Advanced Accounting II Midterm Exam: Branch & Consolidated

advertisement

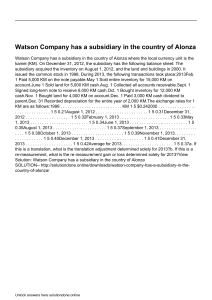

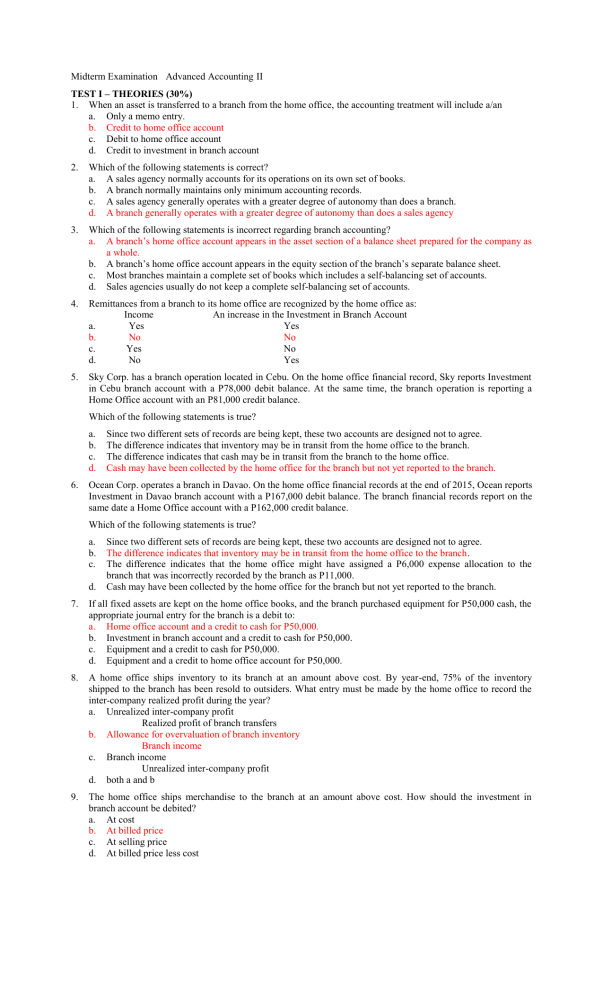

Midterm Examination Advanced Accounting II TEST I – THEORIES (30%) 1. When an asset is transferred to a branch from the home office, the accounting treatment will include a/an a. Only a memo entry. b. Credit to home office account c. Debit to home office account d. Credit to investment in branch account 2. Which of the following statements is correct? a. A sales agency normally accounts for its operations on its own set of books. b. A branch normally maintains only minimum accounting records. c. A sales agency generally operates with a greater degree of autonomy than does a branch. d. A branch generally operates with a greater degree of autonomy than does a sales agency 3. Which of the following statements is incorrect regarding branch accounting? a. A branch’s home office account appears in the asset section of a balance sheet prepared for the company as a whole. b. A branch’s home office account appears in the equity section of the branch’s separate balance sheet. c. Most branches maintain a complete set of books which includes a self-balancing set of accounts. d. Sales agencies usually do not keep a complete self-balancing set of accounts. 4. Remittances from a branch to its home office are recognized by the home office as: Income An increase in the Investment in Branch Account a. Yes Yes b. No No c. Yes No d. No Yes 5. Sky Corp. has a branch operation located in Cebu. On the home office financial record, Sky reports Investment in Cebu branch account with a P78,000 debit balance. At the same time, the branch operation is reporting a Home Office account with an P81,000 credit balance. Which of the following statements is true? a. b. c. d. 6. Since two different sets of records are being kept, these two accounts are designed not to agree. The difference indicates that inventory may be in transit from the home office to the branch. The difference indicates that cash may be in transit from the branch to the home office. Cash may have been collected by the home office for the branch but not yet reported to the branch. Ocean Corp. operates a branch in Davao. On the home office financial records at the end of 2015, Ocean reports Investment in Davao branch account with a P167,000 debit balance. The branch financial records report on the same date a Home Office account with a P162,000 credit balance. Which of the following statements is true? a. b. c. d. Since two different sets of records are being kept, these two accounts are designed not to agree. The difference indicates that inventory may be in transit from the home office to the branch. The difference indicates that the home office might have assigned a P6,000 expense allocation to the branch that was incorrectly recorded by the branch as P11,000. Cash may have been collected by the home office for the branch but not yet reported to the branch. 7. If all fixed assets are kept on the home office books, and the branch purchased equipment for P50,000 cash, the appropriate journal entry for the branch is a debit to: a. Home office account and a credit to cash for P50,000. b. Investment in branch account and a credit to cash for P50,000. c. Equipment and a credit to cash for P50,000. d. Equipment and a credit to home office account for P50,000. 8. A home office ships inventory to its branch at an amount above cost. By year-end, 75% of the inventory shipped to the branch has been resold to outsiders. What entry must be made by the home office to record the inter-company realized profit during the year? a. Unrealized inter-company profit Realized profit of branch transfers b. Allowance for overvaluation of branch inventory Branch income c. Branch income Unrealized inter-company profit d. both a and b 9. The home office ships merchandise to the branch at an amount above cost. How should the investment in branch account be debited? a. At cost b. At billed price c. At selling price d. At billed price less cost 10. The allowance for overvaluation of inventory account is debited by the home office a. When the home office ships merchandise to the branch at a billed price that exceeds cost b. In a journal entry to close the account at the end of an accounting period c. When the branch returns merchandise to an outside supplier d. In a journal entry to adjust the account at the end of the accounting period. 