Accounts Receivable: Definition, Measurement, and Adjustments

advertisement

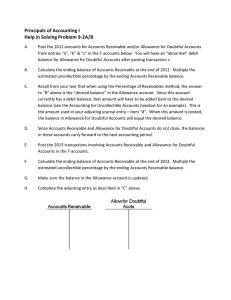

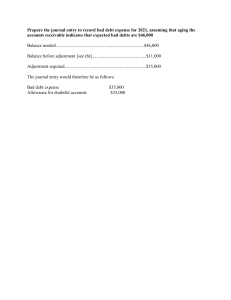

Accounts Receivable Receivable = financial assets that represent a contractual right to receive cash or another financial asset from another entity. For retailers or manufacturers, it is classified into Trade receivable and Non-trade receivable. Trade receivables = refer to claims arising from sale of merchandise or services in the ordinary course of business = it includes accounts receivable and notes receivable. = if it expected to be realized in cash within the normal operating cycle (one year), whichever is longer, are classified as current assets. Accounts receivable = open accounts or those not supported with promissory note. = aka customer’s accounts, trade debtors, and trade accounts receivable. Notes receivable = are those supported by formal promises to pay in the form of notes. Nontrade receivable = represent claims arising from sources other than the sale of merchandise or services in the ordinary course of business. = if it is expected to be realized in cash within one year, the length of the operating cycle notwithstanding, are classified as current assets. = if collectible within one year, it is classified as noncurrent assets. According to Pas 1, paragraph 6 (Presentation of Financial Statements): “An entity shall classify an asset as current when the entity expects to realize the entity expects to realize the asset or intends to sell or consume it in the entity’s normal operating cycle, or when the entity expects to realize the asset within twelve months after the reporting period.” “Trade receivables and nontrade receivables which are currently collectible shall be presented on the face of the statement of financial position as one lime item called trade and other receivable.” Examples of Nontrade receivables 1) Advances to or receivables from shareholders, directors, officers or employees. = If advances are collectible within one year, it is classified as current assets, otherwise, noncurrent asset. 2) Advances to affiliates are usually treated as long-term investments. 3) Advances to suppliers for the acquisition of merchandise are current assets. 4) Subscription receivable are current assets if collectible within one year. Otherwise, they are shown preferably as a deduction from subscribed share capital. Customer’s credit balance = are credited balances in accounts receivable resulting from overpayments, returns and allowances, and advance payments from customers. = classified as current liabilities and are not offset against the debit balances in other customers’ accounts, EXCEPT when the same is not material in which case only the net accounts receivable may be presented. Example Illustration The accounts receivable controlling account reports a balance of Php400,000.00. Examination of the subsidiary ledgers reveals the following details in the customer’s accounts. Sales Sales Sales Credit balance Customer A 500,000 Collections Debit Balance 500,000 200,000 300,000 500,000 Customer B 700,000 Collections Debit Balance 700,000 400,000 300,000 700,000 Customer C 500,000 Collections 200,000 50,000 Returns 550,000 250,000 550,000 The accounts receivable should be presented as current asset at Php600,000.00 representing the accounts of A and B. The credit balance in the account of C is classified as current liability and not offset against the debit balances in the accounts of A and B. No adjustment is necessary to formally recognize the customers’ credit balances because ultimately these are canceled for sales and cash settlement. But an adjustment may be made only for worksheet purposes, meaning, not formally journalized and posted to the ledger, as follows: Accounts receivable 50,000 Customers’ credit balance 50,000 PFRS 9, paragraph 5.1.1, provides that a financial asset shall be recognized initially at fair value plus transaction costs that are directly attributable to the acquisition. Fair value of financial asset is usually the transaction price, meaning, the fair value of the consideration given. For short term receivables, fair value = face value or original invoice amount. Cash flows relating to short-term receivables are not discounted because the effect of discounting is usually immaterial. Therefore, accounts receivable shall be measured initially at face value. For long-term receivables that are interest bearing, the fair value is equal to face value. But, the long term receivables that are not interest bearing, the fair value is equal to present value of all future cash flows discounted using the prevailing market rate of interest for similar receivables. Therefore, long-term interest-bearing notes receivable shall be measured initially at face value and long-term noninterest-bearing notes receivable shall be measured at present value. Accounts receivable = are open accounts arising from sale of merchandise or services in the ordinary course of business. = measured initially at face value or original invoice amount. = subsequently, the accounts receivable shall be measured at net realizable value = based on established basic principle that “assets shall not be carried at above their recoverable amount.”, meaning to say, the initial amount recognized for accounts receivable shall be reduced by adjustments which in the ordinary course of business will reduce the amount recoverable from the customer. Net realizable value = the amount of cash expected to be collected or the estimated recoverable amount. The following deductions are