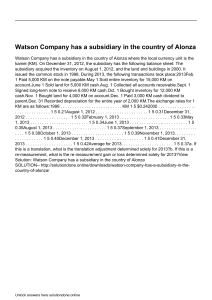

CHAPTER 1: THEORIES TRUE OR FALSE 1. When two entities competing in the same industry combine, it is called a horizontal business combination. TRUE 2. Horizontal business combinations are likely to occur when management is attempting to dominate a geographic segment of the market. FALSE 3. One way that a horizontal business combination can increase sales for an entity is to expand into new product markets. TRUE 4. A vertical business combination generally involves companies attempting to improve the efficiency of operations by purchasing suppliers of inputs or purchasers of outputs. TRUE 5. When a retail clothing store purchases a competitor in city, a vertical combination has occurred. FALSE 6. A vertical combination is one where the entities have a potential buyer-seller relationship. TRUE 7. A business combination in which a supplier of raw materials is acquired is a conglomerate combination. FALSE 8. A conglomerate combination is often undertaken to help increase income stability due to diversifying the asset base of an entity. TRUE 9. Conglomerate combinations are easy for the government to challenge in court. TRUE 10. If negotiation between management groups leads to a mutually agreeable business combination, the process is called a friendly takeover. TRUE 11. An offer by an acquirer to buy the stock of another company is commonly called a tender offer. TRUE 12. A tender offer that is opposed by the acquiree management is called a hostile bid. TRUE 13. Greenmail exists when a company is encouraged to buy a potential acquiree. FALSE 14. A poison pill is the term used to describe the issuance of a special kind of convertible preferred stock to deter the acquisition of the company. FALSE 15. The sale of the crown jewels defensive maneuver involves the sale of more assets than does the scorched earth defense. FALSE 16. The fatman defensive maneuver involved the acquisition of assets by the potential acquiree. TRUE 17. Golden parachutes give a bonus to all employees if the company is acquired. FALSE 18. The packman defensive maneuver is where a potential acquire attempts to purchase the acquirer. TRUE 19. A business combination occurs when one entity gains control over the net assets of another entity. TRUE 20. The only way to attain control over the net assets of another entity is to purchase the net assets. FALSE 21. In an acquisition where the acquirer pays cash for the acquiree assets, the book value of the acquirer increases. FALSE 22. In an acquisition of assets for assets, the ownership structure of the acquiree does not change. TRUE 23. In an acquisition of assets for assets, the ownership structure of the acquirer changes. FALSE 24. There is an increase in the total capitalization of an acquirer when the acquirer issues stock for acquiree assets. TRUE 25. In an exchange of stock (acquirer) for assets (acquiree), the ownership structure of the acquiree does not change. TRUE 26. In an exchange of stock (acquirer) for assets (acquiree), the acquiree stockholders become acquirer stockholders. FALSE 27. Control over the acquiree assets is directly achieved in an asset for asset exchange but indirectly achieved in an asset (acquirer) for stock (acquiree) exchange. TRUE 28. A business combination that occurs where only one of the original entities in existence after the combinations called a statutory consolidation. FALSE 29. The acquiree entity is liquidated in a statutory merger. TRUE 30. For a business combination to qualify as a statutory consolidation, a new corporation must be formed. TRUE 31. In a statutory consolidation form of business combination, the Retained Earnings account of the newly formed corporation has a balance of zero immediately after the combination. FALSE 32. After completing a business combination in the form of a statutory merger or statutory consolidation, there is only one legal entity in existence. TRUE 33. In a business combination accomplished as a stock acquisition normally two companies exist after the combination. TRUE 34. A business combination accomplished as a stock acquisition must be accomplished with a stock for stock exchange. FALSE 35. A stock acquisition is the only form of business combination that might require the preparation of consolidated financial statements. TRUE 36. The substance of statutory mergers, statutory consolidations, and stock acquisitions is the same if income tax considerations are ignored. TRUE 37. There are no uncertainties when two companies agree on a business combination. FALSE 38. When the acquisition price of an acquiree is contingent on acquiree future earnings, the acquisition price may change? TRUE 39. When the acquisition price of an acquiree is contingent on the market value of the acquirer stock, the acquisition price may change? FALSE 40. For business combinations to qualify as reorganizations (for tax purposes), the acquiree Stockholders must receive voting common stock of the acquired. FALSE 41. There are different required levels of stock ownership in the acquiree for the three different types of reorganizations for tax purposes. TRUE 42. One important benefit in a business combination is any net operating loss carry forward that might exist and be available to the acquirer. FALSE MULTIPLE CHOICE 43. Which of the following types of business combinations typically occurs when management is tempting to monopolize a particular industry? HORIZONTAL COMBINATION 44. Horizontal business combinations occur when one entity purchases which of the following? A COMPETITOR 45. Horizontal business combinations help sales increase by all but which of the following? TAKING CONTROL OF A DISTRIBUTION SYSTEM 46. Which of the following types of business combinations typically occurs when management is attempting to improve the efficiency of operations? VERTICAL COMBINATION 47. A vertical combination occurs when one entity acquires another entity which has the following characteristic(s)? EITHER A OR C (The acquiree purchases the acquirer's outputs; The acquiree supplies raw materials to the acquirer.) 48. Which of the following is a vertical combination? A COMBINATION WHERE THE TWO ENTITIES HAVE A POTENTIAL BUYER/SELLER RELATIONSHIP 49. Which of the following types of business combinations typically occurs when management is attempting to diversify its investment? CONGLOMERATE COMBINATION 50. Management acquires a business in a tangentially related industry to the current business. What form of business combination is accomplished? CONGLOMERATE COMBINATION 51. One reason for conglomerate combinations is that management has become more aware that it helps accomplish which of the following? IT HELPS INCREASE INCOME STABILITY PROVIDED BY DIVERSIFYING THE ASSET BASE OF AN ENTITY 52. Business combinations that result in one dominant company in an industry are said to have formed which of the following? MONOPOLY 53. The business enterprises that enter into a business combination are termed the: CONSTITUENT COMPANIES 54. When an offer is made to acquire a company and the acquiree management supports the offer, the offer is called which of the following? FRIENDLY TAKEOVER 55. The defensive maneuver where a company buys stock from a potential acquirer at a premium over the market price is called which of the following? GREENMAIL 56. The defensive maneuver where a company seeks to be acquired by a company perceived to be a better match than the company making an offer to buy the potential acquiree is called which of the following? WHITE KNIGHT 57. Company A makes a hostile take-over bid for control of Company B. In response, Company B makes a counteroffer to purchase shares from Company A's shareholders. Which of the following best describes Company B's response? PACMAN DEFENSE 58. Company A has made an offer to purchase all of the outstanding shares of Company B for P10 per share (the current market value of the shares). In response to Company A's offer, the shareholders of Company B were given rights to purchase additional shares at P8 per share. Which of the following tactics was employed by Company B to prevent Company A from acquiring control of Company B? POISON PILL 59. What is the term used for the defensive maneuver where management of a potential acquiree sells desirable assets to reduce the company's value? SALE OF THE CROWN JEWELS 60. Shark repellent is a term for administrative measures that may make a hostile takeover more difficult. Which of the following is not a form of shark repellent? ISSUANCE OF CONVERTIBLE PREFFERED STOCK THAT CONVERTS INTO COMMON STOCK OF THE ACQUIRER IF A TAKEOVER IS ACCOMPLISHED. 