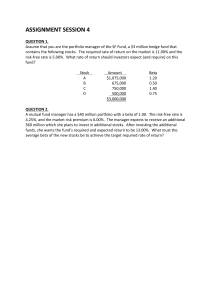

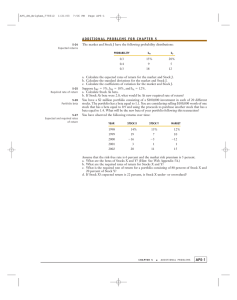

Risk Return, and the Capital Asset Pricing Model 1. An individual has $35,000 invested in a stock with a beta of 0.8 and another $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her portfolio’s beta? 2. Suppose that the risk-free rate is 5% and that the market risk premium is 7%. What is the required return on (1) the market, (2) a stock with a beta of 1.0, and (3) a stock with a beta of 1.7? 3. As an equity analyst you are concerned with what will happen to the required return to Universal Toddler’s stock as market conditions change. Suppose rRF = 5%, rM = 12%, βUT =1.4. Under current conditions, what is rUT, the required rate of return on UT stock? 4. Suppose you hold a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio’s beta is 1.12. Now, suppose you sell one of the stocks with a beta of 1.0 for $7,500 and use the proceeds to buy another stock whose beta is 1.75. Calculate your portfolio’s new beta. 5. Your retirement fund consists of a $5,000 investment in each of 15 different common stocks. The portfolio’s beta is 1.20. Suppose you sell one of the stocks with a beta of 0.8 for $5,000 and use the proceeds to buy another stock whose beta is 1.6. Calculate your portfolio’s new beta. 6. Stock R has a beta of 1.5, Stock S has a beta of 0.75, the expected rate of return on an average stock is 13%, and the risk-free rate is 7%. By how much does the required return on the riskier stock exceed that on the less risky stock? 7. AA Corporation’s stock has a beta of 0.8. The risk-free rate is 4% and the expected return on the market is 12%. What is the required rate of return on AA’s stock? 8. Suppose rRF = 5%, rM =10%, and rA =12%. a. Calculate Stock A’s beta. b. If Stock A’s beta were 2.0, then what would be A’s new required rate of return? 9. The spreadsheet problem solved in the class. 10. A stock’s return has the following distribution: Calculate the stock’s expected return, standard deviation, and coefficient of variation. 11. The market and Stock J have the following probability distributions: Calculate the expected rates of return, the standard deviations, and the coefficients of variation for the market and Stock J. 12. Suppose you manage a $4 million fund that consists of four stocks with the following investments: If the market’s required rate of return is 14% and the risk-free rate is 6%, what is the fund’s required rate of return? 13. You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: Year rA rB 2012 20.00% 5.00% 2013 42.00 15.00 2014 20.00 13.00 2015 8.00 50.00 2016 25.00 12.00 a. Calculate the average rate of return for each stock during the 5-year period. b. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? c. Calculate the standard deviation of returns for each stock and for the portfolio. d. Suppose you are a risk-averse investor. Assuming Stocks A and B are your only choices, would you prefer to hold Stock A, Stock B, or the portfolio? Why? 14. You have observed the following returns over time: Assume that the risk-free rate is 6% and the market risk premium is 5%. a. What are the betas of Stocks X and Y? b. What are the required rates of return on Stocks X and Y? c. What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y?