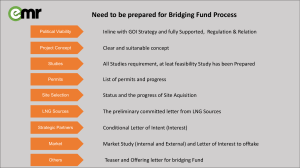

LNG LIQUEFACTION — NOT ALL PLANTS ARE CREATED EQUAL Authors: Heinz Kotzot - Section Leader, LNG and Gas Processing Charles Durr - Energy Technology David Coyle - Technology Manager Chris Caswell - Principal Technical Professional Publication / Presented: Date: Paper PS4-1 ABSTRACT As the LNG industry has matured, there is often an inclination to compare the successes and challenges among projects over time. Many publications have fallen into the habit of using a specific cost term of “dollars (USD) per ton of annual LNG production” as an indicator for comparing the engineering and execution skills of owners, licensors and contractors. This dollar per annual ton benchmark, commonly abbreviated as “dollars per ton” is highly dependent on site specific factors. These factors include the remote nature of the site, local content requirements, design criteria, marine conditions, design practices, and scope differences. The purpose of this paper is to discuss the impact of such factors and determine the relative effect each factor could have on the benchmark cost for a specific project. The analysis begins with a minimal scope plant, in an environment where all conditions are ideal, to establish a lowest cost LNG project. Individual site and scope specific factors are then added to determine the impacts on the plant benchmark cost. As a result, the unavoidable local issues are thus quantified. Furthermore, site specific criteria, often imbedded in a project design basis, are more clearly defined by enumerating and quantifying the elements that differ from a low cost reference design with a minimal scope. In addition to the technical analysis, a review of commercial issues is presented for the benefit of a technical audience. Commercial risks are entered into a capital asset pricing model to determine an additional project specific element of each cost benchmark. PS4-1.1 Paper PS4-1 INTRODUCTION Building any multi-billion dollar project requires a well coordinated plan, aligned project sponsors, and financial backing. The viability of such a project will be scrutinized on a continual basis, sometimes even after the project is completed. In order to develop a liquefaction facility for the 21st century, a few key elements are necessary to place a new project on the LNG world map: • • • • • • Having the right location Having the right partners Having the right financial plan Determining the right equipment Delivering the right equipment to the site at the right time Having the right people to put it all together The difficult part of this plan is to define what is “right” in order to achieve the lowest cost and the shortest schedule. “Lowest cost” is the most crucial driving factor in every project. Although Life Cycle Cost is often cited as a criterion in plant design, it seldom becomes more influential than lowest capital cost. This paper will determine the major contributors to the cost of an LNG plant and why certain elements are necessary, which add a corresponding, and unavoidable, cost. The specific cost of an LNG plant has become a fashionable metric to compare projects against each other. This dollar per ton per year number, commonly referred to as “dollars per ton”, is frequently cited in technical and commercial literature in spite of the fact that the location, the market, and the scope make valid project comparisons difficult. Due to ‘economy of scale’, a relative increase in capacity will usually lower the specific cost as long as equipment sizes increase in a proportional manner (as opposed to adding one or more modules of equal capacity). In addition, variations in capital cost are strongly affected by: • • • • Plant location Cost of labor Feed gas composition Product specification Competition among contractors and liquefaction process technologies are often attributed as significant factors that affect specific cost. The cost impact of technology selection is not as significant as often portrayed in the total project cost, but technology will impact the operation, availability, and efficiency of the plant. With equal conditions among participating contractors, the cost impact of contractor competition is limited. Most of the project cost is beyond the influence of the designers and contractors and is mainly a function of site related conditions, project development, and project execution objectives. Capital cost reduction must be balanced with other important objectives, such as safety, reliability, and operation and maintenance practices. PS4-1.2 Paper PS4-1 For this paper, a base production rate of 4.5 Mt/a (million tons per year) of LNG is chosen to allow fair comparisons without distortion due to ‘economy of scale’. In the analysis, this paper addresses only the LNG liquefaction portion of the LNG value chain, as highlighted in Figure 1. Gas Field Liquefaction P lant LNG Storage Tank LNG Storage Tank LNG Tanker PRODUCING REGION TRANSPORTATION Vaporizers CONSUMING REG ION Figure 1: The LNG Value Chain and the focus area for specific liquefaction cost In the commercial evaluation, all elements of the LNG chain have to be considered, because every element of the chain contributes to the cost of financing. Commercial considerations, which are presented for a technical audience, are included in this paper to show the significant impact on the overall cost of an LNG project. As the global market for LNG has developed, financing has always required careful planning and is becoming increasingly complex. Aspects to be considered include project rate of return, long-term demand, political and regulatory stability, production covered by take-or-pay arrangements, risk allocation among the sponsors, the creditworthiness of the