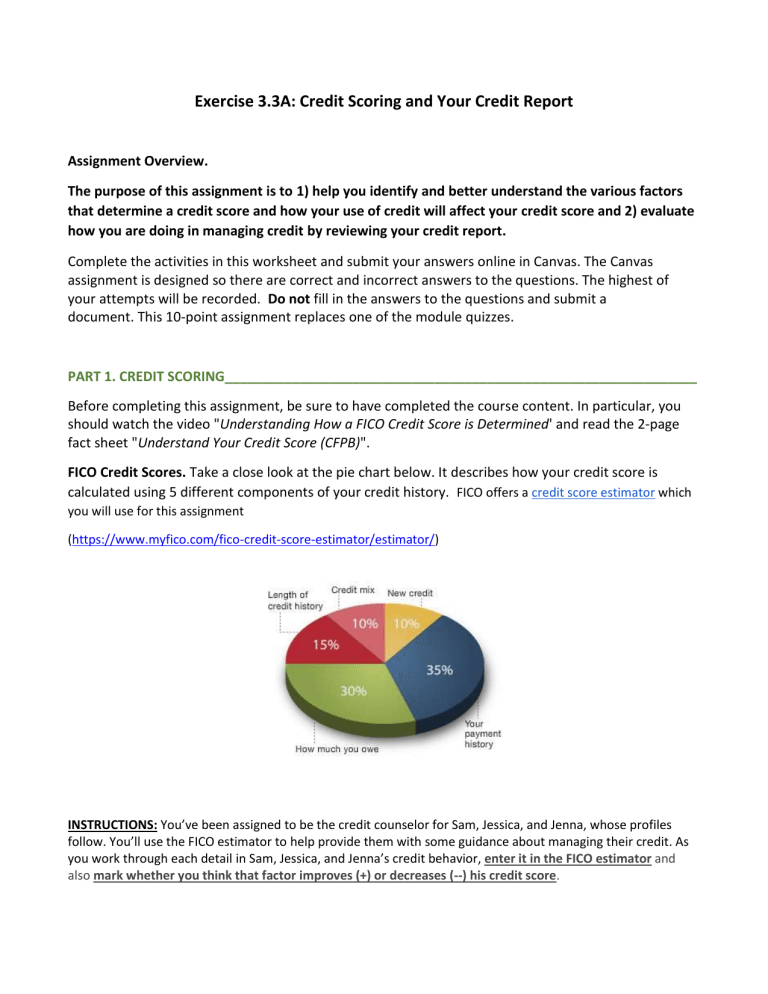

Exercise 3.3A: Credit Scoring and Your Credit Report Assignment Overview. The purpose of this assignment is to 1) help you identify and better understand the various factors that determine a credit score and how your use of credit will affect your credit score and 2) evaluate how you are doing in managing credit by reviewing your credit report. Complete the activities in this worksheet and submit your answers online in Canvas. The Canvas assignment is designed so there are correct and incorrect answers to the questions. The highest of your attempts will be recorded. Do not fill in the answers to the questions and submit a document. This 10-point assignment replaces one of the module quizzes. PART 1. CREDIT SCORING_______________________________________________________________ Before completing this assignment, be sure to have completed the course content. In particular, you should watch the video "Understanding How a FICO Credit Score is Determined' and read the 2-page fact sheet "Understand Your Credit Score (CFPB)". FICO Credit Scores. Take a close look at the pie chart below. It describes how your credit score is calculated using 5 different components of your credit history. FICO offers a credit score estimator which you will use for this assignment (https://www.myfico.com/fico-credit-score-estimator/estimator/) INSTRUCTIONS: You’ve been assigned to be the credit counselor for Sam, Jessica, and Jenna, whose profiles follow. You’ll use the FICO estimator to help provide them with some guidance about managing their credit. As you work through each detail in Sam, Jessica, and Jenna’s credit behavior, enter it in the FICO estimator and also mark whether you think that factor improves (+) or decreases (--) his credit score. SCENARIO 1: SAM SPENDTHRIFT is a college junior. He couldn’t wait until he turned 21, so he could apply for a few credit cards. Here are some details about his profile: # Detail 1 He currently has 3 credit cards 1 He got his first credit card 8 months ago 2 He doesn’t have any student loans 3 He has applied for 5 credit cards in the last year (and had 3 applications accepted) 4 He opened his last credit card 4 months ago 5 All of his 3 credit cards currently have a balance, as he has had trouble paying off his card each month 6 He has $4,000 currently outstanding on all his credit cards 7 He missed a payment in the last three months when he forgot to notify the card company that he had recently moved out of his apartment. He was 30 days behind on making a payment. 8 He has no cards currently past due 9 His credit card balances of $4,000 are about 65% of his overall limits + or -- 10 He has never gone through a bankruptcy or other proceeding ANSWER THESE QUESTIONS ABOUT SAM. You will enter them into the Canvas assignment space. 1. What is Sam’s estimated credit score? 2. What does Sam’s score say about his creditworthiness? 3. As his credit counselor, what recommendations would you make to Sam to improve his credit score? SCENARIO 2: JESSICA CREDITSMART is a college senior. Her parents gave her a credit card when she turned 17 by making her an authorized user on their credit card. As an authorized user on their account, she benefitted from her parent’s diligent credit card habits. She also has a few student loans in college that she will start repaying after she graduates. Here are some details about her for the profile: # Detail + or 1 1 (cont) She currently has 1 credit card She got this first credit card more than 15 years ago. This is a great credit score hack; she benefits from the fact that her parents had this credit card for 15 years. 2 She got her first student loan 3 years ago 3 She has received one student loan in the last year 4 She got that student loan over six months ago 5 Only her three student loans carry a balance, since she and her parents always bill the credit card bill off in full every month 6 She has $15,000 currently outstanding on her student loans 7 She (and her parents) have never missed a payment 8 None of her loans or credit cards are past due (and her parents are always on time with their credit card) 9 Since she and her parents pay off the bill every month, she has $0 balance 10 She has never gone through a bankruptcy or other negative proceeding ANSWER THESE QUESTIONS ABOUT JESSICA. You will enter them into the Canvas assignment space. 4. What is Jessica’s estimated credit score? 5. What does Jessica’s score say about her creditworthiness? 6. As her credit counselor, what recommendations would you make to Jessica to improve her credit score? -- SCENARIO 3: JENNA DEBTFREE is also a college junior. She has always been very cautious with money and thinks her friends with credit cards are crazy. She pays only with cash and debit cards and while she knows she can handle credit cards given her frugal ways, she doesn’t want to ask her parents to sign off on a credit card for her, as she doesn’t turn 21 for a few more months. # Detail + or -- 1 She currently has no credit cards 2 She has no loans outstanding ANSWER THESE QUESTIONS ABOUT JENNA. You will enter them into the Canvas assignment space. 