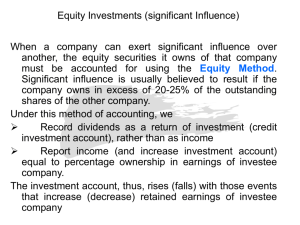

1 MODULE Long-Term Inter-Corporate Investments Companies invest in other entities for various reasons; sometimes to advance their strategic objectives and other times to allocate excess cash. In this module, we examine the accounting and reporting for the various types of intercompany investments made. We begin with an analysis of the various types of investments in Chapter 1 and then focus on those strategic investments where control exists. Business combinations are complex transactions that require knowledge of all aspects of accounting and reporting. We look at the fundamental principles in chapters 2 and 3 and then continue with the detailed reporting of consolidated financial statements in chapters 4 and 5. In tackling this module it is necessary to master each chapter before attempting the next. Each chapter is part of a process and one chapter builds from the previous one. We begin by exploring the fair value adjustments needed to record the acquiree’s net assets at fair value at the day of acquisition and in subsequent periods. Once this concept is understood, we introduce the adjustments needed to remove intragroup transactions and profits. Finally, we learn how to allocate the comprehensive income and assets to a non-controlling interest when the investment is less than 100% owned. In our last chapter in this module, Chapter 6, we revisit investments in associates and joint ventures, which were introduced in Chapter 1. This allows us to address in detail the equity method of reporting. Many of the topics in this module are new with the adoption of IFRS and ASPE, and as such, illustrative examples are useful in understanding the intent and purpose of the CICA Handbook sections. Investments in the Mining Industry Source: © Ugurhan Betin/iStockphoto SCORPIO MINING CORPORATION is a Canadianbased silver and base metal producer located in Mexico that conducts exploration and development on mining properties in the United States. Through the years, the corporation has grown primarily by focusing on internal growth through aggressive exploration. With its expansion to Mexico and the United States, the company aims to be a lowcost operation with the benefit of flexible mining methods and diversified metal production. Scorpio holds many different types of financial instruments, each of which is reported differently in the financial statements based on their nature. Some examples of its financial instruments are investments in the different subsidiaries as well as new mines for future developments. In the mining industry, it is common to observe companies joining forces in order to acquire new mines and develop new excavation facilities. As illustrated below with the acquisition of Scorpio Gold, these partnerships allow entering new markets without baring all the risks of the large cash outflow. The agreement as well as the level of ownership are the main criteria used when determining the type of investments to be presented in the financial statements. Being traded on the stock market, it is important for Scorpio to present its financial instruments in accordance with accounting guidelines in order to present the real economic situation of the company to the shareholders. Scorpio classifies its financial instruments in accordance with IAS 39 into the following categories. Fair value through profit and loss instruments are measured at fair market value, with all changes in value going through profit and loss. Assets available for sale are measured at fair market value, with all changes recognized in other comprehensive income. Loans and receivables, assets held to maturity, and other financial liabilities are also measured at fair value and are also recorded at amortized cost. In 2010, the company acquired a 70% interest in the Mineral Ridge gold mine in Nevada and related assets from Golden Phoenix Mineral. As a result of the agreement with Golden Phoenix, the parties jointly incorporated a new limited liability company called Mineral Ridge Gold to own, explore, develop, and exploit the Mineral Ridge property. The ownership of Mineral Ridge Gold is proportional to the interest held in the property and therefore, Scorpio Mining has significant influence in the new entity. Mineral Ridge Gold started production on January 1, 2012. As of March 26, 2012, Scorpio Mining held approximately 11.3 million shares of Scorpio Gold Corporation, which is involved in the acquisition, exploration, and development of resource properties. The investment in the Mineral Ridge Gold mine is a very important transaction for Scorpio Mining Corporation since its ability to meets its obligations and continues as a going concern depends on its future ability to generate cash flows from its operations or to raise the financial required. Sources: Scorpio Mining Corporation website, www.scorpiomining.com; Scorpio Mining Corporation audited financial statements, December 31, 2011; CICA Handbook, IAS 39. CHAPTER 1 Accounting for Investments LEARNING OBJECTIVES When you have studied this chapter, you should be able to: 1. Identify and account for non-strategic investments in equity. 2. Identify and account for parent–subsidiary relationships. 3. Identify and account for associates. 4. Identify and account for joint arrangements. ACCOUNTING FOR INVESTMENTS Non-Strategic Investments in Equity Strategic Investments— Parent–Subsidiary Relationship ■ Identifying non-strategic investments in equity ■ Identifying parent–subsidiary relationships ■ Recording non-strategic equity investments ■ Presentation of consolidated financial statements for controlled entities Strategic Investments— Associates Strategic Investments—Joint Arrangements ■ Identifying associates ■ Identifying joint arrangements ■ Equity method of accounting ■ Accounting and reporting for joint arrangements 4 Accounting for Investments chapter 1 In Canada, some of the most interesting business news items have been the acquisitions of companies, mergers between companies, and divestitures. Most mergers and acquisitions involving Canadian corporations are decided by management and the company shareholders. Sometimes companies decide they must grow to survive, and other times they put themselves up for sale after deciding their survival depends on another company buying all or part of them. Takeovers can be friendly or hostile. Deals can be structured as mergers of equals and they can involve more than two companies. Transactions can be accomplished through cash, shares, share exchanges, and/or debt financing. The Canadian government has even become an interested party in these transactions as it must consider the issue of foreign control over Canadian companies. Many people think that the typical takeover involves an American multinational buying up a smaller Canadian firm, but that is often not the case. In early 2011, for example, Canadian-led acquisitions outnumbered foreign-led acquisitions by a 2-to-1 margin, consistent with historical levels.1 American firms do account for the majority of takeovers by foreign firms; since 1985, they have accounted for 60% of foreign acquisitions of Canadian businesses.2 But there are still many large cross-border deals involving foreign firms outside of the United States. Among the 228 transactions announced in the first quarter of 2011, for example, was the London Stock Exchange Group plc’s proposed $3.2-billion merger with the TMX Group Inc. and PetroChina Company Limited’s agreement to acquire a 50% interest in Encana Corporation’s Cutbank Ridge business assets in British Columbia and Alberta for $5.4 billion.3 In 2011, Montreal-based CSL Group Inc. made a key acquisition in Europe to help it build an expanding worldwide marine transportation business. CEO Rod Jones reported that CSL, with large international and Great Lakes-St. Lawrence Seaway shipping businesses, had bought control of a European fleet of 11 self-unloading cargo ships owned by Norway’s Kristian Jebsens Rederi AS. Jones would not disclose financial details but a new subsidiary, CSL Europe, was set up, based in London and Bergen, to service European clients. “Jebsens is a famous name in world shipping and Abe Jensen was a pioneer in building a self-unloading business in Europe,” Jones said. “We’ll build off the base that Jebsens has created, bringing our own brand of self-unloader services to the new venture.” CSL Group is the world’s largest owner and operator of self-unloaders, with activities in North America and Australasia and offices in Canada, the United States, Australia, and Singapore. It is owned by the family of former prime minister Paul Martin. Source: Robert Gibbens, “CSL Sets Up New Subsidiary; Buys control of European business,” Montreal Gazette, March 31, 2011. These transactions are all considered strategic since they further the long-term strategic goals of the companies involved. This is the case, for example, when a company acquires another business that has been its supplier to ensure a steady supply at reasonable prices. A company might also want to acquire a competitor to eliminate competition and therefore increase market share. Or a company might buy an investment in the United States and another in France as part of its strategic plan to become a global competitor. In today’s global business environment, many companies hold investments in other entities for strategic purposes but they may also have investments in shares of a non-strategic type. 1 Giancomelli, CROSBIE press release June 9, 2011, Q1 2011, www.crosbieco.com/ma/index.htm Quarterly Statistics of Business Acquisitions Made in Canada from Other Countries, Industry Canada, www.ic.gc.ca/eic/site/ica-lic.nsf/eng/lk-5110.html 3 Giancomelli, CROSBIE press release June 9, 2011, Q1 2011, www.crosbieco.com/ma/index.html 2 Non-strategic Investments in Equity 5 There are two primary reasons why a company invests in the shares of another company: to advance strategic objectives and to invest excess cash in a non-strategic manner. The focus of this module is the reporting for strategic investments. However, we will review the accounting and reporting for non-strategic investments as well since it is important to understand the distinction between them and to assess the reporting requirements correctly. You may have covered non-strategic investments in an intermediate accounting course; however, we review this topic as a necessary introduction to the understanding of strategic investments. Nonstrategic investments in shares are those that a company makes as an alternative to putting excess funds in a bank. The company hopes to obtain a return on its investment that is greater than the bank’s interest rate. Accounting standards provide for different methods of accounting for strategic and non-strategic investments, depending on the nature of the investments and the relationship between the investor and the investee. We need to remember that as accountants, our goal is to ensure that the financial statements properly record the substance of the relationship that exists so that the user can make informed decisions. International Financial Reporting Standards (IFRS) identify three types of investments of a strategic nature. These are: those investments in which a company has a parent– subsidiary relationship, a company has an associate, or a company has a joint arrangement. To understand the types of investments, we need to understand that there are three types or levels of control that one company can exercise over another: control or dominance (relating to subsidiaries), significant influence (relating to associates), and joint control (relating to joint arrangements). Later in this chapter we will introduce you to each of the types of strategic investments and will explore the reporting for the various types of strategic investments made in the shares of other entities. Throughout this chapter, boxes highlight the identification of and accounting for each type of investment according to Accounting Standards for Private Enterprises (ASPE), comparing ASPE with IFRS. We begin with the discussion of non-strategic investments in equity. NON-STRATEGIC INVESTMENTS IN EQUITY Identifying Non-strategic Investments in Equity Objective 1 Identify and account for non-strategic investments in equity. ASPE Companies invest in non-strategic investments to obtain a higher return than holding cash in a bank account. The standards for reporting non-strategic investments are covered under IFRS 9 Financial Instruments, IAS 32 Financial Instruments—Presentation, and IFRS 7 Financial Instruments— Disclosure. Under private entity GAAP (Accounting Standards for Private Enterprises or ASPE), this topic is covered in Section 3856 Financial Instruments. Criteria If a company makes a non-strategic investment, it is considered a financial asset. In its simplest terms, you may recall that a financial asset is simply a contract for cash or another financial instrument. The shares of another company are just pieces of paper that entitle the holders to dividends and growth. The paper itself has no value. The value of the share is derived from the underlying worth of the company. It would follow that strategic investments in shares would also be financial assets; however, IFRS specifically exempts strategic investments from 6 Accounting for Investments chapter 1 the definition of financial asset. This is done so that the reporting for strategic investments can be tailored to the needs of the users. A financial asset is defined (in IAS 32.11) as any of the following: 1. Cash 2. An equity instrument of another company 3. A contractual right to receive cash or another financial asset from another company 4. A contractual right to exchange financial instruments under conditions that are potentially favourable Investments in the equity of other companies that are non-strategic meet the second criteria of the definition of a financial asset. From a practical perspective, the issue is how a company is to recognize that something is in fact a non-strategic investment. Under IFRS, an investment that does not meet the definition of strategic is classified as a financial asset. However, IFRS provides some guidance in that respect. There is a presumption that a company that owns less than 20% of the voting shares of another company does not have control, joint control, or significant influence. It can therefore be inferred that the company must have a non-strategic investment unless other factors prove otherwise (IAS 28). Initial Recognition A company recognizes an investment in equity instruments on its statement of financial position when it becomes a party to the contractual provisions of the instrument. Practically speaking, this would occur when the company is deemed to own the shares. Until 2015, companies will be required to classify shares in equity instruments as either “fair value through profit or loss” or “available for sale” (IAS 39). Illustration 1.1 shows excerpts from Abitibi Mining Corporation’s financial statements, showing the different types of investments in non-strategic equity under IAS 39. For year ends beginning January 1, 2015, IFRS 9 Financial Instruments replaces IAS 39.4 In this textbook we assume the early adoption of IFRS 9. For a more thorough discussion of IAS 39 please refer to the online material that accompanies the text. When adopting IFRS 9, companies must classify their investments in equity instruments at fair value through profit and loss (FVTPL). All equity instruments are recorded at fair value even if a market does not exist. In limited circumstances, cost may be an appropriate estimate of fair value. That may be the case if insufficient, more recent information is available to determine fair value, or if there is a wide range of possible fair value measurements and if cost represents the best estimate of fair value within that range (IFRS 9 B5.5). Some examples where cost might not be representative of fair value (under IFRS 9 B5.6) include: • a significant change in the performance of the investee compared with budgets, plans, or milestones • changes in expectation that the investee’s technical milestones will be achieved • a significant change in the market for the investee’s product • a significant change in the market for the investee’s equity • a significant change in the global economy or the economic environment in which the investee operates 4 Early adoption was permitted beginning in years starting on January 1, 2011, for the section of IFRS 9 that was complete by 2011. If companies adopted the requirements of IFRS 9 related to financial asset classification and measurement for reporting periods beginning prior to January 1, 2012, they were not required to restate prior periods. Retained earnings and/or other relevant equity accounts were adjusted at the beginning of the annual reporting period in which IFRS 9 was adopted. For companies that were new or were transitioning to IFRS in 2011, it may have been more prudent to adopt early so that they would not have to do a retrospective adjustment in 2015. Non-strategic Investments in Equity Illustration 1.1 Excerpts from Abitibi Mining Corp. Financial Statements Abitibi Mining Corp. Balance Sheets May 31 2011 Assets Current Cash Sales tax receivable Prepaid expenses Marketable securities (Note 3) $ 849 68,798 7,746 — Due From Related Party (Note 8) Mineral Property Costs (Note 4) Liabilities Current Accounts payable and accrued liabilities Due to related parties (Note 8) Shareholders’ Equity Share Capital (Note 5) Share Subscriptions Contributed Surplus Accumulated Other Comprehensive Loss Deficit May 31 2010 $ 7,547 11,535 1,061 1,665 77,393 21,808 — 883,537 65,252 833,474 $ 960,930 $ 920,534 $ 528,979 120,103 $ 366,765 9,912 649,082 376,677 15,240,791 60,000 883,150 — (15,872,093) 311,848 14,616,517 — 836,250 (385) (14,908,525) 543,857 $ 960,930 $ 920,534 2. SIGNIFICANT ACCOUNTING POLICIES c) Financial Instruments Financial instruments are classified into one of five categories: held-for-trading, held-to-maturity investments, loans and receivables, available-for-sale financial assets, or other financial liabilities. Financial instruments and derivatives are measured in the balance sheet at fair value except for loans and receivables, held-to-maturity investments, and other financial liabilities which are measured at amortized cost. Subsequent measurement and changes in fair value will depend on their initial classification. Held-fortrading financial assets are measured at fair value and changes in fair value are recognized in net income. Available-for-sale financial instruments are measured at fair value with changes in fair value recorded in other comprehensive income until the instrument is derecognized or impaired. The Company has classified its cash as held-for-trading, amounts receivable as loans and receivables and accounts payable, accrued liabilities, and due to related parties as other financial liabilities. The carrying values of the Company’s financial instruments were a reasonable approximation of fair value. Disclosures about the inputs to financial instrument fair value measurements are made within a hierarchy that prioritizes the inputs to fair value measurement. The three levels of the fair value hierarchy are: Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities; Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and Level 3 – Inputs that are not based on observable market data. 3. MARKETABLE SECURITIES May 31, 2011 Number Amount Klondike Gold Corp. Klondike Silver Corp. Neodym Technologies Inc. Strike Mineral Inc. — — — — $ — — — — $ — Number 10,000 2,000 1,250 25,000 May 31, 2010 Amount $ 300 90 25 1,250 $ 1,665 Marketable securities were comprised of investments in public companies. Klondike Gold Corp., Klondike Silver Corp., and Neodym Technologies Inc. are related by directors in common. 