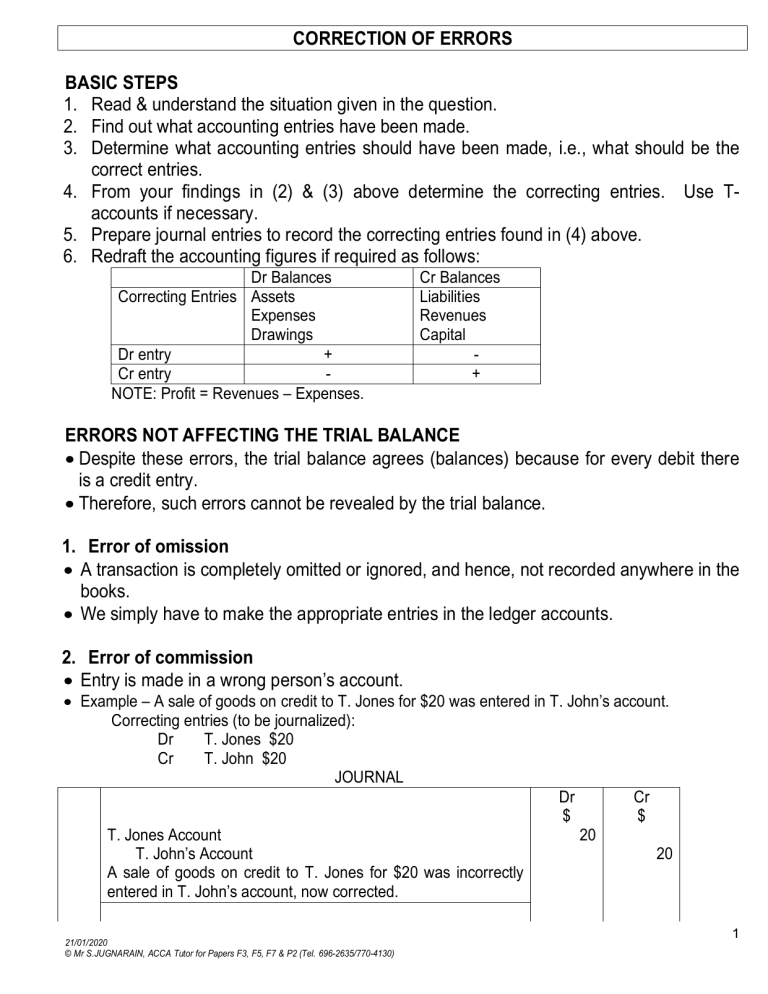

CORRECTION OF ERRORS BASIC STEPS 1. Read & understand the situation given in the question. 2. Find out what accounting entries have been made. 3. Determine what accounting entries should have been made, i.e., what should be the correct entries. 4. From your findings in (2) & (3) above determine the correcting entries. Use Taccounts if necessary. 5. Prepare journal entries to record the correcting entries found in (4) above. 6. Redraft the accounting figures if required as follows: Dr Balances Correcting Entries Assets Expenses Drawings Dr entry + Cr entry NOTE: Profit = Revenues – Expenses. Cr Balances Liabilities Revenues Capital + ERRORS NOT AFFECTING THE TRIAL BALANCE • Despite these errors, the trial balance agrees (balances) because for every debit there is a credit entry. • Therefore, such errors cannot be revealed by the trial balance. 1. Error of omission • A transaction is completely omitted or ignored, and hence, not recorded anywhere in the books. • We simply have to make the appropriate entries in the ledger accounts. 2. Error of commission • Entry is made in a wrong person’s account. • Example – A sale of goods on credit to T. Jones for $20 was entered in T. John’s account. Correcting entries (to be journalized): Dr T. Jones $20 Cr T. John $20 JOURNAL Dr Cr $ $ T. Jones Account 20 T. John’s Account 20 A sale of goods on credit to T. Jones for $20 was incorrectly entered in T. John’s account, now corrected. 21/01/2020 © Mr S.JUGNARAIN, ACCA Tutor for Papers F3, F5, F7 & P2 (Tel. 696-2635/770-4130) 1 3. Error of principle • Entry is made in a wrong type of account. • Example – The purchase of office equipment for $100 was correctly entered in the cash book but was posted to the purchases account. JOURNAL Dr Cr $ $ Office Equipment Account 100 Purchases Account 100 The purchase of an office equipment for $100 wrongly posted to the purchases account, now corrected. 4. Error of original entry • The first entry in the books of prime entry is made with an incorrect figure such that the double entry is made with the wrong figure. • Example – An invoice for goods received from Wendy & Sons for $120 was entered as $1,200 in the purchases day book. Correcting entries (to be journalized): Dr Wendy & Sons $1,080 Cr Purchases $1,080 5. Compensating error • Errors that cancel out each other. • Example – The sales account and the drawings account are both overstated by $500. Correcting entries (to be journalized): Dr Sales $500 Cr Drawings $500 6. Complete reversal of entries • Entries are made on the opposite side, i.e., both entries are reversed. • Example – A cheque from L. Watson for $35 was debited to his account and credited to the bank account. Correcting entries (to be journalized): Dr Bank $70 Cr L. Watson $70 ERRORS AFFECTING THE TRIAL BALANCE • The trial balance does not agree (balance) with these errors because there is no debit entry followed by a corresponding credit entry or vice versa. • These errors cause a difference in the trial balance. This difference becomes a Suspense Account balance which is eliminated once the errors are corrected. A Suspense Account balance enables the TB to balance temporarily: such a balance represents the net discrepancies in the ledger accounts. • The correcting entries will always involve an entry in the Suspense Account. 2 Types of errors affecting the trial balance 1. Single entry – only one entry is made (either debit only or credit entry only). 2. Double entry with different amounts. 3. Double entry in the same side – debit entry followed by a debit entry or credit entry followed by a credit entry. 4. Ledger balances are wrongly calculated. 5. Omission of a ledger balance in the trial balance. 6. A ledger balance is listed on the wrong side in the trial balance. 7. The trial balance contains extra balances. Example 1 – Cash paid to H. Gill $60 was correctly entered in the cash book but not posted to his account. Correcting entries (to be journalized): Dr H. Gill $60 Cr Suspense $60 Example 2 – The drawings account balance of $300 was not entered in the trial balance. Correcting entries (to be journalized): Dr Trial balance $300 (No ledger entry) Cr Suspense $300 QUESTION 1 The trial balance of G. Force as at 31 January 2015 did not balance. The total credits exceeded the total debits by $2,000. Nevertheless, the financial statements for the year ended 31 January 2015 were prepared that showed a net profit of $15,430. Upon investigation the following errors and omissions were found in the accounting records: (i) An invoice received from a regular supplier of goods, T. Power, for $110 was misplaced and not entered anywhere in the books. (ii) A cheque of $30 received from a credit customer, M. Watts, was posted to M. Watson’s account. (iii) The purchase of office equipment for $200 was correctly entered in the cash book and posted to the purchases account. (iv) Goods returned by a credit customer with a resale value of $100 was entered in the Returns Inwards Day Book as $1,000. (v) Cash of $70 received from Kinetic Limited was debited to its account and credited in the cash account. (vi) A sales returns of $110 from K.Bytes was not posted to his account. (vii) The Purchases Day Book for the month of January 2015 was overcast by $1,000. (viii) A cheque of $800 paid to Decibel & Sons was correctly entered in the cash book but was posted to the wrong side of Decibel & Sons’ account. (ix) The balance in the wages account was undercast by $10. (x) The payment of $300 for plant repairs was correctly entered in the cash book and posted to the credit side of the plant account. (xi) The balance of $450 in the drawings account was taken as a credit balance in the trial balance. Required: (a) Prepare journal entries to correct the above errors and omissions. (b) Prepare the suspense account after correcting all the errors. (c) Prepare a statement of corrected net profit for the year ended 31 January 2015. [Ans: (b) Totals $3,110; (c) $17,110] 21/01/2020 © Mr S.JUGNARAIN, ACCA Tutor for Papers F3, F5, F7 & P2 (Tel. 696-2635/770-4130) 3 QUESTION 2 The ledger balances of Saphire as at 31 December 2014 was as follows: Purchases Revenue Capital Trade receivables Trade payables Drawings Non-current assets Inventory at 1 January 2014 Sundry operating expenses Cash at bank $ 12,300 33,500 12,500 6,200 1,600 5,100 11,500 2,000 7,900 2,200 (a) You are required to prepare a trial balance as at 31 December 2014 from the above list of balances and to calculate the difference in the trial balance to be transferred to the suspense account. Upon investigation the following discrepancies were found in the records of Saphire: (i) The purchase of office furniture costing $1,300 was debited to the purchases account. (ii) The Sales Day Book was undercast by $1,000. (iii) The total of the discounts received amounting to $200 was not posted to the ledger. (iv) A cheque paid to a trade supplier for $400 was correctly entered in the cash book but posted to the wrong side of the supplier’s account. (v) The bank statement for the month of December 2014 showed bank charges of $100 that were not included in the cash book. (vi) Private expenses of the owner for $800 correctly entered in the cash book had not been posted. Required: (b) Prepare journal entries (narratives not required) to show the correction of the above errors. (c) Prepare a suspense account starting with the balance calculated in (a) above. (d) Prepare the revised trial balance as at 31 December 2014. [Ans: (a) Suspense $400Dr; (c) Totals $1,600] QUESTION 3 The list of account balances of Andromeda, a limited liability company, at 31 December 2000 did not balance. On investigation the following errors and omissions were found. When all were corrected, the list of account balances agreed. 1) A loan of $20,000 from Jason, one of the directors of the company, had been correctly entered in the cash book but posted to the wrong side of the loan account. 2) The purchase of a motor vehicle on credit for $28,600 had been recorded by debiting the supplier’s account and crediting motor expenses account. 3) A cheque for $800 received from A Smith, a customer to whom goods are regularly supplied on credit, was correctly entered into the cash book but was posted to the credit of bad debts recovered account in the mistaken belief that it was a receipt from B Smith, a customer whose debt had been written off some time earlier. 4) In reconciling the company’s cash book with the bank statement it was found that bank charges of $380 had not been entered in the company’s records. 5) The totals of the cash discount columns in the cash book for December 2000 had not been posted to the discount accounts. The figures were: Discount allowed $ 1,840 Discount received $ 3,970 6) The company had purchased some plant on 1 January 2000 for $16,000. The payment was correctly entered in the cash book but was debited to plant repairs account. The depreciation rate for such plant is 20% per year on the straight-line basis. Required: Prepare journal entries with narratives to correct the errors, write up the suspense account and hence derive the opening balance on the suspense account representing the original difference. [Ans: 42130Cr] 4