ACCT 151 Financial Accounting Syllabus - Lehigh University

advertisement

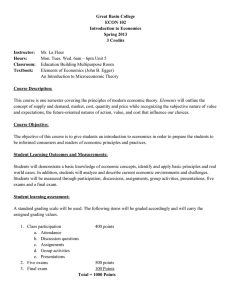

College of Business and Economics ACCT 151 Introduction to Financial Accounting COURSE OBJECTIVES AND SYLLABUS Fall 2018 INSTRUCTOR Joseph M. Manzo Jmm6@lehigh.edu Rauch Business Center Room 307 Office Hours: Monday 4:00 – 6:00pm, Wednesday 3:30 – 5:30pm and by Appointment COURSE DESCRIPTION This course provides an introduction to financial accounting which is often considered the “language of business.” One must understand accounting to function effectively in today's world and cope with a myriad of business decisions and situations. To obtain more than a basic understanding of accounting, we stress the use and interpretation of accounting information. The course will emphasize the principal financial statements issued by business organizations which include the balance sheet, income statement, statement of stockholder’s equity, and the statement of cash flows. Even students who do not choose accounting as a major will find their skills strengthened by being able to work with and explain the meaning and limitations of accounting information. Course requirements are also designed to enhance your critical thinking, research, and teamwork skills. LEARNING OBJECTIVES Understand the roles played by accountants in society providing and ensuring the integrity of financial and other information for decision-making. Develop an awareness of the ethical and regulatory environment for accountants. Demonstrate proficiency in recording, analysis, and interpretation of historical and prospective financial and non-financial information. Develop and apply critical thinking skills. 1 College of Business and Economics REQUIRED TEXT and MATERIALS Libby, Libby and Short , Financial Accounting, 9e McGraw-Hill, 2017 Connect Software by McGraw-Hill The link to access the Connect materials for this section of ACCT 151 is below. If you do not have a Connect access code, you can purchase one after clicking the link below. Please note that you must use this link to access the assignments that are specific to this class. Assignments in other ACCT 151 sections will differ. You will only receive credit for the assignments that are completed through this link: Link to Connect Assignments for Manzo Fall 2018 COURSE WEBSITE Materials, requirements, and assignments for this course will be located on coursesite. You can access the site through the following address http://coursesite.lehigh.edu/. You should visit coursesite frequently to view the assignments that are due for each class. ACCOMMODATIONS FOR STUDENTS WITH DISABILITIES If you have a disability for which you are or may be requesting accommodations, please contact both your instructor and the Office of Academic Support Services, Williams Hall, Suite 301 (610-758-4152) as early as possible in the semester. You must have documentation from the Academic Support Services office before accommodations can be granted. GRADE CRITERIA Your grade will be determined based upon your performance in the following: Homework 10% Quizzes 10% Final Project 10% Exam 1 20% Exam 2 20% Final Exam (Cumulative) 30% 2 College of Business and Economics HOMEWORK Your homework grade is based on three types of assignments: custom problems (CP), problems that are required to be done in Excel, and Learnsmart / Connect Simulations that will be posted on the Connect system. Custom problems (CP): These are pdf files that will be posted on coursesite. These assignments must be hand written and turned in at the beginning of class on the date specified on coursesite. I do not expect these assignments to be completely accurate. You will be doing each assignment a second time in class when we develop a solution together as a class. You will be graded on effort and completeness. Fully completed assignments with work shown will receive 100%, assignments with one omission and/or missing some work will receive 85%, assignment with two or more omissions/and or show very little work as to how the solution was derived will receive 70%, and no submission is given a grade of 0. No homework will be accepted once we review the solution in class. If you have an excused absence from class, you must submit your homework to me before the next class. Excel Problems: For assignments that are due in Excel, you will be asked to upload your files to coursesite the morning of the due date. The system must receive your file by 10:00am of the due date. No late homework assignments will be accepted. Grading for these assignments will be based on completeness and functionality of your Excel worksheet. You must