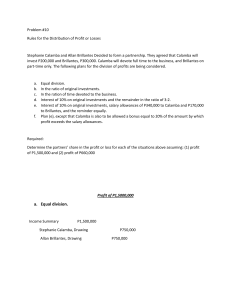

Problem #10 Rules for the Distribution of Profit or Losses Stephanie Calamba and Allan Brillantes Decided to form a partnership. They agreed that Calamba will invest P200,000 and Brillantes, P300,000. Calamba will devote full time to the business, and Brillantes on part-time only. The following plans for the division of profits are being considered. a. b. c. d. e. f. Equal division. In the ratio of original investments. In the ration of time devoted to the business. Interest of 10% on original investments and the remainder in the ratio of 3:2. Interest of 10% on original investments, salary allowances of P340,000 to Calamba and P170,000 to Brillantes, and the reminder equally. Plan (e), except that Calamba is also to be allowed a bonus equal to 20% of the amount by which profit exceeds the salary allowances. Required: Determine the partners’ share in the profit or loss for each of the situations above assuming: (1) profit of P1,500,000 and (2) profit of P660,000 Profit of P1,5000,000 a. Equal division. Income Summary P1,500,000 Stephanie Calamba, Drawing Allan Brillantes, Drawing P750,000 P750,000 b. In the ration of original investments. Income Summary P1,500,000 Stephanie Calamba, Drawing P600,000 Allan Brillantes, Drawing P900,000 Computation: Calamba: P1,500,000 × P200,000 / P500,000 = P600,000 Brillantes: P1,500,000 × P300,000 / P500,000 = P900,000 c. In the ratio of time devoted to the business. Income Summary P1,500,000 Stephanie Calamba, Drawing P1,000,000 Allan Brillantes, Drawing P500,000 Computation: Calamba: P1,500,000 × 2 ÷ 3 = P1,000,000 Brillantes: P1,500,000 × 1 ÷ 3 = P500,000 d. Interest of 10% on original investments and the remainder in the ratio of 3:2. Income Summary P1,500,000 Stephanie Calamba, Drawing P890,000 Allan Brillantes, Drawing P610,000 Computation: 10% interest in Original investment Calamba: P200,000 × 10% = P20,000 Brillantes: P300,000 × 10% = P30,000 Balance to be divided in the ratio of 3:2 (P1,500,000 – P50,000 = P1,450,000) Calamba: P1,450,000 × 3/5 = P870,000 Brillantes: P1,450,000 × 2/5 = P580,000 Share in Profit Calamba: P20,000 + P870,000 = P890,000 Brillantes: P30,000 + 580,000 = P610,000 e. Interest of 10% on original investments, salary allowances of P340,000 to Calamba and P170,000 to Brillantes, and the remainder equally. Income Summary P1,500,000 Stephanie Calamba, Drawing P830,000 Allan Brillantes, Drawing P670,000 Computation: Calamba Brillantes Total Salary Allowances P340,000 P170,000 P510,000 Interest in Original Investment P20,000 P30,000 P50,000 Balance to be divided equally (P1,500,000 – P510,000 – P50,000 = P940,000) Calamba: P940,000 × 50% P970,000 Brillantes: P940,000 × 50% Share in Profits P830,000 P470,000 P940,000 P670,000 P1,500,000 f. Plan (e), except that Calamba is also to be allowed a bonus equal to 20% of the amount by which profit exceeds the salary allowances. Profit of P660,000 a. Equal division. Income Summary P660,000 Stephanie Calamba, Drawing P330,000 Allan Brillantes, Drawing P330,000 b. In the ratio of original investments. Income Summary P660,000 Stephanie Calamba, Drawing P264,000 Allan Brillantes, Drawing P396,000 Computation: Calamba: P660,000 × P200,000 / P500,000 = P264,000 Brillantes: P660,000 × P300,000 / P500,000 = 396,000 c. In the ration of time devoted to the business. Income Summary P660,000 Stephanie Calamba, Drawing P440,000 Allan Brillantes, Drawing P220,000 Computation: Calamba: P660,000 × 2 ÷ 3 = P440,000 Brillantes: P660,000 × 1 ÷ 3 = P220,000 d. Interest of 10% on original investments and the remainder in the ratio of 3:2. Income Summary P660,000 Stephanie Calamba, Drawing P386,000 Allan Brillantes, Drawing P274,000 Computation: 10% interest on original investments Calamba: P200,000 × 10% = P20,000 Brillantes: P300,000 × 10% = P30,000 Balance to be divided in the ratio of 3:2 (P660,000 – P50,000 = P610,000) Calamba: P660,000 × 3/5 = P366,000 Brillantes: P660,000 × 2/5 = P244,000 Share in Profit Calamba: P20,000 + P366,000 = P386,000 Brillantes: P30,000 + P244,000 = P274,000 e. Interest of 10% on original investments, salary allowances of P340,000 to Calamba and P170,000 to Brillantes, and the reminder equally. Income Summary P660,000 Stephanie Calamba, Drawing P410,000 Allan Brillantes, Drawing P250,000 Computation: Calamba Brillantes Salary Allowances P340,000 P170,000 Interest on Orig. Investment P20,000 P30,000 Total P510,000 P50,000 Balance to be divided equally (P660,000 – P510,000P50,000 = P100,000) Calamba: P100,000 × 50% P50,000 Brillantes: P100,000 × 50% Share in Profit P410,000 P50,000 P100,000 P250,000 P660,000 f. Plan (e), except that Calamba is also to be allowed a bonus equal to 20% of the amount by which profit exceeds the salary allowances.