About Us. (2020). Retrieved 3 November 2020, from https://www.mckinsey.com/about-us/overview. Bain & Company. Bain. (2020). Retrieved 6 November 2020, from https://www.bain.com/. Bain & Company | Company Profile. Craft. (2020). Retrieved 16 November 2020, from https://craft.co/baincompany. Bauer, T., & Erdogan, B. (2020). Essentials of Organizational Behavior. Flatworld. Bhide, A. (1995). Building the Professional Firm: McKinsey & Co.: 1939-1968. Hbs.edu. Retrieved 6 November 2020, from https://www.hbs.edu/faculty/Publication%20Files/95-010_a0b1e5db-f200-470a-aa97-7f38c7b10986.pdf. Blair, F. (2020). Is management consulting about to get 'Amazoned'?. Managementtoday.co.uk. Retrieved 9 November 2020, from https://www.managementtoday.co.uk/management-consultingamazoned/innovation/article/1683934. Boston Consulting Group | Management Consulting | BCG. BCG Global. (2020). Retrieved 6 November 2020, from https://www.bcg.com/. Bogdanich, W., & Forsythe, M. (2018). How McKinsey Has Helped Raise the Stature of Authoritarian Governments (Published 2018). Nytimes.com. Retrieved 15 November 2020, from https://www.nytimes.com/2018/12/15/world/asia/mckinsey-china-russia.html. (Bogdanich & Forsythe, 2018) Boston Consulting Group | Company Profile. Craft. (2020). Retrieved 16 November 2020, from https://craft.co/boston-consulting-group. Byrne, J. (2017). How The Top Consulting Firms Rank: From Prestige To Life/Work Balance. Linkedin.com. Retrieved 10 November 2020, from https://www.linkedin.com/pulse/how-top-consulting-firms-rank-from-prestigelifework-balance-byrne/. Christensen, C., Wang, D., & van Bever, D. (2013). Consulting on the Cusp of Disruption. Harvard Business Review. Retrieved 6 November 2020, from https://hbr.org/2013/10/consulting-on-the-cusp-of-disruption. (Christensen et al., 2013) Deshler, R. (2019). The Formula for Assessing Organization Change Success. HRPS Blog. Retrieved 14 November 2020, from https://blog.hrps.org/blogpost/The-Formula-for-Assessing-Organization-Change-Success. Earnings Reports. Investor.accenture.com. (2020). Retrieved 5 November 2020, from https://investor.accenture.com/filings-and-reports/earnings-reports/2019. Evans, N. (2003). The Need for Enterprise Innovation | Business and IT Trends | InformIT. Informit.com. Retrieved 16 November 2020, from https://www.informit.com/articles/article.aspx?p=30424. Great American Business Leaders of the 20th Century | Marvin Bower. Hbs.edu. (2020). Retrieved 6 November 2020, from https://www.hbs.edu/leadership/20th-century-leaders/Pages/details.aspx?profile=marvin_bower. Greiner, L., Olson, T., & Poulfelt, F. (2005). Casebook for teaching The contemporary consultant. Thomson/Southwestern. History of Our Firm. (2020). Retrieved 3 November 2020, from https://www.mckinsey.com/aboutus/overview/history-of-our-firm. Jones, S. (2018). Who is McKinsey's new global managing partner Kevin Sneader?. Managementtoday.co.uk. Retrieved 5 November 2020, from https://www.managementtoday.co.uk/mckinseys-new-global-managing-partnerkevin-sneader/food-for-thought/article/1458053. Kivestu, K. (2019). How to read a Bain & Co. relative market share chart. RocketBlocks. Retrieved 15 November 2020, from https://www.rocketblocks.me/blog/relative-market-share.php. Kolhatkar, S. (2018). McKinsey’s Work for Saudi Arabia Highlights its History of Unsavory Entanglements. The New Yorker. Retrieved 16 November 2020, from https://www.newyorker.com/news/news-desk/mckinseys-workfor-saudi-arabia-highlights-its-history-of-unsavory-entanglements. MacDougall, I. (2019). How McKinsey Helped the Trump Administration Carry Out Its Immigration Policies. Nytimes.com. Retrieved 16 November 2020, from