use formulas and functions in your files such that when an input is changed the worksheet generates new outputs. Homework that is complete with fully functional worksheets is 100%, missing part of a problem or some functional deficiencies is 85%, missing one or more entire problems, or a worksheet that does not contain any formulas and/or functions is 70%. Homework that is not turned in or completed late receives a grade of 0. Learnsmart / Connect Simulations: The Learnsmart and Connect Simulations are graded based on how much of the module you completed. If you completed the entire module, your grade is 100% for that assignment. These assignments must be completed by 10:00 am of the due date. ALL homework assignments require individual effort. Completing homework assignments in groups or as a team is unacceptable and is considered cheating. The use of any third party answer keys or solution manuals is also unacceptable and is considered cheating. Violating these requirements will be considered a violation of the student code of conduct and will immediately be referred to the University Committee on Discipline. For your reference, the student code of conduct is provided at the end of this syllabus. The two lowest homework grades for the course will be dropped. 3 College of Business and Economics ATTENDANCE POLICY AND CLASS PARTICIPATION While there is no formal grade for attendance and class participation, missing class or not being prepared for class can negatively impact your final grade. Being prepared for and participating in class is a vital part of the learning process. For many classes, you will be working with a partner to review and evaluate assignments that you will prepare ahead of time. Missing a class will make it impossible for you to benefit from this process. Also, not attempting the assignment before class will greatly diminish the benefits you can receive from this process. To support the importance of the in class learning process, the attendance policy is as follows: If you miss 4 classes unexcused, you will receive a warning via a section 3 notice. Once you miss 5 classes, your final grade may be reduced one increment. For example, your grade could be reduced from a B to B-, C+ to C, etc. Conversely, if you attend all classes and are an active participator, your final grade could be increased by one increment if you are on the border between two grades. Assessment of class participation and the adjustment of final grades are at the sole discretion of the instructor. Note that for an absence to be considered excused, you must provide the appropriate documentation or you must be given make-up privileges by the Associate Dean of Students office. QUIZZES The quiz grade will be comprised of four quizzes. There will be a total of four quizzes administered throughout the semester. There are no make-up quizzes. The format for the quiz will be five multiple choice questions. Quiz dates are only announced in class. If you have a valid excuse for missing class, with documentation, your grade will be based on the quizzes you took. Again, there are no make-up quizzes. EXAMS There will be two common 4 O’clock exams for this course and a cumulative final exam. The exam dates and room locations will be posted on the registrar’s website. If you are not present for a 4 O’clock exam, you must be issued make-up privileges by the Associate Dean of students or provide the appropriate documentation in order to take the exam at an alternate date. The final exam will take place at the day and time specified by the registrar. Any requests to make-up the final exam must be approved by the Standing of Students committee. No make-up privileges for the final exam will be granted without permission from the SOS committee. FINAL PROJECT You will be assigned to one of approximately 7 teams in your section for the group project. Each team will be assigned a public company and will be required to research and analyze that company’s financial statements, make an in-class presentation and prepare a professional report discussing the group’s findings. Your team’s report must be uploaded using the Turn-it-in link on coursesite and a 4 College of Business and Economics hard copy must be brought to class on the last day of the course. Detailed requirements for the final project are provided with this syllabus. ACCESSING THE CONNECT SYSTEM Click the link to the Connect system provided on page 2 of this syllabus. Click on REGISTER NOW…. Student registration tutorials are available if you need help. Next, enter your email address. If you already have a McGraw-Hill account, you will be asked for your password