7 8 Accounting for Investments chapter 1 • a significant change in the performance of comparable entities • internal matter of the investee such as fraud, commercial disputes, litigation, changes in management strategy A company is required to use all available information in order to assess if cost is a good approximation of fair value. Cost is never considered the best estimate of fair value for shares that are quoted on an active market. There are possible exceptions to FVTPL. At the day of acquisition when the investment in shares is originally recorded, the company has the option of making an “irrevocable election” where it decides that subsequent changes to fair value will be put in other comprehensive income rather than through profit and loss. This election cannot be made for investments that are held for trading.5 In addition, this amount cannot be “recycled” through profit and loss. Recycling is a new concept under IFRS that relates to items that are originally placed in Other Comprehensive Income. Some items are recycled, which means they flow through net income when they are realized, and others are not recycled, which means that when realized they are flowed directly to equity. Recording Non-strategic Equity Investments When the non-strategic equity investment is initially recorded, it must be measured at its fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. IFRS 13 Fair Value Measurement, issued in 2011 and effective for year ends beginning January 1, 2013, provides guidance on how to determine fair value. Transaction costs for investments that are FVTPL are expensed immediately. Transaction costs are incremental costs directly attributable to the acquisition of a financial asset. This would include legal fees, administrative costs, and broker fees. The investment in equity must be restated to fair value at the end of each reporting period. Any gain or loss on the change in fair value is recorded in net income (see Illustrative Example 1.1). If the irrevocable election is made, the gain or loss is recorded in other comprehensive income (see Illustrative Example 1.2). Illustrative Example 1.1 FVTPL Journal Entries ABC acquires 500 shares in XYZ on January 1, 2013. ABC pays $10,000 to acquire the shares. The investment represents 10% of the ownership in XYZ. The investment is classified as FVTPL. At December 31, 2013, the shares are still unsold and have a current market value of $30 per share. On February 15, 2014, the shares are sold for $12,000. Journal entries: Jan. 1, 2013 FVTPL—Investment 10,000 Cash 10,000 (To record the acquisition at fair value) Dec. 31, 2013 FVTPL—Investment (30 × 500) – 10,000 Gain on Change in Fair Value of FVTPL Investment 5,000 5,000 (To record the change in fair value at year end) 5 An investment in equity instruments is considered held for trading if it is acquired or incurred principally for the purpose of selling or repurchasing it in the near term or if it is part of a portfolio of identified financial instruments that are managed together and for which there is evidence of a recent actual pattern of short-term profit taking. Trading generally reflects active and frequent buying and selling with the objective of generating profit. 9 Non-strategic Investments in Equity Feb. 15, 2014 Cash 12,000 FVTPL—Investment Loss on Sale of FVTPL Investment 15,000 3,000 (To record the sale of FVTPL investment) Comprehensive Income Statement 2014 Unrealized gain on fair value adjustment 2013 5,000 Realized loss on sale of FVTPL investment –3,000 Net income –3,000 5,000 2014 2013 0 $15,000 Statement of Financial Position Short-term FVTPL Investments If the company makes the irrevocable election to put the changes in fair value through Other Comprehensive Income, the journal entries will be the same as those shown in Illlustrative Example 1.1 for FVTPL except that the gains or losses will be put in Other Comprehensive Income (OCI). The balance in the cumulative OCI will go directly to Equity—Retained Earnings when realized through sale. Illustrative Example 1.2 FVTPL Investment: Irrevocable Election ABC acquires 500 shares in XYZ on January 1, 2013. ABC pays $10,000 to acquire the shares. The investment represents 10% of the ownership in XYZ. ABC makes the irrevocable election to have the changes in fair value recognized in OCI. These shares are not considered held for trading. At December 31, 2013, the shares are still unsold and have a current market value of $30 per share. On February 15, 2014, the shares are sold for $12,000. The journal entries are: Jan. 1, 2013 FVTPL—Investment 10,000 Cash 10,000 (To initially record the investment at fair value) Dec. 31, 2013 FVTPL—Investment (30 × 500) – 10,000 5,000 OCI—Change in Fair Value of the Investment 5,000 (To revalue the investment to fair value at year end) Feb. 15, 2014 OCI—Loss on Restatement of FVTPL 3,000 FVTPL—Investment 3,000 (To restate the investment to fair value at the day of sale) Feb. 15, 2014 Cash 12,000 FVTPL—Investment (To record cash received on sale) 12,000 10 Accounting for Investments chapter 1 Feb. 15, 2014 OCI—Restatement of FVTPL 2,000 Retained Earnings 2,000 (To reclassify the balance in the Cumulative OCI that is not recycled and therefore is put directly to retained earnings) Comprehensive Income Statement Net income Other comprehensive income 2014 2013 –0– –0– $–3,000 $5,000 Reclassification of OCI –2,000 –0– Comprehensive income $–5,000 $5,000 The dividend received is recorded through income in the year that the company is entitled to it.6 Assume that XYZ paid dividends in 2013 in the amount of $600 to shareholders of record on that date. ABC would make the following entry regardless of the classification of the gains and losses on changes in fair values: Cash 60 Dividend Income 60 (To record 10% of the dividend income for 2013) There is no requirement that dividend income be disclosed separately on the statement of comprehensive income. Under IFRS, if the dividend is a return of capital (i.e., the dividend is paid from the permanent capital of the investee rather than its retained earnings) and gains and losses are put through OCI, the dividend—which is actually a refund of capital—would be recorded in OCI. If a non-strategic investment is reported at FVTPL, there is no requirement to test for impairment. This is logical since the investment already reflects the fair value and any adjustment, whether an increase in value or an impairment, has been reflected in net income. Applying ASPE to Non-strategic Equity Investments ASPE Under ASPE, financial assets are covered in Section 3856. A company must recognize the equity investment when the company becomes a party to the contractual provisions of the financial instrument. This would generally be when it is deemed the property of the acquiring company. Upon initial recognition, all equity that is purchased in an arm’s-length transaction is recorded at its fair value. If the equity will not be subsequently measured at fair value, the transaction costs that are directly associated with the acquisition are added to the cost of the equity (Section 3856.07). If the transaction is with a related party, the criterion for related parties applies rather than this section. In subsequent periods, a company must measure the equity instrument at the original cost unless there are impairments issues. There are exceptions to this requirement: 1. Investments in equity instruments that are quoted in an active market must be restated to fair value. Any gain or loss would be flowed directly through net income. This should be evident as other comprehensive income does not exist under ASPE. 6 The investor is entitled to the dividend revenue once it has been declared by the investee. 11 Non-strategic Investments in Equity 2. A company may elect to measure any equity instrument at fair value by designating that fair value measurement will apply (Section 3856.12). If a company makes this designation, it is irrevocable. If we examine Illustrative Example 1.1, we see that if the shares are restated to fair value, the journal entries are the same as those proposed under IFRS for investments that are FVTPL. If, however, the shares are in a private company that does not trade on an active market, the investment is subsequently recorded at cost (known as the cost method), which results in the journal entries in Illustrative Example 1.3. Illustrative Example 1.3 Financial Asset of a Private Company Under ASPE Journal Entries Let’s assume that ABC is not a publicly accountable enterprise. ABC acquires 500 shares in XYZ, a private company, on January 1, 2013. ABC pays $10,000 to acquire the shares. The investment represents 10% of the ownership in XYZ. ABC records the investment at cost since there is no market for the shares of XYZ. At December 31, 2013, the shares are still unsold. On February 15, 2014, the shares are sold for $12,000. The journal entries are: Jan. 1, 2013 Investment in XYZ 10,000 Cash 10,000 (To record the acquisition at fair value) Dec. 31, 2013 No entry since the equity investment is shown at the original cost and there is no reason to believe it is impaired. Feb. 15, 2014 Cash 12,000 Investment 10,000 Gain on Sale of Investment 2,000 (To record the sale of FVTPL investment) Income Statement 2014 2013 Realized gain on sale of investment 2,000 Net income 2,000 –0– 2014 2013 –0– $10,000 Statement of Financial Position Short-term or long-term investments The classification as short-term or long-term would be based on the intent of ABC. Notice that over the entire period, the method under ASPE results in the same amount of a $2,000 ($12,000 ⫺ $10,000) gain being reflected in net income as the method under IFRS FVTPL. The difference is a timing issue that affects whether the gain is recorded in 2013 or 2014. Under ASPE, the dividend received is recorded through income in the year that the company is entitled to it,7 which is the same as IFRS. 7 The investor is entitled to the dividend revenue once it has been declared by the investee. 12 Accounting for Investments chapter 1 Like IFRS, impairment testing is only required for investments that are not carried at fair value. At the end of each reporting period, a company assesses whether there are any indications of impairment (Section 3856.16). However, the measurement of the impairment under ASPE is not the same as IFRS. When an impairment exists, the carrying value is reduced to the highest of: ASPE • the present value of the cash fl ows expected to be generated by holding the investment discounted using the current market rate of interest appropriate to the asset or • the amount that could be realized by selling the asset at the balance sheet date (Section 3856.17). Under ASPE, impairments may be reversed if the increase in value is due to an event that occurred after the impairment was recognized. For example, an investment that was incurring losses changes the nature of its operations and returns to profitability. The reversal cannot result in the investment being valued at an amount greater than the original cost. The reversal is also recognized in net income. ✓ LEARNING CHECK • There is a general assumption that an ownership interest of less than 20% is a financial asset and not a strategic investment. • Entities are required to present non-strategic investments in equity as financial assets. • Financial assets under IFRS 9 are shown at fair value with the difference in fair value going through income. • Entities may make an irrevocable election to show the gains and losses through other comprehensive income. • Under ASPE, all financial investments in shares are reflected at cost unless the shares trade in a public market. In that case, they are reflected at fair value and the gain or loss is flowed through income. STRATEGIC INVESTMENTS— PARENT–SUBSIDIARY RELATIONSHIP Objective Identify and account for parent–subsidiary relationships. 2 In the previous section we examined investments in equity that are made as an alternative to earning a return in the bank. In this section we begin our review of those investments that are made to advance the company’s strategic goals. Identifying Parent–Subsidiary Relationships We begin our discussion of strategic investments with parent–subsidiary relationships. In IFRS 10, a subsidiary is defined as an entity that is controlled by another company, the parent. The criterion for identifying a parent–subsidiary relationship is control. IFRS 10 also requires that consolidated financial statements be prepared when there is a parent–subsidiary relationship. Determining whether one company controls another is then crucial to determining which entities should prepare consolidated financial statements. Strategic Investments—Parent–Subsidiary Relationship 13 IFRS 10 contains the following definition of control: An investor controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee (IFRS 10.6). Note that three criteria must be present in order for there to be control. The parent must have: 1. the ability to direct the financial and operating policies of another company (the power criterion), 2. the ability to obtain returns from the other company (the returns criterion), and 3. the ability to use its power to affect those returns (the link criterion). The rationale behind the definition of control is that consolidation should be driven by the principle of reporting a parent and its subsidiaries as if they were a single company. If you own shares of the parent company and that parent owns shares of a subsidiary, in substance you also own the subsidiary company. Identifying whether an entity is a subsidiary should be based on control. Only one company can control another company; control cannot be shared. Note that a reporting company must assess control continuously. A company’s ability to control another company changes as a consequence of actions by the reporting company or because of changes in facts and circumstance. The investor must reassess if circumstances indicate that there are changes to one or more of the three elements of control listed above. The Power Criterion The ability to direct financial and operating policies refers to a company’s capacity to control. The capacity to control is obtained through existing rights that give the parent the ability to direct relevant activities. One key aspect of control is the distinction between the capacity to control and that of actual control. Capacity to control does not require the holder to actually exercise control. Similarly, a company that is actually controlling another may not have the capacity to control. Power arises from rights. These rights must exist now so that the investor has the current ability to direct relevant activities. IFRS 10 describes some examples of rights that provide power to the investor: • rights in the form of voting rights (or potential voting rights) of an investee; • rights to appoint, reassign, or remove members of an investee’s key management personnel who have the ability to direct the relevant activities; • rights to appoint or remove another entity that directs the relevant activities; • rights to direct the investee to enter into, or veto any changes to, transactions for the benefit of the investor; and • other rights (such as decision-making rights specified in a management contract) that give the holder the ability to direct the relevant activities (IFRS 10.B15). Sometimes power is easy to assess if it is obtained through voting shares of an entity. In that case the parent obtains this power through its ability to oversee financial and operating policies, but it is not the only means of gaining this power. Power can be achieved in other ways, including by having voting rights, options or convertible instruments, or contractual arrangements, or a combination of these. The controlling company could have an agent with the ability to direct the activities for the benefit of the controlling company. These rights must give the parent power over “relevant activities.” This means that the investor must have the ability to determine operating and financing activities of the investee 14 chapter 1 Accounting for Investments that would significantly affect their returns. IFRS 10 provides the following examples of relevant activities: • selling and purchasing of goods or services; • managing financial assets during their life (including upon default); • selecting, acquiring, or disposing of assets; • researching and developing new products or processes; and • determining a funding structure or obtaining funding (IFRS 10 B11). IFRS provides examples of relevant decisions: • establishing operating and capital decisions of the investee, including budgets; and • appointing and remunerating an investee’s key management personnel or service providers and terminating their services or employment (IFRS 10 B12). It is therefore clear that the investor must understand the design and nature of the investee so that it can determine the relevant activities of that investee. Passive versus active control. The company having the power to direct activities, or the capacity to control, may not be actively involved in the management of the controlled company; the controller may play a passive role. However, in situations where another party is actively formulating the policies of a subsidiary, in order for another company to be the controlling company, it must have the ability to change or modify those policy decisions if the need for change is seen to exist. The existence of actual control (i.e., determining the actual policies of the subsidiary) often signals the existence of capacity to control, but the two do not necessarily coexist. Non-shared control. Regardless of whether the control is passive or active, there can be only one controlling company; there cannot be two or more entities that share the control. It is possible that one company may delegate control to another company, but the first company is considered to have the capacity to control even if it is the delegated party that actually controls the subsidiary. Level of share ownership. Control is presumed to exist when the parent owns, directly or indirectly through subsidiaries, more than half of the voting power of an entity. Hence, where the parent owns more than 50% of the shares of another entity, it is expected that the other entity is a subsidiary of the parent. However, it is possible to own more than 50% of the voting shares and not have control. This could occur if legal requirements, the founding documents of the other company, or other contractual arrangements restrict the reporting company’s power to the extent that it does not have the power to direct the company’s relevant activities. Ownership of shares normally provides voting rights that enable the holder of the majority of shares to dominate the appointment of directors or a company’s governing board. Control can exist when the parent owns half or less of the voting power of a company. IFRS 10 provides the following situations, where there is: (a) a contractual arrangement between the investor and other vote holders that provides the power to the investor; (b) rights arising from other contractual