buyers and the availability of security or guarantees. This paper will attempt to quantify these technical and commercial influences in order to develop transparency in regard to LNG specific cost. TECHNICAL The primary drivers for the capital cost of an LNG liquefaction facility are site specific in nature. Surprisingly, less than 50% of the LNG plant cost is capacity related. As a result, most of the cost of an LNG liquefaction project is beyond the influence of the design engineer and is a function of site related conditions, project development and project execution efforts. Although there is no typical or standard LNG plant, the major elements that are found in most LNG plants include: • a feed gas handling and treating section • a liquefaction section • a refrigerant section • a fractionation section • an LNG storage section • a marine and LNG loading section • a utility and offsite section PS4-1.3 Paper PS4-1 Even with all these elements, each LNG plant is unique to a specific location and market destination. A typical cost distribution for an LNG plant is shown in Table 1. Table 1. Cost Distribution for a “Typical” Liquefaction Facility Liquefaction Cost Distribution Percentage of Total Cost Gas Treating Fractionation Liquefaction Refrigeration Utilities Offsites (storage, loading, flare) Site preparation Total 7 3 28 14 20 27 1 100 While this information may be of interest, the table does not provide insight as to what the plant cost will be for a specific location with a certain feed composition, array of products, design specifications, and site conditions. This paper will discuss relative cost of the various plant sections, instead of using percentages. By starting with the most basic plant design, site specific elements will be added to the project to show the impacts on plant specific cost. Alternative Cost Distribution Instead of evaluating the total plant cost by process area, this paper will present the plant cost in five major categories: material related cost, location related cost, sponsor & contractor cost, labor cost, and financing cost. Defining overall plant cost within these areas will allow for cost sensitivity analysis of project specific items, and how strongly they influence the cost metric. Material Related Cost. This cost component includes all tagged equipment and auxiliary material, including bulks (e.g. piping, electrical, structural steel, concrete, etc.). Material costs can vary substantially from historical norms depending on the technical requirements of the project and the condition of the materials market during the procurement effort. Location Related Cost. Site preparation is not a large component of the plant cost, but the cost of site preparation will vary significantly with the soil conditions and location. This cost is also dependent on the plant size. A separate sensitivity analysis will show the cost effects for different degrees of site preparation work. LNG storage tanks are not a strong function of plant production rate, but depend on ship size and loading frequency. Similarly, the cost of marine facilities is largely independent of plant capacity and configuration and totally depends on the location of the plant. PS4-1.4 Paper PS4-1 Sponsor and Contractor Cost. This element of total project cost covers the owner’s personnel used during project development and items such as legal, permitting, etc. The cost for the owner’s personnel is commonly estimated as 10% of total plant cost. The contractor cost includes engineering, construction management, and other related costs. Labor Cost. This cost element consists of the labor cost at the plant location, which is commonly identified as a “subcontract” cost. Although this cost includes some material related items such as paint and insulation, the vast majority of this component covers the workhour cost for erecting the plant. Financing Cost. The financing cost includes the interest on equity and debt, as well as the operating capital necessary for the initial phases of the project until LNG revenues will cover operating costs. This cost is seldom included in the evaluation of the specific cost metric. Upon review, these financing costs rank on the same level as labor, sponsor/contractor, and equipment costs. Capital Cost (CAPEX) versus Life Cycle Cost All project stakeholders would prefer a low CAPEX and a low Life Cycle Cost project. This commercial outcome is the most desirable goal for any project. However, as the CAPEX is the largest single component of the life-cycle cost and to avoid the complications of life-cycle analysis, this paper will only address the CAPEX of a project. KBR has developed a cost analysis model that allows detailed modifications to a project, such as adding equipment, modifying labor cost and efficiency, or adjusting the cost of capital based on risk assessment. Results from this model will be presented for a variety of plant configurations giving an absolute cost for the referenced areas of expense. The plant costs are reported using a generic metric of currency per annual ton of LNG product, symbolized by “¢/t” and referred to as “currency per ton”. This metric allows easy comparison from one design with known parameters to another with assumed (or known) differences. Plant Configurations The primary factors that set the plant configuration are: • Feed gas composition and conditions that establish the gas treating and NGL recovery • LNG Product Specifications, which control the severity of NGL recovery and nitrogen rejection The pictograph in Figure 2 illustrates the elements of feed gas treating that could be required for any LNG project and the corresponding shrinkage of the available feed gas to achieve the targeted LNG capacity. Higher