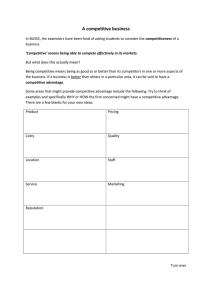

Environmental Analysis Environmental analysis is a strategic tool. It is a process to identify all the external and internal elements, which can affect the organization’s performance. The analysis entails assessing the level of threat or opportunity the factors might present. These evaluations are later translated into the decision-making process. The analysis helps align strategies with the firm’s environment. Our market is facing changes every day. Many new things develop over time and the whole scenario can alter in only a few seconds. There are some factors that are beyond your control. But, you can control a lot of these things. Example of environmental analysis tool SWOT Analysis PEST Analysis Economic Forces Economic factors may include costs such as wages, interest rates, governmental activity, laws, policies, tax rates, and unemployment. All of these factors occur outside of the business or investment itself, but they heavily influence the value of the investment in the future. These factors can also include any information that has an effect on the current or future value what is being examined. Let’s look at an example. Labor costs have been and continue to be one of the largest and most controversial economic factors in the world. Discussion and actions about it has led countless companies to turn to other countries for labor, commonly called outsourcing. Interest rates are integral to determining the costs and benefits of certain ventures and business decision. Interest rates are highly regarded in investment terms. When interest rates are higher, a response from many investors is to turn to more secure vehicles for returns, such as bonds or certificates of deposit (CDs). Government policies, laws, and taxes make up yet another reason why so many businesses and organizations have used foreign countries or have chosen particular to become incorporated or to handle operations. Physical Environment The physical environment is a vital component of the business environment in which you intend to operate or in which you already run your business irrespective of whether it’s conventional or online, small or big. It refers to the availability of resources that you need to run your business efficiently. These resources may generally include among other inputs like materials, services, land, climate, water, physical plants and facilities. Every business needs these resources to get started or to have its work done efficiently and effectively. Your physical environment comprises of both natural and human-made resources. Features like land, water, climate, wildlife and vegetation are natural components of the physical environment in which we live and operate our businesses. On the other hand, dams, roads, premises and much more are human-made resources that your business. Political Factors Political factors are government regulations that influence business operation positively and negatively. Managers must keep a bird’s eye view over political factors. These factors may be current and impending legislation, political stability and changes, freedom of speech, protection and discrimination laws are factors affecting business operation and activities With a change in administration policies, there arise political factors that can change the entire business scenario. These changes can be economic, legal or social and can include the following factors: Tax and economic policies: Increasing or decreasing rate of taxes is a good example of a political component. Government regulations may raise the tax rate for some businesses and can lower the same for others due to specific reasons. This decision will directly impact businesses. This is why maintaining a strategy which can deal with such situations is very important. Political stability: Lack of political stability within a country can significantly impact the operations of a business. This can especially be true for businesses that are operating on the global scale. For instance, a hostile takeover can take over a government. Eventually, such a situation will lead to looting, riots and general disorder within the environment. Such situations can disrupt business operations and activities which can have a major impact on its bottom line. Foreign Trade Regulations: Every business has a need to expand business operation to other countries. However, political background of a country can influence the desire for a business to expand its operations. Tax policies that are particularly controlled by the government can induce a particular business to expand operations in different regions whereas; other tax policies can hinder the process of business expansion for some industries. Government initiatives, which have been designed to support local businesses, might work against international companies when the question is of their competitiveness in a foreign region. Employment Laws: Employment laws are made to protect the rights of employees and include every aspect of employer/employee relationship. Employment law is an aspect that is very complex and involves several pitfalls as well. When businesses’ are in touch with the latest developments in this law, they can manage to take their business in the right direction however, those who get it wrong needs to be completely prepared for the expensive results it will generate. In modern corporations, employees are almost 98% of the company for the accomplishments or lack thereof and any changes within employment law will, of course, have a great impact on the business operations. Cultures and Lifestyles It includes belief systems and practices, customs, traditions and behaviours of all people in given country, fashion trends and market activities influencing actions and decisions. Socio-cultural perspective is one of the most important factor influencing decision of marketing managers and strategic goals of companies entering new foreign markets. It should be noted that legal factors affecting business is also considered as one of the major socio-cultural factors that can influence companies. Competition A