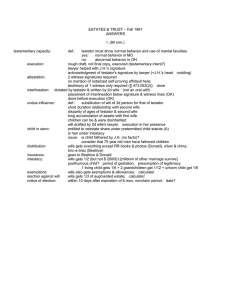

Wills and Trusts Outline Last updated 2/23/22 Brief Overview of Default Rules 1. Intestacy and Probate ● ● ● Probate vs nonprobate ○ Probate property is the decedent’s property that passes by way of a state court supervised “probate” procedure ○ Nonprobate property bypasses the probate process Probate ○ The default system -- upon individual’s death, all property falls into probate unless the person took the necessary steps to shift the property from probate to nonprobate ○ First step after someone dies is to “open” probate by going to the appropriate court who will then appoint someone ○ The appointed person’s duties are ■ (1) ascertain the scope of the decedent’s probate property ■ (2) give notice to the decedent’s creditors to assert their claims as part of the probate process (must be in a timely manner) and pay those claims asserted properly ■ (3) distribute remaining probate property to parties entitled to receive it ○ Judge in probate serves as a disinterested third party there to ensure (a) creditor claims against the decedent are properly resolved, (b) the estate’s personal representative properly performs their duties, and (c) the decedent’s assets are distributed according to the testator’s wishes Nonprobate property ○ Common critiques of probate: costly, too invasive, takes too long, delays distribution of assets ○ Four classic nonprobate arrangements or “will substitutes” that de facto transfer property at time of death are ■ (1) transferring the property to an inter vivos trust ■ (2) putting the property into joint tenancy, ■ (3) purchasing a life insurance policy (where the time of death benefits are paid to the policy beneficiary pursuant to the terms of the insurance contract, and/or ■ (4) creating a legal life estate and remainder ○ Revocable living trust ■ Functionally similar to a will (created inter vivos, revocable until death, and transfers property to beneficiaries identified in instrument at time of death) ■ “Will substitute” paradigm: functions like a will but is actually a will substitute because of its ability to avoid probate ● ● Typical estate plan (client view) ○ Wills and/or revocable living trust: in general, these documents provide instructions about who gets your property after you die ○ Durable power of attorney: these documents appoint someone to make financial decisions for you if you are unable to manage your own finances ○ Advance Healthcare Directive: these documents appoint someone to make health care decisions for you if you are unable to make your own health care decisions ○ Nominations of guardians for young children: these documents designate who you want to serve as guardians for your children if you are unable to care for them due to incapacity or death (In)testacy ○ Laws of intestacy are the default rules that determine what happens to a person’s property if they die intestate ○ If a decedent dies testate (with a valid will) and names someone, that person is the executor ○ If died intestate (without a valid will) or did not name someone, the court appoints an administrator or “personal representative” ○ Gift of real property is called a “devise” and can also be used as a verb ○ If the gift was a personal item or money, it is called a bequest or legacy ■ Modern uses “devise” for both California Intestate Scheme Surviving Spouse’s Share 2. ● Surviving spouse’s share ○ Layers of intestacy ■ The first layer is that a single decedent’s property goes to their closest family members ■ If the decedent is married, this adds a layer of determining what the surviving spouse’s share is ■ A married or single decedent with children adds the layer of who qualifies as a “child” ○ Marriage: characterization of property ■ Separate property: property owned before marriage, acquired during marriage by gift, devise, or inheritance. Must be kept separate from community property to remain separate property ■ Community property: any property acquired by either spouse as a result of their labor during marriage. CP is held 50/50 by the spouses while both are alive ○ CPC 6401 Surviving spouse’s intestate share; calculating size of share ■ (a) surviving spouse gets decedent’s share of CP ■ ■ ● (b) one half quasi-community property (c) separate property, surviving spouse might get ● Entire intestate if decedent did not have surviving issue, parent, sibling, or issue of sibling ● One half if decedent leaves only one child or issue of one deceased child; no issue but leaves a parent or parents or their issue or the issue of either of them ● One third if