levels of NGL recovery may be driven by the overall product economics; i.e. if the value of LPG exceeds the value of incremental LNG. Although deep NGL recovery can improve the revenue stream and life-cycle cost for the entire project, it will increase the metric when evaluating LNG specific cost. PS4-1.5 Paper PS4-1 100% Plant Feed `7 0 - 8 0 % Maximum Treating Plant Liquid Slug Condensate Removal Stabilization Acid Gas Removal Water Removal Fuel Gas NGL Nitrogen Removal LNG Boil Off Figure 2. Maximum Feed Gas Treating and the Effect on LNG Production In order to develop proper cost comparisons for different project configurations, the analysis will keep the following items constant: • Production rate of 4.5 Mt/a of LNG • 95% plant availability • Average ambient temperature of 22ºC. • Gas turbine drivers and air cooling Development of the Base Plant If the feed gas arriving at an LNG plant is within the range of the required product specifications, only a core plant is needed, which includes liquefaction and refrigeration. The base plant cost (defined as Plant 1) is determined by the minimum number of equipment items that would be required for such an LNG project. This scenario could be achieved by the presence of an existing upstream LPG recovery plant. Figure 3 illustrates this base scenario. 100% Plant Feed 95% Minimum Treating Plant Fuel Gas LNG Boil Off Figure 3. Plant 1 – Minimum Feed Gas Treating The base plant will require a minimal scope for utilities and offsite facilities. This scope would include LNG storage tanks, a jetty with loading equipment, relief systems, fire protection, and the storage of imported refrigerant. This scheme could be developed if an LNG plant is adjacent to an industrial complex. Utilities such as electric power, water, effluent treatment, and heating and cooling medium can be obtained from outside the LNG plant boundary limits. This example is represented by Figure 4. PS4-1.6 Inlet Flare & Liquid Burner Liquefaction Propane Refrigeration Product Storage Refrigerant Storage MR Refrigeration Loading Utilities Offsites Process Train Paper PS4-1 Shipping Fire Protection Figure 4. Plant 1 – Minimum Number of Units in LNG Facility Plant 1 will be incrementally expanded by adding utilities, acid gas treating, fractionation, extensive feed gas treating, and other processes that could be required at various locations. Plant 1 results in a small LNG plant, where utilities that are imported result in an increase in operating costs for a minimum capital cost. This scenario can be achieved by upstream feed gas treating (reflected in feed gas price) with imported utilities adding to operating expenses instead of capital investment. The plant will be increased in size, adding treating and processing units, up to the maximum (Plant 6), as shown in Figure 5. AG Disposal Utilities Offsites Process Train Slugcatcher Inlet Fractionation Flare & Liq. Burner Inhibitor Recovery Liquefaction Product Storage Power Generation Fuel Gas Sea Water Fresh Water Stabilization Propane Refrig. Dehydration & Mercury Removal AGRU MR Refrig. Refrigerant Storage SRU & AG Enrichment Loading Heat Medium Diesel Storage Air & Nitrogen BFW/Steam/ Condensate Waste Water Effluents Fire Protection Figure 5. Plant 6 – Maximum Number of Units in LNG Facility PS4-1.7 Shipping Paper PS4-1 Outlining the Six Design Cases Plant 1, illustrated in Figure 4, includes only the process units that are required for liquefaction. Feed gas arriving at the plant boundary limit is expected to be ready for liquefaction. In this case, all utilities are imported except fire protection and relief system equipment which is integral to the safe operation of the facility. Offsite facilities include only LNG storage and the loading system. Plant 2 includes all items in Plant 1 plus all utility systems while Plant 3 will include all of the items in Plant 2 with the addition of feed gas treatment units. The treatment systems included in Plant 3 are acid gas removal (AGRU), dehydration, and mercury removal. Plant 4 will add a fractionation unit to Plant 3. The presence of a fractionation unit includes additional equipment for LPG storage and loading. Plant 5 will add extensive feed gas treating facilities to Plant 4. These facilities include a slug catcher, condensate stabilization, and the provision for high CO2 extraction within the AGRU. As a result of the high CO2 extraction, there will be accommodation for CO2 sequestering. Plant 6 will add a sulfur recovery unit (SRU) to Plant 5 and provide for maximum LPG recovery within the process unit. An overview of the units for Plant 6 is illustrated in Figure 5. The comparison of the six cases will highlight the effects of site specific criteria on the overall project cost. Each case has a different cost per annual ton due to the particular scope required to produce the same amount of LNG. The baseline result for each case is presented in Table 2. The metric is shown as an internally developed “currency per annual ton”, abbreviated as ¢/t. This currency unit can be used to allow comparison among designs with known parameters to other locations with assumed (or known) differences. Table 2. Variation of Specific Plant Cost Based on Site-specific Criteria Plant 1 Plant 2 Plant 3 Plant 4 Plant 5 Plant 6 Mt/a # 4.5 99 4.5 137 4.5 202 4.5 255 4.5 327 4.5 397 Cost of Material ¢/t 38 50 61 69 86 110 Site Preparation Tanks Marine Facilities ¢/t ¢/t ¢/t 2 17 26 3 17 26 4 17 26 5 22 26 7 22 26 8 22 26 Sponsor & Contractor Cost Labor Cost Financing Cost ¢/t ¢/t ¢/t 41 39 37 53 53 45 74 77 56 91 97 67 114 124 80 138 150 95 Total Cost at Startup ¢/t 200 247 315 377 459 549 Production Rate Equipment Count PS4-1.8 Paper PS4-1 Changes to an individual cost item, such as site