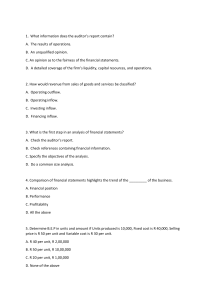

Study Guide Overview of Financial Statements and the Income Statement I. A variety of users, or stakeholders, depend on financial statements to determine the financial position and health of organizations. These may be parties within the organization, or outside of the organization. A. Internal users: 1. Managers use financial statements to determine whether the organization is utilizing resources in the most cost-effective manner and to make key investment and financing decisions. 2. Employees analyze financial statements for their own job security and to determine the impact of profit-based compensation. B. External users: 1. Shareholders and prospective investors use financial statements to determine whether they can receive an appropriate return on investment. 2. Financial institutions assess the ability of organizations to comply with debt covenants and to repay loans or other debt through financial statement analysis. 3. Suppliers use financial statements to assess the ability of their customers to pay bills on time. 4. Customers use financial statements to assess whether their suppliers will remain in business to provide an ongoing supply of goods and services. 5. Competitors compare their performance to others in their industry or area using financial statements. 6. Regulators review financial statements to assess whether public organizations have adhered to statutory reporting requirements and to determine if additional rules are necessary for other stakeholders to be fully informed. II. While the financial statements are useful for a variety of purposes noted above, they contain some inherent limitations. Some of these items require additional disclosure in the notes to the financial statements to enable stakeholders to make fully informed decisions. A. Periodicity: Monthly, quarterly, and annual reporting periods are generally not good indicators of the natural business cycle. Users should be aware of this issue as it relates to the specific organization in order to properly interpret the financial statements. B. Historical information: Because the financial statements are issued several weeks after the close of a fiscal period, the information contained therein is purely historical in nature and may not be directly relevant to ongoing operations. Organizations generally present two to three years of financial information together to enable users to better project future results using trend analysis. Still, the historical nature of the information presented must be considered together with any additional information known about the current status of the organization in order to maximize usefulness of the financial statements. C. Valuation: A variety of measures are used for financial statement elements. Organizations are required to disclose their policies for significant accounting estimates and measurements in the notes to the financial statements. 1. Historical cost: Some non-monetary accounts use historical cost because it is objectively measured, but it is less relevant as time passes (i.e., Inventory, Property and Equipment). 2. Estimates: Some accounts are based on management estimates and judgements. These estimates introduce an element of uncertainty in the financial information (i.e., Warranty Reserves, Allowance for Doubtful Accounts). 3. Fair value: Accounts with objective market prices are often recorded at market value (i.e., Marketable Securities, Bonds). D. Accounting Methods: Organizations often have a choice in accounting methods for various accounts and transactions. These choices may create difficulty when comparing the results of two different organizations (i.e., depreciation methods, inventory cost flow assumptions). Organizations are required to disclose their significant accounting policy choices in the notes to the financial statements. E. Omissions: Several relevant items are omitted from the financial statements. For example, organizations are not permitted to include the value of their workforce, customer base, or internally developed intangibles, such as reputation, in the assets on the balance sheet. In addition, certain non-cash investing and financing transactions are omitted from the cash flow statement. For example, a purchase of a building through the issuance of stock would not appear on the cash flow statement, but would be included in the notes to the financial statements. III. Organizations use four main financial statements to communicate financial information to stakeholders. A. The income statement shows the organization's sources of revenues, gains, expenses, and losses for the period presented which result in the net income or loss for that period. 1. Revenues and expenses generally result from the primary operations of the organization. 2. Gains and losses result from peripheral activities of the organization. 3. Elements on the income statement are recorded on an accrual basis. Revenues are recorded when earned and realized or realizable and expenses are recorded when incurred, regardless of when cash or other consideration is exchanged. 4. The income statement is often combined with a presentation of Other Comprehensive Income items. These items are not considered part of net income, but represent additional changes to the organization's economic position during the period presented. When this information is included, the financial statement is called the Statement of Comprehensive Income. B. The statement of changes in equity presents the organization's detailed changes in each equity account over the course of the period presented. The accounts typically presented in the statement of changes in equity include the following: 1. Preferred Stock: Contributed capital for non-voting stock which generally carries a stated dividend rate that will be paid first in the event the organization declares a dividend. 2. Common Stock (at par value, if applicable): Contributed capital for voting stock with no specified return, whether through growth or through dividends. 3. Additional Paid-In Capital: Contributed capital in excess of par values. 4. Treasury Stock: A contra equity account for recording stock repurchased by the organization. 5. Retained Earnings: Accumulated net income earned by the organization from inception less any dividends declared during that same time. 6. Accumulated Other Comprehensive Income: Accumulated other comprehensive income items not included in the calculation of net income. C. The balance sheet shows the organization's classification of assets, liabilities, and owners’ equity as of the end of the period presented. 1. Assets represent the resources available to the organization for carrying out its purpose such as cash, accounts receivable, inventory, or property and equipment. 2. Liabilities represent third-party claims to the assets of the organization. Liabilities are the amounts owed by the organization to third parties, such as debt, accounts payable, or wages payable. 3. Equities represent owner claims to the assets of the organization. Equity can arise through contributions from owners (i.e., common stock) or through the operations of the organization (i.e., retained earnings). D. The Statement of Cash Flows explains the overall change to the organization's cash position over the course of the period presented. This change is broken down into three categories of cash flows, the combination of which equal the total change in cash for the period presented: 1. Operating Cash Flow: The cash flows from the central operations of the organization. Generally, this would include cash inflows from customers, cash outflows to employees and suppliers, and cash flows for interest and taxes. 2. Investing Cash Flow: The cash flows associated with longer term investing activities of the organization. Generally, this would include cash outflows for purchases of property and equipment and other investments, and cash inflows from the sale of these same items. 3. Financing Cash Flow: The cash flows associated with the financing strategy of the company. Generally, this would include cash inflows from borrowings (bank or bond), cash inflows from the sale of stock (common or preferred), cash outflows from the principal repayments on debt, cash outflows from purchasing treasury stock, and cash payment of dividends to owners. IV. The income statement may be presented using one of two methods. A. The single-step method shows the organization's total revenues and gains compared to total expenses and losses. Net income is simply the difference between these two amounts. B. Illustration of single-step income statement: ABC Co. has the following revenues, expenses, gains, and losses in 20X2: Sales Revenue $3,000,000 Dividend Revenue 20,000 Gain on Sale of Equipment 40,000 Cost of Goods Sold 1,900,000 Wage Expense 380,000 Administrative Expenses 360,000 Interest Expense Income Tax Expense Loss on Sale of Securities 20,000 150,000 10,000 The following income statement presents ABC's results of operations for 20X2 using the single-step method: ABC Co. Income Statement for the year ended December 31, 20X2 Sales Revenue $3,000,000 Dividend Revenue 20,000 Gain on Sale of Equipment 40,000 Total Revenues and Gains Cost of Goods Sold $3,060,000 1,900,000 Wage Expense 380,000 Administrative Expenses 360,000 Interest Expense 20,000 Loss on Sale of Securities 10,000 Income Tax Expense 150,000 Total Expenses and Losses 2,820,000 Net Income $ 240,000 C. A multi-step income statement shows how an organization's revenue, gains, expenses, and losses are split into operating and non-operating activities. This type of income statement provides a more detailed look at how an organization's primary business operations are performing compared to peripheral activities. D. Illustration of multi-step income statement: Using the same information for ABC Co. above, the following income statement presents ABC's results of operations for 20X2 using the multiple-step method: ABC Co. Income Statement for the year ended December 31, 20X2 Sales Revenue Cost of Goods Sold $3,000,000 1,900,000 Gross Profit Wage Expense $1,100,000 380,000 Administrative Expenses 360,000 Operating Expenses 740,000 Operating Income 360,000 Dividend Revenue 20,000 Gain on Sale of Equipment 40,000 Other Revenues and Gains 60,000 Interest Expense 20,000 Loss on Sale of Securities 10,000 Other Expenses and Losses 30,000 Income Before Tax 390,000 Income Tax Expense 150,000 Net Income $ 240,000 E. Earnings per common share are required to be shown on the face of the income statement for public companies. V. Discontinued operations are shown separately after the results from continuing operations in the income statement. A. Discontinued operations result when an organization disposes of a component of a business and those operations and cash flows are clearly distinguishable from other operations of the organization. B. Gains or losses from discontinued operations are shown net of their tax impact. C. If a public company has discontinued operations, earnings per common share is required to be shown for income from continuing operations, discontinued operations, and net income. Practice Question LMNO Company is a well-diversified company. They decided to discontinue the paint-producing division of their company. During year 20X5, the paintproducing division lost $150,000 (net of tax). At the end of the year, LMNO sold the paint-producing division for a loss of $60,000 (net of tax). Aside from the paint-producing division, LMNO had the following additional activity during year 20X5. Sales Revenue $7,000,000 Dividend Revenue 35,000 Gain on Sale of Equipment Cost of Goods Sold 5,000 3,200,000 Wage Expense 960,000 Administrative Expenses 770,000 Interest Expense 65,000 Income Tax Expense for Continuing Operations Loss on Sale of Securities 807,200 27,000 Produce a multi-step income statement in good form. Answer LMNO Co. Income Statement for the year ended December 31, 20X5 Sales Revenue Cost of Goods Sold $7,000,000 3,200,000 Gross Profit $3,800,000 Wage Expense 960,000 Administrative Expenses 770,000 Operating Expenses 1,730,000 Operating Income 2,070,000 Dividend Revenue Gain on Sale of Equipment 35,000 5,000 Other Revenues and Gains Interest Expense 40,000 65,000 Loss on Sale of Securities 27,000 Other Expense and Losses 92,000 Income Before Tax $2,018,000 Income Tax Expense 807,200 Income from Continuing 1,210,800 Operations Discontinued Operations Loss from discontinued paint-producing division (net of tax) Loss from disposal of paint-producing division (net of tax) 150,000 60,000 210,000 Net Income 1,000,800 VI. Other Comprehensive Income (OCI) is made up of economic gains and losses that are not defined as part of net income. A. Common components of OCI include the following: 1. Unrealized holding gains and losses on available-for-sale (AFS) securities 2. Gains and losses on cash flow hedges 3. Increases and decreases in equity due to foreign currency translation adjustments arising from the translation of foreign subsidiaries into U.S. dollars 4. Certain gains and losses related to defined benefit pensions B. OCI can be presented in one of two ways: 1. In a combined Statement of Income and Comprehensive Income, which begins with the individual components of the income statement presented first followed by the individual components of OCI and ending with total Comprehensive Income (Net Income plus OCI) for the period presented. 2. In a separate fifth financial statement titled Statement of Comprehensive Income, which begins with net income as the first line followed by the individual components of OCI and ending with total Comprehensive Income for the period presented. 3. OCI amounts are accumulated in equity through Accumulated Other Comprehensive Income (AOCI) in a manner similar to the way revenues, expenses, gains, losses, and dividends are accumulated in equity through Retained Earnings. C. Illustration: Continuing the ABC Co. example from above, ABC has a $5,000 (net of tax) unrealized holding loss on AFS securities during 20X2. ABC's combined Statement of Comprehensive Income would appear as follows: ABC Co. Statement of Income and Comprehensive Income for the year ended December 31, 20X2 Sales Revenue Cost of Goods Sold $3,000,000 1,900,000 Gross Profit $1,100,000 Wage Expense 380,000 Administrative Expenses 360,000 Operating Expenses 740,000 Operating Income 360,000 Dividend Revenue 20,000 Gain on Sale of Equipment 40,000 Other Revenues and Gains Interest Expense 20,000 Loss on Sale of Securities 10,000 Other Expenses and Losses 30,000 Income Before Tax 390,000 Income Tax Expense 150,000 Net Income 240,000 Unrealized Holding Loss (net of tax) Comprehensive Income Practice Question 60,000 5,000 $ 235,000 Gregory Corporation uses a multi-step format on a combined Statement of Income and Comprehensive Income to report its results of operations each year. During 20X3, Gregory Corporation reported the following selected information on that statement: Comprehensive Income $ 64,000 Gross Profit $382,000 Operating Expenses $261,000 Sales Revenue $596,000 Net Income $ 60,000 Income Before Tax $100,000 What are the total amounts Gregory Corporation reported for Cost of Goods Sold, Other Losses, Income Tax Expense, and Other Comprehensive Income (net of tax) in 20X3? Answer Amounts can be derived by recreating a combined Statement of Income and Comprehensive Income for Gregory Corporation and deriving the required amounts from those given in the problem data. Gregory Corporation Statement of Income and Comprehensive Income for the year ended December 31, 20X3 Sales Revenue $596,000 Cost of Goods Sold ? Gross Profit 382,000 Operating Expenses 261,000 Operating Income Other Losses ? Income Before Tax 100,000 Income Tax Expense ? Net Income 60,000 Other Comprehensive Income (net of tax) Comprehensive Income ? $ 64,000 Cost of Goods Sold = Sales Revenue less Gross Profit ($596,000 − $382,000) or $214,000 Other Losses = difference between Income Before Tax and Operating Income. Operating Income of $121,000 can be derived from the given information ($382,000 − $261,000), so Other Losses is $21,000 ($100,000 − $121,000). Income Tax Expense = Income Before Tax less Net Income ($100,000 − $60,000) or $40,000 Other Comprehensive Income (net of tax) = Comprehensive Income less Net Income ($64,000 − $60,000) or $4,000 Gregory Corporation Statement of Income and Comprehensive Income for the year ended December 31, 20X3 Sales Revenue $596,000 Cost of Goods Sold 214,000 Gross Profit 382,000 Operating Expenses 261,000 Operating Income 121,000 Other Losses Income Before Tax 21,000 100,000 Income Tax Expense 40,000 Net Income 60,000 Other Comprehensive Income (net of tax) Comprehensive Income 4,000 $ 64,000 Summary Stakeholders both inside and outside an organization use financial statements to better understand the financial position and health of an organization. Financial statements have inherent limitations, some of which are addressed in the notes to the financial statements. It is important to understand other inherent limitations as well. The first financial statement is the income statement and can be presented using a single-step method or multi-step method. Both methods for preparing the income statement should be understood. Additionally, you should understand other comprehensive income, which is made up of economic gains and losses that are not defined as part of net income. The other three financial statements will be discussed in subsequent lessons. Flashcards Overview of Financial Statements and the Income Statement 1 FC.fin.inc.FC001_1802 Name some internal users of the financial statements and briefly discuss why each party uses them. Managers: Use financial statements to determine whether the organization is utilizing resources in the most cost-effective manner and to make key investment and financing decisions. Employees: Analyze the statements for their own job security and to determine the impact of profit-based compensation. 