PPCBL Internship Report: Banking & Cooperative Sector Analysis

advertisement

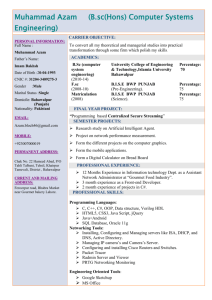

Internship Report THE PUNJAB PROVINCIAL COOPERATIVE BANK LIMITED 1|Page PPCBL CHOWK AZAM TOPIC INTERNSHIP REPORT ON THE PUNJAB PROVINCIAL COOPERATIVE BANK LIMITED SUBMITTED BY Shakila Bano SUBMITTED TO Mr. Naveed Arshad GOVT COLLEGE OF COMMERCE LAYYAH Bahauddin Zakariya University, Multan 2|Page PPCBL CHOWK AZAM Dedication: I dedicate this report to my loving mother and sister and friends without whose help and encouragement it would not have been possible. For me accomplish this task within the specific time limit. I was provided with every facility by my mother who was necessary in order to complete this challenge assignment. 3|Page PPCBL CHOWK AZAM Acknowledgement: I am very thankful to “Almighty Allah” the most beneficent, the most mercy full who has given the strength to complete this task. I am also thankful to branch manager and operational manager respectively of THE PUNJAB PROVINCIAL COOPERATIVE BANK LIMITED CHOWK AZAM BRANCH. Without whose guidance and support it would not have been possible for me to accomplish this assignment. Furthermore, I am indebted the staff of the Punjab Provincial Bank. From whom I have gained much experience regarding operational work of bank is concerned. The last but not the last I convey my credit and thankfulness to the GOVT. COLLEGE OF COMMERCE, LAYYAH Authorities. Without whose well in time support and guidance it would be much difficult for me to achieve this task successfully. 4|Page PPCBL CHOWK AZAM TABLE OF CONTENT Sr. No. Contents Page No. 1 Dedication 3 2 Acknowledgement 4 3 Executive Summary 6 4 The Punjab Provincial Cooperative Bank 7 5 Introduction 7 6 Mission Statement 8 7 Vision Statement 8 8 Objectives 8 9 Department where I worked as internee 9 10 Account Opening Department 9 11 Accounts Department 11 12 Remittance Department 11 13 Clearing Department 12 14 Bill for Collection Department 13 15 Advance and Credit Department 13 16 FINANCIAL ANALYSIS 14 17 SWOT ANALYSIS OF PPCBL 17 18 Strengths 17 19 Weaknesses 17 20 Opportunities 18 21 Threats 18 22 PEST ANALYSIS 19 23 Political Environment 19 24 Economic Environment 19 25 Social Environment 19 26 Technological Environment 19 27 Learning as a student internee (week wise) 20 28 Applications of classroom learning 21 29 Recommendation 22 30 Conclusion 23 BIBILIOGRAPHY 24 5|Page PPCBL CHOWK AZAM Executive Summary: The Punjab Provincial Cooperative Bank Limited (PPCBL) established in 1989 and got the status of scheduled bank in 1994. The Punjab Provincial Cooperative Bank Limited offer number of products in their customer. There are 151 branches of PPCBL in the whole country. Functionally The Punjab Provincial Cooperative Bank Limited is divided in the division and the each division is headed by the general managers. The government of the Punjab holds the majority of the shares in PPCBL. It is doing business in commercial banking and the retail banking. Corporate banking treasury and investment and trade finance. The shares of PPCBL are traded in all three stock Exchanges of the Pakistan. During internship, I worked in Accounts opening Department, Accounts Department, Clearing Department, Remittance Department, Advance and Credit Department and Bill for Collection Department. Report will also show you the SWOT analysis, where readers could able to understand PPCBL strength, weakness, opportunity and threats. At the end the conclusion and the recommendations are the part of the report. Bibliography is the part, which contain all the references from I, obtained data to prepare this report. 6|Page PPCBL CHOWK AZAM The Punjab Provincial Cooperative Bank Limited Introduction: The Punjab Provincial Cooperative Bank Limited started functioning with the inauguration of its first branch of 7-Egerton Road, Lahore on November 15, 1989. The founder of the bank Mr. Nawaz Sharif performed the inauguration. The Punjab Provincial Cooperative Bank Limited is working as a scheduled bank with its 151 branches in all major cities of the country. The bank provides all types of banking services such as Deposit in Local currency, Client Deposits in Foreign currency, Remittances and Advances to businesses, trade, industry and agriculture. The Punjab Provincial Cooperative Bank Limited has entered into a new era of science to the nation under the experienced and professional hands of its management. The Punjab Provincial Cooperative Bank Limited has played a vital role in the national economy through mobilization of untapped local resources, promoting savings and providing funds for investments. The Punjab Provincial Cooperative Bank Limited has played a vital role in the economy through mobilization of untapped local resources, promoting savings and providing funds for investment. The Punjab Provincial Cooperative Bank Limited has the privilege to discharge its responsibilities towards national prosperity and progress. Within the couple of years of its scheduling, the bank has not only carved out for itself prominent niche in the mainstream 7|Page PPCBL CHOWK AZAM banking of the country but in certain areas it has the distinction of taking the lead. In short span of time the Bank has been able to evolve a distinct corporate culture through of its owned-based policies, which are realistic and are on highly professional footings. The government of the Punjab holds the majority of the shares in PPCBL. It is doing business in commercial banking and the retail banking. Corporate banking treasury and investment and trade finance. The shares of PPCBL are traded in all three stock Exchanges of the Pakistan. 