and will not be required to create a new account. You’ll see three options: (1) Enter your access code and click Submit (codes are packaged with a new textbook in the bookstore); (2) Click Buy Online to purchase access. If you’re purchasing access online, choose: “Buy Connect” OR “Buy ConnectPlus” (includes online access to an eBook; (3) Start a Free Trial (typically limited to three weeks). Next, you will need to fill out the registration form. Please make sure to click on “Go To Connect Now” to complete your registration and continue to your instructor’s course. You are now at your instructor’s course. This is where you can access your assignments and study resources. EQUITABLE COMMUNITY STATEMENT Lehigh University endorses The Principles of Our Equitable Community http://www4.lehigh.edu/diversity/principles . We expect each member of this class to acknowledge and practice these Principles. Respect for each other and for differing viewpoints is a vital component of the learning environment inside and outside the classroom. STUDENT CODE OF CONDUCT Lehigh University Student Senate: Statement of Academic Integrity: Each student must adhere to the following statement issued by the Lehigh University’s Student Senate on Academic Integrity: “We, the Lehigh University Student senate, as the standing representative body of all undergraduates, reaffirm the duty and obligation of the students to meet and uphold the highest principles and values of personal, moral and ethical conduct. As partners in our educational community, both students and faculty share the responsibility for promoting and helping to ensure an environment of academic integrity. As such, each student is expected to complete all academic work in accordance with the standards set forth by the faculty and in compliance with the University’s Code of Conduct.” Per Lehigh University Student Handbook: “University Conduct System”: Expectations of Conduct “Lehigh University is a community that has expectations of its student members. These expectations and a list of non-inclusive examples of behavior that might breach these expectations are below. I. A. Academic Integrity Lehigh University expects that all students will act in a manner that reflects personal and intellectual honesty. PROSCRIBED CONDUCT: Cheating. This includes but is not limited to: 1. The use of any unauthorized assistance in taking quizzes, tests, or examinations. 5 College of Business and Economics i. 2. 3. 4. 5. 6. B. The possession at any quiz or examination of any articles which are prohibited will be regarded as evidence of responsibility. The dependence upon the aid of sources beyond those authorized by the instructor in writing papers, preparing reports or homework, solving problems, or carrying out other assignments. The acquisition, without permission, of tests or other academic material belonging to a member of the university faculty or staff. Any attempt to falsify an assigned grade in an examination, quiz, report, program, grade book, or any other record or document. The creation and/or submission of falsified data in any experiment, research paper, laboratory assignment, or other assignment. Collusion occurs when students willfully give or receive unauthorized or unacknowledged assistance. Both parties to the collusion are considered responsible. Plagiarism. This includes but is not limited to: 1. The direct use or paraphrase, of the work, themes or ideas, of another person without full and clear acknowledgement. 2. Submitting the work of another as your own in any assignment (including papers, tests, labs, homework, computer assignments, or any other work that is evaluated by the instructor).” Any violation of this policy or any other course policies as stated in this course syllabus or orally communicated by Professor Manzo during class will be referred to the University Committee on Discipline. TUTORING RESOURCES The CBE Undergraduate Programs Office helps coordinate tutoring options for students. It is best to seek out tutoring early in the semester and to continue to use it regularly for best results. No matter the GPA, tutoring is a way for students to take proactive action to ensure their success. The Center for Academic Success offers tutoring in most CBE first-year and sophomore-level core courses free of charge to students. Tutoring begins the third week of classes and continues through the last week of classes every semester. The Center for Academic Success offers weekly group tutoring in which students sign up for a weekly tutoring session (usually no more than six students in a group) with an upper class undergraduate student. The accounting