2 FC.fin.inc.FC002_1802 List some external users of the financial statements and briefly discuss why each party uses them. Shareholders and prospective investors: To determine their return on investment. Financial institutions: Assess the ability to pay on loans and keep debt covenants. Suppliers: Assess the ability of their customers to pay bills on time. Customers: Assess whether the suppliers will remain in business. Competitors: Compare their performance to others in the industry. Regulators: Assess whether public organizations have adhered to accounting and reporting requirements. 3 FC.fin.inc.FC003_1802 When looking at the financial statements, what are some inherent limitations that must be considered? Periodicity: The monthly, quarterly, and annual statement periods are generally not good indicators of the natural business cycle. Historical information: The information is historical and should be considered with current knowledge of the company. Valuation: Some items use historical cost, others use estimates, and other items are reported at fair value. Accounting Methods: Differences between methods might make it difficult to compare two organizations. Omissions: Several relevant items are omitted from the financial statements. 4 FC.fin.inc.FC004_1802 Describe the purposes of the income statement and the balance sheet. 5 FC.fin.inc.FC005_1802 Income Statement: Shows the sources of revenues, gains, expenses, and losses for a reporting period. Elements on the income statement are recorded on an accrual basis. The income statement is often combined with a presentation of Other Comprehensive Income. The income statement may be presented using either the single-step or multi-step method. Balance Sheet: Shows the assets, liabilities, and owners’ equity of the organization as of the end of a reporting period. Describe the purposes of the Statement of Changes in Equity and the Statement of Cash Flows. Statement of Changes in Equity: Presents the detailed changes in each equity account over the course of the reporting period. The accounts typically included in equity include: Preferred Stock, Common Stock, Additional Paid-In Capital, Treasury Stock, Retained Earnings, and Accumulated Other Comprehensive Income. Statement of Cash Flows: Explains the overall change in the cash position over the reporting period. The change is broken down into three categories of cash flows: Operating, Investing, and Financing. Notes Overview of Financial Statements and the Income Statement You haven’t made any notes or highlights yet. Test Bank Questions Overview of Financial Statements and the Income Statement Question 1 1.A.2.ee 1A1-W001 The multi-step income statement, with additional income statement items, for Harrington Technologies Inc. is given below. Net sales Less: Cost of goods sold Gross profit $2,000,000 890,000 1,110,000 Less: Transportation and travel 45,000 Depreciation 68,000 Pension contributions Operating income Less: Discontinued operations Income before taxes Less: Tax expense @ 30% Net income 21,000 976,000 76,000 900,000 270,000 $630,000 Glen Hamilton, a financial analyst, analyzed the company's financial statements and concluded that the real net income should be $683,200 instead of $630,000. Which of the following arguments is most likely to support his conclusion? $53,200 due from a client was written off as irrecoverable after the finalization of accounts for the current period. The company valued its inventory using the specific identification method, whereas the financial analyst used the last in, first out (LIFO) method for the current period. The company might have liquidated its LIFO reserve. The company has included expenses in relation to discontinued operations as part of income from continued operations. Question 2 1.A.2.cc 1A1-W007 The management of Arthur Energy recognized a contingent liability of $50,000 in the current year. However, before the annual report was issued, the company resolved the issue, making a lump-sum payment of $42,000. The board of directors has decided to incorporate the transaction in the subsequent year's financial statements. Which of the following provisions of U.S. GAAP, if applicable, is likely to prove the management decision wrong? Loss contingencies must be recognized when it is probable that a loss has been incurred and the amount of the loss is reasonably estimable. Whenever GAAP or industry-specific regulations allow a choice between two or more accounting methods, the method selected should be disclosed. If an event alters the estimates used in preparing the financial statements, then the financial statements should be adjusted. If an event provides additional evidence about conditions that existed as of the balance sheet date and alters the estimates used, then the financial statements should be adjusted. Question 3 1.A.1.a 1A1-W009 Suzanne Rogers, a financial analyst, is analyzing Capital One's stock. She is more interested in estimating the cash flows Capital One can generate. From the financial analyst's perspective, which of the following balance sheet reporting is best suited to avoid adjustments? Inventory reported at current market value; fixed assets reported at historical cost. Inventory reported at replacement cost; fixed assets reported at market value. Inventory reported at historical cost; fixed assets reported at historical cost. Inventory reported at historical cost; fixed assets reported at fair value. Question 4 1.A.1.g 1A1-W012 The following information is available for Matthews Holdings Inc.: Net sales Depreciation 2,000 Cost of goods sold 3,500 Gain on sale of asset 3,000 Loss from discontinued operations 5,400 Gain from unusual items Calculate the income from continuing operations. $23,000 $17,100 $17,600 $22,500 $25,000 500 Question 5 1.A.1.f 1A1-W013 Which of the following is true of an income statement presented as per U.S. GAAP? It reconciles beginning and ending balances of stockholders' equity. Bank overdrafts are always included as a component of operating activities on the cash flow statement. Financial measures of contractual agreements such as pension obligations, lease contracts, and stock option plans are required to be disclosed on the income statement as a separate line item. When a company sells a component of its business, the income or loss associated with the component should be reported net of tax separately from income from continuing operations. Question 6 1.A.1.a 1A1-W014 How does the balance sheet help users? It depicts the true value of an entity. It measures the nonfinancial performance of an entity. It shows the financial performance of an entity over a specific accounting period. It assesses an entity's liquidity, solvency, financial flexibility, and operating capability. Question 7 1.A.1.d 1A1-W017 "Employing different accounting methods will yield different net incomes." How is this factor a limitation of financial statements? Choice between cash-based accounting and accrual accounting for financial reporting allows companies to smooth earnings for a longer period. The flexibility of employing different methods for presentation of financial statements can lead to inaccurate disclosure of information. Change in net income due to change in accounting methods affects the determination of future performance of a company. Difference in results due to change in accounting methods makes it difficult for users to compare the performance of different entities. Question 8 1.A.1.e 1A1-W020 Juan Baker Inc. filed a suit against Foster Desserts in the second quarter of the current year and claimed damages worth $15,000. There was also a pending litigation against Juan Baker Inc. for $12,000 to its customers for supplying lower-quality goods. The company was expecting to win the suit against Foster Desserts. For presenting the financial statements for the year, Juan Baker's accountant realized a net gain of $3,000 as other comprehensive income. As per U.S. GAAP, how should this information be presented? The accountant should recognize contingent liability of $12,000 and disclose contingent gains of $15,000 as footnotes. This information should not be presented as part of financial statements but should be disclosed in footnotes to financial statements. The accountant should realize net gain of $3,000 as part of gains from discontinued operations. This information should not be presented in financial statements but should be disclosed in the directors' responsibility statement. Question 9 1.A.1.c 1A1-W022 The management accountant of Kathryn Software decided to alter the financial statements due to an event that occurred after the balance sheet date. Which of the following is the most likely reason for her decision? The event provides evidence about a loss of expected income due to inefficient collection efforts. The company has decided to shift the company's headquarters to a country that follows IFRS in the next year. The event provides additional evidence about conditions that existed as of the balance sheet date and alters the estimates used. There is a sharp decline in the stock price. Question 10 1.A.1.e 1A1-W025 While approving the financial statements for the current year, the management accountant of Rachael Groups discovered that sales were overstated. Which of the following is the most likely reason for the overstatement? Sales returns recorded are more than actual returns. Abnormal losses are not accounted for. General sales tax collected from customers was not accounted for. The last in, first out method is used for valuation of inventory. Question 11 1.A.1.e 1A2-W005 AWS Inc. is engaged in the construction of rail tracks. The CEO suggests allocating all of the insurance, property taxes, and supervisory factory labor to construction, but the management accountant disagrees. The management accountant will argue that the indirect costs should be allocated in what way? The indirect costs should be allocated to the extent of the difference between net realizable value and carrying value. The indirect costs should be allocated to the extent of proportionate completion. The indirect costs should be allocated proportionally based on the value of the asset. The indirect costs should not be capitalized to the rail tracks. Question 12 1.A.1.e 1A2-W010 Under which of the following circumstances will cash, set aside to fulfill terms of an agreement, be determined as a long-term asset? When it is not material and is subject to a significant risk of change in value due to change in the value of the associated long-term asset. When it is used to pay liabilities beyond the operating cycle or year, whichever is longer, or for the retirement of a specific long-term debt. When the minimum balance requirements designed to offset part of the risk of lending is more than the estimated value of the liability. When there is a debt instrument that is expected to mature after the operating cycle. Question 13 1.A.2.aa 1A2-W011 The following information is extracted from the records of Silvia Garner Laboratories about marketable securities. Date of purchase Jan-1 Acquisition cost $25,000 Option premium $4,000 Holding cost $8,000 Brokerage fees $2,000 Market value on Dec-31 $30,000 Calculate the amount of gain or loss on revaluation to be reported of the income statement as of December 31. Loss of $9,000. Loss of $1,000. Gain of $3,000. Gain of $5,000. Question 14 1.A.1.c 1A2-W025 An extract of the footnotes of Chavez Inc., with 13 subsidiaries across 4 countries, reads as follows: "The company uses the current rate method for translation of subsidiary accounts. Paid-in capital accounts have been translated using the historic rate. All assets and liabilities have been translated using the current exchange rate on the balance sheet date, whereas income statement accounts have been translated using the end-of-year rate." The CEO of the company did not approve the financial statements, stating that the accounting policies followed are not in line with U.S. GAAP. Which of the following statements support the CEO's decision? Income statement accounts should be translated based on the current exchange rate on the balance sheet date. Income statement accounts should be translated based on the average rate for the current year. All assets and liabilities should be translated using the average rate for the current year. Paid-in capital accounts should be translated using the end-of-year rate. Question 15 1.A.2.ee TREPD-0015 On January 1, Year 2, Dart, Inc. entered into an agreement to sell the assets and product line of its Jay Division, considered a segment of the business. This activity is considered a strategic shift. The sale was consummated on December 31, Year 2, and resulted in a gain on disposition of $400,000. The division’s operations resulted in losses before income tax of $225,000 in Year 2 and $125,000 in Year 1. Dart’s income tax rate is 30% for both years. In a comparative statement of income for year 2 and Year 1, Dart should report a gain (loss) from discontinued operations for the years 2 and 1 of: Year 2 Year 1 $ 122,500 $0 $ 122,500 $(87,500) $175,000 $(125,000) $(157,500) $(87,500) Question 16 1.A.2.dd cma11.p1.t1.me.0002 The following was reported for Jyn's Company for 2016: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale securities Cash dividends received on the securities What would be the amount of comprehensive income for 2016? $411,000 $315,000 $96,000 $321,000 $1,530,000 1,050,000 165,000 90,000 6,000 Question 17 1.A.2.ee cma11.p1.t1.me.0005_0820 According to U.S. GAAP, where on the income statement should a multinational company report the loss from the disposal sale of a major operating unit? *Source: Retired ICMA CMA Exam Questions. Report the loss, pretax, in a separate section between income from continuing operations and net income. Report the loss, net of tax, in a separate section between income from continuing operations and net income. Report the loss, pretax, in a separate section between income from operations and income