Uploaded by

Chezka Gravador

Partnership Accounting: Formation, Distribution, Liquidation

advertisement

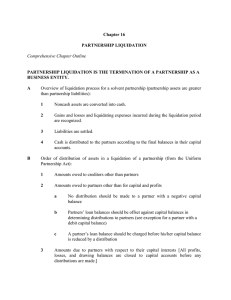

MODULE 4 OBJECTIVES Module 4: Partnership Accounting Objectives: 1. Record transaction for the formation, operation, dissolution and liquidation of a partnership 2. Distribute profit or loss to partners in a partnership 3. Prepare statement of liquidation of a partnership 4. Solve case problems peculiar to partnership accounting Topics: Lesson 1: Formation Lesson 2: Profit or loss distribution Lesson 3: Dissolution Lesson 4: Liquidation --------------------------------------------------------------------------------------------------- LESSON 1: FORMATION What is a Partnership? Partnership is a contract between two or more persons who contributes money, property or industry to a common fund with the intention of dividing profits among themselves (Article 1767 Civil Code). What are the elements of a Partnership? Based on the definition given, the five elements of a partnership are as follows: 1. There must be a valid contract 2. The parties must have legal capacity to enter into the contract 3. There must be mutual contribution of money, property or industry to a common fund 4. The object must be lawful 5. The primary purpose must be to obtain profit and to divide the same among the partners What are the features of a Partnership? 1. Partnership is a form of voluntary association entered into by persons. It is a personal relation which involves trust and confidence between partners. 2. The element of trust and confidence provides each partner the right to choose co-partners and the power to dissolve the partnership which gives the partnership limited life. 3. Among the partners. mutual agency arises that allows each partner to act on behalf of the partnership. 4. There must be mutual contribution of money, property or industry to a common fund which would create co-ownership of properties among partners 5. Article 1768 of the civil code gave a partnership legal entity separate and distinct of its partners providing it the right to acquire, sell or dispose properties, incur obligations and transact business in its name. 6. Each partner is personally and individually liable for all partnership liabilities which gives each partner unlimited liability. Accordingly, the personal assets of the partners can be used to help settle the partnership’s obligations. What are the different types of Partners? Partners are grouped based on the following: As to liability ➢ ➢ General partner whose liability extends to his personal assets when the partnership assets are not sufficient to settle its partnership liabilities Limited partner whose liability is limited only to the extent of his capital contributions. As to contribution ➢ Capitalist partner whose contribution to the partnership is in the form of money or property Article 1808 of the Civil Code states that: “The capitalist partner cannot engage for their own account in any operation which is of the kind of business in which the partnership is engaged, unless there is a stipulation to the contrary” ➢ Industrial partner whose contribution to the partnership is in the form of industry, work or labor. Article 1789 of the Civil Code states that: “An industrial partner cannot engage in business for himself, unless the partnership expressly permits him to do so” ➢ Capitalist-Industrial partner whose contribution to the partnership includes money or property plus his industry or services. As to management ➢ ➢ Managing partner who actively participates in the operations of the partnership Silent partner who has equity interest in the partnership but does not participate in the management of the partnership. Other classifications ➢ ➢ ➢ ➢ ➢ Ostensible partner who has equity interest in the partnership and actively participates in the operations of the partnership and is publicly known as a partner Secret partner who has equity interest in the partnership and actively participates in the operations of the partnership but is not publicly known as a partner Dormant partner who has equity interest in the partnership but does not participates in the operations of the partnership and is not publicly known as a partner Nominal partner who has no equity interest in the partnership but allows his name to appear as a partner and assumes the unlimited liability inherent in a general partner. Liquidating partner who is in-charge of the liquidation process