https://www.nytimes.com/2019/12/03/us/mckinsey-ICEimmigration.html. Malcolm Baldrige National Quality Award. NIST. (2020). Retrieved 19 November 2020, from https://www.nist.gov/baldrige/baldrige-award. McKinsey & Co. | Company Profile. Craft. (2020). Retrieved 6 November 2020, from https://craft.co/mckinsey. McKinsey & Company Global Management Consulting. (2020). Retrieved 3 November 2020, from https://www.mckinsey.com/. McKinsey & Company Organizational Profile. Bloomberg.com. (2020). Retrieved 10 November 2020, from https://www.bloomberg.com/profile/company/13143Z:US. Meet our next global managing partner: Kevin Sneader. McKinsey & Company. (2018). Retrieved 3 November 2020, from https://www.mckinsey.com/about-us/new-at-mckinsey-blog/meet-our-next-managing-partner-kevinsneader. MOVES-McKinsey elects Asia boss Sneader as new global managing partner. Reuters. (2018). Retrieved 5 November 2020, from https://www.reuters.com/article/mckinsey-moves-sneader/moves-mckinsey-elects-asia-bosssneader-as-new-global-managing-partner-idUSL4N1QF0MQ. Murray, S. (2015). Inside View: McKinsey & Company. Businessbecause.com. Retrieved 4 November 2020, from https://www.businessbecause.com/news/inside-view-top-jobs/3246/inside-view-mckinsey-company. Our People. (2020). Retrieved 3 November 2020, from https://www.mckinsey.com/businessfunctions/organization/our-people. Profile | Kevin Sneader. (2020). Retrieved 3 November 2020, from https://www.mckinsey.com/our-people/kevinsneader. Quality Management Principles. Iso.org. (2015). Retrieved 19 November 2020, from https://www.iso.org/files/live/sites/isoorg/files/store/en/PUB100080.pdf. Reibstein, D., Bendle, N., Farris, P., & Pfeifer, P. (2006). Relative Market Share and Market Concentration | Marketing Metrics: Understanding Market Share and Related Metrics | InformIT. Informit.com. Retrieved 14 November 2020, from https://www.informit.com/articles/article.aspx?p=463943&seqNum=3. Rothaermel, F. (2020). Strategic Management. [VitalSource Bookshelf]. Retrieved from https://online.vitalsource.com/#/books/9781264103713/ Sambit, K. (2020). Global Due Diligence Investigation Market Size 2020 Industry Share, Growth Opportunities | Key Manufacturers PwC (Price Waterhouse Coopers Consulting), Boston Consulting Group, McKinsey & Company, Bain & Company, Alvarez & Marsal, KPMG (Peat Marwick International (PMI) & Klynveld Main Goerdeler (KMG)) – PRnews Leader. Prnewsleader.com. Retrieved 14 November 2020, from https://prnewsleader.com/uncategorized/709367/global-due-diligence-investigation-market-size-2020-industryshare-growth-opportunities-key-manufacturers-pwc-price-waterhouse-coopers-consulting-boston-consulting-groupmckinsey-company/. The Disruption of Management Consulting l CB Insights. CB Insights Research. (2020). Retrieved 9 November 2020, from https://www.cbinsights.com/research/disrupting-management-consulting/. The Top-10 Strategy Consulting Firms Compared | CaseCoach. CaseCoach. Retrieved 16 November 2020, from https://casecoach.com/b/the-top-10-strategy-consulting-firms-compared/. Total Quality Management Strategy, Implementation & Systems | ASQ. Asq.org. (2020). Retrieved 19 November 2020, from https://asq.org/quality-resources/total-quality-management/implementing-tqm. What is a PESTEL analysis? - Oxford College of Marketing Blog. Oxford College of Marketing Blog. (2020). Retrieved 14 November 2020, from https://blog.oxfordcollegeofmarketing.com/2016/06/30/pestel-analysis/. What is the Malcolm Baldrige National Quality Award (MBNQA)? | ASQ. Asq.org. (2020). Retrieved 19 November 2020, from https://asq.org/quality-resources/malcolm-baldrige-national-quality-award. View publication stats