before income tax. Report the loss, net of tax, in a separate section between income before tax and net income. Question 18 1.A.1.e cma11.p1.t1.me.0006_0820 A company reported first quarter revenues of $10,000,000, gross profit margin of 25%, and operating income of 15%. To reduce overhead expenses, a consultant recommends that the company outsource some of its operating activities beginning with the second quarter. This recommendation is anticipated to reduce operating expenses by 20% without affecting sales volume. The company has an income tax rate of 35%. Assuming cost of sales remains at 75%, what is the impact on the income statement if the company implements the recommendation? *Source: Retired ICMA CMA Exam Questions. Gross profit will increase by 8.0%. Operating income will increase by 8.7%. Operating income will increase by $200,000. Operating expenses will be reduced by $300,000. Question 19 1.A.1.e cma11.p1.t1.me.0010_0820 For a manufacturing firm, which of the following would be included in cash outflows from financing activities on the Statement of Cash Flows? *Source: Retired ICMA CMA Exam Questions. Payment of salaries and wages Repayment of the principal portion of firm debt Issuance of new stock Interest payments on firm debt Question 20 1.A.2.ee cma11.p1.t1.me.0013_0820 A company uses the calendar year as its financial results reporting time period. On May 31 of the prior year, the company committed to a plan to sell a line of business. As a result, the operation of this line of business and cash flows will be eliminated from the company's operations, and the company will have no significant continuing involvement with the line of business subsequent to the disposal. For the period January 1 through May 31of the prior year, the line of business had revenues of $1,000,000 and expenses of $1,600,000. The assets of the line of business were sold on November 30 at a loss for which no tax benefit is available. In its income statement for the year ended December 31of prior year, how should the company report the line of business operations from January 1 through May 31? *Source: Retired ICMA CMA Exam Questions. $600,000 should be reported as part of the loss on disposal of a component. $600,000 should be reported as an extraordinary loss. $600,000 should be included in the determination of income or loss from operations of a discontinued component. $1,000,000 and $1,600,000 should be included with revenues and expenses, respectively, as part of continuing operations. Question 21 1.A.1.e fin.inc.tb.047_0120 Best Billiard Company owns 40% of Supreme Table Company’s stock at a historical cost of $300,000. Supreme Table recently reported its earnings for the prior year. Best Billiard’s proportional share of Supreme Table’s prior year net income was $10,000. Best Billiard also received $15,000 in dividends from Supreme Table in the prior year. Best Billiard uses the equity method as the accounting treatment for this investment. Based on the information presented, the proper presentation of this investment would result in Best Billiard reporting: *Source: Retired ICMA CMA Exam Questions. a decrease in the book value of its investment in Supreme Table. an increase in the book value of its investment in Supreme Table. its investment in Supreme Table at the original cost. consolidated financial statements with Supreme Table. Question 22 1.A.2.dd fin.inc.tb.048_0120 A company is preparing its financial statements in accordance with U.S. GAAP. Listed below are select financial data for the company. Net income = $950,000 Depreciation = $40,000 Investment by owners = $60,000 Unrealized gain on available-for-sale securities = $90,000 Foreign currency translation loss = $20,000 What is the amount that would be reported as comprehensive income? *Source: Retired ICMA CMA Exam Questions. $970,000 $1,020,000 $1,060,000 $1,120,000 Question 23 1.A.1.a tb.fin.inc.001_1805 Which aspect of a firm's statement of cash flows most interests potential stockholders? The firm's investments in new plant assets Changes in the firm's inventory balance The firm's gains and losses from selling plant assets The firm's ability to pay dividends Question 24 1.A.1.a tb.fin.inc.003_1805 How are financial statements related to the objective of financial reporting? Companies use financial statements to document their cash flow, and documenting cash flow is the objective of financial reporting. Companies use financial statements to determine selling prices of products, and determining selling prices of products is the objective of financial reporting. Companies use financial statements to determine which new projects to pursue, and deciding which projects to pursue is the objective of financial reporting. Companies use financial statements to provide financial information to potential capital providers, and providing information to capital providers is the objective of financial reporting. Question 25 1.A.1.a tb.fin.inc.004_1805 To get the best possible idea of a firm's ability to pay cash dividends to its stockholders, potential investors should focus on the firm's: Balance sheet Statement of cash flows Income statement Retained earnings statement Question 26 1.A.1.b tb.fin.inc.005_1805 How does the balance sheet differ from the statement of cash flows in regard to reporting a company's financial information related to cash? The balance sheet reports how the company plans to use available cash balances, and the statement of cash flows reports how cash is used over a period of time. The balance sheet reports the cash amount at a single point in time, and the statement of cash flows reports how the company plans to use available cash balances. The balance sheet reports the cash amount at a single point in time, and the statement of cash flows reports how cash is used over a period of time. The balance sheet reports the cash amount over a period of time, and the statement of cash flows reports how cash was used at a single point in time. Question 27 1.A.1.b tb.fin.inc.006_1805 A firm's statement of cash flows is often said to be ________ than its other financial statements because it ________. less reliable; does not employ accrual-based accounting more reliable; employs accrual-based accounting more reliable; does not employ accrual-based accounting less reliable; employs accrual-based accounting Question 28 1.A.1.b tb.fin.inc.007_1805 Your boss at Trinitron Inc. wants to discuss the origin of the company's cash in the last year and how it was used. What documents should you bring to the meeting? The comparative balance sheet and the retained earnings statement The income statements from last year and the year before The statement of cash flows and supplementary schedules The balance sheet and the income statement Question 29 1.A.1.b tb.fin.inc.008_1805 Assets, liabilities, and equity describe the amount of resources and claims to resources that a company has at which time(s)? At a moment in time and during a period of time During a period of time Neither at a moment in time nor during a period of time At a moment in time Question 30 1.A.1.b tb.fin.inc.009_1805 Which of the following describes a similarity between an income statement and a statement of cash flows? Both statements reflect the adjusting entries made at the end of an accounting period. Both statements summarize activities that took place during an accounting period. Both statements carry over accounting data from one accounting period to the next. Both statements measure differences between the beginning of the accounting period and the end of the period. Question 31 1.A.1.b tb.fin.inc.010_1805 The most likely use of an income statement prepared by a business enterprise is its use by which of the following? Investors interested in the financial performance of the entity. Labor unions to examine earnings closely as a basis for salary discussions. Government agencies to formulate tax and economic policy. Customers to determine a company's ability to provide needed goods and services. Question 32 1.A.1.b tb.fin.inc.011_1805 You have hired a third-party consultant to improve efficiency at your company. The consultant requests a detailed summary of what cash was available to the company and how it was spent. What would be the most helpful documents? Lists of account receivables, accounts payables, and long-term debt The retained earnings statements from the last three years The statement of cash flows and supplementary schedules The balance sheet and the income statement Question 33 1.A.1.e tb.fin.inc.012_1805 In 20x7, Sweet Treats sold a piece of equipment with a purchase value of $371,000 and accumulated depreciation of $247,000 for $75,000. Sweet Treats realized a loss of $49,000 on the sale. How would this transaction affect overall cash flows? Cash flows would increase by $26,000. Cash flows would decrease by $49,000. Cash flows would increase by $75,000. Cash flows would increase by $49,000. Question 34 1.A.1.e tb.fin.inc.013_1805 Emerson Industries sold a new issue of common stock to investors. How would this be recorded differently in the statement of cash flows than if they used the stock to purchase equipment? The sale of stock to investors should be disclosed in a separate schedule, whereas exchange of stock for equipment should be included in cash flows from investing activities. The sale of stock to investors should be included in cash flows from financing activities, whereas exchange of stock for equipment should be disclosed in a separate schedule. The sale of stock to investors should be included in cash flows from investing activities, whereas the exchange of stock for equipment should be included in cash flows from financing activities. The sale of stock to investors should not be disclosed in the statement of cash flows, whereas exchange of stock for equipment should be disclosed in a separate schedule. Question 35 1.A.1.e tb.fin.inc.014_1805 In which section of the statement of cash flows would depreciation expense be found? Investing Operating Financing Noncash activities Question 36 1.A.1.e tb.fin.inc.015_1805 In which section of the statement of cash flows would a gain on the sale of equipment be reported? Investing Operating Financing Noncash activities Question 37 1.A.1.e tb.fin.inc.016_1805 Which section of the statement of cash flows includes interest payments? Operating Investing Financing Expenditure Question 38 1.A.1.e tb.fin.inc.017_1805 Holcomb Industries sold a piece of machinery with a purchase value of $918,000 and accumulated depreciation of $856,800 for $80,000. They realized a gain of $18,800 on the sale. How would this transaction affect overall cash flows? Cash flows would increase by $18,800. Cash flows would increase by $98,800. Cash flows would increase by $80,000. Cash flows would increase by $61,200. Question 39 1.A.1.e tb.fin.inc.018_1805 When using the indirect method, which statement provides the most accurate description of the relationship between accounts receivable and the operating activities section on the statement of cash flows? An increase in accounts receivable results in an increase in the operating activities section on the statement of cash flows. An increase in accounts receivable results in a decrease in the operating activities section on the statement of cash flows. A decrease in accounts receivable results in a decrease in the operating activities section on the statement of cash flows. A decrease in accounts receivable results in no change in the operating activities section on the statement of cash flows. Question 40 1.A.1.e tb.fin.inc.019_1805 Which of the following would be in the investing section of the statement of cash flows? Depreciation expense Conversion of bonds into common stock Issuing shares of common stock Proceeds from selling equipment Question 41 1.A.1.e tb.fin.inc.020_1805 Which section of the statement of cash flows includes the proceeds from selling equipment? Investing Financing Operating Noncash activities Question 42 1.A.1.e tb.fin.inc.021_1805 In good years, Dailey Industries often loans cash to other companies, but in difficult years, they have to borrow cash from other entities. How would they record these differently on the statement of cash flows? Loaning money would be classified as an investing activity, whereas borrowing money would be classified as a financing activity. Loaning money would be classified as a financing activity, whereas borrowing money would be classified as an investing activity. Loaning money would be classified as an operating activity, whereas borrowing money would be classified as a financing activity. Loaning money would be classified as a financing activity, whereas borrowing money would be classified as an operating activity. Question 43 1.A.1.e tb.fin.inc.022_1805 What is one way that cash flows from investing activities are the opposite of cash flows from financing activities? Cash flows from investing activities frequently reflect cash flows related to the purchase of property, plant, and equipment, whereas cash flows from financing activities frequently reflect cash flows related to the sale of property, plant, and equipment. Cash flows from investing activities frequently reflect cash flows related to cash the company has loaned to others, whereas cash flows from financing activities frequently reflect cash flows related to cash the company has borrowed from others. Cash flows from investing activities frequently reflect cash flows related to the receipt of dividends and interest from purchased securities, whereas cash flows from financing activities frequently reflect cash flows related to the payment of dividends and interest to investors and creditors. Cash flows from investing activities frequently reflect cash flows related to the purchase of treasury stock, and cash flows from financing activities frequently reflect cash flows related to the sale of treasury stock. Question 44 1.A.1.e tb.fin.inc.023_1805 When preparing a statement of cash flows, a company must make an adjustment to net income for sales that have been made but for which cash collections have not yet been received. Which of the following describes this circumstance? An increase in accounts receivable account during the year A decrease in accounts payable account during the year A decrease in accounts receivable account during the year An increase in accounts payable account during the year Question 45 1.A.1.e tb.fin.inc.024_1805 Last year Urban Kicks earned $5.2 million from the sale of shoes and $1.4 million from the sale of one of their manufacturing plants. How would these cash flows be categorized on the statement of cash flows? Both would be recorded as an operating activity on the statement of cash flows. Both would be recorded as an investing activity on the statement of cash flows. Money from the sale of shoes would be recorded as an operating activity in the statement of cash flows, while money from the sale of property would be recorded as an investing activity in the statement of cash flows. Money from the sale of property would be recorded as an operating activity on the statement of cash flows, while money from the sale of shoes would be recorded as an investing activity on the statement of cash flows. Question 46 1.A.1.e tb.fin.inc.025_1805 Last week, Sweet Treats Bakery spent $30,000 on wages for employees and $15,000 on new ovens. How do these expenses compare? Both would be recorded as an operating activity on the statement of cash flows. Both would be recorded as an investing activity on the statement of cash flows. Money spent on wages would be recorded as an operating activity on the statement of cash flows, while money spent on ovens would be recorded as an investing activity on the statement of cash flows. Money spent on ovens would be recorded as an operating activity on the statement of cash flows, while money spent on wages would be recorded as an investing activity on the statement of cash flows. Question 47 1.A.1.e tb.fin.inc.026_1805 Last quarter