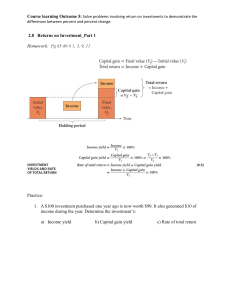

1. Which of the following $1,000 face-value securities has the lowest yield to maturity? A) a 5 percent coupon bond selling for $1,000 B) a 10 percent coupon bond selling for $1,000 C) a 15 percent coupon bond selling for $1,000 D) a 15 percent coupon bond selling for $900 1. Answer: A Since yield to maturity (YTM) is defined as the interest rate that equates the PV from a debt instrument with its value today, coupon bond (A)’s YTM would be Face Value $1, 000 For simplicity , let ' s say n 1; PV 1, 000 Coupon ( Interest Payment ) Face Value Current Yield 1, 000 0.05 50 1 1 1, 000 50 1, 000 1, 000 50 1 n n 1 i 1 i 1 i 1 i 1 i YTM i 0.05 (B): likewise, Face Value $1, 000 For simplicity, let ' s say n 1; PV 1, 000 Coupon ( Interest Payment ) Face Value Current Yield 1, 000 0.10 100 1 1 1, 000 100 1, 000 1,100 1, 000 100 1 n n 1 i 1 i 1 i 1 i 1 i 1 i YTM i 0.1 (C) Likewise, Face Value $1, 000 For simplicity, let ' s say n 1; PV 1, 000 Coupon ( Interest Payment ) Face Value Current Yield 1, 000 0.15 150 1 1 1, 000 150 1, 000 1,150 1, 000 150 1 n n 1 i 1 i 1 i 1 i 1 i 1 i YTM i 0.15 Page 1 / 7 (D) Face Value $1, 000 For simplicity, let ' s say n 1; PV 1, 000 Coupon ( Interest Payment ) Face Value Current Yield 1, 000 0.15 150 1 1 900 150 900 1, 050 1, 000 150 1 n n 1 i 1 i 1 i 1 i 1 i 1 i YTM i 0.05 2. Explain and show all your work for each part. 1) If the interest rate is 5%, what is the present value of a security that pays you $1, 050 next year and $1,102.50 two years from now? 2) If this security sold for $2200, is the yield to maturity greater or less than 5%? 3) Why? 2. Answer: 1) PV = $1,050/(1 +.05) + $1,102.50/(1 + 0.5)2 = $2,000 2) and 3) If this security sold for $2200, the yield to maturity is less than 5%. The lower the interest rate the higher the present value. 3. What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $900 next year? 3. Answer: -5% Rate of returns 50 900 1, 000 50 0.05 5% 1, 000 1, 000 1, 000 Page 2 / 7 4. Suppose you are holding a 5 percent coupon bond maturing in one year with a yield to maturity of 15 percent. If the interest rate on one-year bonds rises from 15 percent to 20 percent over the course of the year, what is the yearly return on the bond you are holding? 4. Answer: Suppose Face Value be $1, 000 Coupon ( Interest Payment ) Face Value Current Yield 1, 000 0.05 50 PV0 50 PV1 50 1 1 0 1 i0 1 1 i1 Rate of returns 1, 000 1 50 0 50 1 i0 1, 000 1 i1 1 1 0.15 1 1 1 0.2 0 1, 000 1 0.15 1 1, 000 1 0.2 0 1050 $913 1.15 1050 $1, 050 1.20 50 1050 913 137 0.15 913 913 913 Thus the answer is 15%. 5. Would it make sense to buy a house when mortgage rates are 14% and expected inflation is 15%? Explain your answer. 5. Answer: Even though the nominal rate for the mortgage appears high, the real cost of borrowing the funds is -1%. Yes, under this circumstance it would be reasonable to make this purchase. 6. Duration is A) an asset's term to maturity. B) the time until the next interest payment for a coupon bond. C) the average lifetime of a debt security's stream of payments. D) the time between interest payments for a coupon bond. 6. Answer: C Duration is expressed in terms of years, but it is not the same thing as a bond’s maturity date. That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond’s coupon rate. In the case of a zero-coupon bond, the bond’s remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond’s duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. 7. All else equal, the ________ the coupon rate on a bond, the ________ the bond's duration. A) higher; longer B) higher; shorter Page 3 / 7 C) lower; shorter D) greater; longer 7. Answer: B Generally, bonds with long maturities and low coupons have the longest durations. These bonds are more sensitive to a change in market interest rates and thus are more volatile in a changing rate environment. Conversely, bonds with shorter maturity dates or higher coupons will have shorter durations. Bonds with shorter durations are less sensitive to changing rates and thus are less volatile in a changing rate environment. For example, if rates were to rise 1%, a bond or bond fund with a five-year average duration would likely lose approximately 5% of its value. 