honor society, Beta Alpha Psi, offers walk-in tutoring for ACCT 151 and 152 most weekdays. The CBE Undergraduate Programs Office publishes a grid outlining the various business tutoring options and times at the beginning of every semester. If you have any questions or concerns about tutoring, please contact Assistant Dean Emily Ford at eaf311@lehigh.edu. 6 College of Business and Economics GROUP PROJECT GUIDELINES FOR ANNUAL REPORT ANALYSIS Purpose. To read, analyze and evaluate information in an annual report and utilize comparative peer company financial ratios. You will be evaluated on the general requirements spelled out below, as well as your critical thinking skills. This is your opportunity to demonstrate healthy skepticism when evaluating a business. General Requirement. You will be placed onto a team and your team will be assigned a public company to research. You must obtain the most recent 10K annual report for your company through any of the following: financial website, company website, or SEC.gov. You will also need to select and research the 10K annual report of a peer or competing company. Your objective is to make a recommendation to “Buy” or “Sell” the company's stock based on your assessment of its recent performance, comparison to peer company, and future prospects. Specific Requirements. Write your paper in your own words; avoid paraphrasing other sources, place exact quotes within quotation marks (“ ”) and give sources thereof. Your paper shall contain the following four main parts, each clearly labeled: Executive Summary: This concise overview of your paper should be no more than one paragraph. You will give your recommendation as to whether you believe the stock should be a “Buy” or “Sell”. Then, you will provide a few brief highlights to support your decision. Place the Executive Summary on a separate page at the front of the paper; center the heading "Executive Summary" at the top of the page. Introduction (1-2 pages): Use this section to provide background about the company’s business. Also, be very specific as to what your company must do in order to succeed and be profitable. You should cite one to three critical success factors and no more for your company. Then, provide a few key items from the letters from executives (CEO, President, etc.) and Management Discussion and Analysis (MD&A) that support the critical success factors you cited. If you believe the critical success factors were not adequately addressed by management, you may certainly identify this and provide a critique of management. Ratio Analysis (3-4 pages): This section should contain the following: Calculate all the ratios presented in Chapter 13 of the text for at least two years for your company and your peer company. The calculations for your company MUST use the data from the financial statements. I will check to make sure you have calculated your numbers properly by referring to the financial statements you submit with your report. You will be required to submit all ratio calculations as an appendix with your report so doing these calculations in Excel is strongly suggested. Provide a written assessment for each ratio and explain how your results support your decision to buy or sell the stock. Also, tie each result to the critical success factors of the company. If a ratio is not relevant for your company, no calculation is necessary, BUT you must explain why the calculation was omitted. In order to provide a strong and relevant analysis, you must compare your ratios to the peer company. Conclusion (1 Page): Make a decisive recommendation whether to buy or sell the stock. Also include current events and published financial information for the company that would not have been available when your annual financial statements were published. Use this information to further strengthen your recommendation, or cite items that could reverse your decision. Formatting and Other Requirements: Reports must be 12-point font, double spaced, 1” margins, and include page numbers. Write your report in your own words; do not copy or paraphrase other sources; give exact sources of direct quotes. Make reports no more than 7 written pages (not including the Executive Summary). 7 College of Business and Economics APPENDIX: Your appendix must include the following: Spreadsheet showing ratios for your company and peer company, Company and Peer Company Income Statement, Balance Sheet, and Statement of Cash Flows. This report is a piece of business writing and the style should be straightforward, written in active voice, and the report sections shall be labeled as above. **Reports submitted late lose 25 points and earn no credit if not received by 4 PM on last day of classes for the semester. 