61. Defensive maneuvers can be internal to the potential acquiree (management or stockholders) or may involve activities external to the acquiree. Which of the following is, not an internal defensive maneuver? PACMAN DEFENSE 62. Able Ltd. offers to buy shares from the existing shareholders of Wei Co. at a premium price. The current management and board of directors of Wei have let the Wei shdreholders know that they do not approve of this. This is an example of a(n)? HOSTILE TAKEOVER 63. Control over an acquiree can be attained through which of the following? EITHER ACQUISITION OF THE ACQUIREE ASSETS OR STOCK 64. In an acquisition of assets, the acquirer must give up which of the following? ANY OF THE ABOVE CAN BE GIVEN 65. In an acquisition where there is an exchange of assets for assets, how does the value of the acquiree net assets change? THE NET ASSETS MAY INCREASE, DECREASE OR REMAIN THE SAME 66. In an acquisition where there is an exchange of assets for assets, how does the ownership structure of the acquiree change? THERE IS NO CHANGE IN THE ACQUIREE OWNERSHIP STRUCTURE 67. In an acquisition where there is an exchange of assets for assets, how does the ownership structure of the acquirer change? THERE IS NO CHANGE IN THE ACQUIRER OWNERSHIP STRUCTURE 68. In an acquisition where there is an exchange of stock (acquirer) for assets (acquiree), how does the value of the acquiree net assets change? THE NET ASSETS MAY INCREASE, DECREASE OR REMAIN THE SAME 69. In an acquisition where there is an exchange of stock (acquirer) for assets (acquiree), how does the ownership structure of the acquiree change? THERE IS NO CHANGE IN THE ACQUUREE OWNERSHIP STRUCTURE 70. In an acquisition where there is an exchange of stock (acquirer) for assets (acquiree), how does the ownership structure of the acquirer change? THE ACQUIREE COMPANY BECOMES A STOCKHOLDER OF THE ACQUIRER 71. Control over acquiree assets is attained in a business combination. Indirect control is attained in which type of exchange? STOCK FOR STOCK 72. Which of the following forms of business combination is not subject to laws specific to business combinations? ASSET FOR ASSET ACQUISITION 73. Which of the following is not a true statement with regard to a statutory merger? THE NAME OF THE NEW ENTITY IS NOT THE SAME AS EITHER OF THE ENTITIES 74. Which of the following is not true with regard to the statutory consolidation form of business combination? THE NET ASSETS OF THE COMBINING ENTITIES MUST BE ACQUIRED WITH ASSETS OF THE NEW CORPORATION 75. Following the completion of a business combination in the form of a statutory consolidation, what is the balance in the new corporation's Retained Earnings account? THE ACQUIRER RETAINED EARNINGS ACCOUNT BALANCE 76. Which of the following is not true with regard to a business combination accomplished in the form of a stock acquisition? ALL OF THE ABOVE STATEMENTS ARE TRUE 77. Which of the following contingencies may change the cost of an acquisition? FUTURE ACQUIREE EARNINGS 78. To qualify as a reorganization (for tax purposes), a business must meet which of the following criteria? ALL OF THE ABOVE CRITERIA ARE REQUIRED FOR A COMBINATION TO QUALIFY AS REORGANIZATION 79. Which of the following is not a business combination? JOINT VENTURE 80. Under PFRS 3, Business Combinations, which method must be used to account for business combinations? ACQUISITION METHOD 81. After an exchange of shares in a business combination, each group of shareholders held 50% of the voting rights. Which of the following factors should be considered in determining the acquirer? COMPOSITION OF THE BOARD OF DIRECTORS 82. Perez Co. plans to acquire Roo Co. Roo has substantial depreciable assets that have fair values in excess of their book values. Considering only the income tax impact, which of the following statements is true? PEREZ WOULD PREFER TO PURCHASE ROO'S ASSETS AND ROO WOULD PREFER TO SELL ITS SHARES TO PEREZ. 83. Perez Co. acquired Roo Co. in a business combination. Roo issued new shares to Perez's shareholders in exchange for their outstanding shares. What type of share exchange is this? REVERSE TAKEOVER 84. Perez Co. acquired Roo Co. in a business combination. Perez issued new shares to Roo's shareholders in exchange for their outstanding shares. What type of share exchange is this? HOSTILE TAKEOVER 85. Ha Ltd. and Hee Ltd. exchanged shares in a business combination. After the s are exchange, each company held the same number of voting shares. Which of the following statements is true? A NUMBER OF FACTORS MUST BE CONSIDERED TO DETERMINE WHICH COMPANY IS THE ACQUIRER 86. How should the transaction costs of issuing shares in an acquisition be recognized? DEDUCTED FROM SHAREHOLDERS' EQUITY, NET RELATED INCOME TAX BENEFITS 87. How should the cost of issuing debt in an acquisition be recognized? DEDUCTED FROM THE VALUE OF THE DEBT 88. How should accounting fees for an acquisition be treated? EXPENSED IN THE PERIOD OF ACQUISITION 89. Which of the following is not a reason why a private enterprise may be acquired as a bargain purchase? THE BUSINESS ONLY HAS EQUITY FINANCING AND HAS NO DEBT FINANCING 90. Which of the following statements about a bargain purchase is true? ASSETS AND LIABILITIES OF THE ACQUIRED COMPANY ARE REPORTED AT THEIR FAIR VALUE 91. What is the most common valuation method used for intangible assets? INCOME-BASED 92. How should negative goodwill be shown on the consolidated financial statements of the acquirer? AS A GAIN ON THE STATEMENT OF COMPREHENSIVE INCOME 93. Raj Co. acquired all of Event .Ltd.'s common shares. At the date of acquisition, Event had P80,000 of goodwill resulting from its acquisition of Baker Ltd. a few years ago. At Raj's date of acquisition, what is the proper treatment of Event's P80,000 of goodwill? EVENT'S GOODWILL IS NOT AN IDENTIFIABLE ASSET AND SHOULD NOT BE INCLUDED AS PART OF RAJ'S PPD. 94. Which of the following does NOT constitute a Business Combination under IFRS 3? A CORP ENTERS INTO A JOINT VENTURE WITH B CORP 95. What is a statutory merger? A BUSINESS COMBINATION WHICH ONLY ONE COMPANY CONTINUES TO EXIST AS A LEGAL ENTITY 96. Statutory merger is a(n)? BUSINESS COMBINATION WHICH ONLY ONE OF THE TWO CONPANIES CONTINUES TO EXIST AS A LEGAL CORPORATION 97. Liabilities assumed in an acquisition will be valued at the? ESTIMATED FAIR VALUE 98. In reference to the IASB disclosure requirements, which of the following is correct? NOTES TO FINANCIAL STATEMENTS OF AN ACQUIRING CORPORATION MUST BE DISCLOSED THAT THE BUSINESS COMBINATION WAS ACCOUNTED FOR BY THE ACQUISITION METHOD. 99. Goodwill arising from business combination is: NEVER AMORTIZED 100. In reference to international accounting for goodwill, which of the following statements is correct? ALL OF THE ABOVE ARE CORRECT 101. In recording acquisition costs, which of the following procedures is correct? CONSULTUNG FEES ARE EXPENSED 102. Which one of the following statements is incorrect? A STOCK ACQUISITION OCCURS WHEN ONE CORPORATION PAYS CASH, ISSUES STOCK, OR ISSUES DEBT FOR ALL OR PART OF THE VOTING STOCK OF ANOTHER COMPANY; AND THE ACQUIRED COMPANY DISSOLVES AND CEASES TO EXIST AS A SEPARATE LEGAL ENTITY 103. Which of the following can be used as consideration in a stock acquisition? ANY OF THE ABOVED MAY USED 104. Slocum Corporation and Merton Company, both publicly owned companies, are planning a merger, with Slocum being the survivor. Which of the following is a requirement of the merger? THE BOARD OF DIRECTORS BOTH SLOCUM AND MERTON MUST APPROVE THE MERGER 105. PFRS 3 requires that all business combinations be accounted for using? EITHER THE ACQUISITION OR THE POOLING OF INTERESTS METHODS 106. Under the acquisition method, if the fair values of identifiable net assets exceed the value implied by the purchase price of the acquired company, the excess should be? ALLOCATED TO REDUCE ANY PREVIOUSLY RECORDED GOODWILL ON THE SELLER'S BOOKS AND CLASSIFY ANY REMAINDER AS AN ORDINARY GAIN 107. PFRS 3 requires that the acquirer disclose each of the following for each material business combination except the? EACH OF THE ABOVE IS A REQUIRED DISCLOSURE 108. When the acquisition price of an acquired firm is less than the fair value of the identifiable net assets, all of the following are recorded at fair value except? EACH OF THE ABOVE IS RECORDED AT FAIR VALUE 109. Under PFRS 3: BOTH DIRECT AND INDIRECT COSTS ARE TO BE EXPENSED 110. A business combination is accounted for properly as an acquisition. Which of the following expenses related to effecting the business combination should enter into the determination of net income of the combined corporation for the period in which the expenses are incurred? NO, YES 111. In a business combination, which of the following costs are assigned to the valuation of the security? NO, YES 112. Parental Company and Sub Company were combined in an acquisition transaction. Parental was able to acquire Sub at a bargain price. The sum of the fair values of identifiable assets acquired less the fair value of liabilities assumed exceeded the cost to Parental. After eliminating previously recorded goodwill; there was still some "negative goodwill." Proper accounting treatment by Parental is to report the amount as? AN ORDINARY GAIN 113. With an acquisition, direct and indirect expenses are? EXPENSED IN THE PERIOD INCURRED 114. In a business combination accounted for as an acquisition, how should the excess of fair value of net assets acquired over the consideration paid be treated? RECORDED AS AN ORDINARY GAIN 115. If the value implied by the purchase price of an acquired company exceeds the fair values of identifiable net assets, the excess should be? ALLOCATED GOODWILL 116. P Co. issued 5,000 shares of its common stock, valued at P200,000, to the former shareholders of Company two years after S Company was acquired in an all-stock transaction. The additional shares were issued because P Company agreed to issue additional shares of common stock if the average post combination earnings over the next two years exceeded P500,000. P Company will treat the issuance of the additional shares as a (decrease in)? PAID-IN CAPITAL 117. The fair value of assets and liabilities of the acquired entity is to be reflected in the financial statements of the combined entity. When the acquisition takes place over a period of time rather than all at once, at what time is the fair value of the assets and liabilities of the acquired entity determined? THE DATE THE ACQUIRER OBTAINS CONTROL OF THE ACQUIREE 118. Under PFRS 3, what value of the assets and liabilities is reflected in the financial statements on the acquisition date of a business combination? FAIR VALUE 119. What is the appropriate accounting treatment for the value assigned to in-process research and development acquired in a business combination? CAPITALIZE AS AN ASSET 120. An acquired entity has a long-term operating lease for an office building used for central management. The terms of the lease are very favorable relative to current market rates. However, the lease prohibits subleasing or any other transfer of rights. In its financial statements, the acquiring firm should report the value assigned to the lease contract as? AN INTANGIBLE ASSET UNDER THE CONTRACTUAL-LEGAL CRITERION. 