decedent leaves more than one child, one child + issue of one or more deceased children, or issue of 2 or more deceased children CPC 6402 Distribution of intestate estate not passing to surviving spouse ● Most intestate schemes say no surviving spouse → issue of decedent take next and they take equally ● ● Calculating degree of relationship ○ Count the steps in the family tree ○ Once a lineal descendent takes, the other issue of that taker do not Taking by representation ○ If the child is dead, the grandchild takes their share ● No live takers in the first generation → take by representation ● 2 approaches ○ Per stirpes: the first division of a decedent’s estate is always at the first generation, regardless of whether anyone is alive at the generation. One share is given to each person alive, and one share is given to each party in that generation who is dead but survived by issue ○ Per capita by representation: first division is made at the first generation where there is a live taker. At that generation, one share is given to each person who is alive, ande one share is given to each party at that generation who is dead but survived by issue CPC 240 Equal shares defined CPC 245 Application of section 240; express contrary intent CPC 6406 Half Bloods ○ Inherit same share as if they were full blood CPC 6413 relation through two lines of relationships; single share Estate of Dye ○ FACTS: Dye had 2 natural sons who were adopted away by his first wife’s new husband in 1959. Law at that time cut off their right to inherit from him. Dye gets remarried to Eleanor and adopts her son, Scott Dye. The law was changed in 1985 to permit some adopted-out children to inherit from their natural parents. In 1989 Dye and Eleanor sign wills leaving everything to each other. Eleanor dies and then Dye dies, both in 1999. Scott Dye petitioned to probate decedent’s estate and one of Dye’s adopted out sons filed an objection seeking a share in Dye’s estate. ● ● ● ● ● 3. Survivorship Requirements ● SUMMARY select CA survivorship rules ○ Intestate takers: CA requires an intestate taker to survive the decedent by 120 hours (5 days) CPC 6403 ○ Written instruments: if the decedent dies with a written instrument, only clear and convincing evidence is required that the decedent survived by a millisecond or as provided in the instrument, in which case the instrument governs CPC 21109 ○ Joint tenancy: if decedents held property as joint tenants and they simultaneously die with neither able to meet the clear and convincing evidence survival requirement, then by operation of law the property is severed and converted into tenancy-in-common, with proportional shares CPC 223 Calculating the Share to “Issue” 4. ● Issue of a person means all of his or her lineal descendants of all generations, with the relationship of parent and child at each generation being determined by the definitions of child and parent ○ 3 analytical steps involved in calculating the issue’s shares ■ (1) of the decedent’s property that is passing to the decedent’s issue, where do we make the 1st division? ■ (2) who gets a share at that level? ■ (3) what happens to the dropping shares? Who Qualifies as a “Spouse” or “Child” 5. ● Qualifies as spouse ○ Traditional hetero married couples ○ Same sex married couples ● ● ○ Putative spouse -- good faith belief that married (sometimes qualify) Does not qualify as spouse ○ Cohabitants ○ No common law marriage in california Who qualifies as child or parent for inheritance purposes? ○ Inheritance rights depend on legally recognized “parent-child relationship” ○ Children born out of wedlock ■ A legally recognized parent-child relationship must be proven before inheritances rights attach between the parties ■ In CA, a natural parent-child relationship may be established for inheritance purposes: ● Where the relationship is presumed, and not rebutted, under the Uniform Parentage Act ● If a court order declaring paternity was entered during the father’s lifetime; or ● If paternity is established by clear and convincing evidence after a natural father’s death ○ Adoption: natural parents and adoptive parents ■ When can an adopted child continue to inherit from the natural parents’ estate? ■ 6451 ● (a) an adoption severs the relationship of parent child between an adopted person and a natural parent of the adopted person unless both of the following requirements are satisfied: ○ (1) the natural parent and the adopted person lived together at any time as parent and child, AND ○ (2) the adoption was by the spouse of either of the natural parents or