8|Page PPCBL CHOWK AZAM Mission Statement: Achieving business excellence by catering the financial requirements of the rural community at the grass root level through provision of quality services and infused values of cooperation in a conductive and supportive environment. Vision Statement: To be a well structured and efficient Cooperative financial institution for helping its members and individuals to unite voluntarily for building up their resources and meeting their common socioeconomic needs through democratically controlled enterprise. 9|Page PPCBL CHOWK AZAM General Banking: Deposit Products: Current Account Non profit account Free cheque book subject to average balance Rs. 50,000/No commission will be charged subject to below mentioned average balance in account a) Individual for Rs. 25,000/- & above ( maximum 5 waivers to Rs. 0.5 Million PM) b) Companies for Rs. 200,000/- & above ( maximum 5 waivers to Rs. 5 Million PM) Saving Account Initial deposit amount for opening of regular saving account is Rs. 100/- only. (Bank instructions 1000/-, SBP instruction 100/-) No monthly minimum balance requirement. Profit is calculated on the monthly average balance. Profit is paid semi-annually. Unlimited transaction admissible. Assan Account Facility for low income people 10 | P a g e PPCBL CHOWK AZAM It opens single or joint accounts The type of Current Assan Account and Saving Assan Account On Saving Assan Account the profit will be similar to PLS Saving Account. This facility to open the Minor Account Initial deposit amount for opening of Assan Account is Rs. 100/Total debit and credit per month is restricted maximum of Rs. 500,000/ Basic Banking Account\ Non-remunerative account The minimum initial deposit will be Rs. 1000/No limit on minimum balance, where balance in BBA remains nil for a continuous six-month period, such accounts will be closed. No fee for maintaining BBA Unlimited free of charge ATM withdrawals from the Bank’s own ATM, In case of withdrawal from BBA through the ATM machines of other bank’s the respective/ other ban may recover charges for such transactions. Maximum two deposit transactions and two cheque’s withdrawals are allowed, free of charge through cash / clearing per month Statement of account will be issued once in a year. Monthly Saver Account Profit is calculated on the monthly average balance. 11 | P a g e PPCBL CHOWK AZAM Profit paid on monthly basis. Minimum balance requirement Rs. 50,000/Unlimited transaction admissible Loan facility also offered against deposit. Apna Paisa Apna Munafa Fixed deposit scheme. Minimum investment amount from Rs. 25,000/Advance profit payment for entire investment period. Investment period on quarterly basis (from 03 months to 24 months) Lockers Lockers facility available for all customers Three sizes available i.e. Small, Medium and Large. Key deposit amount is Refundable upon vacation of locker. KIDs Education Plan Profit calculation on monthly average balance. Monthly deposit Rs. 2,000/No deposit limit. No charges on first standing instructions. Nomination facility available. Two free remittances in a month, within PPCBL branches. 12 | P a g e PPCBL CHOWK AZAM In case of discontinuation the PLS SB rate will apply. Financial Services Having dual port folio of Cooperative Bank as well as Schedule Bank, PPCBL is also providing financial services to Societies as well as individual customers. 1. Services for Societies Financial Services to Societies Agriculture Production Loan Maximum finance up to approved maximum credit limit to purchase Agri inputs. Rate of mark up 14% P.A. Period of finance ranging from 8 to 10 months. Finance up to Rs. 2 Lac clean, above Rs. 2 Lac against security of agriculture land. Sanction of fiancé by the Branch manager Revolving Credit Society (Crop Loan) Maximum finance up to approved maximum credit limit. 