of the partnership. What are the classifications of Partnership? Based on liability: ➢ General partnership is composed of all general partners ➢ Limited partnership is composed of at least one general partner and one or more limited partners. The word Limited or Ltd. Is attached to the name of the partnership to inform the public. Based on duration: ➢ ➢ Partnership at will is formed with no particular undertaking and specific period of existence Partnership with a fixed term is formed with a particular undertaking and specific period of existence Based on legality of existence: ➢ ➢ ➢ De Jure partnership operates after fully complying with the legal requirements of its existence De Facto partnership operates before fully complying with the legal requirements of its existence Partnership by estoppel which in reality is not a partnership but is considered as one only in relation to those who, by their conduct or omission are precluded to deny or disprove the partnership’s existence. Based on object: ➢ ➢ Universal partnership of all present property where the partnership assets consist of those which have been contributed at the time of the formation of the partnership and all subsequent acquisitions. Universal partnership of all profits where the partnership assets consist of assets acquired during the term of the partnership as well as the usufruct of the assets contributed at the time of formation (properties remain as personal properties of the partners) What are the changes in owners’ equity? Accounting for partnership operation is basically the same as that of a sole proprietorship. The difference would be seen in accounting for owner’s equity. In partnership accounting there is plurality of capital and drawing accounts where the number of capital and drawing accounts should be equal to the number of partners. Accordingly, each capital and drawing account should be properly identified to a specific partner (normally the name of the partner is written on the capital and drawing account). ➢ ➢ ➢ Partner’s (name) capital account – Investment / Permanent withdrawal Partner’s (name) drawing account – Share in the net profit / Personal drawings Loan payable to or receivable from partner (name) How do we open the books of the Partnership? The first entry in the books of a partnership will be to record the contributions made by the partners. Contribution to a partnership may be in the form of money or cash, property or non-cash assets, and/or industry or services. Valuation of contribution and corresponding capital credits are made based on the following: ➢ ➢ ➢ ➢ ➢ Cash – Face value Non-assets contributed – Agreed Value / FMV Liabilities assumed – Carrying value Industry – Memo entry is recorded Capital account credits – Agreement / Actual contribution Illustration: On January 1, 2018, Lorna, Aida and Fe formed a partnership. Lorna contributed cash amounting to P600,000 while Aida contributed P300,000 cash and an equipment valued at P450,000. Fe shall contribute her services to the partnership. Journal entry: Date Jan. 1 Description/Account Title Debit Cash 900,000 Equipment 450,000 Credit Lorna, capital 600,000 Aida, capital 750,000 Memo: Fe is an industrial partner Note: The capital credits are based on their actual contributions and a memo entry on the journal was made to record the contribution of Fe as an industrial partner. Illustration: On January 1, 2018, Pepe and Pilar formed a partnership. Pepe contributed cash amounting to P600,000 while Pilar contributed P300,000 cash and an equipment valued at P450,000. The partners agreed to have equal capital credits in the partnership. Journal entry: Date Jan. 1 Description/Account Title Debit Cash 900,000 Equipment 450,000 Credit Pepe, capital 675,000 Pilar, capital 675,000 Note: Total capital contribution was divided equally among the partners When one of the prospective partners has an existing business prior to the formation of the partnership, the partnership may either: (1) use the books of the existing business or (2) open a new set of books of accounts. If the existing books of accounts will be used, corresponding adjustments have to be made to update the balances of the existing books based on agreements/fair value before recording contributions of other partners. However, it is recommended that a new set of books of accounts be opened for the new business structure. LESSON 2: PROFIT OR LOSS DISTRIBUTION What are the rules in distributing profit or loss? Profit and