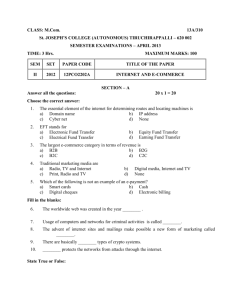

ABOUT OUR PLATFORM We have created an online e commerce b2c website concept which has been created to link consumers directly to their desired stores. Through Tundamart a customer can order products directly from their favourite retail stores and have them picked up by our shoppers and delivered directly at their doorsteps. All stores to be registered on our website are to be registered with KYC identification and a trading license number so they are legally registered stores. This insures customer security and also takes out competition from unlicensed sellers. Stores will also be given a dashboard where they can track their sales and customers and also a profile where they can update their information, location and even upload links Therefore, the potential project simplifies shopping experience for the consumers, allowing them to get access to all the information and details about the different products of different stores, without even visiting them, saving their time and efforts and even have the delivered by our shoppers direct at their doorsteps. The Vision The company's vision is to make local shopping as easy and convenient as it is possible for the consumers, and create extra opportunities for local retailers. The Mission We are creating a technology start-up with the mission of making buying goods faster and more convenient by finding all your desired products in one place and from a range of stores. It combines the benefits of traditional shopping with the convenience of online shopping. We provide the consumers with a wide range of items from numerous local retailers, filtering them according to price, size, colour, brand, manufacturer etc. The shoppers have the possibility to reserve the desired item and pick it up later in the shop, or order it online and receive it within 1 to 2 business days. The company aims to ensure long-term profitability and growth due to innovation, uniqueness, social awareness, and high-quality service. Shopping should be a fast, easy and smooth experience, not distracting us from life real goals and objectives BUSINESS FRAMEWORK THE E-COMMERCE INDUSTRY MODE OF OPERATION SWOT ANALYSIS Marketing strategy Risk management FORMALITIES INVOLVED OPERATIONAL SYSTEM MARKET STUDY HR STRUCTURE Financial forecast PRODUCT STRATEGY TECHNOLOGY OVERVIEW THE E-COMMERCE INDUSTRY The UAE e-commerce market is on an upward trajectory, driven by the demand for online purchasing by a young tech-savvy population. With the country comprising a high percentage of digital native millennials who are at ease with technology, the expectation is for seamless and convenient online purchasing. Merchants have striven hard throughout the 2010s to meet the ever-increasing consumer demand for e-commerce and have recognized the need for online presence to ensure business continuity and longevity. While traditional bricks and mortar retail is still very strong in the UAE, these retailers have acknowledged the need for a dual face to face and online strategy with the focus on customer experience. These are complemented by e-commerce “pure play” retailers who have been increasing consumer product choice, both organically and through partnerships, and smaller retailers coming online facilitated by online commerce platforms and payment gateway capability. Both demand and supply sides are supported by logistics infrastructure that is on a-par with some of the most developed ecommerce markets in the world. In addition, e-commerce start-ups continue to attract significant investment, supported by government policies promoting innovation and a cashless economy, all resulting in enhanced consumer trust and a thriving e-commerce market in the UAE poised for significant growth. The COVID-19 pandemic has further accelerated retailers’ innovation and digital transformation plans, in response to the sudden consumer demand to shop online. The step change in demand across the first half of 2020 is sure to have a lasting effect over the next few years, as many consumers and merchants have shifted consumer behaviour and gained confidence in online purchasing during this time. In this fast-growing market, when e-commerce is becoming the norm, there is still significant opportunity to grow and shape consumers’ path to purchasing products online. FORMALITIES INVOLVED Trademark Registration Trademark registration protects the brand name, domain name, logo, slogan, etc. used by the ecommerce business and prevents anyone from using it without permission or license. Tax Registration Tax registration for GST return filing is mandatory for all ecommerce businesses in Dubai Shop and Establishment Registration We will also be required to obtain the State regulated Shop and Establishment registration certificate to run a backend