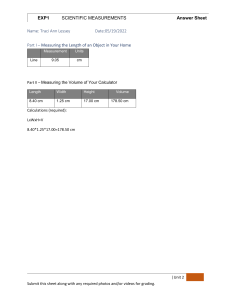

Learning Objectives 1. Use excel to solve annuity and perpetuity problems, NPV, IRR, PV 2. Understand how to use non-annual time intervals Lesley Tims Chapter 4 (Part 3): The Time Value of Money FNCE 317: Introduction to Finance Term: 2022 3. Given 4 of 5 inputs (PV, FV, N, r, PMT), compute the missing (for a single sum with no PMT it could be 3 out of 4 inputs) • Understand the use of the formulas/calculator • Solve for cash flow (a consumer loan problem) • Compute the IRR for a series of cash flows, given cash flows and either PV or FV • Solve for N periods given cash flows and rate !1 FNCE 317: 2022 Using a Spreadsheet/Calculator ❖ ❖ ❖ If you have 4 out of 5 variables, you can solve for the last one! Predefined functions : PV, NPV, IRR Understand the inputs and signage FNCE 317: 2022 !3 Spreadsheet Calculator Meaning Trick PV PV Present Value Usually negative PMT PMT Payment Constant RATE I/Y FV FV NPER N Do not put decimal # in calculator Error if Future there isn’t a Value negative Not Number necessarily of in years Periods match rate !2 Lesley Tims Make An Excel Annuity Calculator ❖ Understand the assumptions of the predefined functions ❖ Be sure to understand inputs ❖ Inputs are not consistent across functions ❖ Use simple formula with smart referencing Rate Lesley Tims ❖ IF formulas can help here ❖ Double check your work! ❖ Use goal seek for numerical solutions FNCE 317: 2022 !4 Lesley Tims Excel Spreadsheets Date ❖ ❖ 1 2 3 PV PMT PMT PMT NPER PMT+FV The excel functions are all based on a timeline of an annuity ❖ Test out your excel calculator: ❖ What would it cost us today to receive $30 every year for 6 years at 4% interest rate? They all solve the problem: NPV = PV + PMT * ❖ … 0 Excel Example 1 1 FV 1− + RATE ( (1 + RATE)N ) (1 + RATE)N Where you input four variables and solve for the fifth, ensuring the NPV=0 FNCE 317: 2022 !5 Lesley Tims FNCE 317: 2022 Excel Example !6 Lesley Tims Non-Annual Time Intervals ❖ Determine the correct rate for the specific time interval and the number of periods of this interval ❖ Test out your excel calculator: ❖ Ie. If it is a semiannual rate; ❖ What would it cost us today to receive $30 every year for 6 years at 4% interest rate? ❖ How many semiannual periods are there? => n ❖ Or make it an annual equivalent rate ❖ FNCE 317: 2022 !7 Lesley Tims Example: How many months does it take a $100 GIC to grow 15% at a monthly rate of 0.25%? FNCE 317: 2022 !8 Lesley Tims Non-Annual Time Intervals ❖ ❖ Determine the correct rate for the specific time interval and the number of periods of this interval ❖ Ie. If it is a semiannual rate; ❖ How many semiannual periods are there? => n ❖ Or make it an annual equivalent rate Savings Example on Excel ❖ You are considering a promotional savings account that pays interest of 2% every 18 months. You plan to deposit $600 every 18 months and keep the interest invested, starting in 18 months with your first deposit. What will the balance be in 9 years? Example: How many months does it take a $100 GIC to grow 15% at a monthly rate of 0.25%? You can use the excel calculator and/or you can use a timeline on excel and calculate the PVs and/or FVs PV=-100 FV=115 r=0.25 PMT=0 n=? n = 55.97 months or 4.66 years…. So 5 years! FNCE 317: 2022 !9 Lesley Tims Savings Solution FNCE 317: 2022 You may know the amount you would like to borrow (PV) and the amount you have to pay back (FV), but you might not know the loan payments (cash flow/constant = C) ❖ Blended payments of principal and interest ❖ A normal consumer loan is an arrears annuity (starts in one period) ❖ Solve for PMT by manipulating the annuity equation PV = !11 Lesley Tims A Consumer Loan (Solve for C using PV) ❖ FNCE 317: 2022 !10 Lesley Tims C 1 * 1− r ( (1 + r)n ) FNCE 317: 2022 C= !12 PV * r (1 − 1 (1 + r)n ) Lesley Tims Example - Consumer Loan A Consumer Loan (Solve for C using FV) ❖ You may know the amount you would like to borrow (PV) and the amount you have to pay back (FV), but you might not know the loan payments (cash flow/constant = C) ❖ ❖ ❖ ❖ Blended payments of principal and interest A normal consumer loan is an arrears annuity (starts in one period) You plan to purchase a house for $350,000. You need to make a down payment of 20% of the purchase price for the bank to lend you the rest on a 30-year loan. If the interest rate is 5% per year, what are your annual payments to the bank? C= Solve for PMT by manipulating the annuity equation C= FV = C/r * ((1 + r)n − 1) FV * r (1 + r)n − 1 !13 FNCE 317: 2022 Lesley Tims You plan to purchase a