after the death of either of the natural parents ○ Estate of Dye ■ FACTS: Dye had 2 natural sons who were adopted away by his first wife’s new husband in 1959. Law at that time cut off their right to inherit from him. Dye gets remarried to Eleanor and adopts her son, Scott Dye. The law was changed in 1985 to permit some adopted-out children to inherit from their natural parents. In 1989 Dye and Eleanor sign wills leaving everything to each other. Eleanor dies and then Dye dies, both in 1999. Scott Dye petitioned to probate decedent’s estate and one of Dye’s adopted out sons filed an objection seeking a share in Dye’s estate. ■ ISSUE: Do Haskell’s two natural children, Jimmy and Phillip share of Haskell’s estate with Haskell’s adopted son, Scott Dye? Capacity to Make a Will and Related Issues 6. Testamentary Capacity ● ● ● ● ● 7. Layers of intestacy ○ The first layer is that a single decedent’s property goes to their closest family members ○ If the decedent is married, this adds a layer of determining what the surviving spouse’s share is ○ A married or single decedent with children adds the layer of who qualifies as a “child” Testamentary capacity is concerned with the testator’s mental capacity at the time they executed their will CPC 6100.5 An individual is not mentally competent to make a will if, at the time of making the will, he or she is unable to ○ (1) understand the nature of the testamentary act, or ○ (2) understand the nature and situation of her property, or ○ (3) remember and understand her relations with family members that are affected by her will Estate of Mann ○ Issue: Was she of sound mental capacity if she had second stage dementia and floated in and out of lucidity? ○ Court found that evidence suggested she was fine and that conservatorship is not a strong indicator of mental incapacity because it does not require a declaration ○ Witnesses testified that she was lucid during the will drafting/signing ○ KEY RULES ■ Burden is on contestant to overcome presumption of competence and presumption of execution during lucid period ■ Testamentary capacity must be determined at time of execution Testamentary intent must be clear and understood Undue Influence ● ● ● In general: undue influence is when a party unduly influences the testator to substitute the undue influencer’s intent for the testator’s intent Three types of undue influence ○ (1) Presumption of undue influence ○ (2) CA indicia of undue influence ○ (3) general indicia of undue influence CA Judicial presumption of undue influence -- use this rule ○ Requires contestant to show: ■ (1) a confidential relationship between the decedent and the alleged undue influencer; ■ (2) that the alleged undue influencer was active in the procurement or execution of the will, and ■ (3) that the alleged undue influencer unduly benefits from the will 8. ● ● Fraud (in the Inducement & Execution) Fraud in the inducement is when the will says what the testator wants it to sau, but that intent was induced by fraudulent misrepresentations - deception - made by a beneficiary under the will to induce the testator to include the beneficiary or exclude a gift, or with respect to the size of the gift in the will Fraud in the execution occurs when a testator is unaware she is signing a will or the will is forged by another resulting in the entire will being invalid 9. Attested Will Requirements ● ● ● ● Big picture functions of formalities ○ Evidentiary function -- supplies evidence to the court of testator's intent to transfer property ○ Protective function -- safeguards testator’s testamentary intent ○ ritualistic/cautionary function -- reminds the testator about the significance of the act ○ Channeling function -- encourages people to consult estate planning attorneys to draft wills CA Probate code 6110 (a)-(c)(1) ○ (a) shall be in writing ○ (b) shall be signed by one of the following ■ Testator ■ In testator’s name by some other person in the testator’s presence and by the testator’s direction ■ By a conservator pursuant to a court order (we wont apply this one in our class) ○ (c) (1) shall be witnessed by being signed, during the testator’s lifetime, by at least two persons each of whom (A) being present at the same time, witnessed either the signing of the will or the testator’s acknowledgment of the signature or of the will and (B) understand that the instrument they sign is the testator’s will Harmless error doctrine/rule (CA has a limited one) CPC 6110c2 ○ If a will was not executed in compliance with paragraph 1, the will shall be treated as if it was executed in