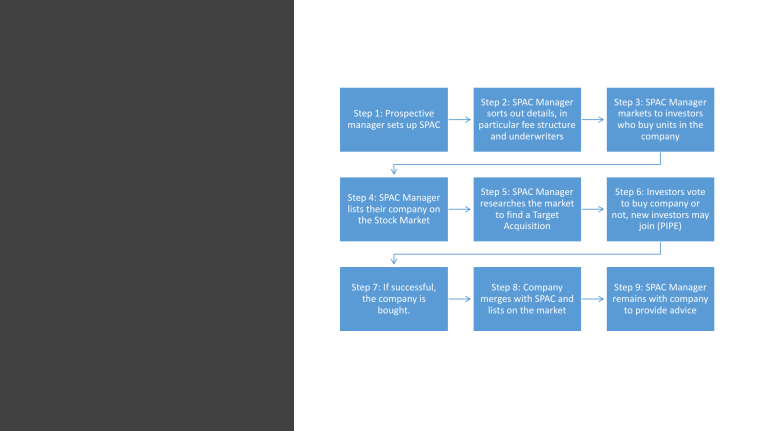

Step 1: Prospective manager sets up SPAC Step 2: SPAC Manager sorts out details, in particular fee structure and underwriters Step 3: SPAC Manager markets to investors who buy units in the company Step 4: SPAC Manager lists their company on the Stock Market Step 5: SPAC Manager researches the market to find a Target Acquisition Step 6: Investors vote to buy company or not, new investors may join (PIPE) Step 7: If successful, the company is bought. Step 8: Company merges with SPAC and lists on the market Step 9: SPAC Manager remains with company to provide advice