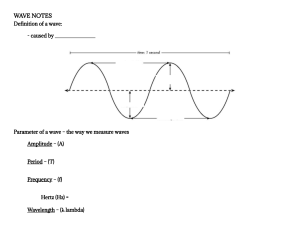

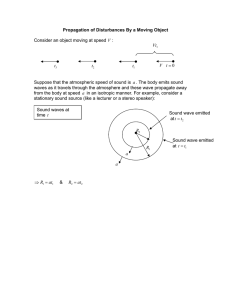

LESSON 3 LESSON 4 LESSON 5 LESSON 6 LESSON 7 LESSON 8 LESSON 9 LESSON 10 LESSON 11 LESSON 12 LESSON 13 LESSON 14 LESSON 15 LESSON 16 LESSON 17 LESSON 18 LESSON 19 LESSON 20 LESSON 21 LESSON 22 LESSON 23 LESSON 24 LESSON 25 and LESSON 26 LESSON 27 LESSON 28 The classic Elliott Wave theory is dead — Long Live the Modified and Better Elliott Wave theory! Part 2. What is the Harmonic Elliott Wave and how it is different from the classic version of the Wave Principle. In the first part of this article I noted that the major discovery made by R.N.Elliott in 1930’s was a phenomenon of repeating patters regularly played out by financial markets. More than eighty years ago he studied self-made charts of the US Industrials stock index and discovered that any major trend either up or down had a similar structure that could be subdivided into five distinctive segments or “waves” (see the chart below). The waves 1, 3 and 5 drive the price in direction of the main trend. In up trend each of those waves drive price to higher highs. In a down trend each of those waves push price to lower lows. And waves 2 and 4 are temporary countertrend pullbacks. You can read more details about this pattern in the first part of this article. But even more important breakthrough he made was the discovery of fractal nature of price structures. That means that the same price patterns combined together formed identical pattern on a larger scale. As you can see on the chart below, Elliott proposed a theory according to which waves 1, 3 and 5 of the five wave fractal are themselves subdivided into five waves of a smaller size (subwaves i, ii, iii, iv and v). A word “theory” comes from the Greek theoria, which means “contemplation or speculation.” A theory is a set of organized principles that is supposed to explain some natural phenomenon. In many cases theory is different from practice, when those organized principles are tested. This is exactly what happened to the Wave Principle formulated by R.N. Elliott. He simply went too far when he proposed that waves 1, 3 and 5 themselves represent smaller five wave patterns. That made the structure too perfect and rigid for semi random price structures. Because price was reluctant to follow five wave fractal all the time instead of finding a more flexible uniform fractal Elliott proposed a number of acceptable exceptions to the original rules. The wide variety of exceptions like “leading diagonal”, “ending diagonal” or “truncation” made the Classic Elliott Wave theory highly susceptible to subjective interpretations and difficult to learn and apply in real trading. In 1999 Ian Copsey, an experienced technical analyst who had been practicing the classic Wave Principle for years published a book where he proposed a simple and elegant modification to the classic Elliott Wave theory. He proposed that the the impulsive waves 1, 3 and 5 within the five wave fractal were subdivided into three waves rather than perfect five waves as proposed R.N.Elliott. He called that modified version of the Elliott Wave theory “the Harmonic Elliott Wave theory”. That was not something completely new because that modified version acknowledged that the classic five wave fractal is the backbone of any trending move either up or down. Moreover, the modified version did not propose any change to classifications and rules with respect to corrective waves 2 and 4 as originally proposed by R.N.Elliot, the founding father of the Wave Principle. However, that small change in subdivision of impulsive waves 1, 3 and 5 consequently increased number of waves in direction of the main trend from three (waves 1, 3 and 5 ) to six ( waves A of 1, C of 1, A of 3, C of 3, A of 5 and C of 5 ). And it also increased number of corrective waves from two ( waves 2 and 4 ) to five ( waves B of 1, 2, B of 3, 4 and B of 5 ). If you are an expert in the classic version of the Elliott Wave theory at this point you may feel anger and denial. You may even feel almost irresistible urge to throw something into your monitor. Give me a second and I will show you two more charts that may help you to calm down and encourage you to continue reading that provocative text. Do you recognize that pattern below called by R.N. Elliott “the Leading Diagonal”? Would you agree that the pattern below called by R.N.Elliott “the Ending Diagonal” has the very same structure? Indeed, all the five waves, impulsive and corrective alike of both, the Leading Diagonal and the Ending Diagonal are subdivided into a-b-c waves. Now I would ask you to compare those two patterns, the Leading Diagonal and the Ending Diagonal to the structure of the modified Five Wave fractal proposed by the Harmonic Elliott wave I introduced above. Surprise, surprise, they are identical! That confirms that R.N. Elliott himself recognized that pattern. But the idea that in every five wave fractal waves 