Finance Recruiting Guide for Western University Students

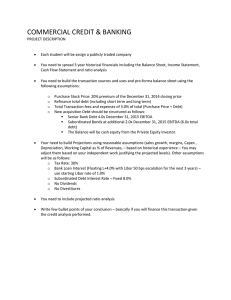

advertisement