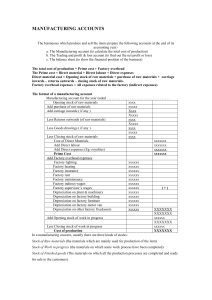

MANUFACTURING ACCOUNTS The businesses which produce and sell the items prepare the following accounts at the end of its accounting year:a. The Manufacturing account (to calculate the total cost of production) b. The Trading and profit & loss account (to find out the net profit or loss) c. The balance sheet.(to show the financial position of the business) The total cost of production = Prime cost + Factory overhead The Prime cost = Direct material + Direct labour + Direct expenses Direct material cost = Opening stock of raw materials + purchase of raw materials + carriage inwards – returns outwards – closing stock of raw materials. Factory overhead expenses = All expenses related to the factory (indirect expenses) The format of a manufacturing account Manufacturing account for the year ended . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Opening stock of raw materials xxxx Add purchase of raw materials xxxxx Add carriage inwards ( if any ) Xxxx Xxxxx Less Returns outwards (of raw materials) xxxx Xxxxx Less Goods drawings ( if any ) xxxx xxxxx Less Closing stock of raw materials xxxx Cost of Direct Materials xxxxxxx Add Direct labour xxxxxxx Add Direct expenses (Eg: royalties) xxxxxxx Prime Cost xxxxxxx Add Factory overhead expenses Factory lighting xxxxxx Factory heating xxxxxx Factory insurance xxxxxx Factory rent xxxxxx Factory maintenance xxxxxx Factory indirect wages xxxxxx Factory supervisor’s wages xxxxxx (+) Depreciation on plant & machinery xxxxxx Depreciation on factory building xxxxxx Depreciation on factory furniture xxxxxx Depreciation on factory motor van xxxxxx Depreciation on other factory fixedassets xxxxxx XXXXXXX XXXXXXX Add Opening stock of work in progress xxxxxx XXXXXXX Less Closing stock of work in progress xxxxxx Cost of production XXXXXXX In a manufacturing concern, usually there are three kinds of stocks: Stock of Raw materials (the materials which are mainly used for production of the item) Stock of Work in progress (the materials on which some work process have been completed) Stock of Finished goods (The materials on which all the production processes are completed and ready for sale to the customers) Format of trading account of a manufacturing concern Sales of finished goods xxxxx Less Returns inwards xxxxx xxxxxx Less Production cost of goods sold Opening stock of finished goods xxxxx Add Cost of production xxxxxxx (-) xxxxxx Less closing stock of finished goods xxxxx xxxxxxx Less finished goods drawings by the owner xxxxx Gross profit or Gross loss xxxxxxx XXXXXX The profit & loss account and the balance sheet preparations will be the same as that of a sole trader’s. So the students have to follow the previous method for the preparation of these. Fixed expenses and Variable expenses Some expenses will remain constant whether the level of activity increases or falls. These expenses are called fixed expenses E.g. rent of building The expenses which change with changes in activity are called variable expenses E.g: cost of materials. Key points: Carriage on raw materials means carriage inwards and it is a part of prime cost. Carriage outwards is shown in the profit & loss account as an expense. Royalties paid is to be treated as direct expense. Depreciation on Plant and Machinery or any other factory asset is to be treated as factory overhead expense. Stocks of raw materials and work-in-progress are taken in the manufacturing account and stock of finished goods is taken in the trading account. Stocks at the end of the year (raw materials, work-in-progress and finished goods) are shown in the balance sheet as current assets. Owner’s raw materials drawings are shown in the manufacturing account while calculating the prime cost. Finished goods drawings are shown in the trading account while calculating the cost of goods sold. The purchase of finished goods is added with cost of production in the trading account. The depreciation of any asset used in the office should be shown as an expense in the profit & loss account. Cost of readymade items bought for the production of items manufactured should be treated as direct expense. Unit cost of production = Total cost of production No of units produced