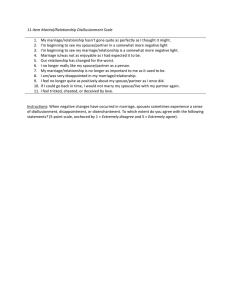

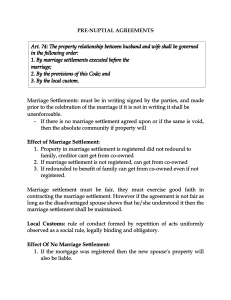

Matrimonial Property Regimes in South Africa Presentation by Caleb Kipa LLB (Cum Laude) & Bcom Law – University of Johannesburg Introduction • Many couples wish journey to marriage as stress free and pleasurable as possible. • Many couples disregard the importance of the matrimonial property regime that will govern their marriage. • The unfortunate reality in South Africa and most developed counties is that many marriages end in divorce. • There are three types of of matrimonial property regimes in South Africa; namely, marriage in community of property; marriage out of community of 2 property with the accrual; and marriage out of community of property without the accrual. • These regimes are governed in terms of the Matrimonial Property Act 88 of 1984. Marriage in Community of Property 3 • The most popular regime is marriage in community of property. Which is also the default position. • The reason for this is due to the fact that it is the default regime and requires no antenuptial contract. • Being married in community of property results in the estate of the husband and wife joining and becoming one joint estate. • The implication of this means that the one spouse could be held responsible for any debt incurred by one’s spouse, which includes debt that was incurred before marriage. • What do we mean by joint estate – husband car, money and house before marriage and wife's car, money and businesses before wedding – after wedding forms part of joint estate and the husband and wife each are entitled to 50% of the value of each item in the joint estate during the marriage and after divorce. 4 • In general, subject to certain exceptions, a spouse in a MICOP may perform any juristic act in respect of the joint estate without the consent of the other spouse. • However, because you are in a joint estate – the actions of the one spouse affects the action of the other spouse. Therefore the law has listed a number of actions which a spouse cannot do without the permission of the other spouse I will list some of the below: Sell, mortgage any immovable property of the joint estate; Sell, cede or pleadge any shares, stocks, insurance policies that form part of the joint estate; Sell or pledge jewellery, coins, stamps or paintings that are held mainly as investments and form part of the joint estate; Enter into a credit agreement as a consumer – incurring loans; Enter into a contract for the purchase of immovable property; Institute legal proceedings; or Binding oneself as a surety – quickly this means that you can not enter into an agreement in which you offer to pay the debts of another if such person fails to pay the debts – without permission of the other spouse. 5 • In the event that you want to enter into an excluded transaction however the other spouse unreasonably withholds consent, the spouse can apply to the court for permission to enter into the transaction without the consent of their spouse, if the court is satisfied that the consent has been unreasonably been withheld and there is good reason to dispense with the consent. For example – you want to buy a house on auction – it is affordable, can get it cash, or if on credit low interest rate – unreasonable to withhold consent especially when we know property value always appreciates. • It is also worth mentioning that certain assets are excluded from the joint estate for example – • Damages awarded to a spouse arising from a delictual claim (payout from road accident fund for being involved in an accident). 6 Marriage out Community of Property 7 • The most common reason why people elect to marry out of community of property is to protect their assets and financial position prior to and during the marriage. • How to conclude ANC – what are the requirements and procedures A marriage out of community of property is achieved by drawing up an antenuptial contract (ANC). The ANC will be the most important contract that a married couple will sign in their lifetime. Entered into before marriage, the purpose of the contract is to change some or all of the automatic financial consequences of marriage. The ANC allows the husband and wife to tailor-make their very own matrimonial property regime. They can include any provisions they like in their ANC, as long as the provisions are not against the law, good morals or the nature of marriage. 8 Registration of the ANC • Only an attorney who is a notary public may execute an ANC. It is important that both parties consult with the notary public beforehand. • Once the ANC has been drafted, both parties and the notary public must sign it in duplicate prior to the marriage. • The ANC will then be forwarded to the deeds office in the area where the parties reside to be registered. • Registration must be affected within three months of the date it was signed by the notary public. • Apart from the usual fees, a prescribed fee is payable to the deeds office upon registration of the contract. When you marry out of community of property, there are two options to consider regarding your ANC – with accrual or without accrual. 9 Marriage out Community of Property (with the accrual) 10 • When you marry out of community of property it means that each spouse retain ownership of the assets acquired before and during the marriage and the other spouse does not have any claim or right of such assets. • The ‘accrual’ is the extent to which the husband and wife have become richer by the end of the marriage • When you marry of community of property with the accrual it means that: At the dissolution of the marriage (whether by divorce or death of one or both spouses), the spouse whose estate shows no accrual or a smaller accrual than the estate of the other spouse acquires a claim against the other spouse or his estate. The claim is for an amount equal to half of the difference between the accrual of the respective estates of the spouses. 