[Wiley Trading] Al Brooks - Trading Price Action Reversals Technical Analysis of Price Charts Bar by Bar for the Serious Trader (2012, Wiley) - libgen.lc

advertisement

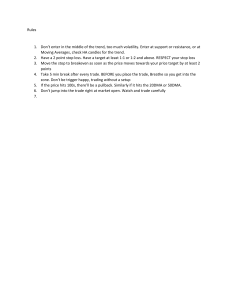

![[Wiley Trading] Al Brooks - Trading Price Action Reversals Technical Analysis of Price Charts Bar by Bar for the Serious Trader (2012, Wiley) - libgen.lc](http://s2.studylib.net/store/data/025809584_1-735dafef7f2e8832f8cf516c06efa10a-768x994.png)