arrangements that provide power to the investor to direct the relevant activities; (c) the investor’s voting block is sufficient to obtain the power; (d) potential voting rights provide the substantive rights that permit the investee to have power; or (e) a combination of (a)–(d). Strategic Investments—Parent–Subsidiary Relationship 15 There is no debate about the existence of control where the parent has a majority shareholding in the subsidiary. However, where the ownership interest is less than 50% or is based on possible future actions, it is less evident as to whether control exists. A distinction needs to be made between non-shared control and what can be described as “unilateral control.” Unilateral control means that the controlling party does not depend on the support of others to exercise control, which is the case where the parent owns more than 50% of the shares of the subsidiary. Where the holding is less than 50%, the parent has a non-shared or dominant control. This is not control in a legal sense as with unilateral control, but is control that may be achieved both because of its own actions and because of the actions (or inactions) of other parties. The following factors must be considered for determining whether an investor has unilateral control even though it owns less than 50% of the voting shares. • Existence of contracts: The investor may have power because of the existence of contracts: 1. power over more than half of the voting rights by virtue of an agreement with other investors; or 2. power to govern the financial and operating policies of the company under a statute or an agreement. The contract or agreement may take many forms; however, a contract may cover a limited time period. Control will then exist only while the contract is current. • Size of the voting interest: An investor with less than a majority of voting right still has enough rights to give it power when it has the practical ability to direct the relevant activities unilaterally (IFRS 10.B41). The assessment of this ability requires professional judgement. For example, although all shareholders may attend general meetings and vote in matters relating to governance of a company, it is rare for this to occur. If, therefore, only 75% of the eligible votes are cast at a general meeting and a company has a 35% interest in that company, and three other shareholders have 5% each, it can cast the majority of votes at that meeting. In this case, the active participation of the other shareholders indicates that the investor would not have the ability to direct the relevant activities unilaterally, regardless of whether the investor has directed the relevant activities. • Dispersion of other shareholders: Shareholders can be dispersed geographically as well as in numbers of shares held. The annual general meeting may be held in Toronto, but the majority of shareholders may live in southeast Asia. The probability of these shareholders attending the general meeting is then lessened by location. Further, even if all the shareholders live in Toronto, if they hold small parcels of shares, then the probability of attendance at general meetings is reduced. For example, if the number of shares issued by the subsidiary is 1,000, the shareholders will be more dispersed if there are 1,000 shareholders with one share each than if there are four shareholders with 250 shares each. However, assuming the prospective parent has a 40% interest, it is not clear where the cut-off point is between lack of control when there are two other shareholders with 30% interest each and having control when there are 60 other shareholders with 1% each. • Level of disorganization or apathy of the remaining shareholders: This factor is affected by the dispersion of the shareholders, and reflected in their attendance at general meetings. Holders of small parcels of shares do not often form voting blocks. Shareholders with environmental or ethical concerns about a company may be less apathetic about its actions and management policies, and may form voting blocks. Illustrative Example 1.4 demonstrates the application of the concept of power to direct the relevant activities unilaterally, where the parent has less than 50% of the shareholding in a subsidiary. In the example, the ownership by Plato Inc. of shares in Socre Ltd. reduces over time from 100% to 60% to 45% and finally to 35%. The question is whether Plato Inc. retains the power to direct relevant activities of Socre Ltd. as its shareholding decreases. 16 chapter 1 Accounting for Investments Illustrative Example 1.4 Power Based on Voting Shares Plato Inc., a cement manufacturer, acquired all of the voting shares of Socre Ltd., a rug manufacturer, as part of a diversification program. Several years later, Plato decided as part of its corporate strategy to commit capital resources only to its primary line of business, and was unwilling to support the projected growth of Socre. Plato caused Socre to issue additional shares in an initial public offering, resulting in a reduction in Plato’s ownership interest in Socre from 100% to 60%. Shortly after the offering, the newly issued shares are widely held, and no other party has more than 3% of Socre’s outstanding shares. Both before and after the initial public offering, Plato’s shareholding represents a majority interest in Socre, which leads to a presumption of control in the absence of evidence to the contrary. Moreover, there is no evidence that demonstrates that Plato, through its 60% interest, no longer has the ability to dominate the nomination and selection of Socre’s board members. Five years later, to raise additional capital needed to finance the growth of Socre, Plato causes Socre to issue additional shares, which reduces Plato’s ownership of outstanding shares to 45%. At this time, Plato’s 45% holding is the largest block of shares held by any single party, and the remaining shares outstanding continue to be widely held: no other party holds more than 3% of the outstanding shares. Ten days after the public offering, Plato is able, through Socre’s board of directors, to cause the renomination of all of its choices for the 11 board members of Socre. During the past five years, about 80% of the eligible rights to vote in an election of Socre’s board of directors were cast at any given annual meeting. The percentage of votes cast in each of the past five years was 76, 81, 82, 79, and, most recently, 82. Plato voted all of its shares each year, but only about half of the other eligible votes were cast in each of those years. In this case, Plato no longer has legal control of Socre but, based on the facts, the power has not been lost. Plato still has the ability to dominate the process of nominating and electing Socre’s members of the board, which is based mainly on two factors: Plato’s large minority holding and the wide dispersion of the remaining shares. About two years later, another issue of Socre’s shares reduces Plato’s holdings to 35%, and the voting patterns and all other facts remain constant. Plato’s 35% holding is now less than half of the 80% of votes typically cast in past elections and may still be nearly half of the votes cast in future elections. In this case, Plato’s ability to maintain its power becomes questionable. However, assurance of a company’s ability to maintain its control is not a condition for consolidation. Rather, the assessment is based on whether a company has a current ability to direct the relevant activities of another company, unilaterally. In this case, based on the facts and the weight of evidence—the 35% voting interest, the strong ties to the directors of Socre and the continuing success of Socre’s operations under its control—collectively give Plato Inc. the ability to dominate the nomination and election of Socre’s board of directors. In this case, there is no evidence that the power of Socre Ltd. has been lost. However, in Illustrative Example 1.4, it is unclear why the other shareholders are not voting. Do the non-voting shareholders not vote because they are happy with Plato’s management ability as opposed to being apathetic? Would they be willing to combine to outvote Plato if they felt its decisions were untenable? The success of Socre Ltd.’s operations under the power of Plato Inc. is a further factor to motivate generally passive shareholders to cast a vote at the next general meeting. When shareholders see positive results, they are less likely to react against Plato Inc. When the company is performing poorly, the interest of shareholders increases as well as their willingness to become involved. Poor performance with resultant lowering of share price may also result in a current or new shareholder acquiring a large block of shares and changing the voting mix at general meetings. As such, you would have to conclude that Plato Inc. does not have the power to determine the relevant activities of Socre Ltd. Strategic Investments—Parent–Subsidiary Relationship 17 A number of problems arise in applying the concept of power. First, there is the question of temporary power. Where the parent holds more than 50% of the shares of the subsidiary, there is no danger of a change in the identity of the parent. However, if the identification of the parent is based on factors that may change over time, the process becomes difficult. For example, the percentage of votes cast at general meetings may historically be 70%, but in a particular year it may be 50%. A shareholder with 30% of the voting shares has power in the latter circumstance but not in the former. This control may, however, last for only a year until the next general meeting. Second, a company’s ability to control another may be affected by relationships with other parties. For example, a holder of 40% of the voting power may be friendly with the holder of another 11% of the votes. This friendly relationship could include a financial institution that has invested in the holder of the 40% votes and that plans to vote with that party to increase its potential for repayment of loans. However, business relationships and loyalties are not always permanent. Third, a minority holder that did not have control may, due to changing circumstances, find itself with the capacity to control. For example, a holder of a 30% block of shares may not have had control because the remaining shares were tightly held by a small number of parties. However, if one or more of these parties sold their shares in small lots, the minority holder could have the controlling parcel of shares. Regardless of whether this shareholder wanted to exercise that power or not, he or she has the capacity to control and is the parent. The theoretical question is whether in these circumstances a company really controls in its own right or in fact has control that is shared with the other shareholders, as control is affected by their actions. The conclusion would be that if control is affected by the actions of other shareholders, it is shared control and therefore would not meet the definition of control. Potential voting rights. Potential voting rights are rights to obtain substantive voting rights of an investee, such as those arising from convertible instruments or options. A company may have share call options or convertible instruments that, if exercised or converted, give the company voting power over the financial and operating policies of another company. Consider the following two examples: 1. Investor A holds 70% of the voting rights of an investee. Investor B has 30% of the voting rights of the investee as well as an option to acquire half of investor A’s voting rights. The option is exercisable for the next two years at a fixed price that is currently higher than the market value of the shares (and is expected to remain so for that two-year period). Investor A has been exercising its votes and is actively directing the relevant activities of the investee. In such a case, investor A is likely to meet the power criterion because it appears to have the current ability to direct the relevant activities. Although investor B has currently exercisable options to purchase additional voting rights (that, if exercised, would give it a majority of the voting rights in the investee), the terms and conditions associated with those options are such that the options are not considered substantive. 2. Investor A and two other investors each hold a third of the voting rights of an investee. The investee’s business activity is closely related to investor A. In addition to its equity instruments, investor A also holds debt instruments that are convertible into voting shares of the investee at any time for a fixed price that is higher than the current market price for the shares (but not significantly higher). If the debt were converted, investor A would hold 60% of the voting rights of the investee. Investor A would benefit from realizing synergies if the debt instruments were converted into voting shares. Investor A has power over the investee because it holds voting rights of the investee together with substantive potential voting rights that give it the current ability to direct the relevant activities (IFRS 10.B50). It may be argued that control should be based on the actual situation at the end of the reporting period and, as the holder of the convertible instrument has not exercised the instrument, the actual situation is that the holder is not yet in control. In other words, it would 18 chapter 1 Accounting for Investments require an action on the part of the holder to have a current capacity to control. However, as stated previously in this chapter, control exists even when the holder is passive. A holder of 51% of the shares of another company is the parent of that company even if the holder does not attend general meetings or participate in determining the directors of the company. There are circumstances where the voting shares of an entity do not determine which company in effect has power. It is possible that the votes at the level of the board of directors do not entitle the holder to any substantive power over the investee. The most common circumstance would be the case where the entity’s actions are directed by a contractual arrangement. Explicit or implicit decision-making rights may be embedded in the contract. As an example, the company could have the power to direct the manufacturing processes of another company, appoint personnel, or direct other operating activities by virtue of an agreement. Economic dependence of an entity on the company does not, by itself, lead to the company having the power to direct the activities of that other company. However, the company may have this power if this dependence is viewed in conjunction with the voting interest. Consider the following example. Receival Inc. is formed in order to collect the accounts receivables of Mack Inc. When considering the purpose and design of Receival, it is evident that the only relevant activity is managing the accounts receivable of Mack Inc. if they are in default a separate firm, Oldscool Inc., has been charged with managing the accounts receivable collections. The shareholders of Receival Inc. do not have power since it is Oldscool that manages the accounts receivable and has the power over it. The Returns Criterion As stated earlier, in order to have control you must meet three criteria: the power criterion, the returns criterion, and the link criterion. In the previous section we examined the nature of power. In this section we review the criteria for exposure or rights to returns from an investee. Variable returns are defined as “returns that are not fixed and have the potential to vary as a result of the performance of the investee” (IFRS 10.B56). You will note that returns could be both positive and negative. If a company owns common shares of another company it can expect variable returns since the dividend and changes in value of the shares are variable. If a company charges a fee based on the performance of another company, this company is subject to variable returns since the amount it will receive is affected by the performance of the other company, which will vary. IFRS 10.B57 provides the following examples of returns: • dividends, other distributions of economic benefits from an investee (e.g., interest from debt securities issued by the investee), and changes in the value of the investor’s investment in that investee; • remuneration for servicing an investee’s assets or liabilities, fees and exposure to loss from providing credit or liquidity support, residual interests in the investee’s assets and liabilities on liquidation of that investee, tax benefits, and access to future liquidity that an investor has from its involvement with an investee; and • returns that are not available to other interest holders. For example, an investor might use its assets in combination with the assets of the investee, such as combining operating functions to achieve economies of scale, cost savings, sourcing scarce products, gaining access to proprietary knowledge, or limiting some operations or assets, to enhance the value of the investor’s other assets. Trustees and those with fiduciary relationships with the subsidiary would not be entitled to variable returns. These parties may be able to direct certain activities of the subsidiary, but apart from fees for service, the activities do not lead to increased or decreased returns to these parties. The Link Criterion In this last section we examine the third criterion, the ability to use power over the investee to affect the amount of the investor’s returns, which links the first two criteria (the power criterion and the returns criterion). Strategic Investments—Parent–Subsidiary Relationship 19 When a company has more than 50% of the voting shares, and it is the votes that determine a company’s power, it is obvious that this same company will have the ability to affect the returns since it is through their votes that relevant decisions are made. A company that buys a bond receives the returns that can vary due to the risk of the issuer. However, this company has no ability to affect the returns and therefore would not control the entity. In some circumstances it is not easy to establish whether a company that receives returns has any say in how those returns are affected. Power by having an agent act on its behalf. IFRS 10 introduced the scenario where a company can have “power” for purposes of determining control even if it does not own any shares. A reporting company can have power by having an agent act on its behalf. In contrast, a reporting company does not have power when it is acting solely as an agent. An agent is defined in IFRS 10 as: “A party primarily engaged to act on behalf and for the benefit of another party or parties (the principal(s)).” It is possible that the agent has the ability to direct the activities of a company; for example, by making decisions concerning the company’s operating and financing activities. However, that ability is governed by an agreement, law, or fiduciary responsibility that requires the agent to act in the best interests of the principal. The agent must use any decision-making ability delegated to it to generate returns primarily for the principal. In substance the principal is controlling the entity through its agent. Evidence of this type of relationship exists where the principal has the right to remove, without cause, an agent that is empowered to direct the activities of a company for the