Accounting Receivables Problem Set: Journal Entries & Analysis

advertisement

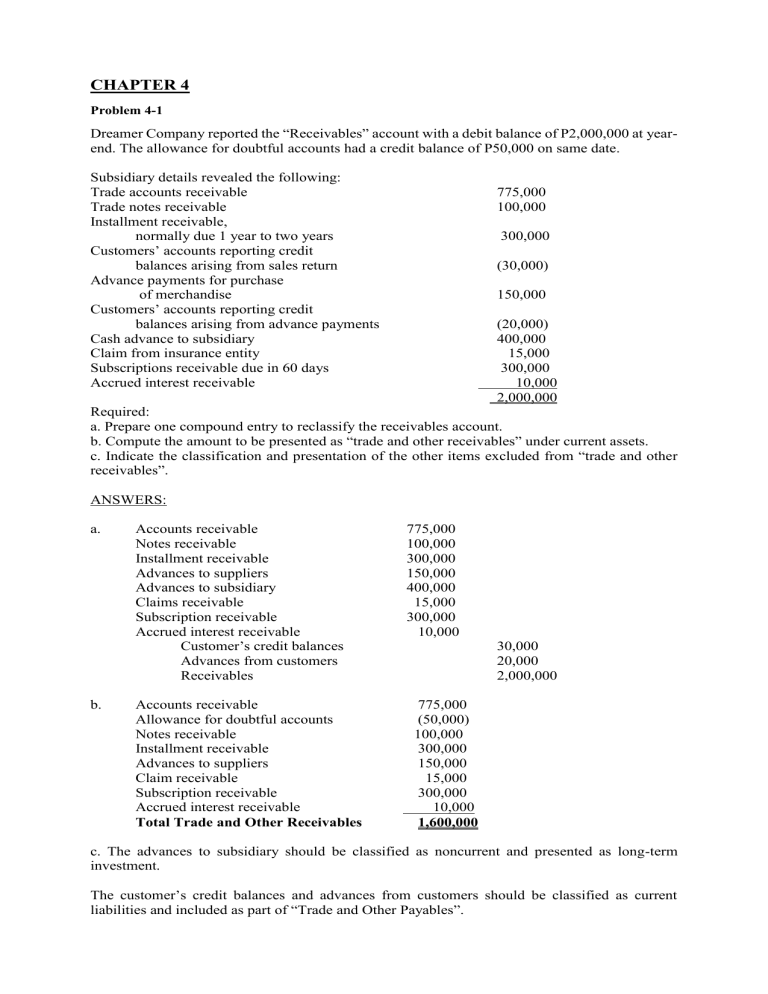

CHAPTER 4 Problem 4-1 Dreamer Company reported the “Receivables” account with a debit balance of P2,000,000 at yearend. The allowance for doubtful accounts had a credit balance of P50,000 on same date. Subsidiary details revealed the following: Trade accounts receivable Trade notes receivable Installment receivable, normally due 1 year to two years Customers’ accounts reporting credit balances arising from sales return Advance payments for purchase of merchandise Customers’ accounts reporting credit balances arising from advance payments Cash advance to subsidiary Claim from insurance entity Subscriptions receivable due in 60 days Accrued interest receivable 775,000 100,000 300,000 (30,000) 150,000 (20,000) 400,000 15,000 300,000 10,000 2,000,000 Required: a. Prepare one compound entry to reclassify the receivables account. b. Compute the amount to be presented as “trade and other receivables” under current assets. c. Indicate the classification and presentation of the other items excluded from “trade and other receivables”. ANSWERS: a. b. Accounts receivable Notes receivable Installment receivable Advances to suppliers Advances to subsidiary Claims receivable Subscription receivable Accrued interest receivable Customer’s credit balances Advances from customers Receivables Accounts receivable Allowance for doubtful accounts Notes receivable Installment receivable Advances to suppliers Claim receivable Subscription receivable Accrued interest receivable Total Trade and Other Receivables 775,000 100,000 300,000 150,000 400,000 15,000 300,000 10,000 30,000 20,000 2,000,000 775,000 (50,000) 100,000 300,000 150,000 15,000 300,000 10,000 1,600,000 c. The advances to subsidiary should be classified as noncurrent and presented as long-term investment. The customer’s credit balances and advances from customers should be classified as current liabilities and included as part of “Trade and Other Payables”. Problem 4-3 Affectionate Company sold merchandise on account for P500,000. The terms are 3/10, n/30. The related freight charge amounted to P10,000. The account was collected within the discount period. Required: Prepare journal entries to record the transactions under the following freight terms: 1. FOB destination and freight collect 2. FOB destination and freight prepaid 3. FOB shipping point and freight collect 4. FOB shipping point and freight prepaid ANSWERS: FOB destination and freight collect 1. Accounts receivable Freight out Sales Allowance for freight charge 2. Cash Sales discount Allowance for freight charge Accounts receivable FOB destination and freight prepaid 1. Accounts receivable Freight out Sales Cash 2. Cash Sales discount Accounts receivable FOB shipping point and freight collect 1. Accounts receivable Sales 2. Cash Sales discount Accounts receivable FOB shipping point and freight prepaid 1. Accounts receivable Sales Cash 2. Cash Sales discount Accounts receivable 500,000 10,000 500,000 10,000 475,000 15,000 10,000 500,000 500,000 10,000 500,000 10,000 485,000 15,000 500,000 500,000 500,000 485,000 15,000 500,000 510,000 500,000 10,000 495,000 15,000 510,000 Problem 4-4 Fiancee Company records sales return during the year as a credit to accounts receivable. However, at the end of the accounting period, the entity estimates the probable sales return and records the same by means of an allowance account. The following transactions occurred in summary form: 1. 2. 3. 4. 