Hyperion Enterprises sold new stock and paid dividends. How do these activities compare? Both would be reported as an operating activity on the statement of cash flows. Both would be reported as a financing activity of the statement of cash flows. Both would be reported as an investing activity on the statement of cash flows. Both would be reported on a separate schedule attached to the statement of cash flows. Question 48 1.A.1.e tb.fin.inc.027_1805 In January of last year, Newton Inc. sold 15,000 shares of its own common stock for $180,000. Ten months later, Newton repurchased 5,000 of those shares at a price of $11 per share. When compiling its statement of cash flows for the year, Newton should record which of the following entries in relation to these stock transactions, and why? A net cash inflow of $125,000 should be recorded in the financing section because both transactions involve stockholders’ equity items, and all cash flows related to a particular activity must be netted against one another. A $180,000 cash inflow should be recorded in the financing section because the stock sale affects stockholders’ equity, and a $55,000 cash outflow should be recorded in the investing section because the stock repurchase represents an investment. Both a $180,000 cash inflow and a $55,000 cash outflow should be recorded in the financing section because both transactions involve stockholders’ equity items, and all cash flows must be reported gross. A net cash inflow of $125,000 should be recorded in the investing section because both transactions involve changes in the company's investments, and all cash flows related to a particular activity must be netted against one another. Question 49 1.A.1.e tb.fin.inc.028_1805 In March, Parker Products repurchased 25,000 of its outstanding common shares at a price of $14 per share. Seven months later, Parker sold 15,000 of these shares on the open market for $15.50 each. When recording the effects of these transactions on its annual statement of cash flows, Parker reports only a $117,500 cash outflow related to financing activities. Is this entry correct, and why? Parker is correct in placing this entry in the financing section. It is also correct in reporting only a cash outflow of $117,500 because the $350,000 cash outflow from the stock repurchase must be netted against the $232,500 inflow from the stock sale. Parker is incorrect in placing this entry in the financing section. However, it is correct in reporting only a cash outflow of $117,500 because the $350,000 cash outflow from the stock repurchase must be netted against the $232,500 inflow from the stock sale. Parker is incorrect in placing this entry in the financing section. It is also incorrect in recording only a net cash flow of $117,500 rather than both a cash outflow of $350,000 and a cash inflow of $232,500. Parker is correct in placing this entry in the financing section. However, rather than recording only a net cash outflow of $117,500, Parker should have reported both a cash outflow of $350,000 and a cash inflow of $232,500. Question 50 1.A.1.e tb.fin.inc.029_1805 Last year, XYZ Inc. sold one of its warehouse facilities for $1.5 million. It also earned $25,000 in interest on a loan that it made to another company. How should these transactions be reflected on XYZ's annual statement of cash flows, and why? The two transactions should be reported in separate sections of the statement because one involves income while the other involves financing activities. Specifically, XYZ should record a $1.5 million cash inflow in the operating activities section and a $25,000 cash inflow in the financing activities section. The two transactions should be reported in separate sections of the statement because one involves long-term assets while the other involves income. Specifically, XYZ should record a $1.5 million cash inflow in the investing activities section and a $25,000 cash inflow in the operating activities section. Both transactions should be reported in the operating activities section of the statement because both involve income statement items. Because the two transactions are unrelated, they should be recorded separately—as a $1.5 cash inflow from the facility sale and a $25,000 cash inflow from interest income. Both transactions should be reported in the investing activities section of the statement because both involve asset items. Because the two transactions are unrelated, they should be recorded separately—as a $1.5 cash inflow from the facility sale and a $25,000 cash inflow from interest income. Question 51 1.A.1.e tb.fin.inc.030_1805 Last year, Alpha Corporation spent $250,000 to repurchase 15,000 shares of its own outstanding common stock. The company also paid $40,000 in interest on a construction loan that it had obtained from its bank. How should these transactions be reflected on Alpha's annual statement of cash flows, and why? The two transactions should be reported in separate sections of the statement because one involves a change in equity while the other involves a change in income. Specifically, Alpha should record a $250,000 cash outflow in the financing section and a $40,000 cash outflow in the operating section. The two transactions should be reported in separate sections of the statement because one involves long-term assets while the other involves long-term liability. Specifically, Alpha should record a $250,000 cash outflow in the investing section and a $40,000 cash outflow in the financing section. Both transactions should be reported in the operating activities section of the statement because both involve alterations in the company's income. Because the two transactions are unrelated, they should be recorded separately—as a $250,000 cash outflow from the stock repurchase and a $40,000 cash outflow from the interest payment. Both transactions should be reported in the financing activities section of the statement because both involve long-term liability and/or equity items. Because the two transactions are unrelated, they should be recorded separately—as a $250,000 cash outflow from the stock repurchase and a $40,000 cash outflow from the interest payment. Question 52 1.A.1.e tb.fin.inc.031_1805 Maxwell Foods purchased raw materials from a local farm and also redeemed bonds that they issued eight years ago. How do these transactions compare when reported in the statement of cash flows? Both transactions result in cash outflow, but the purchase of raw materials is a financing activity and the redemption of bonds is an investing activity. Both transactions result in cash inflow, but the purchase of raw materials is an operating activity and the redemption of bonds is an investing activity. Both transactions result in cash inflow, but the purchase of raw materials is an investing activity and the redemption of bonds is an operating activity. Both transactions result in cash outflow, but the purchase of raw materials is an operating activity and the redemption of bonds is a financing activity. Question 53 1.A.2.aa tb.fin.inc.032_1805 What is the difference between a revenue and a gain? Revenue results from transactions related to peripheral operations, whereas gains result from transactions related to central operations. Revenues result from transactions related to central operations, whereas gains result from transactions related to peripheral operations. Revenue results from external transactions, whereas gains result from internal transactions. Revenue results from internal transactions, whereas gains result from external transactions. Question 54 1.A.2.aa tb.fin.inc.033_1805 How are expenses and losses similar? They both increase net income. They both decrease net income. They both refer to transactions related to major operations. They both refer to transactions related to peripheral operations. Question 55 1.A.2.cc tb.fin.inc.034_1805 Benson Toys spent $21 million on research and development in 20x6. This R&D resulted in eight new product patents. The fees associated with obtaining the patents totaled $517,000. When Benson does their accounting, how will they record these costs? They will expense $21 million and capitalize $517,000. They will capitalize $21 million and expense $517,000. They will expense $21,517,000. They will capitalize $21,517,000. Question 56 1.A.2.cc tb.fin.inc.035_1805 Alex and Grace are both analyzing intangible assets to determine if they need to be amortized. Alex is analyzing an indefinite-life intangible asset, whereas Grace is analyzing a limited-life intangible asset. What do you expect their conclusions will be? Alex will decide to amortize his asset, while Grace will decide not to amortize her asset. Both Alex and Grace will decide to amortize their assets. Alex will decide not to amortize his asset, while Grace will decide to amortize her asset. Both Alex and Grace will decide not to amortize their assets. Question 57 1.A.2.cc tb.fin.inc.036_1805 A justification for the periodic recording of depreciation expense can be demonstrated by which of the following? The association of efforts (expense) with accomplishments (revenue) Immediate recognition of an expense Minimization of income tax liability Systematic and rational allocation of cost over the periods benefited Question 58 1.A.2.cc tb.fin.inc.037_1805 When considering research and development costs, how are equipment costs different if they are used for one project only versus current and future projects? If equipment is purchased for one project only, the costs are capitalized and amortized; if equipment is purchased for more than one project, the costs are capitalized but not amortized. If equipment is purchased for one project only, the costs are capitalized but not amortized; if equipment is purchased for more than one project, the costs are expensed as incurred. If equipment is purchased for one project only, the costs are expensed as incurred; if equipment is purchased for more than one project, the costs are capitalized but not amortized. If equipment is purchased for one project only, the costs are expensed as incurred; if equipment is purchased for more than one project, the costs are capitalized and amortized. Question 59 1.A.2.cc tb.fin.inc.039_1805 What is the difference in accounting between a research cost and a development cost? Research costs are expensed as incurred, whereas development costs are capitalized and amortized over the life of the new product. Research costs are capitalized and amortized over the life of the project, whereas development costs are expensed as incurred. There are no differences in accounting between research costs and development costs. Research costs are capitalized and amortized until the product goes to market, whereas development costs are capitalized and amortized from the time the product hits the market until the product is withdrawn from the market. Question 60 1.A.2.cc tb.fin.inc.040_1805 Madsen Pharmaceuticals has spent 15 years developing a new medication for epileptic seizures. They finally have a new FDA-approved drug and have applied for a patent. When you look at Madsen's accounting books, what would you expect to find? The research and development costs for the new drug would have been capitalized at the beginning of the project and amortized as money was used. The research and development costs for the new drug would have been expensed throughout the past 15 years as money was spent on the project. The research and development costs for the new drug would have been expensed in one lump sum at the end of the project when total costs were determined. The research and development costs for the new drug would have been capitalized throughout the past 15 years as money was spent on the project. Question 61 1.A.2.dd tb.fin.inc.041_1805 The calculation of comprehensive income includes which of the following? Operating income Neither operating income nor distribution to owners Distribution to owners Operating income and distribution to owners Question 62 1.A.2.dd tb.fin.inc.042_1805 According to the FASB's conceptual framework, which of the following is/are included in comprehensive income? Neither gross margin nor operating income Gross margin and operating income Gross margin Operating income Question 63 1.A.2.dd tb.fin.inc.043_1805 Comprehensive income includes which of the following? Gross margin but not gains Gains but not gross margin Gains and gross margin Neither gains nor gross margin Question 64 1.A.2.dd tb.fin.inc.044_1805 With regard to comprehensive income, how does net income differ in a one-statement approach compared to a two-statement approach? Net income includes comprehensive income in a one-statement approach but not in a two-statement approach. Net income in a one-statement approach is used to calculate earnings per share, but earnings per share are not reported in a two- statement approach. Net income is reported as a subtotal in a one-statement approach but as a total on a two-statement approach. Net income includes income, expenses, gains, and losses all together in a one-statement approach, but income and expenses are separated from gains and losses when calculating net income in a two-statement approach. Question 65 1.A.2.ee tb.fin.inc.045_1805 Parisi Incorporated and Keeling International both sold some old equipment. Parisi sold their equipment because it was outdated, and they replaced it with new equipment. Keeling sold their equipment because the operations that needed the equipment are being shut down by the company. How would the income or loss from the sale of this equipment be reported differently by these companies? Parisi would report their income or loss under discontinued operations, whereas Keeling would not. Keeling would report their income or loss under discontinued operations, whereas Parisi would not. Keeling would report their income or loss as a note to the financial statements, whereas Parisi would report their income or loss in the actual financial statements. Parisi would report their income or loss as a note to the financial statements, whereas Keeling would report their income or loss in the actual financial statements. Question 66 1.A.2.ee tb.fin.inc.046_1805 Disposal of which of the following would qualify as a disposal of a component? A technology company upgrades its software. A transportation company sells its bus operations but not its airline operations. An auto parts manufacturer sells one of its five parts-manufacturing subsidiaries. A toy company phases out one product line. Answered Question 1 1.A.2.ee 1A1-W001 The multi-step income statement, with additional income statement items, for Harrington Technologies Inc. is given below. Net sales Less: Cost of goods sold Gross profit $2,000,000 890,000 1,110,000 Less: Transportation and travel 45,000 Depreciation 68,000 Pension contributions Operating income Less: Discontinued operations Income before taxes Less: Tax expense @ 30% Net income 21,000 976,000 76,000 900,000 270,000 $630,000 Glen Hamilton, a financial analyst, analyzed the company's financial statements and concluded that the real net income should be $683,200 instead of $630,000. Which of the following arguments is most likely to support his conclusion? $53,200 due from a client was written off as irrecoverable after the finalization of accounts for the current period. The company valued its inventory using the specific identification method, whereas the financial analyst used the last in, first out (LIFO) method for the current period. The company might have liquidated its LIFO reserve. The company has included expenses in relation to discontinued operations as part of income from continued operations. Revenue and expenses from discontinued operations do not form part of income from continued operations. In this case, the analyst has excluded discontinued operations since it is a nonrecurring item. Answered Question 2 1.A.2.cc 1A1-W007 The management of Arthur Energy recognized a contingent liability of $50,000 in the current year. However, before the