121. Under PFRS 3, when is a gain recognized in consolidating financial information? WHEN ANY BARGAIN PURCHASE IS CREATED 122. Company B acquired the net assets of Company S in exchange for cash. The acquisition price exceeds the fair value of the net assets acquired. How should Company B determine the amounts to be reported for the plant and equipment, and for long-term debt of the acquired Company S? Plant and Equipment FAIR VALUE Long-Term Debt FAIR VALUE 123. Goodwill represents the excess cost of an acquisition over the? SUM OF THE FAIR VALUES ASSIGNED TO TANGIBLE AND IDENTIFIABLE INTANGIBLE ASSETS ACQUIRED LESS LIABILITIES ASSUMED. 124. When an acquisition of another company occurs, IASB recommends disclosing all of the following EXCEPT: RESULTS OF OPERATIONS FOR THE CURRENT PERIOD IF BOTH COMPANIES HAD REMAINED SEPARATE 125. Separately identified intangible assets are accounted for by amortizing: BASED UPON A PATTERN THAT REFLECTS THE BENEFITS CONVEYED BY THE ASSET 126. Acquisition costs such as the fees of accountants and lawyers that were necessary to negotiate and consummate the purchase are? EXPENSED IN THE PERIOD OF THE PURCHASE 127. Which of the following income factors should not be factored into an estimation of goodwill? EXTRAORDINARY ITEMS CHAPTER 2 CHAPTER 3 1. An Investor adjusts the investment account for the amortization of any difference between coast and book value under the FAIR VALUE MODEL 2. Goodwill is: GENERALLY SMALLER FOR SMALL COMPANIES AND INCREASES IN AMOUNT AS THE COMPANIES ACQUIRED INCREASE IN SIZE. 3. Under the cost method, the workpaper entry to establish reciprocity. CREDITS-RETAINED EARNINGS P-COMPANY 4. Under the cost method, the investment account is reduced when NONE OF THESE 5. The parent company records its share of a subsidiary’s income by NONE OF THESE 6. In years subsequent to the year of acquisition, an entry to establish reciprocity is made under the COST MODEL 7. A parent company received dividends in excess of the parent company’s share of the subsidiary’s earnings subsequent to the date of the investment. How will the parent company’s investment account be affected by those dividends under each of the following accounting methods? NO EFFECT (Cost Method and FV Method) 8. Consolidated net income for a parent company and its partially owned subsidiary is best defined as the parent company’s INCOME FROM INDEPENDENT OPERATIONS PLUS SUBSIDIARY’S INCOME RESULTING FROM TRANSACTIONS WITHOUTSIDE PARTIES. 9. In preparation of a consolidated statements workpaper, dividend income recognized by a parent company for dividends distributed by its subsidiary is ELIMINATED 10. In the preparation of a consolidated statement of cash flows using the indirect method of presenting cash flows from operating activities, the amount of the non-controlling interest is consolidated income: COMBINED WITH THE CONTROLLING INTEREST IN CONSOLIDATED NET INCOME 11. A parent company uses the partial equity method to account for an investment in common stock of its subsidiary. A portion of the dividends received this year were n excess of the parent company’s share of the subsidiary’s earnings subsequent to the date of the investment. The mount of dividend income that should be reported in the parent company’s separate income statement should be THE PORTION OF THE DIVIDENDS RECEIVED THIS YEAR THAT WERE IN EXCESS OF THE PARENTS’S SHARE OF SUBSIDIARY’S EARNINGS SUBSEQUENT TO THE DATE OF INVESTMENT. 12. Which one of the following describes a difference in how the equity method is applied under GAAP than under IFRS? IFRS REQUIRES UNIFORMACCOUNTING POLICIES, WHERE GAAP DOES NOT. 13. When the implied value exceeds the aggregate fair values of identifiable net assets, the residual difference is accounted for as GOODWILL 14. Under which set of circumstances would it not be appropriate to assume the value the non-controlling shares is the same as the controlling shares? ACTIVE MARKET PRICES FOR SHARES NOT OBTAINED BY THE IMPLY A DIFFERENT VALUE 15. When the value implied by the purchase price of a subsidiary is in excess of the fair value of identifiable net assets, the workpaper entry to allocate the difference between implied and book value includes a 3. CREDIT TO DIFFERENCE BETWEEN INPLIED AND BOOK VALUE 16. If the fair value of the subsidiary’s identifiable net assets exceeds both the book value and the value implied by the purchase price, the workpaper entry to eliminate the investment account DEBITS DIFFERENCE BETWEEN IMPLIED AND BOOK VALUE 17. The entry to amortize the amount of difference between implied and book value allocated to an unspecified intangible is recorded 3. ON THE CONSOLIDATED STATEMENTS WORKPAPER 18. The excess o fair value implied value must be allocated to reduce proportionally tef ai values initially assigned to NONE OF THE ABOVE 19. The SEC requires the use of push down accounting when the ownership change is greater than 95% 20. A 70 percent owned subsidiary company declares and pays a cash dividend. What effect does the dividend have on the retained earnings and non-controlling interest balances in the parent company’s consolidated balance sheet? NO EFFECT ON TETAINED EARNINGS AND A DECREASE IN NON-CONTROLLING INTEREST 21. In a business combination accounted for as an acquisition, how should the excess of fair value of identifiable net assets acquired over implied vale be treated? RECOGNIZED AS AN ORDINARY GAIN IN THE YEAR OF ACQUISITION 22. Goodwill represents the excess of the implied value of an acquired company over the AGGREGATE FAIR VALUES OF IDENTIFIABLE ASSETS LESS LIABILITIES ASSUMED. 23. In preparing consolidated working papers, beginning retained earnings of the parent company will be adjusted in years subsequent to acquisition with an elimination entry whenever: IT DOES NOT REFLECT THE QUITY METHOD 24. Dividends declared by a subsidiary are eliminated against dividend income recorded by the parent under the COST MODEL AND FAIR VALUE OPTION/MODEL 25. What is the effect if an unconsolidated subsidiary is accounted for by the equity method, but consolidated statements are being prepared for the parent company and other subsidiaries? THE CONSOLIDATED RETAINED EARNINGS WILL BE THE SAME AS IF THE SUBSIDIRY HAD BEEN INLUDED IN THE CONSOLIDATION. 26. Which of the following statements applying to the use of the equity method versus the cost method is true? THE METHOD USED HAS NO IGNIFICANCE TO CONSOLIDATED STATEMENTS. 27. In consolidated financial statements, it is expected that: NET INCOME EQUALS THE SUM OF TH INCOMEDISTRIBTED TO THE CONTROLLING INTEREST AND THE IINIICOME DISTRIBUTED TO THE NON-CONTROLLING INTEREST. 28. How is the portion of consolidated earnings to be assigned to non-controlling interest in consolidated financial statements determined? THE AMOUNT OF THE SUBSIDIARY’S EARNINGS IS MULTIPLIED BY THE NONCONTROLLING’S PERCENTAGE OWNERSHIP AND IS ADJUSTED FOR THE EXCESS COST AMORTIZATION APPLICABLE TO THE NCI. 29. Alpha purchased an 80% interest in Beta on June 30,20x4. Both Alpha’s and Beta’s reporting periods end December 31. Which of the following represents the controlling interest in consolidated net income for 20x4? 100% of Alpha’s January 1 – December 31 income plus 80% of Beta’s July 1 - December 31 income. 30. In a mid-year purchase when the subsidiary’s books are not closed until the end of the year, the purchased income account contains the parent’s share of the SUBSDIARY’S INCOME EARNED FROM THE BEGINNING OF THE YEAR TO THE DAT OF ACQUISITION 31. What is a basic premise of the acquisition method regarding accounting for a non-controlling interest? A SUBSIDIARY IS AN INDIVISIBLE PART OF A BUSINESS COMBINATION ANDSHOULD BEINCLUDED IN ITS ETIRELY REGARDLESS OF THE DEGREE OF OWNERSHIP. 32. JJ Company acquired 85% of R Company on April 1. On its December 31, consolidated income statement, how should JJ account for MR’s revenues and expenses that occurred before April 1. EXCLUDED 100 PERCENT OF THE PREACQUISITION REVENUES AND 100 PERCENT OF THE PRE—ACQUISITION EXENSES FROM THEIR RESPECTIVE CONSOLIDATED TOTALS. 33. A parent buys 32 percent of a subsidiary in one year and then buyers an additional 40 percent in the next year. In a step acquisition of this type, the original 32 percent acquisition should be ADJUSTED TO FAIRVALUE AT THE DATE OF THE SECOND ACQUISITION WITH A RESULTING GAIN ORLOSS RECORDED. 