losses in general shall be distributed based on the agreement among the partners. In the absence of an agreement, the partners shall share in the profits in proportion to their capital contributions after satisfying the share of the industrial partner on such profit. Article 1797 Civil Code: “The losses and profits shall be distributed in conformity with the agreement. If only the share of each partner in the profits has been agreed upon, the share of each in the losses shall be in the same proportion. In the absence of stipulation, the share of each partner in the profits and losses shall be in proportion to what he may have contributed, but the industrial partner shall not be liable for the losses. As for profits, the industrial partner shall receive such share as may be just and equitable under the circumstances. If besides his services he has contributed capital, he shall also receive a share in the profits in proportion to his capital” An industrial partner has a priority in the profits in the profit distribution Capital contribution should be interpreted to be original capital / beginning capital of each year in the absence of original capital What are the common agreed methods of distributing profit and losses? The common methods of distribution of profits are as follows: 1. Equal distribution where the profits shall be divided by the number of partners to arrive at the share each partner to the profit. 2. Use of arbitrary ratio where each partner shall be assigned with corresponding percentage, decimal, fraction or ratio as their share in the profit. 3. Using the capital ratio where the share of each partner shall be based on their respective capital balances. The capital ratio to be used can be based on the following: a. Initial or original capital b. Capital at the beginning of the period c. Capital at the end of the period d. Average capital 4. Interest on capital is given to recognize the difference in capital contribution 5. Salaries to partners is given to recognize the time and effort that a partner may devote in running the partnership business operations 6. Bonus to managing partner is given as an incentive to the managing partner which normally is a percentage of the profit earned by the partnership. Note: Profit share as interest, salary, or bonus should not be considered as business expenses. The partnership agreement or articles of partnership should clearly state the manner of profit distribution. Illustration: On December 31, 2018, the partnership of May, Hero and Academia showed an annual profit of P600,000. Profit and loss distribution are based on the following independent cases: Case 1 – Equal distribution Date Dec. 31 Description/Account Title Debit Income Summary Credit 600,000 May, capital 200,000 Hero, capital 200,000 Academia, capital 200,000 Computation: May (600,000 / 3) Hero (600,000 /3) Academia (600,000 / 3) Total 200,000 200,000 200,000 600,000 Case 2 – Arbitrary ratio of May = 20%; Hero = 30%; and Academia = 50% Date Dec. 31 Description/Account Title Debit Income Summary Credit 600,000 May, capital 120,000 Hero, capital 180,000 Academia, capital 300,000 Computation: May (600,000 x 20%) Hero (600,000 x 30%) Academia (600,000 x 50%) Total 120,000 180,000 300,000 600,000 Case 3 – Capital ratio based on May, capital = 100,000; Hero, capital = 300,000; and Academia, capital = 400,000. Total capital (100T+300T+400T) = 800,000 Date Dec. 31 Description/Account Title Income Summary Debit Credit 600,000 May, capital 75,000 Hero, capital 225,000 Academia, capital 300,000 Computation: May (600,000 x 100T/800T) Hero (600,000 x 300T/800T) Academia (600,000 x 400T/800T) Total 75,000 225,000 300,000 600,000 Case 4 – The P600,000 profit shall be distributed based on the following: 1. 10% interest on capital balance: May, capital = 200,000; Hero, capital = 300,000; and Academia, capital = 400,000 2. P50,000 annual salary for each partner 3. 