annual report was issued, the company resolved the issue, making a lump-sum payment of $42,000. The board of directors has decided to incorporate the transaction in the subsequent year's financial statements. Which of the following provisions of U.S. GAAP, if applicable, is likely to prove the management decision wrong? Loss contingencies must be recognized when it is probable that a loss has been incurred and the amount of the loss is reasonably estimable. Whenever GAAP or industry-specific regulations allow a choice between two or more accounting methods, the method selected should be disclosed. If an event alters the estimates used in preparing the financial statements, then the financial statements should be adjusted. If an event provides additional evidence about conditions that existed as of the balance sheet date and alters the estimates used, then the financial statements should be adjusted. In this case, the amount of contingent liability needs to be revised, as the estimate of the amount of liability has changed. The subsequent event provides evidence regarding conditions present on the balance sheet date. Therefore, the financial statements need to be adjusted. Answered Question 3 1.A.1.a 1A1-W009 Suzanne Rogers, a financial analyst, is analyzing Capital One's stock. She is more interested in estimating the cash flows Capital One can generate. From the financial analyst's perspective, which of the following balance sheet reporting is best suited to avoid adjustments? Inventory reported at current market value; fixed assets reported at historical cost. Inventory reported at replacement cost; fixed assets reported at market value. Inventory reported at historical cost; fixed assets reported at historical cost. Inventory reported at historical cost; fixed assets reported at fair value. The current market value of inventory closely reflects the value at which it can be sold. Fixed assets reported at historical cost will help to estimate depreciation expense, and in turn the tax shield from depreciation, correctly. Answered Question 4 1.A.1.g 1A1-W012 The following information is available for Matthews Holdings Inc.: Net sales $25,000 Depreciation 2,000 Cost of goods sold 3,500 Gain on sale of asset 3,000 Loss from discontinued operations 5,400 Gain from unusual items 500 Calculate the income from continuing operations. $23,000 $17,100 $17,600 $22,500 Income from continuing operations is calculated as: Net sales $25,000 Less: Cost of goods sold 3,500 Less: Depreciation 2,000 Add: Gain on sale of asset 3,000 Add: Gain from unusual items 500 $23,000 Answered Question 5 1.A.1.f 1A1-W013 Which of the following is true of an income statement presented as per U.S. GAAP? It reconciles beginning and ending balances of stockholders' equity. Bank overdrafts are always included as a component of operating activities on the cash flow statement. Financial measures of contractual agreements such as pension obligations, lease contracts, and stock option plans are required to be disclosed on the income statement as a separate line item. When a company sells a component of its business, the income or loss associated with the component should be reported net of tax separately from income from continuing operations. When a company sells a component of its business, the income or loss associated with the component should be reported net of tax separately from income from continuing operations in a separate line item on the income statement. Both the after-tax operating income or loss the component generated during an accounting period prior to the sale and the after-tax gain or loss recognized from the sale should be reported separately. Answered Question 6 1.A.1.a 1A1-W014 How does the balance sheet help users? It depicts the true value of an entity. It measures the nonfinancial performance of an entity. It shows the financial performance of an entity over a specific accounting period. It assesses an entity's liquidity, solvency, financial flexibility, and operating capability. The balance sheet assesses an entity's liquidity, solvency, financial flexibility, and operating capability. These factors can be observed by calculating an entity's financial ratios. Answered Question 7 1.A.1.d 1A1-W017 "Employing different accounting methods will yield different net incomes." How is this factor a limitation of financial statements? Choice between cash-based accounting and accrual accounting for financial reporting allows companies to smooth earnings for a longer period. The flexibility of employing different methods for presentation of financial statements can lead to inaccurate disclosure of information. Change in net income due to change in accounting methods affects the determination of future performance of a company. Difference in results due to change in accounting methods makes it difficult for users to compare the performance of different entities. Employing different accounting methods will yield different net incomes. Each choice of two or more accounting methods will further change the results reported, making the task of comparing different entities very difficult, even when these methods are disclosed. Answered Question 8 1.A.1.e 1A1-W020 Juan Baker Inc. filed a suit against Foster Desserts in the second quarter of the current year and claimed damages worth $15,000. There was also a pending litigation against Juan Baker Inc. for $12,000 to its customers for supplying lower-quality goods. The company was expecting to win the suit against Foster Desserts. For presenting the financial statements for the year, Juan Baker's accountant realized a net gain of $3,000 as other comprehensive income. As per U.S. GAAP, how should this information be presented? The accountant should recognize contingent liability of $12,000 and disclose contingent gains of $15,000 as footnotes. This information should not be presented as part of financial statements but should be disclosed in footnotes to financial statements. The accountant should realize net gain of $3,000 as part of gains from discontinued operations. This information should not be presented in financial statements but should be disclosed in the directors' responsibility statement. Accounting recognition is not given to gain contingencies to avoid the premature recognition of income before its realization. However, loss contingencies must be recognized when it is both probable that a loss has been incurred and the amount of the loss is reasonably estimable. Answered Question 9 1.A.1.c 1A1-W022 The management accountant of Kathryn Software decided to alter the financial statements due to an event that occurred after the balance sheet date. Which of the following is the most likely reason for her decision? The event provides evidence about a loss of expected income due to inefficient collection efforts. The company has decided to shift the company's headquarters to a country that follows IFRS in the next year. The event provides additional evidence about conditions that existed as of the balance sheet date and alters the estimates used. There is a sharp decline in the stock price. If a subsequent event provides additional evidence about conditions that existed as of the balance sheet date and alters the estimates used in preparing the financial statements, then the financial statements should be adjusted. Answered Question 10 1.A.1.e 1A1-W025 While approving the financial statements for the current year, the management accountant of Rachael Groups discovered that sales were overstated. Which of the following is the most likely reason for the overstatement? Sales returns recorded are more than actual returns. Abnormal losses are not accounted for. General sales tax collected from customers was not accounted for. The last in, first out method is used for valuation of inventory. Usually sales tax is included in the selling price of a product. The sales account should be adjusted for the amount of sales tax collected, and it should be recorded as a liability. Answered Question 11 1.A.1.e 1A2-W005 AWS Inc. is engaged in the construction of rail tracks. The CEO suggests allocating all of the insurance, property taxes, and supervisory factory labor to construction, but the management accountant disagrees. The management accountant will argue that the indirect costs should be allocated in what way? The indirect costs should be allocated to the extent of the difference between net realizable value and carrying value. The indirect costs should be allocated to the extent of proportionate completion. The indirect costs should be allocated proportionally based on the value of the asset. The indirect costs should not be capitalized to the rail tracks. A proportional amount of the indirect costs should be allocated to a self-constructed asset based on value. Any costs incurred in excess of the asset's market value should not be capitalized but would be recorded as a loss. Answered Question 12 1.A.1.e 1A2-W010 Under which of the following circumstances will cash, set aside to fulfill terms of an agreement, be determined as a long-term asset? When it is not material and is subject to a significant risk of change in value due to change in the value of the associated long-term asset. When it is used to pay liabilities beyond the operating cycle or year, whichever is longer, or for the retirement of a specific long-term debt. When the minimum balance requirements designed to offset part of the risk of lending is more than the estimated value of the liability. When there is a debt instrument that is expected to mature after the operating cycle. Restricted cash is a current asset if it will be used to pay liabilities within a year or the operating cycle, whichever is longer. Otherwise, it is reported as a longterm asset. Answered Question 13 1.A.2.aa 1A2-W011 The following information is extracted from the records of Silvia Garner Laboratories about marketable securities. Date of purchase Jan-1 Acquisition cost $25,000 Option premium $4,000 Holding cost $8,000 Brokerage fees $2,000 Market value on Dec-31 $30,000 Calculate the amount of gain or loss on revaluation to be reported of the income statement as of December 31. Loss of $9,000. Loss of $1,000. Gain of $3,000. Gain of $5,000. Revaluation gain = $30,000 − ($25,000 + $2,000) = $3,000. Incidental costs should be added to acquisition cost in the calculation of revaluation gain. Answered Question 14 1.A.1.c 1A2-W025 An extract of the footnotes of Chavez Inc., with 13 subsidiaries across 4 countries, reads as follows: "The company uses the current rate method for translation of subsidiary accounts. Paid-in capital accounts have been translated using the historic rate. All assets and liabilities have been translated using the current exchange rate on the balance sheet date, whereas income statement accounts have been translated using the end-of-year rate." The CEO of the company did not approve the financial statements, stating that the accounting policies followed are not in line with U.S. GAAP. Which of the following statements support the CEO's decision? Income statement accounts should be translated based on the current exchange rate on the balance sheet date. Income statement accounts should be translated based on the average rate for the current year. All assets and liabilities should be translated using the average rate for the current year. Paid-in capital accounts should be translated using the end-of-year rate. In the current rate method, all assets and liabilities are translated using the current exchange rate on the balance sheet date. Paid-in capital accounts are translated using the historic rate. For simplicity, ASC 830 Foreign Currency Matters (formerly SFAS No. 52, Foreign Currency Translation) requires translation of income statement accounts based on the average rate for the current year. Answered Question 15 1.A.2.ee TREPD-0015 On January 1, Year 2, Dart, Inc. entered into an agreement to sell the assets and product line of its Jay Division, considered a segment of the business. This activity is considered a strategic shift. The sale was consummated on December 31, Year 2, and resulted in a gain on disposition of $400,000. The division’s operations resulted in losses before income tax of $225,000 in Year 2 and $125,000 in Year 1. Dart’s income tax rate is 30% for both years. In a comparative statement of income for year 2 and Year 1, Dart should report a gain (loss) from discontinued operations for the years 2 and 1 of: Year 2 Year 1 $ 122,500 $0 $ 122,500 $(87,500) $175,000 $(125,000) $(157,500) $(87,500) This answer is correct. Financial statements of current and prior periods should disclose the results of the operations of the disposed component, less applicable taxes, as a separate component of income. Therefore, the discontinued operations should be reported separately, net of taxes, for both Year 2 and Year 1. The computations are Year 2 Year 1 Discontinued operations: Loss from operating discontinued segment Gain on disposal of discontinued segment Loss from discontinued operations -0- $(87,500)** 122,500* -0- $122,500 $(87,500) * [($400,000 − $225,000) − 30% ($400,000 − $225,000)]. ** [$125,000 − (30% × $125,000)]. Answered Question 16 1.A.2.dd cma11.p1.t1.me.0002 The following was reported for Jyn's Company for 2016: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale securities Cash dividends received on the securities $1,530,000 1,050,000 165,000 90,000 6,000 What would be the amount of comprehensive income for 2016? $411,000 $315,000 $96,000 $321,000 To find the comprehensive income, we must subtract the cost of goods sold and the operating expenses from sales revenue and then add both the unrealized holding gain and the cash dividends received: $1,530,000 –– $1,050,000 – $165,000 + $90,000 + $6,000 = $411,000 Answered Question 17 1.A.2.ee cma11.p1.t1.me.0005_0820 According to U.S. GAAP, where on the income statement should a multinational company report the loss from the disposal sale of a major operating unit? *Source: Retired ICMA CMA Exam Questions. Report the loss, pretax, in a separate section between income from continuing operations and net income. Report the loss, net of tax, in a separate section between income from continuing operations and net income. Report the loss, pretax, in a separate section between income from operations and income before income tax. Report the loss, net of tax, in a separate section between income before tax and net income. The gain or loss from the disposal sale of a major operating unit known as discontinued operations is reported separately, net of tax, after income from continuing operations and before net income. Answered Question 18 1.A.1.e cma11.p1.t1.me.0006_0820 A company reported first quarter revenues of $10,000,000, gross profit margin of 25%, and operating income of 15%. To reduce overhead expenses, a consultant recommends that the company outsource some of its operating activities beginning with the second quarter. This recommendation is anticipated to reduce operating expenses by 20% without affecting sales volume. The company has an income tax rate of 35%. Assuming cost of sales remains at 75%, what is the impact on the income statement if the company implements the recommendation? *Source: Retired ICMA CMA Exam Questions. Gross profit will increase by 8.0%. Operating income will increase by 8.7%. Operating income will increase by $200,000. Operating expenses will be reduced by $300,000. Operating income will increase by $200,000, as can be seen in the calculations below. Answered Question 19 1.A.1.e cma11.p1.t1.me.0010_0820 For a manufacturing firm, which of the following would be included in cash outflows from financing activities on the Statement of Cash Flows? *Source: Retired ICMA CMA Exam Questions. Payment of salaries and wages Repayment of the principal portion of firm debt Issuance of new stock Interest payments on firm debt Repayment of the principal portion of firm debt would be included in cash outflows from financing activities on the