34. C. 35. If AA Company acquires 80 percent of the stock of BB Company on January 1, 20x2, immediately after the acquisition: CONSOLIDATED RETAINED EARNINGS AND AA COMPANY RETAINED EARNINGS WILL BE THE SAME 36. Which of the following statements is correct? TOTAL ASSETS REPORTED BY THE PARENT GENERALLY WILL BE LESS THAN TOTAL ASSETS REPORTED ON THE CONSOLIDATED BALANCE SHEET 37. Which of the following statements is correct? CONSOLIDATED RETAINED EARNINGS DO NOT INCLUDE THE NONCONTROLLING INTREST’S CLAIM ON THE SUBSIDIARY RETAINED EARNINGS. 38. How is the portion of consolidated earnings to be assigned to the non-controlling interest in the consolidated financial statements determined? THE SUBSIDIARY’S NET INCOME IS EXTENDED TO THE NON-CONTROLLING INTEREST. 39. Under push down accounting, the work paper entry to eliminate the investment account includes a CREDIT TO REVALUATION CAPITAL 40. Which of the following observations is NOT consistent with the use of push-down accounting? ELIMINATING ENTRIES RELATED TO THE DIFFERENTIAL ARE NEEEDED IN THE WORKPAPERS 41. Which companies employ push-down accounting: THE CONSOLIDATED FINANCIAL STATEMENTS WILL APPESR EXACTLY AS IF PUSH-DOWN ACCOUNTING HAD NOT BEEN USED. 42. Which of the following statements is false regarding push-down accounting? PUSH-OWN ACCOUNTING MUST BE APPLIED FOR COMBINATIONS UNDER A POOLING OF INTEREST 43. When a company applies the initial value method in accounting for its investment in a subsidiary and the subsidiary reports income less than dividends pad, what entry would be made for a consolidated worksheet? RETAINED EARNINGS (DEBIT) INVESTMENT IN SUBSIDIARY (CREDIT) CHAPTER 4: ELIMINATION OF UNREALIZED PROFIT ON INTERCOMPANY SALES OF INVENTORY 1. 2. 3. 4. 5. Inventory sales from a parent to one of its subsidiaries are referred to as downstream sales. TRUE Under current GAAP, intercompany transactions are to be recorded in separate general ledger accounts. FALSE Under current GAAP, elimination by rearrangement is mandatory. FALSE For the income statement, reciprocal account balances do not exist for all types of intercompany transactions. TRUE The intercompany sales account is an example of an account that would always have a reciprocal balance. FALSE 6. All intercompany transactions generally are related-party transactions. TRUE 7. All related-party transactions are intercompany transactions. FALSE 8. Intercompany transactions can occur between an investor company and a company in which the investor owns 25% of the investee's outstanding common stock. FALSE 9. The term intercompany transaction generally is restricted to control situations. TRUE 10. Intercompany transactions are eliminated in consolidation because they are related-party transactions. FALSE 11. Because all intercompany transactions are eliminated in consolidation, the use of improper or unfair transfer prices has no consequences for consolidated reporting purposes. TRUE 12. Intercompany inventory transfers at cost need not be eliminated in consolidation. FALSE 13. Downstream intercompany inventory transfers at cost to a 100%-owned subsidiary need not be eliminated in consolidation. FALSE 14. The concept of profit on intercompany transactions to be deferred for consolidated reporting purposes is gross profit. TRUE 15. If intercompany profit is deferred for consolidated reporting purposes, then any income taxes recorded on that profit must also be deferred for consolidated reporting purposes. TRUE 16. When a noncontrolling interest exists, intercompany sales on downstream intercompany inventory transfers need not be eliminated for consolidated reporting purposes. FALSE 17. When a noncontrolling interest exists, intercompany sales on downstream intercompany inventory transfers need be eliminated only to the extent of the non-controlling interest ownership percentage—not 100%. FALSE 18. Fractional elimination is not allowed under current GAAP. TRUE 19. Under current GAAP, the amount of intercompany profit or loss to be deferred for consolidated reporting purposes is not affected by the existence of a noncontrolling interest. TRUE 20. If an intercompany inventory transfer occurs in 20x5 and all this inventory is not resold to an outside, third party until 20x6, the intercompany sale is eliminated in consolidation in 20x6—not 20x5. FALSE 21. If an Intercompany inventory transfer occurs in late 20x5 and all this inventory is not resold to an outside, third party until 20x6, the intercompany sale is eliminated in consolidation in 20x5—not 20x6. TRUE 22. If an intercompany inventory transfer occurs in late 20x5 and all this inventory is not resold to an outside, third party until 20x6, the intercompany sale is eliminated in consolidation in 20x5 and 20x6. FALSE 23. Intercompany inventory transfers cannot be a. Bonafide transactions d. Related-party transactions b. Arm’s-length transactions e. None of the above c. Related-party transactions 24. Which of the following statements is the correct reason for eliminating intercompany transactions for consolidated reporting purposes? a. Intercompany transactions are related-party transactions. b. From the perspective of either of the individual companies, intercompany transactions are not bonafide transactions. c. It is often impractical and in many cases impossible to determine whether the transfer prices approximate prices that could have been obtained with outside, independent parties. d. The parent company could manipulate the intercompany transfer prices in a manner that is not equitable to the subsidiary. e. None of the above. 25. Which of the following statements is true? a. All intercompany transactions are related-party transactions. b. All related-party transactions are intercompany transactions. c. An unsupportable, artificially high or low Intercompany transfer price with an overseas unit cannot have any impact on the consolidated financial statements because all intercompany transactions are eliminated in consolidation. d. For income tax-reporting purposes, transfer prices need not be comparable to sales to outside, third parties. e. None of the above. 26. In consolidation, which of the following intercompany transactions need not be undone? a. Intercompany management charges. b. Intercompany lease income and expense. c. Intercompany dividend income (when the parent uses the cost method). d. intercompany equipment transfers involving a gain or loss. e. None of the above. f. 27. Which of the following accounts need not be eliminated in consolidation? a. Intercompany Sales. d. Long-term Intercompany Receivables. b. c. Intercompany Cost of Sales. Intercompany Interest Expense e. None of the above. 28. Which of the following accounts would not require reconciliation or adjustment to a reciprocal balance prior to beginning the consolidation process? a. Intercompany Receivables. c. Intercompany Sales b. Intercompany Interest Income. d. Intercompany Management Fee Income. 29. Which of the following accounts would require reconciliation or adjustment to a reciprocal balance prior to beginning the consolidation process? a. b. c. d. e. Intercompany Dividend Income (when the parent uses the cost method). Intercompany Sales Intercompany Cost of Sales Long-term Intercompany Payable None of the above. 30. Intercompany accounts that are to have reciprocal balances but are not currently in agreement are adjusted a. Before the consolidation process. b. During the consolidation process. c. After the consolidation process. d. Not before, during, or after the consolidation process. 31. In consolidation, the most efficient way to eliminate intercompany accounts that are to have reciprocal balances is to use a. Elimination by proxy. d. Elimination by reciprocity. b. Elimination by rearrangement. e. None of the above. c. Elimination by default. 32. Which of the following statements is true? a. Elimination by rearrangement is mandatory under current GAAP. b. Intercompany inventory transfers at cost do not have to be eliminated. c. If an intercompany inventory transfer is made in late 20x4 but the inventory is not resold to an outside, third party until 20x5, the intercompany inventory sale must also be eliminated in 20X5. d. Downstream intercompany inventory sales do not have to be eliminated if the subsidiary is 100% owned. e. None of the above. 33. For which of the following accounts would it be inappropriate to use elimination by rearrangement? a. Intercompany Operating Lease Income. b. Intercompany Cost of Sales. d. Intercompany Notes Payable. e. None of the above. c. Intercompany Interest Income. 