1, 3 and 5 are perfectly subdivided into smaller five wave fractals sounded so enticing and elegant so he introduced that pattern for selective use only. As I explained in the first part of this article he was forced to introduce that patter because he stumbled upon numerous cases when price did not follow the ideal theoretical five wave fractal on a smaller time frame. Instead, in those cases all the five waves were subdivided into a-b-c’s rather than five subwave fractals. Now it is you turn to ask what the benefit of that modification is. It turned out that this modified fractal fits the natural path of price much better then the original one. First, you do not longer need to keep in mind numerous exceptions like Ending or Leading Diagonals and you should not worry about “truncations”. Moreover, that new version of the Five Wave fractal perfectly explains cases with extra strong wave 3. The classic version of the Wave principle provides you with specific additional structures called “extended” and “double extended” while the Harmonic Elliott Wave equips you with one legacy five wave structure that fits all the different cases including extended ones!!! I will dive deeper into detailed comparison of practical application in trading of those two versions of the five wave fractal in the third part of this article. Now I want to propose a theory to justify why the modified version of the five wave fractal is better suited to describe trending moves in prices. When Elliott introduced the five wave fractal he acknowledged that he could not find any rational explanation of the fractal nature of the markets that keep playing out similar patterns: “possibly the reason why I have not yet, and possibly will never know why this series occurs is because it is a law of nature. The laws of nature, and incidentally economics, are ruthless, which is as it should be.” Let me offer you a potential explanation of the phenomenon of repeating five wave fractal as modified by Ian Copsey. In 1962 Everett Rogers, a professor of rural sociology, published his book “Diffusion of Innovations”. This book was based on his findings in research that examined how ideas are spread among groups of people. He identified five major stages of adoption of innovation, new idea, product or practice by members of a given culture. Rogers found out that new ideas are not adopted by all individuals in a social system at the same time. It takes different time for different people to begin using the new idea. He proposed a classification of all the members of a society into five groups based on criteria of how long it takes for them to begin using the new idea. Since its start in rural sociology, Diffusion of Innovations has been applied to numerous contexts, including medical sociology, communications, marketing, development studies, health promotion, organizational studies, knowledge management and conservation biology. Let’s try to apply tenets of the diffusion theory to financial markets in order to explain different stages of a trending move by type of investors who drive the price at different stages of rallies. Our goal would be to align the basic five wave up fractal proposed by the Harmonic Elliott Wave theory with classification of social groups proposed by Rogers. “Innovators” or “Reversal Hunters” or “Contrarian”. Innovators are the first customers to try a new product. They are, by nature, risk takers and are excited by the possibilities created by new ideas and new ways of doing things. Innovators are the first 2.5 percent of a group to adopt a new idea. In financial markets they are “reversal hunters” or “contrarians”. They can’t stand a sustained trending move. They love to oppose themselves to the general prevailing sentiment in the market. They buy when most others are selling and sell when others are buying. They are risk takers and tend to buy too early in the bear market and short too early in the bull market. But they are financially and emotionally prepared to withstand pressure of the market. As Rogers noted: “The innovator is also willing to accept the occasional setback when new ideas prove unsuccessful.” (Rogers, 1971). That concept perfectly explains why wave 1 of a new developing trend is always weak. The driving force behind the wave 1 of a new trend is “innovators”. There are only few innovators, traders who believe that preceding decline is over and a new trend is under way. The majority of market participants still feels bearish and considers that first move up off a major low made by preceding decline as an opportunity to add to their shorts. “Early Adopters” or “Experts” Early adopters tend to be integrated into the local social system more than innovators. People in the early adopter category seem to have the greatest degree of opinion leadership in most social systems. They provide advice and information sought by other adopters about a novelty. The early adopter is usually respected by his or her