office. Vendor Agreements Vendor agreements between our company and its product vendors laying down the conditions relating to supply of goods, prices, quality standards, etc. Service Level Agreements Service level agreements define the terms and conditions relating to any business services availed by the ecommerce retail store, such as logistics, internet services, etc. Employment and HR Documents Employment agreement lays down the terms of employment for the business’s employees and staff; HR Documents include HR policies and procedures relating to code of conduct, promotions, complaints, appraisals, etc. Terms of Use Our mission is the reason why our company exists. We want to make the shopping experience more dynamic and simple where someone can virtually shop from stores of their choice and have their products delivered in time. Privacy Policy The Privacy policy lays down the manner in which user or visitor information would be manage by the company Disclaimer A disclaimer frees the business from any liability arising out of content posted by any user or third party. Refund, Return and Cancellation Policy This policy lays down the conditions relating to order refunds, product returns and order cancellation by customers. TECHNOLOGY OVERVIEW The key feature of an ecommerce business is undoubtedly its digital platform. We have built the platform to be able to handle bulk traffic and be compatible with web browsers such as Mozilla, Firefox, edge, chrome, etc., and mobile operating systems such as iOS and Android. We also plan on our ecommerce business website having complete data backup on an external server as well for full-backup 1. Our plan is the UI/UX Designs creating a user-friendly and attractive ecommerce platform that allows a seamless buying experience 3. We plan on building Mobile Application tools includes programming languages, and suites for developing the mobile app such as: For iOS App, programming languages like Objective-C, Swift; toolkit like Apple Xcode; iOS SDK for application programming interface. For Android App, programming languages such as Java, Kotlin; Android Studio & Android Developer Tools as toolkits; Android SDK for API integration. 2. UX/UI WEBSITE STACK MOBILE APPLICATION PAYMENT GATEWAY We plan on designing the Website Slack involving frontend and backend development tools such as: • Programming languages such as JavaScript, PHP and Python for the backend, and • HTML, JavaScript, and CSS for the frontend 4. We plan on incorporating a Payment Gateway to receive payment for online purchases, such as gateway with ability to receive payments through Cash on Delivery, NEFTs, UPI, debit and credit card payments like flutterwave and also mobile payments. SWOT ANALYSIS Strengths • • • • Lower Maintenance Costs 24*7 Store Accessibility Digital-savvy consumers and consumer readiness in the region support further growth of e-commerce going forward Low online penetration rates compared to global leaders like China imply there is still significant room for growth of online sales compared to store-based retailing Weaknesses • • Online payment gaps remain as consumers still prefer cash on delivery, ultimately resulting in lower trust by consumers for online purchases. Delivery and logistics challenges continue to hamper growth in online retailing, mainly relating to the speed and cost of delivery in the region. Opportunities • • • • • Connectivity to a large customer base Barriers to location are removed Increasing competition in the online space will likely lead to further investment by major players in an effort to maintain their dominant position Growth of third-party delivery services offers opportunities for companies to reach a wider audience both locally and globally. Greater acceptance of online platforms is expected to reshape the way people shop, with many returning to online shopping after the Covid 19 outbreak. Threats • • • Hit or miss digital marketing Highly competitive business sector E-commerce players are under pressure to take more control of their delivery services to ensure consistent, timely deliveries and a higher rate of returning consumers. HR STRUCTURE Our plan is to have an experienced and skilled Human Resource team that can efficiently handle the digital operations as well as on-field activities. We plan on hiring subject matter and industry experts from different fields as team heads for core departments such as product management, technology, sales, marketing, logistics, finance, etc., and establish its internal HR department to recruit experienced individuals who possess subject matter knowledge. BOARD OF DIRECTORS This will be the CEO, other executives and investors who will be responsible for the total control and quality of operations. TEAM LEADERS Here we will have PR and marketing management