34. An intercompany inventory transfer above cost occurred in 20x5. At 12/31/x5, a portion of the transferred inventory remained unsold. Which of the following accounts would not require adjustment or elimination in consolidation at the end of 20x5? a. Intercompany Cost of Sales. c. Inventory b. Intercompany Sales. d. Sales e. none of the above 35. In 20x5, an intercompany inventory transfer above cost occurred. In 20x6, all this inventory was resold to an outside party. Which of the following accounts would require adjustment or elimination in consolidation at 12/31/x6? a. Cost of Sales. c. Intercompany Sales b. Intercompany Cost of Sales. d. Inventory e. none of the above 36. In 20x5, Palex sold inventory costing P45,000 to its 100%-owned subsidiary, Salex, for P70,000. By 12/31/X5, Salex had resold all this inventory for P100,000. Which of the following accounts would have to be eliminated in consolidation at 12/31/x5? Intercompany Sales Intercompany Cost of Sales a. Yes Yes b. No No c. Yes No d. No Yes 37. In 20x5, Palco sold inventory costing P70,000 to its 100%-owned subsidiary, Salco, for P110.000. At 12/31/X5, P33,000 of this inventory was reported in Salco's balance sheet. In 20x6, Salco resold this inventory for P55,000. Which of the following accounts is eliminated in consolidation at 12/31/x6 as a result of the above transactions? Intercompany Sales Intercompany Cost of Sales a. Yes Yes b. No No c. Yes No d. No Yes 38. In 20x6, Puzco resold for P70,000 inventory that it had acquired from its 100%-owned subsidiary, Suzco, in 20x5 for P50,000. Suzco’s cost was P36,000. In consolidation at the end of 20x6, which of the following accounts is credited on the worksheet? a. Intercompany Cost of Sales. c. intercompany Sales. b. Equity in Net Income of Subsidiary. d. Inventory e. None of the above 39. At 12/31/X6, Pozak reported P80,000 of intercompany-acquired inventory in its balance sheet. This inventory was acquired in 20x5—not 20x6—from its 100%-owned subsidiary, Sozak. Sozak's cost was P60,000. Which of the following accounts is credited in consolidation at 12/31 /x6? a. Cost of Sales. c. Intercompany Sales. b. Intercompany cost of sales d. Inventory e. None of the above 40. Sales from one subsidiary to another are called a. downstream sales c. inter subsidiary sales b. upstream sales d. horizontal sales 41. Non-controlling interest in consolidated income is never affected by a. upstream sales c. Non-controlling interest is affected by all sales. b. downstream sales d. None of the above 42. Failure to eliminate intercompany sales would result in an overstatement of consolidated a. net income c. cost of sales b. gross profit d. all of these 43. The non-controlling interest's share of the selling affiliate’s profit on intercompany soles is considered to be realized under a. partial elimination. c. 100% elimination. b. total elimination. d. d. both total and 100% elimination. 44. The work paper entry in the year of sale to eliminate unrealized intercompany profit in ending inventory includes a a. credit to Ending Inventory (Cost of Sales) of Sales) c. debit to Ending Inventory (Cost b. credit to Sales Sheet d. debit to Inventory- Balance 45. 90% owned subsidiary sold merchandise at a profit to its parent company near the end of 2013. Under the partial equity method, the work paper entry in 2014 to recognize the intercompany profit in beginning inventory realized during 2014 includes a debit to a. Retained Earnings – P b. Non-controlling interest c. Cost of Sales d. both Retained Earnings- P and Non-controlling Interest 46. The non-controlling interest in consolidated income when the selling affiliate is an 80% owned subsidiary is calculated by multiplying the non-controlling minority delete minority ownership percentage by the subsidiary’s reported net income a. plus unrealized profit in ending inventory less unrealized profit in beginning inventory. b. plus realized profit in ending inventory less realized profit in beginning inventory. c. less unrealized profit in ending inventory plus realized profit in beginning inventory. d. less realized profit in ending inventory plus realized profit in beginning inventory. 47. In determining controlling interest in consolidated income in the consolidated financial statements, unrealized intercompany profit on inventory acquired by a parent from its subsidiary should: a. not be eliminated. b. c. be eliminated in full. be eliminated to the extent of the parent company’s controlling interest in the subsidiary. d. be eliminated to the extent of the non-controlling interest in the subsidiary. 48. The material sale of inventory items by a parent company to an affiliated company: a. enters the consolidated revenue computation only if the transfer was the result of arm's length bargaining. b. affects consolidated net income under a periodic inventory system but not under a perpetual inventory system. c. does not result in consolidated income until the merchandise is sold to outside parties. d. does not require a working paper adjustment if the merchandise was transferred at cost. 49. A parent company regularly sells merchandise to its 80%-owned subsidiary. Which of the following statements describes the computation of non-controlling interest income? a. the subsidiary's net income times 20%. b. (the subsidiary’s net income x 20%) + unrealized profits in the beginning inventory - unrealized profits in the ending inventory. c. (the subsidiary's net income + unrealized profits in the beginning inventory unrealized profits in the ending inventory) x 20%. d. (the subsidiary's net income + unrealized profits in the ending inventory unrealized profits in the beginning inventory) x 20%. 50. The amount of intercompany profit eliminated is the same under total elimination and partial elimination in the case of 1. upstream sales where the selling affiliate is a less than wholly owned subsidiary. 2. all downstream sales. 3. horizontal sales where the selling affiliate is a wholly owned subsidiary. a. 1. c. b. d. both 2 and 3. 2. 3. 51. Polly, Inc. owns 80% of Saffron, Inc. During 20x4, Polly sold goods with a 40% gross profit to Saffron. Saffron sold all of these goods in 20x4. For 20x4 consolidated financial statements, how should the summation of Polly and Saffron income statement items be adjusted? a. Sales and cost of goods sold should be reduced by the intercompany sales. b. Sales and cost of goods sold should be reduced by 80% of the Intercompany sales. c. Net income should be reduced by 80% of the gross profit on intercompany sales. d. No adjustment is necessary. 52. Schiff Company owns 100% of the outstanding common stock of the Viel Company. During 20x1, Schiff sold merchandise to Viel that Viel, in turn, sold to unrelated firms. There were no such goods jn Viel's ending inventory. However, some of the intercompany purchases from Schiff had not yet been paid. Which of the following amounts will be incorrect in the consolidated statements if no adjustments are made? a. inventory, accounts payable, net income b. inventory, sales, cost of goods sold, accounts receivables c. Sales, cost of goods sold, accounts receivable, accounts payable. d. accounts receivable, accounts payable 53. The material sale of inventory items by a parent company to an affiliated company a. enters the consolidated revenue computation only if the transfer was the result of arm's length bargaining. b. affects consolidated net income under a periodic inventory system but not under a perpetual inventory system. c. does not result in consolidated income until the merchandise is sold to outside entities. d. does not require a working paper adjustment if the merchandise was transferred at cost. 54. Williard Corporation regularly sells inventory items to its subsidiary, Petty, Inc. If unrealized profits Petty's 20X1 year- end inventory exceed the unrealized profits in its 20x2 year-end inventory, 20x2 combined a. cost of sales will be less than consolidated cost of sales in 20x2. b. gross profit will be greater than consolidated gross profit in 20x2. c. sales will be less than consolidated sales in 20x2. d. cost of sales will be greater than consolidated cost of sales in 20x2. 55. Sally Corporation, an 80%-owned subsidiary of Reynolds Company, buys half of its raw materials from Reynolds. The transfer price is exactly the same price as Sally pays to buy identical raw materials from outside suppliers and the same price as Reynolds sells the materials to unrelated customers. In preparing consolidated statements for Reynolds Company and Subsidiary Sally Corporation. a. the intercompany transactions can be ignored because the transfer price represents arm's length bargaining. b. any unrealized profit from intercompany sales remaining in Reynolds' ending inventory must be offset against the unrealized profit in Reynolds’ beginning inventory. c. any unrealized profit on the intercompany transactions in Sally's ending inventory is eliminated in its entirety. d. eighty percent of any unrealized profit on the intercompany transactions in Sally's ending inventory is eliminated. 56. The material sale of inventory items by a parent company to an affiliated company a. enters the consolidated revenue computation only if the transfer was the result of arm's length bargaining. b. affects consolidated net income under a periodic inventory system but not under a perpetual inventory system. c. does not result in consolidated income until the merchandise is sold to outside parties. d. does not require a working paper adjustment if the merchandise was transferred at cost. 57. Honeyeater Corporation owns a 40% interest in Nectar Company, acquired several years ago at a cost equal to book value and fair value. Nectar sells merchandise to Honeyeater for the first time in 20x5. In computing income from the investee for 20x5 under the equity method, Honeyeater uses which equation? a. 40% of Nectar's income less 100% of the unrealized profit in Honeyeater’s ending inventory. b. 40% of Nectar's income plus 100% of the unrealized profit in Honeyeater’s ending inventory. c. 40% of Nectar's income less 40% of the unrealized profit in Honeyeater's ending inventory. d. 40% of Nectar's income plus 40% of the unrealized profit in Honeyeater's ending inventory. 