compliance with that paragraph if the proponent of the will establishes by clear and convincing evidence that, at the time the testator signed the will, the testator intended the will to constitute testator’s will Evolution of the presence test ○ Line of sight: W’s do not actually have to see the T sign but must be able to see them were they to look ○ Conscious presence: W, from a totality of the circumstances (sight, hearing, or general awareness of what was going on etc.) can tell that the T is signing 10. Writing Requirement 11. Signature Requirement 12. Witness Requirement ● ● CPC 6112 ○ Any person generally competent can be a witness ○ A will or any provision thereof not invalid because the will is signed by an interested witness ○ Unless 2 other uninterested witnesses, there’s a presumption of duress, undue influence, atc ○ If a gift made to interested witness fails because the presumption, interested witness takes such proportion of the gift made to witness in the will that does not exceed the share of the estate which would be distributed if the will were not established Rule statements ○ An interested witness is a witness who benefits from the will. An interested witness creates a rebuttable presumption that the witness procured the devise by duress, menace, fraud, or undue influence, unless there are two other uninterested witnesses ○ If the witness can rebut the presumption, the witness takes the whole gift. If the witness cannot rebut the presumption, the gift to the witness will be “purged.” Under a purging approach, the witness cannot receive more than what they’d receive under the rules of intestacy. Thus, any excess gift beyond the witness’s intestate share fails 13. “Interested Witnesses” ● ● CPC 6112 ○ Any person generally competent can be a witness ○ A will or any provision thereof not invalid because the will is signed by an interested witness ○ Unless 2 other uninterested witnesses, there’s a presumption of duress, undue influence, atc ○ If a gift made to interested witness fails because the presumption, interested witness takes such proportion of the gift made to witness in the will that does not exceed the share of the estate which would be distributed if the will were not established Rule statements ○ An interested witness is a witness who benefits from the will. An interested witness creates a rebuttable presumption that the witness procured the devise by duress, menace, fraud, or undue influence, unless there are two other uninterested witnesses ○ If the witness can rebut the presumption, the witness takes the whole gift. If the witness cannot rebut the presumption, the gift to the witness will be “purged.” Under a purging approach, the witness cannot receive more than what they’d receive under the rules of intestacy. Thus, any excess gift beyond the witness’s intestate share fails 14. California’s Limited Harmless Error Doctrine 15. Holographic Will Requirements ● ● CPC 6111 ○ (a) a will that does not comply with 6110 is valid as a holographic will, whether witnessed or not, if the signature and material provisions are in the handwriting of the testator ○ (b) if a holographic will does not contain a statement as to the date of its execution and ■ (1) if the omission results in doubt as to whether its provisions of the inconsistent provisions of another will are controlling, the holo will is invalid to the extent of the inconsistency unless the time of its execution is established to be after the date of the execution of the other will ■ (2) if established that testator lacked testamentary capacity at any time during which the will might have been executed the will is invalid unless it is established that it was executed at a time when the testator had testamentary capacity ○ (c) any statement of testamentary intent contained in a holographic will may be set forth either in testator’s handwriting or as part of a commercially printed form will In re estate of williams pg 195 ○ Williams wrote a will, material provisions in his own handwriting, includes people’s addresses and lays out gifts by hand ○ No signature, but wrote his own name and address ○ Rule drafting ■ R: no requirement that signature be at the end of the document so long as it appears on the document ■ R: Signature does not need to be identical to other signatures ■ (1) A signature anywhere on the document is sufficient as a valid signature, it need not be at the bottom of the document ■ (2) It must appear that the signature was intended to authenticate the document ■ (3) There must be indicia of completeness if the signature