in charge of establishing partnerships with suppliers and contract agreements, establishing cooperation with influencers/bloggers, finance issues and accounting ASSOCIATES These will mainly be store ownersDBBBB and suppliers as well as sponsors and partners that we will be working with. SUPPORT STAFF IT Support will be in charge of maintenance and future developments, Customer Support Specialist will be in charge of settlement of any issues of the customers. Supplier Relationship Specialist will supervise the quality of suppliers' work as well as deliveries. DELIVERY STAFF Most of the delivery staff will be outsourced and will not be fulltime employers of the company but will however get paid depending on the number deliveries thy make. BOARD OF DIRECTORS TEAM LEADERS ASSOCIATES SUPPORT STAFF DELIVERY STAFF PRODUCT STRATEGY This could be described as systems and processes enabling the organisation to deliver the service. Three major categories during the process can be distinguished: • Pre-sales process: communication with suppliers, cooperation with suppliers, creating and updating their portfolio, ensuring availability of requested goods, quality of goods; • Sales process: user friendly ordering process, security during transactions performed on the website, security of data collected and stored from the customers, efficient response to customers' requests and enquiries, ensuring prompt and reliable delivery, monitoring the quality of suppliers' work • After – sales process: prompt attention to complaints, courtesy calls. Starting as a small company, we will execute a quite flexible approach of process. We will enrich the experience of the customers by engaging them in the interactive community of shoppers and selected trendsetters, who will give tips and share major trends in their articles, prompting community discussions and different interactive competitions. We also plan on providing the following features; • Searching products by model, type, manufacturer, price etc. • Searching products by browsing through a number of stores • Filtering suggestions according to specifications • Visibility of the remaining stock (sizes, colours, locations) • Providing store locations on a map, this is a feature we plan on coming up with later • Possibility to reserve the product or order online and exchange at the local shop, we also plan on having this feature on later • Computer/tablet/smartphone mode • Quick deliveries within 1 to 2 business days • 24 hour shopping experience OPERATIONAL SYSTEM Purchasing Process There will be no subscription fee to open up a store and set up is completely free, however we will charge a 5% commission fee for grocery sales and 10 % for all other sales When the customer orders the product online from the stores there will be a few options of payment. The payment procedure will be easy and safe, as it is one of the key requirements for customers to make purchase in the internet. We will offer three kinds of payment opportunities: • Payment with PayPal, which is considered one of the easiest and safest methods of online payments • Payment with credit/debit card/ Visa • payment with cash at the time of receiving goods. Delivery We will be responsible for the delivery of the products through outsourced shoppers, but there will be generally guidelines applied: • There will be fixed delivery charge, however it could adjusted depending on the size of the product and distance to delivery point. • Orders will be delivered within 1-2 business days • Orders done till 12 am, will be delivered on the same day, afternoon and evening orders will be delivered on the next day. • Deliveries will be mainly done during business days, though weekend delivery is possible, if coordinated and confirmed with the suppliers Returns In case the customer wants to return their order, we are not responsible for any refunds or returns unless the product is faulty, misplaced or isn’t the product that the customer ordered for. However if a customer has any further inquiry or complaint, they can contact the store they purchased from and show them the purchase order. If things aren’t resolved, they can leave a review or contact our team so we can contact the supplier directly and resolve the issue. The Internet and E-commerce penetration in the Middle East 90% of population using the internet Countries from the Middle East, such as the UAE, Saudi Arabia, Oman and Kuwait, have relatively high internet penetration rates, with more than 90% of the population using the internet. 70% of Middle East population use mobile devices to access the internet This parameter discloses an even bigger difference between countries in the region. The UAE is a clear leader in this category, with 84% of its population using mobile devices for browsing, e-commerce or other similar activities, followed by Turkey at 74% and India at just 17%. 