preparation, will affect other cost elements of the table. Therefore, an increase of the site preparation cost will have a greater effect on the total cost than the basic change of cost in that row. The sensitivity analysis in the following paragraphs will show the overall effect on the total cost as a function of basic changes in scope. Examining the Elements of Specific Plant Cost Cost of Material. As the number of equipment items increases, the total cost of material will increase. However, the relative increase in equipment cost over the six configurations rises at a lower proportional rate than expected, since major equipment, such as refrigerant compressors, process drivers, and the main cryogenic heat exchanger (MCHE), are already included in the base configuration. The cost of material includes bulk materials and any other costs that are related to equipment (e.g. electrical items). The cost of materials is a primary concern in the currently active marketplace to build baseload LNG facilities. The proportion of material cost to total plant cost will affect comparisons of specific cost among LNG projects as the material market has outpaced economy of scale benefits over recent years. Site Preparation. The required plot area will increase as a function of the total equipment count. Therefore, the cost for site preparation increases, from Plant 1 through Plant 6, with the incremental scope added to each plant. In Table 2, basic site preparation cost is included in the calculation, which requires some earth movement-type work for each example. Table 3 illustrates the relative impact of a less advantageous jobsite which could significantly increase the site preparation cost and contribute to the increase in overall cost. Table 3. Variation of Specific Plant Cost Based on Enhanced Site Preparation Production Rate Equipment Count Base Site Preparation Cost Total Cost w/ Original Site Preparation Revised Total Cost w/ Enhanced Site Preparation Plant 1 Plant 2 Plant 3 Plant 4 Plant 5 Plant 6 Mt/a # 4.5 99 4.5 137 4.5 202 4.5 255 4.5 327 4.5 397 ¢/t 2 3 4 5 7 8 ¢/t 200 247 315 377 459 549 ¢/t 210 261 335 404 493 592 Tanks. Although many plants have used single containment (SC) tanks over the last 40 years, the trend is now toward the use of full containment (FC) tanks. Full containment tanks reduce the plot space required for LNG storage, but increase the tank cost as much as 70% [3]. In addition to increasing the cost, FC tanks require a longer construction time, which may have a cost impact on the schedule. The LNG storage tank cost does not vary in our constant capacity analysis, but cost differences could arise due to varying soil and seismic site conditions. For the analysis in this paper, site deviations for LNG storage are not included. As seen in Table 2, the LNG tank cost is kept constant for all cases and LPG storage tanks are added to the cost for Plants 4, 5, and 6. PS4-1.9 Paper PS4-1 Marine Facilities. In general, LNG liquefaction sites are located in remote locations with less favorable conditions than those in major population centers. To reach a sea bed clearance of at least 13.5 m, the jetty head needs to be located far enough offshore or dredging will be required. Some locations may also require a breakwater (i.e. a physical wave barrier) to achieve the necessary targets for ship loading availability. The costs for marine facilities can be quite significant and are totally independent of the process configuration and plant capacity, unless a second berth is required to offload a high plant capacity. For the 4.5 Mt/a facility, a 700 m long jetty trestle and a breakwater was considered. The jetty consists of two major sections, the jetty head and the trestle. The construction of the jetty head, consisting of breasting dolphins, mooring dolphins, and gangways, will vary little from site to site. The trestle cost is primarily dependent on its length and sub-sea soil conditions, which will affect both the structure and the LNG loading lines. If the jetty head needs to be moved further offshore, the trestle length will increase as well as the overall cost of the marine systems. In some cases, the trestle length could extend to several kilometers. To review the sensitivity of a longer jetty trestle, the impact of a 3 km jetty extension is shown in Table 4. Table 4. Variation of Specific Plant Cost Based on Enhanced Marine Facilities Production Rate Equipment Count Base Marine Facility Cost Total Cost w/ Original Marine Facilities Revised Total Cost w/ Enhanced Marine Facilities Plant 1 Plant 2 Plant 3 Plant 4 Plant 5 Plant 6 Mt/a # 4.5 99 4.5 137 4.5 202 4.5 255 4.5 327 4.5 397 ¢/t 26 26 26 26 26 26 ¢/t 200 247 315 377 459 549 ¢/t 218 265 333 395 477 567 Sponsor and Contractor Cost. For this paper, the cost for the sponsors is kept at a constant ratio of the total plant cost, but could vary for issues such as permitting and legal costs. As each plant requires additional scope, the sponsor costs will increase due to the added complexity. The contractor cost is a function of the scope of work and the project location, and is determined in proportion to the number of equipment items. The contractor cost includes home office services, construction management, construction equipment and temporary facilities. Business expenses that are not part of the other categories are included in this section. Labor Cost. A major contributor to the specific cost metric is the cost of labor, which is both plant size and location dependent, and varies significantly based on project location. With labor costs accounting for up to 50% of the cost of construction, the impact of labor has to be considered separately from the cost of equipment. The difference in labor from site