is not at the bottom ■ (4) The signature need not be identical to the person’s signature on other legal document ■ ● (1) Non-testamentary provisions do not make the instrument inoperative as a will ■ (2) The instrument does not have to dispose of all of the decedent’s property in order to be valid or to indicate testamentary intent ■ There aren’t particular words that are necessary to establish testamentary intent, only that the testator intended to dispose of property after death Some requirements that you always analyze with holographic wills ○ Signed ○ Testator’s handwriting ○ Testamentary capacity ○ Testamentary intent 16. Role of Extrinsic Evidence ● Extrinsic evidence is admissible to determine whether a document constitutes a will pursuant to section 6110 attested will or 6111 holographic will, or to determine the meaning of a will or a portion of a will if the meaning is unclear Will Revocation, Revival, and DRR 17. Express Revocation ● ● ● ● ● Introduction ○ Big picture: the right to revoke or amend a will is an important corollary to the principle of freedom of disposition. A person remains free to rework his or her estate plan until the moment of death ○ Capacity: revocation requires the same capacity Overview of revocation rules (slide) ○ Express revocation by writing: T writes a new will which expressly revokes the prior will ○ Express revocation by act: T destroys the old will by some destructive physical act + INTENT ○ Implied revocation by writing: T writes a new will which revokes the prior will by inconsistency ○ Implied revocation by act: a presumption of revocation arises in some situations in which a will cannot be found ○ Implied revocation by operation of law: think about this as revocation by divorce Express revocation by writing CPC 6120(a) ○ A will or any part thereof is revoked by any part of the following: (a) a subsequent will which revokes the prior will or part Codicil: when writing only partially revokes a previous willm, it is considered a codicil to the prior will Revocation of a will v codicil (slide) ○ CPC 6120(a) ■ ● A will or any part thereof is revoked by any of the following ● (a) a subsequent will which revokes the prior will or part expressly or by inconsistency ○ Revocation of a codicil ■ Revocation of a will revokes all codicils thereto, but revocation of a codicil only affects the codicil -- it does not revoke the underlying will Express revocation by act CPC 6120(b) ○ Requires destructive act and intent 18. Implied Revocation ● ● ● ● Implied Revocation CPC 6124 Presumption of revocation by physical act pg 227 ○ If the testator’s will was ■ Last in the testator’s possession ■ The testator was competent until death, and ■ Neither the will nor a duplicate original; of the will can be found after the testator’s death ○ THEN it is presumed that the testator destroyed the will with intent to revoke it. This presumption is a presumption affecting the burden of producing evidence Duplicate original wills and revocation ○ If a testator destroys a duplicate original will with the intent to revoke it, the other duplicate will (typically in attorney;s or executor’s possession) is also revoked CPC 6121 A PHOTO COPY IS NOT A DUPLICATE ORIGINAL Implied revocation by operation of law ○ A will or part of a will is revoked by operation of law to remove all devises to an ex-spouse after divorce or annulment, and to prevent the spouse from serving as executor of the will 19. Revival of a Revoked Will ● Revival ○ Typical fact pattern ■ Testator executes Will 1. Testator then executes Will 2 which revokes Will 1. Then testator revokes Will 2. Does revocation of Will 2 revive Will 1? ● Will 2 can be revoked by an act or by a 3rd will ● When Will 2 was revoked, did testator intend to revive Will 1? ○ CPC 6123a [will 2 revoked by act] ■ If a second will which, had it remained effective at death, would have revoked the first will in whole or in part, is thereafter revoked by ACTS under 6120, ■ THEN the first will is revoked in whole or in part UNLESS it is evident from the circumstances of the revocation of the second will or from the ○ ○ testator’s contemporary or subsequent declarations that the testator intended the first will to take effect as executed CPC 6123b [will 2 revoked by will 3] ■ If a second will which, had it remained effective at death, would have revoked the first will in whole or in part, is thereafter revoked by a third will, ■ THEN the first will is revoked in whole or in part, except to the extent it appears from the terms of the third will that the testator intended the