competitive analysis is a critical part of your company marketing plan. With this evaluation, you can establish what makes your product or service unique--and therefore what attributes you play up in order to attract your target market. Evaluate your competitors by placing them in strategic groups according to how directly they compete for a share of the customer's dollar. For each competitor or strategic group, list their product or service, its profitability, growth pattern, marketing objectives and assumptions, current and past strategies, organizational and cost structure, strengths and weaknesses, and size (in sales) of the competitor's business. Answer questions such as: Who are your competitors? What products or services do they sell? What is each competitor's market share? What are their past strategies? What are their current strategies? What type of media are used to market their products or services? How many hours per week do they purchase to advertise through the media used in this market? What are each competitor's strengths and weaknesses? What potential threats do your competitors pose? What potential opportunities do they make available for you? A quick and easy way to compare your product or service with similar ones on the market is to make a competition grid. Down the left side of a piece of paper, write the names of four or five products or services that compete with yours. To help you generate this list, think of what your customers would buy if they didn't buy your product or service. Across the top of the paper, list the main features and characteristics of each product or service. Include such things as target market, price, size, method of distribution, and extent of customer service for a product. For a service, list prospective buyers, where the service is available, price, website, toll-free phone number, and other features that are relevant. A glance at the competition grid will help you see where your product fits in the overall market. The Circular Flow of Economic Activity The all pervasive economic problem is that of scarcity which is solved by three institutions (or decision-making agents) of an economy. They are households (or individuals), firms and government. They are actively engaged in three economic activities of production, consumption and exchange of goods and services. These decision-makers act and react in such a manner that all economic activities move in a circular flow. Households: Households are consumers. They may be single-individuals or group of consumers taking a joint decision regarding consumption. They may also be families. Their ultimate aim is to satisfy the wants of their members with their limited budgets. Households are the owners of factors of production—land, labour, capital and entrepreneurial ability. They sell the services of these factors and receive income in return in the form of rent, wages, and interest and profit respectively. Firms: The term firm is used interchangeably with the term producer in economics. The decision to manufacture goods and services is taken by a firm. For this purpose, it employs factors of production and makes payments to their owners. Just as household’s consumer goods and services to satisfy their wants, similarly firms produce goods and services to make a profit. Government: The government plays a key role in all types of economic systems capitalist, socialist and mixed. In a capitalist economy, the government does not interfere. It simply establishes and protects property rights. It sets standards for weights and measures, and the monetary system. The Circular Flow Of Economic Activity The circular flow of economic activity is a model showing the basic economic relationships within a market economy. It illustrates the balance between injections and leakages in our economy. Half of the model includes injections, and half of the model includes leakages. The circular flow model shows where money goes and what it's exchanged for. The model includes households, businesses and governments. We also have the banking system that facilitates the exchange of money and, as we'll see in a minute, helps to productively turn savings into investment in order to grow the economy. In the circular flow of the economy, money is used to purchase goods and services. Goods and services flow through the economy in one direction while money flows in the opposite direction. The Circular Flow Intra-Production Payment Flows In the circular flow, the transfer of money in payment in exchange for the counter-clockwise physical flow of goods and services. The payment flow is the monetary payment for goods and services received by the household sector from the business sector through product markets and the monetary payment for resource services obtained by the business sector from the household sector through resource markets. The payment flow is usually illustrated as a clockwise flow for a model with the product markets at the top, resource markets at the bottom, household sector at the left, and business sector at the left. The physical flow moves in the opposite direction. The payment flow, payments made in exchange for goods and services, highlights the essence of the circular flow model. While the physical movement of goods and services is important to the economy, the countering flow of payments provides greater insight into the complexity of the macroeconomy. Revenue collected by the business sector from selling goods is used to pay the services of the factors of production. These factor payments become income which is used by household sector to buy production from the business sector. This completes the circle back to revenue received by the business sector. Intra-Production Payment Flow Resources Production Payment Flow The physical flow, the physical movement of goods and services, is the foundation of the circular flow model. The fundamental problem of scarcity is addressed by physically transforming scarce resources into goods and services that are then used to satisfy wants and needs. This requires the physical exchange of commodities between the household