to site can be as much as US$50/ton [4]. The cases presented in Table 2 are for a labor rate and productivity factor for an African location. Table 5 illustrates relocating the plant to a more expensive location (e.g. Australia) which will significantly change the contribution of labor to the metric for specific cost. PS4-1.10 Paper PS4-1 Table 5. Variation of Specific Plant Cost Based on Higher Labor Cost Plant 1 Plant 2 Plant 3 Plant 4 Plant 5 Plant 6 Production Rate Equipment Count Mt/a # 4.5 99 4.5 137 4.5 202 4.5 255 4.5 327 4.5 397 Base Labor Cost ¢/t 39 53 77 97 124 150 Total Cost w/ Original Labor ¢/t 200 247 315 377 459 549 Revised Total Cost w/ Higher Labor Cost ¢/t 239 299 391 475 583 701 Financing Cost. The cost of financing, i.e. the interest required for equity and debt during project development, will vary according to the risk and availability of capital for a specific project. Due to the complex nature of project financing, this subject is addressed in the commercial section of this paper. Additional Cost Contributors Stick Built Construction vs. Modular Design. Most plants are stick built (constructed piece by piece) unless the availability of labor, cost of traditional construction, or adverse climate conditions favors a modular design. Modular design is proposed when stick built construction is not feasible based on the site conditions and the project execution plan. Modular design allows the manufacture of sections of the plant at specialized industrial fabrication yards, and is commonly used in the design of topsides for offshore projects. This approach is intended to relocate construction labor and reduce the magnitude of site-specific construction costs. Modular design allows parallel construction paths, but can add schedule risk if shipping the modules has to occur within a small window of favorable weather conditions. In general, there is no cost advantage to modular design. Commonly, more structural steel and engineering is required than for a stick-built plant, but a modular design could mitigate the escalating costs anticipated for a challenging or remote location. Environmental Issues. Project costs influenced by environmental issues mainly address plant emissions. Guidelines from the World Bank are commonly applied for NOx emissions, which determine the limits on gas turbine exhaust and required mitigating controls. In addition to turbine emissions, another major issue is the management of the acid gases removed from the feed gas for the plant. Acid gas present in the plant feed can have varying levels of CO2, sulfur, mercaptans, and H2S. Acid gas removed from a feed with low CO2 could be discharged to the atmosphere, but if the acid gas contains sulfur or hydrocarbons, incineration is required. In some cases, a sulfur recovery unit (SRU) is necessary, which requires an acid gas enrichment unit upstream of the SRU. In environmentally conscientious areas, projects may require CO2 sequestering, which results in extensive acid gas handling for reinjection into a nearby deep reservoir. For Snøhvit LNG, Statoil estimated an investment cost of 190 million US$ for CO2 sequestering alone, which includes compression and drying facilities [5]. PS4-1.11 Paper PS4-1 Process Operation. Many papers and presentations have discussed the impact on CAPEX, operating costs, and operability for the following areas: • • • • • • Compressor drivers (Steam Turbine, Gas Turbine, Electric Motor) Heat Rejection (Seawater, Cooling Water, Air) Heat Medium Plant Availability Factors Liquefaction Process Technology Other plant differentiators These considerations have been omitted from this paper in order to focus on the basic issue of the major cost contributors and their effect on the “currency per ton” of production. Ambient Air Temperature. If the annual ambient temperature fluctuation is minor, e.g. areas close to the equator for an air cooled plant with gas turbine drivers; the impact on the production is relatively minor. In areas with a larger ambient temperature fluctuation, the plant can be designed for a low, high, or average air temperature. If the plant is sized for a low ambient condition, the equipment will be underutilized for most of the year; if sized for a higher ambient temperature, the equipment will be constrained for most of the year. Finding the right balance is a challenge for the designer, if the plant capacity is not dictated by marketing. For the same plant configuration, relocating the plants to a site with a 5 ºC higher temperature profile will decrease the plant production by approximately 4 %. Due to the decrease in production rate, the specific plant cost will rise accordingly, as shown in Table 6. Reducing the plant availability will have a similar effect as raising the design temperature. Table 6. Variation of Specific Plant Cost Based on Higher Ambient Temperature Original Production rate Original Total Cost at Startup Reduced Production Rate Revised Total Cost at Startup Mt/a Plant 1 4.5 Plant 2 4.5 Plant 3 4.5 Plant 4 4.5 Plant 5 4.5 Plant 6 4.5 ¢/t 200 247 315 377 459 549 Mt/a 4.3 4.3 4.3 4.3 4.3 4.3 ¢/t 209 258 329 395 480 575 Safety. There is no clear “cost of safety” for a plant unless the cost of insurance can be considered as part of the overall cost metric. If proper layout rules are followed and the inventory of liquid hydrocarbons is kept low, a plant can be considered safe at startup. In addition, if the proper operating and maintenance rules are implemented and followed, the plant can be safe throughout its useful life. Other Cost Items. There are other site specific cost issues that are beyond the scope of this paper, but affect the overall cost depending on the specific project requirements. These issues can add to