5% of total Middle East retail sales are through e-commerce. E-commerce penetration in the Middle East has almost doubled in 2020 compared to 2019 (from 3% to 5%) on the back of COVID-19 accelerating digitalization. E-commerce in the Middle East is growing at a faster rate than countries like China as retailers accelerate the shift to online, further encouraged by digital-savvy populations. RISK MANAGEMENT POLICIES Management and mitigation of risks is critical for business since it is susceptible to an array of risk factors. We plan on laying down an internal and external policy or strategy which is essential to counter any such situations TYPE OF RISK RISK MANAGEMENT PLAN TECHNOLOGY DATA ENCYPTION AND BACKUPS ACCOUNT FRAUD FRAUD DETECTION API VENDOR DISPUTES LEGAL CONTRACTS CONSUMER DISPUTES USAGE POLICIES MARKET STUDY The UAE’s e-commerce sales were projected to hit $16 billion in 2019. Currently, the UAE is considered the most advanced e-commerce market in MENA, with a penetration rate of 4.2%, compared to advanced western markets such as the UK (15.6%), U.S. (12.3%) and France (10%)6 . Its consumer demographic includes a young internet-savvy population, with high social media usage. These people are more likely than some of their cohorts globally to spend time online. E-commerce companies, whether they are online marketplaces, domestic retailers, or cross-border merchants, are tapping into this high latent demand, disposable incomes, and digital penetration that is favourable for the sector. UAE consumers are among the most connected in the world, with some of the highest levels of internet, smartphone, and social media penetrations globally; much higher than most of the mature e-commerce markets7 . The internet plays a critical role in their path to purchase – discovery, research, and actual purchase. Regardless of whether they shop online or in-store, UAE consumers are heavily influenced by their online activities. The UAE retail industry - classified into store and non-store sales, which include e-commerce – was estimated at $55 billion in 2018 and forecast to rise to $63.8 billion by 2023. The e-commerce segment is classified under non-store retailing, which encompasses online shopping, direct selling, mobile internet, social media, and home shopping. The non-store category is forecast to grow by 78% from 2018 to 2023 . Additionally, developed logistics infrastructure, financial account penetration and support for digital payments, increased consumer trust in online transactions, increased retailers’ adoption of e-commerce platforms and government policies which support innovation and entrepreneurial activities are all supporters for e-commerce growth in the UAE. At first, the demographic criterion age of the end users will be analysed, as well as the geographic criterion type of area and social criterion class. The conclusions are based on the results previously obtained from our research as well as on the information provided by online surveys Age - According to the survey the largest part of the consumers (70%) are young males and females aged 19-24, 26-35 years old. People aged 36-45 represented should also be considered since they represent 21%. Consumers aged 46-55 years old represent a small percentage of 8%. According to our research, the highest proportion of internet users is aged 16-24, 25-54 years old. Area - At first the project will be targeted at the consumers in Dubai area. Later, with gaining more popularity and stability, other U.A.E cities will be considered (Abu Dhabi, etc.). Social class - Obviously, to take advantage of any kind of service it is necessary to have funds of it, thus unemployed people and people with low income tend to represent a relatively small percentage of the end users. Still, the service provided by the project allows to compare different items according to the price criterion, and therefore can be beneficial for those consumers looking for a deal or wishing to save money. In conclusion, the target-market to which the company will appeal are middle and upper-middle consumers in the U.A.E area, aged 19-55, due to the little interest shown by people above 55 years old in this service. Still the demographic pattern tends to change over time, since the population is ageing each current year. Therefore, in future the company will include the older age bracket in its target by making sure that the current target-market is loyal to the company and satisfied with the services. MENA e-commerce per category as a percentage of total E-commerce (2020) 8.4 19.2 3.6 1.9 MEDIA PRODUCTS HOMEWARE AND HOME FURNISHING CONSUMER HEALTH CONSUMER ELECTRONICS BEAUTY AND PERSONAL CARE 29.3 21.9 CONSUMER APPLIANCES HOME CARE FOOD AND DRINKS APPAREL AND