11. When a home office ships merchandise to branch A which is later shipped to branch B. the additional freight charges to ship the merchandise from branch A to branch B should: a. Treated as an expense on the home office books b. Included as part of the cost of merchandise to branch B c. Included as part of the cost of merchandise to branch A d. Both b and c 12. When the home office ships merchandise to the branch above its cost, the cost of goods sold on the branch income statement is: a. Understated by the overvaluation of the inventory. b. Overstated by the overvaluation of the branch inventory acquired from outsiders. c. Overstated by the overvaluation of the branch inventory acquired from home office. d. Overstated by the difference between the unadjusted and post-closing balance in the allowance for overvaluation in branch inventory account on the home office books. 13. When the home office ships merchandise to the branch above its cost, the net income on the income statement prepared by the branch is: a. Overstated by the unadjusted balance in the allowance for overvaluation account on the home office books. b. Understated by the unadjusted balance in the allowance for overvaluation account on the home office books. c. Understated by the post-closing balance in the allowance for overvaluation account on the home office books. d. Understated by the difference between the unadjusted and the post-closing balance in the allowance for overvaluation account on the home office books. 14. The allowance for overvaluation account is: a. b. c. d. Eliminated in the working paper used to combine the home office and branch accounts. Credited for the realized portion of the mark-up. Debited for the mark-up in the branch ending inventory. Credited for the mark-up in the branch ending inventory. 15. The unadjusted balance in the allowance for overvaluation account at year-end represents: a. The mark-up on merchandise shipped to the branch during the year. b. The mark-up on merchandise shipped to the branch during the year less than mark-up on the merchandise returned by the branch during the year. c. The mark-up on the merchandise available for sale by the branch for the year. d. The mark-up on the cost of goods sold by the branch for the year. 16. In stock acquisition resulting in a parent company – subsidiary relationship, difference between current fair values and book values of the subsidiary’s identifiable net assets on the date of acquisition are: a. Disregarded b. Entered in the accounting records of the subsidiary c. Accounted for in appropriately titled ledger accounts in the parent company’s accounting records. d. Provided in a working paper elimination 17. Consolidated financial statements are prepared when a parent-subsidiary relationship exists, in recognition of the accounting principle or concept of: a. Materiality b. Entity c. Reliability d. Going-concern 18. In acquisition of stock resulting in a parent-subsidiary relationships, the parent company’s Investment in Subsidiary Stock account balance is: a. Allocated to individual asset and liabilities accounts in a parent company journal entry. b. Eliminated with a working paper elimination entry for consolidation purposes. c. Displayed among noncurrent assets in the consolidated statement of financial position. d. Used as a basis for adjusting the subsidiary’s asset and liability account balances in the subsidiary’s books to current fair values. 19. Working paper eliminations are entered in: a. Both the parent company’s and the subsidiary’s accounting records b. Neither the parent company’s nor the subsidiary’s accounting records c. The parent company’s accounting record only d. The subsidiary company’s accounting record only 20. On the date of acquisition of stock, the difference between the fair values and book values of the subsidiary’s identifiable net assets are: a. b. c. d. Included to recognize in a working paper elimination entry. Recognized in the applicable asset and liability accounts of the subsidiary Recognized in the applicable asset and liability account of the parent Not recognized at