first will to take effect Sample rule statement ■ Revival rule: when a second will (that revoked the first will) is revoked by a physical act or third will, the first will is revived if the testator intends for it to be revived ■ What evidence will CA courts accept? The evidence that a court will accept depends on how Will 2 was revoked. In short, where Will 2 is revoked by act, the CA courts will accept virtually any evidence of the intent to revive. Where Will 2 is revoked by writing, the intent to revive must be expressed in Will 3 20. Dependent Relative Revocation (DRR) ● ● Dependent Relative Revocation ○ Typical fact pattern ■ Tom revokes Will 1 because he plans to execute Will 2 ■ Unfortunately Tom is wrong about Will 2’s validity because there was something wrong with Will 2 ■ Tom Dies, so we ask ■ What would Tom have wanted if he had to pick between the following two options? ● Will 1 v. No will (laws of intestacy) ■ To decide what Tom would have preferred, we compare what he sought to achieve thorough Will 2 with his two remaining options ■ We refer to Will 2, an invalid will, as the “failed alternative plan of disposition” For DRR to apply, there must be ○ (1) a valid revocation ○ (2) based upon a mistake ○ (3) evidence of a mistake. Failed “APD” or evidence in writing. Element 3 depends on how Testator performed the revocation that the court is being asked to ignore ■ If T revoked will 1 by act, there must be a failed alternative plan of disposition ■ If T revoked will 1 by substantially similar writing, the revoking instrument must provide evidence of the mistake ○ ○ ● (4) T would not have revoked but for the mistake Additional rule: If will 2 is invalid due to fraud, duress, menace, undue influence of ineffective execution, the revocation of the first will was never valid, so DRR is not applicable Summary of DRR ○ DRR is an equitable doctrine by which the court will ignore an otherwise valid revocation of a will ○ Where the testator revoked by act, before a court will apply DRR one must convince the court (1) there was a valid revocation (2) based upon mistake, (3) there’s a failed alternative plan of disposition, and (4) T would not have revoked but for the mistake ○ Where the testator revoked by writing, before a court will apply DRR one must convince the court (1) there was a valid revocation, (2) based upon mistake, (3) the revoking instrument evidences the mistake, and (4) T would not have revoked but for the mistake Components of a Will 21. Codicil Requirements 22. Republication by Codicil ● ● A codicil is an amendment to an existing will made the testator to change or “republish” her will. In general, it must meet the same formalities as an attested will or holographic will Republishing a will: a codicil “republishes” a will. Republishing a will means that a codicil re-executes and re-dates the will to the date of the codicil 23. Integration ● Papers are integrated into the will if they were present at the time of the execution of the will and the testator intended them to be part of his will, such as several writings connected by a sequence of thought, folded together, stapled, or physically forming one document 24. Incorporation by Reference ● Incorporation by reference ○ A writing in existence when a will is executed may be incorporated by reference if the language of the will manifests this intent and describes the writing sufficiently to permit its identification 25. Tangible Personal Property Lists (Modern Trend) ● ● Tangible personal property lists (modern trend) ○ A will may refer to a writing that directs disposition of tangible personal property not otherwise disposed of by the will/ The writing must be dated and either be in the testator’s handwriting or be signed by the testator ○ The testator may make subsequent handwritten or signed changes to the writing, and the most recent writing controls the disposition. If there are inconsistent dispositions, a dated writing will control over an undated writing unless it can be established that the undated writing was created later than the dated writing ○ The value of any single item of TPP disposed of by the writing may not exceed $5,000 and the total value of TPP disposed of by the writing may not exceed $25,000 EXAM TIP: if you issue spot integration, you should also consider incorporation by reference 26. Acts of Independent Significance ● Acts of independent significance ○ A will may dispose of property by reference to acts and events that have significance apart from their effect upon the dispositions made by the will, whether the