20% bonus based on profit given to May as managing partner 4. The remainder shall be distributed equally Date Dec. 31 Description/Account Title Debit Income Summary Credit 600,000 May, capital 270,000 Hero, capital 160,000 Academia, capital 170,000 Computation: 10% interest Annual salary 20% Bonus Total Remainder (600T-360T) Equal distribution (240T / 3) Total share May 20,000 50,000 120,000 190,000 Hero 30,000 50,000 -80,000 Academia 40,000 50,000 -90,000 Total 90,000 150,000 120,000 360,000 80,000 270,000 80,000 160,000 80,000 170,000 240,000 600,000 LESSON 3: DISSOLUTION What is partnership dissolution? Partnership dissolution is a change in the relation of the partners caused by any partner ceasing to be associated in carrying on the business (Article 1828, Civil Code): a. Acts of the partners (ex. admission and withdrawal of a partner) b. Operation of law (ex. insolvency and death of a partner) c. Judicial decree (ex. insanity and fraud of a partner) On dissolution the partnership is not terminated, but continues until winding up of partnership affairs is completed (Article 1829, Civil Code). Some partnerships are dissolved without being noticed by third parties because immediately after a new agreement is created. What are the conditions resulting to partnership dissolution? The following conditions will result to partnership dissolution: 1. Admission of a new partner – A new partner can be admitted with the consent of all partners. Upon admission of a new partner, the partnership is dissolved by change in ownership structure and a new ownership structure is formed. A new partner can be admitted into the partnership by purchase or thru investment. a. Purchase of interest ❖ Partnership assets will not change; transfer of capital from selling to buying partner; total partner’s equity will not change ❖ Asset revaluation to update capital accounts of partners before admitting a new partner Illustration: Apple and Dell are partners with capital balances of P100,000 and P50,000 respectively. They share profits and losses equally. On October 1, 2018, Sony was admitted to the partnership under the following independent cases: Case 1: Sony purchased 1/5 interest from Apple for P30,000 Date Oct. 1 Description/Account Title Apple, capital Debit Credit 20,000 Sony, capital 20,000 Computation: 100,000 x 1/5 = 20,000 Case 2: Sony purchased 1/5 interest of the partnership from the existing partners for P40,000 Date Oct. 1 Description/Account Title Debit Apple, capital 20,000 Dell, capital 10,000 Sony, capital Credit 30,000 Computation: Apple 100,000 x 1/5 = 20,000 and Dell 50,000 x 1/5 = 10,000 b. Admission by investment ❖ Asset revaluation (upward / downward) – total contributed capital is not equal to total agreed capital. Asset revaluation is an adjustment for the existing partners only. ❖ Bonus (new / existing partner) – total agreed capital is the same as total contributed capital but partner’s capital credit is not the same as actual contribution. Illustration: Apple and Dell are partners with capital balances of P200,000 and P100,000 respectively. They share profits and losses equally. On October 1, 2018, Sony was admitted to the partnership under the following independent cases: Case 1: Sony invests P100,000 for a 1/4 interest in an agreed total partnership capitalization of P400,000 Date Oct. 1 Description/Account Title Cash Debit Credit 100,000 Sony, capital 100,000 Computation: 400,000 x 1/4 = 100,000 (investment made by new partner is equal to the interest acquired by the new partner) Case 2: Sony invests P100,000 for a 1/5 interest in an agreed total partnership capitalization of P400,000 Date Oct. 1 Description/Account Title Cash Debit Credit 100,000 Sony, capital 80,000 Apple, capital 10,000 Dell, capital 10,000 Computation: 400,000 x 1/5 = 80,000 (investment made by new partner is more than the interest acquired by the new partner resulting to a bonus (100.000 – 80,000 = 20,000) given to the old partners. Case 3: Sony invests P100,000 for a 30% interest in an agreed total partnership capitalization of P400,000 Date Oct. 1 Description/Account Title Cash Debit Credit 100,000 Apple, capital 10,000 Dell, capital 10,000 Sony, capital 120,000 Computation: 400,000 x 30% = 120,000 (investment made by new partner is less than the interest acquired by the new partner resulting to a bonus (100.000 – 80,000 = 20,000) given to the new partner. 2. Retirement / Withdrawal of a partner – a partner may withdraw or retire from the partnership by selling all his interest to a new partner (third party), remaining partner/s or to the partnership. If the sale was made to a third party or to the remaining partner/s, the transaction is recorded in the same manner as in admission of a new partner by purchase. In this case the partnership recognizes only the transfer of capital interest from the retiring partner to the buying party/partner. Any gain or loss from the sale is a personal gain or loss of the retiring partner. If the sale was made to the partnership, considerations have to be made based on the following: a. Selling price = capital balance b. Selling price > capital balance (upward asset revaluation or bonus to retiring partner) c. Selling price < capital balance (downward asset revaluation or bonus to remaining partners) Note: Asset revaluation will affect all the partners 3. Death, incapacity or bankruptcy of a partner – the remaining partners may continue operations based on a new contract. The interest of the deceased or incapacitated partner must be determined by the partnership in order to make necessary settlement with his legal representatives. 