all. 21. Consolidated financial statements are intended primarily for the use of: a. Stockholders of the parent company b. Taxing authority c. Management of the parent company d. Creditors of the parent company 22. How is the non-controlling interest displayed in a consolidated statement of financial position? a. As a separate item between the liabilities and stockholders’ equity b. As a deduction from goodwill, if any c. By means of a note to consolidated financial statements d. As a separate item in the stockholders’ equity section 23. Shooks Company, a subsidiary acquired for cash, owned equipment with a fair value higher than the book value as of the date of acquisition. A consolidated statement of financial position prepared immediately after the acquisition would include this difference in: a. Goodwill b. Retained earnings c. Income statement d. Equipment 24. Anjoks Company acquired a subsidiary for cash in acquisition combination on January 2, 2016. The price paid was greater than subsidiary interest at fair value. A consolidated statement of financial position prepared immediately after the combination would: a. Include part of the excess as gain on business combination b. Include at least some of the excess as part of land c. Include all of the excess as part of goodwill d. Not include the excess 25. The consolidated stockholders’ equity for a parent and its partially owned subsidiary consists of: a. The parent’s stockholders’ equity accounts only. b. The parent’s and the subsidiary’s stockholders’ equity accounts. c. The parent’s equity accounts and the non-controlling interest. d. The parent’s equity accounts, the subsidiary’s equity accounts and the non-controlling interest. Use the following choices for numbers 26 - 30: a. Both statements are true b. Both statements are false c. 1st statement is true; 2nd statement is false d. 1st statement is false; 2nd statement is true 26. If the portion of equity owned by the parent is less than 100%, the share of the non-controlling interest in the net assets of the subsidiary should be presented in the unconsolidated balance sheet of the parent. False Non-controlling interest refers to equity over subsidiary other than interest of parent. True D 27. If the parent’s interest over subsidiary is 60% then retained earnings of the parent and 60% of the subsidiary’s retained earnings should be consolidated.False Parent’s shareholders’ equity is also the consolidated stockholders’ equity for as long as its percent of ownership over the subsidiary is 100%.True D 28. Gain on bargain purchase is a reduction from consolidated stockholders’ equity.False If parent acquires 75% interest and there is an excess of investment over subsidiary interest, then goodwill is recognized in the consolidated reports also at 75%. False B 29. If A Co owns 90% of the shares of B Co who owns 60% shares of C Co then B Co need not prepare consolidated reports even if C Co is its subsidiary.True A Co prepares consolidated reports where the assets and liabilities of B Co and C Co are consolidated 100% together with its own assets.True A 30. The excess of cost over subsidiary interest is considered goodwill from consolidation after considering asset revaluation including contingent liabilities which are probable and can be measured reliably.True Control is said to exist if one entity holds 50% or more of the subsidiary’s interest.False C TEST II- Problem Solving 70% Questions 1 and 2 are based on the following information: The income statement submitted by Iloilo Branch to the Home Office for the month of December 31, 2016 follows: Sales Cost of Sales: Inventory, December 1, 2016 Shipments from Home office Purchased locally by branch Total Inventory, December 31, 2016 Gross Margin Operating Expenses Net Income for the month P 600,000 P 80,000 350,000 30,000 P460,000 100,000 360,000 P 240,000 180,000 P 60,000 The Branch inventories consisted of: Merchandise purchased from home Local purchases 12/01/2016 P70,000 10,000 12/31/2016 P84,000 16,000 After effecting the necessary adjustments, the Home Office ascertained the true net income of the Branch to be P156,000. 1. 