8 College of Business and Economics GROUP EVALUATION AND HONOR PLEDGE RELATED TO GROUP PROJECT Students in the past sought the opportunity to provide me with their evaluations of the effort and contributions of members of their groups. This is to prevent the so-called “free-rider problem.” Moreover, to protect the integrity of these projects, we require each group to pledge that they did their project in accordance with the Lehigh Student Code of Conduct. Accordingly, please complete the electronic copy of this form, which will be posted to coursesite by the end of the semester, and upload back to coursesite using the link provided. Company ____________________________________________________________________________ Name of Group Member Approximate % of Total Effort Contributed to Group Project_ ______________________________ _____________ ______________________________ _____________ ______________________________ _____________ ______________________________ _____________ ______________________________ _____________ Total 100 % Honor Pledge: I pledge that in completing my work on this project I neither gave nor received help from individuals outside my group and adhered to the Lehigh Student Code of Conduct. Your name________________________________________________ Date _______________________ Class Section Time______________________________________________ 9 College of Business and Economics SUPPLEMENT TO CHAPTER 9: CONTINGENT LIABILITIES A contingent liability is an obligation involving an existing condition for which the ultimate outcome is unknown, and depends on some future event. For instance, the company is being sued, or the company has sold warranty on its products. The outcome of the lawsuit is unknown, and will be determined in the future. The outcome of how many people will claim their warranties is also unknown, and must be estimated. If the liability is probable and estimable, it must be recorded by crediting a contingent liability and debiting an expense/loss. Therefore, the liability is reported in the financial statements. If the liability is (a) either probable but cannot be estimated, or (b) can be estimated but is not probable, the liability is not reported in the financial statements, but must be disclosed in the Notes to the financial statements. If the occurrence of the liability is reasonably possible, the liability must be disclosed in the Notes . EXAMPLE of a liability that is reported in the financial statements: PRODUCT WARRANTIES 1. In the period in which the company sells the product and provides the warranty, the company records its estimate of the liability by debiting Warranty expense and crediting Estimated Warranty Liability. The estimate is based on past history and industry information. 2. In the period in which the company incurs the actual costs, the company debits (i.e., reduces) the Estimated Warranty Liability, and credits Cash. PROBLEM: ABC Co. sells computers for $5,000, and provides a two-year warranty on its products, in case the products must be repaired. During December 2012, ABC sold 200 computers and recorded sales revenue of $1,000,000. At the end of 2012, ABC recorded the estimated warranty costs related to these sales. Based on past experience and warranty records, ABC estimates that the repair costs it will incur are 3% of sales. During December, 2012, ABC also incurred actual warranty costs on previously sold computers, of $45,000. REQUIRED: (A) Provide the entry to record the estimated warranty liability. (B) Provide the entry to record the costs incurred. (C) If ABC’s Estimated Warranty Liability had a balance of $200,000 at 12/1/2012, what was the balance in the account at 12/31/2012? 10 College of Business and Economics SUPPLEMENT TO CHAPTER 10: EARLY RETIREMENT OF BONDS ILLUSTRATED PROBLEM: Five-year, 5% bonds with a face value of $50,000 are issued on Jan 1, 2008. Interest is paid annually on December 31. The market rate of interest on that date is 4%, and the proceeds of the bonds issued equal $52,230. REQUIRED: (A) Assume the company retires the bonds on December 31, 2008, at 101 (i.e., 101% of par). Make the retirement journal entry. (B) Assume the company retires the bonds on December 31, 2008, at 107 (i.e., 107% of par). Make the retirement journal entry. SOLUTION: (A) First, we calculate the gain or loss on retirement of the debt, as follows. i. The carrying value of bonds at the time of retirement is equal to: Carrying value at the beginning of this period (equals the bonds payable at par or face of $50,000 plus the unamortized premium