the cost of equipment, engineering workhours, investments in the host country, or other costs passed through to the bottom line. Some of these issues include client or regional specifications, taxes and import duties, local content requirements (e.g. training), and local infrastructure development. PS4-1.12 Paper PS4-1 COMMERCIAL The following section regarding commercial issues is presented for the benefit of a technical audience. The concepts are comprehensive enough to support the evaluation of LNG specific cost. A fully comprehensive understanding of the commercial issues regarding the LNG value chain is beyond the scope of this paper. The commercial aspect of an LNG project addresses the financeability that leads to an “investment grade project”. With the cost of funding varying significantly with the commercial risk, financing will contribute to a plant’s specific cost. These commercial risks are based on facts and conditions specific to the locations along the entire LNG chain and the strengths of the sponsoring parties. Items that are considered by commercial parties include: • • • • • • • • • • • • • • • Reservoir size and asset quality Expandability Stability of reservoir owner Predictability of tax regime/regulations in host country Level of proven technology Participating company track record By-product economics Transportation advantages Access to open and proven markets Long term contracts for the entire LNG chain Customers and markets Pricing formula Strength of marketing entity Pricing stability Location This list can grow longer and more complex as the parties involved anticipate and address every potential risk. However, the most important considerations are: • • The issues that guarantee the return of investment The impact of the uncertainties This section addresses the major risks and attempts to quantify the impact on the cost of financing. The model presented might not necessarily be among the work processes of the financing companies, but the model illustrates the decision process and is meant to inject some transparency into the complexity of financing. Equity and Debt The equity portion of a project can vary significantly. If the projects sponsors choose a 100% equity arrangement, they can avoid complex financing issues; however, the immense cost of an LNG project will impact the balance sheet of even the largest company, requiring most projects to seek outside financing. Since the interest required for equity can be between 4 and 5 % above the interest to incur debt, the ratio of equity to debt will heavily impact the overall cost of financing. For a low risk project, the equity portion can be as low as 10% and increase to 30% to 50% for a high risk project. PS4-1.13 Paper PS4-1 Assessing commercial risk is what keeps many owners, partnerships, financial institutions and analysts in extensive negotiations to ensure each member can assure a win-win situation to their stakeholders. For example, a low risk project might qualify for a cumulative interest rate as low as 8%, while a high risk project would have to offer 15% or more to attract the necessary funds. A project relies on the credit rating of its sponsors to mitigate risk. The sponsors might even have some obligations beyond their equity obligations, such as a completion guarantee or limited price support. To achieve investment grade ratings, the sponsors may put a nominal amount of their assets at risk for a limited time. There are many publications that discuss the issues to be considered; however, it is difficult to clearly determine the value or cost of these non-technical considerations. Assessing the Risk The element that impacts the cost of money beyond a baseline is risk. This paper will address only the major risk factors and use a simplified CAPM (Capital Asset Pricing Model) to quantify risk. For each risk element we assign a risk factor between 1 (low risk) and 5 (high risk). These individual factors are combined in a factored summation (ß) which will be entered into the following CAPM formula: E(Ri) = Rf + ß (Rm - Rf) or E(rate of return) = R(risk free interest) + ß ( R(expected return of market) - R(risk free interest) ) This rate of return is used to determine the cost of financing. Based on a “Risk Free Interest” of 4 % and an “Expected Return of Market” of 7%, the ß factor will be determined for two projects with opposite risk profiles. The results of these calculations are included at the end of this section. Thomson Financial, which sponsored the pfi – market intelligence publication LNG Finance: Funding the Fuel of the 21st Century [6], suggests three levels of analysis: • • • Project level risk Sovereign risk Institutional business and legal risk As there are many references that address these risks in great detail, this paper will only highlight the major issues. Project Level Risk. Project level risk addresses the contractual foundation that protects the investors from market, operating and ownership risk for assurance of repayment. In essence, the project and local law will give investors the security of the entire project’s assets. Financial leverage is used to find common ground for multisponsor projects that have different relative strengths that impact the cost of funding; especially if local partners have sub-par investment ratings and include political risk. The choice between an incorporated and unincorporated joint venture is driven by the PS4-1.14 Paper PS4-1 partners’ willingness to seek funds on a project basis rather than individually. This choice could also be driven by the degree of integration of the overall LNG chain if it is easier to finance each phase of the project vs. a single large scale financing. The credit rating of sponsors has an effect