Statement of Cash Flows. Answered Question 20 1.A.2.ee cma11.p1.t1.me.0013_0820 A company uses the calendar year as its financial results reporting time period. On May 31 of the prior year, the company committed to a plan to sell a line of business. As a result, the operation of this line of business and cash flows will be eliminated from the company's operations, and the company will have no significant continuing involvement with the line of business subsequent to the disposal. For the period January 1 through May 31of the prior year, the line of business had revenues of $1,000,000 and expenses of $1,600,000. The assets of the line of business were sold on November 30 at a loss for which no tax benefit is available. In its income statement for the year ended December 31of prior year, how should the company report the line of business operations from January 1 through May 31? *Source: Retired ICMA CMA Exam Questions. $600,000 should be reported as part of the loss on disposal of a component. $600,000 should be reported as an extraordinary loss. $600,000 should be included in the determination of income or loss from operations of a discontinued component. $1,000,000 and $1,600,000 should be included with revenues and expenses, respectively, as part of continuing operations. The results of operations of a line of business that has been or will be disposed of are reported in conjunction with the gain or loss on disposal. Answered Question 21 1.A.1.e fin.inc.tb.047_0120 Best Billiard Company owns 40% of Supreme Table Company’s stock at a historical cost of $300,000. Supreme Table recently reported its earnings for the prior year. Best Billiard’s proportional share of Supreme Table’s prior year net income was $10,000. Best Billiard also received $15,000 in dividends from Supreme Table in the prior year. Best Billiard uses the equity method as the accounting treatment for this investment. Based on the information presented, the proper presentation of this investment would result in Best Billiard reporting: *Source: Retired ICMA CMA Exam Questions. a decrease in the book value of its investment in Supreme Table. an increase in the book value of its investment in Supreme Table. its investment in Supreme Table at the original cost. consolidated financial statements with Supreme Table. When a company owns between 20% and 50% of the voting stock of another company, it accounts for this investment using the equity method of accounting. This is because the investor has significant (but not absolute) control over the investee’s activities. Under the equity method, the investment asset on the investor’s balance sheet is increased by its proportionate share of the investee’s net income and decreased by its proportionate share of the dividends paid by the investee. In this example, Best’s investment in Supreme increases by $10,000 from its share of Supreme’s net income and decreases by $15,000 from its share of dividends paid by Supreme. This results in a net decrease in book value of $5,000. Answered Question 22 1.A.2.dd fin.inc.tb.048_0120 A company is preparing its financial statements in accordance with U.S. GAAP. Listed below are select financial data for the company. Net income = $950,000 Depreciation = $40,000 Investment by owners = $60,000 Unrealized gain on available-for-sale securities = $90,000 Foreign currency translation loss = $20,000 What is the amount that would be reported as comprehensive income? *Source: Retired ICMA CMA Exam Questions. $970,000 $1,020,000 $1,060,000 $1,120,000 The calculation of comprehensive income starts with net income and includes unrealized gains and losses on available-for-sale securities, cash flow hedges gains and losses, foreign currency translation gains and losses, and gains and losses in pension and post-retirement benefit plans. In this example, comprehensive income includes the net income of $950,000, the unrealized gain on available-for-sale securities of $90,000, and the foreign currency translation loss of $20,000 ($950,000 + $90,000 − $20,000). This results in comprehensive income of $1,020,000. Answered Question 23 1.A.1.a tb.fin.inc.001_1805 Which aspect of a firm's statement of cash flows most interests potential stockholders? The firm's investments in new plant assets Changes in the firm's inventory balance The firm's gains and losses from selling plant assets The firm's ability to pay dividends Potential shareholders are generally interested in a firm's ability to increase its stock price and pay dividends. The statement of cash flows provides information about cash generated (that can be used for future dividends) and cash used to pay dividends in the past. Therefore, this is the correct answer. Answered Question 24 1.A.1.a tb.fin.inc.003_1805 How are financial statements related to the objective of financial reporting? Companies use financial statements to document their cash flow, and documenting cash flow is the objective of financial reporting. Companies use financial statements to determine selling prices of products, and determining selling prices of products is the objective of financial reporting. Companies use financial statements to determine which new projects to pursue, and deciding which projects to pursue is the objective of financial reporting. Companies use financial statements to provide financial information to potential capital providers, and providing information to capital providers is the objective of financial reporting. The main objective of financial reporting is to provide information to capital providers (investors and creditors). Financial statements are one way that information is provided to capital providers. Therefore, this is the correct answer. Answered Question 25 1.A.1.a tb.fin.inc.004_1805 To get the best possible idea of a firm's ability to pay cash dividends to its stockholders, potential investors should focus on the firm's: Balance sheet Statement of cash flows Income statement Retained earnings statement In order for a firm to be able to pay cash dividends to its shareholders, it needs to generate cash on a consistent basis. The statement of cash flows provides the best source of information concerning a firm's ability to generate cash and to sustain cash generation. Therefore, this is the correct answer. Answered Question 26 1.A.1.b tb.fin.inc.005_1805 How does the balance sheet differ from the statement of cash flows in regard to reporting a company's financial information related to cash? The balance sheet reports how the company plans to use available cash balances, and the statement of cash flows reports how cash is used over a period of time. The balance sheet reports the cash amount at a single point in time, and the statement of cash flows reports how the company plans to use available cash balances. The balance sheet reports the cash amount at a single point in time, and the statement of cash flows reports how cash is used over a period of time. The balance sheet reports the cash amount over a period of time, and the statement of cash flows reports how cash was used at a single point in time. The balance sheet provides a “snapshot” of balances for asset, liability, and equity accounts as of a given date, while the statement of cash flow provides information on the sources and uses of cash for a given time period. Therefore, this is the correct answer. Answered Question 27 1.A.1.b tb.fin.inc.006_1805 A firm's statement of cash flows is often said to be ________ than its other financial statements because it ________. less reliable; does not employ accrual-based accounting more reliable; employs accrual-based accounting more reliable; does not employ accrual-based accounting less reliable; employs accrual-based accounting The statement of cash flows does not rely on accrual-based accounting. It is based on cash-based accounting. Cash-based accounting is typically considered more reliable than accrual-based accounting since it does not rely on as many assumptions. Therefore, this is the correct answer. Answered Question 28 1.A.1.b tb.fin.inc.007_1805 Your boss at Trinitron Inc. wants to discuss the origin of the company's cash in the last year and how it was used. What documents should you bring to the meeting? The comparative balance sheet and the retained earnings statement The income statements from last year and the year before The statement of cash flows and supplementary schedules The balance sheet and the income statement The statement of cash flows provides information about the amount of cash generated by and used in operating, investing, and financing activities for a given period of time. Supplementary schedules provide information on how much cash was used for interest and tax payments, as well as information on significant non-cash activities. Therefore, this is the correct answer. Answered Question 29 1.A.1.b tb.fin.inc.008_1805 Assets, liabilities, and equity describe the amount of resources and claims to resources that a company has at which time(s)? At a moment in time and during a period of time During a period of time Neither at a moment in time nor during a period of time At a moment in time Assets, liabilities, and equity are displayed on a company's balance sheet. Their balances are measured as of a particular moment in time (the balance sheet date). The ending balance for one period becomes the beginning balance for the next period. In other words, the account balances do not begin at zero every period. Therefore, this is the correct answer. Answered Question 30 1.A.1.b tb.fin.inc.009_1805 Which of the following describes a similarity between an income statement and a statement of cash flows? Both statements reflect the adjusting entries made at the end of an accounting period. Both statements summarize activities that took place during an accounting period. Both statements carry over accounting data from one accounting period to the next. Both statements measure differences between the beginning of the accounting period and the end of the period. The income statement and statement of cash flows both summarize activities that took place during an accounting period. That is why the date in each statement is listed as “For the Period Ended xx/xx/xxxx.” Therefore, this is the correct answer. Answered Question 31 1.A.1.b tb.fin.inc.010_1805 The most likely use of an income statement prepared by a business enterprise is its use by which of the following? Investors interested in the financial performance of the entity. Labor unions to examine earnings closely as a basis for salary discussions. Government agencies to formulate tax and economic policy. Customers to determine a company's ability to provide needed goods and services. The FASB's conceptual framework identifies potential investors and creditors as the primary focus of financial statements. An income statement provides information about a business's profitability. Whether a business is profitable is likely to influence an investor's decision to invest in that business as it is one aspect of its financial performance. Therefore, this is the correct answer. Answered Question 32 1.A.1.b tb.fin.inc.011_1805 You have hired a third-party consultant to improve efficiency at your company. The consultant requests a detailed summary of what cash was available to the company and how it was spent. What would be the most helpful documents? Lists of account receivables, accounts payables, and long-term debt The retained earnings statements from the last three years The statement of cash flows and supplementary schedules The balance sheet and the income statement The statement of cash flows and supplementary schedules provide information about cash generated and used in operating, investing, and financing activities. This is the type of information requested by the consultant. Therefore, this is the correct answer. Answered Question 33 1.A.1.e tb.fin.inc.012_1805 In 20x7, Sweet Treats sold a piece of equipment with a purchase value of $371,000 and accumulated depreciation of $247,000 for $75,000. Sweet Treats realized a loss of $49,000 on the sale. How would this transaction affect overall cash flows? Cash flows would increase by $26,000. Cash flows would decrease by $49,000. Cash flows would increase by $75,000. Cash flows would increase by $49,000. Only the $75,000 cash received from selling the equipment affects cash flow. The $49,000 loss is a non-cash item. This means cash flows would increase by $75,000 from this transaction. Therefore, this is the correct answer. Answered Question 34 1.A.1.e tb.fin.inc.013_1805 Emerson Industries sold a new issue of common stock to investors. How would this be recorded differently in the statement of cash flows than if they used the stock to purchase equipment? The sale of stock to investors should be disclosed in a separate schedule, whereas exchange of stock for equipment should be included in cash flows from investing activities. The sale of stock to investors should be included in cash flows from financing activities, whereas exchange of stock for equipment should be disclosed in a separate schedule. The sale of stock to investors should be included in cash flows from investing activities, whereas the exchange of stock for equipment should be included in cash flows from financing activities. The sale of stock to investors should not be disclosed in the statement of cash flows, whereas exchange of stock for equipment should be disclosed in a separate schedule. Issuing stock to investors is classified as a cash inflow from financing activities. Any cash-related transaction involving equity (new stock issuances, stock repurchases, and dividend payments) are considered financing activities. When stock is exchanged for equipment, it is classified as a significant non-cash activity. Significant non-cash activities are disclosed on a supplementary schedule to the statement of cash flows. Therefore, this is the correct answer. Answered Question 35 1.A.1.e tb.fin.inc.014_1805 In which section of the statement of cash flows would depreciation expense be found? Investing Operating Financing Noncash activities Operating cash flows are cash flows that involve the calculation of net income. Depreciation expense is subtracted when calculating net income. Since it is a non-cash expense, it must be added back when calculating cash flow. It is included in cash flows from operating activities since it involves the calculation of net income. Therefore, this is the correct answer. Answered Question 36 1.A.1.e tb.fin.inc.015_1805 In which section of the statement of cash flows would a gain on the sale of equipment be reported? Investing Operating Financing Noncash activities Operating cash flows are cash flows that involve the calculation of net income. A gain on the sale of equipment is added when calculating net income. Since it is a non-cash item, it must be subtracted when calculating cash flow. It is included in cash flows from operating activities since it involves the calculation of net income. Therefore, this is the correct answer. Answered Question 37 1.A.1.e tb.fin.inc.016_1805 Which section of the statement of cash flows includes interest payments? Operating Investing Financing Expenditure Operating cash flows are cash flows that involve the calculation of net income. Interest expense is subtracted when calculating net income. Consequently, cash used to pay interest is included in cash flows from operating activities. Therefore, this is the correct answer. Answered Question 38 1.A.1.e tb.fin.inc.017_1805 Holcomb Industries sold a piece of machinery with a purchase value of $918,000 and accumulated depreciation of $856,800 for $80,000. They realized a gain of $18,800 on the sale. How would this transaction affect overall cash flows? Cash flows would increase by $18,800. Cash flows would increase by $98,800. Cash flows would increase by $80,000. Cash flows would increase by $61,200. The only item that impacts cash flow is the $80,000 received from the buyer. Therefore, this is the correct answer. Answered Question 