principal. An agent is remunerated for the services it performs by means of a fee that is commensurate with those services. This fee may be fixed or performance related. If the agent receives a performance-based fee, the agency relationship can be difficult to distinguish from a controlling relationship. This is because the agent can use its ability to direct the company’s activities to affect its remuneration. However, if this ability is limited by the agent’s responsibility to act in the best interest of the principal, the fee that the agent receives is remuneration for the services it performs and does not indicate involvement with the entity beyond that of an agent. A principal will benefit from increases in the value of the entity but will also suffer from decreases in the value. In contrast, an agent might be paid a performance-based fee for a specified period and the agent is unlikely to be required to contribute additional funds to the company if there is a decrease in value. Structured entities. With the implementation of IFRS 10 for year ends beginning January 2013, there was no need for separate guidance on special purpose entities (SPEs; see SIC 12). A special purpose entity was defined under SIC 12 as an entity that was set up to perform a specific purpose. IFRS 10 refers to these types of arrangements as structured entities. Using the current definition of control allows these types of entities to be dealt with in the same manner as other types of strategic investments. The company may not own any shares of the entity but typically the equity is not sufficient to sustain the entity. Examples might be an entity that is formed to effect a lease or to do research and development activities. SPEs may take the form of a corporation, trust, partnership, or unincorporated entity. However, the entity is set up such that the operating and financial policies are virtually fixed (see Illustrative Example 1.5). An entity that engages in transactions with an SPE may in substance control the SPE. The determination of whether the investor has control focuses on the power, exposure, or rights to returns, and the ability to use that power to affect the returns. Previously, the criterion for control of SPEs was whether the investor was able to obtain the benefits and the exposure to risk (SIC 12). Consider the case in Illustrative Example 1.5 of Desjardin Ltd., a sailboat manufacturer. We see that Desjardin Ltd. does not control the board of directors of Marine Inc. However, there are not many decisions left for Marine Inc. to make as the product and dealers are all predetermined. In terms of returns, the investor group receives a return on the investment when the inventory is sold. However, Desjardin receives a greater range of benefits as Marine Inc. is acting as a sales agent for its boats. Desjardin still runs all the risks in producing the 20 Accounting for Investments chapter 1 boats and disposing of any unsold boats, and receives the major benefits from the sale of the boats via the fee for services. Desjardin Ltd. controls Marine Inc. Illustrative Example 1.5 Structured Entities8 Desjardin Ltd., a public company, is a boat manufacturer specializing in sailboats for private use. Desjardin Ltd., with the assistance of an investment banker and in conjunction with an independent investor group, created Marine Inc. The business purpose of Marine is to purchase all Desjardin’s luxury line sailboats on completion of production. The investor group contributed $600,000 and Desjardin contributed $400,000 to capitalize Marine. The investor group will own 60% of the voting interest in Marine, with Desjardin having the remaining 40% voting interest. Marine Inc. is governed by a board of directors and consists of 10 directors: six appointed by the investor group and four appointed by Desjardin. All significant business decisions must be approved by 60% of the board, except for decisions relating to liquidation, issue of additional debt or equity capital, and changes to the size of the board of directors. These decisions require approval by 80% of the board. Marine Inc.’s operations consist of acquiring 100% of Desjardin Ltd.’s luxury line sailboats at cost of production. Marine may, at its option, return any unsold inventory to Desjardin after one year at cost. Marine is allowed to enter into other transactions with unrelated parties, but the investor group and Desjardin have agreed that Marine will not enter into such transactions. Desjardin has an agreement with Marine to maintain relationships with its dealer network. Desjardin will provide all necessary postproduction storage facilities, arrangements for shipment to dealers, incentive plans to dealers, and manufacturer’s warranties. Apart from inventory, Marine will not have any substantive assets. Desjardin Ltd. receives a fee for services provided to Marine Inc. equal to the revenue from sales after deducting the cost of sales, financing fees, and a facilitation fee paid to the investor group. Dissimilar activities. In determining the existence of a parent–subsidiary relationship, the fact that the parent is involved in totally different activities from the subsidiary is not sufficient to exclude the subsidiary from consolidating financial statements. Some have argued that if, for example, the parent’s activities are in mining while the subsidiary’s are in retailing clothing, the consolidated financial statements will lack meaning. However, the criterion for consolidation is control. As the parent controls the assets of the subsidiary, regardless of the activities of the entities within the group, consolidated financial statements are necessary to measure performance and assess the economic responsibility of the parent’s management for the subsidiary’s activities. For example, the disclosures required by IFRS 8 Operating Segments help to explain the significance of different business activities within the group. Summary of Process to Determine Control The following are the steps to follow to determine if one company controls another and therefore a parent–subsidiary relationship exists: 1. Determine the purpose and design of the investee. 2. Determine the relevant activities of the investee. 3. Determine how decisions are made regarding the relevant activities. 4. Determine whether the investor has the current ability to direct those relevant activities. 8 Adapted from a case written by the Financial Accounting Standards Board (FASB) as part of its testing of the FASB exposure draft. Strategic Investments—Parent–Subsidiary Relationship 21 5. Determine whether the investor has the right and risks to the variable returns of the investee. 6. Determine whether the investor has the ability to use its power to affect those returns. If the answer in points 4, 5, and 6 is yes, then the investor has control over the investee. Presentation of Consolidated Financial Statements for Controlled Entities When a company has control over another company, a parent–subsidiary relationship is said to exist. Paragraph 4 of IFRS 10 details which entities are required to prepare consolidated financial statements: An entity that is a parent shall present consolidated financial statements. Hence, all parents, other than the exceptions in paragraph 4, are responsible for the preparation of consolidated financial statements. The process of consolidation requires the parent company to combine its financial statements with the financial statements of its subsidiary. The investment account as recorded on the parent’s financial statements is eliminated and replaced on a line-by-line basis with each asset and liability of the subsidiary. In addition, all income and expense accounts are combined. Since the parent has the ability to control the subsidiary, from the user’s perspective they are one economic entity. By consolidating the two statements, the economic entity is presented as one single company. Consolidated financial statements recognize that the separate legal entities are components of one economic unit and are distinguishable from the separate parent and subsidiary company statements. Under IFRS there is a distinction made between separate financial statements and consolidated financial statements. Under IFRS a company may present consolidated and separate financial statements. Separate financial statements are defined in paragraph 4 of IAS 27 Consolidated and Separate Financial Statements: Separate financial statements are those presented by a parent, an investor in an associate or a venturer in a jointly controlled company, in which the investments are accounted for on the basis of the direct equity interest rather than on the basis of the reported results and net assets of the investees. Separate financial statements are issued for parent–subsidiary relationships in limited circumstances and are dealt with in Chapter 4. Details of the consolidation process are covered in Chapters 3 to 5. ASPE Under ASPE a company is only permitted to issue one general purpose financial statement. If there is a parent–subsidiary relationship, this may be the consolidated statement. A company that wishes to present a separate financial statement may do so as a “special purpose” financial statement but must refer to the consolidated statements as the general purpose financial statements. Under ASPE a company has the option to not consolidate its subsidiary. It may choose to report using the equity method or the cost method. If a consolidated statement is not prepared, the separate financial statement is the general purpose financial statement. Illustration 1.2 shows an investment note disclosure by Acme Resources Inc. (formerly International KRL Resources Corp.), incorporated in British Columbia, which is primarily engaged in the acquisition and exploration of mineral properties throughout Canada. 22 chapter 1 Illustration 1.2 Sample Investment Note Disclosure—Acme Resources Inc. Accounting for Investments 7. INVESTMENT IN GOLDEN HARP The Company recorded its investment in Golden Harp on a fully consolidated basis until February 29, 2008. Thereafter, the Company no longer had a controlling interest in Golden Harp which was then accounted for under the equity method. As of June 30, 2011, and May 31, 2010, the Company owned 10,000,000 shares of Golden Harp. The Company’s proportionate interest in Golden Harp declined from 65.32% to 40.53% during fiscal 2008 as a result of issuances of common shares by Golden Harp and from the exercise of stock options and warrants. The Company’s proportionate interest in Golden Harp declined further, from 40.53% to 40.51% during fiscal 2010 as a result of issuances of common shares by Golden Harp due to the exercise of warrants. The Company, through its shareholding in Golden Harp, exercises significant influence over that company. As a result, the investment in Golden Harp is accounted for using the equity method. Details of the investment in Golden Harp are as follows: Amount $ Balance, May 31, 2009 Dilution loss from share issuances Proportionate share of net loss Proportionate share of unrealized gain on available for sale marketable securities Write-down of investment 2,291,427 (269) (262,037) 12,153 (541,274) Balance, May 31, 2010 Proportionate share of net loss Proportionate share of unrealized gain on available for sale marketable securities Write-down of investment 1,500,000 (203,265) 16,307 (13,042) Balance, June 30, 2011 1,300,000 As at June 30, 2011, the Company’s investment in Golden Harp had a quoted market value of $1,300,000. The Company’s management believes the decline in quoted market price is other than temporary and the investment was written down to $1,300,000. A parent need not present consolidated financial statements if and only if all of the conditions listed below exist: (a) the parent is itself a wholly owned subsidiary, or is a partially owned subsidiary of another company and its other owners, including those not otherwise entitled to vote, have been informed about, and do not object to, the parent not presenting consolidated financial statements; (b) the parent’s debt or equity instruments are not traded in a public market (a domestic or foreign stock exchange or an over-the-counter market, including local and regional markets); (c) the parent did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market; and (d) the ultimate or any intermediate parent of the parent produces consolidated financial statements available for public use that comply with International Financial Reporting Standards. (.10 IAS 27). As an illustration of the exemption from consolidation, consider the group structure in Illustration 1.3, showing a wholly owned subsidiary. A Ltd. is required to prepare consolidated financial statements combining the financial statements of the parent A Ltd. and its subsidiaries B Ltd. and C Ltd. B Ltd. is also a parent company, with C Ltd. being its subsidiary. Is B Ltd. also required to prepare consolidated financial statements? If B Ltd. meets the requirements of paragraph 10, it does not have to prepare consolidated financial statements. Is B Ltd. itself a wholly owned subsidiary? In Illustration 1.3, B Ltd. is itself a wholly owned subsidiary. Even in the group structure in Illustration 1.4, where A Ltd. has only an 80% interest in B Ltd., B Ltd. may be exempted from preparing consolidated financial statements if, Strategic Investments—Parent–Subsidiary Relationship 23 Illustration 1.3 Exemption from Consolidation (a): Wholly Owned Subsidiary A Ltd. 100% B Ltd. 100% C Ltd. in accordance with paragraph 10(a), B Ltd. can persuade its other owners, the 20% non-controlling interest, not to object to not presenting consolidated financial statements. • Are the debt and equity instruments of B Ltd. traded in a public market? In Illustration 1.3, where B Ltd. is a wholly owned subsidiary, it would be unlikely that its shares would be traded in a public market. • Has B Ltd. filed its financial reports with a regulatory agency for the purpose of issuing any class of instruments in a public market? • Has A Ltd. produced consolidated financial statements complying with International Financial Reporting Standards? A parent is not allowed to exclude any subsidiary from the consolidated financial statements. IAS 27 specifically notes some areas where exclusions of subsidiaries from consolidation are not permitted, namely, where: • the business activities of a subsidiary are different from those of other subsidiaries (paragraph 17) and • the investor is not a company, such as a trust, partnership, a mutual fund, or a venture capital organization (paragraph 16). Similarly, exclusions from consolidation do not exist where: • there is a large non-controlling interest and • there are severe long-term restrictions that impair the ability to transfer funds to the parent. Illustration 1.4 Exemption from Consolidation (a): Partially Owned Subsidiary A Ltd. 80% A 80% B Ltd. 100% C Ltd. NCI 20% 24 chapter 1 Accounting for Investments Illustrative Example 1.6 shows the presentation of the consolidated statement of financial position. Illustrative Example 1.6 Consolidation Presentation Assume that ABC Co. acquires its 100%-owned investment in XYZ Co. on December 31, 2013. The amount paid for the investment is equal to the book value of XYZ at that date. ABC CO. Statement of Financial Position As at December 31, 2013 Assets Cash Accounts receivable Inventory Investment in XYZ Co. $ 1,000 2,000 4,000 3,000 $10,000 Liabilities and Equity Accounts payable Common shares Retained earnings Cumulative other comprehensive income $ 2,000 4,500 3,000 500 $10,000 XYZ CO. Statement of Financial Position As at December 31, 2013 Assets Cash Accounts receivable Inventory $1,200 1,000 2,000 $4,200 Liabilities and Equity Accounts payable Common shares Retained earnings Cumulative other comprehensive income $1,200 1,500 1,200 300 $4,200 ABC CO. Consolidated Statement of Financial Position As at December 31, 2013 Assets Cash (1,000 + 1,200) Accounts receivable (2,000 + 1,000) Inventory (4,000 + 2,000) Liabilities and Equity Accounts payable (2,000 + 1,200) Common shares Retained earnings Cumulative other comprehensive income $ 2,200 3,000 6,000 $11,200 $ 3,200 4,500 3,000 500 $11,200 Strategic Investments—Parent–Subsidiary Relationship 25 Applying ASPE to Each Type of Investments in Shares ASPE Under ASPE, the criteria for control are covered in Section 1590 Subsidiaries. The definition of control is different than under IFRS. Section 1590.03 states that control is: The continuing power to determine its strategic operating, investing and financing policies without the co-operation of others. In practice, this definition should usually result in the same companies being defined as parent–subsidiary relationships under ASPE as under IFRS. In addition, ASPE contains accounting guideline 15, Consolidation of Variable Interest Entities, which requires the consolidation of special purpose entities where the reporting company is the primary beneficiary. It was expected that ASPE would adopt the new definition of IFRS 10 by 2014 and also eliminate the guideline at that time. Under ASPE, a reporting company can make an accounting policy choice to report a subsidiary on its financial statements using the equity method or the cost method. It is not required to consolidate subsidiaries. If the company chooses the cost or equity method, it must provide additional disclosures to the reader. All subsidiaries of the reporting company must use the same method. If the equity of the subsidiary is quoted on an active market, the cost method is not an alternative. In that case, the investment would be recorded at fair value with the gain or loss recorded in net income. Under ASPE, a parent and its subsidiaries may prepare combined financial statements, where the financial statements of the subsidiaries are combined but the parent’s financial statements are excluded. This may be useful when one individual owns a controlling interest in several corporations. These combined statements could also be used to present the financial position and the results of operations of a group of subsidiaries, or to combine the financial statements of companies under common managements (1601.04). ✓ LEARNING CHECK • There are three characteristics of control: the power criterion, the returns criterion, and the link between power and returns. • Power over an investee exists when the investor has existing rights that give it the ability to direct relevant activities. • The investor must have the current ability to determine relevant activities in order to have power. • The benefit/returns that a parent may receive by obtaining control are not just dividends, but relate to any circumstances or relationships that potentially change the parent’s earning capacity. • There is a presumption that control exists where the company owns more than 50% of the voting shares of the investee. • The parent must be able to use its power to affect the returns. • Parent entities are required to prepare consolidated financial statements by combining the financial statements of the parent and its subsidiaries since they are considered to be one economic entity. • Under ASPE, companies may report their investments using the cost method or the equity method. 26 chapter 1 Accounting for Investments STRATEGIC INVESTMENTS— ASSOCIATES Objective Identify and account for associates. 