house for $350,000. You need to make a down payment of 20% of the purchase price for the bank to lend you the rest on a 30-year loan. If the interest rate is 5% per year, what are your annual payments to the bank? C= PV * r (1 − 1 (1 + r)n ) Lesley Tims !14 Lesley Tims IRR (Internal Rate of Return) ❖ When you know the cash flows and the PV of an investment opportunity, you might want to know the IRR: ❖ Internal Rate of Return = The interest rate that sets the NPV to zero ❖ Also known, in business as a discount rate or cost of capital ❖ There is no formula to solve for this (can’t manipulate annuity to solve for r) PV = ❖ !15 1 (1 + r)n ) FNCE 317: 2022 = (280,000*0.05)/ (1- (1/(1.05)30)) = $18,214 You can use this equation or your calculator and solve for PMT/C FNCE 317: 2022 (1 − You can use this equation or your calculator and solve for PMT/C Example - Consumer Loan ❖ PV * r C 1 * 1− r ( (1 + r)n ) Good thing your exam is multiple choice - Use trial and error! ❖ Or use your calculator 5 buttons and solve for I/Y ❖ Or use CF function and CPT IRR FNCE 317: 2022 !16 Lesley Tims Calculator Logistics (IRR) FNCE 317: 2022 !17 IRR Calculator Lesley Tims IRR Solution !18 FNCE 317: 2022 Lesley Tims Solving for the Number of Periods PV ❖ Can solve the equation for n, however we need to use ln ❖ If your algebra is not strong, thankfully the exam is multiple choice- Use trial and error! ❖ PV = Or Use your calculator 5 buttons with proper signs C 1 * 1− r ( (1 + r)n ) 1 1− C PV * r ln = (1 + r)n ( 1 − PVC* r ) !19 Lesley Tims FNCE 317: 2022 1 1− PV * r C = n * ln(1 + r) 1 ln(1 + r) FNCE 317: 2022 ln !20 =n Lesley Tims Solving for the Number of Periods FV ❖ We can do this using the FV equation as well ❖ Can solve the equation for n, however we need to use ln ❖ If your algebra is not strong, thankfully the exam is multiple choice- Use trial and error! Example - Solve for Number of Periods ❖ ❖ Or Use your calculator 5 buttons with proper signs FV = C/r * ((1 + r)n − 1) (1 + r)n = FV * r +1 C n= !21 FNCE 317: 2022 ln ( FV * r C ln + 1) ln(1 + r) You plan to purchase a house for $350,000. You need to make a down payment of 20% of the purchase price for the bank to lend you the rest. If the interest rate is 5% per year and the annual payments are $15,000, how long will it take you to pay back the loan? What if the payments were $20,000? Or $10,000? ln (1− 1 PV * r C ln(1 + r) ) =n 1 =n You can use this equation or your calculator or excel and solve for N (make sure your signs make sense) FNCE 317: 2022 !22 Lesley Tims Example - Solve for Number of Periods ❖ Instead you make a $70,000 investment today and add $20,000 every year to that account. If the interest rate is 5% per year, how many years until your investment is worth $1,200,000? FV = [P * (1 + r)n] + [C/r * ((1 + r)n − 1)] For $15,000 ln(15)/ln(1.05) = 2.708/0.04879 = 55.5 years Investment in future For $20,000 payment ln(3.3333)/ln(1.05) = 2.708/0.04879 = 24.6 years For $10,000 ln(1/(1-1.4))/ln(1.05) =ln(1/(-0.4))/ln(1.05) —> Can’t take ln of x<0 Therefore this won’t work if your PV*r > C !23 FNCE 317: 2022 ( 1 − PVC* r ) ln(1 + r) Lesley Tims Example - Solve for Number of Periods ❖ You plan to purchase a house for $350,000. You need to make a down payment of 20% of the purchase price for the bank to lend you the rest. If the interest rate is 5% per year and the annual payments are $15,000, how long will it take you to pay back the loan? What if payments were $20,000? Or $10,000? FV of annuity payments How good is your algebra?? —> Use your calculator and solve for N Lesley Tims FNCE 317: 2022 !24 Lesley Tims CHALLENGER PART 2 Example - Solve for Number of Periods ❖ Instead you make a $70,000 investment today and add $20,000 every year to that account. If the interest rate is 5% per year, how many years until your investment is worth $1,200,000? n n FV = [P * (1 + r) ] + [C/r * ((1 + r) − 1)] Investment in future FV of annuity payments ❖ How long will it take you to save for your down payment of $70,000? If you save $15,000 per year starting next year and the interest rate is still 5%. ❖ What if you start with savings of $10,000? ❖ What if you start with debt of $10,000? How good is your algebra?? —> Use your calculator and solve for N FNCE 317: 2022 !25 Lesley Tims CHALLENGER ❖ How long will it take you to save for your down payment of $70,000? If you save $15,000 per year starting next year and the interest rate is still 5%. ❖ What if you start with savings of $10,000? ❖ What if you start with debt of $10,000? FNCE 317: 2022 !27 Lesley Tims FNCE 317: 2022 !26 Lesley Tims