13 | P a g e PPCBL CHOWK AZAM Rate of mark up 14% P.A. Period of finance 3 years with one time documentation. Annual cleanup of the account once in a year is mandatory. Required security AGRI land valuing double the amount of not finance. Live Stock Revolving Finance Maximum finance Rs. 8 Lac @ one Lac per member. Rate of mark up 13% P.A. Period of finance 3 years with one time documentation. Annual cleanup of the account once in a year is mandatory. Required security AGRI land valuing double the amount of not finance. Medium Term Finance (Society) Maximum finance according to cost of tractor after adjustment of 10% margin money. Period of finance 7 years recoverable in 14 half yearly installments. Under general permission of Registrar Cooperatives, Punjab maximum finance Rs. 20 Lac @ 5 Lac per member of a society. Rate of mark up 18% P.A. Required security AGRI land valuing double the amount of not finance. Eligibility of the borrower having 40 Kanal of Agricultural land. Live Stock Project Finance 14 | P a g e PPCBL CHOWK AZAM Maximum finance 5 Lac per member of a society. Under General permission of the RCS eight member are eligible. Rate of mark up 18% Period of finance 5 years recoverable in 10 half yearly installments Required security AGRI land valuing double the amount of net finance. Eligibility of the borrower having 40 Kanal of Agricultural land. Two borrowers having blood relatives can also apply jointly. Medium Term Lease Finance Scheme Maximum fiancé according to cost of tractor after adjustment of 10% margin money Period of finance 7 years recoverable in 14 half yearly installments. Rate of markup is 17%. Required security AGRI land valuing double the amount of net finance. Eligibility of borrower having 5 Acres of Agriculture land at least double of loan amount 2. Services for Individuals 15 | P a g e PPCBL CHOWK AZAM Financial Services to Individuals Live Stock Farming Goat & Sheep Maximum finance Rs. 2 Lac Rate of markup 19% Period of finance 1 year repayable in two installments or whole recovery after 1 year Re-financing facility on timely repayment of finance on the same security document. Required security Agri land valuing double the amount of net finance. Eligibility of borrower having 1 Acre for 1 Lac and 2 Acre or above for 2 Lac. Live Stock Project Finance Maximum finance Rs. 2 Lac Rate of markup 19% Period of finance 5 years repayable in 10 half yearly installments. Required security Agri land valuing double the amount of net finance. Eligibility of the borrower having 40 Kanal of Agricultural land. Two borrowers having blood relation can also apply jointly. Medium Term Finance maximum finance upto Cost of implement after adjustment of 10% margin money 16 | P a g e PPCBL CHOWK AZAM Period of finance 5 years repayable in 10 half yearly installments. Rate of markup 19% Required security Agri land valuing double the amount of net finance. Eligibility of the borrower having 40 Kanal of Agricultural land. Finance against GOLD Maximum limit of fiannce Rs. 500,000/- against pludge of Gold. Rate of markup 19% Finance up to 65% of net value of Gold (35% margin) Period of finance 1 year Agriculture Running Finance Maximum finance upto Rs. 5 Lac Period of finance 3 years subject to annual clean up of loan. Rate of markup 17% Required security Agri land valuing double the amount of net finance. Eligibility of the borrower having 16 Kanal of Agricultural land. Medium Term Lease Finance Scheme Maximum finance according to cost of tractor after adjustment of 10% margin money Period of finance 7 years recoverable in 14 half yearly installments Rate of markup is 16%. 17 | P a g e PPCBL CHOWK AZAM Required security AGRI land valuing double the amount of net finance. Eligibility of the borrower having 5 Acre of Agricultural land at least double of loan amount. PPCBL Business Finance (Individual) Maximum finance 0.5 million to 3.0 million Rate of markup 15% Required security Urban / Agri land or building valuable double the amount of finance Running finance to meet day to day working capital need to business. Period of finance one year subject to renewal of limit on annual basis PPCBL Home Loan Maximum finance 1.0 million to 3.0 million Rate of mark up 13% Minimum net salary 50,000/- or above per month as per the latest salary slip as provided by the borrower Debt burden ratio will be 50% of gross salary after including monthly installment of proposed House loan as mentioned in latest salary slip Minimum age 25 years and maximum age 55 years Two personal reference and two guarantors who will undertake to pay on behalf of primary borrower incase primary borrower fails to pay. 18 | P a g e PPCBL CHOWK AZAM Loan to value Ratio: Residential Building: 70.0% of market value of house as assessed by PBA approved Panel evaluator Construction of open plot: 60.0% of market value of plot as assessed by PBA approved Panel evaluator. 