made in estimating the net realizable value of trade accounts receivable: a) Allowance for freight charge b) Allowance for sales return c) Allowance for sales discount d) Allowance for doubtful accounts Terms related to freight charge FOB Destination = the ownership of the goods purchased are transferred to the buyer upon receipt. = the seller is responsible for related freight charges up to the point of destination. FOB Shipping point = the ownership of goods purchased are transferred to the buyer upon in transit or shipment. = the buyer is responsible for related freight charges from the point in transit upon the point of destination. FOB means Free On Board. Freight Collect = freight charges on the goods shipped is not yet paid. = the buyer is the one who paid the related freight charge. Freight Prepaid = freight charges on the goods shipped is already paid by the buyer. Accounting for Freight Charge There are instances that the goods are sold “FOB Destination” but shipped “freight collect” with the situation that the buyer will pay for the freight charge and deduct the same when remittance is made by him. On the part of seller, the freight charge is recorded by debiting freight out and crediting allowance for freight charge. Example scenario: Devenecia company has a Php100,000.00 account receivable at the end of accounting period. The terms are 2/10, n/30 FOB Destination and freight collect. The customer paid freight charge of Php5,000.00. 1) To record the sale. Accounts receivable Freight Out Sales Allowance for freight charge 2) To record the collection within the discount period. Cash Sales Discount Allowance for freight charge Accounts receivable 100,000 5,000 100,000 5,000 93,000 2,000 5,000 100,000 Accounting for sales returns The measurement of accounts receivable shall also recognize the probability that some customers will return goods that are unsatisfactory, defective or will make other claims requiring reductions in the amount due as in the case of shipment shortage and defects. For example, an amount of Php70,000.00 of the total accounts receivable at year-end represents selling price of goods that will probably be returned. The entry to recognize the probable return is: Sales return Allowance for sales 70,000 return 70,000 Sales discount Cash discount = is a reduction from an invoice price by reason of prompt payment. = aka sales discount on the part of seller while purchase discount on the part of buyer. = can be expressed as 6/10, n/30 which means that the buyer will grant 6% discount when the payment is made within 10 days. The n/30 pertains to the credit period given by the seller to the buyer which means the buyer should pay within 30 days, Methods of recording credit sales 1) Gross method = the accounts receivable and sales are recorded at gross amount of the invoice. = Most common and widely used by the entity because it is simple to apply. 2) Net method = the accounts receivable and sales are recorded at net amount of the invoice (invoice price minus the cash discount). Illustration (Gross Method) 1) Sale of merchandise for Php200,000.00, terms 8/10, n/30. Accounts receivable Sales 200,000 2) Assume collection is made within the discount period. Cash Sales discount Accounts receivable 184,000 16,000 3) Assume collection is made beyond the discount period Cash Accounts receivable 200,000 200,000 200,000 200,000 Illustration (Net method) 1) Sale of merchandise for Php200,000.00, terms 8/10, n/30. Accounts receivable Sales 184,000 184,000 2) Assume collection is made within the discount period. Cash Accounts receivable 3) Assume collection is made beyond the discount period Cash Accounts receivable Sales discount forfeited 184,000 184,000 200,000 184,000 16,000 The sales discount forfeited account is classified as other income. Allowance for sales discount If customers are granted cash discounts for prompt payment, then, conceptually estimates of cash discounts on open accounts at the end of the period based on past experience shall be made. For example, of the accounts receivable of Php900,000.00 at the end of reporting period, it is reliably estimated that discounts to be taken will amount to Php50,000.00. The adjustment to record the expected sales discount is: Sales discount Allowance for sales discount 50,000 50,000 The adjustment may be reversed at the beginning of the next period in order that discounts can then be charged normally to sales discount account. Accounting for bad debts Business entities that sell on credit assumes the risk that some customers will not pay their accounts. When an account becomes uncollectible, the entity has sustained a bad debt loss. This loss is simply one of the costs of doing the business on credit. Two method for accounting in bad debt loss: 1) Allowance method 2) Direct writeoff method Allowance method = requires recognition of a bad debt loss if the accounts are doubtful of collection. The entry to recognize the doubtful accounts is: Doubtful accounts xx Allowance for doubtful accounts xx The allowance for doubtful accounts is deduction from accounts receivable. If the doubtful accounts are subsequently found to be worthless or uncollectible, the accounts are written off as follows: Allowance for doubtful accounts xx Accounts receivable xx GAAP require the use of the allowance method because it conforms with the matching principle. Moreover, accounts receivables would be properly measured at net realizable value. Recoveries of accounts written off 1) Accounts of Php40,000.00 are considered doubtful of collection. Doubtful accounts 40,000 Allowance for