5. Sale of merchandise on account, 2/10, n/30 Collection within the discount period Collection within the discount period Sales return granted Sales return estimated at the end of the year 4,000,000 1,470,000 1,000,000 100,000 20,000 Required: Prepare journal entries to record the transactions ANSWERS: Trans 1: Trans 2: Trans 3: Accounts receivable Sales 4,000,000 Cash (98% of receivable) Sales discount Accounts receivable 1,470,000 30,000 Cash 1,000,000 4,000,000 1,500,000 Accounts receivable Trans 4: Trans 5: 1,000,000 Sales return Accounts receivable 100,000 Sales return Allowance for sales returns 20,000 100,000 20,000 Problem 4-7 Raven Company started business in January 2021. Sales for the first year totaled P4,000,000. The entity priced its merchandise to yield a 40% gross profit based on sales. Industry statistics suggest that 10% of the merchandise sold to customers will be returned. The entity estimated sales returns based on the industry average. During the year, customers returned goods with sale price of P300,000. Required: Prepare journal entries to record sales, sales returns and the year-end adjusting entry for estimated sales returns ANSWERS: Sales 1. Accounts receivable 4,000,000 Sales revenue 4,000,000 Sales Return 2. Sales return 300,000 Accounts receivable 300,000 Year-end adjusting entry 3. Sales return 100,000 Allowance for sales return 100,000 Estimated sales return (10% x 4,000,000) 400,000 Actual returns Balance 300,000 100,000 Problem 5-1 (IAA) Marvelous Company reported the following information before adjustments at year-end: Accounts receivable 500,000 Notes receivable 200,000 Allowance for doubtful accounts 20,000 Sales 5,000,000 Sales return and allowances 30,000 Sales Discount 20,000 Required: Prepare adjusting entry to provide for doubtful accounts under each of the following independent assumptions: Past experience indicates that 75% of all sales are credit sales and that an average 2% of credit sales may prove uncollectible. One percent of gross sales may prove uncollectible An analysis of the aging of trade receivables indicates that accounts receivable in the amount P80,000 may prove uncollectible. The policy is to maintain an allowance for doubtful accounts equal to 10% of the outstanding accounts receivable. MARVELOUS COMPANY Credit Sales (5,000,000x.75) 3,750,000 Entry: Doubtful Account (3,750,000x0.2) 75,000 Allowance for doubtful accounts Doubtful Accounts (5,000,000x0.1) 75,000 50,000 Allowance for doubtful accounts Allowance required 80,000 Less: Balance of Allowance 20,000 Doubtful Account Expense 60,000 50,000 Entry: Doubtful Accounts 60,000 Allowance for doubtful accounts Allowance required 50,000 Less: balance of allowances 20,000 Doubtful Account Expense 30,000 Entry: 60,000 Doubtful Accounts 30,000 Allowance of doubtful accounts 30,000 Problem 5-2 (IAA) At the beginning of current year, Template Company showed the following account balances: Accounts receivable 1,000,000 Allowance for doubtful accounts 40,000 The following summary transactions occurred during the current year: Sales on account, 2/30, n/30 7,000,000 Collections from customers within the discount period 2,450,000 Collections from customers beyond the discount period 3,900,000 Accounts receivable within off as worthless 30,000 Recovery of accounts previously written off not included 10,000 in the above collections Credit memo for sales return 70,000 Required: Prepare journal entries pertaining to accounts receivable. Prepare the adjustment for doubtful accounts at year-end if the entity uses the percentage of accounts receivable method consistently. What is the realizable value of account receivable at year-end? Template Company Required: Prepare journal entries pertaining to accounts receivable. Answers: Sales on account 2/30, n/30 Accounts receivable 7,000,000 Sales 7,000,000 Collections from customers within the discount period. Cash 2,450,000 Sales discount 50,000 Accounts receivable 2,500,000 Collections from customers beyond the discount period Cash 3,900,000 Accounts receivable 3,900,000 Accounts receivable written off as worthless Allowance for doubtful accounts 30,000 Accounts receivable 30,000 Recovery of accounts previously written off not included in the above collections. Accounts receivable 10,000 