4. Incorporation of a partnership – the partnership is dissolved and transformed into a corporation thru changes in equity. LESSON 4: LIQUIDATION What is a partnership liquidation? Partnership liquidation – process of winding up the affairs of the business towards termination. The association of the partners for purposes of carrying out normal activities of the partnership is considered ended. The remaining activities of the partners would be for the purpose of final settlement of partnership affairs. The partnership assets are sold, the partnership creditors are paid, and the remaining assets, if any, are distributed to the partners as a return on their capital. The priorities for creditor’s claims against the assets available involve two concepts: 1. Marshaling of assets – provides the order of creditor’s right over the partnership assets and the personal assets of the individual partner. Partnership assets will be marshaled as follows: 1. Partnership creditors other than partners 2. Partner’s claims other than capital and profits 3. Partner’s claims to capital or profits Personal assets of individual partners will be marshaled as follows: 1. Personal creditors of individual partners 2. Partnership creditors on unpaid partnership liabilities. 2. Right of offset – involves offsetting a deficit in a partner’s capital accounts against the loan payable to that partner. The loan payable to a partner has a higher priority in liquidation than a partner’s capital balance but a lower priority than liabilities to outside creditors. What are the types of partnership liquidation? The two types of partnership liquidation are as follows: 1. Lump sum distribution / distribution by totals / simple distribution – under this type of liquidation, the distribution of cash to partners is done only after all the non-cash assets have been sold or realized, any gain or loss on realization is known and all liabilities have been paid. Procedures in lump-sum liquidation: a. Sale of non-cash asset b. Distribution or allocation of gain or loss c. Payment to creditors d. Distribution of cash to partners When sale or realization of non-cash assets results in a loss, the loss is charged or deducted to the capital balance of the partners which may result in a debit balance or deficiency of a partner. Said deficiency need to be eliminated before any distribution of cash is to be made to the partners. Capital deficiency is eliminated by: 1. Right of offset 2. Additional cash investment of deficient partner 3. If deficient partner is insolvent, charge the deficiency to the remaining partners Illustration: Mr. High, Mr. Medium and Mr. Low are partners with the following Balance Sheet as of December 1, 2018: High, Medium and Low Balance Sheet December 1, 2018 ASSET Cash Non-cash assets. LIABILITIES P 8,000 136,000 Accounts payable Loan payable to Low P 44,800 2,000 PARTNERS’ EQUITY High, capital Medium, capital Low, capital ________ P144,000 TOTAL 38,000 35,200 24,000 ________ P144,000 TOTAL The partners decided to dissolve and liquidate the partnership and sold all non-cash assets for P68,000. All partners are solvent. a. Sale of non-cash assets Date Dec. 31 Description/Account Title Debit Cash 68,000 High, capital 27,200 Medium, capital 13,600 Low, capital 27,200 Non-cash assets Credit 136,000 High, Medium and Low Statement of Liquidation December 1-31, 2018 Profit and loss ratio Balances before liquidation a. Sale of non-cash assets Balances Cash Non-cash assets Accounts payable Loan payable to Low 8,000 68,000 76,000 136,000 (136,000) - 44,800 2,000 44,800 2,000 High, Capital Medium, Capital Low, Capital 40% 38,000 (27,200) 10,800 20% 35,200 (13,600) 21,600 40% 24,000 (27,200) (3,200) b. Payment of liabilities Date Dec. 31 Description/Account Title Debit Accounts payable Credit 44,800 Cash 44,800 High, Medium and Low Statement of Liquidation December 1-31, 2018 Cash Profit