19 | P a g e PPCBL CHOWK AZAM 20 | P a g e Deputy Head HR & Operation /VP AGRI Credit and Recovery Officer Deputy Head Credit and Recovery /VP Operation Branch Officer Deputy Head Stat. and Compliance /VP Manager / AVP Cash Officer PPCBL CHOWK AZAM Zonal Head’s / SVP Legal Division SAM Division General Administration Division Internal Control and Compliance Division Audit and Inspection Division Risk Management and Credit Admin. Division HR Division Business Development Division Operation Division MANAGEMENT OF BANK President / CEO Department where I worked as internee First Day in The Punjab Provincial Cooperative Bank Limited: I started my internship program in Punjab Provincial Bank Limited. On first day of my program I was briefed by the branch manager about different branches of the bank I was also told the major rules and regulations which were being observed by the management of the bank I was also giving some briefing by the Manager Operation which proved as a miles stone during my internship program. I also met different members of the staff in different branches of the bank where am I SWOT for basic knowledge about those branches. Then I started my working in accounting opening department. Account Opening Department: In First week of my internship program, I worked in Account Opening department. The opening of an account is the establishment of banker customer relationship. Before a banker opens a new account, the banker should determine the prospective customer’s integrity, respectability, occupation and the nature of business by the introductory references given at the time of account opening. Account Opening Procedure: Account Opening Form: Customer approach to bank and an account opening is given to him for competing and signed by the account holder at different places of the form. 21 | P a g e PPCBL CHOWK AZAM Completion of the Form: Account form is completed in all respect and checked by the bank officer and is duly signed by the customer which is also verified by the Operation Manager. Specimen Signature Card (SSC): Signature specimen card is compulsory for opening an account in the bank. Without getting signature of customer you cannot open the account. Signature Difference Form: If client signature differs from the CNIC, the signature of the client is taken on a signature difference form Computerized Checking: The bank officer connected via internet to the NADRA website checks the record of his customer’s social life. If the record of the person is ok, then the officer of the bank authenticates the record under his signature and stamp and send it to the Branch Manager Account Number: Account number is written on the cheque book requisition. After completion of all procedures, the bank prepares a letter and sends it to the client at his postal address to pay gratitude to the customer. 22 | P a g e PPCBL CHOWK AZAM Cheque Book Issuance: The first cheque book consists of 25 leaves and no charges are deducted from the account the account of client. There after bank sends a recommendation for 25, 50 and 100 leaves with different prices and charges are deducted from the account of clients. Procedure for Closing of an account: If customer wants to close the account, he fills up an account closing form and signs there in, account balance should be zero, approval is taken from the Branch Manager Specimen card is taken back and is attached with the form and account is closed. Procedure of issuance of Bank Statement: A requisition slip is taken from the customer duly signed and the period from which the customer wants to take the statement. After verification of signature Bank Statement is issue to the customer and Rs. 55 are deducted from account of customer. Procedure for ATM/PIN Issuance: Punjab Provincial Bank Limited provides the ATM facility to its Customers and they can withdraw their amount at any time through ATM. For issuance of ATM, customer has to sign an ATM form and Bank office make an entry in the system and within 15 days bank receives ATM card from Head Office which is given to the customer. 23 | P a g e PPCBL CHOWK AZAM Accounts Department: When I completed my training in Account Opening Department, the Branch Manager sent me to Account Department. In Second week of my internship program, I worked in Accounts Department. Account department is responsible for budgeting keeping record of the revenue and expenses all transaction that are take place in the bank and their physical prove (voucher) are come to the account department next day these voucher are also posted to computer and the computer generated report of daily transaction is created in IT department and then they send to the account department to match or tell to computer generated report and their voucher of daily transaction and save it as a physical record that these transaction are take place in the bank at following date. The report generated by the accounts department on a daily, weekly, monthly, bi-yearly and yearly is written in a proper format. It is neither necessary nor possible to get acquainted by all of these reports in a short period of time. Some of the common reports are: Monthly Assets & Liabilities, Monthly Budget Review Report, Monthly Monitory statement, Monthly Performance Review Report and Monthly fixed investment. For these statements, five reports carry extreme importance. The five reports are: Daily position of advances and deposit, Statement of affairs, Daily exchange position report, fixed assets statement and Monthly review of performance. 