3 The relationship between an investor and its associated entities is seen as being of special significance so that a specific accounting method—the equity method of accounting—is required to provide information about the investor and its associates. The nature of the investor–associate relationship is clearly defined, in this case in IAS 28 Investments in Associates and Joint Ventures, and the principles of the equity method are specifically established. The equity method is explained at the end of this section and is relevant for both associates and joint ventures; however, the accounting for investments in associates is our first focus. Identifying Associates An associate is defined in paragraph 2 of IAS 28 as follows: An associate is an entity, including an unincorporated company such as a partnership, over which the investor has significant influence and that is neither a subsidiary nor an interest in a joint venture. The criteria used to identify an associate are discussed in the next section. Significant Influence The key characteristic determining the existence of an associate is that of significant influence. This term is defined in paragraph 2 of IAS 28 as follows: Significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control or joint control over those policies. Note the following features of this definition: • The definition requires the investor to have the power, or the capacity, to affect the investee. The definition does not require the investor to actually exercise that power, only to possess it. • The specific power is that of being able to participate in the financial and operating decisions of the investee. Whereas the parent–subsidiary relationship is defined in terms of the power or capacity to dominate the financial and operating decisions of the subsidiary, the investor–associate relationship relates to the power to participate in those same decisions. Hence, the investor–associate relationship is of the same nature as that existing between a parent and subsidiary, the difference being the level of power that can be exercised. • In the definitions of an associate and significant influence, there is no requirement for the investor to hold any shares, or have a beneficial interest, in the associate. However, as is discussed in more detail later in this section, the application of the equity method of accounting is based on the investor owning shares in the associate. In other words, if significant influence is exercised by one company over another by virtue of an association or contract other than from the holding of shares, then the equity method cannot be applied in relation to the associate. Even in such cases, however, some of the disclosures required by IAS 28 in relation to associates may still be required. Assessing the existence of significant influence requires accountants to exercise judgement. IAS 28 provides further guidance to help in this determination. It states that where an investor holds, directly or indirectly (for example, through subsidiaries), 20% or more of the voting power of the investee, it is presumed that the investor has significant influence over the investee. However, if the investor can demonstrate that such influence does not exist, the Strategic Investments—Associates 27 investee is not classified as an associate. Further, where the investor owns less than 20% of another company, there is a presumption that the investee is not an associate. It is therefore possible for more than one company to have significant influence over another company, but there can be only one parent company in relation to a subsidiary. IAS 28 also provides a list of factors that may provide evidence of the existence of significant influence: (a) representation on the board of directors or equivalent governing body of the investee (b) participation in policy-making processes, including participation in decisions about dividends or other distributions (c) material transactions between the investor and the investee (d) interchange of managerial personnel (e) provision of essential technical information. In all of these examples, the evidence relates to actual participation. In general, the most common form of participation is that of representation on the board of directors. In other words, because of the significance of the ownership interest of the investor in the associate, the investor is able to obtain representation on the board of directors and hence influence the decision-making in the investee. The potential effect of the exercise of options or convertible securities should be considered in cases where the holder currently has the ability to exercise or convert those rights. Where the rights are not exercisable because they are subject to a time constraint or tied to some future event, they should not be taken into consideration. Note that there must be a current ability to exercise power, not a future ability to do so (IAS 28.9). Exclusions to the Definition of Associate Some entities that would meet the definition of associates are excluded from the requirements of IAS 28. IAS 28 does not apply to investments in associates held by venture capital organizations, or mutual funds, unit trusts, and similar entities, including investment-linked insurance funds. Upon initial recognition, these entities report their associates as FVTPL and account for them at fair value in accordance with IFRS 9. Such entities must recognize changes in the fair values of those investments in the current period profit or loss. These exclusions were made because of the lack of relevance of equity-accounted information to those entities, as well as the frequent changes in the level of ownership in these investments by such entities. Generally these types of companies are interested in the return on their investment and therefore fair value information is considered more useful information for their financial statement users. As of the time of writing, there was an exposure draft outstanding that would exclude companies that meet the definition of an investment company from the requirements of this section for the same reasons as outlined in the previous section. IAS 28 also provides exclusions from applying the equity method to associates. In particular, where the investment in the associate is acquired and held exclusively with a view to its disposal within 12 months of acquisition, and the management is actively seeking a buyer, the equity method does not have to be applied to that associate. Appendix B of IAS 5 Non-current Assets Held for Sale and Discontinued Operations establishes criteria for classifying assets as “held for sale.” Such assets are required to be measured at the lower of their carrying amounts and fair values less costs to sell. If the associate is not disposed of within 12 months, the financial statements must be restated and the investment accounted for according to the equity method. Where all these conditions apply, the company must account for the associate as a FVTPL investment accounted for at fair value, with changes in fair value affecting current period income. 28 chapter 1 Accounting for Investments There is also a list of other exemptions to the requirement to report affiliates using the equity method. Where all the following apply, an investor need not apply the equity method of accounting: • The investor is a wholly owned subsidiary, or is a partially owned subsidiary of another entity and its owners have been informed about and do not object to the investor not applying the equity method. • The investor’s debt or equity securities are not traded in a public market such as a domestic or foreign stock exchange. • The investor did not file, and is not in the process of filing, its financial statements with a securities commission or other regulatory organization, for the purpose of issuing any class of securities in a public market. • The ultimate or any intermediate parent of the investor produces consolidated financial statements that comply with Canadian accounting standards and thus International Financial Reporting Standards. Illustration 1.5 is an excerpt regarding investments in associates from the financial statements of Scorpio Mining Corporation, a Canadian-based silver and base metal producer in Mexico. Illustration 1.5 Excerpt from the Scorpio Mining Corporation Financial Statements (m) Investments An associate is an entity over which the Corporation has significant influence and that is neither a subsidiary nor an interest in a joint venture. Significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control or joint control over those policies. Management determined that since the Corporation holds approximately 19.4% of the outstanding shares of Scorpio Gold and had two of Scorpio Mining’s directors seating on Scorpio Gold’s board of directors until June 15, 2011, Scorpio Mining had significant influence over Scorpio Gold until that time. Subsequently, the number of directors in common changed from two to one at which time the Corporation ceased to have significant influence over Scorpio Gold. Accordingly, the results of Scorpio Gold are incorporated in these consolidated financial statements using the equity method of accounting until June 15, 2011, and thereafter the investment in Scorpio Gold’s shares has been recorded as an available-for-sale financial instrument recorded at fair value with fair value adjustments recorded in other comprehensive earnings (loss). Investments in companies over which the Corporation exercises neither control nor significant influence and are designated as available-for-sale financial instruments are recorded at fair value. Unrealized gains and losses on available-for-sale financial instruments are recognized in other comprehensive earnings (loss), unless the unrealized earnings (loss) are considered other than temporary, in which case, the earnings (loss) is recorded in the statements of operations. Equity Method of Accounting The equity method is used for reporting of associates and joint ventures (which are discussed in the next section). Under the equity method, the investment account is updated for the investor’s share of profit and distributions. In this chapter we introduce the basics of the equity method. The complexities are covered in detail in Chapter 6 since applying the equity method requires an analysis of the acquisition similar to that undertaken when accounting for subsidiaries. Rationale When reflecting an investment using the cost method, the investment is initially recorded at cost and the balance is not adjusted in subsequent periods unless there is an impairment. Dividends are reported as income. Reflecting the investment at cost may be unsatisfactory for associates because the recognition of dividends may not be an adequate measure of the income earned by the investor. The distribution received may bear little relation to the performance of the associate. Further, it is argued that applying the equity method provides more informative reporting of the net assets and profit or loss of the investor. The criterion of control used for identifying subsidiaries has similarities with the definition of significant influence used for associates. IAS 28 states: Many of the procedures appropriate for the application of the equity method are similar to the consolidation procedures described in IAS 27 Consolidated and Separate Financial Statements. Strategic Investments—Associates 29 Furthermore, the concepts underlying the procedures used in accounting for the acquisition of a subsidiary are also adopted in accounting for the acquisition of an investment in an associate. Because of the similarity with the principles and procedures used in applying the consolidation method to subsidiaries, the equity method of accounting has sometimes been described as “one-line consolidation.” However, IAS 28 does not consistently use the consolidation principles in its application of the equity method. Similarities and differences between the consolidation method and the equity method are noted in Chapter 6, where the equity method is described in detail. Applying the Equity Method: Basic Method IAS 28 provides a description of the basics of the equity method. The key steps are: 1. Recognize the initial investment in the associate or joint venture at cost. 2. Increase or decrease the carrying amount of the investment by the investor’s share of the profit or loss of the investee after the date of acquisition (post-acquisition profit or loss). 3. Reduce the carrying amount of the investment by distributions (such as dividends) received from the associate or joint venture. 4. Increase or decrease the carrying amount of the investment for changes in the investor’s share of the changes in the investee’s other comprehensive income. This may apply to changes arising from the revaluation of property, plant, and equipment and from foreign exchange translation differences. The investor’s share of those changes is recognized in other comprehensive income of the investor. Although potential voting rights may be used in assessing the existence of significant influence, they are not used in any of the calculations (paragraph 12 IAS 28). Illustrative Example 1.7 demonstrates the basic application of the equity method. Illustrative Example 1.7 Basic Application of the Equity Method On January 1, 2013, Flute Ltd. acquired 25% of the shares of Fife Ltd. for $42,500. At this date, all the identifiable assets and liabilities of Fife were recorded at amounts equal to fair value, and Fife’s equity consisted of: Share capital $100,000 Asset revaluation—OCI 20,000 Retained earnings 50,000 During 2013, Fife reported a profit of $25,000. The asset revaluation reserve increased by $5,000, reported in other comprehensive income, and Fife paid a $4,000 dividend. At January 1, 2013, Flute recorded the investment in Fife at $42,500. At December 31, 2013, the journal entries to apply the equity method in the investor’s records are: 1. Recognition of share of profit or loss of associate Investment in Associate Share of Profit or Loss of Associate 6,250 6,250 (Share of associate’s profit: 25% × $25,000) The Share of Profit or Loss of Associate is disclosed as a separate line item in the statement of comprehensive income, per IAS 1 paragraph 82(c). 30 chapter 1 Accounting for Investments 2. Recognition of increase in asset revaluation reserve—OCI Investment in Associate 1,250 Asset Revaluation Reserve 1,250 (Share of reserve: 25% × $5,000) This increase is also disclosed as a separate line item in the statement of comprehensive income, per IAS 1 paragraph 82(h) Share of Other Comprehensive Income of Associate. 3. Adjustment for dividend paid by associate Cash 1,000 Investment in Associate 1,000 (Adjustment for dividend paid by associate: 25% × $4,000) Because the investor has recognized its share of the equity of the associate, the dividend is simply a receipt of equity already recognized in the investment account. At December 31, 2013, the investment in the associate is measured at $49,000 (i.e., $42,500 ⫹ $6,250 ⫹ $1,250 ⫺ $1,000). The equity of Fife consists of: Share capital $100,000 Asset revaluation reserve ($20,000 + $5,000) 25,000 Retained earnings ($50,000 + $25,000 − $4,000) 71,000 $196,000 The investor’s share of the associate’s equity is 25% of $196,000 (i.e., $49,000), which is the same as the recorded amount of the investment in the associate. In other words, the equity method, in this case, is designed to show the investment in the associate at an amount equal to the investor’s share of the reported equity of the associate. As will be explained in Chapter 6, this relationship is not always achieved because of the effects of pre-acquisition equity, the existence of goodwill, and adjustments made for the effects of inter-company transactions. Now assume that during 2014, Fife reported a profit of $6,000. The asset revaluation reserve increased by $4,000, as reported in other comprehensive income, and Fife paid a $12,000 dividend. At December 31, 2014, the journal entries to apply the equity method, in the records of the investor, are: 1. Recognition of share of profit or loss of associate Investment in Associate 1,500 Share of Profit or Loss of Associate 1,500 (Share of associate’s profit: 25% × $6,000) 2. Recognition of increase in asset revaluation reserve—OCI Investment in Associate 1,000 Asset Revaluation Reserve 1,000 (Share of reserve: 25% × $4,000) 3. Adjustment for dividend paid by associate Cash 3,000 Investment in Associate 3,000 (Adjustment for dividend paid by associate: 25% × $12,000) Note that it does not matter that the dividend is greater than the income earned in the current period. Strategic Investments—Associates 31 At December 31, 2014, the investment in the associate is measured at $48,500 (i.e., $49,000 ⫹ $1,500 ⫹ $1,000 ⫺ $3,000). The equity of Fife consists of: Share capital $100,000 Asset revaluation reserve ($20,000 + $5,000 + $4,000) 29,000 Retained earnings ($50,000 + $25,000 − $4,000 + $6,000 − $12,000) 65,000 $194,000 The investor’s share of the associate’s equity is 25% of $194,000 (i.e., $48,500), which is the same as the recorded amount of the investment in the associate. In other words, the equity method in this case is designed to show the investment in the associate at an amount equal to the investor’s share of the associate’s reported equity. Again, as will be explained in Chapter 6, this relationship is not always achieved because of the effects of fair value adjustments, the existence of goodwill, and adjustments made for the effects of inter-company transactions. A company is required to follow the same impairment testing as is required for tangible capital assets (IAS 36 Impairment of Assets). However, the company may also be responsible for losses in addition to the investment itself. The company may have guaranteed liabilities of the associate or may have agreed to purchase goods from the associate. This issue is explored further in Chapter 6. The measurement of the impairment is based on comparing its recoverable amount (higher of value in use and fair value less costs to sell) with its carrying amount. The impairment is recorded in net income and may be reversed to the extent that the recoverable amount of the investment subsequently increases (IAS 28.33). Applying ASPE to Each Type of Investment ASPE Under ASPE, significantly influenced investments are covered in Section 3051. The criteria are the same as those proposed under IFRS for identifying significantly influenced investments and for the equity method. The only difference is that under ASPE, the company has the option of using the cost method rather than the equity method for reporting its investment, which is significantly influenced. This would be an accounting policy choice. If the company chooses to use the cost method for reporting, it must use that same method for all of its significantly influenced investments. If the company chooses to use the equity method for reporting, it must use that method for all of its significantly influenced investments. If the investment is in shares of a public company, the cost method is not an option. If the equity method is not used, the available option is fair value. Under ASPE, the treatment of impairment is the same as it was for non-strategic investments. One of the goals of ASPE was to simplify the accounting process by creating one type of impairment testing for all investments. ✓ LEARNING CHECK • The key criterion for identifying an investor–associate relationship is that the investor has significant influence over the associate. • IAS 28 provides guidelines to help determine the existence of significant influence, including the ability to influence the investee’s board of directors and the existence of material transactions between the investor and the investee. 