8. John spends $4,000 on a perpetuity that pays $150 each year. The yield to maturity of this perpetuity is 8. Answer: 3.75% 4, 000 150 150 i 0.0375 3.75% i 4, 000 9. On September 1, 2012, Al buys a bond for $15,000 that makes coupon payments of $750 after each of the following three years and returns its principal of $15,000 at the end of the three years. In other words, it is a standard coupon bond with a 5 percent annual interest rate making payments once each year. On September 1, 2013, Al receives his first coupon payment of $750. At that time, the market interest rate on bonds like Al's has risen to 6 percent. Al sells his bond to Biff at that time, for a price equal to the present value of the bond's payments. A. How much does Biff pay Al for the bond? B. Calculate Al's current yield, capital-gains yield, and total return for the year. On September 1, 2014, Biff receives a coupon payment of $750. The market interest rate on bonds like his remains 6 percent. Biff sells his bond to Cass at that time, for a price equal to the present value of the bond's payments. C. How much does Cass pay Biff for the bond? D. Calculate Biff's current yield, capital-gains yield, and total return for the year. Page 4 / 7 On September 1, 2015, Cass receives a coupon payment of $750 and the principal of $15,000. Over the course of the year (between September 1, 2014, and September 1, 2015), the market interest rate on bonds like his rose to 7 percent. But Cass decided to keep the bond. E. What is Cass's total return for the year? Explain and show all your work for each part. 9. Answer: A. P 750 15,750 $14,724.99 1.06 1.062 B. Current yield= 750 0.05 5% 15, 000 and Capital-gains yield = 14, 724.99 15, 000 0.0183 1.83% 15, 000 Therefore, Total return = current yield + capital–gains yield =5% - 1.83% =3.17% C. P 15,750 $14,858.49 1.06 D. Current yield= 750 0.0509 5.09% 14, 724.99 and Capital-gains yield = 14,858.49 14, 724.99 0.0091 0.91% 14, 724.99 Total return = current yield + capital-gains yield = 5.09% + 0.91% = 6%. You should expect this because Biff bought the bond at a yield to maturity of 6 percent and held it for a year, and the market interest rate did not change. E. Six percent, since Cass bought it when the yield to maturity was 6 percent and held it until it matured. You could also do this one the hard way: Current yield= 750 0.0505 5.05% 14,858.49 and 15, 000 14,858.49 0.0095 0.95% 14,858.49 Total return = current yield + capital-gains yield = 5.05% + 0.95% = 6% Page 5 / 7 Capital-gains yield = 10. On February 1, 2013, Janet buys a bond for $10,000 that makes coupon payments of $600 after each of the following two years and returns its principal of $10,000 at the end of the second year. In other words, it is a standard coupon bond with a 6 percent annual interest rate making payments once each year On February 1, 2014, Janet receives her first coupon payment of $600. At that time, the market interest rate on bonds like hers has fallen to 4 percent. She sells her bond to Justin at that time, for a price equal to the present value of the bond's payments. A. How much does Justin pay Janet for the bond? Both Janet and Justin have tax rates of 30 percent on interest income and 20 percent on capital gains. (Note that if someone has a capital loss, you may assume that he or she can reduce taxes by the amount of the capital loss times the tax rate of 20 percent.) B. Calculate Janet's after-tax rate of return for the past year (from Feb. 1, 2013, to Feb. 1, 2014). Justin holds onto the bond from February 1, 2014, to February 1, 2015, so it matures and he receives the second coupon payment and the principal. C. What is Justin's after-tax rate of return for the year from Feb. 1, 2014, to Feb. 1, 2015? Explain and show all your work for each part. You may assume, of course, that the market works and does not malfunction. 10. Answer: A. The bond has one year left to maturity, which pays interest of $600 and repays principal of $10,000, so the price of the bond is P=10,600/10.4=10,192.31 B. Her total return consists of current yield plus capital-gain yield. Doing these in after-tax terms means subtracting off the taxes for each. * Interest payment = $600 * Tax on interest payment = $600 × 0.3 = $180 * Interest after taxes = $600 − $180 = $420 * After-tax current yield =$420/$10,000=0.042=4.2% * Capital gains = $10,192.31 − $10,000 = $192.31 * Tax on capital gains = $192.31 × 0.2 = $38.46 * Capital gains after taxes = $192.31 − $38.46 = $153.85 * After-tax capital-gains yield =$153.85/$10,000= 0.015 = 1.5% * Total after-tax return= after-tax current yield + after-tax capital-gains yield = 4.2% + 1.5%= 5.7% Page 6 / 7 C. Justin gets $600 in interest, so his interest after taxes is the same as Janet's was, which is $420. But he paid more, so his current yield will be lower: * After-tax current yield =$420/10,192.31 = 0.041 = 4.1% Justin gets a capital loss because he bought the bond for $10,192.31 and it pays only $10,000 when it matures. * Capital gains = $10,000 − $10,192.31 = −$192.31 * Tax on capital gains = −$192.31 × 0.2 = −$38.46 * Capital gains after taxes = −$192.31 − (−$38.46) = −$153.85 * After-tax capital-gains yield =-$153.85/10,192.31=−0.015 = −1.5% * Total after-tax return = after-tax current yield + after-tax capital-gains yield = 4.2% + (−1.5%)= 2.6% Page 7 / 7