24 | P a g e PPCBL CHOWK AZAM The account department of PPCBL has to record even the minor expenses of the branch like tea for staff, stationery for the branch. Remittance Department: In Third week of my internship program, I worked in Remittance Department. Remittance department transfers the fund form one bank to another bank and one place to another place. In this department collection take place. The Punjab Provincial Cooperative Bank Limited makes payment of only open cheque on the counter and prohibits the payment of crossed cheques. Punjab Provincial Bank Limited transfer money from one place to another place by way of payment order, demand draft, inward collection, outward collection. Demand Draft: An order to pay money to the payee who is residing outside the city, Demand draft can be for a customer who may or may not have and account in the bank but the other person’s account must be maintained with the bank for which the payer has demanded the demand draft. Payment Order: Pay order is order money but this payment is to be made within city. In other words it can be said that the payee and the payer should be in one city. In pay order payment can be made in cash, clearing and transfer. 25 | P a g e PPCBL CHOWK AZAM Clearing Department: In Fourth week of my internship program, I worked in clearing department. I learnt their about clearing of different cheques and remittance handling. I was told there the main objects of clearing. I received all the clearing cheques and made a schedule of these cheques after making entries in outward and inward clearing registers and sent the same to main branch where at all the cheques were sent to NIFT(National Institutional Facilitation Technology). NIFT: NIFT stand for National Institutional Facilitation Technologies. Clearing house of SBP has shifted a part of its work to private institution names NIFT. NIFT collets cheques, demand draft, pay order, travelers cheques etc. from all branches of different banks within city through its carriers and send them to the branches on which these are drawn for clearing. NIFT prepare a sheet for each branch and send it to each branch as well as to State Bank of Pakistan where accounts of Banks are settled. Types of clearing: Inward clearing: When cheques of other Banks are deposited in our bank, after clearing these cheques through NIFT by the other Banks on which these are down. Accounts of customers are credited. 26 | P a g e PPCBL CHOWK AZAM Outward clearing: When cheques of our bank are deposited in other Banks and these cheques are sent to us for verification, we debit the cash of our client after verification their account. Bill for Collection Department: In Fifth week of my internship program, I worked in Bill for Collection Department. Bill for collection is the clearing procedure for cheque; draft, bill of exchange, and promissory note in case that a collection branch and a paying branch are located in different clearing areas. Bill of collection provides service to their customer to get payment from the nearer bank at nominal chargers. Advance and Credit Department: In Six week of my internship program, I was worked in advance and credit department. Advances and credit department is the most important department in the bank in this department advances are giving to the business man, exporter etc. before giving advance, credit worthiness of the borrower is taken into account i.e. character, capacity, collateral, credit terms etc. advances are also given to different banks. 27 | P a g e PPCBL CHOWK AZAM BALANCE SHEET 28 | P a g e PPCBL CHOWK AZAM 29 | P a g e PPCBL CHOWK AZAM INCOME STATEMENT 30 | P a g e PPCBL CHOWK AZAM 31 | P a g e PPCBL CHOWK AZAM FINANCIAL ANALYSIS 32 | P a g e PPCBL CHOWK AZAM RATIO ANALYSIS: In finance, a financial ratio or accounting ratio is a ratio of two selected numerical values taken from an enterprise's financial statement. There are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. Financial ratios may be used by managers within a firm, by current and potential shareholders of a firm, and by a firm's creditors. Security analyst use financial ratios to compare the strengths and weaknesses in various companies. If shares in a company are traded in financial markets, the market price of the shares is used in certain financial ratios. Financial ratios allow for comparisons Among companies Among industries Among the different time periods for one company between a single company and its industry average The ratios of firms in different industries, which face different risks, capital requirements, and competition, are not usually comparable. Financial ratios quantify many aspects of a business and are an integral part of financial statement analysis. Financial ratios are