acts and events occur before or after the execution of the will or before or after the testator’s death. The execution or revocation of a will of another person is such an event. ■ Ex. professor executes a valid will: “i give 1000 to whomever is my research assistant at the time of my death” ■ Ask yourself if the identity of the research assistant independent of its effect on testator’s estate? ○ Two step ■ (1) identify the act or event referenced in the will that is to occur outside the will ■ (2) analyze whether that act or event has significance (ie meaning or consequence) independent of its effect upon the testator’s probate estate ○ Property can be switched in and out over time ■ Ex household furniture at time of death ■ Safety deposit box at time of death Interpreting a Will ● Classification of gifts ○ Specific gift: gift of a particular thing, specified and distinguished from all other items of the same kind ■ Ex. I give my wedding ring to A ○ General gift: a gift from the general estate that does not give specific property ■ ● ● If at the time of the death of the testator the testator does not own any asset that matches the general gift, the personal representative has a legal duty to go out and purchase the asset and give it to the beneficiary ■ Ex. I give 300 shares of GM Corp. Common Stock to B ■ Ex. I give B $5000 ○ Demonstrative gift: designates a particular fund or asset from which the gift is to be made ■ Ex. I give the sum of $5000 to C to be paid from my credit union savings account (hybrid of specific and general gifts) ■ Treated as a subset of general gifts, SO they get the gift even if it can’t come out of the account that the testator wanted ○ Residuary gift: a gift of all that remains after all specific and general gifts are discharged ■ Ex. residue of my estate goes to D Testamentary gifts that fail ○ Estate of Macfarland ■ Macfarland executed a will that bequeathed the remainder of her estate be divided among 18 individuals ■ 3/18 predeceased macfarland ■ ISSUE whether the lapsed residuary gifts pass to the testator’s heirs at law (by intestacy) or to the remaining named beneficiaries ○ CPC 211111 Lapse and Antilapse ○ Issue spotting: lapse and antilapse rules apply when the persons taking under the will are no longer alive at the time of testator’s death ○ Lapse: when a gift fails because a beneficiary predeceases the testator, the gift “lapses” ■ Traditionally, when a beneficiary predeceased the testator, the gift to the beneficiary lapsed and fell into the residue, or was distributed via intestate succession if there was no residue ○ Antilapse: when a beneficiary predeceases the testator, the issue of the beneficiary take in his place, thus avoiding the lapse of the gift, unless a contrary intention appears in the will ■ Sample rule statement: when a beneficiary predeceases the testator, the issue of the beneficiary take in his place, thus avoiding the lapse of the gift, unless a contrary intention or substitute disposition appears in the will ■ Elaboration: antilapse only applies if the beneficiary is a person who is kindred to the testator or kindred of a surviving, deceased, or former spouse of the testator. But a spouse is not considered kindred ○ KINDRED definition ○ Gift over clause ○ Class gifts ■ To determine if class gift (if not obvious) ● (1) how the takers were described by the instrument ● ● ● ● ● (2) how the instrument described the gift (3) whether the beneficiaries “are united or connected by some common tie” (4) testator’s overall testamentary scheme Ademption ○ Issue spotting ■ In general, ademption refers to the failure of a specific gift because the property is not in the testator’s estate when the testator dies ● Asset could have been sold, given away, consumed, stolen, or destroyed ○ By extinction -- ONLY APPLIES TO SPECIFIC GIFTS ■ A specific gift adeems by extinction if the specific gift identified in the will is not part of the estate at the time of the testator’s death ○ EXCEPTION to ademption: change in form, not in substance ■ Courts will look at the testator’s intent to determine whether the specific gift adeems. A specific gift which changes in form will not adeem, unless the testator intended that the gift fail ○ By satisfaction ■ A specific gift or general gift adeems by satisfaction if (1) the testator’s will provides for deduction of the lifetime gift or (2) the testator declares in writing that the gift is satisfied or (3) the beneficiary testator declares in writing that the gift is satisfied ■ If the gift is a specific gift, and that same specific gift