39 1.A.1.e tb.fin.inc.018_1805 When using the indirect method, which statement provides the most accurate description of the relationship between accounts receivable and the operating activities section on the statement of cash flows? An increase in accounts receivable results in an increase in the operating activities section on the statement of cash flows. An increase in accounts receivable results in a decrease in the operating activities section on the statement of cash flows. A decrease in accounts receivable results in a decrease in the operating activities section on the statement of cash flows. A decrease in accounts receivable results in no change in the operating activities section on the statement of cash flows. An increase in accounts receivable means that sales made on credit exceeded collections from customers. Since net income (the starting point of the operating activities section) uses cash sales and not cash collections, the increase in accounts receivable must be subtracted when calculating cash flow from operating activities. Therefore, this is the correct answer. Answered Question 40 1.A.1.e tb.fin.inc.019_1805 Which of the following would be in the investing section of the statement of cash flows? Depreciation expense Conversion of bonds into common stock Issuing shares of common stock Proceeds from selling equipment Investing cash flows are cash flows that involve the purchase and sale of long-term assets. Since equipment qualifies as a long-term asset, cash received from selling equipment is an investing activity. Therefore, this is the correct answer. Answered Question 41 1.A.1.e tb.fin.inc.020_1805 Which section of the statement of cash flows includes the proceeds from selling equipment? Investing Financing Operating Noncash activities Investing cash flows are cash flows that involve the purchase and sale of long-term assets. Since equipment qualifies as a long-term asset, cash received from selling equipment is an investing activity. Therefore, this is the correct answer. Answered Question 42 1.A.1.e tb.fin.inc.021_1805 In good years, Dailey Industries often loans cash to other companies, but in difficult years, they have to borrow cash from other entities. How would they record these differently on the statement of cash flows? Loaning money would be classified as an investing activity, whereas borrowing money would be classified as a financing activity. Loaning money would be classified as a financing activity, whereas borrowing money would be classified as an investing activity. Loaning money would be classified as an operating activity, whereas borrowing money would be classified as a financing activity. Loaning money would be classified as a financing activity, whereas borrowing money would be classified as an operating activity. Investing cash flows are cash flows that involve the purchase and sale of long-term assets. Because loaning money to other companies qualifies as the purchase of a long-term asset (a note receivable), it is an investing activity. Financing cash flows are cash flows that involve transactions with shareholders and borrowing and repaying debt. Borrowing cash from other entities qualifies as a financing activity. Therefore, this is the correct answer. Answered Question 43 1.A.1.e tb.fin.inc.022_1805 What is one way that cash flows from investing activities are the opposite of cash flows from financing activities? Cash flows from investing activities frequently reflect cash flows related to the purchase of property, plant, and equipment, whereas cash flows from financing activities frequently reflect cash flows related to the sale of property, plant, and equipment. Cash flows from investing activities frequently reflect cash flows related to cash the company has loaned to others, whereas cash flows from financing activities frequently reflect cash flows related to cash the company has borrowed from others. Cash flows from investing activities frequently reflect cash flows related to the receipt of dividends and interest from purchased securities, whereas cash flows from financing activities frequently reflect cash flows related to the payment of dividends and interest to investors and creditors. Cash flows from investing activities frequently reflect cash flows related to the purchase of treasury stock, and cash flows from financing activities frequently reflect cash flows related to the sale of treasury stock. Investing cash flows are cash flows that involve the purchase and sale of long-term assets. Because loaning money to other companies qualifies as the purchase of a long-term asset (a note receivable), it is an investing activity. Financing cash flows are cash flows that involve transactions with shareholders and borrowing and repaying debt. Borrowing cash from other entities qualifies as a financing activity. Therefore, this is the correct answer. Answered Question 44 1.A.1.e tb.fin.inc.023_1805 When preparing a statement of cash flows, a company must make an adjustment to net income for sales that have been made but for which cash collections have not yet been received. Which of the following describes this circumstance? An increase in accounts receivable account during the year A decrease in accounts payable account during the year A decrease in accounts receivable account during the year An increase in accounts payable account during the year An increase in accounts receivable means that sales made on credit exceeded collections from customers. Since net income (the starting point of the operating activities section) uses cash sales and not cash collections, the increase in accounts receivable must be subtracted when calculating cash flow from operating activities. Therefore, this is the correct answer. Answered Question 45 1.A.1.e tb.fin.inc.024_1805 Last year Urban Kicks earned $5.2 million from the sale of shoes and $1.4 million from the sale of one of their manufacturing plants. How would these cash flows be categorized on the statement of cash flows? Both would be recorded as an operating activity on the statement of cash flows. Both would be recorded as an investing activity on the statement of cash flows. Money from the sale of shoes would be recorded as an operating activity in the statement of cash flows, while money from the sale of property would be recorded as an investing activity in the statement of cash flows. Money from the sale of property would be recorded as an operating activity on the statement of cash flows, while money from the sale of shoes would be recorded as an investing activity on the statement of cash flows. Cash flows that impact net income are classified as operating activities on the statement of cash flows. Since money from the sale of shoes impacts net income, it is recorded as an operating activity. Cash flows from the purchase or sale of long-term assets are classified as investing activities on the statement of cash flows. Since a manufacturing plant is a long-term asset, a sale of one is recorded as an investing activity. Therefore, this is the correct answer. Answered Question 46 1.A.1.e tb.fin.inc.025_1805 Last week, Sweet Treats Bakery spent $30,000 on wages for employees and $15,000 on new ovens. How do these expenses compare? Both would be recorded as an operating activity on the statement of cash flows. Both would be recorded as an investing activity on the statement of cash flows. Money spent on wages would be recorded as an operating activity on the statement of cash flows, while money spent on ovens would be recorded as an investing activity on the statement of cash flows. Money spent on ovens would be recorded as an operating activity on the statement of cash flows, while money spent on wages would be recorded as an investing activity on the statement of cash flows. Cash flows that impact net income are classified as operating activities on the statement of cash flows. Since money used on wages impacts net income, it is recorded as an operating activity. Cash flows from the purchase or sale of long-term assets are classified as investing activities on the statement of cash flows. Since the ovens used by a bakery are considered long-term assets, buying them is recorded as an investing activity. Therefore, this is the correct answer. Answered Question 47 1.A.1.e tb.fin.inc.026_1805 Last quarter Hyperion Enterprises sold new stock and paid dividends. How do these activities compare? Both would be reported as an operating activity on the statement of cash flows. Both would be reported as a financing activity of the statement of cash flows. Both would be reported as an investing activity on the statement of cash flows. Both would be reported on a separate schedule attached to the statement of cash flows. Financing cash flows are cash flows that involve transactions with shareholders and borrowing and repaying debt. Selling new stock and paying dividends are both classified as financing activities since both are transactions that involve shareholders. Therefore, this is the correct answer. Answered Question 48 1.A.1.e tb.fin.inc.027_1805 In January of last year, Newton Inc. sold 15,000 shares of its own common stock for $180,000. Ten months later, Newton repurchased 5,000 of those shares at a price of $11 per share. When compiling its statement of cash flows for the year, Newton should record which of the following entries in relation to these stock transactions, and why? A net cash inflow of $125,000 should be recorded in the financing section because both transactions involve stockholders’ equity items, and all cash flows related to a particular activity must be netted against one another. A $180,000 cash inflow should be recorded in the financing section because the stock sale affects stockholders’ equity, and a $55,000 cash outflow should be recorded in the investing section because the stock repurchase represents an investment. Both a $180,000 cash inflow and a $55,000 cash outflow should be recorded in the financing section because both transactions involve stockholders’ equity items, and all cash flows must be reported gross. A net cash inflow of $125,000 should be recorded in the investing section because both transactions involve changes in the company's investments, and all cash flows related to a particular activity must be netted against one another. Financing cash flows are cash flows that involve transactions with shareholders and borrowing and repaying debt. Selling new stock and buying back stock on the open market (treasury stock) are both classified as financing activities since both are transactions that involve shareholders. In addition, they should be listed individually as cash flows are listed in gross form, not net. Therefore, this is the correct answer. Answered Question 49 1.A.1.e tb.fin.inc.028_1805 In March, Parker Products repurchased 25,000 of its outstanding common shares at a price of $14 per share. Seven months later, Parker sold 15,000 of these shares on the open market for $15.50 each. When recording the effects of these transactions on its annual statement of cash flows, Parker reports only a $117,500 cash outflow related to financing activities. Is this entry correct, and why? Parker is correct in placing this entry in the financing section. It is also correct in reporting only a cash outflow of $117,500 because the $350,000 cash outflow from the stock repurchase must be netted against the $232,500 inflow from the stock sale. Parker is incorrect in placing this entry in the financing section. However, it is correct in reporting only a cash outflow of $117,500 because the $350,000 cash outflow from the stock repurchase must be netted against the $232,500 inflow from the stock sale. Parker is incorrect in placing this entry in the financing section. It is also incorrect in recording only a net cash flow of $117,500 rather than both a cash outflow of $350,000 and a cash inflow of $232,500. Parker is correct in placing this entry in the financing section. However, rather than recording only a net cash outflow of $117,500, Parker should have reported both a cash outflow of $350,000 and a cash inflow of $232,500. Financing cash flows are cash flows that involve transactions with shareholders and borrowing and repaying debt. Buying back stock on the open market (treasury stock) and reissuing it are both classified as financing activities since both are transactions that involve shareholders. In addition, they should be listed individually as cash flows are listed in gross form, not net. Reporting cash flows in net form reduces information to statement users. Therefore, this is the correct answer. Answered Question 50 1.A.1.e tb.fin.inc.029_1805 Last year, XYZ Inc. sold one of its warehouse facilities for $1.5 million. It also earned $25,000 in interest on a loan that it made to another company. How should these transactions be reflected on XYZ's annual statement of cash flows, and why? The two transactions should be reported in separate sections of the statement because one involves income while the other involves financing activities. Specifically, XYZ should record a $1.5 million cash inflow in the operating activities section and a $25,000 cash inflow in the financing activities section. The two transactions should be reported in separate sections of the statement because one involves long-term assets while the other involves income. Specifically, XYZ should record a $1.5 million cash inflow in the investing activities section and a $25,000 cash inflow in the operating activities section. Both transactions should be reported in the operating activities section of the statement because both involve income statement items. Because the two transactions are unrelated, they should be recorded separately—as a $1.5 cash inflow from the facility sale and a $25,000 cash inflow from interest income. Both transactions should be reported in the investing activities section of the statement because both involve asset items. Because the two transactions are unrelated, they should be recorded separately—as a $1.5 cash inflow from the facility sale and a $25,000 cash inflow from interest income. Cash flows from the purchase or sale of long-term assets are classified as investing activities on the statement of cash flows. The sale of a warehouse is considered an investing activity since it is a long-term asset. Cash flows related to activities that impact net income are classified as operating activities. The receipt of interest is an operating activity since interest revenue is a part of net income. Therefore, this is the correct answer. Answered Question 51 1.A.1.e tb.fin.inc.030_1805 Last year, Alpha Corporation spent $250,000 to repurchase 15,000 shares of its own outstanding common stock. The company also paid $40,000 in interest on a construction loan that it had obtained from its bank. How should these transactions be reflected on Alpha's annual statement of cash flows, and why? The two transactions should be reported in separate sections of the statement because one involves a change in equity while the other involves a change in income. Specifically, Alpha should record a $250,000 cash outflow in the financing section and a $40,000 cash outflow in the operating section. The two transactions should be reported in separate sections of the statement because one involves long-term assets while the other involves long-term liability. Specifically, Alpha should record a $250,000 cash outflow in the investing section and a $40,000 cash outflow in the financing section. Both transactions should be reported in the operating activities section of the statement because both involve alterations in the company's income. Because the two transactions are unrelated, they should be recorded separately—as a $250,000 cash outflow from the stock repurchase and a $40,000 cash outflow from the interest payment. Both transactions should be reported in the financing activities section of the statement because both involve long-term liability and/or equity items. Because the two transactions