7. What is Jenna’s estimated credit score? 8. What does Jenna’s score say about her creditworthiness? 9. As her credit counselor, what recommendations would you make to Jenna to improve her credit score? PART 2. MANAGING YOUR CREDIT AND YOUR CREDIT REPORT________________________________ This part of the assignment is to evaluate how you are doing in managing credit. Since credit evaluation and credit scoring are important tools in the acquisition of a home and other important purchases, it is important that you understand where you stand. For this part of the assignment you will get a copy of your credit report, review it, and answer questions about what you learned about your credit report. There is a short video (2 minutes) about ordering your Credit Report. Step 1. Obtain a copy of your credit report. If you are from the United States, you can, by law, obtain one free copy of your credit report each year from one of the major credit report suppliers (Experian, TransUnion, or Equifax). Go to www.annualcreditreport.com and supply the necessary information. Alternatively, you can call (877) 322-8228, or download and complete the Annual Credit Report Request Form. You will select one of the major providers and input the necessary identification information, and the credit reporting agency will provide you a copy of your credit report online. In some cases you may have to mail away for your credit report. This will take about 4 weeks. Please let me know if this is the case. Beware of other websites offering free credit reports. Some companies offer free credit reports, but you may have to buy another product or service to get it. While the annualcreditreport.com website is secure, you should avoid accessing it on a public computer or over an unsecured wireless (wifi) Internet connection, because of the sensitive, personally identifiable information (such as your social security number) that the site will ask you to provide. Requesting your free annual credit report will NOT affect your credit rating. During the request process, you’ll be asked to answer a number of identity verification questions. This can be a little tricky; so, it may help to have access to your financial records. You need to provide your name, address, Social Security number, and date of birth. If you have moved in the last 2 years, you may have to provide your previous address. To maintain the security of your file, each credit reporting agency may ask you for some information that only you would know, like the amount of your monthly mortgage payment. Each company may ask you for different information because the information each has in your file may come from different sources. ANSWER THESE QUESTIONS ABOUT YOUR CREDIT REPORT. You will enter them into the Canvas assignment space. 10. What is your Report Number (see example below)? ___________ Step 2. Review your credit report. Once you have your credit report, read it thoroughly and ensure it is accurate. Check that it contains only items about you. Be sure to look for information that is inaccurate or incomplete. Some common errors in credit reports are: Identity errors Errors made to your identity information (wrong name, phone number, address) Accounts belonging to another person with the same or a similar name as yours (this mixing of two consumers’ information in a single file is called a mixed file) Incorrect accounts resulting from identity theft Incorrect reporting of account status Closed accounts reported as open You are reported as the owner of the account, when you are actually just an authorized user Accounts that are incorrectly reported as late or delinquent Incorrect date of last payment, date opened, or date of first delinquency Same debt listed more than once (possibly with different names) Data management errors Reinsertion of incorrect information after it was corrected Accounts that appear multiple times with different creditors listed (especially in the case of delinquent accounts or accounts in collections) Balance Errors Accounts with an incorrect current balance Accounts with an incorrect credit limit ANSWER THESE QUESTIONS ABOUT YOUR CREDIT REPORT. You will enter them into the Canvas assignment space. 11. Was your personal information on your credit report correct? ___________ 12. How many creditors have made requests of your credit history/credit report? ___________ 13. Were there any adverse or potentially negative items on your credit record? ___________ 14. After reviewing your credit report, do you need to dispute any inaccurate information? _______ What to do if there is an error on your credit report: If you find errors, you should contact the credit reporting company who sent you the report, and the creditor or company that provided the information (called the “furnisher” of the information). Your credit report includes directions about how to dispute inaccurate or incomplete information. Additionally, there is a resource developed by the Consumer Financial Protection Bureau that is posted in the Credit module. Refer to this guide “Credit Report Dispute”, it provides information and tools you can use to dispute information in your credit report.