32 chapter 1 Accounting for Investments • The investor does not need to hold shares in an associate, but where more than 20% of the voting power is held, significant influence is presumed to exist. • The equity method is applied from the date the investor obtains significant influence over the investee. • Where dividends are paid or declared by an associate, no dividend revenue is recognized by the investor. STRATEGIC INVESTMENTS— JOINT ARRANGEMENTS Identifying Joint Arrangements Objective Identify and account for joint arrangements. 4 A company may engage in arrangements that provide for joint control. The defi nition of control is the same as that used for the assessment of parent–subsidiary relationships. IFRS 11 Joint Arrangements identifies joint control as: The contractually agreed sharing of control over an arrangement, which exists only when decisions about the relevant activities require the unanimous consent of the parties sharing control (IFRS 11.7). We will use the term “investors” to describe a party that has joint control over that joint arrangement. The investors are bound by a contractual arrangement and it is the contractual arrangement that establishes control. This contractual arrangement may be in the form of minutes of a meeting or it may be a specific legal contract. It may be incorporated in the articles or the by-laws of the joint arrangement. Consider the following example: Assume that three parties establish an arrangement: A has 50% of the voting rights in the arrangement, B has 30%, and C has 20%. The contractual arrangement between A, B, and C specifies that at least 75% of the voting rights are required to make decisions about the relevant activities of the arrangement. Even though A can block any decision, it does not control the arrangement because it needs the agreement of B. The terms of their contractual arrangement requiring at least 75% of the voting rights to make decisions about the relevant activities imply that A and B have joint control of the arrangement because decisions about the relevant activities of the arrangement cannot be made without both A and B agreeing (IFRS 11.B8 application example). All parties must unanimously agree on a decision, which also means that no one party can have control, nor can two parties collude to outvote a third party. Joint arrangements can take different forms and structures. There are two different types of joint arrangements identified in IFRS 11: joint operations and joint ventures. The nature of the joint arrangement is affected by the rights and/or obligations in the normal course of business that the investors have. A joint arrangement is often created as a separate legal company. When joint arrangements are established in a separate company, it will be necessary to consider all relevant facts and circumstances to assess whether the arrangement is a joint operation or a joint venture, including the structure and form of the arrangement and contractual terms agreed by the parties. Each type of joint arrangement is aligned with a distinct reporting requirement. Joint Operations In a joint operation, the investor has a contractual right or obligation to the assets and liabilities of the operation. A joint arrangement that is not structured as a separate entity is a joint operation. However, a separate entity could still be a joint operation. A joint operation is usually a joint Strategic Investments—Joints Arrangements 33 arrangement that involves the use of the assets and other resources of the parties, often to manufacture and sell joint products. Consider the following examples: 1. The contractual arrangement specifies the basis on which the revenue from the sale of joint products and expenses incurred in common are shared among the parties. Two pharmaceutical companies enter into an agreement whereby one of them develops a drug and the other distributes the drug to customers. Each party uses its own assets, incurs its own expenses, and receives an agreed share of the revenue from the sale of the drug. 2. The arrangement may also include an operation that is only one asset. Each party has rights to the asset and often joint ownership. Consider the example where several telecommunication companies jointly operate a network cable. Each party uses the cable for data transfer, in return for which it bears an agreed proportion of the costs of operating the cable. 3. Two investors create a separate company called Venturco. One investor owns 40% of Venturco and the other owns 60%. There is an agreement that provides for joint control. The incorporation documents state clearly that the assets and liabilities of Venturco are the responsibility of one investor equal to their 40% and the other investor equal to their 60%. As such, the two venturers have the rights and obligations for the actual assets and liabilities and this would be a joint operation. Joint Ventures A joint venture must be set up as a separate vehicle. This could mean that a corporation is created but it could also take other legal forms that separate the venture from the investors. A company is a party to a joint venture when it does not have the right to the assets or the obligations for the liabilities. A company is a party to a joint venture if it has rights only to a share of the outcome generated by a group of assets and liabilities carrying on an economic activity (i.e., to share in the net income). The party does not have rights to individual assets or obligation of the venture, only to the net assets. Consider the following example. Stanstead Inc. starts a joint venture, Stanmod Inc., in a foreign country in conjunction with Modern Ltd., which is incorporated in that country. Neither company controls the individual assets or is obliged to pay for the liabilities and expenses of the venture. Stanmod Inc. is responsible for its obligations and has the rights to its assets. Stanstead Inc. and Modern Ltd. together govern the financial and operating policies of the venture; each is entitled to a share of the profit or loss generated by the activities of the venture. Accounting and Reporting for Joint Arrangements Joint Operations The party to the joint operation is required to report its share of each asset and liability, revenue, or expense that it owns. For example, if Lonestar Inc. owns 30% of a jointly controlled operation, it would reflect 30% of each asset, liability, income, or expense that is part of the joint operation on its own financial statements. Joint Ventures Since a joint venture is normally a separate legal entity, the investor in the joint venture will record in its own books an investment in the joint venture equal to the fair value of the contribution made to obtain their percentage ownership. Since by definition the investor has joint control, it follows that all parties must have significant influence, as defined earlier in the chapter. Each investor participates in the operating and financing decisions of the joint venture. As such, the investor is required to report the investment using the equity method. 34 chapter 1 Accounting for Investments The equity method was described in the previous section and is elaborated upon in Chapter 6. Consolidation is not deemed appropriate since joint control implies shared control, which means that a parent–subsidiary relationship does not exist. Illustration 1.6 is an excerpt from the financial statements of Canadian-based Barrick Gold Corporation, the world’s largest gold producer, showing a note on joint ventures. Illustration 1.6 Excerpt from the Financial Statements of Barrick Gold Corporation Joint Ventures A joint venture is a contractual arrangement whereby two or more parties undertake an economic activity that is subject to joint control. Joint control is the contractually agreed sharing of control such that significant operating and financial decisions require the unanimous consent of the parties sharing control. Our joint ventures consist of jointly controlled assets (“JCAs”) and jointly controlled entities (“JCEs”). A JCA is a joint venture in which the venturers have control over the assets contributed to or acquired for the purposes of the joint venture. JCAs do not involve the establishment of a corporation, partnership or other entity. The participants in a JCA derive benefit from the joint activity through a share of production, rather than by receiving a share of the net operating results. Our proportionate interest in the assets, liabilities, revenues, expenses, and cash flows of JCAs are incorporated into the consolidated financial statements under the appropriate headings. A JCE is a joint venture that involves the establishment of a corporation, partnership or other entity in which each venturer has a long term interest. We account for our interests in JCEs using the equity method of accounting. On acquisition, an equity method investment is initially recognized at cost. The carrying amount of equity method investments includes goodwill identified on acquisition, net of any accumulated impairment losses. The carrying amount is adjusted by our share of post acquisition net income or loss, depreciation, amortization or impairment of the fair value adjustments made at the date of acquisition, and our share of post acquisition movements in Other Comprehensive Income (“OCI”). ASPE Applying ASPE to Each Type of Joint Venture Investment Under ASPE the topic of joint ventures is covered in Section 3055. This section identifies three types of joint ventures: 1. jointly controlled operations 2. jointly controlled assets 3. jointly controlled enterprises Under ASPE jointly controlled operations and jointly controlled assets are reported using proportionate consolidation. This means that the venturer recognizes on its balance sheet the assets that it controls and the liabilities that it incurs. The venturer recognizes on its income statement its share of the revenue of the joint venture and its share of the expenses incurred by the joint venture. This result is the same as that required for jointly controlled operations under IFRS. However, ASPE provides a choice for jointly controlled enterprises, which aligns with the definition under IFRS of joint ventures. A company has the option of using proportionate consolidation or the equity method to report its investment. In addition, under ASPE a company has an accounting policy choice to report the investment using the cost method. A company tests for impairment if there are any indications that an interest in a joint venture measured at cost or using the equity method may be impaired. Indicators of impairment may be that the joint venture is having significant financial difficulties or there may be a significant adverse change in the technological, market, economic, or legal environment in which the joint venture operates. When the company identifies a significant adverse change in the expected timing or amount of future cash flows, it reduces the carrying amount to the higher of the present value of the cash flows expected to be generated by holding the interest, discounted using a current market rate of interest appropriate to the asset, and the amount that could be realized by selling the interest at the balance sheet date. Any impairment is recognized in net income (Section 3055.42 and .43). Learning Summary ✓ 35 LEARNING CHECK • A joint arrangement is a contractual arrangement that provides for joint control. • Joint control requires the unanimous agreement among the parties sharing control. • Two types of joint arrangements exist: joint operations and joint ventures. • The parties to a joint operation are required to report their share of each asset and liability. • The parties to a joint venture will initially record their share of the investment at fair value. In subsequent periods the equity method will be used for reporting purposes. KEY TERMS Associate (p. 26) Consolidated financial statements (p. 21) Control (p. 12) Equity method (p. 28) Fair value (p. 8) Fair value through profit and loss (p. 6) Joint control (p. 32) Joint operation (p. 32) Joint venture (p. 32) Proportionate consolidation (p. 34) Significant influence (p. 26) Subsidiary (p. 12) LEARNING SUMMARY In this chapter we have studied the different types of investments that companies make in other entities. We reviewed the two primary reasons for these types of investments being strategic or non-strategic. Non-strategic investments are initially recorded at fair value and then restated each year to their current fair value. The gains and losses are reflected in net income unless an election is made to record the gains and losses in other comprehensive income (OCI). If the election is made, the effect in OCI is not recycled through net income. When looking at strategic investments, IFRS identifies the following types of investments: parent–subsidiary, associates, and joint arrangements. A parent–subsidiary relationship exists when the parent controls the subsidiary. Control is achieved when three criteria are present: the company has power over the relevant operating and financing decisions of the investee, the company has the rights to the variable return associated with the investee, and the company has the ability to affect those returns. It is presumed that in situations where the parent owns more than 50% of the shares of the investee it controls that investee. In a parent–subsidiary relationship, the company must prepare consolidated financial statements. In preparing the consolidated financial statements, the investment account on the parent’s books is replaced with the actual assets, liabilities, revenues, and expenses of the investee on the financial statements. A company is deemed to have an investment in an associate when the company has significant influence over that associate. Significant influence exists when the company has the power to participate in the financial and operating policy decisions of the investee. It is presumed that the ownership of between 20 and 50% of the voting shares provides significant influence. A company must report its investment in an associate using the equity method. Under this method the investment is initially recorded at cost and is updated each year for its share of the associate’s total income and dividends. A joint arrangement exists when there is joint control among all the investors who share control. Joint control requires the unanimous consent of the participants regardless of their ownership interest. Joint arrangements can be in the form of joint operations or joint ventures. In a joint operation the investors own the actual assets and liabilities of the joint venture. As such, the investor must pick up its proportion of each asset, liability, revenue, and expense on its financial statement. In a joint venture, the investor is entitled only to the net assets of the joint venture. As such, the investor uses the equity method to report its interest in the joint venture. As for associates, the investor in a joint venture initially records the investment at cost and updates the investment account each year for its share of the total income of the joint venture and any distributions by the joint venture. 36 chapter 1 Accounting for Investments The key differences among the four types of investments discussed in this chapter are presented in the illustration below. Issue Non-strategic Investments in Equity (Financial Assets) Strategic Investments in a Subsidiary Strategic Investments in Associates Strategic Investments in Joint Arrangements Definition Equity instrument in another company where there is no power to participate in the financial and operating decisions of the investee Exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee Power to participate in the financial and operating policy decisions of the investee Joint operation: parties that have joint control of the arrangement have rights to the assets, and obligation for the liabilities Joint venture: parties that have joint control of the arrangement have rights to the net assets of the arrangement Presumption Less than 20% ownership of voting shares Greater than 50% of the voting shares Between 20 and 50% of the voting shares Contractual agreement providing joint control Initial recognition Fair value Cost Cost Cost Presentation Fair value Consolidation Equity method Joint operations: proportionate allocation Joint ventures: equity method Effect on net income Dividend revenue and gain or loss in change in fair value (If election is made the gain or loss will go through OCI) Parent and subsidiary income statement items combined on the income statement Investor share of investee net income Venturer share of joint venture net income Brief Exercises (LO 1) BE1-1 What is a financial asset? (LO 2) BE1-2 What are the three main criteria to determine control? (LO 3) BE1-3 What is an associate company? (LO 3) BE1-4 Why are associates distinguished from other investments held by the investor? (LO 3) BE1-5 Discuss the similarities and differences between the criteria used to identify subsidiaries and those used to identify associates. (LO 3) BE1-6 What is meant by “significant influence”? (LO 3) BE1-7 What factors could be used to indicate the existence of significant influence? (LO 1, 3) BE1-8 (LO 2) BE1-9 (LO 4) BE1-10 Discuss the relative merits of accounting for investments at cost, at fair value, and using the equity method. What is a parent–subsidiary relationship? What is the key difference between a joint operation and a joint venture? Problems 37 Exercises (LO 1) E1-1 Skuttle Inc. buys 200 shares of Berke Inc. on March 1, 2013, for $4.20 per share. Skuttle Inc. incurs transaction costs of $120. At December 31, 2013, the market price is $5.10 per share. Skuttle Inc. sells the shares on February 1, 2014, for $1,020 and incurs transaction costs of $50. Required Prepare the journal entries that Skuttle would make to record its transactions in Berke shares using IFRS 9. (LO 3) E1-2 Max Inc. acquires 40% of the shares of Guarasci Inc. for $80,000 on January 1, 2013. During 2013, Guarasci earned $50,000 and paid dividends to its shareholders of $10,000. During 2014, Guarasci incurred a loss of $5,000 but continued to pay a $10,000 dividend to all shareholders. Required (a) Prepare the journal entries that Max Inc. would make in each of the years 2013 and 2014. (b) Indicate the balance in the Investment in Guarasci on the balance sheet for the years ended 2013 and 2014. (LO 4) E1-3 Campbell Ltd. invested in a joint venture by providing cash of $160,000. Campbell obtained a 22% interest in the joint venture based on its contribution. During the year, the joint venture earned $17,500. Required (a) Prepare the journal entries that Campbell would make with respect to investment in this joint venture. (b) What would the journal entries be if the arrangement was a joint operation? Problems (LO 1) P1-1 On January 1, 2010, Aye buys 500 shares of Que, a public company, for $1.20 per share. On January 4, 2011, Aye buys 200 shares of Are, a public company for $0.84 per share. On September 1, 2012, Aye buys an additional 1,000 shares of Que for $1.65 per share. Aye sold 50 shares in Are on March 1, 2013 for $47.00 in total. Below are some relevant data regarding the transactions: Number of shares outstanding since 2009 Net income 2010 Net income 2011 Net income 2012 Net income 2013 Dividends 2010 Dividends 2011 Dividends 2012 Dividends 2013 Market value per share, December 31, 2010 Market value per share, December 31, 2011 Market value per share, December 31, 2012 Market value per share, December 31, 2013 Que Are 5,000 10,000 8,000 15,000 10,000 1,000 1,000 1,000 1,000 1.40 1.52 1.78 2.30 3,500 7,000 8,000 ⫺2,000 ⫺1,000 500 750 500 200 1.00 1.10 0.70 0.65 • Aye follows IFRS 9 to record its financial instruments and does not make an election. • Income is earned evenly over the year and dividends are declared and paid at year end. Required Assume that no election is made. (a) Calculate the effect on net income of Aye for each of the years 2010 to 2013. (b) Calculate the balance in the investment account to be reflected on each December 31 from 2010 to 2013. (c) Calculate the effect on net income for each of the years 2010 to 2013 assuming that Aye follows ASPE. (d) Calculate the balance in the investment account to be reflected on each December 31 from 2010 to 2013 assuming that Aye follows ASPE. 38 chapter 1 Accounting for Investments (LO 1, P1-2 Acme Corp. has a portfolio of investments purchased at the amounts shown below at December 31, 2013. Acme 3, 4) is a private company but is contemplating going public. 