categorized according to the financial aspect of the business which the ratio measures. Liquidity ratios measure the availability of cash to pay debt. Activity ratios measure how quickly a firm converts non-cash assets to cash assets. Debt ratios measure the firm's ability to repay long-term debt. Profitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return. Market ratios measure investor response to owning a company's stock and also the cost of issuing stock. Now there are some the calculation of the ratios which are shown in the tabular form below: 33 | P a g e PPCBL CHOWK AZAM Ratios 2020 2021 Current Ratio 1.07 1.53 Quick Ratio 0.49 0.88 4884922 39040081 1.28 1.20 0.21 1.48 9.13% 9.14% 0.93 0.91 Net Profit Margin 0.52 0.24 Return on Assets 1.36% 1.89 Operating Income Margin 44.17% 46.19% Operating Asset Turnover 2.92 2.51 Sales to Fixed assets 2.91 2.63 Return on Equity 17.5% 19.2% Gross Profit Margin 30.89% 30.60% Dividend Per Share 0.08 0.11 Earnings Per Share 2.43 1.70 Liquidity Ratios Working Capital Sales to working capital Leverage Ratios Interest Earned Debt Ratio Debt to equity Ratio Profitability Ratios Market Ratios 34 | P a g e PPCBL CHOWK AZAM PUNJAB PROVINCIAL C OOPERATIVE BANK LTD. BILLION (EPS: RS 2.43) IN FY07-08 COMPARED TO RS DECLARED PAT OF RS 1 0.985 BILLION (EPS : RS 2.39) IN FY06 REFLECTING A POSITIVE GROWTH MAINLY DUE TO UPSURGE IN NON - INTEREST INCOME . NET INTEREST INCOME GREW BY 9.6% TO RS FY06 DUE TO AN INCREASE OF PKR 4.7 1.93 BILLION IN FY 07 OVER RS 1.76 BILLION IN NET ADVANCES OF THE BANK ALONG WITH A HIGHER INTEREST RATE SCENARIO . THE GROWTH IN ADVANCES WAS 08, BILLION IN 13% IN 2007- WHICH HELPED THE BANK TO MAINTAIN ITS GROWTH MOMENTUM . IN THE YEAR , THE PROVISIONS INCREASED BY ALMOST SIX FOLDS FROM 36 MILLION (2020) TO 234 MILLION (2020-21). Noninterest income augmented by 41.5% to an amount of 1,064 million which is the major contributor to overall increase in profit before tax (1,476 million) despite of Non Performing Loans provisioning. This helped the bank to maintain its profitability. The noninterest income increased by PKR313 million during the period ended Dec-2020-21. The profit after tax has grown by 1.5% in the year 2020-21 as compared to 7.1% and 41.4% in 2020 and 2021 respectively. The profit trend has been falling in last few years. The falling profitability is in line with the industry, but the Soneri is severely affected than others. Considering 2007-08, the return on assets stood at 1.36% while the industry enjoyed a 2% Return on Assets. As compared to the industry (23% Return on Equity), the Soneri had a Return on Equity of 16.37% which is way less than the competing banks. The bank did not 35 | P a g e PPCBL CHOWK AZAM pay cash dividends; shareholders were given the option to accept bonus stock of approximately 30% (99million shares). The bank deposits have been growing. In 2020-21 alone, these recorded a growth of 13.5% that inflated the deposits to Rs 60 billion (2019: Rs 53 billion). This was the period when the banks didn't make high profits like the previous years. However, since the tightening of the monetary policy in 2006, the interest rates on deposits have increased, thus shrinking the spread that the sector had been enjoying. Moreover, budgetary measures along with monetary policy are all set to further decline the banking sector's spread in FY08. The bank's assets have also grown to PKR76.8 billion in 2020-21, a growth of 8.7% (2019: Rs 70.7 billion). The profits again have not been able to meet the assets growth. Resultantly, the Return on Assets has declined from 1.47% in 2019 to 1.36% in 2020. Compared to the industry average of 2.1%, Soneri Bank lacks behind by a fair margin. In line with the sector's trend, the investments have shown a great increase as compared to advances. The bank issued new shares worth PKR 997 million. This equity injection was done to meet the reserve requirements of the SBP and to finance its expansion plans. Overall, the bank's equity grew by 27.8% in 2020 to PKR 6.61 billion. 36 | P a g e PPCBL CHOWK AZAM SWOT ANALYSIS of PPCBL Strengths: The Punjab Provincial Cooperative Bank Limited has lack of staff members than the required staff level but its performance level is high as compared with its staff level. As a result of the compassionate and personalized services of the officers, the clients’ perception for PPCBL is very high. They have trust and feel themselves to be secure while dealing with PPCBL. PPCBL has opened all its branches at commercial areas so that the customers or clients face no problems in reaching to the bank. One employee in the bank performs many duties. All staff members treat their account holders/general public with well behavior. In Punjab Provincial bank, there is computerized system so performance automatically has been increased having better results. Good security system, diversification of investments, foreign reserves. Not excellent but good