are unrelated, they should be recorded separately—as a $250,000 cash outflow from the stock repurchase and a $40,000 cash outflow from the interest payment. Financing cash flows are cash flows that involve transactions with shareholders and borrowing and repaying debt. Buying back stock on the open market (treasury stock) is classified as a financing activity since it is a transaction that involves shareholders. Cash flows related to activities that impact net income are classified as operating activities. The payment of interest is an operating activity since interest expense is a part of net income. Therefore, this is the correct answer. Answered Question 52 1.A.1.e tb.fin.inc.031_1805 Maxwell Foods purchased raw materials from a local farm and also redeemed bonds that they issued eight years ago. How do these transactions compare when reported in the statement of cash flows? Both transactions result in cash outflow, but the purchase of raw materials is a financing activity and the redemption of bonds is an investing activity. Both transactions result in cash inflow, but the purchase of raw materials is an operating activity and the redemption of bonds is an investing activity. Both transactions result in cash inflow, but the purchase of raw materials is an investing activity and the redemption of bonds is an operating activity. Both transactions result in cash outflow, but the purchase of raw materials is an operating activity and the redemption of bonds is a financing activity. Cash flows related to activities that impact net income are classified as operating activities. The purchase of raw materials is an operating outflow since it is a part of net income. Financing cash flows are cash flows that involve transactions with shareholders and borrowing and repaying debt. Redeeming bonds is classified as a financing outflow since it is a repayment of debt. Therefore, this is the correct answer. Answered Question 53 1.A.2.aa tb.fin.inc.032_1805 What is the difference between a revenue and a gain? Revenue results from transactions related to peripheral operations, whereas gains result from transactions related to central operations. Revenues result from transactions related to central operations, whereas gains result from transactions related to peripheral operations. Revenue results from external transactions, whereas gains result from internal transactions. Revenue results from internal transactions, whereas gains result from external transactions. Both revenues and gains increase net income. Revenues are the result of activities central to the organization, while gains are the result of peripheral activities. Therefore, this is the correct answer. Answered Question 54 1.A.2.aa tb.fin.inc.033_1805 How are expenses and losses similar? They both increase net income. They both decrease net income. They both refer to transactions related to major operations. They both refer to transactions related to peripheral operations. Both expenses and losses decrease net income. Therefore, this is the correct answer. Answered Question 55 1.A.2.cc tb.fin.inc.034_1805 Benson Toys spent $21 million on research and development in 20x6. This R&D resulted in eight new product patents. The fees associated with obtaining the patents totaled $517,000. When Benson does their accounting, how will they record these costs? They will expense $21 million and capitalize $517,000. They will capitalize $21 million and expense $517,000. They will expense $21,517,000. They will capitalize $21,517,000. Under U.S. GAAP, R&D costs are treated as period costs, meaning they are expensed in the period incurred. The reason is that although the costs are incurred in order to provide future economic benefit to the company, the chances of achieving success with R&D are too difficult to gauge. To be conservative, the costs are expensed as incurred and no asset is created. The legal costs and other fees to obtain a patent are capitalized as there is probable future economic benefit to having a patent. The benefits must be expensed over the periods benefitted. Therefore, this is the correct answer. Answered Question 56 1.A.2.cc tb.fin.inc.035_1805 Alex and Grace are both analyzing intangible assets to determine if they need to be amortized. Alex is analyzing an indefinite-life intangible asset, whereas Grace is analyzing a limited-life intangible asset. What do you expect their conclusions will be? Alex will decide to amortize his asset, while Grace will decide not to amortize her asset. Both Alex and Grace will decide to amortize their assets. Alex will decide not to amortize his asset, while Grace will decide to amortize her asset. Both Alex and Grace will decide not to amortize their assets. Amortization is done to recognize expense over the periods an intangible asset provides economic benefit to a company. As the benefits are used up, amortization expense is recorded. An indefinite-life intangible asset has benefits that are not expected to be used up or fully consumed. As a result, they are not subject to amortization expense. However, it is necessary to periodically review them to see if they become limited-life intangible assets or have become impaired. The benefits from a limited-life intangible asset are expected to be used up. Consequently, they are subject to amortization expense. This means Alex should not amortize his asset and Grace should amortize her asset. Therefore, this is the correct answer. Answered Question 57 1.A.2.cc tb.fin.inc.036_1805 A justification for the periodic recording of depreciation expense can be demonstrated by which of the following? The association of efforts (expense) with accomplishments (revenue) Immediate recognition of an expense Minimization of income tax liability Systematic and rational allocation of cost over the periods benefited Fixed assets are subject to depreciation expense. It is necessary to record depreciation expense because fixed assets provide benefits over multiple periods. Because it is not always possible to match accomplishments (revenue) with efforts (expense) concerning fixed assets, depreciation expense must be calculated in a systematic and rational manner. Therefore, this is the correct answer. Answered Question 58 1.A.2.cc tb.fin.inc.037_1805 When considering research and development costs, how are equipment costs different if they are used for one project only versus current and future projects? If equipment is purchased for one project only, the costs are capitalized and amortized; if equipment is purchased for more than one project, the costs are capitalized but not amortized. If equipment is purchased for one project only, the costs are capitalized but not amortized; if equipment is purchased for more than one project, the costs are expensed as incurred. If equipment is purchased for one project only, the costs are expensed as incurred; if equipment is purchased for more than one project, the costs are capitalized but not amortized. If equipment is purchased for one project only, the costs are expensed as incurred; if equipment is purchased for more than one project, the costs are capitalized and amortized. In general, R&D expenditures are expensed in the period incurred. How equipment is expensed depends on the expected usage of the equipment. If equipment is purchased to be used for one project only, the costs are expensed as incurred. This is because the benefits will not extend beyond the project and expenditures on the project are expensed as incurred. If equipment is purchased to be used for more than one project, the costs are capitalized and amortized. This is because the benefits will extend beyond the current year so the expense should also extend beyond the current year. Therefore, this is the correct answer. Answered Question 59 1.A.2.cc tb.fin.inc.039_1805 What is the difference in accounting between a research cost and a development cost? Research costs are expensed as incurred, whereas development costs are capitalized and amortized over the life of the new product. Research costs are capitalized and amortized over the life of the project, whereas development costs are expensed as incurred. There are no differences in accounting between research costs and development costs. Research costs are capitalized and amortized until the product goes to market, whereas development costs are capitalized and amortized from the time the product hits the market until the product is withdrawn from the market. Under U.S. GAAP, research costs and development costs are treated as period costs, meaning they are expensed in the period incurred. The reason is that although the costs are incurred in order to provide future economic benefit to the company, the chances of achieving success with research and development are too difficult to gauge. To be conservative, the costs are expensed as incurred and no asset is created. The result is that there is no difference in accounting for these costs under U.S. GAAP. Therefore, this is the correct answer. Answered Question 60 1.A.2.cc tb.fin.inc.040_1805 Madsen Pharmaceuticals has spent 15 years developing a new medication for epileptic seizures. They finally have a new FDA-approved drug and have applied for a patent. When you look at Madsen's accounting books, what would you expect to find? The research and development costs for the new drug would have been capitalized at the beginning of the project and amortized as money was used. The research and development costs for the new drug would have been expensed throughout the past 15 years as money was spent on the project. The research and development costs for the new drug would have been expensed in one lump sum at the end of the project when total costs were determined. The research and development costs for the new drug would have been capitalized throughout the past 15 years as money was spent on the project. Under U.S. GAAP, R&D costs are treated as period costs, meaning they are expensed in the period incurred. The reason is that although the costs are incurred in order to provide future economic benefit to the company, the chances of achieving success with R&D is too difficult to gauge. To be conservative, the costs are expensed as incurred and no asset is created. Therefore, this is the correct answer. Answered Question 61 1.A.2.dd tb.fin.inc.041_1805 The calculation of comprehensive income includes which of the following? Operating income Neither operating income nor distribution to owners Distribution to owners Operating income and distribution to owners Comprehensive income includes all changes in equity during a period except changes from investments by owners and distributions to owners. Net income is the starting point for calculating it. Since operating income is a component of net income, it is also a component of comprehensive income. Therefore, this is the correct answer. Answered Question 62 1.A.2.dd tb.fin.inc.042_1805 According to the FASB's conceptual framework, which of the following is/are included in comprehensive income? Neither gross margin nor operating income Gross margin and operating income Gross margin Operating income Comprehensive income includes all changes in equity during a period except changes from investments by owners and distributions to owners. Net income is the starting point for calculating it. Since operating income and gross margin are both components of net income, they are also components of comprehensive income. Therefore, this is the correct answer. Answered Question 63 1.A.2.dd tb.fin.inc.043_1805 Comprehensive income includes which of the following? Gross margin but not gains Gains but not gross margin Gains and gross margin Neither gains nor gross margin Comprehensive income includes all changes in equity during a period except changes from investments by owners and distributions to owners. Net income is the starting point for calculating it. Since gains and gross margin are both components of net income, they are also components of comprehensive income. Therefore, this is the correct answer. Answered Question 64 1.A.2.dd tb.fin.inc.044_1805 With regard to comprehensive income, how does net income differ in a one-statement approach compared to a two-statement approach? Net income includes comprehensive income in a one-statement approach but not in a two-statement approach. Net income in a one-statement approach is used to calculate earnings per share, but earnings per share are not reported in a two- statement approach. Net income is reported as a subtotal in a one-statement approach but as a total on a two-statement approach. Net income includes income, expenses, gains, and losses all together in a one-statement approach, but income and expenses are separated from gains and losses when calculating net income in a two-statement approach. Comprehensive income includes all changes in equity during a period except changes from investments by owners and distributions to owners. Net income is the starting point for calculating comprehensive income. It can be provided as part of a one-statement approach or a two-statement approach. In a onestatement approach, net income and comprehensive income are calculated on the same statement. Net income is a subtotal and comprehensive income is the bottom line in the one-statement approach. In a two-statement approach, net income is shown on the income statement and comprehensive income on a second, separate statement called the statement of comprehensive income. Since net income is the starting point for calculating comprehensive income, the total net income is shown at the top of the statement of comprehensive income. Therefore, this is the correct answer. Answered Question 65 1.A.2.ee tb.fin.inc.045_1805 Parisi Incorporated and Keeling International both sold some old equipment. Parisi sold their equipment because it was outdated, and they replaced it with new equipment. Keeling sold their equipment because the operations that needed the equipment are being shut down by the company. How would the income or loss from the sale of this equipment be reported differently by these companies? Parisi would report their income or loss under discontinued operations, whereas Keeling would not. Keeling would report their income or loss under discontinued operations, whereas Parisi would not. Keeling would report their income or loss as a note to the financial statements, whereas Parisi would report their income or loss in the actual financial statements. Parisi would report their income or loss as a note to the financial statements, whereas Keeling would report their income or loss in the actual financial statements. How the sale of equipment is reported on the income statement depends on the reason for the sale. If equipment is sold because the part of the business using the equipment is being shut down, the gain or loss on the sale is included as part of discontinued operations. This is what Keeling would do. If the equipment is sold because it is outdated and needs to be replaced, the gain or loss would not be reported as part of discontinued operations. This is what Parisi would do. Therefore, this is the correct answer. Answered Question 66 1.A.2.ee tb.fin.inc.046_1805 Disposal of which of the following would qualify as a disposal of a component? A technology company upgrades its software. A transportation company sells its bus operations but not its airline operations. An auto parts manufacturer sells one of its five parts-manufacturing subsidiaries. A toy company phases out one product line. To qualify as a disposal of a business component under U.S. GAAP, a disposal must result in the elimination of income and cash flows of the component and the company must have no significant involvement in the operations of the component after disposal. A transportation company selling its bus operations but not its airline operations would qualify since all the income and cash flow of the bus operations are eliminated and there is no indication of any continuing involvement. Therefore, this is the correct answer.