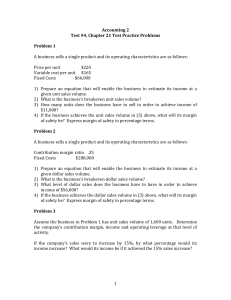

MAS REVIEW Quiz 02 MAY 12, 2022 Instructor: John Bo S. Cayetano Use the following information for the next two (2) questions: Stairway Company sells a single product. The company’s most recent income statement is given below: Less: Less Sales (5,000 units) Variable expenses Contribution margin Fixed overhead Operating income 200,000 120,000 80,000 48,000 32,000 1) What is the contribution margin per unit? A. 16 per unit B. 6.4 per unit C. 40 per unit D. 24 per unit 2) If sales are doubled to P400,000, how much is the total expected variable cost? A. 240,000 B. 200,000 C. 360,000 D. 300,000 3) If sales are doubled to P400,000, how much is the expected total fixed cost? A. 96,000 B. 48,000 C. 116,000 D. 57,500 4) If 100 more units are sold, how much increase in profit is expected? A. 1,600 B. 33,600 C. 6,000 D. 640 5) Janet Company produces a game that sells for P17 per game. Variable expenses are P9 per game and fixed expenses total P172,000 annually. The contribution margin ratio is closest to: A. B. C. D. 47.1% 2.1% 1.9% 52.9% 6) Double Dragon Company produced 500 units of a product and incurred the following costs: Direct materials Direct labor Overhead (20% fixed) P 8,000 10,000 45,000 If sales revenue of 500 units is P102,000, what is the contribution margin percentage? A. B. C. D. 44% 47% 53% 74% Page 1 of 6 7) A recent income statement of Nixon Corporation reported the following data: Sales revenue Variable costs Fixed costs P 5,000,000 3,000,000 1,600,000 If these data are based on the sale of 10,000 units, the contribution margin per unit would be: A. 40 B. 140 C. 200 D. 460 8) The following information pertains to Rica Company: Manufacturing costs Selling and administrative expenses Variable P340,000 10,000 Fixed P 70,000 60,000 During the year, the company sold 50,000 units for P1,000,000. How much is Rica's break-even point in number of units? A. B. C. D. 9,848 10,000 26,000 18,571 9) DEF Company is a retailer for video disks. The projected net income for the current year is P200,000 based on sales volume of 200,000 video disks. DEF has been selling the disk for P16 each. The variable cost consist of P10 unit purchase price of the disks and handling cost of P2 per disk. DEF’s annual fixed costs are P600,000. What is the company’s break-even point for the current year in number of video disks? A. B. C. D. 152,000 150,000 155,000 140,000 10) Asher Company manufactures fans with direct material costs of P10 per unit and direct labor of P7 per unit. A local carrier charges Asher P5 per unit to make deliveries. Sales commissions are paid at 10% of the selling price. Fans are sold for P100 each. Indirect factory costs and administrative costs are P6,800 and P37,200 per month, respectively. How many fans must Asher produce to break even? A. B. C. D. 1,375 647 564 530 11) Given the selling price at P120 per unit; contribution margin ratio at 25% and fixed costs of P250,000, the total variable expenses at the break-even point would be: A. B. C. D. 350,000 750,000 450,000 250,000 12) The following information pertains to Mete Company: Sales Variable costs Fixed costs P400,000 80,000 20,000 Mete’s breakeven point in peso sales is A. 20,000 B. 25,000 C. 80,000 D. 100,000 Page 2 of 6 Use the following information for the next two (2) questions: Swift, Inc., produces only two products, AAA and BBB. These account for 60% and 40% of the total sales of Swift, respectively. Variable costs (as a percentage of sales peso) are 60% for AAA and 85% for BBB. Total fixed costs are P150,000. There are no other costs. 13) What is Swift’s breakeven point in peso? A. 150,000 B. 214,286 C. 300,000 D. 500,000 14) Assume that the total fixed costs of Swift increase by 30%, what amount of total sales would be necessary to generate a net income of P9,000? A. 204,000 B. 464,000 C. 659,000 D. 680,000 15) John Jordan, a sole proprietor, had the following projected figures for next year: Variable cost per unit Total fixed costs P30.00 P210,000 What selling price per unit is needed to obtain a before-tax profit of P90,000 at a volume of 4,000 units? A. B. C. D. 75.00 52.50 100.00 105.00 16) For a profitable company, the amount by which sales can decline before losses occur is known as the A. Sales volume variance C. Contribution margin B. Margin of error D. Margin of safety 17) Margin of Safety A. Is the amount of actual or expected sales which can still be decreased without resulting into a loss. B. May be expressed in terms of pesos or in terms of a per unit figures. C. May be increased by increasing either the expected sales or break even sales. D. Shows how much sales volume can be reduced without sustaining losses. 