1. 10% interest in Plato purchased on January 1, 2013 (fair value of the 10% interest on December 31, $16,000) $ 17,000 2. 40% interest in Bloor purchased five years ago for $250,000. During this period of ownership, Bloor’s retained earnings has grown $70,000. The fair value of the investment at December 31 is 280,000. 250,000 3. 50% interest in a joint venture, Rand, purchased January 1, 2013. During the ownership period, Rand had income of $40,000 and paid dividends of $10,000. 120,000 Required (a) Calculate the balances to be reflected on the Acme December 31, 2013, statement of financial position in accordance with ASPE. (b) What will be different in the reporting of these investments for Acme if it were to become a public company? Writing Assignments (LO 3) WA1-1 The accountant of Cornett Chocolates Ltd., Maria Fraulein, has been advised by her auditors that the company’s investment in Concertina’s Milk Ltd. should be accounted for using the equity method of accounting. Cornett Chocolates holds only 20.2% of the voting shares currently issued by Concertina’s Milk. Since the investment was undertaken purely for cash flow reasons based on the potential dividend stream from the investment, Ms. Fraulein does not believe that Cornett Chocolates exerts significant influence over the investee. Required Discuss the factors that Ms. Fraulein should investigate in determining whether an investor–associate relationship exists, and what avenues are available so that the equity method of accounting does not have to be applied. (LO 2) WA1-2 Two entities, Peter and Paul, invest in a new company, POPP, to manufacture vintage records. Peter has experience in manufacturing records and has developed technology to improve the sound as well as the rights to many recording artists who are interested in preserving this nostalgic form of recording. Paul is a venture capital company that has financed other ideas that Peter has had in the past. Peter will contribute the technology and know-how to the new company while Paul will contribute the financing. Peter will own 45% of POPP and Paul will own 55%. Each company will appoint directors in proportion to their ownership percentage. The managing director and the director of finance will be appointed by Peter. Required How will Peter record its investment in POPP? (LO 2) WA1-3 Godard Inc. enters into an agreement on March 1, 2013, to sell 60% of a wholly owned subsidiary, Combine Ltd., which it has owned for several years to Svelt Inc. Godard’s representatives on the board of directors of Combine will immediately resign and will be replaced by Svelt Inc. Godard has also provided Combine with short-term financing in the form of a demand loan. Svelt has agreed to apply certain operating decisions that Godard requires as long as the demand loan is outstanding. Godard can veto any operating decision that is contrary to Godard’s requirements. Required Does Godard still have control over Combine? Explain. (LO 4) WA1-4 Companies Acorn and Magex form a company Cane, to tender for a public contract with a government to construct a highway between two cities. Acorn and Magex have joint control of the activities of Cane. Acorn will construct three bridges needed to cross rivers on the route; Magex will construct all of the other elements of the highway. Acorn and Magex will each use their own equipment and employees in the construction activity. Cane enters into a contract with the government for delivery of the highway. It also enters into a contract with Acorn and Magex for performance of the government contract. Acorn and Magex will invoice Cane for their respective shares of the total amount invoiced by Cane to the government. Required Discuss the nature and the reporting of this arrangement by Acorn company. (Adapted from ED joint arrangements, IASB) (LO 4) WA1-5 Five advertising companies jointly buy a jet aircraft. They enter into an agreement whereby each party has the right to use the aircraft for its own purposes some days each year. The parties may decide to use that right or they Writing Assignments 39 might lease it to a third party. The parties share decision-making regarding maintenance and disposal of the aircraft. The decisions require the agreement of all the parties. Required Discuss how each company would report this arrangement. (Adapted from ED joint arrangements, IASB) (LO 4) WA1-6 Two real estate companies jointly buy the land and buildings that constitute a shopping centre. The companies separately financed their share of the shopping centre acquisition. They set up a separate legal company for the purpose of operating the shopping centre business and called it Shoppers Heaven. They transferred their ownership in the shopping centre to the company. The activities of the Shoppers Heaven business include renting the retail units, managing the parking lot, maintaining the centre and equipment such as elevators, and building the reputations and customer numbers for the centre as a whole. Strategic decisions relating to the operations require the consent of both companies. The terms of incorporation of Shoppers Heaven are such that each company receives a share of the income from the shopping centre. The companies have the right to sell or pledge their interest in the corporation. Required How would the real estate companies report this arrangement? (Adapted from ED joint arrangements, IASB) (LO 1, WA1-7 2, 3) 1. Taub Co. and Laughlin Co. own 80% and 20%, respectively, of the common shares that carry voting rights at a general meeting of shareholders of Renwill Co. Taub sells one half of its interest to Renwill and buys call options from Renwill that are exercisable at any time at a premium to the market price when issued, and if exercised would give Taub its original 80% ownership interest and voting rights. 2. Companies Taub, Laughlin, and Midas Ltd. own 40%, 30%, and 30%, respectively, of the common shares that carry voting rights at a general meeting of shareholders of Renwill. Taub also owns call options that are exercisable at any time at the fair value of the underlying shares and if exercised would give it an additional 20% of the voting rights in Renwill and reduce Laughlin’s and Midas’s interests to 20% each. If the options are exercised, Taub will have control over more than one half of the voting power. 3. Entities Taub, Laughlin, and Midas own 25%, 35%, and 40%, respectively, of the common shares that carry voting rights at a general meeting of shareholders of Renwill. Entities Taub and Laughlin also have share warrants that are exercisable at any time at a fixed price and provide potential voting rights. Taub has a call option to purchase these share warrants at any time for a nominal amount. If the call option is exercised, Taub would have the potential to increase its ownership interest, and thereby its voting rights, in Renwill to 51% (and dilute Laughlin’s interest to 23% and Midas’s interest to 26%). 4. Companies Taub, Laughlin, and Midas each own 331/3% of the ordinary shares that carry voting rights at a general meeting of shareholders of Renwill. Companies Taub, Laughlin, and Midas each have the right to appoint two directors to the board of Renwill. Taub also owns call options that are exercisable at a fixed price at any time and if exercised would give it all the voting rights in Renwill. The management of Taub does not intend to exercise the call options, even if Midas and Laughlin do not vote in the same manner as Taub. Required For each of the independent situations illustrated above, describe the reporting by Taub Co. (Adapted from IFRS illustrative example) (LO 2, 3) WA1-8 Nepean Corp. and Warren Inc. own 80% and 20%, respectively, of the common shares that carry voting rights at a general meeting of shareholders of Osaka Enterprises. Nepean sells half of its interest to Warren and buys call options from Warren that are exercisable at any time at a premium to the market price when issued, and if exercised would give Nepean its original 80% ownership interest and voting rights. At December 31, 2013, the options are out of the money. Required Discuss whether Nepean is the parent of Osaka. (Adapted from the Implementation Guidance to IAS 27) (LO 2, 3) WA1-9 Clarence Ltd., Nordahl Corp., and Tweed Inc. each own one third of the common shares that carry voting rights at a general meeting of shareholders of Parenteau Ltée. Clarence, Nordahl, and Tweed each have the right to appoint two directors to the board of Parenteau. Clarence also owns call options that are exercisable at a fixed price at any time and, if exercised, would give it all the voting rights in Parenteau. The management of Clarence does not intend to exercise the call options, even if Nordahl and Tweed do not vote in the same manner as Clarence. 40 chapter 1 Accounting for Investments Required Discuss whether Parenteau is a subsidiary of any of the other entities. (Adapted from the Implementation Guidance to IAS 27) (LO 2, 3) WA1-10 Daintree and Hong own 55% and 45%, respectively, of the common shares that carry voting rights at a general meeting of shareholders of Moor. Hong also holds debt instruments that are convertible into common shares of Moor. The debt can be converted at a substantial price, in comparison with Hong’s net assets, at any time, and if converted would require Hong to borrow additional funds to make the payment. If the debt were to be converted, Hong would hold 70% of the voting rights and Daintree’s interest would reduce to 30%. Given the effect of increasing its debt on its debt-equity ratio, Hong does not believe that it has the financial ability to enter into conversion of the debt. Required Discuss whether Hong is a parent of Moor. (Adapted from the Implementation Guidance to IAS 27) (LO 2, 3) WA1-11 On September 1, 2013, Franklin Inc. acquired 40% of the voting shares of Gould Ltd. Under the company’s constitution, each share is entitled to one vote. On the basis of past experience, only 65% of the eligible votes are typically cast at the annual general meetings of Gould. No other shareholder holds a major block of shares in Gould. Gould’s financial year ends on December 31 each year. The directors of Franklin argue that they are not required to include Gould as a subsidiary in Franklin’s consolidated financial statements at December 31, 2013, as there is no conclusive evidence that Franklin can control the financial and operating policies of Gould. The auditors of Franklin disagree, referring specifically to past years’ voting figures. Required Provide a report to Franklin on whether it should regard Gould as a subsidiary in its preparation of consolidated financial statements at December 31, 2013. Cases (LO 1, 2, 3, 4) C1-1 Gunz Inc. is a medium-sized company involved in the manufacture of paints in northern Ontario. It has been owned since inception by the Gunz family. However, the younger Gunz family members are showing no interest in carrying on the business. They have all gone to university and are pursuing their own interests. As such, Richard Gunz, president of Gunz Inc., has decided to sell the company. Toward that end, he has hired you to advise on the financial reporting as the sale price may be based on the net asset values. Gunz has several investments on the statement of financial position and needs to ensure that they are in accordance with the appropriate GAAP. The company has a policy of placing excess funds in shares so that it can earn a higher return than normally in the bank. They have various investments, which cost $120,000. They incurred transaction costs of $1,500 on the acquisitions that are currently included in the cost. The fair value of these investments as a portfolio is $150,000, although some specific investments have increased in value while others have decreased. Gunz invested this year in a company, Compoundco, that supplies chemicals for its paints. It was important to Gunz that it achieve a level of vertical integration (meaning that it is involved in various points of the production process). Gunz provided $50,000 and received an ownership interest of 49%. The other 51% of Compoundco is owned by the children of the original owner. They have agreed to sell 10% of their shares each year and are currently not actively involved in the management of the company. They have hired a manager who has dealt with all issues relating to the operations of the company. Gunz is happy with this manager and has no intention of changing. Compoundco has been losing money for the last few years and is projected to lose an additional $40,000 this year. Gunz believes that it can turn Compoundco around next year since most of its sales will now be to Gunz. In order to maintain its production requirements, Gunz needed an additional manufacturing plant. The plant was set up as a separate corporation. The financing for the acquisition of $4 million was taken out by this corporation but has been guaranteed by Gunz. The shares of the corporation are owned by Mr. Gunz personally and amount to $3,000. All production decisions are taken by Gunz and all production is sold to Gunz. Required Reply to Mr. Gunz’s request. (LO 4) C1-2 Part 1 Three companies jointly buy a 15-floor office building. Each floor in the building has a separate legal title, which allows a floor to be sold separately. Each company takes title of five of the floors, one of which it uses for its own purposes. Each has a right to use that one floor for whatever purpose it chooses. Cases 41 The companies set up a new company, Rental Inc., and each transfers its ownership of four floors of the building to Rental. The 12 floors are rented to third parties. Rental employs a management team to manage the rental business. Rental is controlled jointly by the three companies. The three companies are not liable for any costs of Rental. Required Discuss how each company would report its investment in Rental. Part 2 Assume instead that the three companies set up Rental to purchase all 15 floors. Financing for the acquisition of the building in the name of Rental is secured by the building. Each company leases one floor from Rental. Each has the right to use that floor for its own purpose or to sublease it independently to third parties. The lease term is for all of the expected useful life of the building. Rental rents the remaining 12 floors to third parties and employs a management team. The three companies jointly control Rental. Required Discuss how each company would report its investment in Rental. Part 3 Assume instead that rather than all three companies each having a right to use a floor, only one of them, Socre Ltd., has that right. Socre Ltd. has use of three of the floors for its own purposes, and the remaining 12 floors are rented to third parties by Rental. Required Discuss how each company would report its investment in Rental. (Adapted from ED joint arrangements, IASB) (LO 1, 2, C1-3 Humphrey Enterprises is a public company located in Toronto that follows IFRS and has a December 31 year 3, 4) end. It is involved in the manufacturing of pet supplies that are distributed and sold all over North America. Humphrey has loans outstanding with the People’s Commerce Bank (PCB) and the PCB also holds preferred shares of Humphrey. As part of Humphrey’s bank loan agreement, it has been agreed that the loan would be repayable and the PCB’s preferred shares would be converted to common shares if ever there were two years of successive losses at Humphrey. These common shares would be surrendered by the Humphrey family; as such, they would be diluting their ownership interest and control. Humphrey Enterprises was founded by Daniel Humphrey in 1985 and has consistently expanded and shown financial growth. However, recently, Humphrey was not immune to the economic downfall and it had a loss this past financial year ended December 31. Humphrey is a public company, but is owned 52.1% by Daniel Humphrey and his immediate family. As part of Humphrey’s business plan, it has several investments in different companies of varying levels and its strategy is to use excess cash to invest. One of Humphrey’s investments was Colin Industries, a private company, in which Humphrey owns 27% of the outstanding voting shares. It also holds warrants that are convertible into an additional 5% of the outstanding common shares at Humphrey’s option. Humphrey has the ability to appoint three of the 10 seats on Colin Industries’ board of directors and owns the rights to a patent that Colin used to produce some of its goods, for which Colin paid royalties to use. Humphrey had the ability to appoint the chair of the board of directors, who voluntarily resigned during the past year in November. Due to the chair’s resignation, it became increasingly difficult to obtain information from Colin regarding its operations and financial results. As such, Humphrey stopped using the equity method to account for this investment and began accounting for it at cost. The prior year’s loss of Humphrey was mainly caused by Colin and picking up its 27% share of the loss. These losses were expected to continue at Colin for the foreseeable future. During the year, Humphrey acquired 55% of another company, Petromax Incorporated, as a way to start distributing its products in British Columbia, which has been a difficult area for Humphrey to gain access to. Petromax will start to exclusively sell Humphrey products. It is expected that for the first two years, Petromax will generate losses by exclusively selling Humphrey products. However, after this the brand recognition should increase and Petromax will start to generate positive net income. This investment has been recorded initially at cost by Humphrey and then it intends to start consolidating in two years. The prior year, Humphrey had acquired a 15% interest in Sasha Ltd., which had been accounted for as fair value through profit or loss, as its intention was to sell the shares when the price increased. During the current year, the fair value of the shares of Sasha dropped significantly. Humphrey started to account for this investment as available for sale with the loss recognized in accumulated other comprehensive income, as it is no longer sure of when it will sell this investment due to the current year loss in its value. Required It is presently December, and you, the auditor, have been asked to prepare a report to the audit partner. Write a report that outlines and discusses any accounting issues arising during the current year and their impact to Humphrey. 