58. In situations where there are routine inventory sales between parent companies and subsidiaries, when preparing the consolidation statements, which of the following line items is indifferent to the sales being either upstream or downstream? a. Consolidated retained earnings. c. Non-controlling interest expense. b. Consolidated gross profit. d. Consolidated net income. 59. The consolidation procedures for intercompany sales are similar for upstream and downstream sales a. if the merchandise is transferred at cost. b. under a periodic inventory system but not under a perpetual inventory system. c. if the merchandise is immediately sold to outside parties. d. when the subsidiary is 100% owned. 60. Which of the following describes the impact on consolidated financial statements of upstream and downstream transfers? a. No difference exists in consolidated financial statements between upstream and downstream transfers. b. Downstream transfers affect the computation of the non-controlling interest's share of subsidiary's income but upstream transfers do not. c. Upstream transfers affect the computation of the non-controlling interest's share of the subsidiary's income but downstream transfers do not. d. Downstream transfers can be ignored because the parent company makes them. 61. Subsidiary’s income be adjusted for intercompany transfers? a. The subsidiary's reported income is adjusted for the impact of upstream transfers prior to computing the non- controlling interest's allocation. b. The subsidiary’s reported income is adjusted for the impact of all transfers prior to the computing the non-controlling interest’s allocation. c. The subsidiary’s reported income is not adjusted for the impact of transfers prior to computing the non-controlling interest's allocation. d. The subsidiary s reported income is adjusted for the impact of downstream transfers prior to computing the non- controlling interest’s allocation. 62. A parent company regularly sells merchandise to its 70%-owned subsidiary. Which of the following statements describes the computation of minority interest income? a. The subsidiary's net income times 30%. b. (The subsidiary’s net income x 30%) + unrealized profits in the beginning inventory – unrealized profits in the ending inventory. c. (The subsidiary's net income + unrealized profits in the beginning inventory - unrealized profits in the ending inventory) x 30%. d. (The subsidiary's net income + unrealized profits in the ending inventory - unrealized profits in the beginning inventory) X 30%. Use the following information for questions 63 to 66: Strickland Company sells inventory to its parent, Carter Company, at a profit during 20x4. 63. With regard to the intercompany sale, which of the following choices would be a debit entry in the consolidated worksheet for 20x4? a. Retained earnings d. Investment Strickland Company b. Cost of goods sold e. Additional paid-in capital c. Inventory 64. With regard to the intercompany sale, which of the following choices would be a credit entry in the consolidated worksheet for 20x4? a. Retained earnings d. Investment Strickland Company b. Cost of goods sold e. Additional paid-in capital. c. Inventory 65. With regard to the intercompany sale, which of the following choices would be a debit entry in the consolidated worksheet for 20x5? a. Retained earnings d. Investment Strickland Company b. Cost of goods sold e. Additional paid-in capital c. Inventory 66. With regard to the intercompany sale, which of the following choices would be a credit entry in the consolidated worksheet for 20x5? a. Retained earnings d. Investment Strickland Company b. Cost of goods sold e. Additional paid-in capital c. Inventory Use the following information for questions 67 to 70: . Walsh Company sells inventory to its subsidiary, Fisher Company, at a profit during 20x4. Walsh uses the equity method to account for its investment in Fisher. 67. With regard to the intercompany sale, which of the following choices would be a debit entry in the consolidated worksheet for 20x4? a. Retained earnings d. Investment Fisher Company b. Cost of goods sold c. Additional paid-in capital c. Inventory 68. With regard to the intercompany sale, which of the following choices would be a credit entry in the consolidated worksheet for 20x4? a. Retained earnings d. Investment Fisher Company b. Cost of goods sold e. Additional paid-in capital c. Inventory 69. With regard to the intercompany sale, which of the following choices would be a debit entry in the consolidated worksheet for 20x5? a. Retained earnings d. Investment Fisher Company b. Cost of goods sold e. Additional paid-in capital c. Inventory 70. With regard to the Intercompany sale, which of the following choices would be a credit entry in the consolidated worksheet for 20x5? a. Retained earnings d. Investment Fisher Company b. Cost of goods sold c. Additional paid-in capital c. Inventory 71. In 20x5, Polex sold Inventory costing P100,000 to tits 100%-owned subsidiary, Solex, for P150,000. At the end of 20x5, Solex reported P6O.OOO of intercompany-acquired inventory in its balance sheet. What is the unrealized intercompany profit at 12/31/05? a. P16,000 c. P40,000 b. P20,000 d. P50,000 e. None of the above 72. In 20x5, Palco sold inventory costing P70,000 to its 100%-owned subsidiary, Salco, for P110,000. At 12/31/x5, P33,000 of this inventory was reported in Salco's balance sheet. In 20x6, Salco resold this inventory for P55,000. How much intercompany profit was realized in 20x6—not 20x5? a. P12,000 c. P33,000 b. P21,000 d. P34,000 e. None of the above 73. In 20x5, Punco sold inventory costing P60,000 to its 100%-owned subsidiary, Sunco, for P100,000. At 12/31/x5, P20,000 of this inventory was reported in Sunco's balance sheet. In 20x6, Sunco resold this inventory for P30,000. What is the unrealized intercompany profit at 12/31/x5? a. P8,000 c. P20,000 e. None of the above b. P10,000 d. P30,000 74. In 20x5, Pimco sold inventory costing P45,000 to its 100%-owned subsidiary, Simco, for P75,000. At 12/31/X5, P15,000 of this inventory was reported in Simco's balance sheet. In 20x6, Simco resold this inventory for P25,000. What is the unrealized intercompany profit at 12/31/x5? a. P6,000 c. P16,000 b.P10,000 d. P20,000 e. None of the above 75. ln 20x6, Semco resold for P40,000 inventory that it had acquired in 20x5 from its parent company, Pemco, for P32,000. Pemco's cost was P25,000. In consolidation at the end of 20x6, which of the following accounts is credited in consolidation? a. Intercompany Cost of Soles for P32,000. c. Cost of Sales for P7,000 b. Inventory for P32,000. d. Cost of Sales for P8,000 e. None of the above 76. In early 20x5, Pye sold inventory costing P33,000 to its 100%-owned subsidiary, Slyce, for P44,000. At 12/31/X5, Slyce made a lower-of-cost-or-market adjustment of P6,000 for this inventory, all of which was still on hand. What amount is reported for this inventory in the 12/31/x5 consolidated balance sheet? a. P11,000 c. P33,000 b. P27,000 d. P38,000 e. None of the above 77. In 20x6, Panex sold inventory costing P100,000 to its 75%-owned subsidiary, Sanex, for P150,000. At 12/31/X6, Sanex reported P60,000 of intercompany-acquired inventory in its balance sheet. The amount by which the 20x6 consolidated net income that accrues to the controlling interest will be lower as a result of this being an intercompany transaction is a. P12,000 c. P20,000 e. None of the above b. P15,000 d. P37,500 78. In 20x6, Pulco acquired inventory from its 75%-owned subsidiary, Sulco, for P250 000. Sulco's cost was P200,000. At 12/31/X6, Pulco reported P40,000 of intercompany-acquired inventory in its balance sheet. The amount by which the 2006 consolidated net income that accrues to the controlling will be lower as a result of this being an intercompany transaction is a. P6,000 c. P30,000 b. P8,000 d. P40,000 e. None of the above 79. In its consolidated 20x6 financial statements, Pozak recognized P37,000 of intercompany profit relating to upstream inventory sales from its 75%-owned subsidiary (Sozak). Of this amount, P7,000 pertained to intercompany profit deferred at 12/31/0x5. During 20x6, downstream intercompany sales totaled P100,000 (Pozak's cost was P60,000). What amount was credited to Inventory in consolidation at 12/31/X6? (Hint: Prepare the analysis of unrealized profit for the 2006 transfers-this is possible from the information given.) a. P0 c. P10,000 b. P7,000 d. P30,000 e. None of the above 80. In 20x6, Semco resold for P55,000 inventory that it had acquired in 20x5 from its parent, Pemco, for P30,000. Pemco’s cost was P40,000. Which account is credited in consolidation at 12/31/x6? a. Intercompany Cost of Sales for P40,000 above c. Cost of Sales for P10,000 b. Inventory for P10,000 d. Cost of Sales for P15,000 e. None of the CHAPTER 5- Theories 1. In reference to the downstream or upstream sale of depreciable assets, which of the following statements is correct? Gains and losses appear in the parent-company accounts in the year of sale and must be eliminated by the parent company determining its investment income under the equity method of accounting. 2. In the year, a subsidiary sells land to its parent company at a gain, a workpaper entry is made debiting: Gain on Sale of Land 3. In years subsequent to the year a 90% owned subsidiary sells equipment to its parent company at a gain, the non-controlling interest in consolidated income is computed by multiplying the non-controlling interest percentage by the subsidiary’s reported net income Plus intercompany gain considered realized in the current period. 