peers and has a reputation for successful and discrete use of new ideas (Rogers, 1971). Early adopters will normally have a reasonably high social status. Think of all those traders who post their trading ideas and market analysis on Twitter, Stocktwits or Tradingview and have tens of thousands of followers! They are thought leaders who are considered experts and trusted by thousands of other traders. They do not take as much risk as innovators and tend to make more careful decisions as to whether or not to call a start of a new bullish trend. They will be waiting to get solid confirmation like a bullish cross of the major moving averages. That does not happen in the wave 1 up but it happens in the second leg of an unfolding rally, wave A of 3 up. On average there are 13.5% of a social group who could be considered “Early Adopters”. “Early Majority” or “Momentum Traders”. Members of the early majority category will adopt new ideas just before the average member of a social system. They interact frequently with peers, but are not often found holding leadership positions. As the link between very early adopters and people late to adopt, early majority adopters play an important part in the diffusion process. Their innovation-decision time is relatively longer than innovators and early adopters, since they deliberate some time before completely adopting a new idea. Seldom leading, early majority adopters willingly follow in adopting innovations (Rogers, 1971). When price breaks out over the preceding top of the wave A of 3 the rally starts to accelerate and pullbacks become very shallow. This is when the rally finally begins to draw attention of wide crowds of so called “momentum” traders. This type of traders is reasonably risk averse and wants to be sure that their, often more limited, capital is invested in assets that may quickly appreciate in price. They never try to anticipate a reversal but rather look for an established strong trend to join. They have an active social status but they are not thought leaders. They not only follow the “experts” but early adopters quite often closely communicate with them. When they make decision about joining the very well established trend they take into account opinions of those thought leaders. “Late Majority” The late majority are a skeptical group, adopting new ideas just after the average member of a social system. Their adoption may be borne out of economic necessity and in response to increasing social pressure. They are cautious about innovations, and are reluctant to adopt until most others in their social system do so first. An innovation must definitely have the weight of system norms behind it to convince the late majority. While they may be persuaded about the utility of an innovation, there must be strong pressure from peers to adopt (Rogers, 1971). In financial market this group of traders is too conservative to join a rally when it is accelerating in wave C of 3. They are too cautious and their main concern is not to buy “too late” or “at the top”. They would wait for a pullback of a corrective wave 4 down to buy stocks on weakness. This category of traders has less interaction with thought leaders ( early adopters ) and tends to make more independent decisions than the other groups of traders. This late majority group is rarely active in the social media, does not have many followers and, as a result, does not provide any form of thought leadership for other traders. That may be a good explanation why rally in wave A of 5 driven by “Late Majority” is almost never is strong enough to break over the preceding top made by the rally in wave 3. The “Late Majority” got burned trying to play breakouts many times. That is why they buy stocks on weakness and see them when prices approaches important resistance at previous top. “Laggards are traditionalists”. Laggards are traditionalists and the last to adopt an innovation. Possessing almost no opinion leadership, laggards are localite to the point of being isolates compared to the other adopter categories. Individual laggards mainly interact with other traditionalists. An innovation finally adopted by a laggard may already be rendered obsolete by more recent ideas already in use by innovators. Laggards are likely to be suspicious not only of innovations, but of innovators and change agents as well (Rogers, 1971). Laggards are always late to the party. They are the driving force of the final wave C of 5 that completes the whole rally. This is the last spike of price before reversal. At this point innovators turn skeptical about prospects of this rally and start watching for signs of reversal. This last rally literally drags the laggards into the market when price takes out the previous top made by the wave 3 up. At that point laggards can not longer resist the growing temptation to join that bullish party they have been watching on sidelines. They do not have much available capital to trade