which in this situation is the entire original bond premium of $2,230) less the amount of premium amortized during this period. The premium amortized for this first period is the excess of the cash interest actually paid for this first period (i.e., face value of $50,000 * 5% coupon rate = $2,500) over the actual interest expense incurred for the first period which is based on the market rate of interest at the time of issuance times the beginning of period carrying amount (i.e., beginning of period carrying amount of $52,230 * 4% market rate of interest at time of issuance = $2,089), or $2,500 interest paid - $2,089 interest incurred = $411 of bond premium amortized. the carrying value of the bonds at the end of the period is therefore $52,230 – $411 = $51,819 OR, equivalently, the carrying value of the bonds can also be computed as: Face value plus the balance in the unamortized premium at the end of this period: $50,000 + $1,819 = $51,819. ii. iii. The cash paid to redeem that bond is equal to: 1.01 X $50,000 = $50,500 So, the excess of carrying value at the end of the period over cash paid to redeem it = GAIN of $1,319. Note: the company records a gain, because it got to retire debt with high carrying value in exchange for less cash. This is the opposite case of asset disposals, since it is debt. Journal entry to record the bond retirement: Dr. Bonds Payable (at face value) Dr. Premium on Bonds Payable $50,000 $1,819 Cr. Cash (1.01 * face value of 50,000) Cr. Gain on Retirement of Bonds Payable $50,500 $1,319 (Note that there is still a separate entry required to record the interest expense incurred vs paid for the first period as follows: Dr. to interest expense for $2089, a Dr. to Premium of Bonds Payable for $411, and a Cr. to Cash for the actual interest paid in the first period of $2,500.) 11 College of Business and Economics (B) First, we perform steps i through iii above. We end up with a LOSS of $1,681, because the company pays more cash than the amount for which it carries the debt on its books. Journal entry (to record the bond retirement): Dr. Bonds Payable (at face value) $50,000 Dr. Premium on Bonds Payable $1,819 Dr. Loss on Retirement of B/Payable $1,681 Cr. Cash (1.07 * face value of 50,000) $53,500 (Note that there is still a separate entry required to record the interest expense incurred vs. paid for the first period as follows: Dr. to interest expense for $2089, a Dr. to Premium of Bonds Payable for $411, and a Cr. to Cash for the actual interest paid in the first period of $2,500.) 12 College of Business and Economics SUPPLEMENT TO CHAPTER 11: SMALL AND LARGE STOCK DIVIDENDS ILLUSTRATED (Pages 563-564) SMALL STOCK DIVIDEND – less than 20-25% of currently outstanding shares LARGE STOCK DIVIDEND – more than 20-25% of currently outstanding shares Recorded at the market value of the stock as of the dividend declaration date Therefore, both Common Stock (C/S) and Additional Paid-in Capital (APIC) are credited: C/S at par and the excess to APIC And the corresponding debit is recorded to Retained Earnings EXAMPLE: Recorded at the par value of the stock as of the dividend declaration date Therefore, only Common Stock is credited And the corresponding debit is recorded to Retained Earnings ABC Co. 10,000 shares of $5 par value issued and outstanding. It also has $20,000 in Additional Paid-in Capital, and $60,000 in Retained Earnings. ABC declares and distributes a stock dividend on a date when its stock sells for $50 per share. How should the stock dividend be recorded if: (a) The stock dividend is 10% of ABC’s shares? (b) The stock dividend is 40% of ABC’s shares? SOLUTION: (a) To record a SMALL stock dividend @market: Dr. R/E (10%*10,000 shares*$50) $50,000 Cr. C/S (10%*10,000 shares*$5 par) Cr. APIC (remainder) (b) To record a LARGE stock dividend @par: Dr. R/E (40%*10,000 shares*$5 par) $20,000 $5,000 Cr. C/S (40%*10,000 shares*$5 par) $20,000 $45,000 13 College of Business and Economics STOCKHOLDERS’ EQUITY BEFORE STOCK DIVIDEND STOCKHOLDERS’ EQUITY STOCKHOLDERS’ EQUITY AFTER SMALL STOCK DIVIDEND AFTER LARGE STOCK DIVIDEND Common Stock, $5 par, Common Stock, $5 par, Common Stock, $5 par, 10,000 shares issued and O/S $ 50,000 11,000 shares issued and O/S $ 55,000 14,000 shares issued and O/S $ 70,000 Additional Paid-in Capital – Common Stock $ 20,000 Additional Paid-in Capital – Common Stock $ 65,000 Additional Paid-in Capital Common $ 20,000 Retained Earnings $ 60,000 Retained Earnings $ 10,000 Retained Earnings $ 40,000 Total Stockholders' Equity $ 130,000 Total Stockholders' Equity $130,000 Total Stockholders' Equity $130,000 14 College of Business and Economics 15