4. Company S sells equipment to its parent company (P) at a gain. In years subsequent to the year of the intercompany sale, a workpaper entry is made under the cost method debiting: Retained Earnings-P Non-controlling interest Equipment 5. P Corp. owns 90% of the outstanding common stock of S Company. On December 31, 20x4, S sold equipment to P for an amount greater than the equipment’s book value but less than its original cost. The equipment should be reported on the December 31, 20x4 consolidated balance sheet at: P’s original cost less S’s recorded gain 6. In the year an 80% owned subsidiary sells equipment to its parent company at a gain, the noncontrolling interest in consolidated income is calculated by multiplying the non-controlling interest percentage by the subsidiary’s reported net income Minus the net amount of unrealized gain on the intercompany sale 7. The amount of the adjustment to the non-controlling interest in consolidated net assets is equal to the non-controlling interest’s percentage of the Realized intercompany gain at the beginning of the period 8. In years subsequent to the upstream intercompany sale of non-depreciable assets, the necessary consolidated workpaper entry under the cost method is to debit the Non-controlling interest and Retained Earnings (Parent) accounts and credit the nondepreciable asset. 9. When preparing consolidated financial statement workpapers, unrealized intercompany gains, as a result of equipment or inventory sales by affiliates, are allocated proportionately by percent of ownership between parent and subsidiary only when the selling affiliate is The parent and the subsidiary is less than wholly owned 10. Gain or loss resulting from an intercompany sale of equipment between a parent and a subsidiary is Considered to be unrealized in the consolidated statements until the equipment is sold to a third party 11. WW Company own 80 percent of FF Company’s outstanding common stock. On December 31, 20x9, FF sold equipment to WW at a price in excess of FF’s carrying amount, but less than its original cost. On a consolidated balance sheet at December 31, 20x9, the carrying amount of the equipment should be reported at: WW’s original cost less FF’s recorded gain 12. J Company acquired all of K Company’s outstanding common stock in exchange for cash. The acquisition price exceeds the fair value of net assets required. How should J Company determine the amounts to be reported for the plant and equipment and long-term debt acquired from K Company? Plant & Equipment Long-term Debt Fair Value K’s carrying amount 13. PP Inc. owns 100 percent of SS Inc. On January 1, 20x2, PP sold delivery equipment to SS at a gain. PP had owned the equipment for two years and used a five-year straight-line depreciation rate with no residual value. SS is using a three-year straight-line depreciation rate with no residual value for the equipment. In the consolidated income statement, SS’s recorded depreciation expense on the equipment for 20x2 will be decreased by: 100 percent of the gain on the sale 14. Included in a working paper elimination (in journal entry format) for intercompany sales of merchandise was a debit to Minority Interest in Net Assets of Subsidiary. This debit indicates that: A wholly owned subsidiary sold merchandise to a partially owned subsidiary 15. From a consolidated point of view, the intercompany gain on a parent company’s sale of a depreciable plant asset to the subsidiary is realized when: Some other transaction or event takes place 16. In the measurement of minority interest in net income of a partially owned subsidiary, the credit for Depreciation Expense-Parent in the working paper elimination (in journal entry format ) for intercompany gain in a depreciable plant asset is attributed to net income of: The subsidiary 17. The working paper elimination (in journal entry format) for a second year of intercompany sales made at a markup over subsidiary cost by a partially owned subsidiary to the parent company includes: A debit to Retained Earnings- Subsidiary 18. Which of the following is not an effect of a working paper elimination for intercompany sales of merchandise by a parent company to a subsidiary? It eliminates the overstatement of the Subsidiary’s Sales ledger account balance. 19. If a gain on an intercompany transaction is attributable to a partially owned subsidiary, working paper eliminations (in journal entry format) for accounting periods subsequent to the period of the intercompany transaction will include a debit to Minority Interest in Net Assets of Subsidiary unless the gain arose from: An acquisition of outstanding bonds in the open market 20. The gross profit on an intercompany sale of merchandise costing P500,000 at a gross margin rate of 16 2/3% based on selling price is: P100,000 21. Is the non-controlling interest in net income of a partially owned subsidiary affected by: Elimination of depreciation attributable to intercompany gain on machinery acquired by parent from subsidiary? YES Elimination of intercompany gain on land sold by parent to subsidiary? NO 22. A working paper elimination to remove an intercompany profit or gain is not relevant for an intercompany: Acquisition of an affiliate’s outstanding bonds payable in the open market 23. Blue Company owns 70 percent of Black Company’s outstanding common stock. On December 31, 20x4, Black sold equipment to Blue at a price in excess of Black’s carrying amount but less than its original cost. On a consolidated balance sheet at December 31, 20x4, the carrying amount of the equipment should be reported at: Blue’s original cost less Black’s recorded gain 24. A parent and its 80 percent owned subsidiary have made several intercompany sales of noncurrent assets during the part two years. The amount of income assigned to the noncontrolling interest for the second year should include the noncontrolling interest’s share of gains: Realized in the second year from upstream sales made in both years 25. A wholly owned subsidiary sold land to its parent during the year at a gain. The parent continues to hold the land at the end of the year. The amount to be reported as consolidated net income for the year should equal: The parent’s separate operating income, plus the subsidiary’s net income, minus the intercompany gain 26. A parent sold land to its partially owned subsidiary during the year at a loss. The subsidiary continues to hold the land at the end of the year. The amount to be reported as consolidates net income for the year should equal: The parent’s separate operating income, plus the intercompany loss, plus the subsidiary’s net income 27. Any intercompany gain or loss on a downstream sale of land should be recognized in consolidated net income: III. In the year the subsidiary sells the land to an unrelated party 28. On November 8, 20x4, Power Corp. sold land to Wood Co., its wholly owned subsidiary. The land cost P61,500 and was sold to Wood for P89,000. From the perspective of the combination, when is the gain on the sale of the land realized? When Wood Co. sells the land to a third party 29. Parent sold land to its subsidiary for a gain in 20x4. The subsidiary sold the land externally for a gain in 20x7. Which of the following statement is true? No gain will be reported on the 2010 consolidated income statement 30. An intercompany sale took place whereby the transfer price exceeded the book value of a depreciable asset. Which statement is true for the year following the sale? A worksheet entry is made with a debit to investment in subsidiary for a downstream transfer when the parent uses the equity method 31. Which of the following statements is true concerning an intercompany transfer of a depreciable asset? Non-controlling interest in subsidiary’s net income is affected only when the transfer is upstream. CHAPTER 2 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. At the date of an acquisition which is not a bargain purchase, the acquisition method Consolidate all subsidiary assets and liabilities at fair value Lisa co. paid cash for all of the voting stock of Victoria Corp. Victoria will continue to exist as a separate corporation. Entries for the consolidation of Lisa and Victoria would be recorded in A worksheet What is the primary accounting difference between accounting for when the subsidiary is dissolved and when the subsidiary retains Its incorporation? If the subsidiary retains its incorporation, the consolidation is not formally recorded in the accounting records of the acquiring company. A company is not required to consolidate a subsidiary in which it holds more than 50% of the voting stock when the subsidiary is in bankruptcy Which one of the following is a characteristic of a business combination that should be accounted for as an acquisition? the transactions established an acquisition fair value basis for the company being acquired. Which of the following is the best theoretical justification for consolidated financial statements? In form the companies are separate, in substance they are one entity. what is the appropriate accounting treatment for the value assigned to in-process research and development acquired in a business combination? Capitalized as an asset An acquired entity has a long -term operating lease for an office building used for central management. The terms of the lease are very favorable relative to current market rates. However, the lease prohibits subleasing or any other transfer of rights. In