2. At what percentage of cost did the home office bill the branch for merchandise shipped to it? What is the balance of the allowance for overvaluation in the branch inventory at December 31, 2016? Questions 3 and 4 are based on the following: The Manila Branch of the Mahusay Company is billed for merchandise by the home office at 20% above cost. The branch in turn, prices merchandise for sales purposes at 25% above billed price. On February 29, all of the branch merchandise is destroyed by fire. No insurance was maintained. Branch accounts show the following information: Merchandise inventory, January 1 (at billed price) Shipments from home office (January 1 – Feb. 29) Sales Sales returns Sales allowances Operating expenses (up to date) 3. 4. P 36,960 28,000 21,000 2,800 1,400 3,000 What was the cost to Home Office of the merchandise destroyed by fire? What was the correct branch profit from January 1 – February 29? Question 5 is based on the following: Skywalker Co. established a branch in Quezon City on February 1. Shipments were made to the branch at 125% of cost. During the month, the following shipments were received by the branch from the home office: February 10, P180,000; February 15, P75,000;February 20, P52,500. On February 25, the branch returned defective merchandise worth P4,575 and on February 29, it reported a net loss of P9,300 and merchandise inventory of P127,500. 5. What is the correct branch income (loss)? Questions 6 and 7 are based on the following: Statement of financial position for Han Corporation and Solo Corporation before acquisition on December 31, 2015 are given below: Han Corporation Solo Corporation Cash and cash equivalent P 120,000 P 100,000 Inventory 100,000 60,000 Property and equipment 500,000 220,000 Goodwill 80,000 20,000 Total assets 800,000 P 400,000 Current liabilities Long-term liabilities Share Capital Share Premium Retained Earnings Total Equities P 150,000 180,000 220,000 120,000 130,000 P 800,000 P 100,000 90,000 100,000 60,000 50,000 P 400,000 Han Corporation purchased in cash 80% ownership of Solo Corporation on December 31, 2015, for P180,000. On that date, Solo’s property and equipment had a fair value of P50,000 more than the book value shown, while its long term liabilities has a market value of P120,000. All other book values approximated fair value. 6. In the consolidated statement of financial position, what is the amount of goodwill to be reported? 7. In the consolidated statement of financial position, what is the amount of Total Shareholders’ Equity to be reported? Questions 8 to 12 are based on the following: On January 1, 2016 Kapamilya issued shares of its P5 par value stock to acquire all the share of Kapuso, which was liquidated immediately thereafter. Kapamilya paid out-of-pocket costs totaling P50,000 of which P30,000 is paid for stock registration. The book value Kapuso’s net assets are equal to their fair market value at the time of acquisition except for the inventory which fair value is lower than P10,000 and the land with book value of P50,000. The statement of financial position for Kapamilya Company before acquisition and statement of financial position for the combined company are presented below: Cash Accounts Receivable Inventory Land Buildings and Equipment Accum. Depn. – Building and Equipment Goodwill Total Assets Accounts Payable Bonds Payable Share Capital Share Premium Retained Earnings Total liabilities and equity 8. 9. 10. 11. 12. Kapamilya P 70,000 130,000 100,000 100,000 400,000 150,000 20,000 670,000 Combined 100,000 180,000 220,000 175,000 550,000 150,000 75,000 1,150,000 40,000 100,000 200,000 60,000 270,000 670,000 80,000 160,000 240,000 420,000 250,000 1,150,000 How much is the current asset of Kapuso before acquisition of Kapamilya? What was the value of the shares issued by Kapamilya to acquire Kapuso? What was the fair value of the net assets held by Kapuso immediately before the combination? How many shares of Kapamilya were issued in completing the combination? What was the market price per share of Kapamilya stock at the date of combination? Questions 13 and 14 are based on the following: Ufficio A Casa & Co. is currently preparing its combined financial statements for the year ended December 31, 2015. As of this date, the “investment in branch” account has a balance of P190,000. The following information has been gathered. a. The home office allocated unpaid utilities expenses