sector, which has the resources, and the business sector, which produces the goods. The Economy's Producing Sectors The three main sectors of the economy are: Primary sector – extraction of raw materials – mining, fishing and agriculture. Secondary / manufacturing sector – concerned with producing finished goods, e.g. factories making toys, cars, food, and clothes. Service / ‘tertiary’ sector – concerned with offering intangible goods and services to consumers. This includes retail, tourism, banking, entertainment and I.T. services. Primary sector The primary sector is sometimes known as the extraction sector – because it involves taking raw materials. These can be renewable resources, such as fish, wool and wind power. Or it can be the use of non-renewable resources, such as oil extraction, mining for coal. In less developed economies, the primary sector will comprise the biggest part of the economy. Typically as an economy develops, increased labour productivity will enable workers to leave the agricultural sector and move to other sectors, such as manufacturing and the service sector. Examples of Primary Sector Farming Fishing Coal mining Forestry and logging, Oil extraction, Diamond mining. Secondary or manufacturing industry The manufacturing industry takes raw materials and combines them to produce a higher value added finished product. For example, raw sheep wool can be spun to form a better quality wool. This wool can then be threaded and knitted to produce a jumper that can be worn. Initially, the manufacturing industry was based on labour-intensive ‘cottage industry’ e.g. hand spinning. However, the development of improved technology, such as spinning machines, enabled the growth of larger factories. Benefiting from economies of scale, they were able to reduce the cost of production and increase labour productivity. The higher labour productivity also enabled higher wages and more income to spend on goods and services. Examples of manufacturing sector Small workshops producing pots, artisan production. Mills producing textiles, Factories producing steel, chemicals, plastic, car. Food production such as brewing plants, and food processing. Oil refinery. Service / tertiary sector The service sector is concerned with the intangible aspect of offering services to consumers and business. It involves retail of the manufactured goods. It also provides services, such as insurance and banking. In the twentieth century, the service sector has grown due to improved labour productivity and higher disposable income. More disposable income enables more spending on ‘luxury’ service items, such as tourism and restaurants. The main sectors of the service sector include: Retail industry Computer and I.T. services Hotels and tourism services Restaurants and Cafes Transport – rail, bus, air, sea Communication Banking services Insurance services Pension services Food and beverage services Postal services Competitiveness and Efficiency Competitiveness can be defined: For the company, competitiveness is the ability to provide products and services as or more effectively and efficiently than the relevant competitors. In the traded sector, this means sustained success in international markets without protection or subsidies. Although transportation costs might allow firms from a nation to compete successfully in their home market or in adjacent markets, competitiveness usually refers to advantage obtained through superior productivity. Measures of competitiveness in the traded sector include firm profitability, the firm's export quotient (exports or foreign sales divided by output), and regional or global market share. In the traded sector, performance in the international marketplace provides a direct measure of the firm's competitiveness. In the non-traded sector, competitiveness is the ability to match or beat the world's best firms in cost and quality of goods or services. Measuring competitiveness in the non-traded sector is often difficult, since there is no direct market performance test. Measures of competitiveness in this part of the economy include firm profitability and measures of cost and quality. In industries characterized by foreign direct investment, the firm's percentage of foreign sales (foreign sales divided by total sales) and its share of regional or global markets provide measures of firm competitiveness. Economic efficiency implies an economic state in which every resource is optimally allocated to serve each individual or entity in the best way while minimizing waste and inefficiency. When an economy is economically efficient, any changes made to assist one entity would harm another. In terms of production, goods are produced at their lowest possible cost, as are the variable inputs of production. Some terms that encompass phases of economic efficiency include allocative efficiency, productive efficiency, distributive efficiency, and Pareto efficiency. A state of economic efficiency is essentially theoretical; a limit that can be approached but never reached. Instead, economists look at the amount of loss, referred to as waste, between pure efficiency and reality to see how efficiently an economy functions. The Global Competitiveness Report (GCR) is a yearly report published by the World Economic Forum. Since 2004, the Global Competitiveness Report ranks countries based on the Global Competitiveness Index, developed by Xavier Sala-i-Martin and Elsa V. Artadi. Before that, the macroeconomic ranks were based on Jeffrey Sachs's Growth Development Index and the microeconomic ranks were based on Michael Porter's Business Competitiveness Index. The Global Competitiveness Index integrates the macroeconomic and the micro/business aspects of competitiveness into a single index. The report "assesses the ability of countries to provide high levels of prosperity to their citizens". This in turn depends on how productively a country uses available resources. Therefore, the Global Competitiveness Index measures the set of institutions, policies, and factors that set the sustainable current and medium-term levels of economic prosperity."