its financial statement, the acquiring firm should report the value assigned to the lease contract as An intangible asset under the contractual- legal criterion W company obtains all of the outstanding stock of JJ, inc. In a consolidation prepared immediately after the takeover, at what value will jj inventory be consolidated? At the acquisition-date fair value. Under PFRS 3, when is a gain recognized in consolidating financial information? When the amount of a bargain purchase exceeds the value of the applicable liability held by the acquired company. What is push-down accounting? a subsidiary’s regarding of the fair value allocations as well as subsequent amortization A parent buys 32 percent of a subsidiary in one year and then buys an additional 40 percent in the next year. In a step acquisition of acquisition of this type, the original 32 percent acquisition should be Adjusted to fair value at the date of the second acquisition with a resulting gain or loss recorded. If A company acquires 80 percent of the stock of B company on January 1, 20x2, immediately after the acquisition. consolidated retained earnings and AA company retained earnings will be the same Which of the following statement is correct? Total assets reported by the parent generally will be less than total assets reported on the consolidated balance sheet Which of the following statement is correct? Consolidated retained earnings do not include the non-controlling interest’s claim on the subsidiary’s retained earnings What is the theoretically preferred method of presenting a non-controlling interest in a consolidated balance sheet? As a separate item within the stockholders’ equity section Presenting consolidated financial statements this year when statements of individual companies were presented last year is an accounting change that should be reported by restating the financial statements of all prior periods presented A subsidiary, a acquired for cash in a business combination, owned equipment with a market value in excess of book value as of the date of combination. A consolidated balance sheet prepared immediately after the acquisition would threat this excess as Plant and equipment Goodwill is reported when the fair value of the acquiree is greater than the fair value of the net identifiable assets acquired. 20. Consolidated financial statements are designed to provide the results of operation cash flow, and the balance sheet as if the parent and subsidiary were a single entity 21. Consolidated financial statements are appropriate even without a majority ownership if which of the following exists the parent company has the right to appoint a majority of the members of the subsidiary’s board of directors through a large minority voting interest 22. The IASB has recommended that a parent corporation should consolidate the financial statements of the subsidiary into its financial statements when it exercises control over the Subsidiary, even without majority ownerships. In which if the following situations would control not be evident? Access to subsidiary assets is available to all stockholders 23. The goal of the consolidation process is for asset acquisition and 100% stock acquisitions to result in the same balance sheet 24. A subsidiary was acquired for cash in a business combination on December 31,20x4. The purchase price with a fair value in excess of the book value as of the date of the combination. A consolidated balance sheet prepared on December 31,20x1, would report the excess of the fair value over the book value of the equipment as part pf the plant and equipment account 25. The investment in a subsidiary should be recorded on the parent’s books at the Fair value of the consideration given 26. Which of the following cost of a business combinations can be included in the value charged to paid-incapital in excess of par? Stock issue cost if stock is issued as consideration 27. When a company purchase another company that has existing goodwill and the transaction is accounted for as a stock acquisition, the goodwill should be treated in the following manner. Goodwill is not recorded until all assets are stated at full fair value 28. The sec requires the use of push-down accounting in some specific situations. Push-down accounting results in reflecting fair values on the subsidiary’s separate account. 29. A majority-owned subsidiary that is in legal reorganizations should normally be accounted for using the cost method 30. Under the acquisition method, indirect cost relating to acquisitions should be Expensed as incurred 31. Eliminating entries are made to cancel the effects of intercompany transactions and are made on the Workpaper only 32. One reason a parent company may pay an amount less than the book value of the subsidiary’s stock acquired is the existence of unrecorded contingent liabilities 33. In a business combination accounted for as an acquisition, registration costs related to common stock issued by the parent company are Deducted from other contributed capital 34. On the consolidated balance sheet; consolidated stockholder’s equity is Equal to the parent’s stockholder’s equity 35. Majority-owned subsidiaries should be excluded from the consolidated statements when Any of these circumstances exist 36. Under the economic entity concepts, consolidated financial statements are intended primarily for the benefit of the all of the above 37. Reasons a parent company may pay more than a book value for the subsidiary company’s stock include all of the following except stockholder’s equity may be overvalued 38. What is the method of presentation required by PFRS 10 of non-controlling interest on a consolidated balance sheet? As a part of stockholder’s equity 39. Which of the following is a limitation of consolidated financial statements? consolidated statements of highly diversified companies cannot be compared with industry standards 40. When a company purchases another company that has existing goodwill and the transactions is accounted for as a stock acquisition, the goodwill should be treated in the following manner. Goodwill is not recorded until all assets are stated at full fair value. 41. The use of push-down accounting is some specific situations. Push-down accounting results in Reflecting fair values on the subsidiary’s separate accounts. 42. What is push-down accounting? a subsidiary’s recording of the fair value allocations as well as subsequent amortization. 43. A parent buys 32 percent of a subsidiary in one year and then buys an additional 40 percent in the next year. In a step acquisition of this type, the original 32 percent acquisition should be adjusted to fair value at the date of the second acquisition with a resulting gain or loss recorded 44. A newly acquired subsidiary has pre-existing goodwill on its books. The parent company’s consolidated balance sheet will not show any value for the subsidiary’s pre-existing goodwill. 45. What is push-down accounting? a subsidiary’s recording of the fair value allocations as well as subsequent amortization. 46. The main evidence of control for purposes of consolidated financial statements involves Having decision-making ability that is not shared with others 47. In which of the following cases would consolidation be inappropriate? the subsidiary is in bankruptcy 48. The primary beneficiary of a variable interest entity (VIE) must consolidate the VIE into its financial statements whenever the total equity at risk is not sufficient to permit the entity to finance its activities without additional subordinated financial support from other parties. 49. If an entity is not considered a VIE, the determination of consolidation is based on whether one of the entities in the consolidated group directly or indirectly has controlling financial interest 50. PFRS defines control as the power to govern the entity’s financial and operating policies as to obtain benefits from its activities. 51. Consolidated financial statements are designed to provide the results of operations, cash flow, and the balance sheet as if the parent and subsidiary were a single entity. 52. Consolidated financial statements are appropriate even without a majority ownership if which of the following exist. The parent company has the right to appoint a majority of the members of the subsidiary’s board of directors through a large minority voting interest. 53. IASB has recommended that a parent corporation should consolidate the financial statements of the subsidiary into its financial statement when it exercises control over the subsidiary, even without majority ownership. In which of the following situations would control not be evident? 54. The goal of the consolidation process is for assets acquisition and 100% stock acquisitions to result in the same balance sheet. 55. A subsidiary was acquired for cash in a business combination on December 31,20x1. The purchase price exceeded the fair value of identifiable net assets. The acquired company owned equipment balance sheet prepared on December 31,20x1, would Report the excess of the fair value over the book value of the equipment as part of the plant and Equipment account. 56. The investment in a subsidiary should be recorded on the parent books at the Fair value of the consideration given. 57. Which of the following costs of a business combination can be included in the value charged to paid-incapital in excess of par? Stock issue costs if stock is issued as consideration