11 • First we need to explain How is the accrual of the estate calculated: • It is the difference between the net value of the spouses individual estate at the commencement of the marriage against the net value of the spouses individual estates at the dissolution of the marriage. Husband value of estate at date of wedding is R2 million and at date of divorce is R3 million = therefore the accrual in his estate is R1 million. Wife value of estate at date of wedding R1,5 million and at date of divorce is R1,7 million = therefore the accrual of the wife's estate is R200 000. • The husbands estate is bigger compared to the wife’s. Therefore the wife has a claim over the husbands estate. • How does one calculate the wife’s claim? 12 • Wife will be entitled to an amount equal to half of the difference between the accrual of the two estates. The difference of the two estates is R1 million – R200 000 = R800 000 / 2 = R400 000. Therefore the wife will be entitled to R400 000 from the husband's estate at divorce or death. • The antenuptial agreement can exclude certain assets from the estate. For example the husband can exclude a cars he buys during the marraige. If the car is worth R300 000. The husbands accrual will not be 1 million but R700 000 because you excluded vehicles purchased from the calculation of the accrual. Therefore the wifes claim would be calculated as R700 000k – R200 000 = R500 000 / 2 = R250 000. 13 Marriage out Community of Property (with the accrual) 14 What about inheritances, legacies and donations? • Inheritances, a legacy or donation that a spouse acquires during the marriage does not form part of the accrual of his estate. So if during the marriage the wife inherited a house from her father and the value of the house was R5 million, you would not include that R5 million into the calculation of the accrual of the wife’s estates. Forefeiture of right to accrual sharing or assets in joint estate • The Divorce act provides that the court may make an order that the patrimonial benefits of the marriage be forfeited by one party on favor of the other, if the court having considered the duration of the marriage, the circumstances which gave rise to the break-down of the marriage, or substantial misconduct by either spouse, is satisified that if the order for forfeiture is not made, the one party will in relation to the other be unduly benefited. Examples: married for a short period (i.e 6 months) , abusive spouse, spouse cheated. 15 Marriage out Community of Property (without the accrual) 16 • There is no joining of the spouses’ estates into one joint estate. • Each spouse has his/her own separate estate, consisting of his/her premarital assets and debts, and all the assets and debts he/she acquires during the marriage. • ANC must state that the marriage is out of community of property without accrual. 17 Marriage out Community of Property (with the accrual) 18 Advantages and disadvantages of the matrimonial property regimes 19 Advantages of marriage out of community of property: • Each spouse keeps his/her own assets and is free to deal with his/her own estate as he/she likes. • Spouses are generally not liable for each other’s debts. Thus, if one spouse becomes insolvent, creditors cannot touch the assets of the other spouse. • The financially stronger spouse does not have to share his/her estate with the financially weaker spouse. This is subject to judicial discretion and forfeiture of benefits – unless married out of community with the accrual then the financially weaker spouse has a claim. Disadvantages of marriage out of community of property: • The economically weaker spouse, traditionally the woman, does not get to share in the estate of the stronger spouse, even though she may have indirectly contributed to the estate by running the household and looking after the children - unless married out of community with the accrual then the financially weaker spouse has a claim. • An ANC has to be entered into in order to marry out of community of property. This costs money, and the parties must pay the fees of a notary and costs of registration. 20 Advantages of marriage in community of property: • There are no upfront legal costs involved for the preparation of an antenuptial contract. • As both parties are effectively working together for the benefit of the joint estate, this form of a marital regime can encourage togetherness, equality and oneness of purpose. Disadvantages of marriage in community of property: • One of the greatest disadvantages of this marital regime is that the couple remains jointly liable for each other’s debt, including debt that was incurred before the marriage. If one spouse is unable to pay his/ her debts the credit may go after the other spouse for the debt. • The management of the joint estate can also be cumbersome as spousal consent is needed in certain circumstances, such as selling fixed property, withdrawing from a joint bank account, or selling assets from the joint estate. 21 Post-nuptial agreements 22 • Couples are however allowed to amend their matrimonial property regime to one of out of community of property. • Section 21 (1) of the Matrimonial Property Act provides that a married couple may jointly apply to court to amend their current matrimonial property regime. • It is prudent to note at this point that there are quite a number of requirements that have to be met in order to amend a marital regime. • The court may order a change of the matrimonial property regime, if satisfied that— o there are sound reasons for the proposed change; o sufficient notice of the proposed change has been given to all the creditors of the spouses; and o no other person will be prejudiced by the proposed change. 23 Conclusion 24 • It is important to reiterate that it is of paramount importance that both parties to the marriage understand the implications and consequences of the type of matrimonial property regime they are entering into. Unfortunately, couples focus so much on the big day that they disregard the implications of neglecting to make a well-informed decision regarding the regime that will inevitably govern their marriage. • It is important to bear in mind that should you get married in community of property and later decide that you would prefer to change your matrimonial property regime to one out of community, you can do so but it involves a High Court Application that is both expensive and not guaranteed to be successful. 25 The End. Thank you! Presentation by Caleb Kipa LLB (Cum Laude) & Bcom Law Admitted Attorney of the High Court