on the financing of large complex projects. If financing involves too many financial institutions, it might be easier for each partner to raise its individual share of the project. On the other hand, some partners may be unable to raise the money for the project against their own assets and would prefer to jointly finance the project. A risk factor of 1 → well established partners with superior credit ratings A risk factor of 5 → a myriad of partners including those with sub-par credit LNG sales agreements are quite complex and secretive. An SPA (sales and purchase agreement) for a new project determines LNG revenues. This agreement also includes the financial strength and reliability of the buyer. Long term contracts reduce market risk but also reduce profitability during a time of rising natural gas prices. A pricing formula based on natural gas price fluctuation has a different risk factor than a formula based on oil prices, which historically showed less volatility before 2006. Strength of the marketing entity to support market risk includes the ability to book contracts and terminal capacity and the credit quality of the purchasing entity. Distance to markets and competition with local gas or closer LNG sources require a netback economic model. A risk factor of 1 → several long term contracts with spot cargo capacity A risk factor of 5 → few short term contracts or questionable stability of buyer The Project Lending Agreement defines debt service and creditors rights. These agreements define the terms and conditions of financing and prevent the owners and counter parties from changing the risks and preserving the liquidity and cash flow. A risk factor of 1 → familiar sponsors with good history A risk factor of 5 → new sponsors without established history Technology, construction and operations are crucial to define dependability in achieving the project goal. Investment grade credit will rely on the use of proven technology and standard industry practice. These risks can be separated into ‘Preconstruction’ and ‘Post-construction’ risk. Pre-construction risk includes evaluating proven technology in a similar project environment. Site and permitting (political) risk with good public and government relations can mitigate opposition. The guarantees of the contractor/licensor and their financial stability are contributing factors in this risk category which impact the liquidated damage imposed on the contractor. In times of tight resources, the availability of contractor personnel can be crucial to the success of the project and its reliability. Post-construction risk seeks assurance that the project will run successfully to generate the revenues for debt service. By choosing proven technologies, experienced contractors and capable operators, a degree of confidence can be achieved. PS4-1.15 Paper PS4-1 A risk factor of 1 →contractors with proven local design and operating experience A risk factor of 5 →new contractors without design experience or local knowledge Competitive market exposure, relative to peers, is a principal credit criterion. Low cost production relative to the market is essential for attracting the necessary capital. This exposure includes access to a large amount of natural gas with little domestic demand, which translates to higher long term profits from monetizing natural gas assets. Competitiveness of the project is also influenced by the feed gas price, which includes the stability of the reservoir owner and the predictability of the tax regime in the producing country. The break even cost varies substantially among greenfield vs. brownfield development, the train capacity, and marketable by-product revenues. A risk factor of 1 → high margin between product and netback price A risk factor of 5 → high production cost relative to market pricing LNG, like natural gas, shows high price volatility throughout a year. Demand profiles in targeted markets affect the ability to sustain continuous operation of a baseload plant. Therefore, Pricing Variables are probably the greatest project risks affecting the ability to sustain operation even if the LNG price would drop below a break-even threshold. A risk factor of 1 →buyers in diverse markets balancing the overall demand profile A risk factor of 5 →dedication to limited markets with annual demand fluctuations Counter Party Exposure includes risk from participants such as the feedstock supplier, LNG buyers, EPC contractors, ship constructors and government entities who provide the willingness and ability to honor the obligation to the project. A risk factor of 1 → counter parties with strong balance sheets A risk factor of 5 → low credit assessment of the counter party Other impacts on the project cost are taxes, import duties, and exchange rate fluctuations. Export Credit Agency (ECA) financing requirements could cause the purchase of materials in countries that may not have the lowest prices and exchange rate fluctuations can cause unnecessary financial risk. Several other factors enter into the overall risk assessment including: • Legal structure • Currency • Liquidity • Forecasting results PS4-1.16 Paper PS4-1 Sovereign Risk. A country rating factor such as the “Coface Country Rating Factor” gives an indication of security or territorial risk for the investment. The country risk factor includes the local business environment, economic, and political issues. The developed risk factor is between 0 and 1 in order to give the risk a numerical value. A country such as Australia shows a very low factor of 0.0, while countries like Libya, Indonesia, Yemen and Nigeria may have factors ranging from 0.8 and 1.0. Fiscal issues by the host government will not turn an uneconomical project into a profitable