18) For its most recent fiscal year, Corn Company reported that its contribution margin was equal to 40 percent of sales and that its net income amounted to 10 percent of sales. If its fixed cost for the year were P60,000, how much was the margin of safety? A 150,000 B. 200,000 C. 600,000 D. 50,000 . 19) Black Corporation breakeven point was P780,000. Variable expenses averaged 60% of sales, and the margin of safety was P130,000. What was Black’s contribution margin? A 364,000 B. 546,000 C. 910,000 D. 1,300,000 . 20) Worthy Company has sales of P200,000, a contribution margin of 20% and a margin of safety of P80,000. What is Worthy’s fixed cost? A. 16,000 B. 24,000 C. 80,000 D. 96,000 Page 3 of 6 21) The following information pertains to Clove Company for the year ending December 31, 2021: Budgeted sales Breakeven sales Budgeted contribution margin P 1,000,000 700,000 600,000 Clove’s margin of safety is A. 300,000 B. 400,000 C. 500,000 D. 800,000 22) The following information relates to Knight Company: Sales revenue Contribution margin Net income Knight's operating leverage factor is: A 0.25 B. 0.40 . P5,000,000 2,000,000 500,000 C. 2.50 D. 4.00 23) Kendall Company has sales of 1,000 units at P60 a unit. Variable expenses are 30% of the selling price. If total fixed expenses are P30,000, the degree of operating leverage is: A. 1.50 B. 5.00 C. 1.67 D. 3.50 24) Brown Company has sales of 2,000 units at P70 per unit. Variable expenses are 40% of the selling price. If total fixed expenses are P44,000, the degree of operating leverage is: A. 0.79 B. 1.40 C. 3.50 D. 2.10 25) The Oregano Watch Company manufactures a line of ladies’ watches which are sold through discount houses. Each watch is sold for P1,500; the fixed costs are P3,600,000 for 30,000 watches or less; variable cost is P900 per watch. What is Oregano’s degree of operating leverage at sales of 12,000 watches? A. 2.0 times B. 5.0 times C. 0.5 times D. 0.2 times 26) Chris Brown Company sells two products with the following per unit data: Selling price Variable cost Contribution margin Apple P 75 45 30 Orange P 120 60 60 Sales mix 3 units 2 units If fixed costs are P630,000, the number of Apple and Orange units that Chris Brown must sell to break even is A. 1,800 Apple and 1,200 Orange B. 9,000 Apple and 6,000 Orange C. 3,600 Apple and 2,400 Orange D. 21,000 Apple and 14,000 Orange Page 4 of 6 27) Look At You is a company with P280,000 of fixed costs has the following data: Sales price per unit Variable cost per unit Product Sword P5 P3 Product Shield P6 P5 Assume three units of Product Sword are sold for each unit of Product Shield sold. How much will sales be in peso of Product Shield at the breakeven point? A. 200,000 B. 240,000 C. 280,000 D. 840,000 28) Wren Co. manufactures and sells two products with selling prices and variable costs as follows: Selling price Variable costs Product A P18.00 12.00 Product B P22.00 14.00 Wren's total annual fixed costs are P38,400. Wren sells four units of A for every unit of B. If operating income last year was P28,800, what was the number of units Wren sold? A. 5,486 B. 6,000 C. 9,600 D. 10,500 29) Ace Manufacturing plans to produce two products, Gold and Silver, during the next year, with the following characteristics: Selling price Variable cost per unit Expected sales Gold P 10 8 Silver P 15 10 20,000 units 5,000 units Total projected fixed costs for the company are P30,000. Assume that the product mix would be the same at the breakeven point as at the expected level of sales of both products. What is the projected number of units (rounded) of the Product Gold to be sold at the breakeven point? A. 2,308 units B. 9,231 units C. 11,538 units D. 15,000 units 30) The following revenues and cost budget for two products, Sakit Company sells are made available: Sales price Direct materials Direct labor Fixed overhead Net income per unit Plastic Product P 50 10 15 15 10 Glass Product P 75 15 25 20 15 Budgeted unit sales 150,000 units 300,000 units The budgeted unit sales equal the current unit demand, and total fixed overhead for the year is budgeted at P4,875,000. Assume that the company plans to maintain the same proportional mix. In numerical calculations, the company rounds to the nearest centavos and units. The total number of units Sakit Company needs to produce and sell to breakeven is A. 102,632 units B. 153,947 units C. 171,959 units D. 418,455 units Page 5 of 6 Page 6 of 6