42 (LO 1, 2, 3, 4) chapter 1 Accounting for Investments C1-4 Jackson Capital Inc. ( JCI) is a new private investment company that provides capital to business ventures and is required to follow IFRS. It is not a venture capital organization. JCI’s business mission is to support companies to allow them to compete successfully in domestic and international markets. JCI aims to increase the value of its investments, thereby creating wealth for its shareholders. JCI does not qualify as a venture capital organization or investment company. Funds to finance the investments were obtained through a private offering of share capital, conventional long-term loans payable, and a bond issue that is indexed to the TSX Composite Index. Annual operating expenses are expected to be $1 million before bonuses, interest, and taxes. Over the past year, JCI has accumulated a diversified investment portfolio. Depending on the needs of the borrower, JCI provides capital in many different forms, including demand loans, short-term equity investments, fixed-term loans, and loans convertible into share capital. JCI also purchases preferred and common shares in new business ventures where JCI management anticipates a significant return. Any excess funds not committed to a particular investment are held temporarily in money market funds. JCI has hired three investment managers to review financing applications. These managers visit the applicants’ premises to meet with management and review the operations and business plans. They then prepare a report stating their reasons for supporting or rejecting the application. JCI’s senior executives review these reports at their monthly meetings and decide whether to invest and what types of investments to make. Once the investments are made, the investment managers are expected to monitor the investments and review detailed monthly financial reports submitted by the investees. The investment managers’ performance bonuses are based on the returns generated by the investments they have recommended. It is August 1, 2013. JCI’s first fiscal year ended on June 30, 2013. JCI’s draft statement of financial position and other financial information are provided in the exhibit below. An annual audit of the financial statements is required under the terms of the bond issue. Potter & Cimoroni, Chartered Accountants, has been appointed auditor of JCI. The partner on the engagement is Richard Potter. You, a CA, are the in-charge accountant on this engagement. Mr. Potter has asked you to prepare a memo discussing the significant accounting issues for this engagement. Required Prepare the memo requested by Mr. Potter. JACKSON CAPITAL INC. Draft Statement of Financial Position As of June 30, 2013 (in thousands of dollars) Assets Cash and marketable securities Investments (at cost) Interest receivable Furniture and fixtures (net of accumulated amortization of $2) $ 1,670 21,300 60 50 $23,080 Liabilities Accounts payable and accrued liabilities Accrued interest payable Loans payable $ 20 180 12,000 12,200 Shareholders’ equity Share capital Deficit $12,000 (1,120) 10,880 $23,080 JACKSON CAPITAL INC. Summary of Investment Portfolio As at June 30, 2013 Cost of Investments 15% common share interest in Fairex Resource Inc., a company listed on the TSX Venture Exchange. Management intends to monitor the performance of this mining company over the next six months and to make a hold/sell decision based on reported reserves and production costs. $3.8 million 25% interest in common shares of Hellon Ltd., a private Canadian real estate company, plus 7.5% convertible debentures with a face value of $2 million, acquired at 98% of maturity value. The debentures are convertible into common shares at the option of the holder. $6.2 million Cases 5-year loan denominated in Brazilian currency (reals) to Ipanema Ltd., a Brazilian company formed to build a power generating station. Interest at 7% per annum is due semi-annually. 75% of the loan balance is secured by the power generating station under construction. The balance is unsecured. $8 million 50% interest in Western Gas, a jointly-owned gas exploration project operating in Western Canada. One of JCI’s investment managers sits on the three-member board of directors. $2 million 50,000 stock warrants in Tornado Hydrocarbons Ltd., expiring March 22, 2015. The underlying common shares trade publicly. $1.3 million 43 JACKSON CAPITAL INC. Capital Structure As at June 30, 2013 Loans payable The Company has $2 million in demand loans payable with floating interest rates, and $4 million in loans due September 1, 2017, with fixed interest rates. In addition, the Company has long-term 5% stock indexed bonds payable. Interest at the stated rate is to be paid semi-annually, commencing September 1, 2013. The principal repayment on March 1, 2018, is indexed to changes in the TSX Composite as follows: the $6 million original balance of the bonds at the issue date of March 1, 2013, is to be multiplied by the stock index at March 1, 2018, and then divided by the stock index as at March 1, 2013. The stock-indexed bonds are secured by the Company’s investments. Share capital Issued share capital consists of: – 1 million 8% Class A (non-voting) shares redeemable at the holder’s option on or after August 10, 2017 – 10,000 common shares $7 million $5 million (Adapted from CICA's Uniform Evaluation Report) (LO 2, 3) C1-5 Lachlan Corp. establishes Serouya Ltd. for the sole purpose of developing a new product to be manufactured and marketed by Lachlan. Lachlan engages Mr. Jiang to lead the team to develop the new product. Mr. Jiang is named Managing Director of Serouya at an annual salary of $100,000, $10,000 of which is advanced to him by Serouya at the time Serouya is established. Mr. Jiang invests $10,000 in the project and receives all of Serouya’s initial issue of 10 shares of voting common shares. Lachlan transfers $500,000 to Serouya in exchange for 7%, 10-year bonds convertible at any time into 500 shares of Serouya voting common shares. Serouya has enough shares authorized to fulfill its obligation if Lachlan converts its bonds into voting common shares. The constitution of Serouya provides certain powers for the holders of voting common shares and the holders of securities convertible into voting common shares that require a majority of each class voting separately. These include: • the power to amend the corporate purpose of Serouya, and • the power to authorize and issue voting shares of securities convertible into voting shares. At the time Serouya is established, there are no known economic legal impediments to Lachlan converting the debt. Required Discuss whether Serouya is a subsidiary of Lachlan. (Adapted from Case V issued by the FASB as a part of its Consolidations project) (LO 2, 3) C1-6 Endeavour Films is a production company that produces movies and television shows. It also owns cable television systems that broadcast its movies and television shows. Endeavour transferred to Barco Ltd. its cable assets and the shares in its previously owned and recently acquired cable television systems, which broadcast Endeavour’s movies. Barco assumed approximately $200 million in debt related to certain of the companies it acquired in the transaction. After the transfer date, Barco acquired additional cable television systems, incurring approximately $2 billion of debt, none of which was guaranteed by Endeavour. Barco was initially established as a wholly owned subsidiary of Endeavour. Several months after the transfer, Barco issued common shares in an initial public offering, raising nearly $1 billion in cash and reducing Endeavour’s interest in Barco to 41%. The remaining 59% of Barco’s voting interest is widely held. The managing director of Barco was formerly manager of broadcast operations for Endeavour. Half the directors of Barco are or were executive officers of Endeavour. Barco and its subsidiaries have entered individually into broadcast contracts with Endeavour, pursuant to which Barco and its cable system subsidiaries must purchase 90% of their television shows from Endeavour at payment terms, and other terms and conditions of supply as determined from time to time by Endeavour. That agreement gives Barco 44 chapter 1 Accounting for Investments and its cable television system subsidiaries the exclusive right to broadcast Endeavour’s movies and television shows in specific geographic areas containing approximately 45% of the country’s population. Barco and its cable television subsidiaries determine the advertising rates charged to their broadcast advertisers. Under its agreement with Endeavour, Barco has limited rights to engage in businesses other than the sale of Endeavour’s movies and television shows. In its most recent financial year, approximately 90% of Barco’s sales were Endeavour movies and television shows. Endeavour provides promotional and marketing services and consultation to the cable television systems that broadcast its movies and television shows. Barco rents office space from Endeavour in its headquarters facility through a renewable lease agreement, which will expire in five years. Required (a) Should Endeavour consolidate Barco? Why or why not? (b) If Endeavour had not established Barco but had instead purchased 41% of Barco’s voting shares on the open market, does this change your answer to requirement A? Why? (Adapted from Case III issued by the FASB as a part of its Consolidations project) (LO 2, 3) C1-7 Logan Ltd. has acquired, during the current year, the following investments in the shares issued by other companies: Jarislowsky Corp. Murray Inc. $120,000 (40% of issued capital) $117,000 (35% of issued capital) Logan is unsure how to account for these investments and has asked you, as the auditor, for some professional advice. Specifically, Logan is concerned that it may need to prepare consolidated financial statements under IFRS 10. To help you, the company has provided the following information about the two investee companies: Jarislowsky • The remaining shares in Jarislowsky are owned by a diverse group of investors who each hold a small parcel of shares. • Historically, only a small number of the shareholders attend the general meetings or question the actions of the directors. • Logan has nominated three new directors and expects that they will be appointed at the next annual general meeting. The current board of directors has five members. Murray • The remaining shares in Murray are owned by a small group of investors who each own approximately 15% of the issued shares. One of these shareholders is Jarislowsky, which owns 17%. • The shareholders take a keen interest in the running of the company and attend all meetings. • Two of the shareholders, including Jarislowsky, already have representatives on the board of directors who have indicated their intention of nominating for re-election. Required (a) Advise Logan as to whether, under IFRS 10, it controls Jarislowsky and/or Murray. Support your conclusion. (b) Would your conclusion be different if the remaining shares in Jarislowsky were owned by three institutional investors each holding 20%? If so, why? (LO 2, 3) C1-8 Ord Inc. owns 40% of the shares of Derwent Co. and holds the only substantial block of shares in that entity, no other party owning more than 3% of the shares. The annual general meeting of Derwent is to be held in a month. Two situations that may arise are: • Ord will be able to elect a majority of Derwent’s board of directors as a result of exercising its votes as the largest holder of shares. As only 75% of shareholders voted in the previous year’s annual meeting, Ord may have the majority of the votes that are cast at the meeting. • By obtaining the proxies of other shareholders and, after meeting with other shareholders who normally attend general meetings of Derwent, by convincing these shareholders to vote with it, Ord may obtain the necessary votes to have its nominees elected as directors of the board of Derwent, regardless of the attendance at the general meeting. Required Discuss the potential for Derwent being classified as a subsidiary of Ord. (LO 1, 2, C1-9 Polka Dot Enterprises is a Canadian private company located in Toronto, Ontario. Their business operations con3, 4) sist of event planning for corporations and fundraisers. They have recently begun the necessary steps to go public in the near future. As part of this, they have hired you, CA, to help with all the requirements as part of the process of going public. Enclosed, you have been given the latest year-end statement of financial position (Exhibit C1-9(a)) and extracts of the Notes to the Financial Statements (Exhibit C1-9(b)) of Polka Dot Enterprises to review and to give your preliminary comments on. It is presently February 2014 and the Chief Financial Officer would like to receive your comments as soon Cases 45 as possible so that, if necessary, any changes can be incorporated. He is particularly concerned with the accounting of their investments as he has heard that there might be some differences upon transitioning from accounting standards for private enterprises to IFRS. It is not necessary to restate the statement of financial position, but rather simply discuss and explain any changes required and the impacts it would have on Polka Dot Enterprises. Net income for the year was $315,665. EXHIBIT C1-9(A) POLKA DOT ENTERPRISES Statement of Financial Position As at December 31, 2013 Assets Current Assets Cash Accounts Receivable Inventory Total Current Assets 82,931 101,827 121,844 306,602 Non-Current Assets Property, Plant, and Equipment Investment in Ranger Limited (at cost) Investment in Tulip Inc. (at cost) Investment in Shoes Enterprise (at cost) Investment in Rose Limited (at cost) Total Non-Current Assets 141,729 121,736 102,911 156,192 133,901 656,469 Total Assets Note 1 Note 2 Note 3 Note 4 963,071 Liabilities & Shareholder’s Equity Current Liabilities Bank Indebtedness Accounts Payable Current Portion of Long-Term Debt 111,009 172,619 118,201 Total Current Liabilities 401,829 Long-Term Debt 226,172 Total Liabilities 628,001 Retained Earnings Share Capital 235,070 100,000 Total Liabilities & Shareholder’s Equity 963,071 EXHIBIT C1-9(B) Polka Dot Enterprises Notes the to the Financial Statements For the Year Ended December 31, 2013 Note 1 – The investment in Ranger Limited was one made during 2013 to invest excess cash on hand that Polka Dot Enterprises had. The cost at the time of the 4% purchase of Ranger Limited’s outstanding shares was $121,736. This was a short-term investment and when the cash is needed in 2014, it will be sold. As at December 31, 2013, the fair value of the investment was $156,212 and net income of Ranger Limited for the year was $39,103. Note 2 – In January 2013, Polka Dot Enterprises purchased 100% of Tulip Inc., a company engaged in a similar line of business as them. The cost of the investment was $102,911 and its fair value as at December 31, 2013 was $147,212. In addition, due to the purchase, Polka Dot Enterprises was allowed to appoint three of the four members to the board of directors. They have also been looking for ways to achieve synergies and to utilize each other’s expertise. Tulip Inc.’s net income for the year was $120,921. Note 3 – The cost of the investment in Shoes Enterprise was $156,192 and was made in January 2013 to obtain 19% ownership in Shoes Enterprise. This was done to gain access to a supplier, as prior to this Shoes Enterprise was one of Polka Dot Enterprises1 main supplier of party goods and decorations. The fair value of the investment as at December 31, 2013, was $199,267. Net income for Shoes Enterprise as a whole since the date of investment was $137,934. Note 4 – During the year, in order to expand their business into Montreal, Quebec, Polka Dot Enterprises entered into business with another entity, Marie Inc. They in turn created a new entity, Rose Limited. Each company contributed assets worth $133,901 to the new entity and they will share equally in the profits of Rose Limited. As at December 31, 2013, the fair value of Polka Dot Enterprise’s investment was $176,924. Both Polka Dot Enterprises and Marie Inc. will be running Rose Limited on a day-to-day basis and no major decisions concerning the entity can be made without the consent of the other. Net income since the creation of Rose Limited was $201,692. Note 5 – Investment income consists of the following: Dividend income from Ranger Limited: $71,212 Dividend income from Tulip Inc.: $48,467 Dividend income from Shoes Enterprise: $24,921 Dividend income from Rose Limited: $34,539 Source: Eric Audras/Getty Images ONE OF THE MAIN avenues for growth a company might take is by acquiring another one. Mergers and acquisitions make up a big part of corporate finance. By one count, there were 3,173 such transactions involving Canadian companies during the fiscal year ended December 31, 2011. The total value of those transactions was approximately $189 billion. One such transaction was undertaken by Bell Canada Enterprises (BCE). On April 1, 2011, BCE announced an increase in its ownership of CTV to 85%, granting it control of the television network. The move led BCE to create a new division, Bell Media, which combined CTV’s assets with BCE’s existing media content. “Our acquisition of Canada’s number one media company leverages our strategic investments in broadband networks and services and enables our promise to deliver the content Canadians want most across every screen – smartphone, tablet, computer and TV,” said George Cope, President and CEO of Bell Canada and BCE. The $1.3 billion that BCE paid for the controlling share of CTV was added to BCE’s Combining for Growth in the Media Business existing stake, which was valued at $221 million. At the time, CTV had assets worth approximately $3.1 billion, to which $1.4 billion of goodwill was added upon acquisition by BCE. As a result of the acquisition, BCE’s pre-existing investment in CTV was remeasured when changed from an available-for-sale investment to part of an investment in a subsidiary. BCE recognized a gain of $89 million in other income due to the increase in its fair value. As part of the regulatory approval process, after combining with CTV, BCE was required by the Canadian Radio-television and Telecommunications Commission to spend $239 million over seven years for the benefit of the Canadian broadcasting system. BCE wouldn’t stop there, though. Its acquisition of CTV and creation of Bell Media were additional moves in a string of transactions to expand its media reach. In late 2011, Bell announced its acquisition for approximately $400 million of a 37.5% share of Maple Leaf Sports and Entertainment, which in addition to Toronto’s Air Canada Centre, the Maple Leafs, and Raptors, owns three sports-related TV networks. Sources: PricewaterhouseCoopers, “PwC Capital Markets Flash: Deals Quarterly, Canadian M&A Retrospective and 2012 Outlook,” Volume V, Issue 7, January 20, 2012; BCE Inc. 2011 Annual Report; “Bell Completes Acquisition of CTV, Launches Bell Media Business Unit,” BCE news release, April 1, 2011; “Bell Acquires Ownership Position in Maple Leaf Sports and Entertainment – MLSE,” BCE news release, December 9, 2011.