amounting to P20,000 to the branch which the branch did not record in full. Instead the branch sent a wrong adjusting memo to the home office reducing the charge by P5,000 and setting up a liability for the remaining amount. b. The home office erroneously credited the branch for a return of shipments of merchandise worth P50,000. The branch did not make any return of merchandise. c. The branch mistakenly received a copy of the home office correcting entry for item (b) above dated January 3, 2016 and entered a credit in favor of the home office on December 31, 2015. d. The branch mistakenly sent the home office a debit memo amounting to P6,000 for an apparent remittance of collections which did not happen. The home office did not record the debit memo. 13. What is the correct balance of investment in branch account? 14. What is the unadjusted balance of home office equity account? Questions 15 and 16 are based on the following: The following items was determined during the reconciliation procedures for the reciprocal accounts of a home office and its branch. Investment in Branch is P100,000. a. The credit posting for an expense allocated to the branch amounting to P13,600 was erroneously recorded by the branch as P16,300 b. Thee debit posting for an expense allocated to the branch amounting to P8,000 was expected was erroneously recorded by the branch as of P10,000. c. The debit posting for a cash remittance from the branch amounting to P14,000 was not recorded by the home office. d. The credit posting for a credit memo received from by the home office amounting to P10,000 was recorded twice by the home office. e. The credit posting for a debit memo received from the home office amounting to P6,000 was recorded by the branch as a debit. 15. How much is the difference between the unadjusted “investment in branch” and “home office” accounts? 16. What is the correct balance of home office equity? Questions 17 and 18 are based on the following: The following information are taken from the books of Bill Company and its branch at the end of their second year of operations. Shipments from home office Freight in for shipments Branch Sales Branch Expenses Allowance for overvaluation Branch Inventory, Jan. 1 Branch Inventory, Dec. 31 P 88,800 4,440 120,000 40,000 17,300 15,750 17,640 The branch acquires all of its merchandise from the home office with the freight paid by the home office. Inventory includes allocated freight. 17. At what percentage does the home office bill the branch for merchandise shipments based on billed price? 18. How much is the true profit of the branch? Questions 19 to 25 are based on the following: BA Inc., YA Inc. and NI Inc., are parties to a consolidation agreement. Their respective net assets, retained earnings and estimated earnings as of January 1, 2016 are as follows: Net asset BA Inc. YA Inc. NI Inc. P491,400 P435,600 P333,000 176,400 75,600 108,000 41,742 35,568 27,990 Retained Earnings Estimated annual earnings contribution A new corporation, HERO Inc., shall issue a single class of shares. Book value of their respective net assets are equal to their respective fair value. Earnings in excess of normal earnings of 8% are to be capitalized at 10% in determining goodwill (earnings contribution) of each companies. HERO Inc. shall issue ordinary shares at P20 par value equal to total net assets transferred plus goodwill. No Share Premium is recorded in all three Companies before combination and each of them only has one class of share each having par value of P10. Assume that after consolidation, HERO Inc. distributed cash dividends amounting to P240,000. 19. How much is the goodwill to be recorded? 20. Jose Rizal is a shareholder of Ya Inc.’s 5,400 shares. How many new shares will he receives? 21. Andres Bonifacio is a shareholder of Ba Inc.’s 6,300 shares. How much will he receive from the cash dividend distribution? 22. Instead of giving ordinary shares to earnings contribution, HERO Inc. will give 8% fully-participating Preference shares with par value P100. How many preference share will NI Inc. receive? 23. Using information in #22, how much will Emilio Aguinaldo, a shareholder of Ya Inc.’s 7,200 shares receive as cash dividends? 