Allowance for doubtful accounts Cash 10,000 10,000 Accounts receivable 10,000 Credit memo for sales return Sales returns 70,000 Accounts receivable 70,000 Prepare the adjustment for doubtful accounts at year-end if the entity uses the percentage of accounts receivable method consistently. Doubtful accounts 40,000 Allowance for doubtful accounts 40,000 Rate = 40,000/1,000,000 = 4% Allowance for doubtful accounts (1,500,000 X 4%) 60,000 Less: Allowance before adjustments 20,000 Doubtful accounts expense 40,000 What is the net realizable value of accounts receivable at year-end? Accounts receivable 1,500,000 Allowance for doubtful accounts 60,000 Net realizable value 1,440,000 Problem 5-6 (PHILCPA Adapted) At the beginning of current year, Rampant Company reported that the allowance for doubtful accounts has a credit balance of P170,000. Bad debt recoveries and bad debts written off in the current year were P30,000 and P235,000, respectively. The allowance account had been previously calculated as a percentage of net sales. It was decided however to provide for doubtful accounts commencing with the year-end adjusting entry on the basis of an analysis of the age of the receivable. The following schedule was prepared. Percent uncollectible Not due yet 1,700,000 NIL 1-30 days past due 1,200,000 5 31-60 days past due 100,000 25 61-90 days past due 150,000 50 Over 90 days past due 120,000 100 Additional accounts to be written off 30,000 Required: What is the required allowance for doubtful accounts at year-end? How much would be the doubtful accounts expense for the current year? What is the adjusting entry for the doubtful accounts expense for the current year? What is the net realizable value of accounts receivable at year-end? Answers: What is the required allowance for doubtful accounts at year-end? Percent Uncollectible Not due yet 1,700,000 1-30 days past due 1,200,000 5 31-60 days past due 100,000 25 61-90 days past due 150,000 50 Over 90 days past due 120,000 100 3,270,000 How much would be the doubtful accounts expense for the current year? Required: 280,000 Add: Credit balance of AFDA 170,000 Doubtful accounts expense 110,000 What is the adjusting entry for the doubtful accounts expense for the current year? Doubtful accounts expense 110,000 Allowance for doubtful accounts 110,000 What is the net realizable value of accounts receivable at year-end? Accounts receivable Allowance for doubtful accounts Net realizable value 3,270,000 280,000 2,990,000 Problem 5-3 At the beginning of the current year, Jocose Company reported the following: Accounts receivable 2,000,000 Allowance for doubtful accounts 100,000 Additional information for the current year; 1. 2. 3. 4. Cash sales of the entity amount to P800,000 and represent 10% of gross sales. Ninety percent of the credit sales customers do not take advantage of the 5/10, n/30 terms. Customers who did not take advantage of the discount paid P5,490,000. It is expected that cash discounts of P10,000 will be taken on accounts receivable outstanding at December 31, 2019. 5. Sales returns amounted to P80,000. All returns were from charge sales. 6. During the year accounts totaling P60,000 were written off as uncollectible. Recoveries during the year amounted to P10,000. This amount is not included in the collections. 7. The allowance for doubtful accounts is adjusted so that it represents a certain percentage of the outstanding accounts receivable at year-end. Required: a. Prepare journal entries to record the transactions. b. What is the net realizable value of accounts receivable at year-end? ANSWERS: 1 Cash 800,000 Sales 3 Discount allowed 800,000 33,000 Accounts Receivable 4 Cash Discount 33,000 10,000 Accounts Receivable 5 Sales 10,000 80,000 Accounts Receivable 6 Bad-debts written off 80,000 60,000 Allowance for Doubtful debts 6 Accounts Receivable 60,000 10,000 Allowance for Doubtful debts 6 Cash 10,000 10,000 Accounts