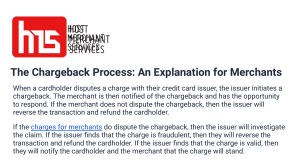

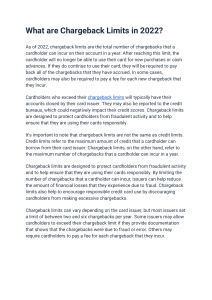

How do chargebacks work for merchants? Detailed Guide When you make a sale, the customer's bank pays you through the card issuer. If the customer then disputes the charge with their bank, the card issuer initiates a chargeback. The card issuer withdraws the funds from your account and gives them back to the customer. You'll also be charged a fee for the chargeback. If you believe that a chargeback is incorrect, you can dispute it with the card issuer. You'll need to provide evidence to support your case, and the card issuer will make a decision. If they decide in your favor, the customer's bank will reverse the chargeback and you'll get your money back. Chargebacks can be a costly and time-consuming issue for merchants. They can often be prevented by taking steps to reduce fraud and chargeback risks, such as verifying customer information and having clear policies in place. What is a chargeback? A chargeback is when a customer disputes a charge with their bank. The bank then reverses the charge, and the funds are returned to the customer. The merchant is also charged a fee for the chargeback. How do chargebacks happen? There are several reasons why a customer might initiate a chargeback. The most common reasons are fraud, such as if the customer didn't make the purchase or if their credit card was stolen; or if there was an issue with the product or service, such as it not being delivered or not being as described. How can chargebacks be prevented? There are several steps that merchants can take to prevent chargebacks. These include verifying customer information, having clear policies in place, and using fraud prevention tools. What are the consequences of chargebacks? Chargebacks for merchants can be costly and time-consuming. They may also result in the merchant being placed on a chargeback monitoring program, which can lead to higher fees and more restrictions. https://www.hostmerchantservices.com/