24. Disregard the arrangements for the issuance of new shares given above. Assume instead that HERO Inc. plans to issue 100,000 ordinary shares with par value P12 to be divided to each company based on their net assets and earnings contributions. How many ordinary shares will BA Inc. receives? 25. Using information in #24, how much will Apolinario Mabini, a shareholder of NI Inc.’s 4,050 share, receive as dividends? Questions 26 to 28 are based on the following: Presented below are items taken from the unadjusted trial balances of BERI Co. and its branch on Dec. 31, 2015. Home Office Books Shipments to branch 324,000 Allowance for overvaluation 107,892 Branch Books Shipments from home office 421,200 Inventory, Jan. 1 58,968 Inventory, Dec. 31 52,650 Purchases ? Sales 583,200 Expense 55,080 It is the company’s policy to bill all branches for merchandise shipments at 30% above cost. Realized profit on overvaluation amounts to P99,792 for the year. 26. How much of the branch inventory in January 1 represents purchases from outsiders? 27. How much of the branch inventory in December 31 represents purchases from outsiders? 28. If the correct net income of the branch amounted to P70,632, how much is the purchases for 2015? Questions 29 to 31 are based on the following: Statements of financial position for Pull Corporation and Bear Company on December 31, 2015 are given below: Pull Company Cash and cash equivalents Bear Company 264,000 72,000 80,000 48,000 Property and equipment (net) 400,000 200,000 Total Assets 744,000 320,000 Current Liabilities 144,000 48,000 Long-term liabilities 160,000 72,000 Common stock (par P10) 240,000 80,000 Retained Earnings 200,000 120,000 Total liabilities and Equity 744,000 320,000 Inventory Pull Corporation purchased 6,400 shares of Bear Company on January 3, 2016. On that date, Bear Company’s stock had a fair value of P32.50 while Pull Company’s stock was selling at P50. Bear Company’s property and equipment had a fair value of P40,000 more than the book value shown, while its long-term liabilities has a market value of P120,000. All other book values approximated fair values. In the consolidated statement of financial position on January 3, 2016: 29. How much is the total current assets? 30. How much is the total non-current assets? 31. Give the stockholders’ equity in detail. Questions 32 to 35 are based on the following: Statements of financial position for Pan Corporation and Sal Company on December 31, 2015 are given below: Pan Company Cash and cash equivalents Inventory San Company 260,000 72,000 80,000 48,000 Goodwill 50,000 Property and equipment (net) 400,000 150,000 Total Assets 740,000 320,000 Current Liabilities 140,000 48,000 Long-term liabilities 160,000 70,000 Common stock (par P10) 240,000 80,000 Retained Earnings 200,000 122,000 Total liabilities and Equity 740,000 320,000 Pan Corporation purchased 4,000 shares of Sal Company on January 3, 2016. Additionally, Pan purchased additional stocks from Sal out of its unissued shares at the current market price of P30. This gave Pan a P75% controlling interest. Sal paid P7,000 for the cost of issuing and registering the securities. Pal paid P75,000 cash for business combination expenses. Sal Company’s property and equipment had a fair value of P80,000 more than the book value shown, while its long-term liabilities has a market value of P90,000. All other book values approximated fair values. Pan borrowed enough cash for this acquisition and still had P50,000 cash and cash equivalents balance after all the transactions. In the consolidated statement of financial position on January 3, 2016: 32. How much is the non-controlling interest if the parent company used the Partial Approach in recognizing gain or goodwill? 33. How much is total current assets? 34. How much is total non-current assets? 35. How much is retained earnings? - END – SOLUTION TEST I 1. B 2.D 11. A 12. C 21. A 22. D 3.A 13. D 23. D 4. B 14. A 24. B 5. D 15. C 25. C 6. B 16. D 26. D 7. A 17. B 27. D 8. B 18. B 28. B 9. B 19. B 29. A 10. D 20. A 30. C TEST II 1. 140% of cost 18. P3,150 2. P 24,000 19. P45,000 3. P 42,000 20. 3,321 shares 4. P 1,667 21. P18,968 5. P 25,785 22. 3,330 preference shares/135 shares 6. P 15,000 23. P16,287 7. P 515,000 24. 39,517 shares 8. P 260,000 25. P11,470 9. P 430,000 26. P12,636 10. P 375,000 27. P17,550 11. 