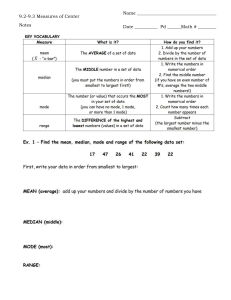

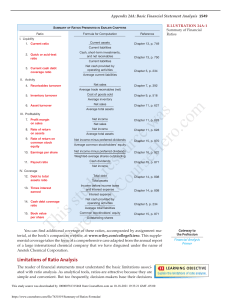

1 Calculate Ratio as listed before! a Current Ratio Current Assets Current liability 2.168.520 2.919.000 0,74 times b Quick Ratio Current Assets - Inventory Current liability h (18.308.920 - 10.069.920) 10.069.920 0,82 times i (2.168.520 - 1.037.120) 2.919.000 0,39 times c Cash Ratio Cash + Bank + Marketable securities Current liability Debt-equity ratio Total Debt Total Equity Equity mulitiplier Total Assets Total Equity 18.308.920 10.069.920 1,82 times j Times interest earned EBIT Interest 441.000 2.919.000 0,15 times d Total Asset Turnover Sales Total Assets 3.040.660 478.240 6,36 times k 30.449.420 18.308.920 1,66 times e Inventory Turnover Sales Inventory 30.449.420 1.037.120 29,36 times Cash coverage ratio EBIT + Depreciation Interest (3.040.660 + 1.366.680) 478.240 9,22 times l Profit margin Net Income Sales 1.537.452 30.449.420 5,05% f Receivable turnover Sales Account Receivable m Return on Asset Net Income Total Assets 30.449.420 708.400 42,98 times g Total debt ratio Total Debt Total Assets 1.537.452 18.308.920 8,40% n Return on Equity Net Income Total Equity (18.308.920 - 10.069.920) 18.308.920 0,45 times 2 1.537.452 10.069.920 15,27% Compare the performance of S&S Air to the industry! S&S is below the median industry ratios for the current and cash ratios. This implies the company has less liquidity than the industry in general. However, both ratios are above the lower quartile, so there are companies in the industry with lower liquidity ratios than S&S Air. The company may have more predictable cash flows, or more access to short-term borrowing. The current ratio is below the industry median, while the quick ratio is above the industry median. This implies that S&S Air has less inventory to current liabilities than the industry median. S&S Air has less inventory than the industry median, but more accounts receivable than the industry since the cash ratio is lower than the industry median. The turnover ratios are all higher than the industry median; in fact, all three turnover ratios are above the upper quartile. This may mean that S&S Air is more efficient than the industry. The financial leverage ratios are all below the industry median, but above the lower quartile. S&S Air generally has less debt than comparable companies, but still within the normal range. The profit margin for the company is lower than the industry median,he ROA and ROE are both below the industry median, but above the lower quartile. Overall, S&S Air’s performance seems good, although the liquidity ratios indicate that a closer look may be needed in this area. The profit margin for the company is lower than the industry median,he ROA and ROE are both below the industry median, but above the lower quartile. Overall, S&S Air’s performance seems good, although the liquidity ratios indicate that a closer look may be needed in this area. 3 Internal growth rate Internal growth rate = (ROA × b) / [1 – (ROA × b)] b = 1 - (Dividend / Net Income) dividend net income 560.000 1.537.452 0,36 0,64 1 - (dividend / net income) = b = 0,64 Internal growth rate = (0,084 x 0,64) / [1 - (0,084 x 0,64)] Internal growth rate = 5,68% Sustainable growth rate Sustainable growth rate = (ROE × b) / [1 – (ROE × b)] Sustainable growth rate = (0,153 x 0,64) / [1 - (0,0153 x 0,64)] Sustainable growth rate = 10,85% 4 Pro forma financial statements for next year at a 12 percent growth rate are: S&S AIR, INC 2011 Pro Forma Income Statement ($) Sales 34.159.350 Cost of goods sold 24.891.530 Other expenses 4.331.600 1.366.680 Depreciation EBIT 3.569.541 478.240 Interest Taxable Income 3.091.301 1.236.520 Taxes (40%) Net Income 1.854.780 Dividend 675.583 Add to retained Earning 1.179.197 EFN = Total assets - Total liabilities and equity EFN = $20.505.990 - $19.594.797 EFN = $ 911.193 Ratio Current ratio Quick ratio Cash ratio Total asset turnover Good Better at managing current accounts. Better at managing current accounts. Better at