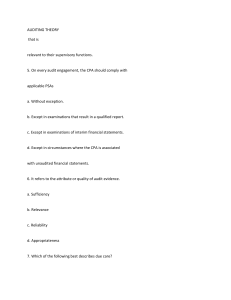

True or False. Chapter 1 1. Assurance engagements require independence on the part of the auditor. 2. The degree of satisfaction achieved (the level of assurance which may be provided) is directly related to the scope of procedures performed and their results. 3. Assurance refers to the responsible party's satisfaction as to the reliability of an assertion being made by one party for use by another party. 4. Assurance engagements performed by professional accountants are intended to enhance the credibility of information 5. An engagement may be classified as an assurance engagement once it meets all six elements required by the Framework for Assurance Engagements. 6. The responsible party and the intended user need to be from separate organizations. 7. The term practitioner is broader in scope compared to the term auditor. 8. A professional accountant may agree to perform an assurance engagement which they are not competent to carry out. 9. The responsible party or parties is the person(s) responsible for the subject matter. 10. The responsible party is always the one who engages the professional accountant. 11. The intended user is the person or class of persons who engages the professional accountant/CPA 12. The responsible party may also be one of the intended users. 13. The subject matter of an assurance engagement may be presented as a point in time or covering a period of time. 14. Criteria are the standards or benchmarks used to evaluate or measure the subject matter of an assurance engagement. 15. In the case of an audit of financial statements, the suitable criteria to be used are Philippine Standards on Auditing (PSAs). 16. Appropriateness refers to quantity, while sufficiency refers to quality, of evidential matter. 17. Evidence obtained directly by the practitioner is less reliable than evidence obtained indirectly or by inference. 18. The responsible party expresses a conclusion that provides a level of assurance as to whether the subject matter conforms, in all material respects, with the identified suitable criteria. 19. In an attestation engagement, the professional accountant expresses a conclusion on the subject matter based on suitable criteria, regardless of whether the responsible party has made a written assertion on the subject matter. 20. The CPA's conclusion provides a level of assurance about the subject matter. 21. Absolute assurance is attainable owing to the fact much of the evidence available to the CPA is persuasive rather than conclusive. 22. Professional standards prohibit CPAs from performing non-assurance engagements. 23. An agreed-upon procedures engagement is an assurance engagement. 24. Non-assurance engagements include: compilations, tax consulting, and compliance audits. 25. Consulting services are two party contracts.