and this is why the top of the final spike in wave C of 5 is normally characterized by thin trading volume and participation. This final move up in many cases comes as a spike because at this point the vast majority of traders except for innovators are convinced that this rally will keep going up. Conversely, bears are demoralized by continuation of the rally and they are often forced to close their shorts when price takes out the previous top. That lack of sellers lets such weak buyers as “laggards” to push price to new higher highs despite relatively low amount of fresh buying. In my opinion, this theory perfectly explains character of each wave. However, you can not apply that theory to the classic five wave fractal originally proposed by R.N. Elliott because he had only three waves in direction of the trend. That is another argument in favor of the modified version of the Wave Principle. Part 1. Why the classic Elliott Wave theory is useless in trading In 1930s Ralph Nelson Elliott made a great discovery that dramatically changed the way how traders and portfolio managers make investment decisions. After reviewing numerous self-made price charts of stocks and commodities he noticed several repeatable patterns drawn by price of assets. He noted that major rallies and declines of price for different assets did not happen in a straight line fashion. Every move up is followed by a pullback down. Every major lasting decline of price for tradeable assets like stocks or commodities was interrupted by a counter trend move in opposite direction. Elliott noted that those price moves in the main direction of the trend and counter trend moves in opposite direction together combined a specific pattern (on the chart above). He decomposed that repeating pattern into several segments when price moved in one direction before a move in a countertrend direction (the red segments on the chart point down and follow blue segments that point up). He called those segments in price charts “waves”. Based on his observations of the actual price charts he was able to generalize main features of that repeating five wave fractal: 1. He called waves 1, 3 and 5 “impulse waves”. In a five wave fractal pointing up waves 1,3 and 5 push price to new higher highs. Wave 3 pushes the price to a new higher high over the top of wave 1 up. And wave 5 pushes price to a new higher high over the top of preceding rally in wave 3 up. 2. He called waves 2 and 4 “corrective waves”. In the five wave up fractal waves 2 and 4 are temporary pullbacks in direction opposite to the direction of the main trend. Wave 2 down is a reaction to a rally in wave 1 up and therefore shall never breach the starting point of the wave 1 up. Or we can say that wave 2 shall not retrace more than 100% of the wave 1 up. 3. Elliott proposed that a corrective wave 4 down shall never go under the top of an impulsive wave 1 up. As a consequence of that rule wave 4 down should make a higher low in comparison to preceding corrective wave 2 down. Because impulsive waves 1, 3 and 5 are supposed to make higher highs and corrective waves 2 and 4 are supposed to make higher lows, the five wave up fractal is a backbone of any trending move up. Indeed, every trader knows that an up trend is a sequence of higher highs and higher lows made by price. Conversely, a down trend is a sequence of lower lows and lower highs. 4. Elliott noted that normally wave 3 is the strongest wave in the five wave fractal. However, the rule he proposed was not that strict. He said that wave 3 could not be the shortest, meaning that he acknowledged possibility that either wave 1 or wave 5 may get extended and be stronger than wave 3. 5. What made that theory a great trading tool is another very important observation made by Elliott about fractal nature of price moves. He found out that waves 1, 3 and 5 are themselves subdivided into five smaller waves. And that smaller waves would follow the very same rules applicable to bigger five wave fractal. On the chart above you can see that waves 1, 3 and 5 are composed of five smaller waves labelled as i, ii, iii, iv and v. In contrast, the corrective waves 2 and 4 have different structure. They are composed of only three smaller waves or “subwaves” a, b and c. The five wave fractal was simply too perfect to be found in every market and any time frame. The theory was supposed to make trading and investing as easy as counting from one to five! Indeed, you sell when you can count five micro waves up and you buy again at lower price when you get an a-b-c shaped corrective move down! The same set of riles can be applied to price charts of any time frame, from 5 min to a monthly one. What could have been easier? It seems like pretty soon Elliott realized that the five wave fractal could not explain every trending price move either up or down. The five wave fractal was simply too perfect to be found in every market and any time frame. He and followers of his