FOOTWEAR 6.7 OTHERS 6.7 1.5 1.4 MARKETING STRATEGY Marketing is an important component of business growth as it can boost brand recognition and sales. Through marketing customers are given information that can motivate them to purchase a product or service. We will be new to the market, therefore being in the initial phase of the life cycle of the brand. During this phase, the emphasis on marketing should be put on PR activities and community creation in order to generate awareness and build the positive image and attitude among the parties, benefiting from the service. The main message in marketing activities will be according to the positioning, mission and vision of the company, which has been described before, therefore emphasizing the benefits of traditional shopping with the convenience of online shopping in one single simple solution. We will promote our brand using traditional advertising channels, such as TV, newspapers or radio, print materials and billboards as well as using modern channels like social media and google ads PAID ADVERTISING NEWSPAPER AND MAGAZINE ADS CONSUMER FORUMS BILLBOARDS PHYSICAL CHANNELS PRINT MARKETING TOOLS, FLYERS,BANNERS SEARCH ENGINE OPTIMIZATION DIGITAL CHANNELS SOCIAL MEDIA MARKETING GOOGLE PLAY ADS EVENTS TELEVISION AND RADIO ADS FINANCIAL FORECASTING With the growth rate of ecommerce sector in the U.A.E predicted to multiply in the coming years, new ecommerce players have outstanding opportunities to enter the ecommerce market and harness latest technologies and employ customer-centric services, and establish a successful and viable ecommerce business in the country. Future Trends The long-term impact of COVID-19 has encouraged retailers and suppliers to restructure their logistical operational models to remain robust, adaptive, and agile. This has ushered in various new trends set to reshape the industrial and logistics sector moving forward. Supply chain management The main challenge for many companies in a post pandemic world is proofing or developing resilience in their supply chains in the face of future disruptions. According to a study by Capgemini Research Institute, almost 66% out of 1,000 organisations surveyed stated that their supply chain strategies would need to change significantly to adapt to the new normal. This not only ensures business continuity but can also provide a competitive advantage. A clear contingency plan, and the localisation and diversification of products and sources, are among the key capabilities needed to ensure supply chain resilience. Timeliness and last-mile delivery The pandemic has accelerated consumers’ shopping habits and their delivery expectations, increasing stores’ promising on-demand services. Along with grocery and convenience stores, the food industry was the first to deliver products to homes within the hour. Now more retailers are promising to get products to doorsteps within the same day and even within hours. This calls for more sophisticated and efficient distribution models and complex last-mile delivery models that ensure a satisfactory customer experience. Data & Technology As the proliferation of property technology increases, the industry will likely witness greater automation in the various processes and stages involved across the supply chain. Artificial intelligence-based technologies, for example, have the ability to automate administrative tasks and plan supply chain processes. Integrating robotics can reduce human error. Last-mile delivery tools, such as drones and smart lockers, are also integral to logistics as they improve customer satisfaction. Lastly, data is essential to providing actionable insights for improving warehouse productivity and the optimal utilisation of resources supply chains. Sustainability The pandemic has reminded us of the fragility of our ecosystem and is expected to drive the increased focus on sustainability and environmental, social and corporate governance issues. With real estate accounting for 40% of greenhouse gas emissions, sustainability in the built environment and transportation and logistics will shape the future of real estate recovery. Major corporates will increasingly seek to decarbonise their logistics to reduce their energy costs, meet regulatory demand, and satisfy customers. The increasing levels of e-commerce adoption and subsequent demand for warehouse space will continue to push the performance of the logistics sector in 2021. Over the next several years, increased requirements for last-mile facilities are anticipated to keep up with online shopping demand. In addition, supply chains will be re-evaluated with more focus on creating efficient and carbon-neutral USD MNS UAE E – COMMERCE SALES 27.082 15.994 2019 e/f = estimate/forecast 19.772 2020 22.346 2021 2022 SOURCE: Fitch Solutions data