facilities are given to employees Weaknesses: Level of bad debts is improving at higher level. There is also lack of workplace in the Bank. 37 | P a g e PPCBL CHOWK AZAM Lack of proper internal controls is one of the major weaknesses of PPCBL. It is also pointed by the auditor in his review. PPCBL has formulized a lot of products and services for its customers, even more than other commercial banks, but any advertisement on electronic media has not been seen. I observed during my internship that some of the employees were burdened with over work. So I think that the work should be distributed according to their post and capabilities. As each staff member performs many duties in one time so this capture extra time which can slows down the performance. Due to lack of workplace, staff members as well as the general public face disturbance in the bank. Opportunities: The Punjab Provincial Cooperative Bank Limited compete its competitors by encouraging agriculture loans. So in such a way it plays an important role for promotion of agriculture sector. Information technology is the future of this dynamic world. Therefore PPCBL should emphasize much on IT, especially on E-Banking. Bank can design a universal account like other foreign banks, to enhance online facilities. 38 | P a g e PPCBL CHOWK AZAM Bank also encourages industrial sector. So in such a way most of industrialists deal with Punjab Bank Diversification, innovation and mission driven approach are the key to success. PPCBL has introduced a number of financial schemes including special ‘Deposit Accounts’. These accounts have their unique features. Great opportunity of starting Islamic banking system. Threats: Increase in no. of banks Modern type of banking The whole structure change to online Customer’s complaints Currently PPCBL is facing a strong competition by its competitors, Business of all these Banks are growing at very high pace. Low security, economic and political instability. 39 | P a g e PPCBL CHOWK AZAM PEST ANALYSIS Political Environment: When we are concerning about the political situation and the back ground of the country, we can see it has good stable government and political environment to develop Pakistan business without any problems or crisis. After over 50 years Pakistan is rapidly developing and foreign and local private investors are starting their investments in Pakistan because of this peace full environment is very good for developing their business. So, the banks have a vital role of this rapidly developing economy because of this peace full environment is pretty much suitable for developing the business. Economic Environment: When we are concerning economic factors which are affecting in to the banking industry and the financial market of Pakistan, mainly we can see the economic environment is very good & strong to develop the industry since it is open and highly competitive rapidly growing market. Also the economy is developing rapidly it creates more opportunities to develop business related services such as transport, Insurance, finance, advertising & etc. Because of very good economic back ground the demand of financial services such as corporate banking, leasing, loans & drafts, 40 | P a g e PPCBL CHOWK AZAM Social Environment: When we are concerning about the social environmental factors relating to the banking industry it has to focus customers age, cultural values and believes, income status, social classes and their behavior in order to develop and create competitive products and services and gain more competitive advantage in this rapidly changing highly competitive market. Social attitudes and believes are not strong in the rural community about the banking sector. So the Banking company have good opportunity to expand their market segments by well aware and attract more rural people to the banking industry and the financial market. Technological Environment: When we are analyzing about the technological environmental factors which are affecting Pakistani banking Industry and the financial market, as we all know technology is rapidly changing in daily so we have to develop our service according to rapidly changing modern technology otherwise our products and service become out of date. Also in this fastest growing modern technological world the financial sector is the one of most fastest changing field in the world. Because the world is now become a cash less society they are using E money such as credit cards, debit cards, E banking and online banking and etc. Also the world is changed the customers are not present in the bank at over the counter all are can be done by on line with in few seconds via internet at pleasure of home. 41 | P a g e PPCBL CHOWK AZAM Learning as a student internee (week wise) 1st week: In First week of my internship program, I worked in Account Opening department. I learnt about Account Opening department. 