theory found many cases where the final wave 5 did not have that perfect subdivision into five smaller waves. And then practitioners of the classic Elliott Wave theory called such case a “truncation”. In plain English it sounds like: “Oops, the theory can’t explain this so lets agree its a rare exception. Lets find a fancy name for that unfilled gap in the theory not to apologize for our inability to nail the top.” On the chart above you will see that the final wave 5 up is subdivided into three smaller waves instead of five waves as prescribed by the Classic Elliott Wave theory. You may say I exaggerate the problem because truncations happen at the very top of the five wave up fractal or very bottom of the five wave down fractal. But let me remind you that the main benefit of the theory was to provide a trader with a mighty yet simple-to-use prediction tool based on assumption that any larger wave or subwave in direction of the trend has to be be subdivided into five waves. Some protagonists of the classic theory may say that I misunderstood the idea behind that method. However, Elliott himself became known for several accurate predictions about exact tops and bottoms in the Industrials index in 1935. One of the most valuable principles of the theory was that the final fifth wave can not stop until it fully replays its own five wave structure of a smaller degree. By complete its own waves i, ii, iii, iv and v wave 5 gets completed and finalizes the whole bigger five wave up fractal. I personally got fooled by that theory many times. I expected any wave 5 up to keep pushing price higher until I could finally count five micro waves inside it. And then suddenly after micro wave iii of 5 price would collapse… That could mean that you might have followed that unfolding five wave up fractal for weeks preparing to short its completion in anticipation of a larger corrective move in counter trend direction only to see it collapsed prematurely! And I used to be left behind mumbling to my followers that according to the theory we really needed one more high in micro wave v of 5… Imagine your boss assigns you a specific task but you perform only 66% of what he said. And then time comes to report and you present a partially completed job explaining that you have truncated the task. Would your boss be pleased with that type of explanation? I was certainly not! More exceptions to the theory But that was only the beginning of the problems with the real life application of the Classic Elliott Wave theory. Pretty soon practitioners of the classic theory found waves in direction of the main trend that were supposed to be structured as impulsive waves and to follow the five wave fractal but they did not. Instead they were just a bunch of a-b-c’s, three wave moves. Did that observation make Elliott or his followers to change the tenets of the theory? Of course not! They called those uncomfortable cases when the theory did not work “exceptions”. This is how they introduced the “Leading Diagonal” and the “Ending Diagonal”. The “Leading Diagonal” can be found on the chart above at the beginning of the five wave fractal, in wave 1. As you can see, the five micro waves i, ii, iii, iv and v together compose a large wave 1 up. But note that each of those five micro waves, impulsive and corrective alike, is composed of three waves a-b-c instead of canonical five micro waves. The “Ending Diagonal” can be found at the very end of the five wave fractal, wave 5. Again, as you can see on the picture below, all the five micro waves that compose wave 5, impulsive and corrective alike are composed of three micro waves a-b-c. At this point I want to remind you that the main idea behind the Classic Elliott Wave theory was that price follows a specific repeating five wave fractal and impulsive waves within that fractal are composed of five waves of a smaller degree. However, as we can see, the author and practitioners of the classic Elliott Wave theory had to admit that the main assumption of that theory just did not work all the time… Many people do not like the classic Elliott Wave theory because of “overabundance of rules and guidelines“. I do not agree. I am thoroughly convinced that in contrast the main problem of the classic Elliott Wave theory is that it does not have enough rules and leaves too much for subjective interpretation. Let me give you an example. As I mentioned before, the only requirement the classic theory proposed for wave 3 is that it can not be the shortest. But that vague principle leaves a lot of room for alternative interpretations and let practitioners to come up with really ugly counts without formal violation of the official rules. Because the classic theory was unable to formulate any specific rules about recognizing wave 3 its practitioners had to conclude that it is nearly impossible to nail the top of the wave 3 up or bottom of the wave 3 down. Why do you need to learn the classic Elliott Wave