is given to the beneficiary during testator’s lifetime, the gift adeems by satisfaction ○ How to ■ Classify the gift ■ Apply the ademption rule ■ Did the gift change in form or substance ○ Specific gifts vs general gifts of stock ■ The issue of ademption of securities often turns on whether the testator intended a specific gift of certain securities or a general gift of the equivalent value of the securities ■ If the gift of stock is a specific gift and testator owned that stock at the time of execution and if the change in form is initiated by the corporate entity, then the gift does NOT adeem, and the beneficiary is entitled to the change in number and change in form of the stock, unless the testator intended otherwise ■ But if the change in form is initiated by the testator, apply the usual california ademption analysis Advancement ○ Similar to satisfaction, except it relates to the situation involving complete or partial intestate distribution ○ If a decedent dies intestate, property that the decedent gave to an heir during lifetime is only treated as an advancement against that heir’s share of the ● ● intestate estate if the decedent declared (contemporaneously) or the heir acknowledged (at any time) such in writing ○ If the heir predeceased the decedent, the property that decedent gave to the heir is not considered an advancement with respect to the property passing to the predeceased heir’s issue, unless the writing provides otherwise Doctrine of exoneration ○ Issue spotting: Addresses the issue that arises when a testator makes a testamentary transfer of an asset that is encumbered with debt ○ Examples ■ Testator devises a house that is subject to a mortgage ■ Testator devises a car subject to a loan ○ RULE: a specific gift passes the property subject to any mortgage, deed of trust, or other lien existing at the date of death, without right of exoneration unless otherwise indicated in the testamentary instrument Abatement ○ Issue spotting: value of the gifts given in the will is greater than the value of the estate (we can’t afford to pay all of the gifts) ○ Abatement occurs when gifts are reduced to enable the estate to pay all debts and legacies that it otherwise would be unable to pay. The shares of beneficiaries abate as is necessary to effectuate the instrument, plan, or purpose ○ Order of gift abatement ■ Property not disposed of by the will ■ Residuary gifts ■ General gifts to nonrelatives ■ General gifts to relatives ■ Specific gifts to nonrelatives ■ Specific gifts to relatives ○ To abate = to reduce gift Protections for Family Members 39. Pretermitted Spouse 40. Pretermitted Child 41. Accidentally Omitted Child Pretermitted spouse ○ RULE: if a (1) surviving spouse married decedent after execution of decedent's “testamentary instruments” and (2) those documents fail to provide for the surviving spouse, then (3) the omitted spouse is entitled to the one-half of decedent’s community property, one half decedent’s quasi-community property, ● ● and the intestate share of decedent’s SP (NOTE this is pretty much the same as intestate distribution) ○ EXCEPTIONS: the pretermitted spouse rule establishes presumption that must be rebutted by the will proponents. There are three ways to rebut the presumption: the spouse was (1) intentionally omitted as indicated on the face of the will; (2) otherwise provided for outside the will with an intent to do so in lieu of the will, or (3) the surviving spouse waived their right to a share with a valid agreement Pretermitted children ○ RULE To qualify as a pretermitted child, the child must be born or adopted after the execution of the decedent’s testamentary instruments. The omitted child is entitled to their intestate share ○ EXCEPTIONS The pretermitted child doctrine establishes a presumption that may be rebutted one of three ways: (1) the child was intentionally omitted as indicated on the face of the will; (2) the decedent devised substantially all of the estate to the parent of the omitted child (if decedent had one or more child); (3) the decedent otherwise provided for the child outside the will with an intent to do so in lieu of the will Accidentally omitted child ○ RULE To qualify as an accidentally omitted child, the child must be alive before the decedent executed her “testamentary instruments”. The decedent must have failed to provide for the child solely because (1) the decedent believed the child was dead or (2) the decedent was unaware of the child’s birth/existence. The presumption is rebuttable. CPC 21622 ○ WHEN ANALYZING explain the word “solely”