8,000 shares 28. P129,762 12. P 53.75 per share 29. P256,000 13. P 235,000 / P240,000 30. P708,000 14. P 170,000 31. Share Capital 240 RE 200 NCI 52 15. P 35,300 32. P111,250 16. P 76,000 33. 483,000 17. Mark Up is 16.67% 34. P656,250 Based in billed price 35. P125,000 1. Net income reported P60,000 against true of P15,000= realized gross profit P96,000 CGS: 70,000 +350,000=84,000=336,000 – RGP 96,000= True CGS 240,000 96,000/240,000= 40% of cost or billed at 140% of cost. 2. Invty end of 84,000/1.4 x .4= P24,000 3. 36,960 + 28,000= 64,960 -14,560 (21,000-2,800=18,200/1.25) = P50,400 /1.2= P42,000 4. Cost of sales (beg and ship of P64,960-mdse destroyed 50,400= 14,560/1.2 x .2= realized 2,427. Gross profit (16,800-14,560 – 3,000)= 760 loss - 2,427= 1,667 5. Net Cost of shipments 302,925 – invty end 127,500= cost of saled 175,425 / 1.25 x .25= realized 35,085 – net loss 9,300= 25,785 true profit 6. 180 / .8 = 225 – 210 (SHE 210- AR-10 + 50) = 210 -225= P15,000 7. 225 x .2= 45 NCI plus controlling interest SHE of 470= P515,000 8. 500 consolidated + AR 10 – Parent 250 (300-50)= P260,000 9. 660 -260 + 30= P430,000 10. 500 – 250 + 175 -100 + 400 -250 – 240 + 140= 375,000 11. Share capital 240-200=40,000/5 / = 8,000/ shares 12. P430,000 / 8,000= P53.75 13. Investment 190 + b) 50= P240,000 – P5,000 = P235,000 14. 240 – c)-50- b) 20 = P170,000 15. 100- 45,300 = P35,300 16. 100 – c)14- d)10= adjusted of Investment P76,000 Adjusted of HO Equity 76 - a)2.7 - b) 2 - e) 12- c) 14= unadjusted 45,300 17. Invty 1/1 15,750/1.05= 15,000 + shiipments 88,800=103,800 17,300 allow/103,800= 16.67% 18. Invty End 17,640/1.05= 16,800 x.16666= 2800 unrealized – 17,300= realized 14,500 Net loss reported (120 – 91.35-40,000= -11,350 + 14,500= P3,150 net profit 19. Total consideration is P1,305,000 – net assets of P1,260,000= P45,000 goodwill Net Assets Earnings Contributions Total Shares issued BA 491,400 24,300 515,700 25,785 YA 435,600 7,200 442,800 22,140 NI 333,000 13,500 346,500 17,325 TOTAL 1,260,000 45,000 1,305,000 65,250 20. 435,600-75,600= 360/10= 36,000 outstanding shares 5,400/36,000 x 22,140=3,321 shares 21. 25,785/65,250 x 240,000= P94,841 cash dividends . 491400-176,400= 315,000 outstanding 22. 6,300/315,000 x P94,841= P18,968 P333,000/100= 3,330 preference shares. If applied to earnings contribution as per problem P13,500/100= 135 Net Assets Preference shares Earnings Contributions Common Shares BA P491,400 4,914 P24,300 1,215 YA P435,600 4,356 P7,200 360 23. Preferred (P1,260,000 x .08) Common (45,000 x .08) Remainder (240 -104.4) 135,600 Preferred (135,600 x 1,260/1,315) Common (135,600-129,929) NI P333,000 3,330 P13,500 675 Preferred 100,800 TOTAL P1,260,000 12,600 P45,000 2,250 Common 3,600 129,929 230,729 5,671 9,271 230,729 x 4,356/12,600= 79,766 x 7200/36000= P15,953 9271 x 360/2,250= 1,483 x 7,200/36,000 = 297 Total P16,250 24. Net Assets Earnings Contributions Total Total shares issued Total cost BA 491,400 24,300 515,700 39,517 YA 435,600 7,200 442,800 33,931 NI 333,000 13,500 346,500 26,552 TOTAL 1,260,000 45,000 1,305,000 100,000 23. 240,000 x 26,552/100,000= P63,725 total dividends x 4,050 /22,500 outstanding= P11,470 24. Total allowance of 107,892- allowance for shipments 97,200= allow beg 10,692/.3= 35,640 invty beg at cost x 1.3= invty beg at billed 46,332- total invty beg of 58,968= P12,636 purchases 25. realized 99792 – total allow 107,892= allow end 8,100 / .3= 27,000 at cost x 1.3=35,100- total ending invty of 52,650= 17,550 purchases 26. Correct net income 70,632 – realized 99,792= reported Net loss 29,160 – expenses 55,080= 25,920 – sales 583,200= cost of sales 557,280 + invty end 52,650- shipment 421,200- invty beg58,968= purchases 129,762 27. 264 +80 +72 + 48 – 208 consideration=P256,000 28. 208/.8= 260 – 200 -40 + 48= 68,000 goodwill 400 + 240 + 68= P708,000 29. 260 x .2 = NCI 52,000 + Share Capital P240,000 + Retained Earnings P200,000 30. 4,000 / .25 for NCI= total outstanding of 16,000 – 4,000= 12,000 total shares bought by parent Subsidiary interest= 202 + 240 (8,000 x P30) – 7 = 435-50 GW + Net Asset Rev + 60= 445 x .25= 111,250 31. 50 + 72 + 240 – 7 + 128= P483,000 32. 400 + 230 + 26.25= P656.25 Consideration 360 (12 x 30) –subsidiary interest at fair value 333.75 (445,000 x .75)= 26,250 GW 33. 200 – 75= P125,000