theory and how you are supposed to trade based on it? Let’s talk business. What high probability setups Elliott Wave theory may offer? Well, every single practitioner of the classic theory would tell you that you’ve got to trade wave 3. Remember, wave 3 is normally the longest wave inside the five wave fractal. Then you should say, ok, I like that idea but how I can catch that monstrous move in direction of the trend? The classic theory proposes that you get the first move up off a major low which has an impulsive structure, meaning it is composed of five smaller waves. That would be your wave 1 up. At this point the majority of market participants do not believe that the initial move up is anything but a temporary pullback before resumption of a preceding down trend. That initial move up is followed by a move down subdivided into three waves of smaller size. You count those three small waves as “a-b-c”. Together they compose a corrective wave 2 down. That pullback in wave 2 down quite often retraces substantial part of the preceding rally in the wave 1 up. At this point many bears use any move up as opportunity to add to their shorts. In contrast, there are very few bulls who is ready to start buying. The general sentiment in the market is still bearish. That wave 2 down, as you may remember from the discussion above, should not violate the starting point of the wave 1 up. As soon as you get that wave 1 up and corrective wave 2 down you are supposed to get that monstrous rally in wave 3 up. At this point you should ask me what the target for that monstrous wave 3 is. Well, this is another problem. Because the theory does not give you an answer to that vitally important question. For example, the most influential book about the classic Elliott Wave theory called “Elliott Wave Principle” written by A.J.Frost and R.Prechter does not offer any technique to set up a target for wave 3. The book does not even try to describe any common ratios between wave 1 and wave 3. Elliott himself was aware of only the one “golden” 0.618 ratio between waves. Back then he applied that ratio predicting termination of a corrective wave once it reaches that ratio to a preceding impulsive wave. Nevertheless, many books written by followers of the classic Elliott Wave theory propose a guidance that the distance covered by price in wave 3 exceeds the distance covered by price in the wave 1 by 161.8%, 261.8% or 461.8%. Based on that guidance you may attempt to prepare a following trading plan: As soon as you get wave 1 off the low structured as micro five waves followed by a corrective pullback in wave 2 down structured as micro three waves a-b-c you go long expecting a strong rally that would move the price to at least 161.8% of the first move up in wave 1 up. Moreover, because we know that wave 2 down shall not breach the starting point of the wave 1 up we can set our stop loss right under the lowest point of the wave 1 up. Now I will show you what price typically does in that kind of a setup. As expected, off the bottom of the corrective wave 2 down we did get an impulsive looking rally subdivided into five smaller waves. However, the problem is that rally normally only slightly exceeds the top of the wave 1 up. Instead of an impressive rally that was supposed to be longer than the wave 1 by at least 61.8% we normally get a move equal in size to the wave 1 up. And then we get another deep corrective a-b-c move down. To explain that price behavior Elliott came up with another fancy term “extension”. As you can see on the chart below, that strange impulsive looking rally that supposed to be a monstrous wave 3 up but failed to exceed in size the first move up off the low in the wave 1 now is counted as subwave ( i ) of the wave 3 up. Let me give you an example. You watch a nice ad on TV where they offer you a shiny German SUV that would be better than what you drive now. You pay the hefty price and start counting days to pick it up from a dealership. On a due date you come to the dealership and they give you four wheels instead of the car. And they say: “Look, dude, now we can give you the wheels and if you stay patient you will eventually get the whole car!”. But this is not what you paid for! The classic Elliott Wave theory created a myth about a mighty wave 3. Every trader who studies the theory is brainwashed that he should be looking for an opportunity to trade only wave 3 because within that wave price covers the longest distance and all pullbacks are of limited size and duration. That reminds me a phenomenon of rogue wave, which was popularized by Hollywood and became widely known. Rogue waves, also known as monster or killer waves, are large, unexpected and suddenly appearing surface waves that can be extremely dangerous, even to large ships such as ocean liners. But the latest research in physics concluded that: “rogue events do not necessarily appear without a warning, but are often preceded by a short