and loss ratio Balances before liquidation a. Sale of non-cash assets Balances b. Payment of liabilities Balances 8,000 68,000 76,000 (44,800) 31,200 Non-cash assets Accounts payable Loan payable to Low 136,000 (136,000) - 44,800 2,000 44,800 (44,800) - - High, Capital Medium, Capital Low, Capital 2,000 40% 38,000 (27,200) 10,800 20% 35,200 (13,600) 21,600 40% 24,000 (27,200) (3,200) 2,000 10,800 21,600 (3,200) c. Right of offset Date Dec. 31 Description/Account Title Debit Loan payable to Low Credit 2,000 Low, capital 2,000 High, Medium and Low Statement of Liquidation December 1-31, 2018 Non-cash assets Accounts payable Loan payable to Low 8,000 68,000 76,000 (44,800) 31,200 136,000 (136,000) - 44,800 2,000 2,000 - 44,800 (44,800) - 31,200 - - Cash Profit and loss ratio Balances before liquidation a. Sale of non-cash assets Balances b. Payment of liabilities Balances c. Right of offset Balances 2,000 (2,000) - High, Capital Medium, Capital Low, Capital 40% 38,000 (27,200) 10,800 20% 35,200 (13,600) 21,600 40% 24,000 (27,200) (3,200) 10,800 21,600 10,800 21,600 (3,200) 2,000 (1,200) d. Additional cash investment Date Dec. 31 Description/Account Title Debit Cash Credit 1,200 Low, capital 1,200 High, Medium and Low Statement of Liquidation December 1-31, 2018 Cash Profit and loss ratio Balances before liquidation a. Sale of non-cash assets Balances b. Payment of liabilities Balances c. Right of offset Balances d. Additional investment Balances Non-cash assets 8,000 68,000 76,000 (44,800) 31,200 136,000 (136,000) - 31,200 1,200 32,400 Accounts payable Loan payable to Low 44,800 2,000 2,000 - 44,800 (44,800) - - - 2,000 (2,000) - - - - High, Capital Medium, Capital Low, Capital 40% 38,000 (27,200) 10,800 20% 35,200 (13,600) 21,600 40% 24,000 (27,200) (3,200) 10,800 21,600 10,800 21,600 10,800 21,600 (3,200) 2,000 (1,200) 1,200 - e. Final settlement to partners Date Dec. 31 Description/Account Title Debit High, capital 10,800 Medium, capital 21,600 Cash Credit 32,400 High, Medium and Low Statement of Liquidation December 1-31, 2018 Cash Profit and loss ratio Balances before liquidation a. Sale of non-cash assets Balances b. Payment of liabilities Balances c. Right of offset Balances d. Additional investment Balances e. Final settlement Non-cash assets 8,000 68,000 76,000 (44,800) 31,200 136,000 (136,000) - 31,200 1,200 32,400 (32,400) Accounts payable Loan payable to Low 44,800 2,000 2,000 - 44,800 (44,800) - - - 2,000 (2,000) - - - - High, Capital Medium, Capital Low, Capital 40% 38,000 (27,200) 10,800 20% 35,200 (13,600) 21,600 40% 24,000 (27,200) (3,200) 10,800 21,600 10,800 21,600 10,800 (10,800) 21,600 (21,600) (3,200) 2,000 (1,200) 1,200 - 2. Installment distribution / piece-meal distribution – under this type of liquidation, cash is distributed to partners on a periodic basis as it becomes available, that is, even before all non-cash assets are converted to cash. The statement of liquidation is accompanied by the either of the following: a. Schedule of safe payments – under a schedule of safe payment, cash distribution considers the following: 1. Determine partner’s interest which is the sum of capital balance and loan balance from partner (if any) and net of receivable balance from partner (if any) 2. From the partner’s interest, the following are deducted as restricted interest: ➢ Unsold non-cash assets that are not available for distribution ➢ Cash reserved for liquidation expenses ➢ Capital deficiency applied against the partner’s interest. 3. The total free interest is equal to the amount of cash available for distribution b. Cash priority program – is a schedule of cash distribution prepared prior to liquidation, that is, before cash becomes available for distribution. The steps in the preparation of the program are as follows: 1. Determine total partner’s interest 2. Divide total partner’s interest by their profit and loss ratio to get each partner’s loss absorption capacity 3. The highest loss absorption capacity shall be given the first allocation by multiplying the difference in absorption capacity to the next highest absorption capacity with corresponding profit and loss ratio. Succeeding allocations are made on the same manner until all absorption balances are equal. 4. After all absorption balances are equal, cash distributions are made based on profit and loss ratio In liquidation proceedings, a loan to or from a partner is in essence treated as an increase or decrease in a partner’s capital account.