investment, but can improve the attractiveness for investors, which can be crucial during times of scarce fund availability among competing projects. Timely provision of permits for construction and operation by the host government are important to expedite project development, since the time between incurring expenditures and earning revenues can be long for a project of this magnitude. In addition, country related factors that will impact the project include: • Duties and taxes (including tax holidays) • Local content for material and labor • Local rules and regulations (unions, training, and sustainability) • Political stability Relative Institutional Risk. This risk addresses the existence of vital business and legal institutions, or non-existence in emerging markets, which are not measured in Standard & Poor’s sovereign country rating. These risks can be property rights and commercial law adverse to investor’s experience, or lack of a legal basis for SPA’s as collateral to lenders. Results of the CAPM Model. The commercial risks are listed in a Financial Risk Calculator with a value between 1 and 5. The factored summation is entered into the CAPM to calculate an interest rate for debt and equity. A simplified version of this calculation is provided in Table 7. The financing cost from Table 2 was based on using low risk interest. The variation in specific cost due to financing a higher risk project is presented in Table 8. The results show that the financing cost can range from 18 to 22% of the total plant specific cost. The difference between a low and high risk project can impact the financing cost similar to the site preparation sensitivity presented in Table 3. PS4-1.17 Paper PS4-1 Table 7. Financial Risk Calculator Using CAPM Model Project Level Risk LNG sales agreement Credit Rating of Sponsors Shipping Contracts Project lending agreement LOW HIGH 1 1 4 4 1 3 Technology, construction and operation Technology, new or well proven Contractor Experience 1 1 3 4 Competitive Market Exposure Gas Reservoir Competitive Projects and Markets 1 2 3 4 Pricing Variables 1 3 Counter Party Exposure 2 2 Legal Structure Currency Risk Liquidity Risk Forecasting Risk 1 1 1 1 3 3 4 4 1 2 3 5 1 2 1.4 2.3 Sovereign Risk General Country Rating Taxes, Duties, and local content Relative Institutional Risk Beta (ß) = E (Ri) Expected Return of Capital Assets Rf Risk Free Interest for example: T-bill = delta to T-bill + 3% 1% Rm Expected Return of Market for example: Rf plus 3% Interest delta between equity and debt 4% E (Ri) LOW RISK CASE EQUITY DEBT 10% 90% INTEREST OF EQUITY INTEREST OF DEBT 12% 8% HIGHER RISK CASE EQUITY DEBT 30% 70% INTEREST OF EQUITY INTEREST OF DEBT 15% 11% = Rf + ß (Rm - Rf) = 4% + 1.4 ( 7% - 4% ) = 4% + 2.3 ( 7% - 4% ) Table 8. Variation of Specific Plant Cost Based on the Cost of Financing Plant 1 Plant 2 Plant 3 Plant 4 Plant 5 Plant 6 Mt/a # 4.5 99 4.5 137 4.5 202 4.5 255 4.5 327 4.5 397 Base Financing Cost (Low Risk Interest) ¢/t 37 45 56 67 80 95 Total Cost w/ Original Interest ¢/t 200 247 315 377 459 549 Revised Total Cost (Higher Risk Interest) ¢/t 208 256 327 393 478 573 Production Rate Equipment Count PS4-1.18 Paper PS4-1 SUMMARY Evaluating the success of an LNG liquefaction project is a difficult task. Historically, LNG projects have proven to be reliable, profitable, safe, and challenging. However, projects are inevitably compared by their overall cost and LNG capacity. Comparisons using a specific cost metric, e.g. USD/ton of LNG do not give credit to the site specific elements that make each project unique. There are many elements that affect the project specific cost. The level of scope will define the intensity of gas treatment, which affects the overall equipment count. Fluctuations in the demand for premium materials will dictate the relative cost of equipment. Although site preparation and LNG storage requirements are different for every project, cost intensive marine systems are wholly customized for every location. Sponsors and contractors each have their own contributions to suitably build the project, but site specific labor is a strong cost driver for facilities in a remote location. Lastly, the commercial issues of bringing together sponsors for multi-billion dollar projects results in a cost of raising financing for such an important endeavor. A redefined specific cost, based on a clear understanding of the scope of each project, could be a suitable way to review complex projects in challenging locations. This paper demonstrates that the cost for a plant can vary by 100% or more when site specific conditions demand different considerations. As a result, it is clear that no two LNG projects are created equal. REFERENCES CITED 1. C.A. Durr, F. F. de la Vega, The M. W. Kellogg Company, Cost Reduction in Major LNG Facilities, 17th World Gas Conference, 5-9 June 1988. 2. Charles Durr, David Coyle, Don Hill and Sharon Smith, KBR, LNG Technology for the Commercially Minded, GasTech 2005, 14-17 March 2006. 3. Sam Kumar, Chicago Bridge and Iron Company, Design and Construction of Above Ground Tanks, Hydrocarbon Asia, July/August 2001. 4. Charles Yost and Robert DiNapoli, Merlin Associates, LNG Plant Costs – Past and Present Trends and a look at the Future, AIChE Spring Meeting, April 2005. 5. Harry Audus, presented on behalf of Statoil, The Sleipner and Snøhvit CO2 Injection Projects, Canadian CO2 Capture and Storage Technology Roadmap Workshop, Calgary, Canada, 18-19 September, 2003. 6. Rod Morrison, Thomson Financial, LNG Finance: Funding the Fuel of the 21st Century, pfi-market intelligence, 2005. 7. Gerald B. Greenwald, Klumer Law International, Ltd., Liquefied Natural Gas: Developing and Financing International Energy Projects, 1998. PS4-1.19