phase of relative order” (Predictability of Rogue Events, Simon Birkholz, Carsten Brée, Ayhan Demircan, and Günter Steinmeyer, Physical Review Letters 114, 213901, 28 May 2015). That conclusion can be fully applied to wave 3, a rogue wave, in financial markets. When traders expect a monster rally right after completion of a corrective wave 2 down they get fooled. Because what they do get instead is a relatively weak starting move up in wave ( i ) of 3 followed by a pullback in wave ( ii ) down. And if you buy calls in anticipation of a killer rally you end up losing money. Because that wave ( i ) of 3 may last weeks and your call options will expire worthless way before that wave reaches expected 161.8% extension target! The structure on the chart above does make a lot of sense. It’s not a problem to accept that the wave 3 is itself subdivided into waves (i),(ii),(iii),(iv) and (v) and waves (i), (iii) and (v ) are accordingly subdivided into micro waves i, ii, iii, iv and v. The real problem is that the classic Elliott Wave theory is unable to predict whether you will or will not get that extended structure. There are cases when you get that monster move up right off the bottom of the wave 2 down. But there are plenty of cases when you get slow moving wave ( i ) of 3 and then a corrective wave ( ii ) of 3. By the time those waves ( i ) up and ( ii ) down get completed the majority of traders gives up their hopes about making big buck on a monster wave 3 rally! There is another weakness of the classic Elliott Wave theory. It does not provide you with any guidance with respect to typical targets for waves (i),(ii),(iii),(iv) and (v) inside that killer rally of the wave 3. Again, you only know that the wave ( iii ) of 3 should be at least 161.8% of a size of the wave ( i ) of 3 and you know that the wave ( v ) of 3 should target at least 161.8% of the wave 1 up. Now lets talk about a corrective wave 4 and the quality of guidance that the classic Elliott Wave theory may provide us with its respect. The classic five wave up fractal implies a corrective wave 4 down starting off the top of the wave 3 up. That wave 4 down should have a corrective structure. It has to be subdivided into three waves or a combination of three waves fractals called double three or triple three. There are cases when wave 4 is subdivide into five waves that are shaped as a triangle. So as you can see, unfortunately, Elliott found a wide variety of alternative shapes for corrective waves and could not come up with any hard rule that could reliably predict a specific shape of upcoming correction. If we can not predict a shape of a corrective wave 4 may we at east predict its depth? Well, the only rule with respect to wave 4 is that it shall not violate the top of the wave 1 up. But as we have learned, Elliott had exception for almost every rule! You may remember, that I mentioned above that Elliott found many cases when price was moving up in five waves making a sequence of higher highs and higher lows or moved down in five waves making lower lows and lower highs but in contradiction to his theory, waves 1, 3 and 5 did not subdivide into five waves of a smaller degree. That forced him to call that formation an exception that he called the “Leading Diagonal”. You can see it on the chart below. Under the “Leading Diagonal” fractal a corrective wave 4 down is allowed to drop under the top of an impulsive wave 1 up! Finally, let’s talk about the wave 5. That is the final wave that should complete the whole five wave fractal. The Classic Elliott Wave theory gives us two important rules about the wave 5. First, wave 5 has to make a new higher high over the top of the preceding rally in the wave 3. Second, wave 5 has to have an impulsive structure and be subdivided into five waves of a smaller degree. And, as you may have already figured it out, the above mentioned rules have exceptions! You may remember that Elliott introduced the Ending Diagonal structure where wave 5 is subdivided into five smaller waves but waves i, iii and v are constructed as a-b-c’s (please see below). But what makes things even worse is that Elliott acknowledged that in some cases wave 5 may fail to make a new higher high over the top of the wave 3 up! Elliott called that unfortunate situation by a simple word “failure”. Years later Robert R.Prechter and A.J.Frost, the most famous followers of the classic theory and authors of the most popular books about the Elliott Wave theory, wrote “we prefer the less connotative term, “truncation,” or “truncated fifth.” I think I have provided enough reasons that can make you question useless of the classic Elliott Wave theory in the real life trading. In my next article I will explain in details what Harmonic Elliott Wave theory is, how it differs from the classic Elliott Wave theory and why it is the best and the most accurate prediction tool you need to learn if you want to trade like a pro. LESSON 29 LESSON 30