doubtful accounts 40,000 2) The accounts are subsequently discovered to be worthless or uncollectible Allowance for doubtful accounts 40,000 Accounts receivable 40,000 3) The same accounts that are previously written off are unexpectedly recovered or collected. Accounts receivable 40,000 Allowance for doubtful accounts 40,000 Cash 40,000 Accounts receivable 40,000 The accounting procedure is to simply reverse the original entry of writeoff regardless of whether the recovery is during the year of writeoff or subsequent thereto. Direct Writeoff Method = requires recognition of bad debt loss only when the accounts proved to be worthless or uncollectible. = worthless accounts are recorded by debiting bad debt loss and crediting accounts receivable. No entry is necessary if the accounts are only doubtful of collection. = often used by small businesses because of it is simple to apply. = BIR (Bureau of Internal Revenue) recognizes only this method for income tax purposes. = it violates the matching principle because the bad debt loss is often recognize in later accounting period than the period in which the sales revenue was recognize. Illustration 1) Accounts of Php40,000.00 are considered doubtful of collection. No entry is necessary 2) The accounts proved to be worthless Bad debts 40,000 Accounts receivable 40,000 3) The same accounts that are previously written off as worthless are recovered or collected. Accounts receivable 40,000 Bad debts 40,000 Cash 40,000 Accounts receivable 40,000 Method of estimating doubtful accounts Doubtful accounts = are recognized when the loss is probable and the amount can be estimated reliably. = this approach is in line with the recognition of “provision” which is both “probable and measurable” in accordance with PAS 37. Three methods of estimating doubtful accounts 1) Aging of accounts receivable (statement of financial position approach). 2) Percent of accounts receivable (statement of financial position approach). 3) Percent of sales (income statement approach). Aging of accounts receivable = involves an analysis of the accounts where they are classified as not due or past due. Past due = refers to the period beyond maximum credit term. = accounts are further classified in terms of the length of the period they are past due. Examples are: a) Not due b)1 – 30 days past due c) 31 – 60 days past due d) More than 1 year past due c) Bankrupt and other litigation Required Allowance for doubtful account = accounts receivable * % uncollectible Net Realizable Value of Accounts receivable Accounts receivable – Allowance for doubtful accounts = net realizable value of accounts receivable Aging of Accounts receivable Advantage: = accurate and scientific computation of allowance for doubtful accounts. = accounts receivable fairly presented. Disadvantage: = violates matching principle. = time consuming of large accounts are involved. Matching principle = recognized the expense every sales on account. Percent of Accounts Receivable = a certain rate is multiplied by the open accounts at the end of the period in order to get the required allowance balance. Allowance for doubtful accounts = rate * amount of sales Percent of accounts receivable Advantage: = simple to apply. Disadvantage: = The experience rate may be excessive or inadequate. Percent of Sales = a certain rate is multiplied by the amount of sales at the end of the period in order to get the doubtful accounts expense/ Doubtful Accounts Expense = rate * amount of sales Percent of Sales Advantage: = matching principle is followed Disadvantage: = allowance for doubtful accounts may be excessive or inadequate. Correction in allowance for doubtful accounts = the correction is to be reported in the income statement either as an addition to or subtraction from doubtful accounts expense. The reason is that the correction is the natural result of a change in estimate. Accordingly, an inadequate allowance is adjusted as follows: Doubtful accounts xx Allowance for doubtful accounts xx An excessive allowance is recorded as follows: Allowance for doubtful accounts xx Doubtful accounts xx Debit balance in allowance account There are instances that the allowance for doubtful accounts have a debit balance because it may be the policy of an entity to adjust the allowance at the end of the period and record accounts written off during the year. Example: On January 1, the allowance account before adjustment has a credit balance of Php30,000.00 and during the year an account of Php60,000.00 is written off and recorded as follows: Allowance for doubtful accounts Accounts receivable 60,000 60,000 Thus, on December 31, the allowance account has debit balance of Php30,000.00 before adjustment. If the required allowance on December 31 is Php30,000.00, the adjustment should be: Doubtful accounts Allowance for doubtful accounts 60,000 60,000 Required allowance Add: Debit balance in allowance Doubtful accounts expense 30,000 30,000 60,000 *Note: after the adjustment for doubtful accounts, the allowance account has a credit of Php30,000.00, which is the required allowance. Doubtful accounts in the income statement 1) Distribution Cost = doubtful accounts are considered as distribution cost if the granting of credit and collection of accounts are under the charge of the sales manager. 2) Administrative expenses = doubtful accounts are considered as administrative expenses if the granting of credit and collection of accounts are under the charge of an officer other than sales manager. = doubtful accounts are considered administrative expenses in the absence of any contrary.