managing current accounts. Better at utilizing assets. Inventory turnover Better at inventory management, possibly due to better procedures. Better at collecting receivables. Receivables turnover Total debt ratio Less debt than industry median means the company is less likely to experience credit problems. Debt-equity ratio Less debt than industry median means the company is less likely to experience credit problems. Equity multiplier Less debt than industry median means the company is less likely to experience credit problems. Times Interest Earned Less debt than industry median means the company is less likely to experience credit problems. Cash coverage Less debt than industry median means the company is less likely to experience credit problems. Profit margin Company may be controlling costs better than the industry or charging a higher margin ROA Company is performing above many of its peers. Company is performing above many of its peers. ROE S&S AIR, INC. 2011 Balance Sheet Assets ($) Current Assets Cash Account receivable Inventory Total current assets. Fixed assets Net plan and equipment Total assets 441.000 708.400 1.037.120 2.186.520 16.122.400 18.308.920 ======== The internal growth rate shows the maximum sales growth rate that can be supported with no external financing by only relying on retained earnings as funding. The IGR can indicate to companies how they can use their existing resources more efficiently and effectively to generate internal growth. So, S&S Air can generate 5% growth rate with no external financing The sustainable growth rate is the growth rate the company can achieve by raising outside debt based on its retained earnings and current capital structure. So, if S&S air get external funding like credit from bank they can maximize the sales until 10,85%. cent growth rate are: S&S AIR, INC. 2011 Pro Forma Balance Sheet Assets ($) Current Assets Cash Account receivable Inventory Total current assets. Fixed assets Net plan and equipment Total assets 493.920 793.408 1.161.574 2.448.902 18.057.088 20.505.990 ======== Bad May be having liquidity problems. May be having liquidity problems. May be having liquidity problems. Assets may be older and depreciated, requiring extensive investment soon. Could be experiencing inventory shortages. May have credit terms that are too strict. Decreasing receivables turnover may increase sales. Increasing the amount of debt can increase shareholder returns. Especially notice that it will increase ROE. Increasing the amount of debt can increase shareholder returns. Especially notice that it will increase ROE. Increasing the amount of debt can increase shareholder returns. Especially notice that it will increase ROE. Increasing the amount of debt can increase shareholder returns. Especially notice that it will increase ROE. Increasing the amount of debt can increase shareholder returns. Especially notice that it will increase Cost mayROE. be too high Assets may be old and depreciated relative to industry. Profit margin and EM could still be increased, which would further increase ROE. S&S AIR, INC. 011 Balance Sheet Liabilities and Equities ($) Current liabilities Account payable Notes payable Total current liabilities Long-term debt Shareholder equity Common stock Retained earning Total Equity Total liabilities and equity 889.000 2.030.000 2.919.000 5.320.000 350.000 9.719.920 10.069.920 18.308.920 ======== S&S AIR, INC. Pro Forma Balance Sheet Liabilities and Equities ($) Current liabilities Account payable Notes payable Total current liabilities Long-term debt Shareholder equity Common stock Retained earning Total Equity Total liabilities and equity 995.680 2.030.000 3.025.680 5.320.000 350.000 10.899.117 11.249.117 19.594.797 ======== S&S AIR, INC 2011 Income Statement ($) Sales Cost of goods sold Other expenses Depreciation EBIT Interest Taxable Income Taxes (40%) Net Income Dividend Add to retained Earning 30.499.420 22.224.580 3.867.500 1.366.680 3.040.660 478.240 2.562.420 1.024.968 1.537.452 560.000 977.452