2nd week: In Second week of my internship program, I worked in Accounts Department. I learnt about Accounts Department. 3rd week: In Third week of my internship program, I worked in Remittance Department. I learnt about Remittance Department. 4th week: In Fourth week of my internship program, I worked in clearing department. I learnt about clearing of different cheques and remittance handling. 5th week: In Fifth week of my internship program, I worked in Bill for Collection Department. I learnt about Bill for Collection Department. 6th week: In Six week of my internship program, I was worked in advance and credit department. I learnt about advance and credit department. 42 | P a g e PPCBL CHOWK AZAM Applications of classroom learning Marketing management: I saw the employees in the marketing department of an organization are responsible for communicating to customers or clients why they need to purchase the goods or services offered. Marketing relays information to customers or clients and helps establish the overall image of the brand. HRM: The human resources management team suggests to the management team how to strategically manage people as business resources. This includes managing recruiting and hiring employees, coordinating employee benefits and suggesting employee training and development strategies. In this way, HR professionals are consultants, not workers in an isolated business function; they advise managers on many issues related to employees and how they help the organization achieve its goals. Accounting and Finance: In an organization, the financial accounting function is responsible for periodically reporting pecuniary information to business owners. Interested parties such as regulators, customers, investors and creditors often require this financial information. If banks refuse to rely on your accounting records, you will have trouble securing loans for your business. Financial accounting dictates the amounts you owe to suppliers, what customers owe you, operating 43 | P a g e PPCBL CHOWK AZAM costs, payroll costs and available cash. You can use financial accounting to analyze significant aspects of your business, such as monthly sales or the reasons for high expenses in one month. Principles of Management: Management principles are guidelines for the decisions and actions of managers. The Principles of Management are the essential, underlying factors that form the foundations of successful management. 44 | P a g e PPCBL CHOWK AZAM Recommendation: The Recommendation for the findings from the study is follows: PPCBL are required to motivate their supervisor, branch managers that they treat with their employees fairly PPCBL should improve its Performance appraisal system and it must be on merit Employee training is essential, PPCBL should conduct training program for their workers. PPCBL should make a good working condition; e.g. branch physical environment, working desk etc. if possible avoid overcrowding and allow each worker his or her own personal space. PPCBL should administer the associate performance review program PPCBL should build a formal recognition program, like employee of the month. Etc. PPCBL should care employees bonus, incentives and stock options PPCBL should motivate its employee with effective communication PPCBL should follows the sound recruitment policy PPCBL should also adopting a good marketing concept, advertising strategy, promotional activities 45 | P a g e PPCBL CHOWK AZAM Conclusion: Internship is an interesting program, which gave me the practical touch of the banking field. Through this, I learnt that what is the banking and its activities. I learnt from the bank officer and understood the operations of banking. This training program enhanced my knowledge about the banks. During internship, I worked in Accounts opening Department, Accounts Department, Clearing Department, Remittance Department, Advance and Credit Department and Bill for Collection Department. The investments, which are the part of earning assets, also decline. Therefore, the sources of the other income also decreased. The Branch is housed in small a banking premises which does not suffice the requirements of visiting clientele as well as corporate clients of the Bank. By having a glance over the current business of the branch, the same should immediately be shifted to some spacious building so that best banking services can be offered to the bank customers. Almost 90% branches of PPCBL are located in Punjab even in Karachi the hub of economic activities of Pakistan only 11 branches. Therefore, the market coverage of PPCBL is much lower. The political factor cannot be avoided in this regard because the Government of Punjab holds the majority of the shares so the government intervenes in the bank activities. 46 | P a g e PPCBL CHOWK AZAM BIBILIOGRAPHY: www.PPCBL.org.com www.PPCBL.org.pk www.google.com www.scribd.com www.pba.com.pk www.brecorder.com.pk www.investopedia.com 47 | P a g e PPCBL CHOWK AZAM