Receivable Balance in Accounts of Accounts Receivable: Opening balance Add: During the year Less:Collection/Writeoff/Adjustements Closing balance 10,000 2,000,000 10,000 133,000 1,877,000 CHAPTER 8 Problem 8-1 Pittance Company provided the following information in connection with a bank loan. March 1 Pittance Company borrowed 2,000,000 from bank on a six-month note carrying an interest of 12% per annum. Accounts of 3,000,000 are pledged to secure the loan. April 1 Pledged accounts of 1,000,000 are collected minus 2% discount. June 1 The remaining pledged accounts are collected. Sept. 1 The bank loan is repaid plus interest. Required: Prepare journal entries to record the transactions. ANSWERS: March 1 Cash 2,000,000 Notes Payable – bank April 1 2,000,000 Cash 980,000 Sales Discount 20,000 Accounts Receivable June 1 Cash 1,000,000 2,000,000 Accounts Receivable Sept. 1 Notes Payable – bank Interest Expense Cash (12%x2,000,000x6/12) 2,000,000 2,000,000 120,000 2,120,000 Problem 8-5 Grateful Company provided the following transactions; July 1 The entity assigned P500,000 of accounts receivable to its bank on a nonnotificaation basis in consideration for a loan. On this date, the bank advanced P400,000 less a service charge of 2% of the total accounts assigned, and the entity signed a promissory note bearing interest of 1% per month on the unpaid loan balance at the beginning of the month. Aug 1 Collected P330,000 on assigned accounts. The entity remitted this amount to the bank in payment first for the interest and the balance to the principal. Sep 1 Collected the remaining balance of assigned accounts. The entity paid off the remaining loan balance. Required: Prepare journal entries to record the transactions. ANSWERS: July 1 Accounts Receivable Assigned A/c 500,000 Accounts Receivable 500,000 Cash A/c Service Charge 390,000 10,000 Note Payable Aug 1 Cash A/c 400,000 330,000 Accounts Receivable 330,000 Note Payable A/c 326,000 Interest Expense A/c 4,000 Cash A/c Sept 1 Cash A/c 330,000 170,000 Accounts Receivable Assigned 170,000 Notes Payable A/c 74,000 Interest Expense A/c 740 Cash 74,740 Problem 8-8 Dainty Company sold accounts receivable without recourse with a face amount of P6,000,000. The factor charged 15% commission on all accounts receivable factored and withheld 10% of the accounts factored as protection against customer returns and other adjustments. The entity had previously established an allowance for doubtful accounts of P200,000 for these accounts. By year-end, the entity had collected the factor’s holdback there being no customer returns and other adjustments. Required: Prepare journal entries to record the factoring and the subsequent collection of the factor’s holdback. ANSWERS: Cash 4,500,000 Allowance for doubtful accounts 200,000 Receivable from factor 600,000 Loss on factoring 700,000 Accounts Receivable 6,000,000 (To record factoring of accounts receivable) Cash 600,000 Receivable from factor 600,000 (To record collection of factors holdback) Problem 8-9 Generous Company provided the information with respect to factoring of accounts receivable. July 1 Factored P800,000 of accounts receivable without recourse with a bank on notification basis. The bank charged a factoring fee of 5% of the amount of accounts receivable factored and withheld 10% of the accounts receivable factored to cover sales return and allowances. July 15 Received notice from the bank that factored accounts are fully collected less sales return and allowances of P20,000. 31 Received a check from the bank as a final settlement of the factoring contract. Required: Prepare journal entries to record the transactions. Answers: July 1 Cash 680,000 Receivable from factor (10% x 800,000) 80,000 Service Charge (5% x 800,000) 40,000 Accounts Receivable July 15 Sales return and allowances 800,000 20,000 Receivable from factor July 31 Cash 20,000 60,000 Receivable from factor 60,000