Chap 1

Relevance- Financial information that makes a difference in a decision.

Faithful Representation- Numbers and descriptions are factual.

Historical Cost Principle- Companies record the asset at their cost of the time they are purchased at that cost remains the same while it is held.

Fair Value Principle- Assets and Liabilities should be reported at the price received to sell and asset or settle a liability.

Monetary Unit Assumption- Companies include in their accounting records only transactions that can be expressed in money terms.

Economic Entity- The activities of the entity be kept separate and distinct from the activities of its owner and all other economic entities.

Proprietorship- A business owned by one person.

Service Revenue- The Revenue a company receives after having performed a service.

Unearned Service Revenue- A company receives money and then owes the performance of a service.

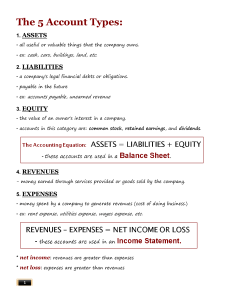

Assets: Cash, Receivables, Supplies, Prepaid Expenses and Equipment

Liabilities: Payables, Unearned Revenues

Stockholders’ Equity: Common Stock, Retained Earnings (Revenue – Expenses – Dividends)

-Investments and revenues INCREASE Stockholders Equity

Dividends and Expenses DECREASE Stockholders Equity

Income Statement: Revenues – Expenses = Net Income

Retained Earnings Statement: Previous Retained Earnings (Sometimes ‘0’ if there are no Retained

Earnings from the past) + Net Income – Dividends = Retained Earnings

Balance Sheet: A sheet with Assets listed and totaled, and total Liabilities and Stockholders’ Equity listed

and totaled.

Chap 2

Debits increase Expenses, Assets and Dividends (Hint: DEAD). Decrease Liabilities, Common Stock and

Revenues.

Credits decrease Expenses, Assets and Dividends (Hint: DEAD). Increase Liabilities, Common Stock and

Revenues.

(Hint: If it’s added in the expanded accounting equation, then decrease the debit and increase the

credit. If it’s decreased in the expanded accounting equation, then increase the debit and decrease the

credit. +Liabilities + Common Stock +Retained Earnings + Revenues – Expenses – Dividends.)

Normal balance is always on the increased side.

Recording Process

Analyze transaction > Enter it into Journal > Transfer journal info into Ledger Accounts.

The Journal has the Debits and Credits of individual transaction separately. The Ledger has all

the Debits and Credits of each individual account added to it over time as transactions are made and

then totaled (Debits – Credits = total for the account)

Trial Balance: The Debit accounts are added up (Cash + Supplies +Equipment…) and the Credit accounts

are added up (Notes Payable + Accounts Payable + Common Stock…) with the plan that they both will

have the same total.

Chap 3

Accrual Basis Accounting: Companies record transactions that change a company’s financial statements

in the periods in which the events occur. Meaning to say, they recognize revenues when services are

performed (rather than when they receive the cash); and they recognize expenses when incurred (rather

than when paid).

Cash Basis Accounting: Companies record revenue when the cash is received and expenses when

they’re paid.

Revenue Recognition Principle- When a company agrees to perform a service or sell a product, it has a

performance obligation. This principle therefore requires that companies recognize revenue in the

period in which the performance obligation is satisfied.

Expense recognition Principle- Companies should recognize expenses in the period in which they make

efforts (consume assets or incur liabilities) to generate revenue.

Types of Adjusting Entries

Deferrals

1) Prepaid Expenses- Expenses paid in cash before they are used or consumed.

-Prepaid expenses are costs that expire either with the passage of time (e.g., rent and insurance) or

through use (e.g., supplies).

-Debit the Expense account (by the amount the asset has been used or expired).

Credit the Asset account (by the amount the asset has been used or expired).

-If the asset was prepaid for, then the name of the account is “Prepaid…” (Prepaid Insurance)

- Depreciation: Debit Depreciation Expense.

Credit Accumulated Depreciation- {Name of Account (i.e., expense)}

2) Unearned Revenues- Cash received before services are performed.

The adjustment made when some of the service has been performed is:

Debit Unearned Revenue. (Since this liability has decreased)

Credit Revenue. (Since Stockholders Equity has increased)

Accruals

1) Accrued Revenues- Revenues for services performed but not yet received in cash or recorded.

Debit Accounts Receivable. (Since the Asset has increased)

Credit Service Revenue. (Since Stockholders Equity has increased)

2) Accrued Expenses: Expenses incurred but not yet paid in cash or recorded.

-Common examples are interest, taxes, and salaries.

Debit Expense Account.

Credit Liability Account. (Since the liability has increased)

(i.e., Interest Payable, Salaries and Wages Payable). (Since the Expense has increased)

Post to Ledger: The tip is to put the balance in whichever column the very first entry was made, even if

the very first entry is the adjustment.